Problem

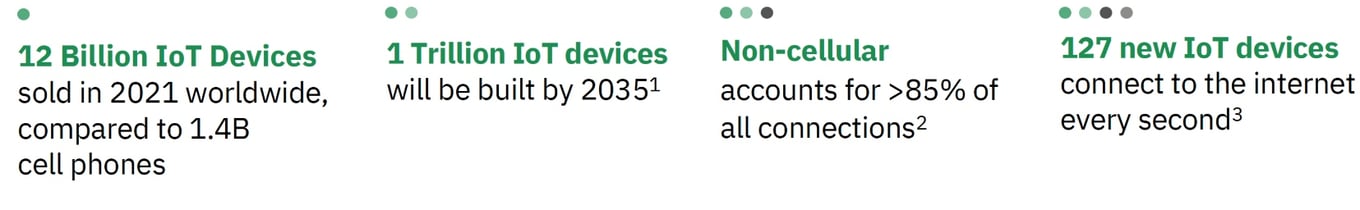

Enterprises in all verticals are increasingly attempting to use wireless connected devices to digitally transform their businesses — this is the vision for the Internet of Things (IoT).

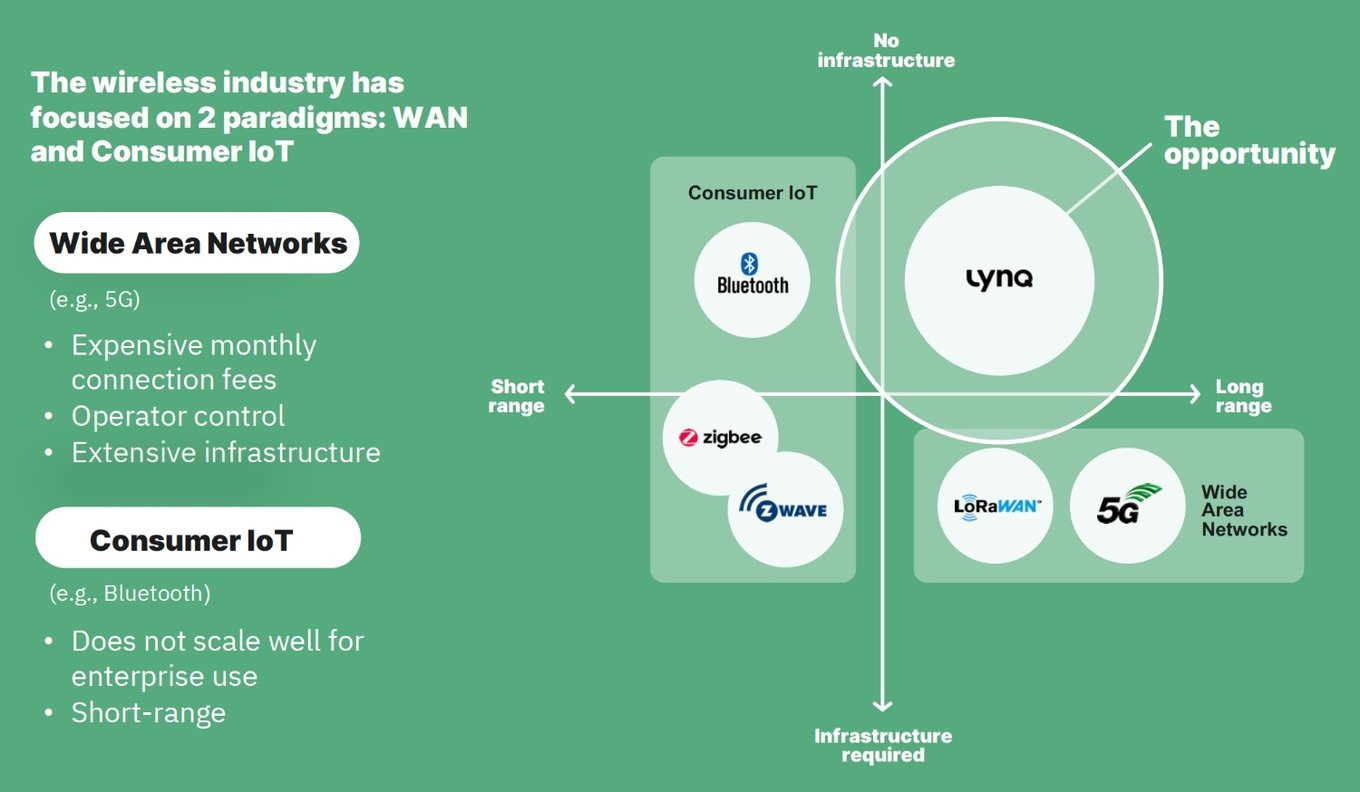

However, current wireless technologies, such as Bluetooth and 5G, don’t respond to the scale, cost and range requirements of most of the devices that are used in the world’s largest industries.

