Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

InnaMed

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

- Smart, at-home blood testing device with several disease specific test cartridges

- Y Combinator company that has raised $1M from leading Silicon Valley investors

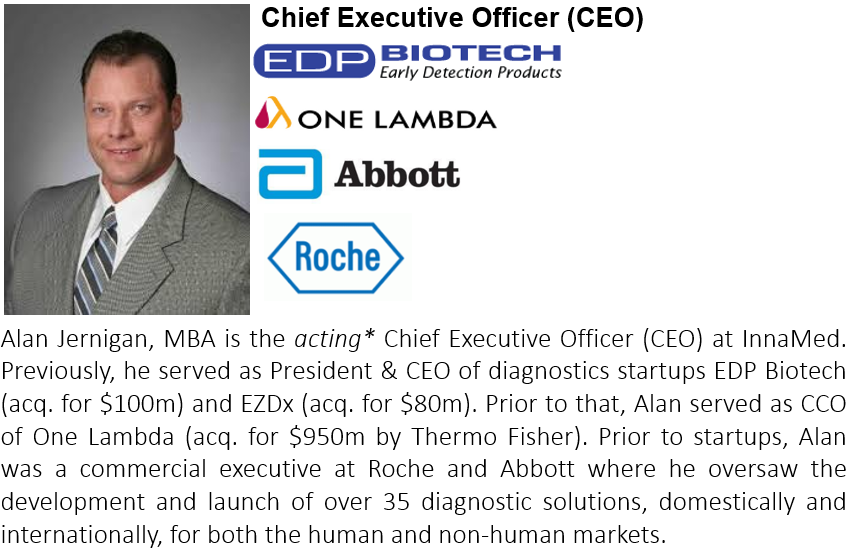

- Leadership team of strong technical founders and CEO and CMO with 30+ years of experience and multiple exits of eight- and nine-figures in the diagnostics industry

- 4 patents and 3 peer-reviewed publications covering the core technology

- $400k in contracts with multiple high impact U.S. government agencies and a top 5 global pharma company

- Initial focus in the $3B+ cardiac diagnostics market segment with plans to expand into the broader $50B+ lab testing and patient monitoring markets

The Problem

Healthcare is broken.

To adapt to this paradigm shift, healthcare providers are turning to new care coordination protocols and patient monitoring technologies to improve the management of complex chronic diseases.

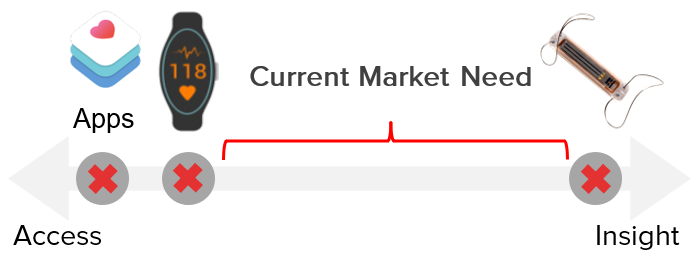

Unfortunately, current tools either lack sensitivity and specificity (e.g., apps and wearables) or are expensive and invasive (e.g., implantable devices) leaving a gap in remote monitoring technologies – until now.

Our Solution

Generating more high resolution snapshots of your health

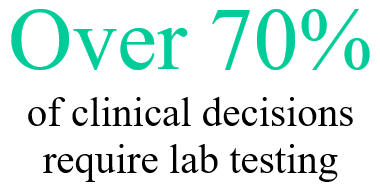

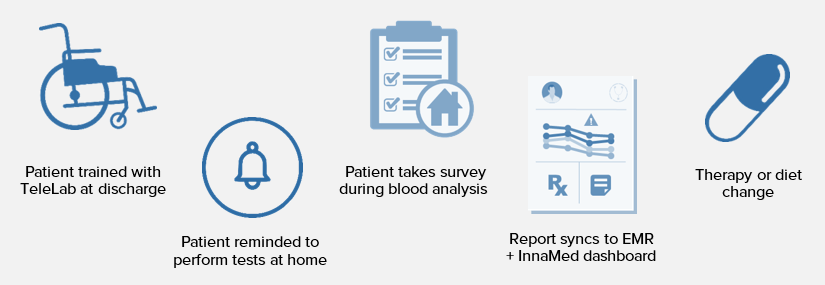

InnaMed is developing a smart, at-home blood testing device called TeleLab for remotely monitoring patients. Serial and frequent blood testing is a foundation of outpatient care as over 70% of clinical decisions require blood tests.

