A total of nine companies have been accepted into Bayer's Digital Health Partnership Program, as annouced on the EU Start...

Problem

7 million people in the United States suffer from polycystic ovarian syndrome (PCOS)

Status quo PCOS care fails patients in many ways.

PCOS impacts 10% of females with the following symptoms:

- Menstruation: Irregular or absent menstrual cycles, painful periods, heavy bleeding, infertility

- Metabolism: Trouble losing weight, insulin resistance

- Skin / hair: Acne, hair loss, hirsutism, skin discoloration

- Mood: Anxiety, depression, insomnia

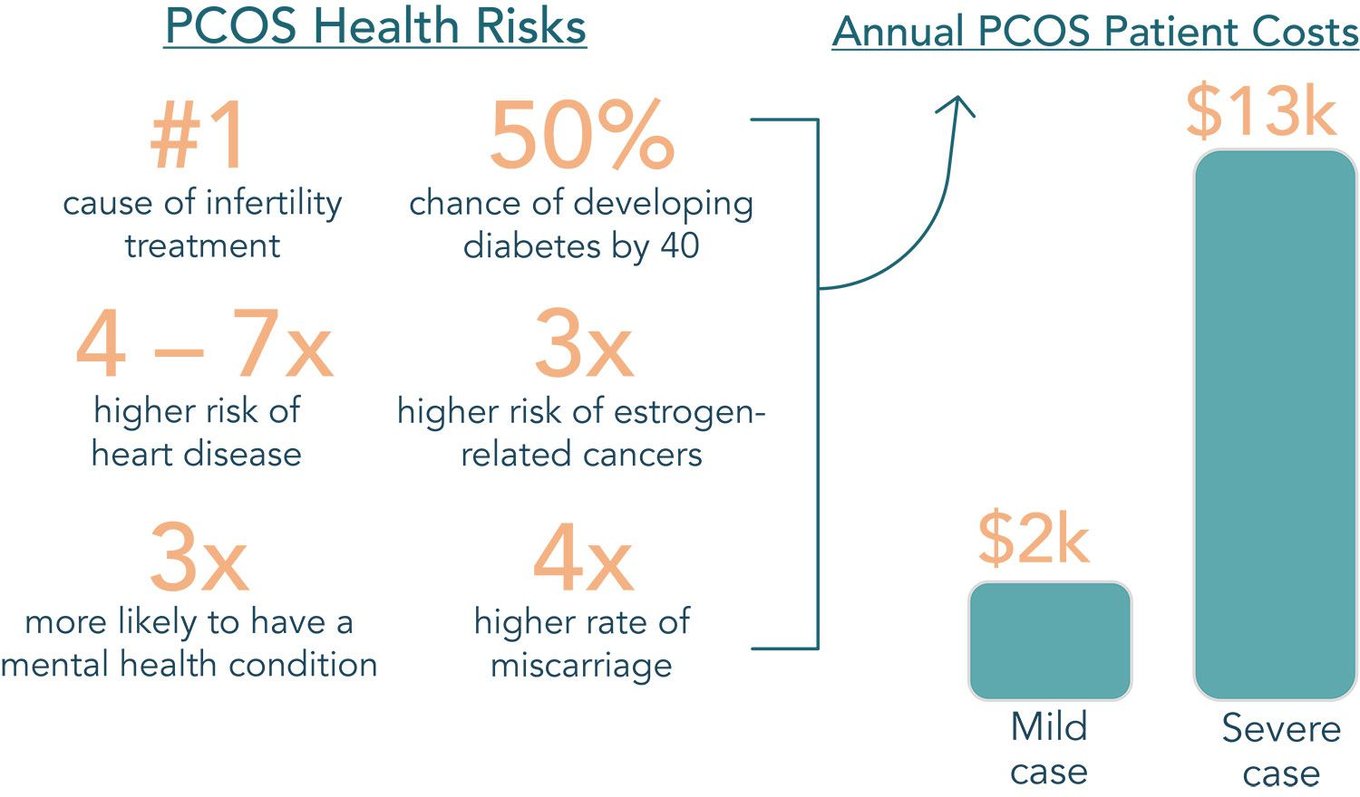

While best known for its fertility implications, PCOS is a whole-body condition that leads to serious complications if left unmanaged. But that status quo treats PCOS symptoms discretely and reactively, and the patient experience is full of frustrations and gaps.

