Equity crowdfunding allows startups and early-stage companies to issue ownership stakes to many investors in exchange for...

* Click here for important information regarding Financial Projections which are not guaranteed.

Problem

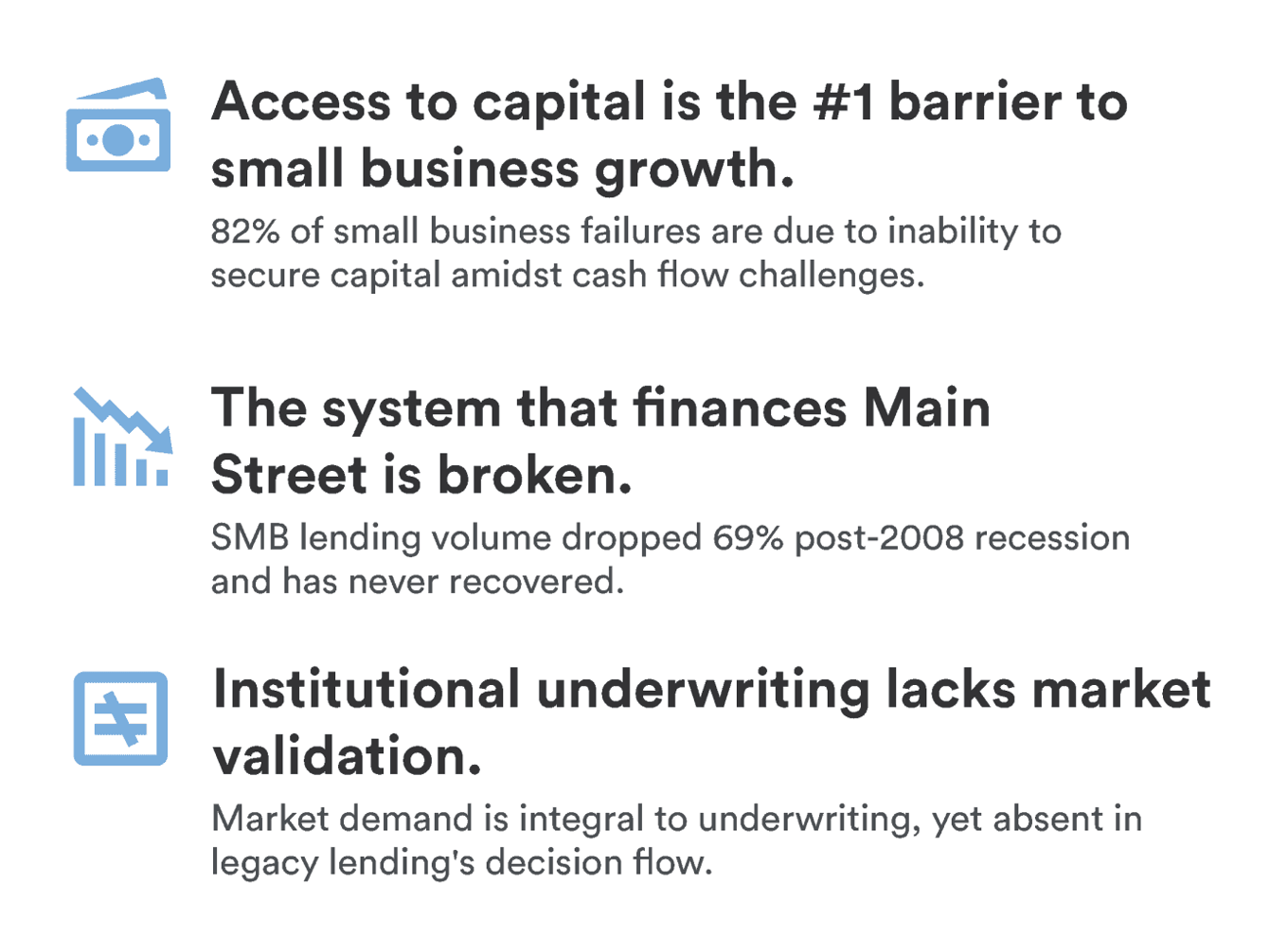

Main Street has a problem

Entrepreneurs are ready to rebuild main street, but legacy lenders are not. This is a massive, and massively inefficient market that fails local entrepreneurs looking to make a difference in their communities and contribute to local economies.