Wide area networks

A wide-area network (WAN, such as 4G, 5G) is a wireless network that covers a broad area, but does so through the use of installed and planned infrastructure, such as base stations. A WAN is characterized by 3 factors:

a) operators running the network, who act as control point

b) coverage only in areas where expensive infrastructure is deployed, leaving remote and many indoor locations without connectivity

c) Monthly connection fees, that don’t make sense for every device type – and you can’t put a SIM card on everything

Consumer IoT

Some consumer IoT wireless technologies, such as Bluetooth and ZigBee, can act as limited solutions, though they don't scale well for large enterprise use and are typically quite short range. For example, Bluetooth is primarily for 1-to-1 connections and only has a range of approximately 10m.

So how do we connect the many devices that fall in between 5G and these consumer-focused technologies?

Solution

Bridging the connectivity gap between Bluetooth and 5G

Lynq's novel software allows devices to communicate over long range, with no installed infrastructure and no connectivity fees.

No Infrastructure Required

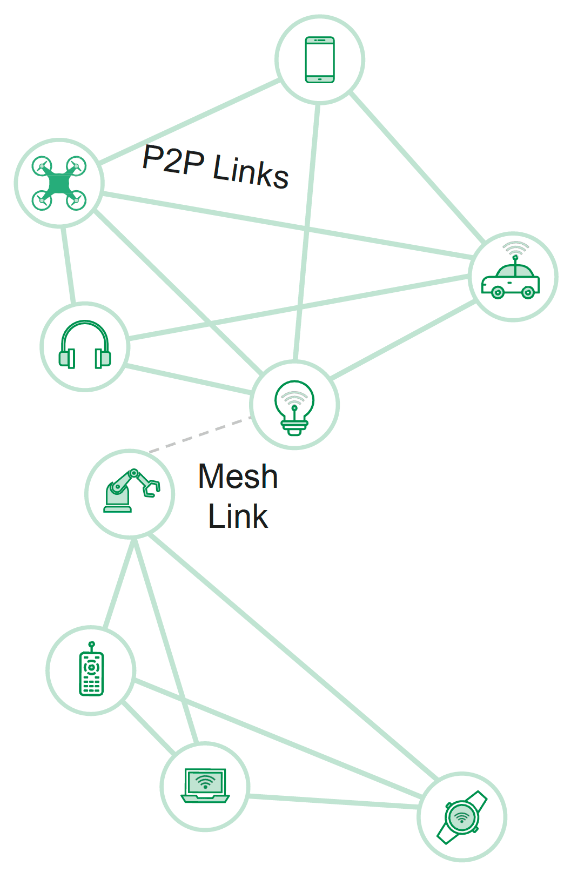

No Infrastructure Required- Enables a Long-Range LAN

- Point-to-Point Mesh

- Rapidly Deployable

- Highly Secure

- Low Power

- Low Cost

- Small Size and Highly Embeddable

- High Reliability

Product

Key features of the Raven Network stack

Complete payload flexibility: Supports transport of any type of data, including high quality voice, telemetry, location and messaging.

Complete payload flexibility: Supports transport of any type of data, including high quality voice, telemetry, location and messaging.

Physical layer agnostic: The software can run on a variety of off-the-shelf chipsets, allowing customers to trade off range, data rates and latency. The chosen chipsets allow for a very low cost, low power, small form factor solution.

Physical layer agnostic: The software can run on a variety of off-the-shelf chipsets, allowing customers to trade off range, data rates and latency. The chosen chipsets allow for a very low cost, low power, small form factor solution.

Highly secure: Hard to detect and hard to intercept with unique methods of security.

Highly secure: Hard to detect and hard to intercept with unique methods of security.

Multiple topologies: Point-to-point, Point-to-Multipoint and Intelligent Mesh

Multiple topologies: Point-to-point, Point-to-Multipoint and Intelligent Mesh

Use cases

Use cases for Lynq's network technology across enterprise, industrial and government include: military tactical teams; construction sites; communications equipment; vehicles; SAT/multimode phones; drone / robot control; precision agriculture; robotics; industry 4.0; disaster response and precise positioning for UGVs (Unmanned Ground Vehicles), such as driverless tractors.

Case studies | ||

|---|---|---|

Otto Lynq Pro | Grab-and-go situational awareness for tactical teams.

Launched last Fall at AUSA, OTTO Lynq PRO is already deployed in active warfare and training. Lynq’s network technology and OTTO Lynq PRO have received formal support and procurement from several agencies across the military service, special operations and the intelligence community. | |

| RavenTalk Wireless Headsets |

| |

| RavenCloud SATCOM Gateweay |

| |

Traction

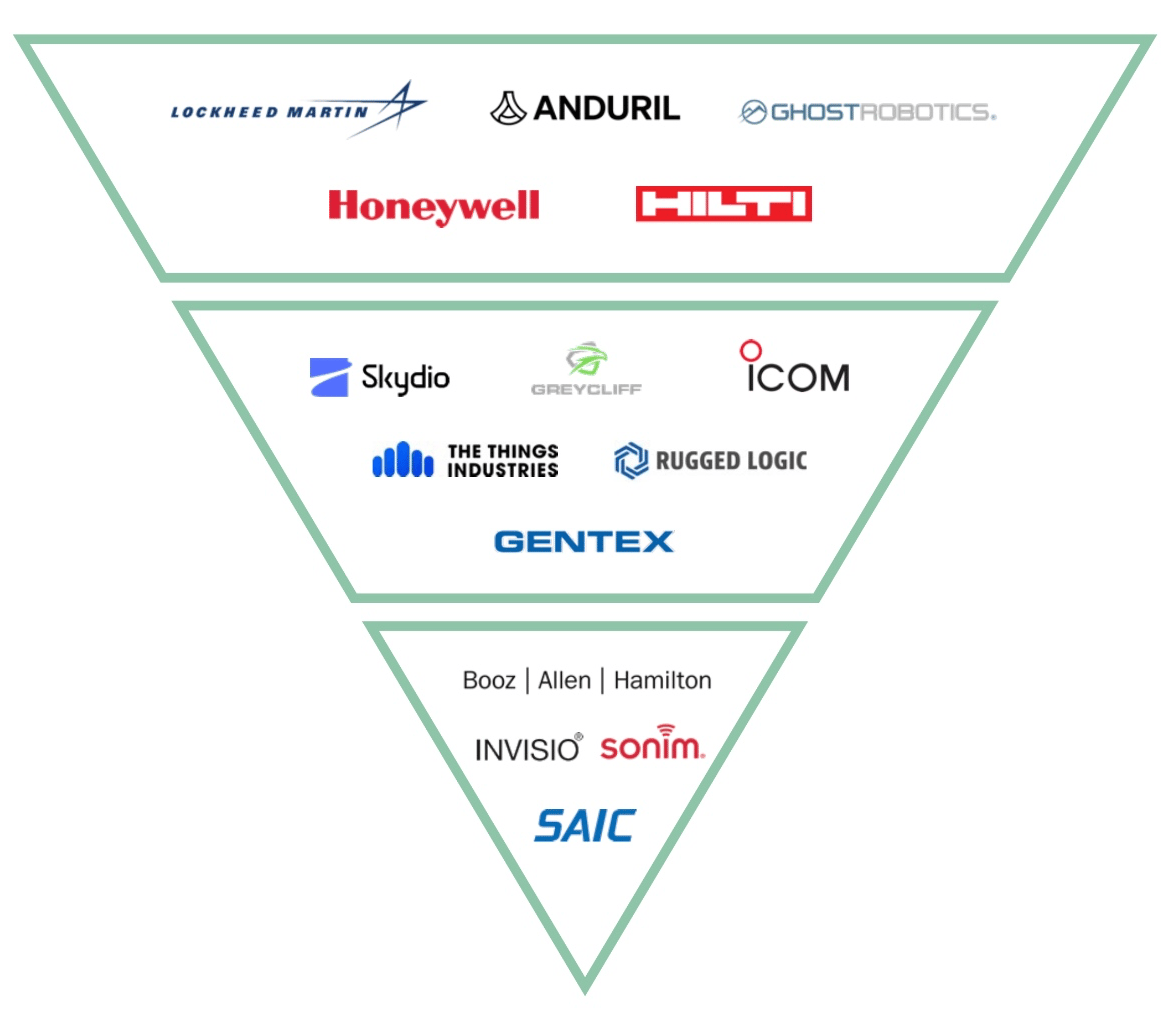

Software deployed across thousands of devices, $50M+ customer pipeline

Lynq gained early traction with a breakout consumer product, the Smart Compass, that sold over 20,000 units, including $1.7m in revenue via IGG over a two month period.

The company currently has a large licensing deal and is commercially deployed by Otto Engineering, the largest manufacturer of radio accessories to government markets. Our second customer is in the tactical headset market, with deployment planned for late 2023. The company has strong traction in the military sector with customers that include the Air Force and multiple intelligence agencies.

Lynq also has a pipeline of over 50 industry-leading customers with a total value of $50M+, including Honeywell, Booz Allen Hamilton, and Lockheed Martin. Lynq is also now gaining traction in the construction and smart agriculture industries. Its solution is horizontally applicable across a broad range of IoT verticals, from oil and gas to Industry 4.0.