Solution

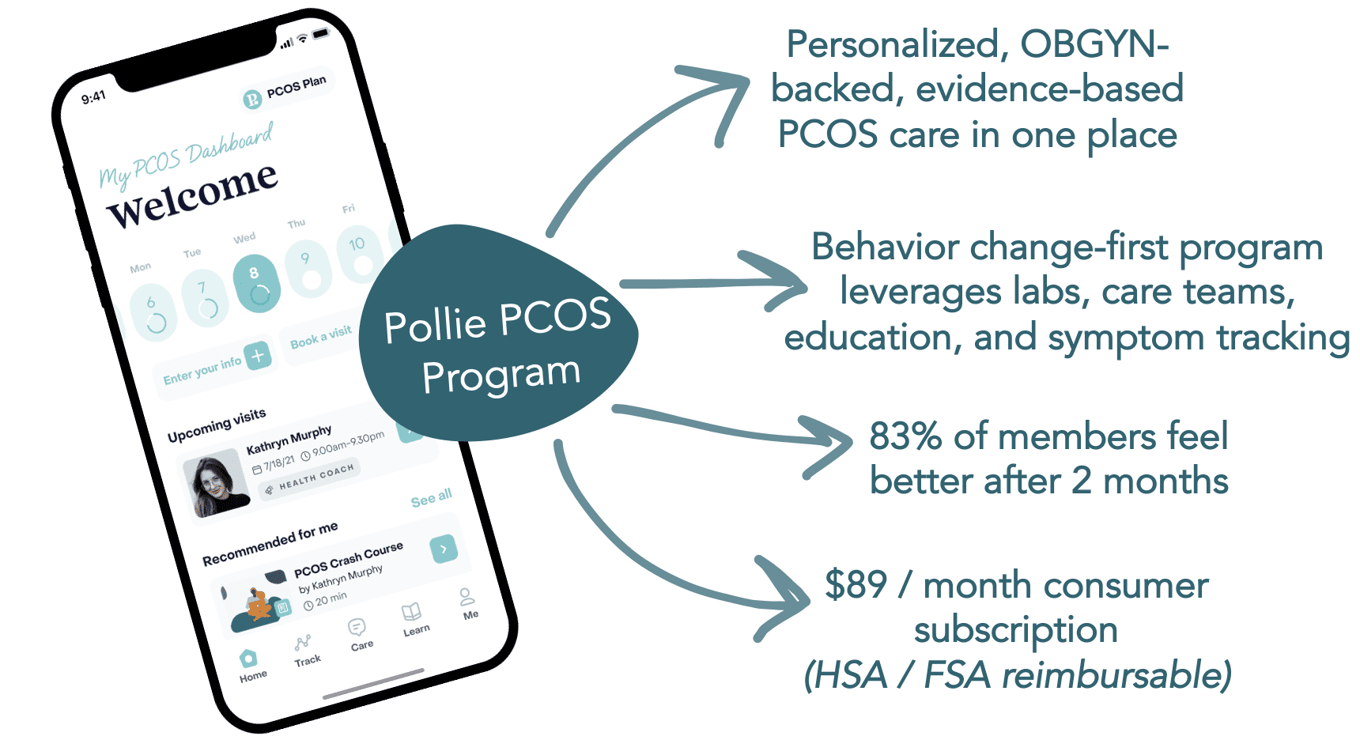

Pollie is redefining PCOS care with our personalized and sustainable digital program

And PCOS is just the beginning: our existing program used as a playbook for expanding into other hormone, autoimmune, and digestive disorders that impact women.