Solution

Mainvest is the investment platform for Main Street

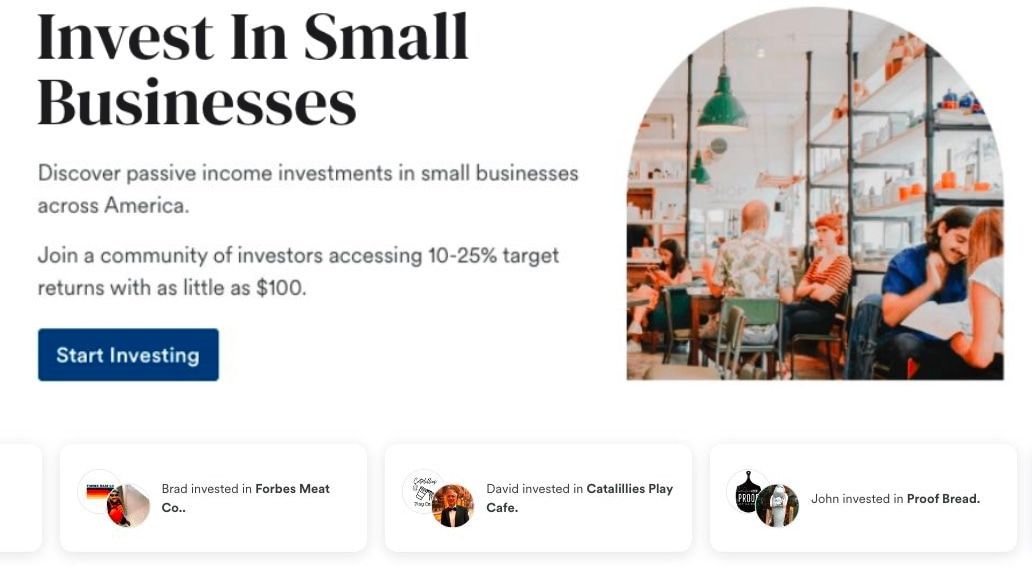

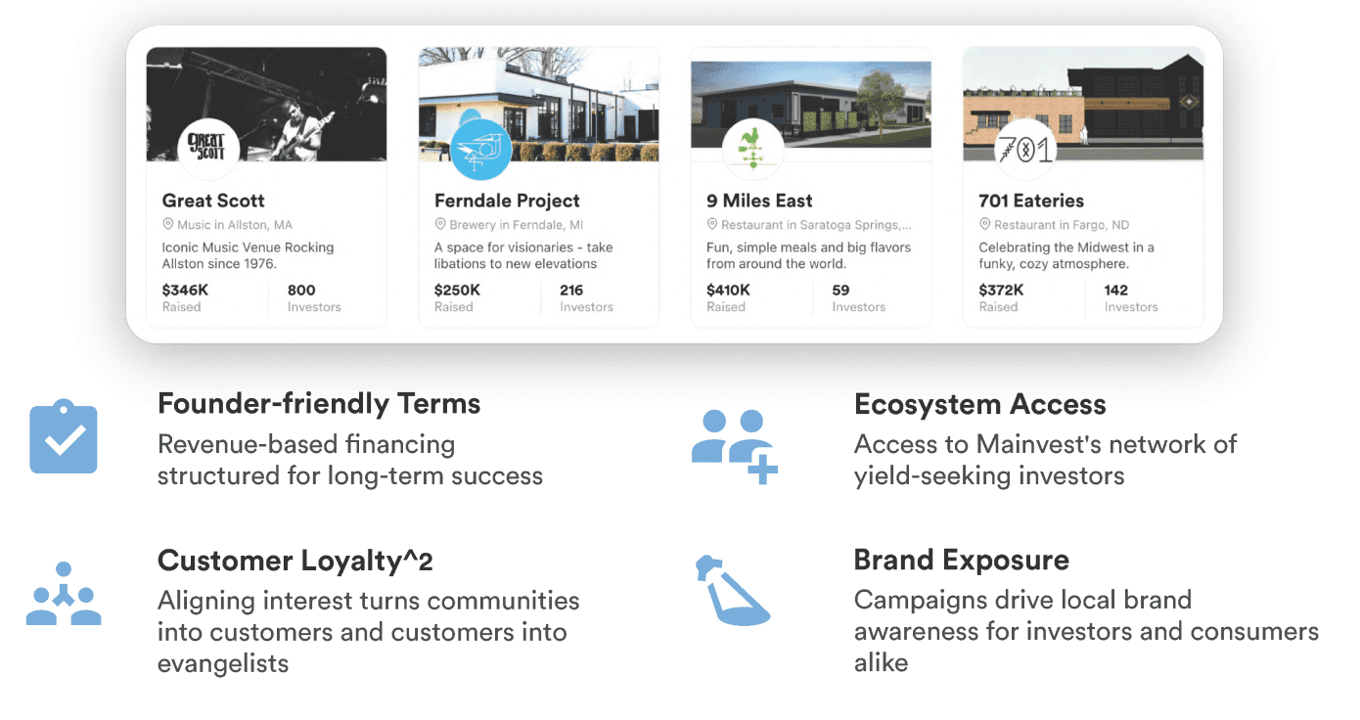

Mainvest lets everyday Americans participate in the economic growth of their communities by empowering them to start, scale, and invest in small businesses.

We give businesses the best-in-class solution for securing capital to empower growth and expansion by leveraging their local communities.

We give consumers access to an asset class of tangible, passive-income investment opportunities into small businesses across America.

Product

We are solving

the biggest challenges

small businesses face,

and unlocking a new high-yield

asset class for retail investors.

—

We've built a more efficient

market for SMB capital access

—

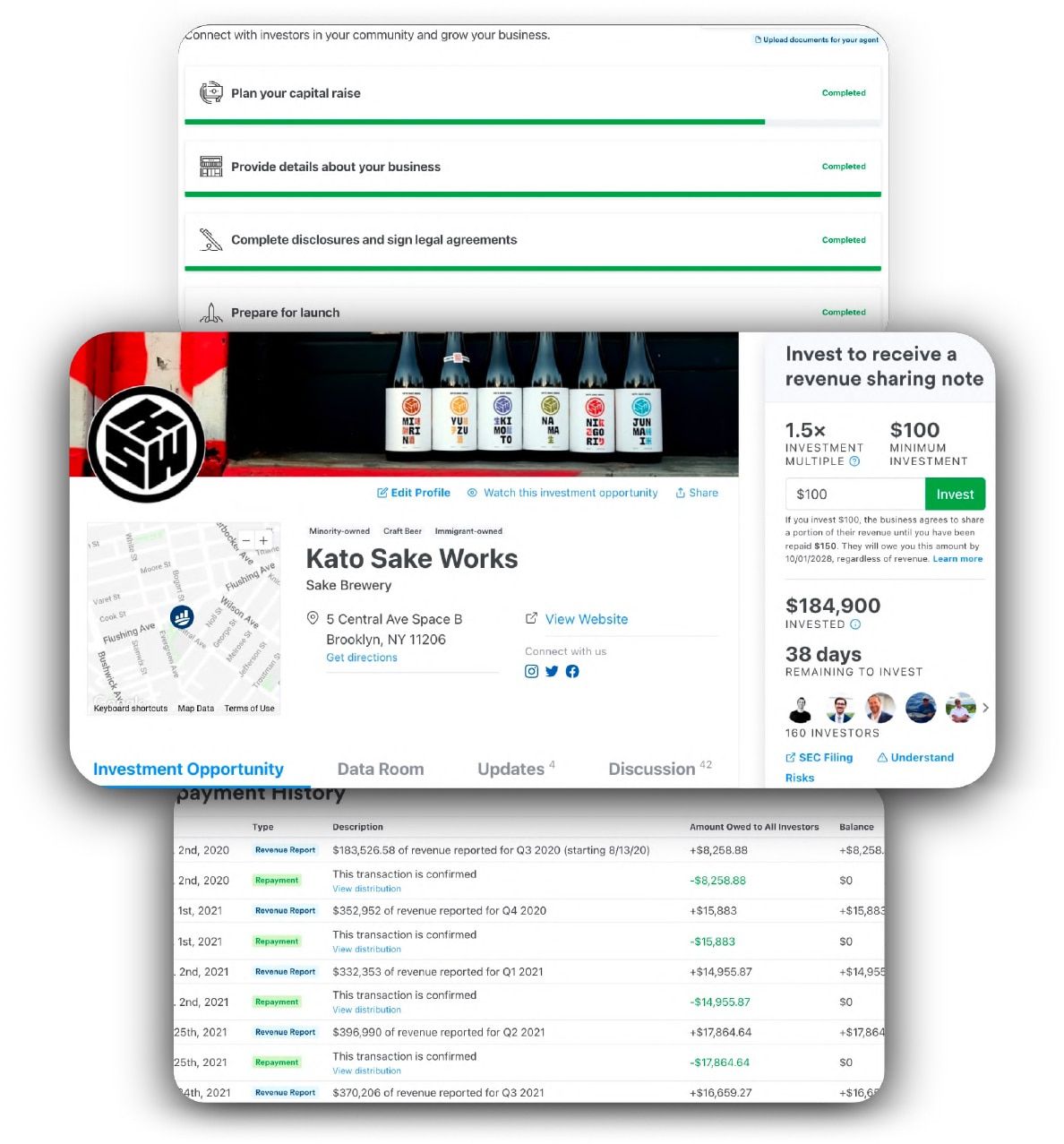

Small business owners have to be the CEO, CFO, and COO all while brewing the beer, baking the bread, and stocking the shelves. We've simplified our onboarding process to allow constrained founders the ability to simply and compliantly build an investment campaign.

Meanwhile, investors of all experience and income levels can easily & transparently access high-yield opportunities that have tangible impact on communities across the country.

Social layer tools encourage repeat investment and engagement with other investors, with more social tools coming soon.