Lynq's device and core technology have already demonstrated life-saving results. After an exercise between the U.S. and Thai governments, U.S. Pacific Command (PACOM) published a formal report stating that the use of Lynq reduced the time spent locating wounded and unconscious soldiers by 61%.

50+ industry-leading companies in active discussion Weighted value: $50M+ |

Formal support across the DoD

Company milestones

Business model

Enterprise and government revenue channels

Lynq’s customers are leading device OEMs and integrators that sell to private enterprise and government. The company licenses its software on a per-unit basis and as part of a module. This opens the door to various use cases, offering customers the flexibility they want.

Going forward, Lynq is building out a set of cloud-based applications, such as device management, network management, provisioning and over-the-air software update. This will migrate Lynq’s business model towards a recurring, SaaS revenue. The company is also developing a strong patent portfolio to ensure the viability of its growth strategy.

Market

'The current moment demands a holistic, future-back approach to transformation', McKinsey

Wireless fuels the American economy, supporting 4.5M jobs and contributing $825B each year, making the US wireless industry the 19th largest economy in the world. Additionally, since 2018, the year 5G launched, wireless providers have invested nearly $121B. This includes an all-time high record investment of $35B in 2021. Over the life of the industry, capital investment now totals over $635B.

Lynq is poised to capitalize on these trends by becoming a leader in long range and infrastructure-free communications, bridging the gap between 5G and Bluetooth for all IoT markets. In doing so, the company will have created its own unique ecosystem.

Lynq is poised to capitalize on these trends by becoming a leader in long range and infrastructure-free communications, bridging the gap between 5G and Bluetooth for all IoT markets. In doing so, the company will have created its own unique ecosystem.

Competition

Well-positioned to fill substantial gaps in the wireless communications ecosystem

Lynq's direct competitors operate in the networking stack software licensing space, but it also competes with the major semiconductor players.

- Wirepas created a wireless, fully meshed network architecture for IoT solutions. The Finland-based company has raised €30.4M from global VC funds, including Karma Ventures and Vito Ventures.

- TrellisWare is dedicated to improving and changing the design and performance of communications and signal processing systems. It's a worldwide leader in highly advanced algorithms, waveforms, and communications systems.

- Qualcomm is continuing to grow its IoT business. Revenue from that department was up 7% to $1.68B in Q1 2022. Qualcomm’s consumer IoT business encompasses its push into the cellular-enabled PC space with its silicon compute platform and partnerships like Windows on Snapdragon.

Lynq's main competitive advantage is its comprehensive solution, which fills the gaps not being addressed by other companies, such as range, simplicity, and support for customer use cases. This makes Lynq more scalable and cost-effective.

Funding

Raised $20M from renowned institutional and strategic investors

Co-investors

- Material Impact (Nauticus Robotics, Jump Aero, Orbion Space Technology)

- Sony (Adrich, Defined.ai, Plunk)

- Plus Eight Equity Partners (Landr, Pacemaker, Splice)

- Techstars (Uber, Twilio, Zipline)

- ffVC (Indiegogo, Honeybee Robotics, Earnest)

- In-Q-Tel (CallMiner, zSpace, Connectify)

- SOSV (FormLabs, GetAround, BitMEX)

Recent large fundraises in IoT and Wireless

VC funding for the IoT market cooled in the first half of 2022 amid challenging economic conditions, but global IoT startups still brought in $2.8B. Companies which raised the most include Helium Systems ($200M), Axonius ($200M), SiFive ($175M), and Eigencomm ($156.8M). The most active investors in the space are Intel Capital, GE Ventures, and a16z.

Leadership

Led by wireless industry veterans and serial entrepreneurs uniquely positioned to capitalize on this market opportunity

Adam Gould (CEO)

Serial entrepreneur (8 startups) with multiple successful exits. Also served in senior leadership positions at large corporations, including Inseego (SVP & GM), ARM (VP), and Nokia (CTO). He did his Bachelor of Science in Electrical Engineering at MIT and Master’s at Drexel University.

Dave Shor (Founder / CDO / Chairman)

Multi-time founder who has brought many products to market, some of which have been selected for the TIME's list of best inventions. He possesses 20+ years of management experience.

Karina Costa (Co-founder / President)

Seasoned venture investor and entrepreneur, founding TechStars Anywhere and Fabrica de Startups. She started her first tech company at the age of 22 and, throughout her career, has worked or invested in over 100 startups.

The rest of the team comprises of world-class technical experts and accomplished business leaders who have worked in world-class organizations, including Qualcomm, Ericsson and Motorola.

| Lynq Networks team |

|---|

|

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...