Today only a small portion of blood testing may be performed at home, such as painful finger stick glucose testing. The bulk of blood testing is performed at outpatient labs, requiring patient willingness, effort, time and money as patients must travel, wait and rely on caregiver support in order to comply with the recommended follow-ups.

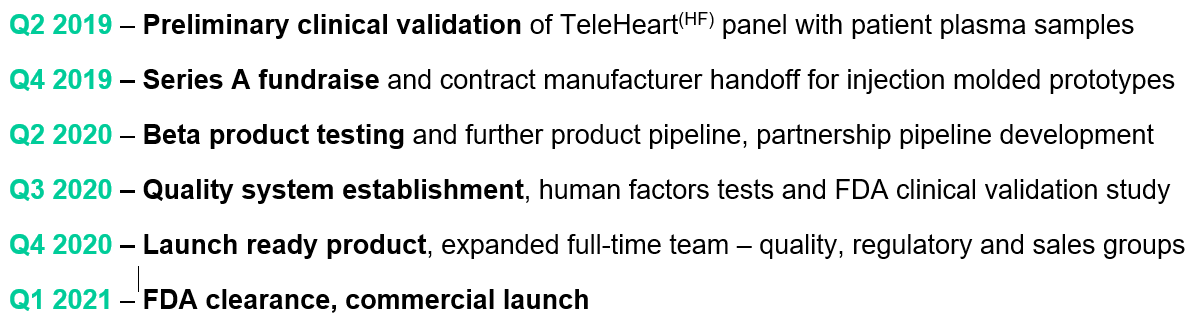

The vision for TeleLab is to deliver clinical value by eliminating the barriers to blood testing, thereby shifting more outpatient care to the home setting and enabling more frequent appraisal of patient health.

How it works

By combining microneedle blood collection, patented electrochemical blood analysis technology and cloud-computing, InnaMed will provide laboratory-level blood testing at the home setting and share the results with your physician for assessment.

It is simple to use:

1. Place cartridge on your upper arm

2. Push button for painless blood draw

3. Insert cartridge into TeleLab reader

The technology inside

InnaMed’s intellectual property encompasses reagents, molecular detection mechanisms and data analysis methods. Our work has been published in several industry leading peer-reviewed journals. Following painless microneedle extraction of capillary blood into the microfluidic cartridge, the following patented technologies are used to quantify molecules in the sample.

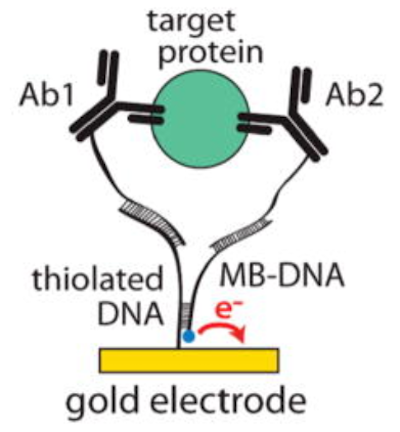

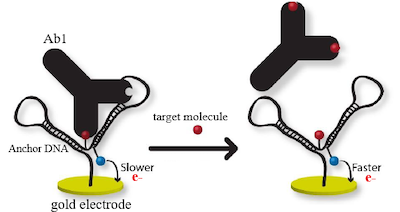

Electrochemical Proximity Assay

Method for detecting proteins in blood

Demonstrated a limited detection of 128 femtomolar for measuring insulin (superior to current ELISA tests)

Electrochemical Nanostructure Assay

This is our proprietary method for detecting small molecules in blood - most small molecule tests require the use of mass spec which is extremely resource intensive