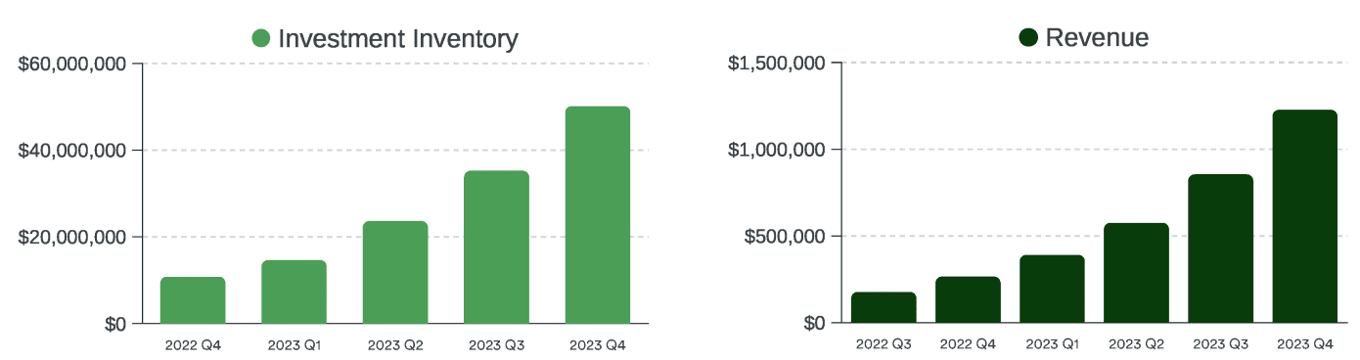

Traction

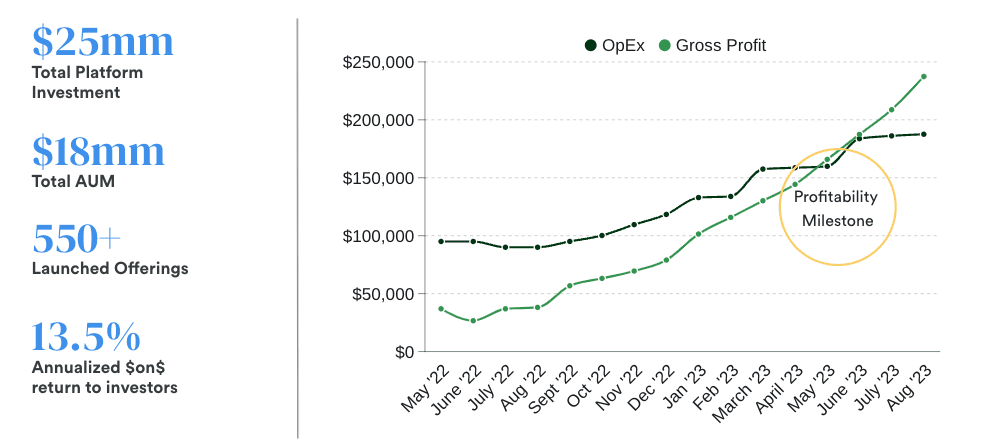

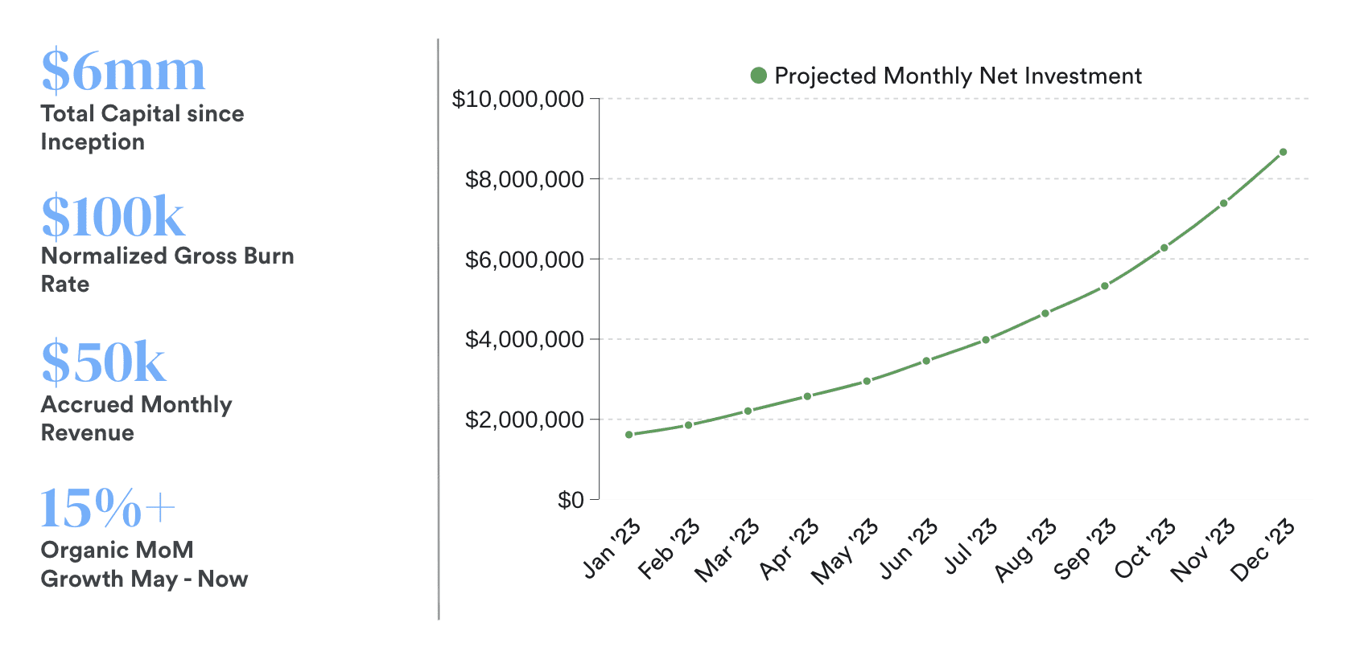

We've built a platform marketplace with a clear path to profit…

...through principled, capital efficient growth:

* Click here for important information regarding Financial Projections which are not guaranteed.

