Addiction takes on many different forms and to surmount it takes a lot of fortitude and strength. We're proud to feature ...

Problem

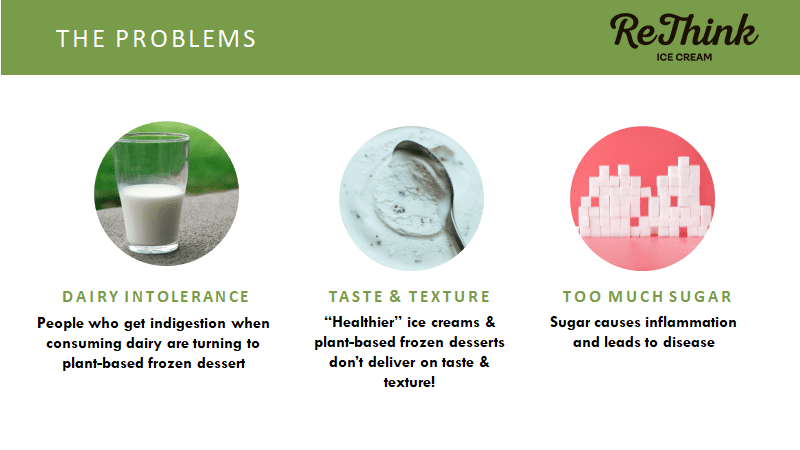

"Better for you" ice creams don't taste REAL, plus sugar is killing us & dairy intolerance is affecting millions worldwide

Wouldn't it be great if someone could make an ice cream that tasted as good and was just as creamy as say, Häagen Dazs, but without the high levels of sugar and fat? Sugar and fat are what gives ice cream its rich, creamy texture. When you reduce either of these to make it "healthier," you lose the taste and texture. That's why every other "better for you" ice cream tastes less than satisfying. Sugar causes inflammation and disease, and is unfortunately at very high levels in most ice creams. The sugar problem—as well as dairy intolerance issues (lactose and new undigestible dairy proteins)—has caused consumers to turn towards “healthier” dairy and plant-based options. However, these alternatives don’t deliver on authentic ice cream taste and texture. What's a health-conscious ice cream lover to do!?

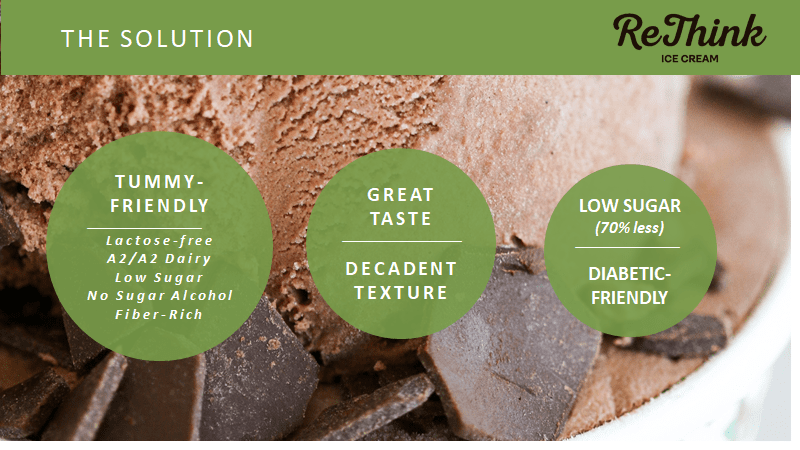

Solution

Decadence with benefits

ReThink has created a decadent and creamy ice cream that's very low in sugar (but no sugar alcohol), completely tummy-friendly and keto/diabetic-friendly. We achieve our rich, creamy texture by replacing the sugar we remove from the recipe with collagen, fiber and protein. Our secret tummy-friendly ingredient is A2/A2 dairy, which is free from the A1 protein chain that can cause dairy intolerance. We also make our A2/A2 dairy lactose-free, in case your intolerance issues are caused by lactose, and not the A1 casein protein. Our ice cream is made from happier, healthier cows, like the way they used to be! We believe ReThink is the best-tasting and textured "better for you" ice cream on the planet, hands down!

Product

Ice cream made from lactose-free A2/A2 cow dairy

How do we achieve great taste and texture when the other better for you brands cannot? By replacing the sugar we remove from the recipe with collagen, fiber and protein. We do not use sugar alcohol (like erythritol) to sweeten, which has a negative aftertaste and impacts texture. Instead, we sweeten with just a touch of agave nectar. We also don't overfill our ice cream with air (as others do), and we use only high-quality ingredients. While ReThink is ideal for anyone seeking a healthier lifestyle, our ice cream targets populations with food sensitivities. We source certified humane dairy from A2 cows because it's “tummy-friendly,” and involves more humane treatment than that for conventional dairy cows.