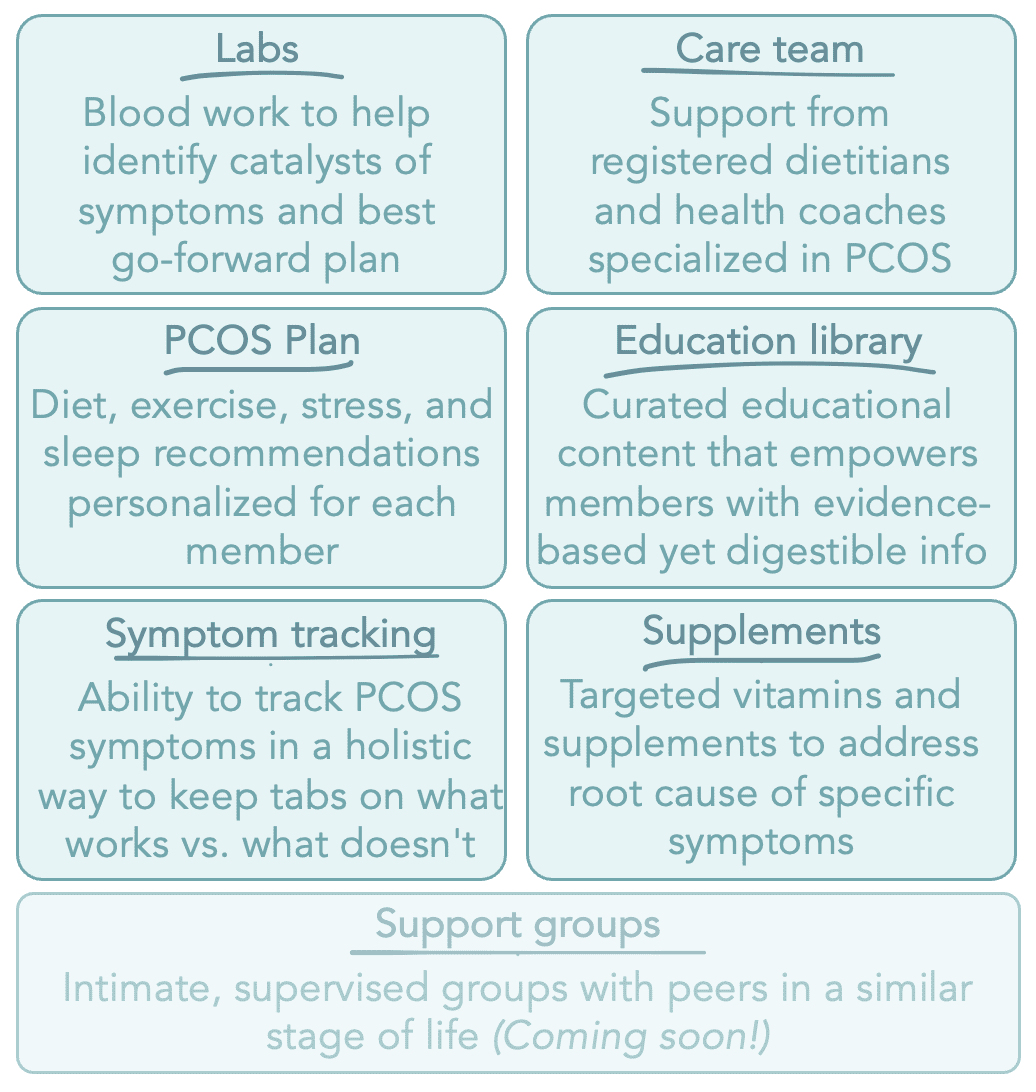

Product

Pollie's PCOS iOS mobile app:

What’s included?

Our approach helps pinpoint the catalyst of symptoms in a convenient, efficient, and personalized way.

Traction

Over 80% of our members see an improvement in symptoms in just 2 months

With nearly entirely organic marketing and almost no paid advertising, we have achieved the following:

- Nearly 1,000 app downloads

- Over 95% satisfaction with Pollie care team visits

- 90% of Pollie members would recommend our app to a friend, colleague, or family member

- 96% weekly active users

- 45% daily active user / monthly active user ratio

Customers

Pollie's target members are menstruating people with a PCOS diagnosis

90% of our members are finding us

through social media, and 10% through search.

Our members come to us because they are not satisfied with the current quality or quantity of care they are receiving and are looking for additional support.

Our members currently live all across the United States and Canada. Most of our members are 25 – 40 years old and are either are young professionals or actively trying to conceive.

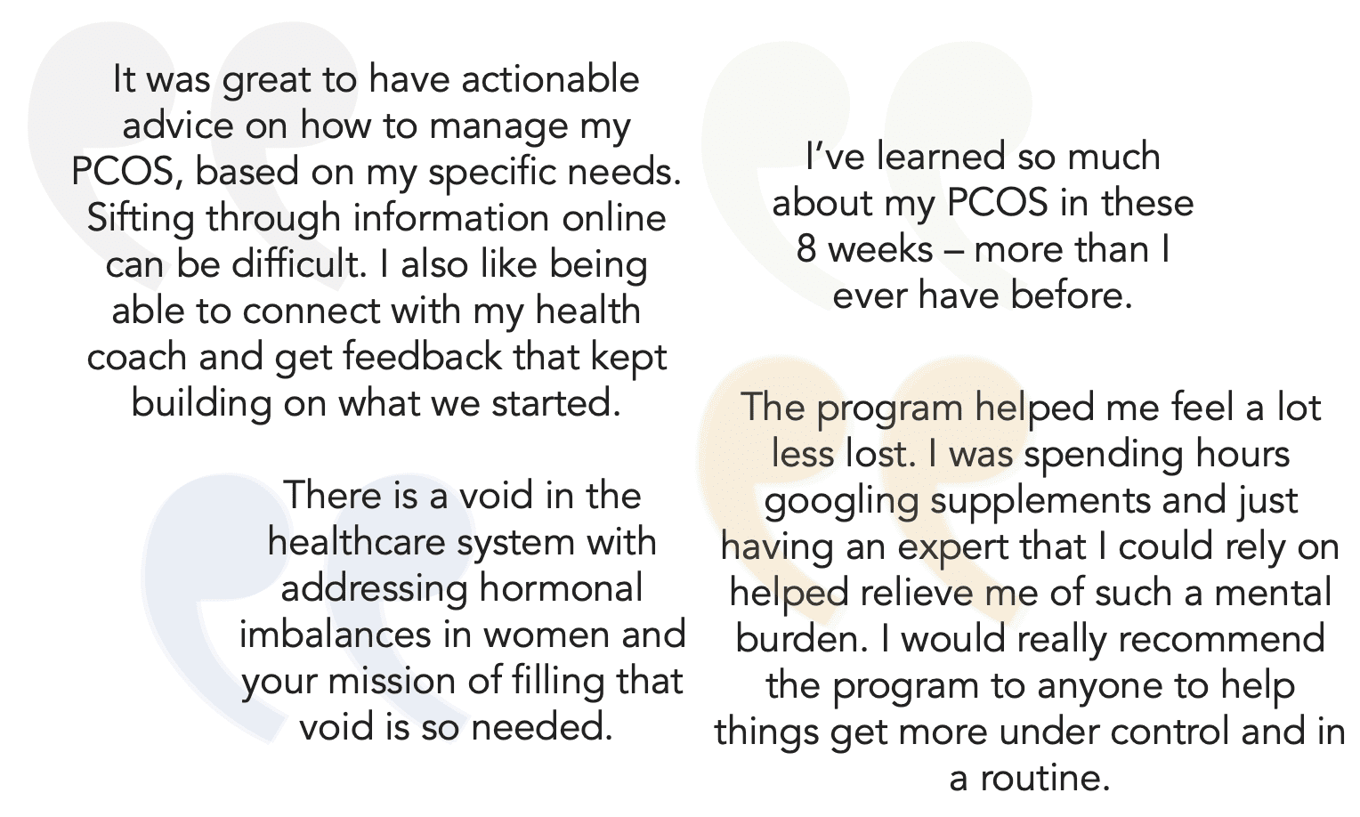

Positive early feedback validates a need for Pollie's app. Here's what our members are saying:

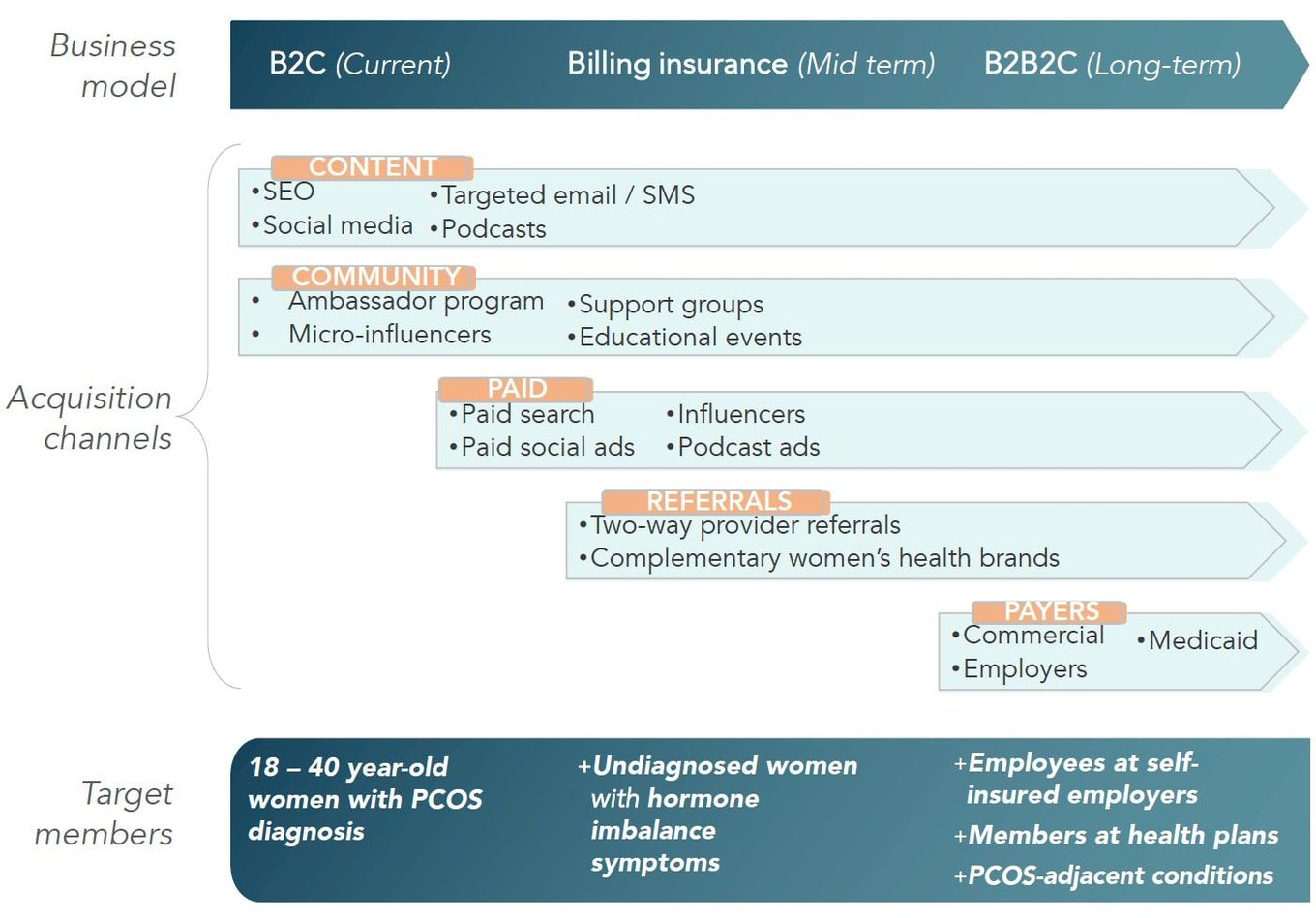

Business model

Today we monetize with an out-of-pocket subscription

In the future, we will contract with

payers to expand access to quality PCOS care.

Similar to other chronic disease management startups, we are working toward a B2B2C model to help payers (commercial health insurance, self-insured employers, and Medicaid plans) lower care costs for their PCOS patients.