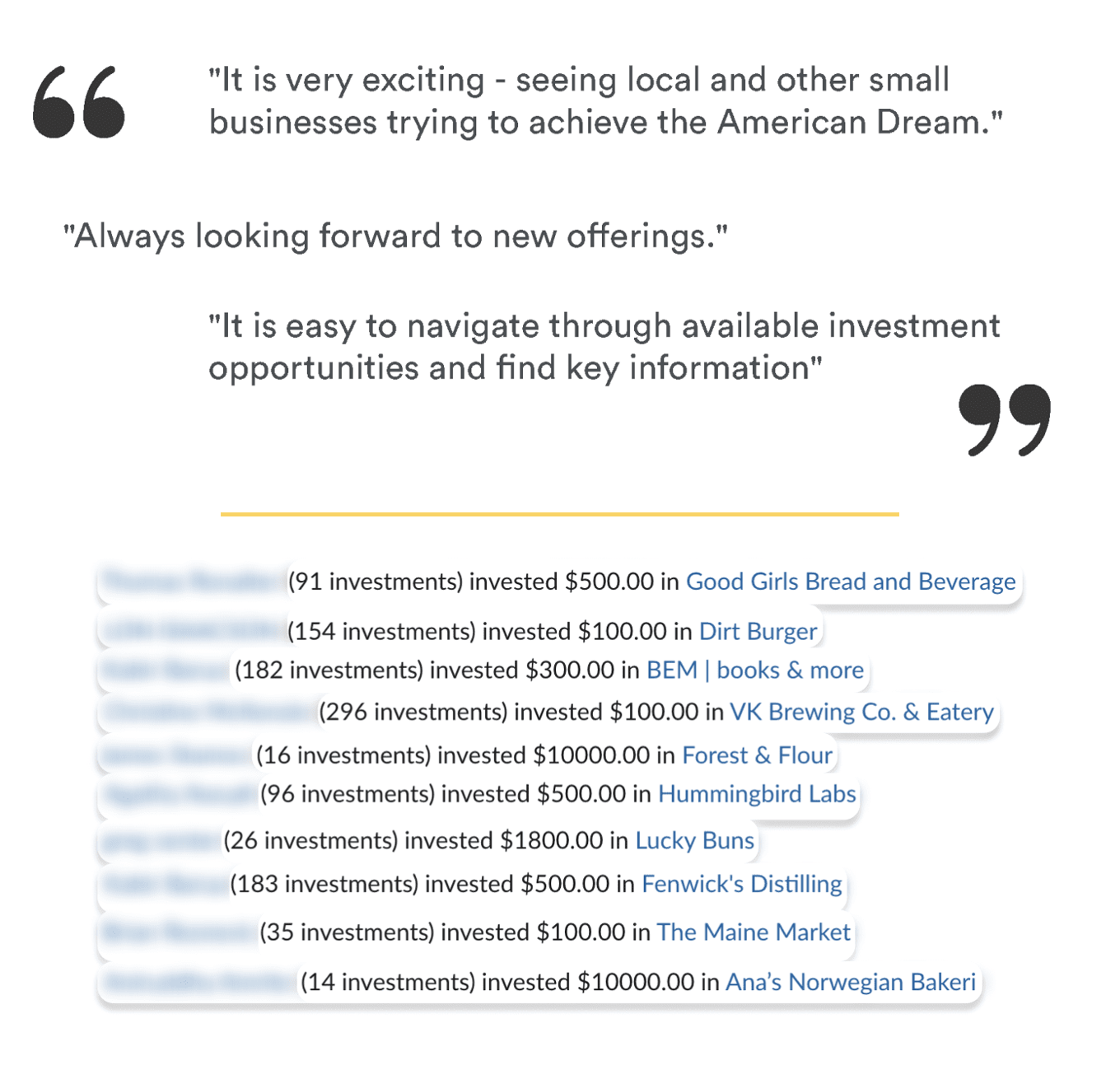

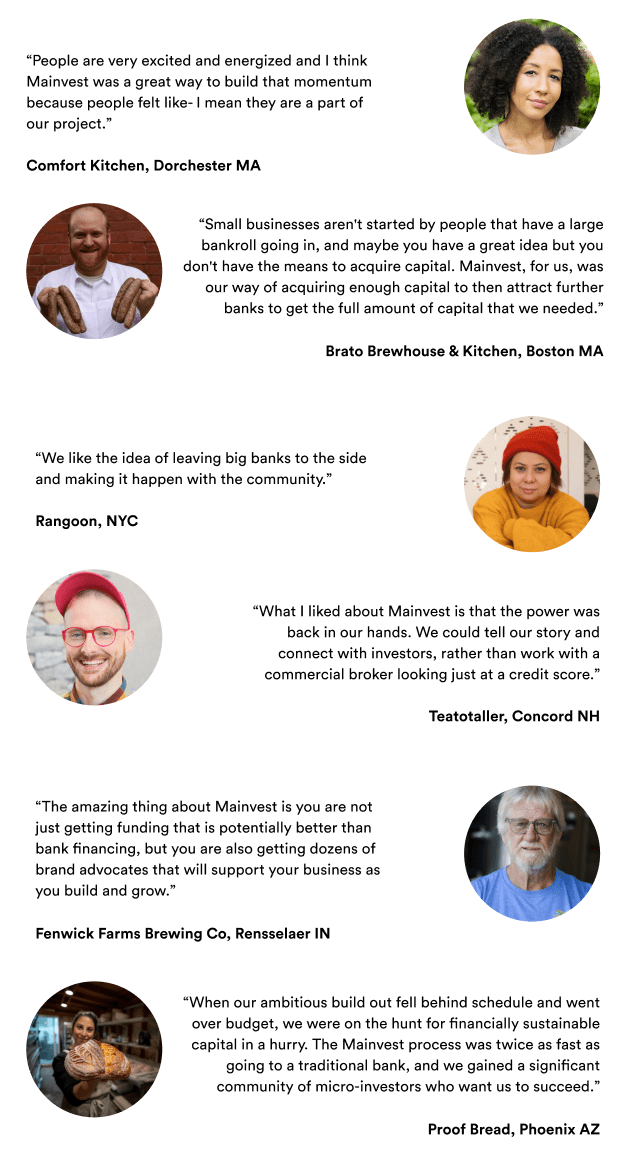

Customers

Making a tangible

impact in the lives of local entrepreneurs

World class customer support, founder-friendly terms, and genuine community engagement set us apart.

But don't listen to us — hear directly from small businesses that have worked with us:

World

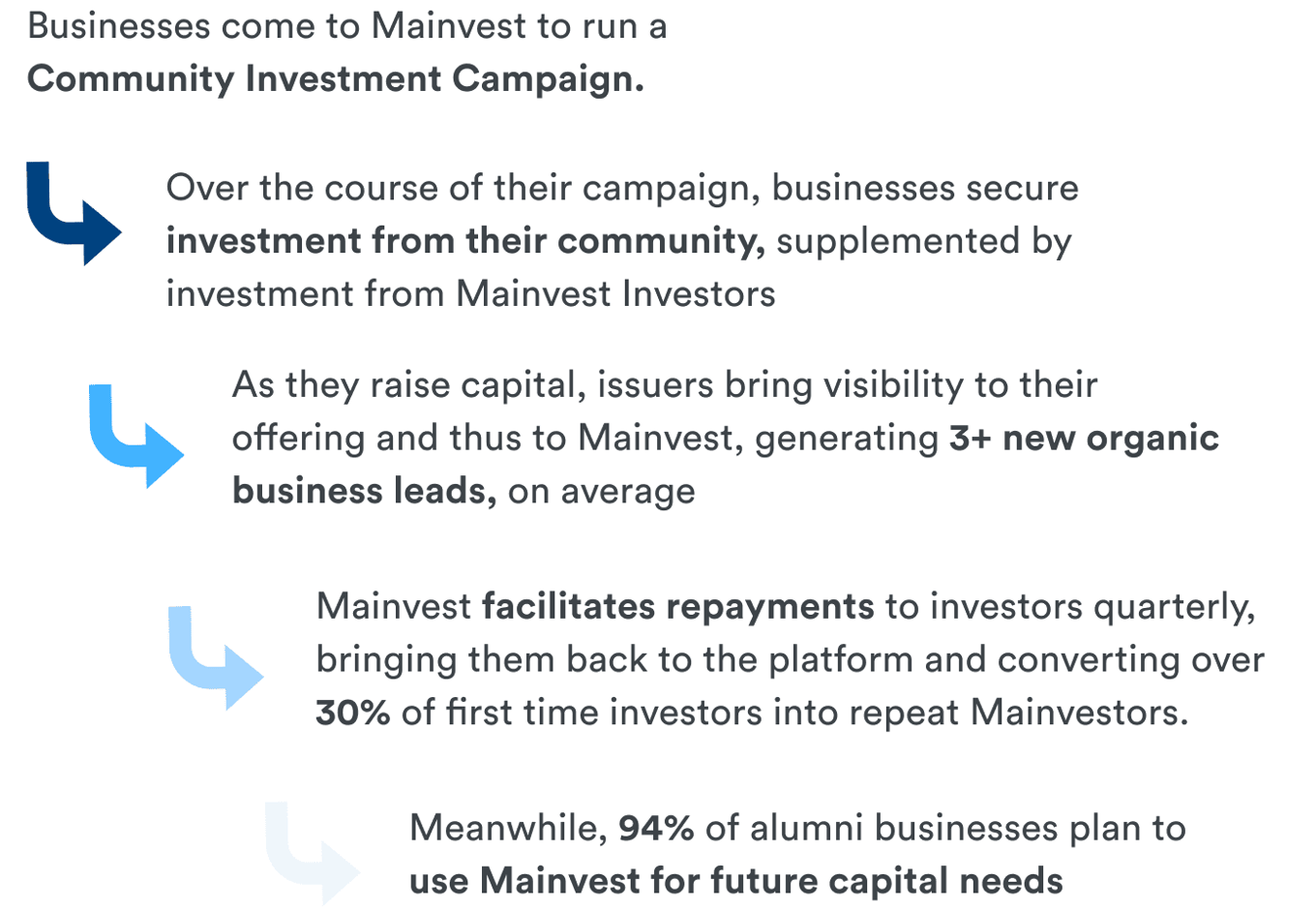

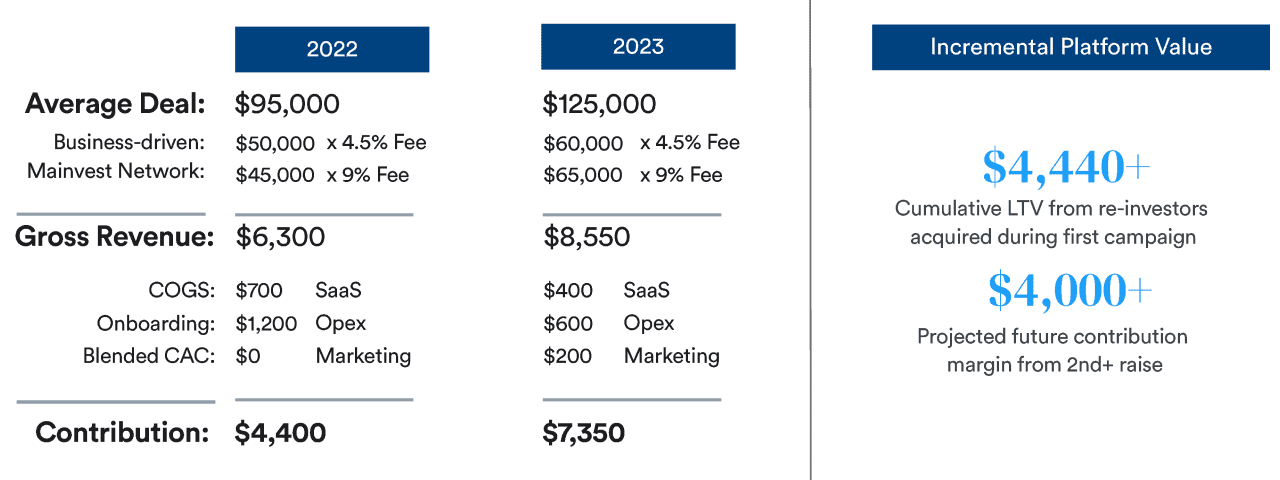

Business model

The Mainvest Model: An engine for organic growth

—

A revenue model driving

unit-economic efficiency

Our unit economics scale with

incremental long-term platform benefits.

—

When local markets drive

underwriting, SMBs flourish

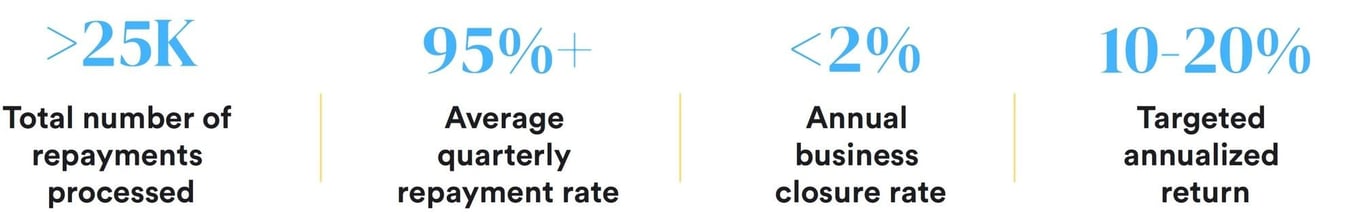

Mainvest's market underwriting process has led to our portfolio outperforming SBA-backed lending on every front.

Mainvest's portfolio default rate is 75% lower than the 10 year SBA average.

Mainvest's portfolio default rate is 75% lower than the 10 year SBA average.- Our business closure rate is 1/10th the national average, despite a pandemic.

