Problem

We noticed two consumer segments with unmet needs...

- Millennial moms struggling to feed their kids healthy and convenient meals

- Gen Z & Millennials seeking products that are delicious without sacrificing health or sustainability

Solution

The healthy breakfast you've been waiting for

Climate-friendly baking mixes that are stacked with fruits, vegetables and whole grains.

Otherworld is the only vegan pancake and waffle mix in the world containing upcycled superfoods.

Product

Created by our team of world-class chefs and registered dietitians

Otherworld™ mixes are 100% plant-based, meaning they don’t require milk, eggs or butter. Our mixes contain no added sugar, no artificial ingredients, no dairy, no nuts and no soy. All of our mixes are loaded with fruits, vegetables and whole grains for a healthy dose of nostalgia.

With Otherworld, consumers can now enjoy delicious pancakes, waffles and brownies that are good for you and good for the planet.

Traction

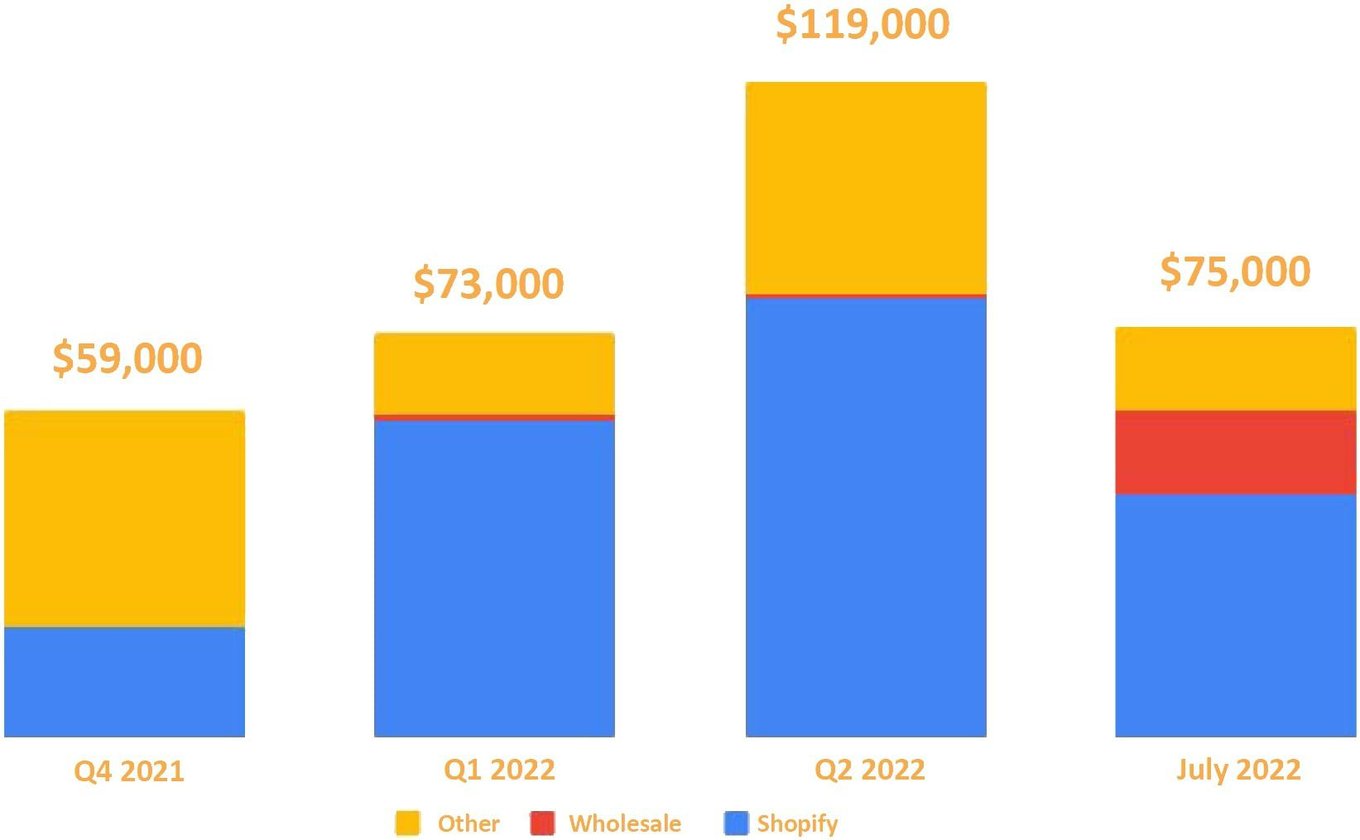

We've scaled effective marketing tactics to achieve a $900k revenue run rate

Strategic partners

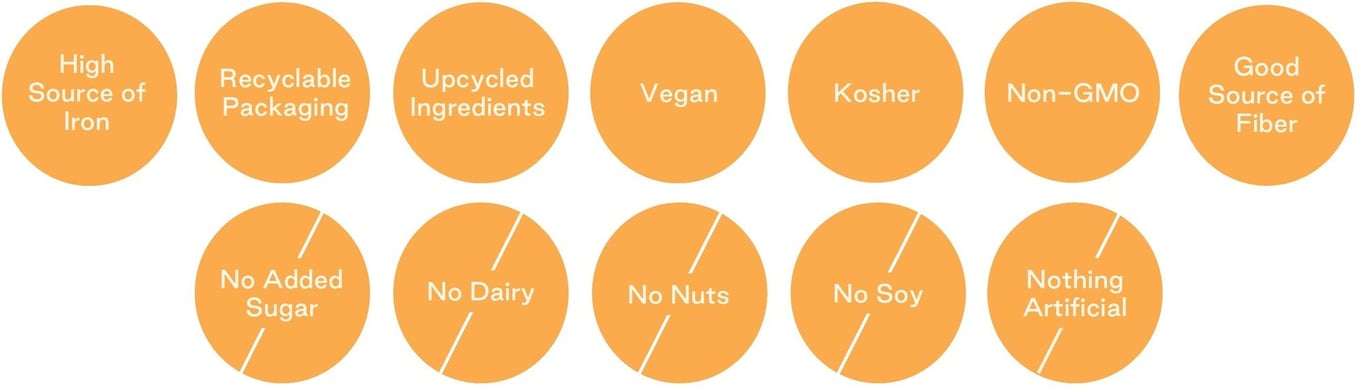

Otherworld in the News

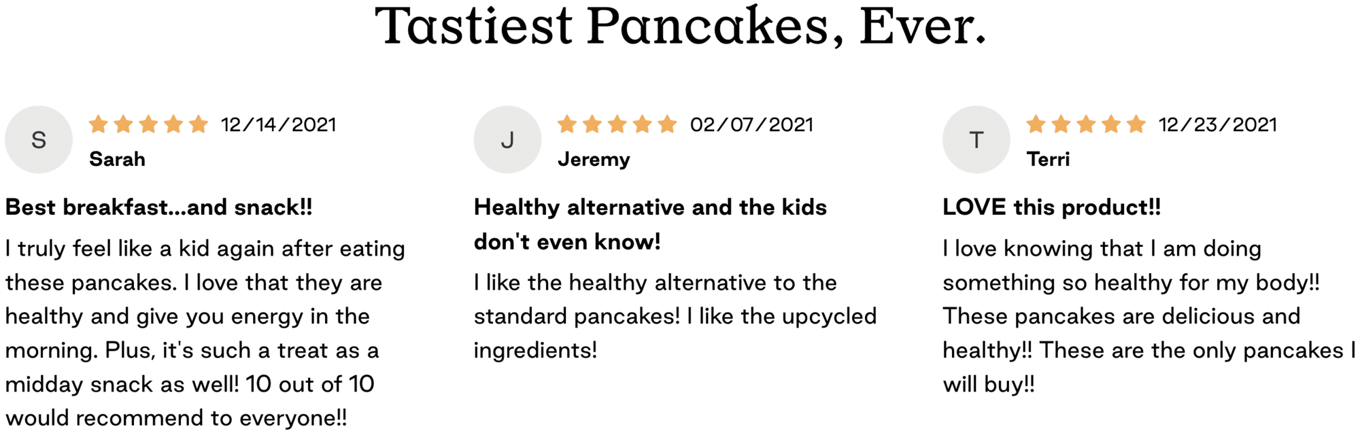

Customers

In our first eight months, we've established

product market fit

~99% five-star reviews

~12,000 Customers

Business model

We're building an omni-channel business

We proved product market fit by launching direct-to-consumer on our Shopify website (www.eatotherworld.com) in December 2021. Shortly after, we expanded our online offerings by launching other channels like Amazon, Weight Watchers, Snackmagic, Faire, Mable and Imperfect Foods. We are focused on other online channels to help grow distribution and we are in conversations with Thrive Market, Hungryroot and a variety of other online platforms.

Customer acquisition and ROAS are

becoming more efficient.

Cost of Customer Acquisition (CAC) = ~$40

Return on Ad Spend (ROAS) = ~.97

We are also focused on expanding our retail footprint. In September 2022, we launched nationwide with Fresh Thyme and we are in conversations with a variety of other Natural and Specialty Grocery stores like Whole Foods, Central Market, Sprouts, The Fresh Market and Foxtrot Market. Currently, our products are sold in about 100 stores and we have a clear line of sight into the next 500 stores over the course of the next 12 months.

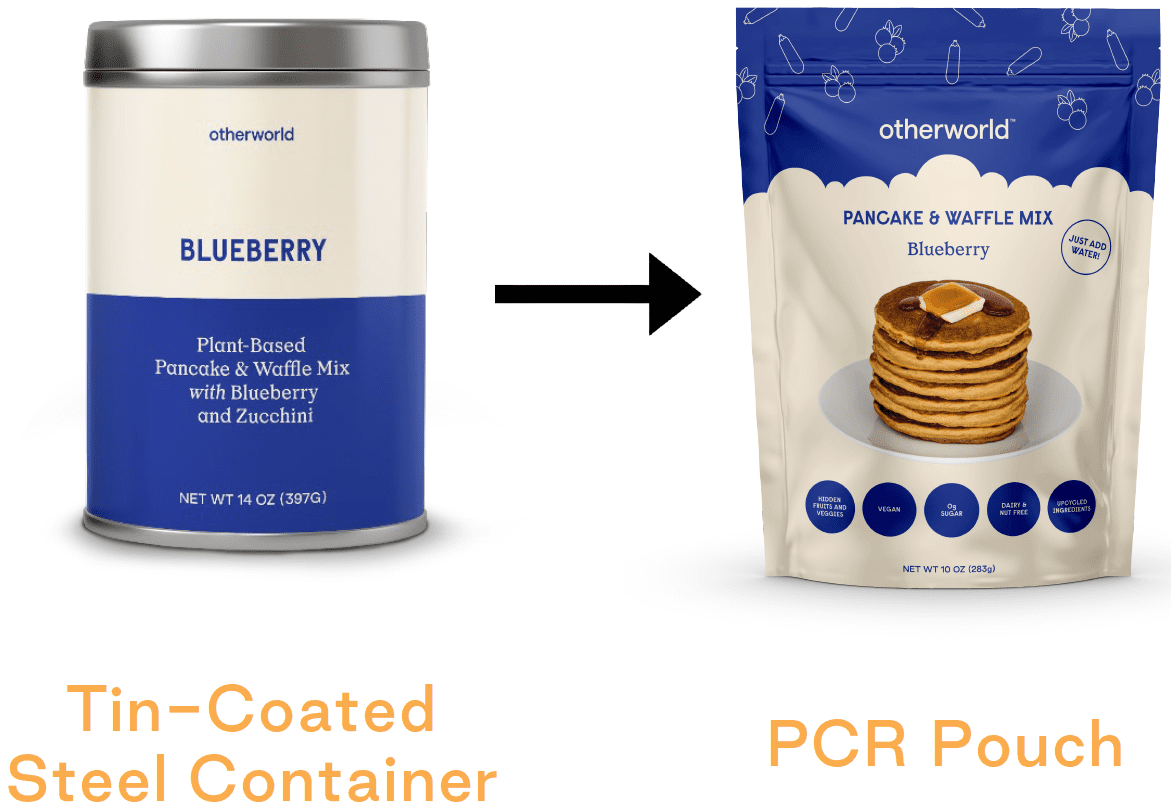

Ultimately, we believe that about 80% of our business will be done in retail stores and about 20% of our business will be done through a variety of online platforms so we are hyper focused on growing our store count in 2023 and beyond. In order to fuel this expansion into grocery we have hired a full-time Director of Sales and we need to reduce the costs of our mixes and increase our gross margin.