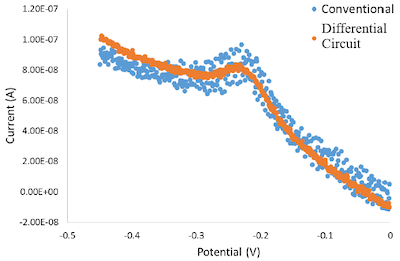

Differential Circuit for Electrochemical Measurements

Method for reducing noise in electrochemical data

~4x noise reduction using ~$100 hardware enabling affordable home testing with clinical accuracy

The First Market

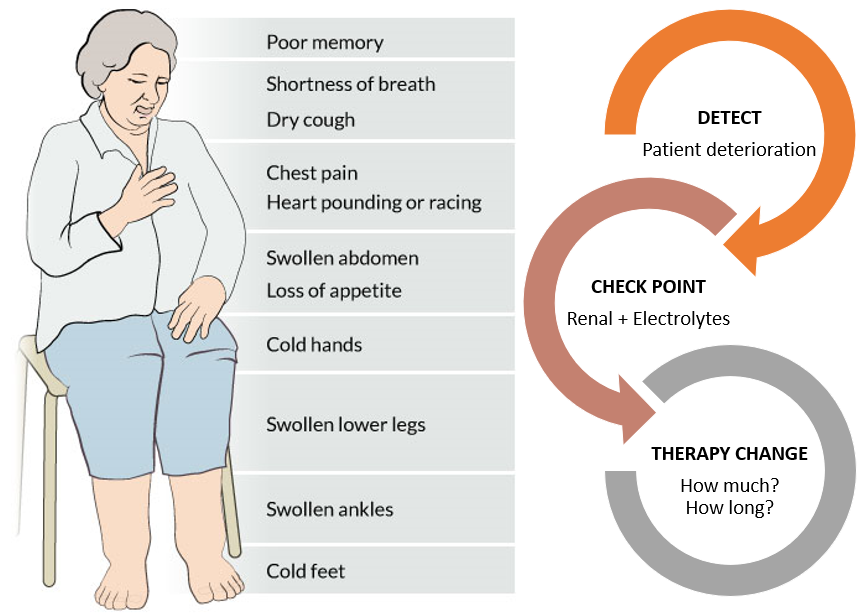

Heart failure

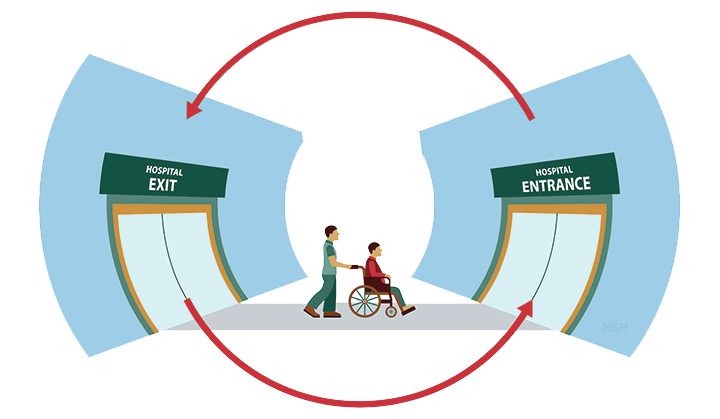

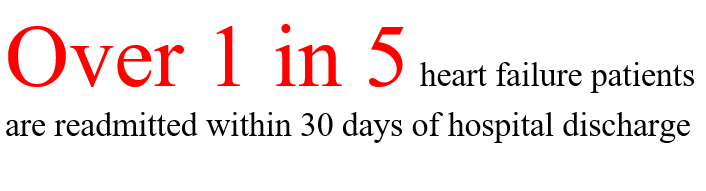

Our first market segment is focused on patients with heart failure. Heart failure is a chronic disease affecting approximately 6 million people in the U.S. in which the heart muscle progressively weakens and cannot sufficiently circulate blood throughout the body. As one of the leading causes of hospitalization in the US in patients over the age of 60, heart failure is becoming a growing public health concern with the aging US population.

The most frightening symptom of heart failure is shortness of breath. Patients are unable to breathe comfortably and as a result rush to the ER in fear of imminent death. These visits are not only traumatizing for the patient but are also expensive, each admission costing upwards of $13,000. Hospitals are also penalized by Medicare for high readmission rates.