—

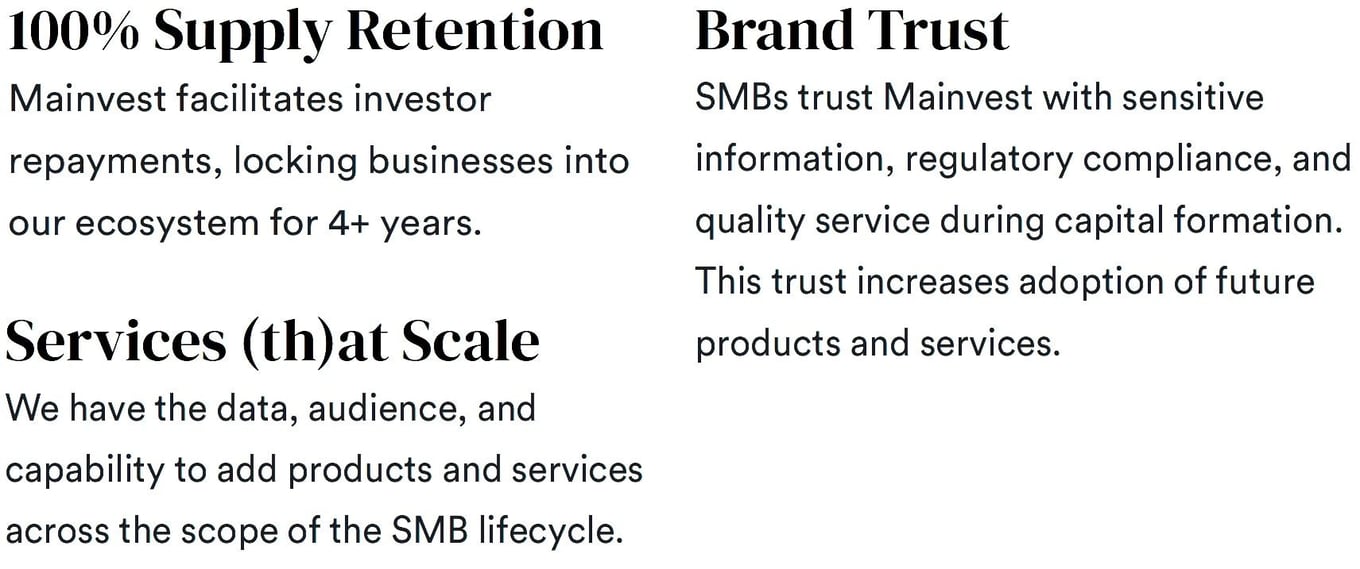

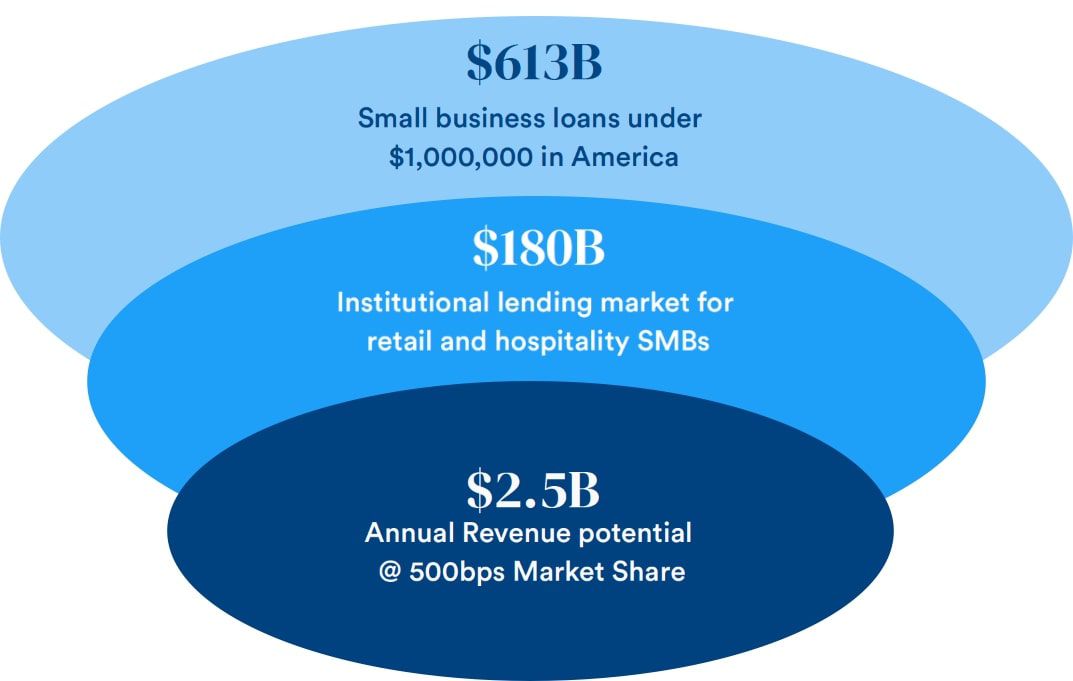

Businesses are in our

ecosystem for their entire lifecycle

The value chain starts with capital,

giving us an unfair advantage in SMB servicing.

Value unlocks across the SMB lifecycle:

Market

Why now:

Post-pandemic tailwinds unlock opportunity

1. Resurgence of high-impact supply channels

Pure-play digital channel acquisition is costly and inefficient in the SMB space.

SMB sales and conversion efficiency accelerates rapidly when paired with in-person sales and education, regional partnerships, and field marketing efforts.

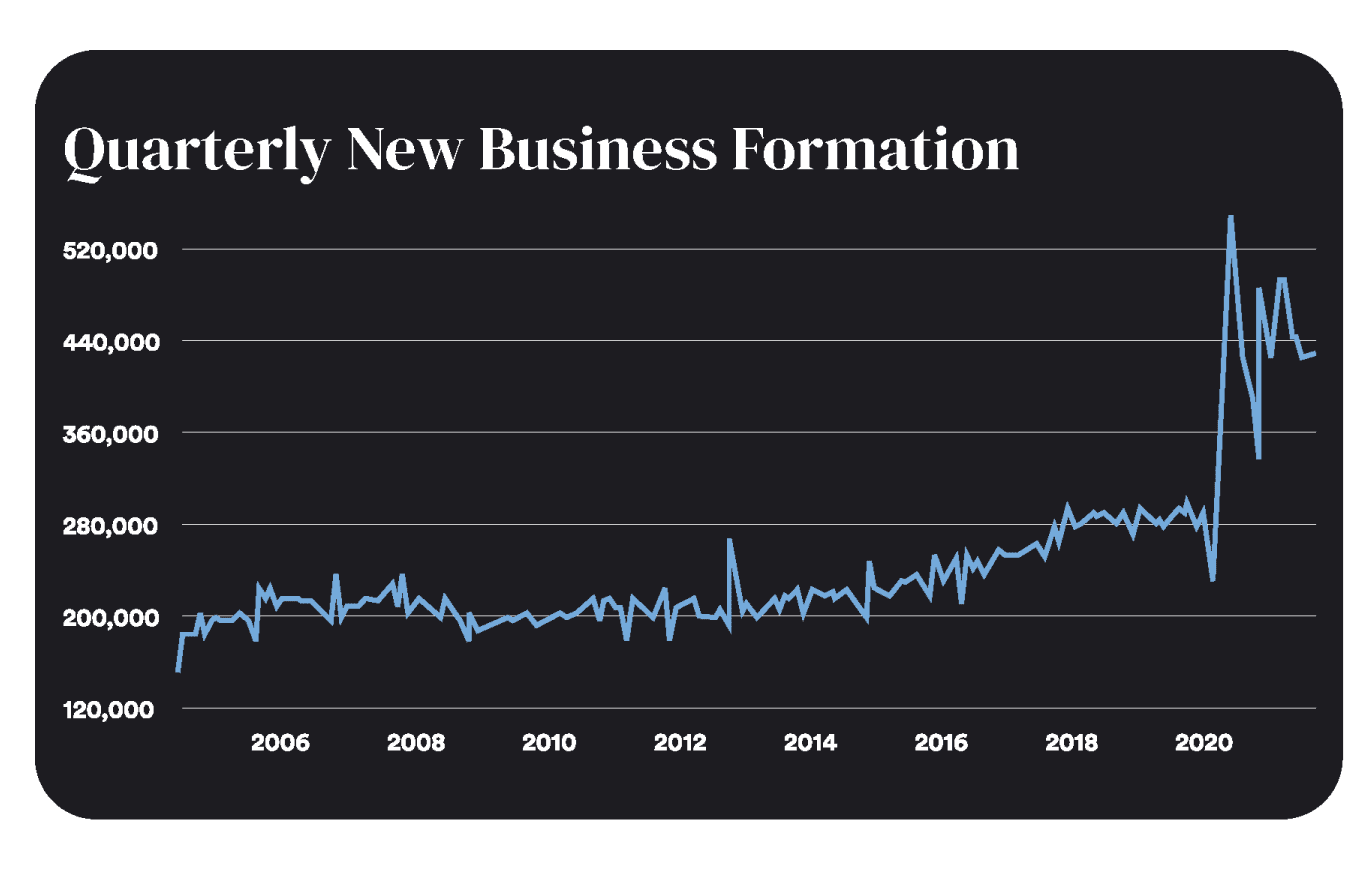

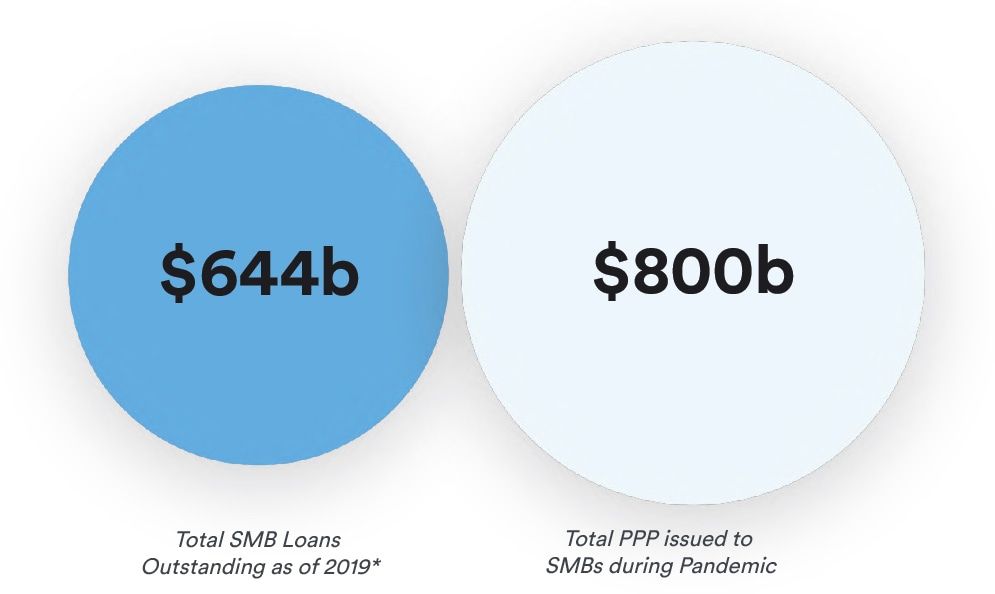

2. SMBs are entering a growth cycle

New business formations are at an all-time high, with capital needs that institutional lending is unable to service.

As the interest rate environment evolves, alternative funding sources become increasingly attractive to SMBs.

PPP is over, back to reality

Governmental relief (PPP) temporarily solved

capital access challenges for SMBs... for free.

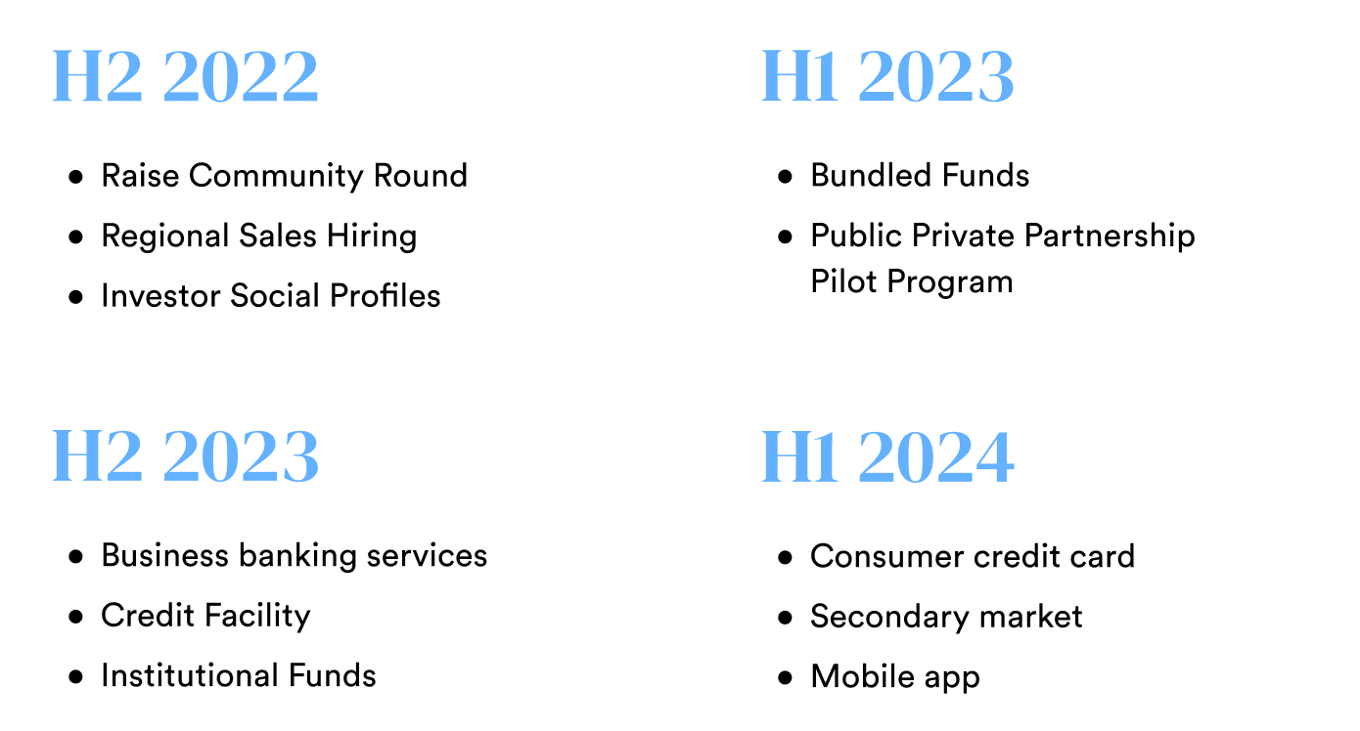

Vision and strategy

We've identified the levers to break escape velocity

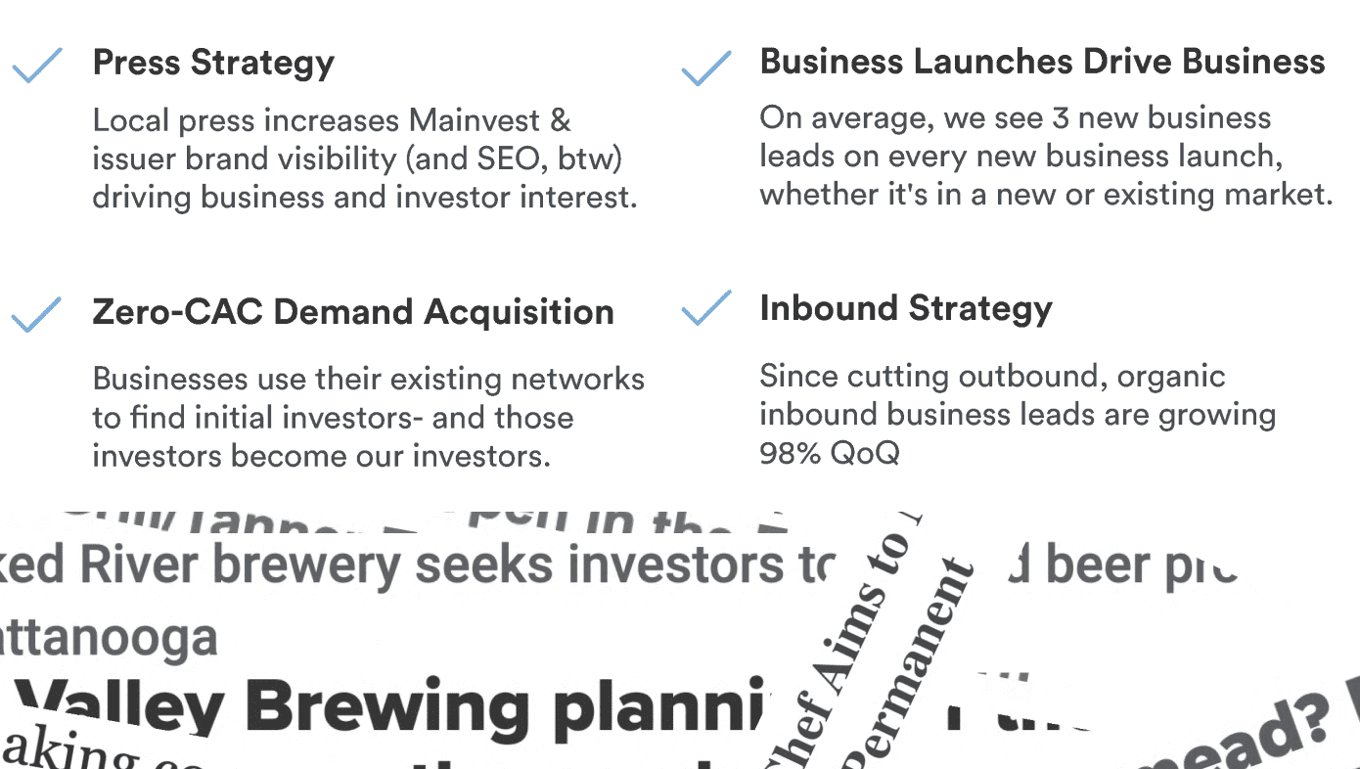

Our Unfair Advantage: Every Business Tells a Story

—

The key to 2023 growth: scaling our most effective, ROI-positive channels in our most mature markets.

—

—

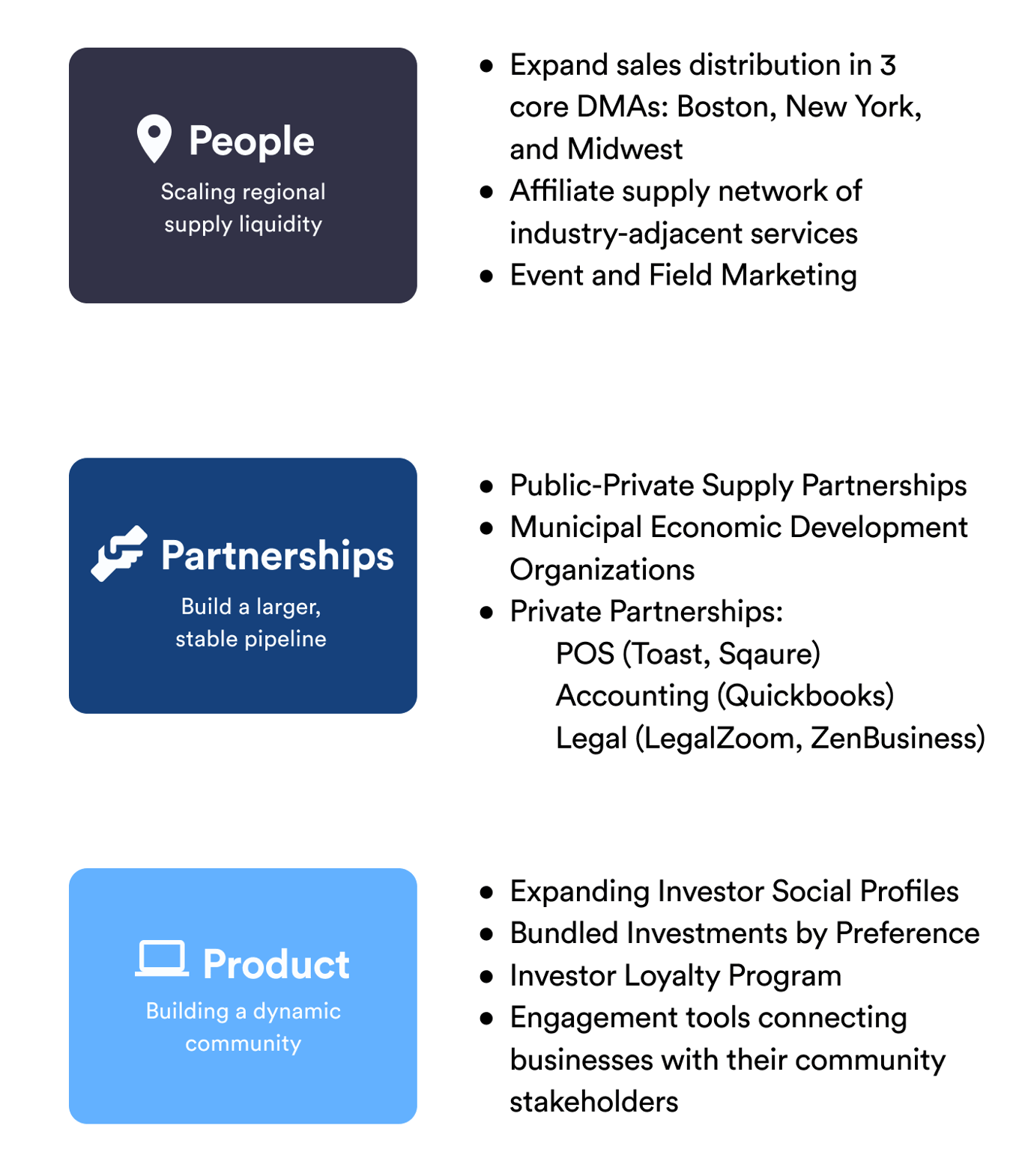

2023 Growth Strategy

Three Strategic Verticals:

—

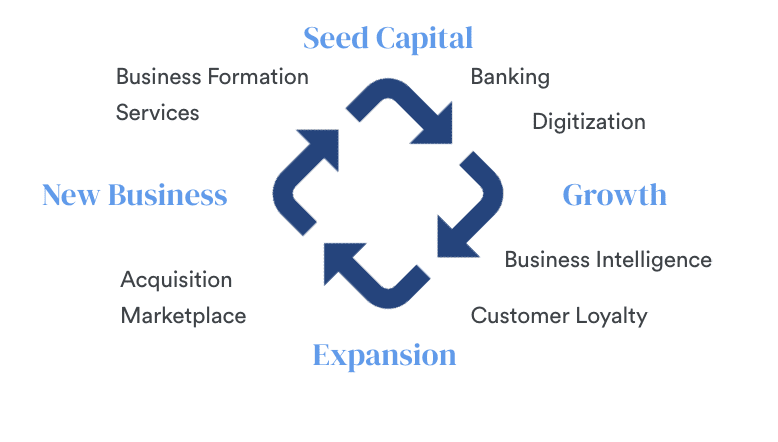

Our core product is just the entry point

We're building the future-state

infrastructure for the SMB ecosystem.

Funding

We're venture-backed and community-focused

We've built our product from the ground up with a focus on giving local entrepreneurs the best-in-class way to secure funding, drive community alignment, and provide returns to their investors.

Founders

Our team has the ideal blend of cross-industry talent to grow and scale

Nick Mathews

Nick Mathews

CEO

An expert in marketing and operational strategy, Nick led the team that launched Uber in Boston back in 2013. While launching Uber in new markets, both suburban and urban, he experienced firsthand local challenges around economic development. He founded Mainvest in 2018 with the goal of empowering communities to determine their own economic development, utilizing new regulations and novel investment vehicles to align incentives between local community members and small businesses.

Summary

$1–5M unlocks 5x+ growth & profitability in 2023

Key milestones and impact:*

* Click here for important information regarding Financial Projections which are not guaranteed.

- Expand regional sales presence to accelerate supply liquidity in key markets

- Invest in a product that keeps investors and businesses coming back for more

- Profitability within reach de-risks growth experiments with a strong and stable core business

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...