We are undergoing a packaging change to reduce our costs of goods sold and facilitate our expansion into grocery. In August of 2022, we switched co-packers, changed packing and reduced the volume of our mixes while layering in an inflationary price increase of about 12%. By taking all of these actions we were able to reduce out costs by over $3 per unit and increase our gross margin from 45% to over 70%.

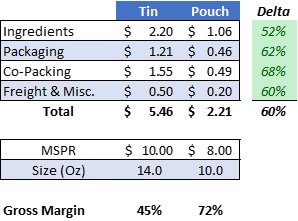

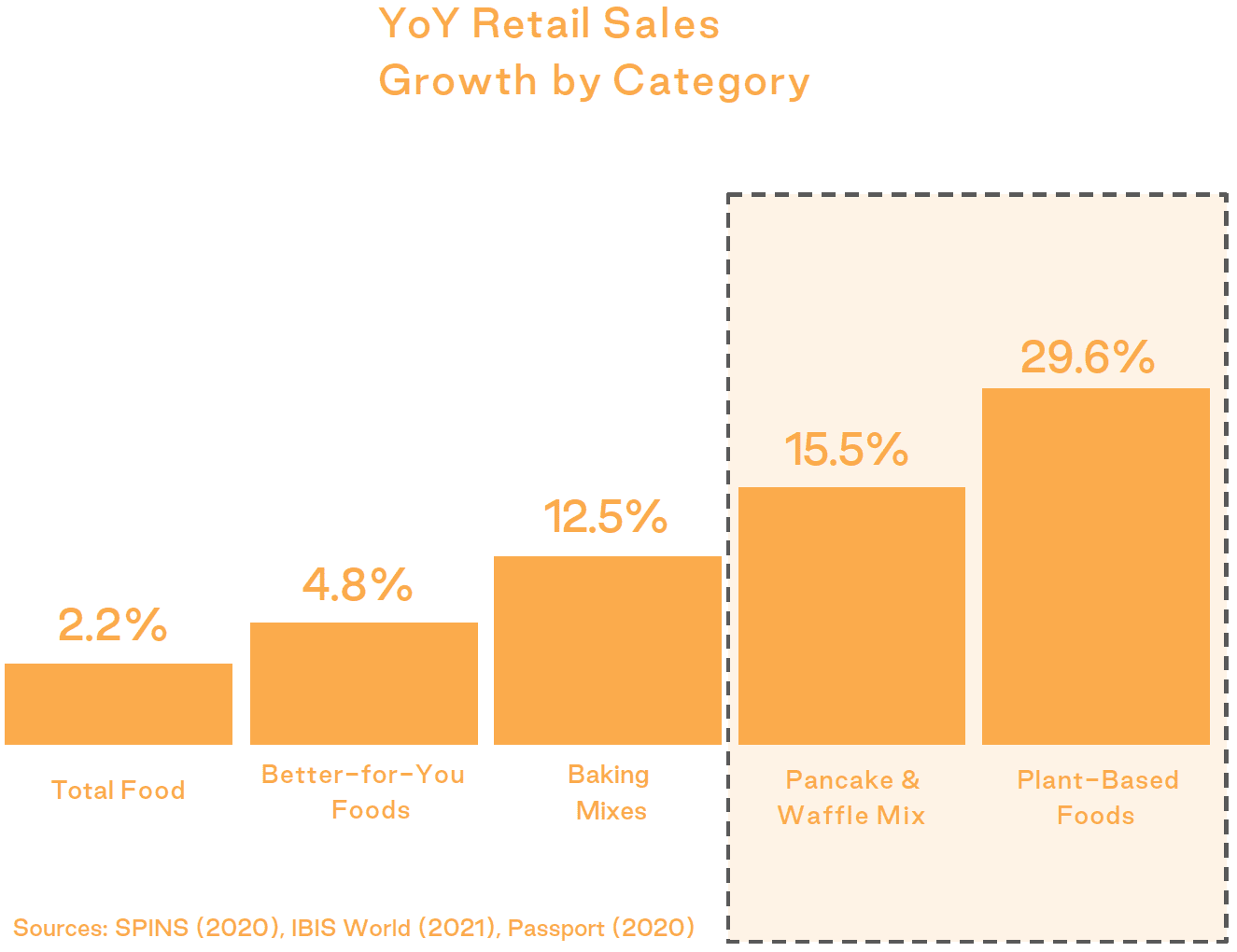

Market

We are capitalizing on two fast-growing categories

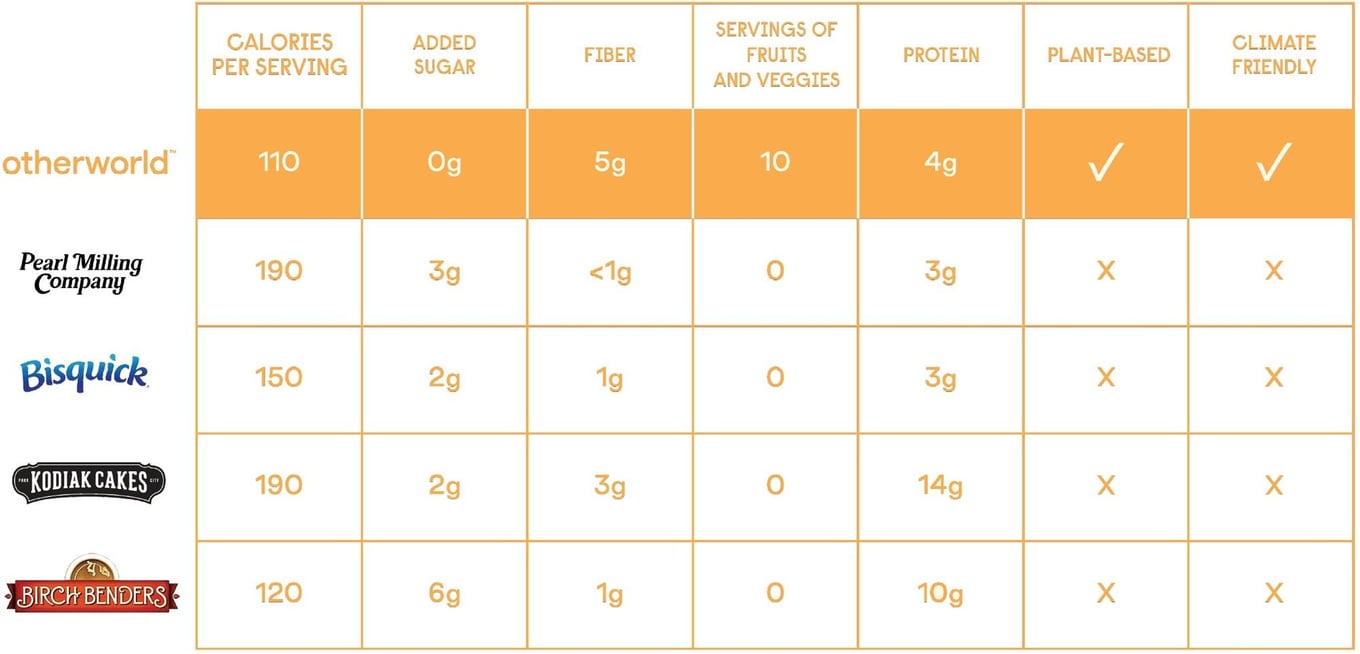

Competition

We win in the Pancake & Waffle Mix vertical

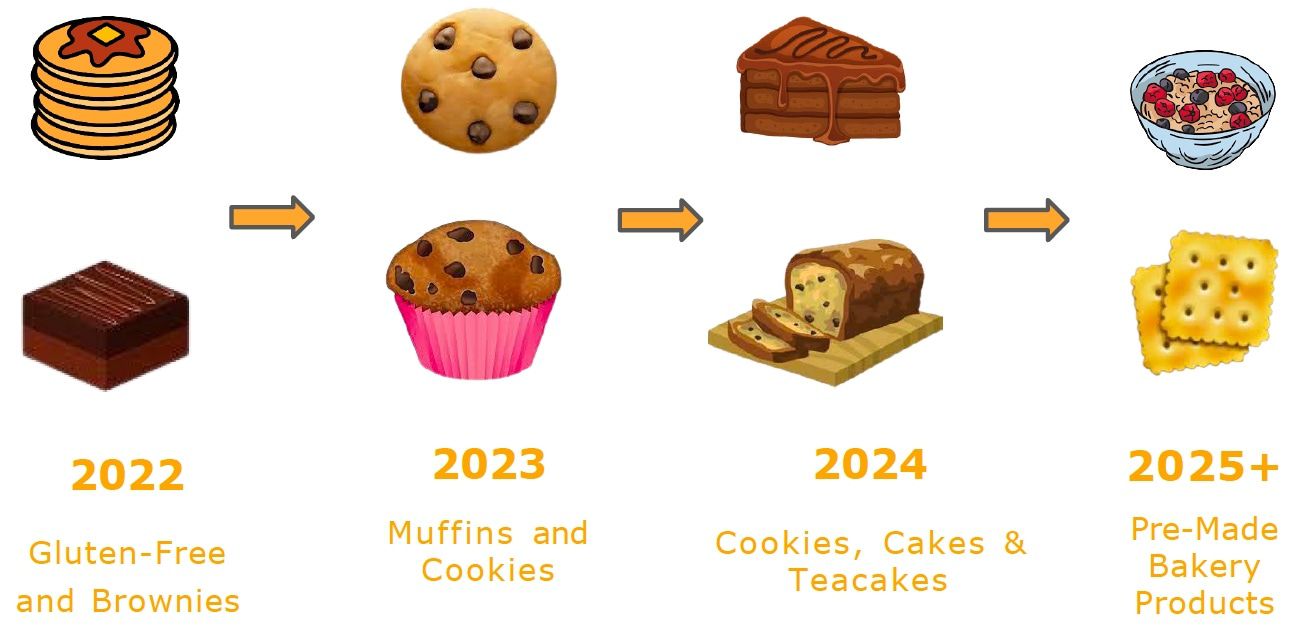

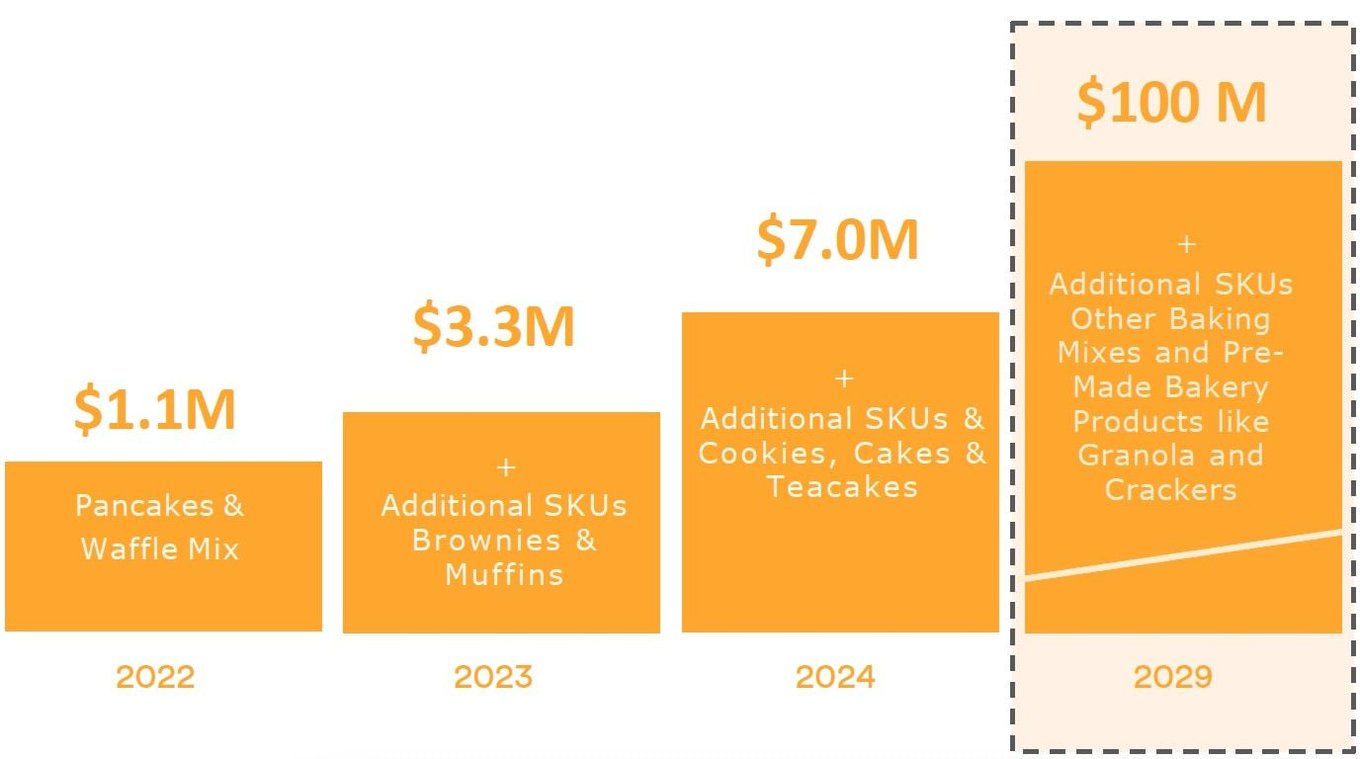

Vision and strategy

We will expand across the $35B baking mixes and prepared foods category

* Click here for important information regarding Financial Projections which are not guaranteed.

In December of 2021 we launched with four flavors of pancake & waffle mix. We have developed and released blueberry and gluten-free pancake & waffle mix and our brownies will be release by the end of September 2022. We plan on continuing to tackle the $35bn Baking Mix and Prepared Foods Category by creating more baking mixes for products like cookies and muffins in 2023 and then expanding into prepared food like pre-baked cookies, granola and crackers in 2024 and beyond.

Recent competitor exits average ~$500M

Impact

We're on a mission to make an impact on health & our environment

We're reinventing the way people consume healthy and sustainably-made food.

Plant-Based Ingredients

We are passionate about accelerating the transition to a plant-based future. All of our baking mixes are plant-based, or vegan, which means that no animal products are used. This also means that our mixes are dairy-free. We've cracked the code on delicious treats without using the milk, butter and eggs traditionally found in baking mixes! Eating plants as opposed to animals uses less energy and water resources, resulting in lower carbon emissions and a healthier planet.

We use only clean ingredients in our mixes: no added sugar, no dairy, no nuts, no soy, no GMOs and no artificial ingredients. We are focused on improving human health by helping people eat more fruits and vegetables through our delicious products. Each tin contains ten full servings of fruits and vegetables.

Tackling Food Waste

Every year in the U.S., 35% of food grown is uneaten and $408 billion worth of food goes to waste (source: reFED). At Otherworld, we are committed to growing the upcycled food economy and elevating food to its highest and best use. and are currently using nine upcycled ingredients across our mixes. We are thrilled to be partnering with Imperfect Foods, Outcast Foods. EverGrain Ingredients and Agricycle Global to tackle food waste. Our beetroot, banana, apple, sweet potato, cauliflower, zucchini, pumpkin, cassava flour and barley fiber are all "upcycled" which means that the ingredients would have otherwise been wasted. Using upcycled ingredients not only helps divert food waste from the landfills but also allows for food production that does not require additional land use.

Sustainable Packaging

Our metal cans are 100% recyclable, widely accepted in recycling facilities across the nation and can be recycled directly in your curbside bins. Our metal cans are also made from at least 40% recycled content, meaning the material is not new, but rather reused and diverted from the waste stream. Otherworld™ cans are sourced from Independent Can in Maryland, USA. Learn more about Independent Can's commitment to sustainability here.

Carbon-Neutral Shipping

We've partnered with Cloverly to provide the option of carbon-neutral shipping for all shipments. Based on your package's weight, origin and destination, Cloverly calculates the carbon emissions generated from each shipment at checkout and then purchases an offset instrument to reduce, avoid or sequester the same amount of carbon elsewhere in the environment. All Cloverly offsets are verified by third parties, such as Gold Standard, the Verified Carbon Standard (VCS) and the American Carbon Registry (ACR). Learn more about carbon offsets HERE.

Funding

Equity raised: $1.3M

As of September 2022

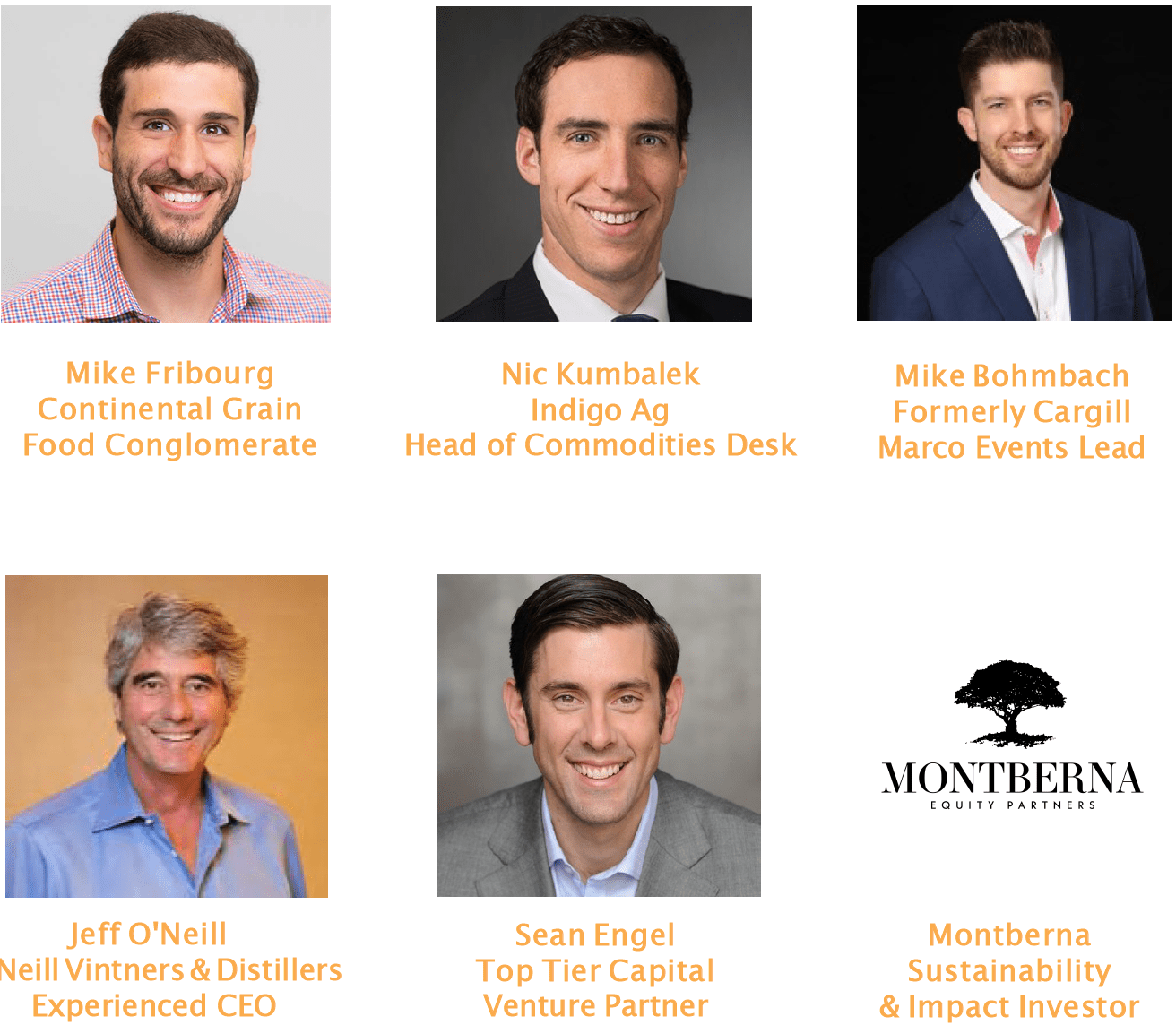

Strategic Investors

Founders

Jen Ballen

& Joe Magliano

Jen Ballen, CEO

Sustainability, Operations and Supply Chain Expert

Sustainability, Operations and Supply Chain Expert- AB InBev, Drinkworks, & Indigo Ag

- MIT Sloan School of Management, MBA

- Lehigh University, B.S. Marketing & Finance, summa cum laude

Joe Magliano, CPO

Bankruptcy & Restructuring and Food Expert

Bankruptcy & Restructuring and Food Expert- Management Consulting at Alvarez & Marsal

- Professional Chef & Hospitality Consultant

- Lehigh University, B.S. Finance

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...