Currently, almost all aspects of heart failure management from data collection to analysis, decision making, and communication are performed manually, resulting in high resource utilization, bottlenecks to treatment and suboptimal outcomes. Our technology is well-positioned to fill this market need as current solutions don’t meet the clinical need.

Our first disposable test cartridge: TeleKidney (HF)

Creatinine | Blood Urea Nitrogen | Sodium | Potassium

Physicians have long used this panel of tests to assess a heart failure patient's renal and electrolyte status to determine the safety of starting or changing a course of therapy.

Frequent, at-home testing enables more frequent and personalized modulation of dosage while maintaining safety as shown by the Home Diuretic Protocol study.

Our second disposable test cartridge: TeleHeart (HF)

NT-proBNP | Hematocrit | Hemoglobin | Other Proteins (stealth)

Physicians have long used NT-proBNP to detect a patient’s worsening heart failure prior to starting them on a new therapy or changing the dosage of their current therapy.

Our panel expands on this test, including other markers that can improve the sensitivity and specificity with which heart failure is detected, allowing for earlier clinical action.

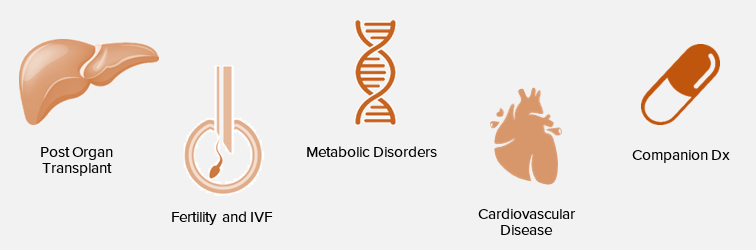

Future pipeline applications

The initial cardiac diagnostics and patient monitoring market is $3B+. InnaMed plans to expand into the $50B+ outpatient blood testing market. These markets are growing rapidly as the population ages, creating a significant market opportunity for InnaMed.

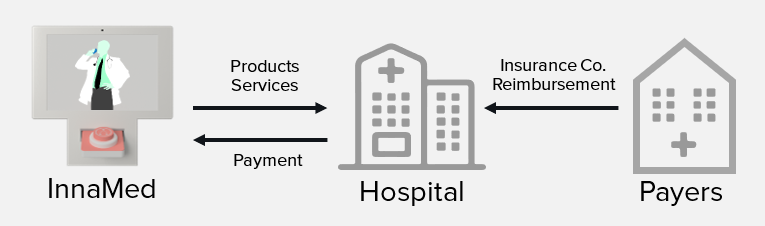

The Business Model

We plan to initially sell our products directly to hospitals, nursing facilities and cardiology and heart failure clinics for in-office and at-home patient monitoring use. In-office use will be priced on a per unit and per cartridge basis (razor/razor-blade model). At-home patient monitoring use will be priced based on a subscription model (hardware as a service model). Simultaneously, we plan to work with insurance companies to establish exclusive reimbursement plans for the use of our product allowing for more rapid hospital and clinic adoption and higher margins.

Current Traction

InnaMed has already secured eight letters of intent (LOIs) from leading hospital systems (listed below) that are looking to purchase the product post-FDA clearance, with several other institutions expressing strong verbal commitments:

Florida Hospital

Valley Health System

Penn State Heart and Vascular Center

NorthBay Cardiology

Bridgeport Hospital

Arkansas Heart Hospital

Monida Healthcare Network

Hahnemann University Hospital

Prior to FDA clearance, InnaMed plans to partner with pharmaceutical companies and government agencies that are interested in using its products for clinical research studies. InnaMed is currently partnering through technology development contracts with multiple high-impact U.S. government agencies and a top 5 global pharmaceutical company. InnaMed currently has $400K in milestone-based contracts with a rapidly growing pipeline of potential partners.