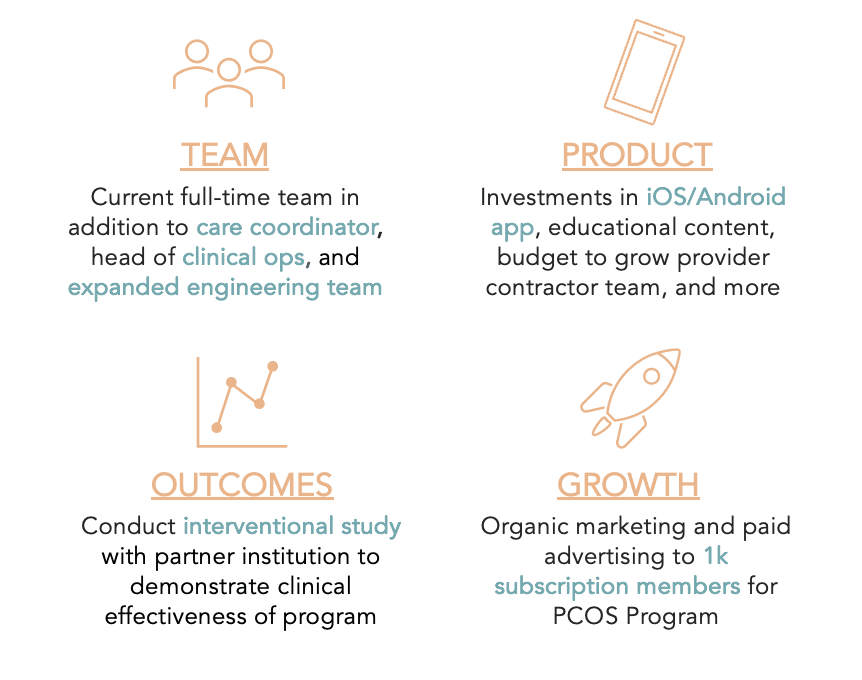

One of the major milestones of our seed round will be to run an interventional study.

Pollie's approach is built on abundant peer-reviewed research that demonstrates our interventions are effective. This, combined with our early outcomes metrics, signal that this study will demonstrate a significant improvement in PCOS health and cost outcomes. This will put us in a strong position to sell to payers.

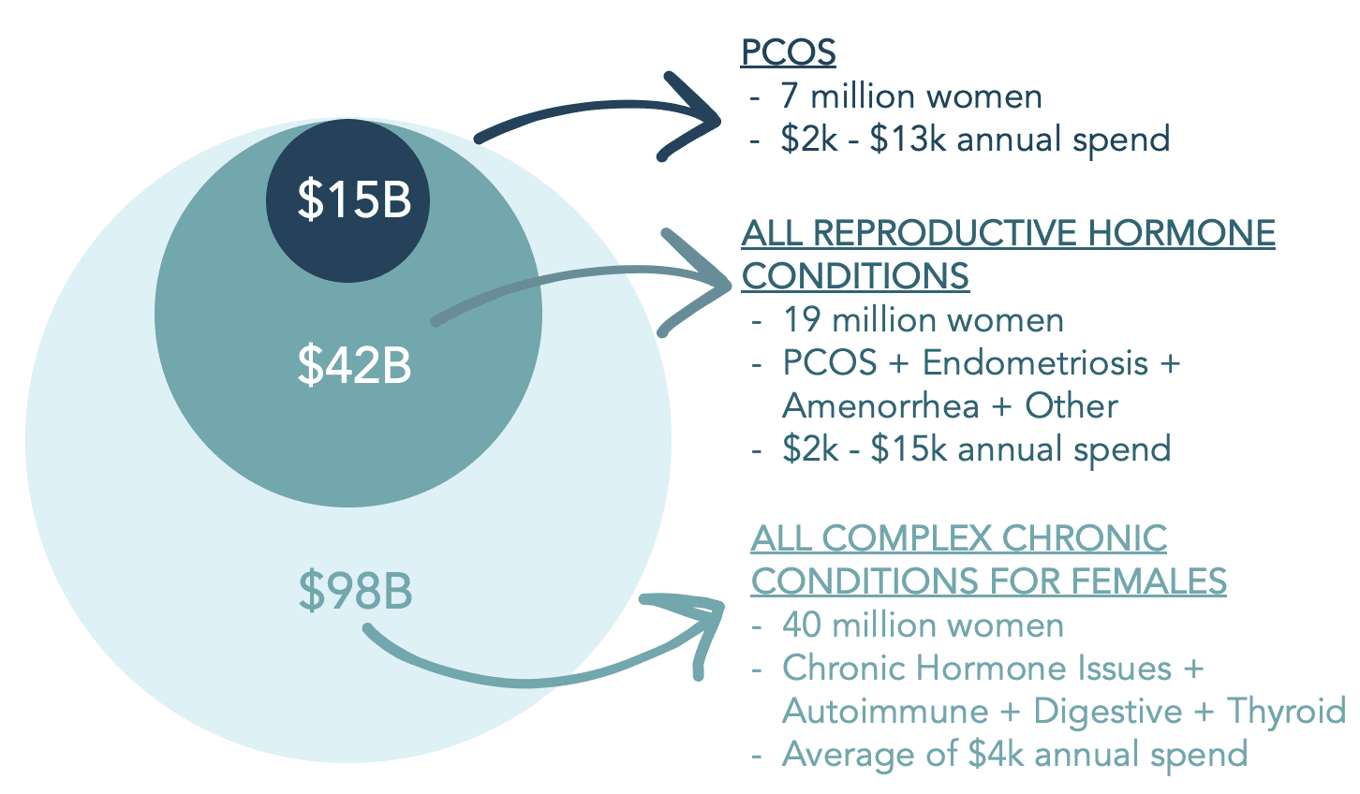

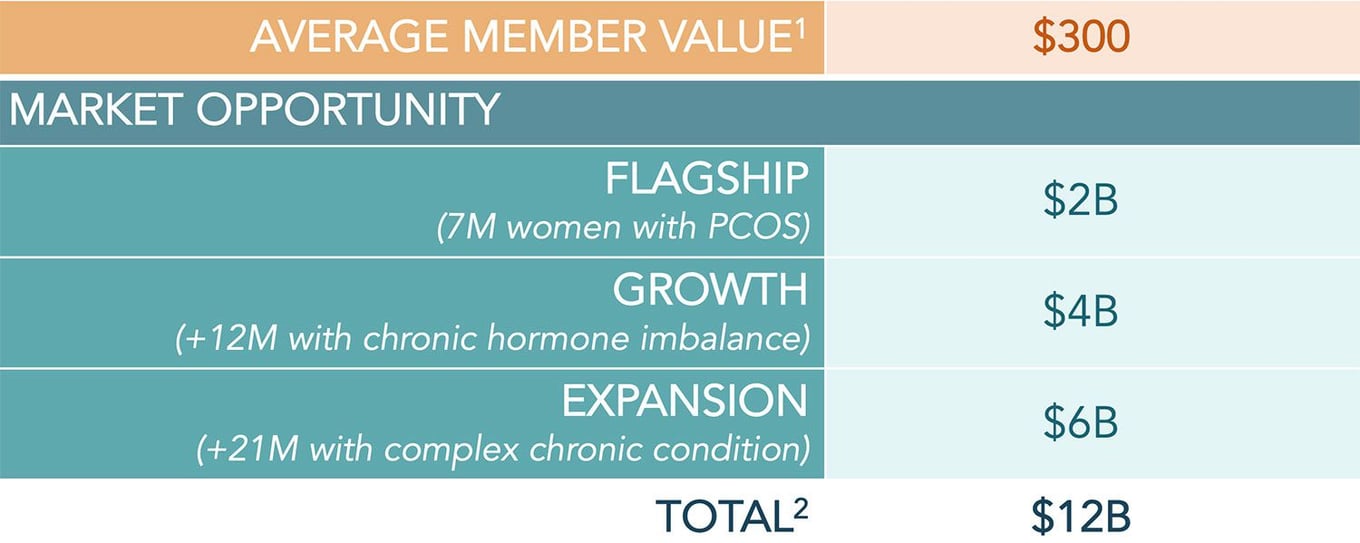

Market

PCOS is a significant opportunity; our growth markets are even larger

PCOS and related conditions are costing individuals and our healthcare system billions of dollars because they are being treated reactively rather than proactively.

Annual U.S. spend on PCOS and similar conditions

Now is the time to disrupt this space. Media sources like The New York Times, HuffPost, Vogue, The Guardian, The Today Show, and countless women's health publications have been spotlighting PCOS. Celebrities with significant influence in our target demographic (e.g., Victoria Beckham, Keke Palmer, Romee Strijd, and more) have also shared their struggles with PCOS, as have a growing number of microinfluencers. Tip: Check out #pcos hashtags Instagram and Tiktok!

The market is showing it is ready for better PCOS solutions.

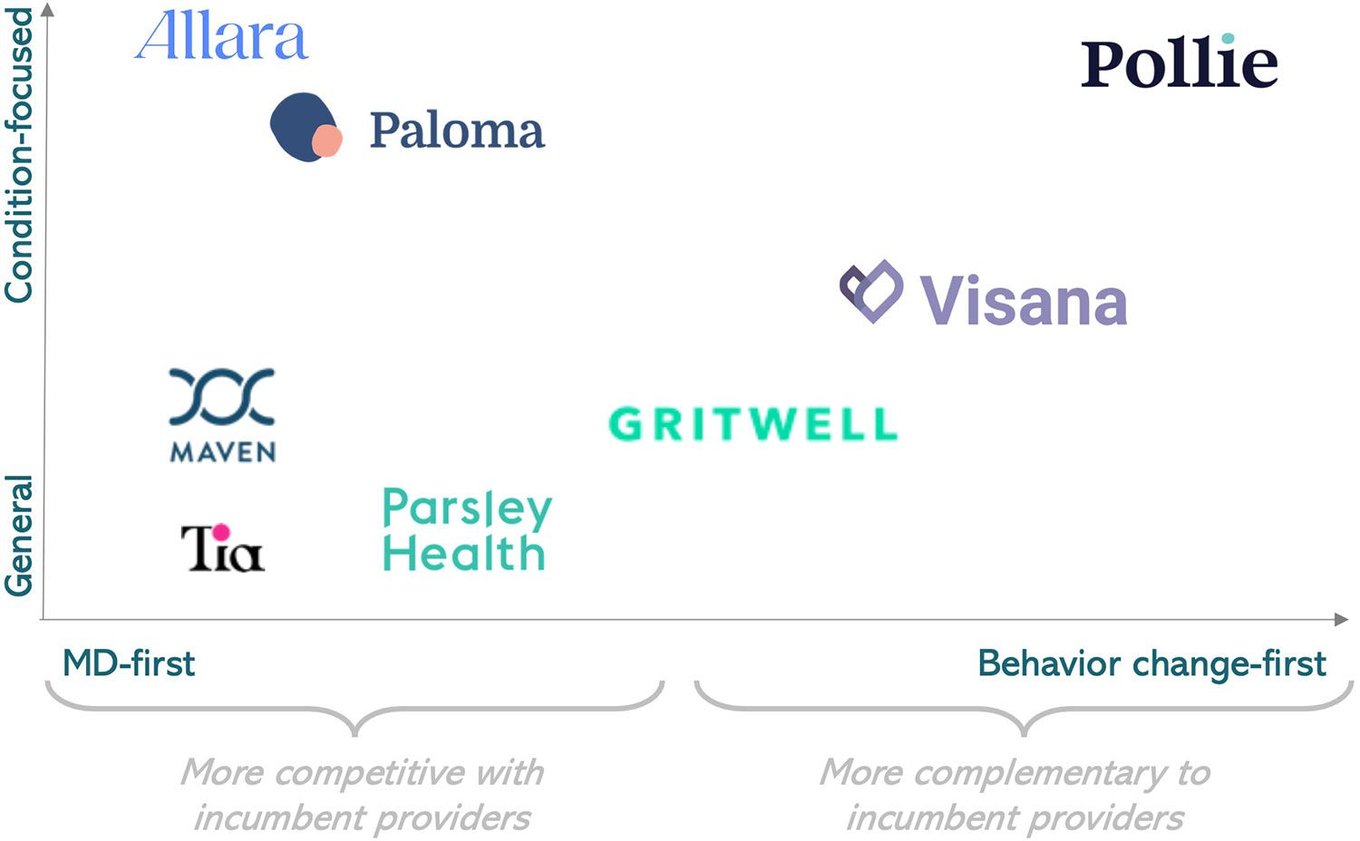

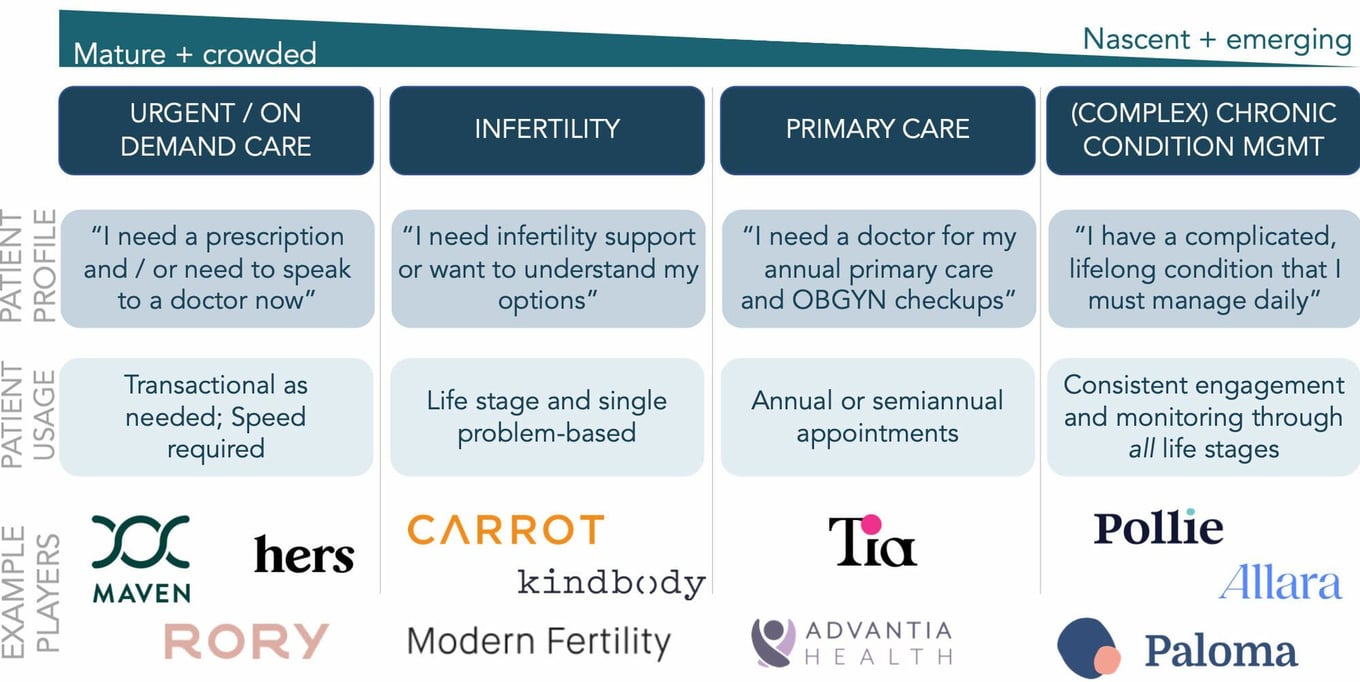

Competition

A one-stop-shop is needed for female complex chronic conditions

Larger female health companies are not meeting this need, and an uptick of competitive offerings validates the demand for a solution like Pollie.

—

We differentiate with our behavior change focus,

partner network approach, and programmatic model:

—

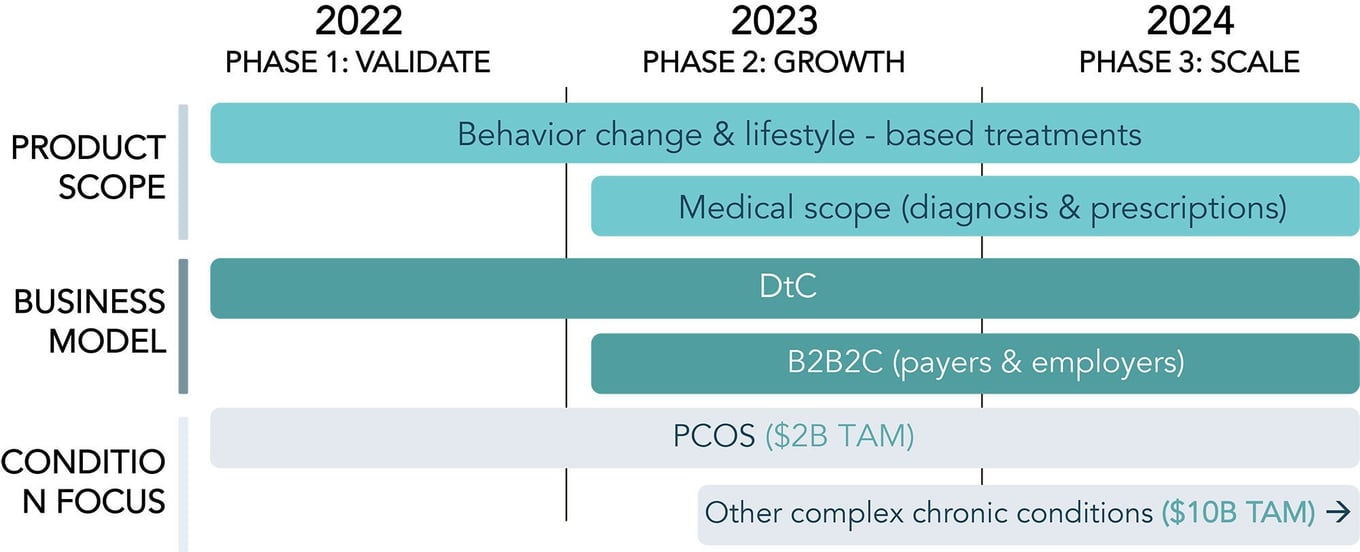

Vision and strategy

Our vision is to redefine care for female complex chronic conditions

PCOS is just the beginning.

PCOS is a massive market, and there is high demand for out-of-pocket consumer health services. But to have the most impact, we will expand into adjacent conditions and also work with healthcare incumbents.

—

We are testing monetization starting with a DtC subscription, and are working with a large TAM

—

Potential exits

- Acquisition by incumbent healthcare player (e.g., fertility clinic chain) to better optimize their results

- Acquisition by larger health tech player in women's health, chronic disease management, or general telehealth who is looking to expand their offerings

- IPO as go-to source for all complex chronic conditions for menstruating people

Impact

Pollie's mission is to make high quality PCOS

care accessible

to all menstruating people, regardless of their socioeconomic status, race, or gender.

Female health is underserved, under-researched, and under-funded. This dynamic is even more extreme for PCOS (and other complex chronic conditions that impact menstruating people) than other markets within female health.

PCOS is a public health issue: not only does it impact 10% of the menstruating population, but it also disproportionately impacts minority racial groups and people in lower income tiers.

That is why eventual insurance reimbursement (commercial plans, self-insured employers, and Medicaid) is such an important priority on our roadmap.

Funding

Backed by angels & VCs

We have raised nearly $900k total thus far from our angel and pre-seed rounds from a variety of institutional, corporate, and angel investors:

—

We are raising a $3 million seed round to give us 18+ months of runway to validate our PCOS app for B2B2C channels.

Founders

Jane Sagui & Sabrina Mason

Our founders Jane and Sabrina met nearly a decade ago while studying abroad in college. The two were randomly assigned as roommates in a single-room quad and were fast friends.

Summary

Join us

Today's typical PCOS patient experience is inadequate to properly manage the condition. For a condition that leads to such debilitating symptoms and costly future health risks, inadequate is unacceptable.

Research and our early outcomes show that Pollie's approach far outperforms status quo PCOS care both in health outcomes and patient satisfaction. We are eager to continue not just improving, but redefining, PCOS care alongside partners who are just as excited by our vision as we are.

- Jane & Sabrina

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...