Each pint of ice cream is around 600 calories, lactose-free, diabetic and keto-friendly, low GI, and gluten-free, with no sugar alcohol. As of August 2021, we have 10 SKUs. Our flavors include Black Cherry Vanilla, Coffee Chocolate Hazelnut, Strawberry with Chia Seed, Lemon Poppyseed, Cardamom Pistachio, and many other unique flavor offerings.

We reformulated our product in early 2021 making it softer and creamier, and redesigned our packaging making it pop more on the shelves with cleaner, simpler positioning and messaging.

We reformulated our product in early 2021 making it softer and creamier, and redesigned our packaging making it pop more on the shelves with cleaner, simpler positioning and messaging.

Great taste, rich, creamy texture—it's so good, you can't even tell it's better for you!

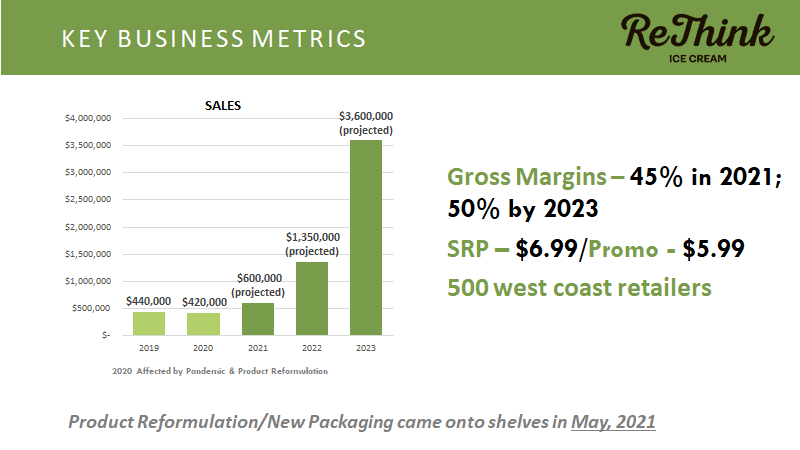

Traction

$1.35M projected revenue in 2022

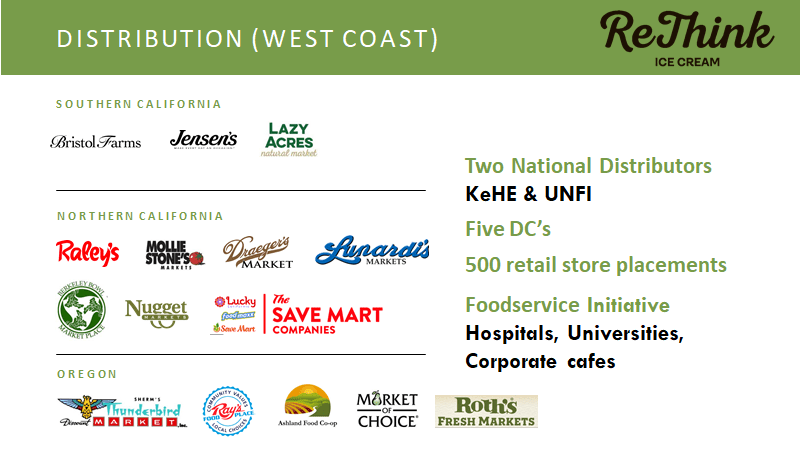

ReThink Ice Cream currently generates $60K in MRR. Our products are now being sold at 500 retail locations across California and Oregon, with plans for expansion in 2022. Our brand can be found in retailers like Raley's, Nugget, Bristol Farms, The Save Mart Companies, Market of Choice, and more. We have partnerships with two national distributors, KeHe and UNFI, and our current traction projects a revenue of $1.35M in 2022.

We've also received numerous press placements for our innovation and philanthropy.

*MRR as of August 2021

Customers

Making ice cream accessible with a community focus

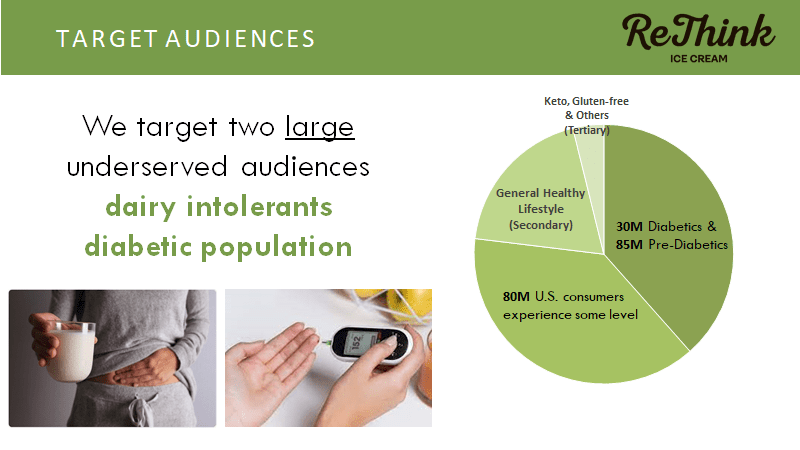

Our products target people living with sugar-related health or digestion concerns (related to dairy). There are 80M US consumers who experience some level of dairy discomfort, most likely caused by the A1 casein protein found in most conventional dairy today, or lactose intolerance. There are another 115M US consumers living with diabetes or pre-diabetes. We’ve seen extremely positive responses from our target consumer base, particularly for our rich, creamy texture and wide variety of unique flavors.

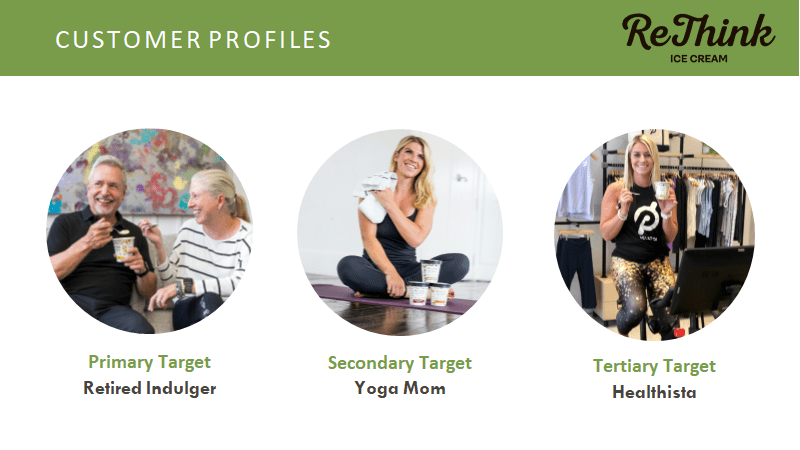

Our target customer personas are all female, as they're typically more inquisitive about healthier eating and generally make the food buying decisions for the household.

Our customers love that they now have an ice cream that fits their health needs and objectives without having to sacrifice on the experience.

Business model

ReThink has a low, fixed cost (mostly variable) model that's easily scalable

ReThink sells most of our products in retail stores (by way of wholesale distribution), with 95% of our revenue coming from in-person purchases and 5% via e-commerce.

Our model is to keep our overhead and fixed costs as low as possible so that we can reach profitability and cash flow stability as quickly as possible. We want to utilize as much of our cash flow as possible on sales-generating marketing activities instead of expenses that don't lead to sales.

We choose to outsource most of the company's critical functions like manufacturing, distribution, and product storage so that we can focus on recipe development, branding, marketing and bringing all the pieces together. By outsourcing all these functions, we keep our overhead low, our costs variable, and can more quickly and easily scale.

Gross margins on our products are currently 45% and can be improved further with increased scaling.

Ultimately, we envision 3 regional "hubs" consisting of a dairy ranch that produces A2/A2 dairy, a co-packer, and a freezer storage facility supported by national and regional distribution—all of which would be contracted with to avoid carrying fixed costs. This "infrastructure" would be enough to support distribution throughout the US and export markets.

*Revenue source ratios (95% in-person, 5% e-commerce) and gross margin percentage as of the end of August 2021

Market

Targeting 2 large underserved audiences: dairy intolerants and people living with diabetes

The size of the total North American ice cream market was $27B+ in 2021. The global non-dairy ice cream market size was $500M+ in 2019. It is estimated to grow at a 13% CAGR between 2020 and 2026. This is mainly driven by an increasing prevalence of dairy intolerance. The global no-sugar added ice cream market (i.e. food safe for diabetics) was valued at $3B in 2018 and is anticipated to reach $5-6B by 2027. We target both of these underserved markets—dairy intolerants and diabetics—by providing low-sugar, low glycemic, tummy-friendly dairy products.

Competition

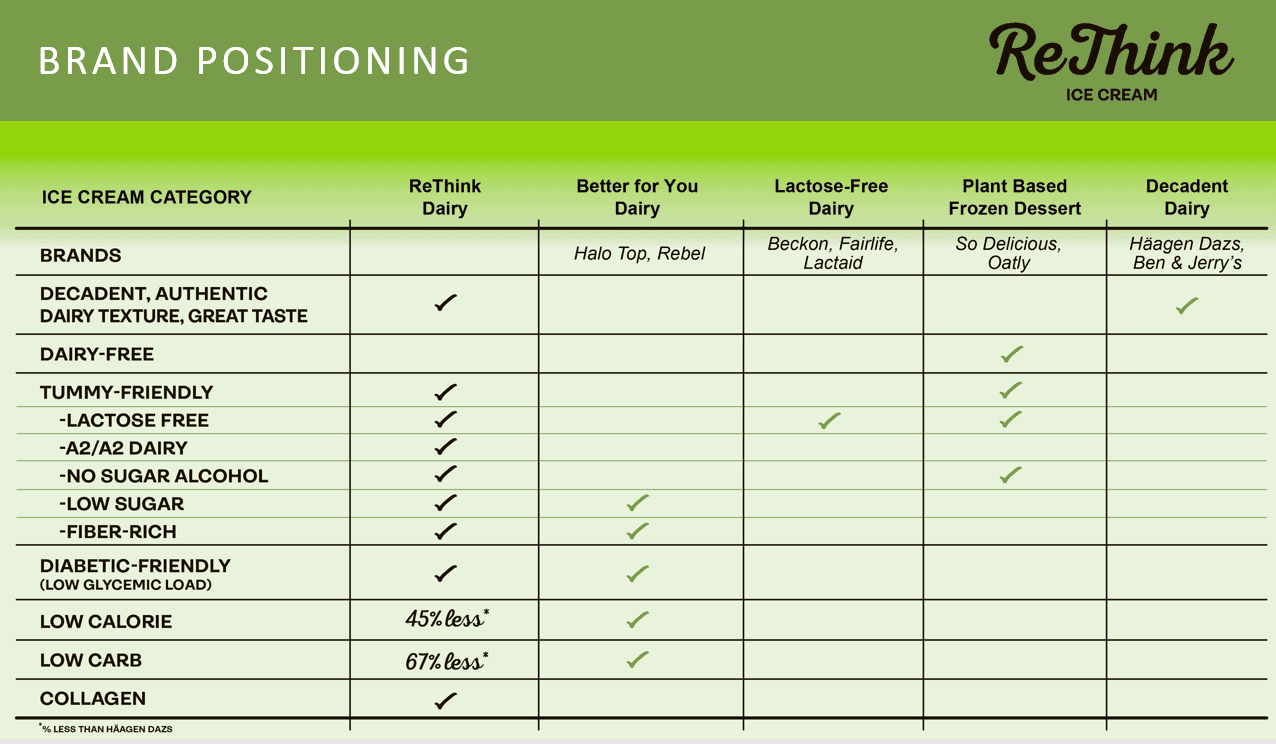

ReThink combines the best of both ends of the ice cream spectrum

Decadence + Better for You

ReThink is the best of all worlds when it comes to dairy ice cream. Our products are better for you, have the decadent experience of dairy, and are currently the only completely tummy-friendly dairy ice cream products of which we are aware.

Vision and strategy

Our vision is to be the most loved "better-for-you" ice cream in the world

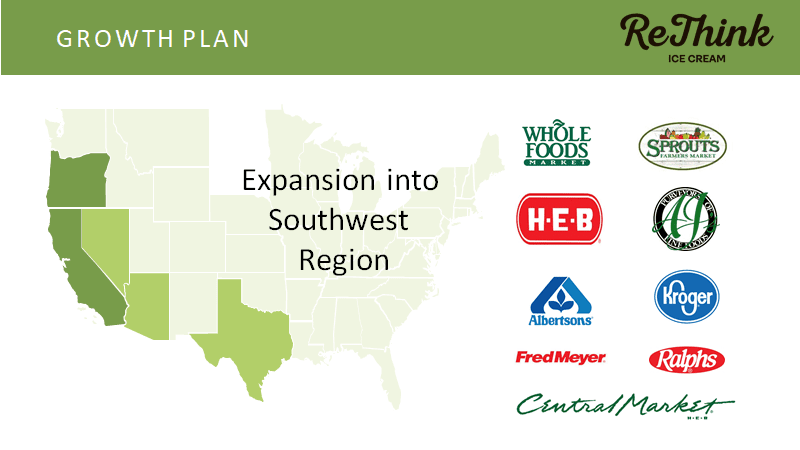

Our vision is to be the most loved and most consumed better-for-you ice cream brand in the world. To achieve this, we plan to begin a national launch by EOY 2022. Our first goal is to build out the West Coast by adding more retailers and increasing velocity in existing stores with our new scaled market strategy. Our second goal is to expand to the Southwest US, in particular Las Vegas, Arizona, and Texas.

We are keenly aware of the need to stay focused on driving momentum and velocity performance within the areas we already serve, and not get overextended with expansion before we have a solid base of support behind us.

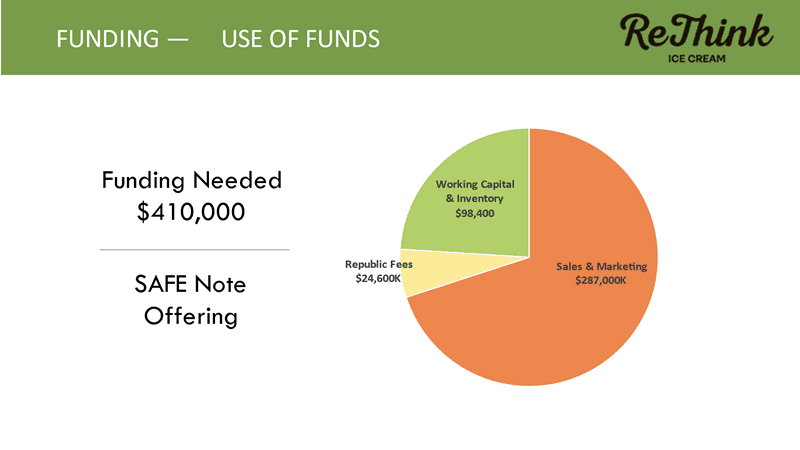

Funding

Mostly bootstrapped to date

We have been funded to date through a combination of founder's equity and guaranteed loans, a convertible note offering through Microventures, and three angel investors. We are ready to carefully scale to the next level. The majority of funding will go towards marketing campaigns to grow sales, with additional working capital going towards Republic crowdfunding fees, R&D for recipe development, inventory investment, and onboarding new retail partners currently in our pipeline. We expect this round of funding to take us to a $3M annual run rate in sales, at which point a Series A capital round will be possible.

Founders

George Haymaker, Founder & CEO

ReThink Ice Cream was born out of my addiction to alcohol and pain pills when years ago, as I stopped drinking alcohol, I started eating way too much ice cream as a substitute for the sugar found in alcohol. As I began to feel and show the effects of all this sugar, I realized I was transferring addictions, and had to do something about it. I looked around for a “healthier” ice cream, but couldn’t find one that gave me anywhere near the same satisfaction as my favorite brand of traditional ice cream. I wanted to be healthier, but I didn’t want to sacrifice on taste or texture. After not finding a healthier ice cream that I considered acceptable, I set about making my own, and wanted to share it with others.

Recovery from addiction and recovery from ice cream have a very important thing in common. In recovery, we seek to find comfort, joy and serenity. When we enjoy a great bowl of ice cream, we are also seeking an experience that brings us joy and comfort. There were things that happened to me earlier in life that made me uncomfortable in my own skin, and this is not uncommon for people that will go on to abuse substances. However, even as a child, I could always find comfort and joy in a bowl of decadent ice cream.

A key to finding serenity in recovery involves finding ways to help others, give back to communities, and become more harmonious with the world around us. It is this pursuit that will be my driving force for the rest of my life. I hope for ReThink to be the engine that allows me to help others on a larger scale than I otherwise would be able.

I am an operations focused executive who recognized a gap in the ice cream market with a multi-billion dollar platform potential. My background includes four different start-up experiences in the last 30 years. My approach is to grow sales as rapidly as possible in order to reach break-even and cash flow stability quickly, all the while using an increase in scale as leverage to drive down costs and open up gross and net margins. I also know what I don't know, and am not afraid to bring in expertise where needed. I believe the best ideas should always win, and am not afraid to hear ideas contrary to my own, and incorporate the best ideas from wherever they come.

In the last year, we have participated (or are currently participating) in the below-mentioned brand accelerator cohorts. These experiences have been invaluable as we evolve, finding better ways to serve our customers and run our business.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...