Fundraising

InnaMed has raised over $1M to date and is a Y Combinator W17 alum. Notable investors include:

What's Next

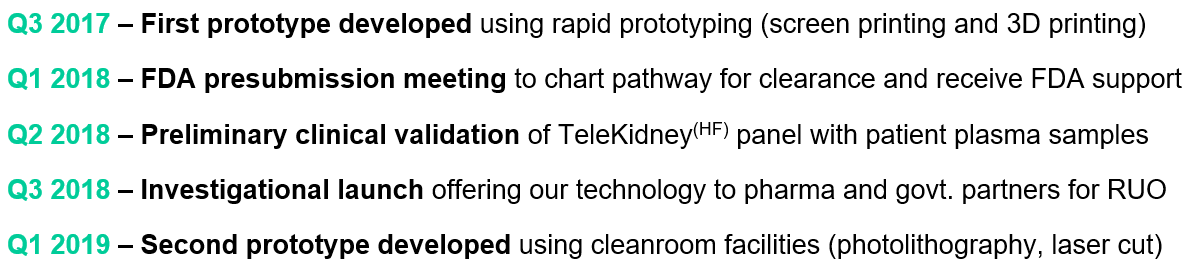

What's been done

What will be done

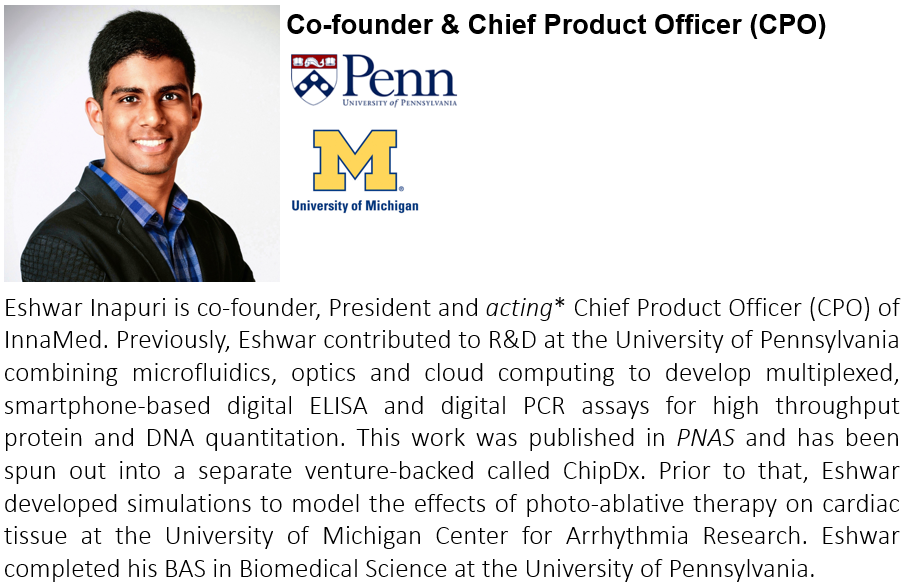

Executive Team

Acting* means engaged in that capacity, but not yet formally appointed to the position by the Company and its Directors

Advisory Board

Employees

Join us in advancing healthcare with personalized medicine. Your contribution can help us improve lives.

Deal terms

$12,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

0%

If a trigger event for InnaMed occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

InnaMed must achieve its minimum goal of $50K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- Participate in a virtual group strategy session with the founding team

-

Sold out (0 left of 72)

-

Meet the founding team & tour our lab/office virtually or in person (transportation not included)

Limited (4 left of 10)

-

Receive a private demo and have dinner with the founders in Philadelphia (transportation not included)

Sold out (0 left of 5)

Why others invested

See all reviews (0) See all (0)As a Medical Technologist, I value a patient’s ability to monitor these important biomarkers from their own home. The people creating and advising in this concept have outstanding qualifications to make a safe, innovative product for healthcare.

As a health provider and Cardiac patient, I believe that you are developing a product that would be wonderful for regular monitoring of a patient's present state. It's easy and painless. If this works out, I will be proud to be a part of it.

Great cause w/ unlimited market potential (baby boomer generation approaching retirement age but comfortable with on-demand products like Uber) and connected with the Wharton brand. Encouraging indicators and I look forward to the future.

About InnaMed

InnaMed Team

Everyone helping build InnaMed, not limited to employees

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC