IBM's supercomputer, Watson, has become the poster child for artificial intelligence (AI) in the age of big data. Watson ...

Problem

Manual workflows waste tons of time for you and your coworkers

“Oh – Jane knows how to do that”

People try to remember procedures and best practices in their head. They are not formalized or shared. Everyone ends up doing procedures differently, leading to inconsistent outcomes and constant uncertainty around “how should we do this?” If the person you need is not available (or leaves) - it’s chaos.

“Yea – we’ve written down and drawn all our processes”

People might try to document (type up) or draw a process in a flowchart. You have no idea if or when anyone actually looked at the flowchart or Word/Excel doc while they were working. What’s the point in spending weeks on documenting a process that nobody will ever look at?

“But I already emailed John that he needs to approve”

People use email and chat to actually do a process. Coworkers hardly ever know who is doing what, when and how. Everything that should be predictable and obvious turns into long chains of chats and emails. It stresses everyone out and wastes tons of time.

“How can we prevent this mistake in future?”

People try to improve a process through hundreds of hours of training and workshops. Awesome employees get engaged and suggest ideas to improve a process, but the old ways continue. Now scale that up. If there were hundreds of people in a company - how would you deploy an improved process to the entire company?

Wouldn’t it be magical if everyone in your company knew how to do every process?

Wouldn’t it be nice if you didn’t get interrupted by email and chat for routine questions?

Wouldn’t it be nice if everyone in your team knew exactly who is doing, what, when, how and why?

Wouldn’t your clients love a way for them to track and get involved in a process?

Why can’t your clients track a workflow online, just like they track a FedEx parcel?

Solution

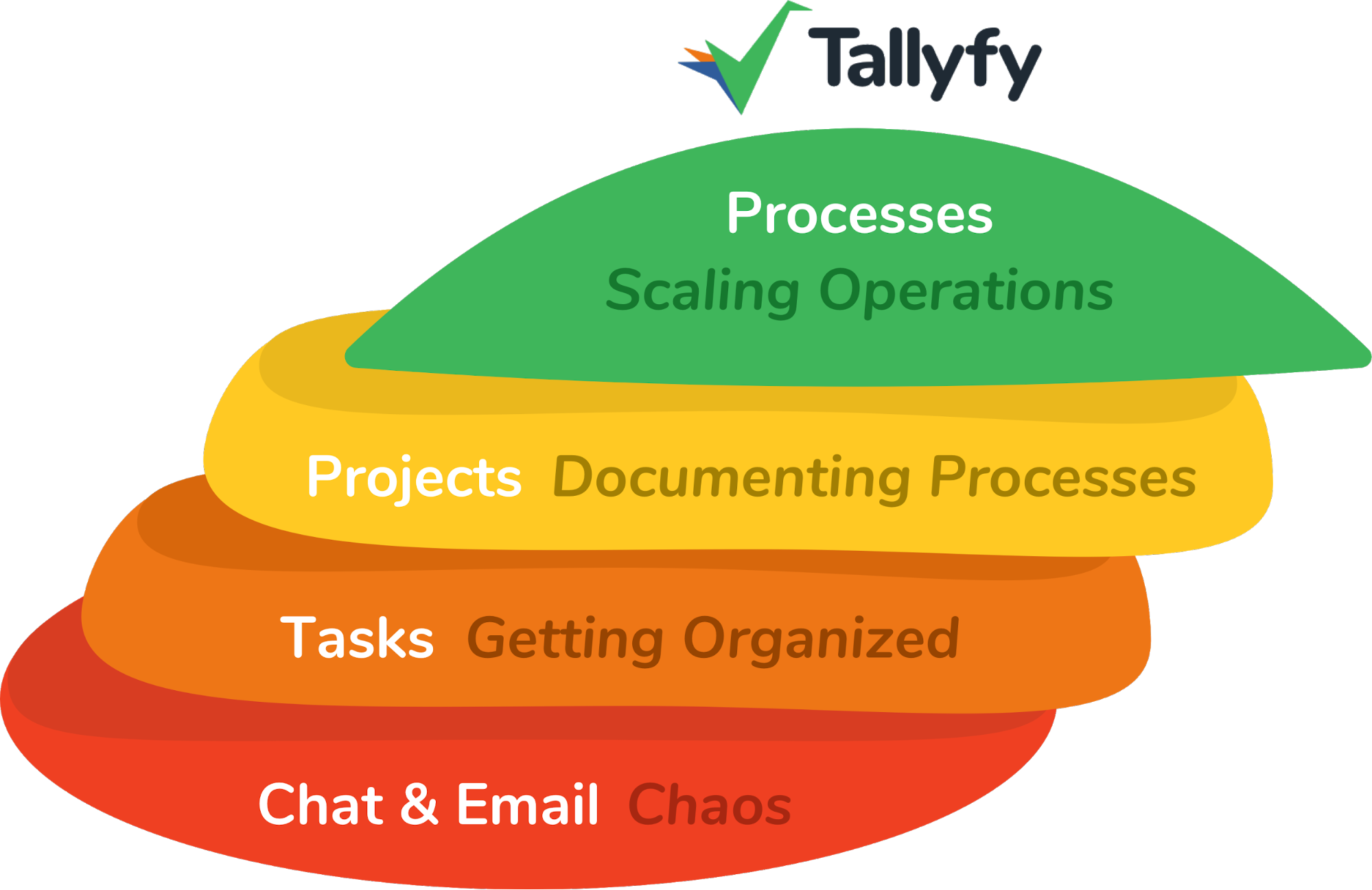

We bring certainty and confidence to every workflow in your business

Tallyfy focuses on repeatable processes. This means there’s one place where procedures are both seen and used.

When you launch a process - you know it will be predictable, consistent and reliable. Tasks will not constantly slip through the cracks like they do in ad-hoc projects.

Product

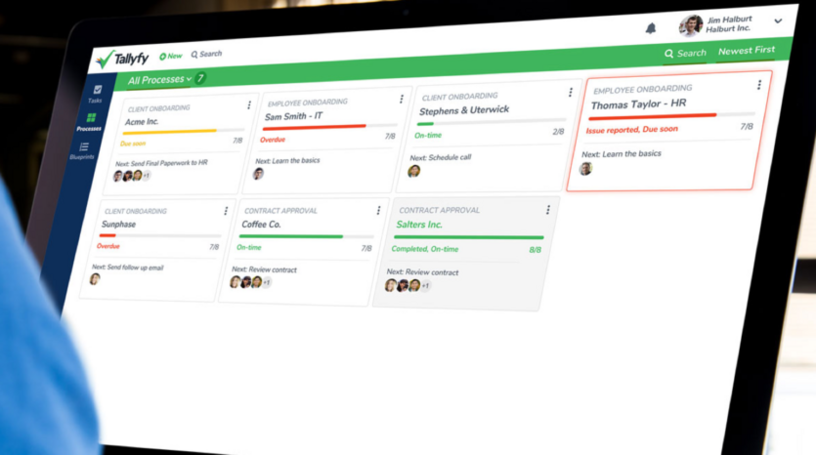

Tallyfy makes it simple to rinse and repeat processes you do every day

Our product allows you to create a blueprint of any repeatable process in your business and launch workflows off of that blueprint. You can track processes visually on a simple dashboard.

Tallyfy can be used for literally any customized, repeatable workflow in your business.

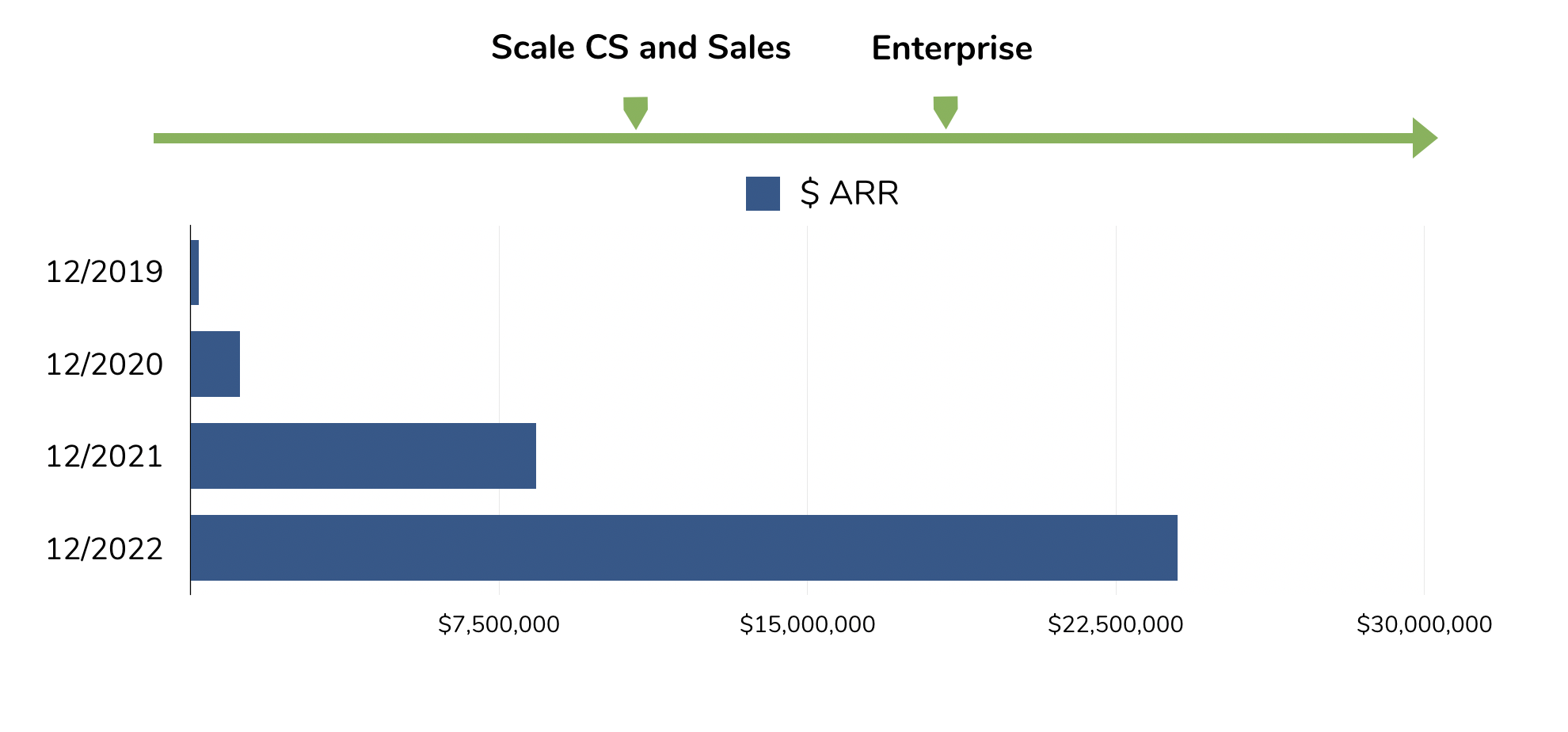

Traction

Over 10,000 sign-ups since we launched

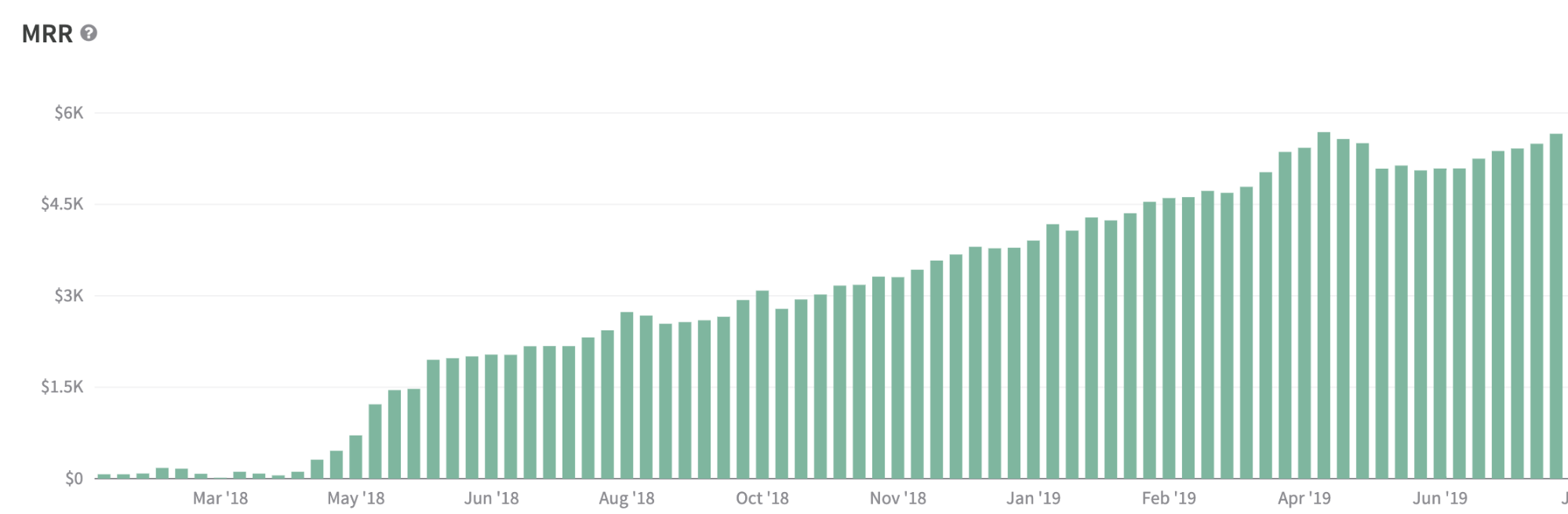

The validation revenue we’ve accumulated from 10k+ signups on our free-forever plan is $65k+ ARR (Annual Recurring Revenue) - generated by companies that chose to upgrade to paid plans.

This validation revenue has helped us build a strong understanding of what thousands of companies want, helping us quickly refine our roadmap.

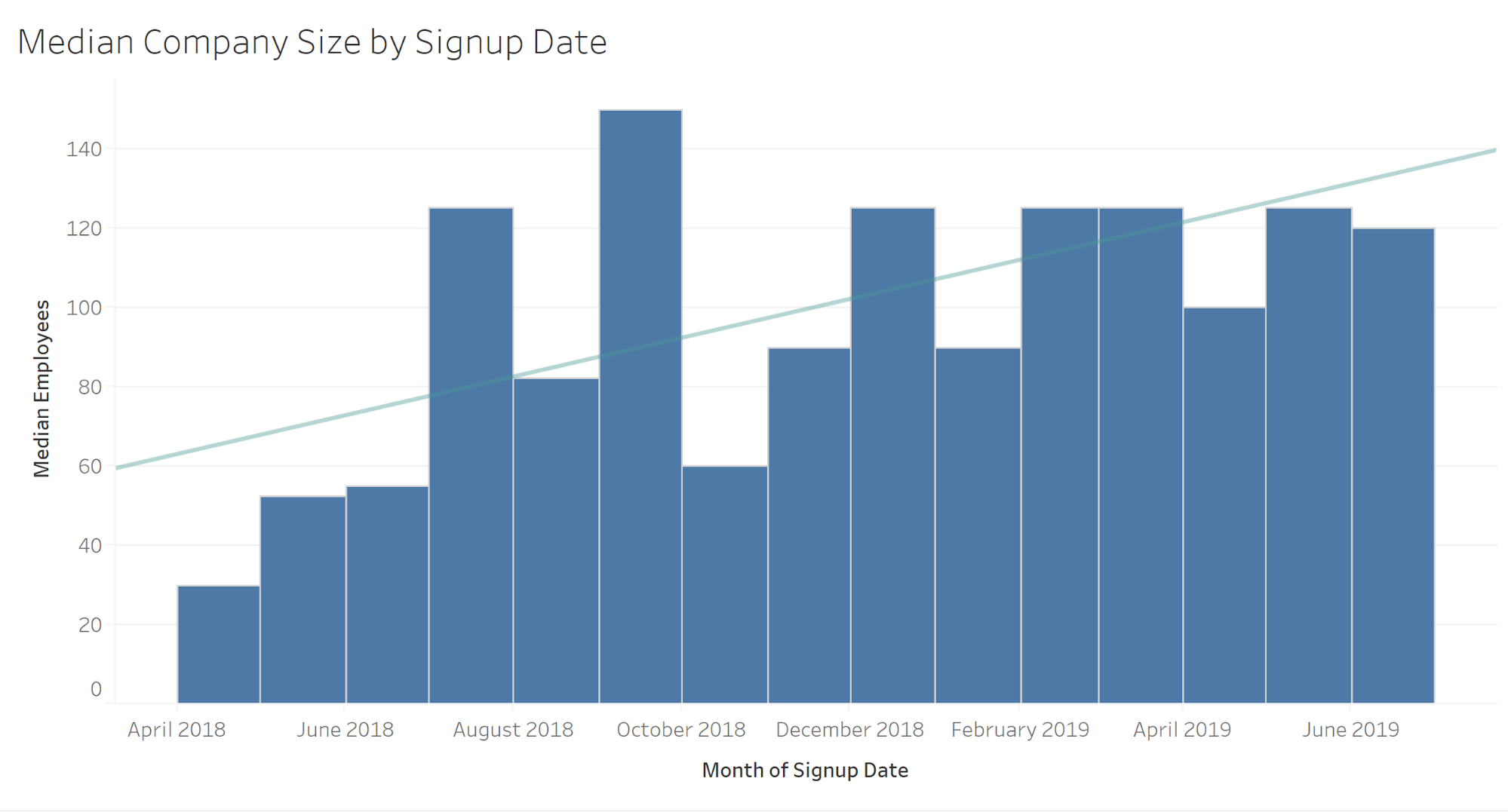

Separately - the average number of employees in the companies signing up is steadily increasing, helping us move up-market.

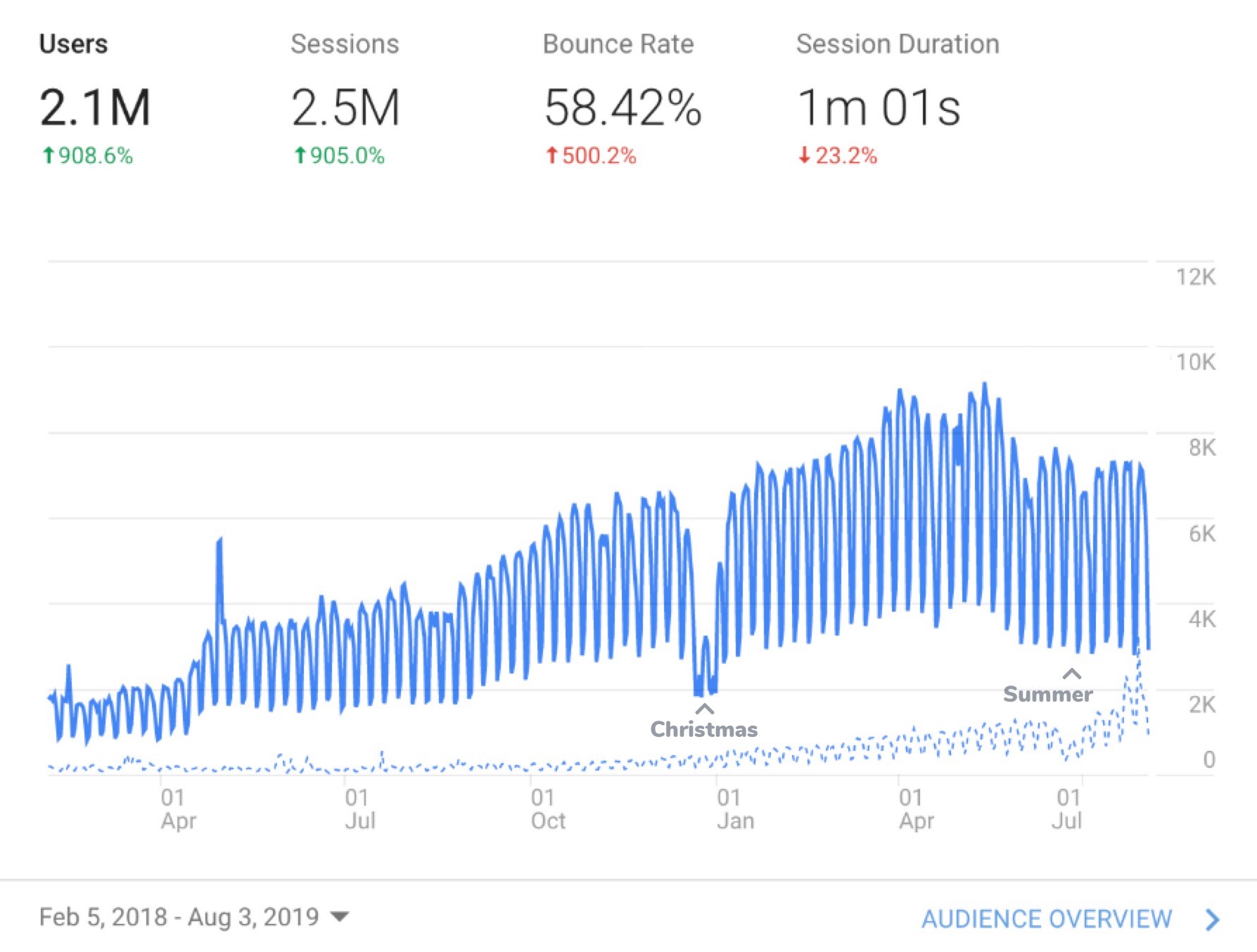

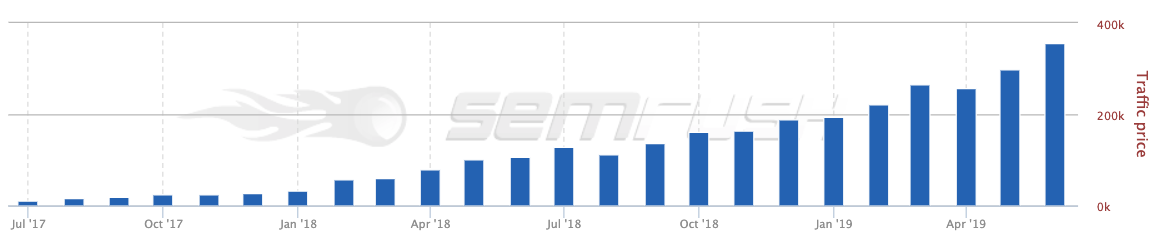

We get $350k+ worth of free clicks from Google search every single month

Most other startups pay hard and heavy dollars for marketing. It's one the biggest expenses in most companies. We don’t pay a dime.

We carefully executed our plan to rank on the first page of Google search for thousands of relevant searches (without having to pay for Adwords).

We’ve done this by producing relevant, evergreen content that’s hugely valuable to people.

Look at the traffic growth to our website below. It’s a huge long-term competitive advantage!

Don’t believe us?

Go ahead - google “client onboarding” or “sop” yourself. See how we’re on page 1 of normal (organic) Google search results.

Those are just two examples from thousands of searches.

What does this mean for our business? Let’s do some math here.

Let’s assume our current traffic does not grow (at all) for the next 3 years.

What would it be worth?

$380k per month x 12 months a year x 3 years is >$13 million.

So basically - we would NOT spend >$13 million in marketing costs over 3 years.

The above assumes traffic stays flat for the next 3 years.

Over the last 2 years, the value of inbound traffic to tallyfy.com has not been flat:

Is this a strong, long-term competitive advantage for brand awareness and free leads?

You should decide on that question - before you decide to invest in us.

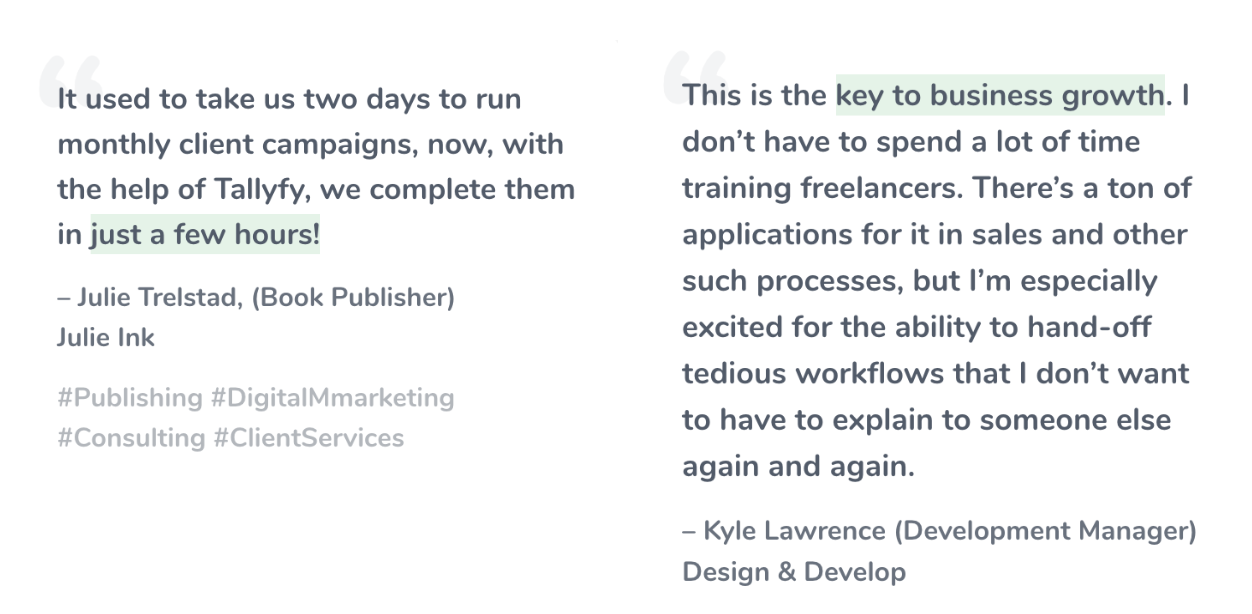

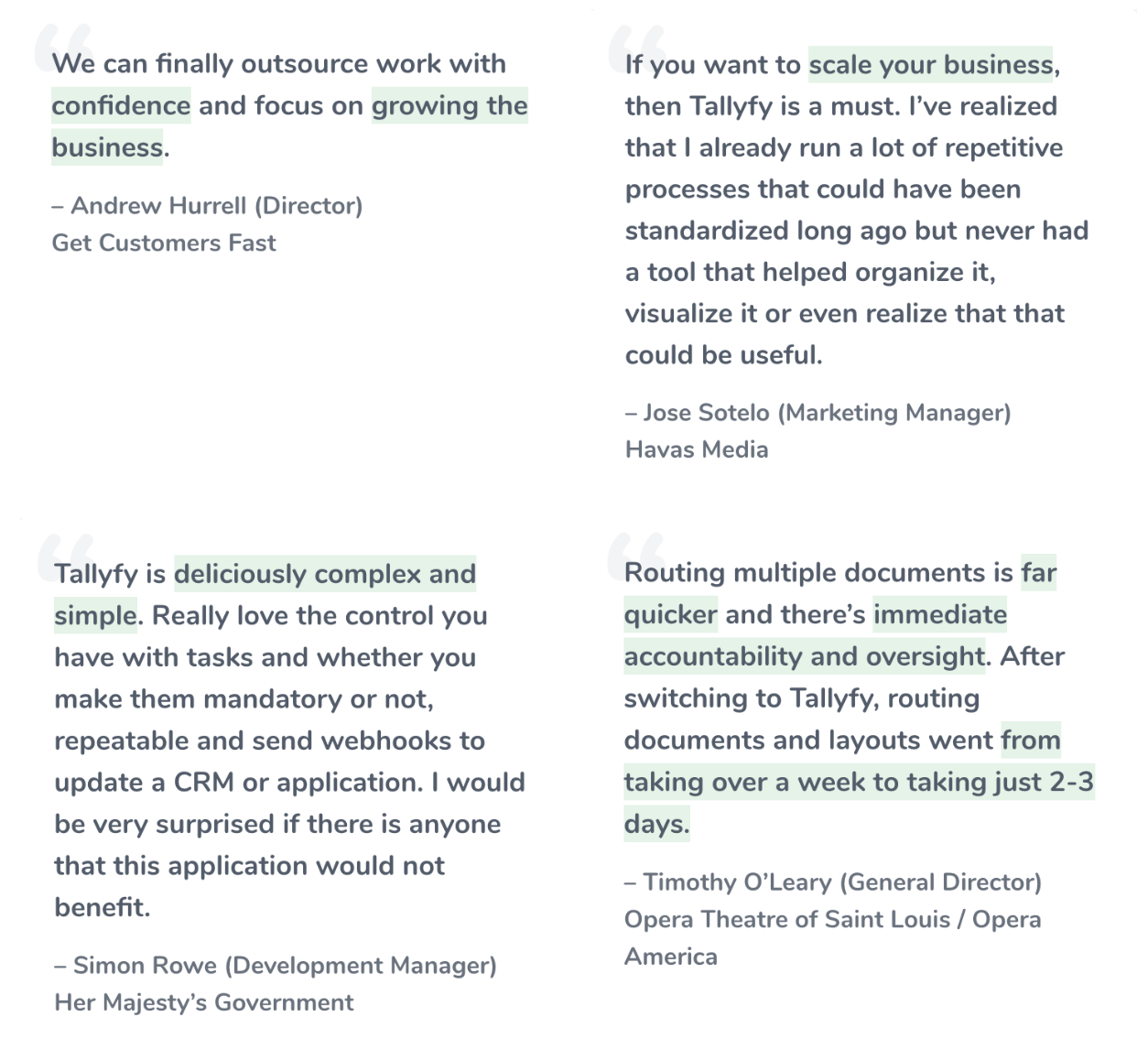

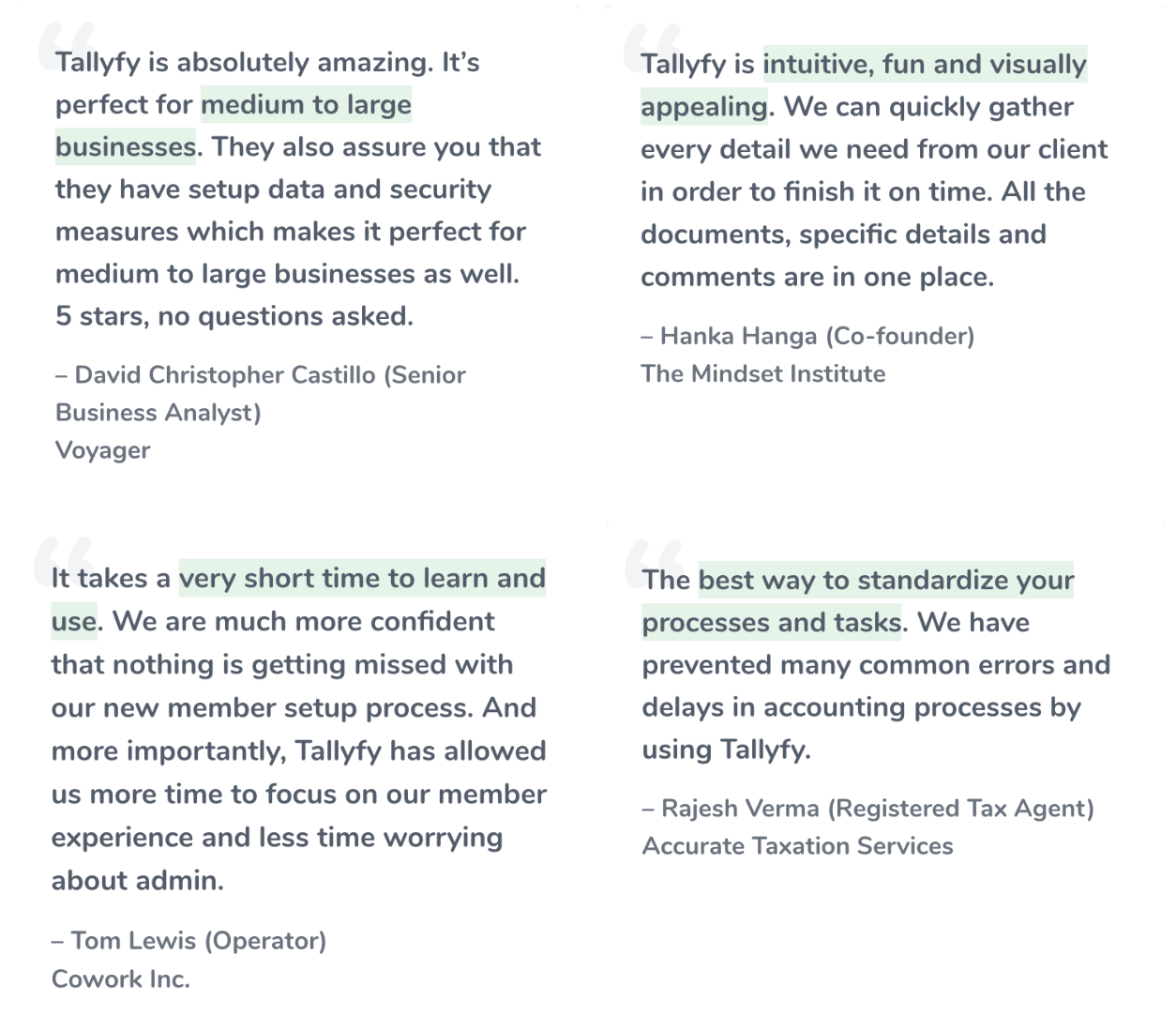

Customers

Tallyfy is used by businesses in a variety of industries

Business model

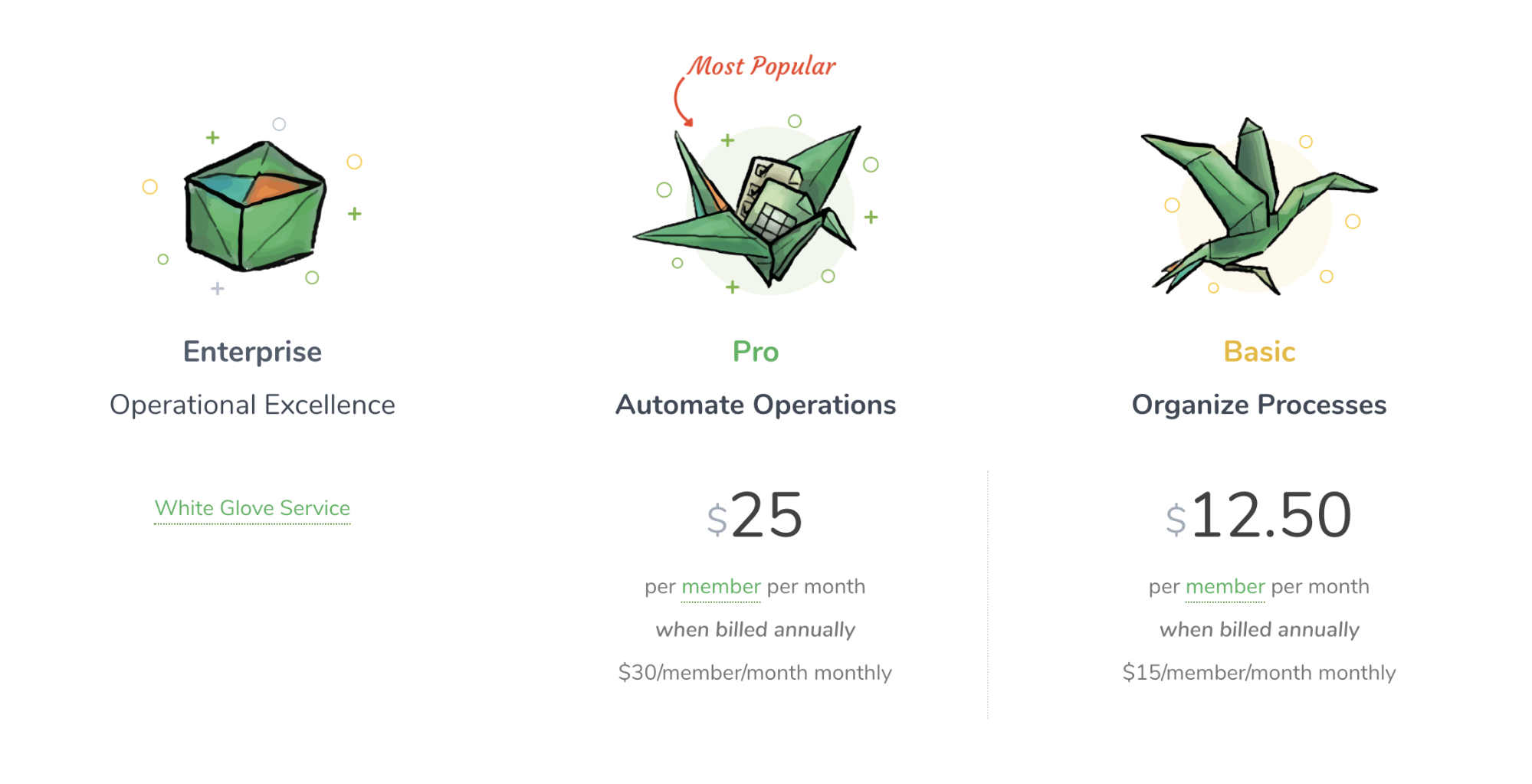

Strong initial success with our tiered subscription model

Tallyfy charges a subscription fee for each member (user). We usually see the number of members grow, as a company adds more workflows on Tallyfy.

Tallyfy has always had a free forever plan since we launched. Until recently, we’ve been purely focused on product development from feedback - not on sales.

Our initial sign-ups (10k+) gave us confidence to monetize to a free trial model (going forward) - along with clarifying our roadmap.

As of August 2019 - we eliminated our free plan and moved to a 14 day free trial. We’re now shifting our focus to growth in recurring revenue and sales.

Market

Tapping into complimentary trends and fast-growing markets

We focus on the SMB (small and medium-sized business) market - where people lack a fully-featured process management tool, which is also really easy to use. Such companies are not able to spend huge amounts of money on enterprise software, and want something that works right now, and works quickly - without needing IT and consultants.

We’re really excited about “riding” bigger markets/trends that are complementary to us - and there’s three major sectors there.

First - there’s middleware, which includes integration tools like Zapier and Microsoft Flow. Second - there’s AI and RPA, since we can slot automations beautifully into everyday tasks. Third - there’s BI (Tableau, PowerBI) - since we stream our data in real-time for visualization.

We play nicely with CRM (just reference leads in your workflows) and chat platforms - so you can go from noisy, messy chats - to trackable actions - in one click.

Our team has enough experience to know about positioning our differentiation in the long-term - and we see a solid plan on what it will take for us to grow to a very large ARR (annual recurring revenue) figure.

Competition

Our simple interface, client-facing workflows and API-first platform set us apart

We have two competitor categories. The first is BPM (Business Process Management) - which is a >$15 billion segment of legacy, complex, IT-driven process management software. The second is project management tools - which focus on projects, not repeatable processes.

Some key strengths for us are our beautiful UX (user experience), our focus on front-office use cases - and a really clean and complementary fit with software that IT has already purchased.

Our special sauce is that we help you scale your operations.

Tallyfy works in minutes - and we run client-facing workflows. This gives you better customer experiences that make you money, not just internal automations that save you money.

Vision and strategy

Setting a solid foundation for strong future growth

So many startups try to scale prematurely.

We believe we’ve set the right foundation. We’re looking to gather steam and project strong growth in the next few years.

Funding

We’ve raised $2M+ from top investors and accelerators

We’ve received investment from MTC (the state VC in Missouri), Alchemist Accelerator and 500 Startups (both in San Francisco). We won $90k in equity-free grant funding from Arch Grants (in St. Louis, MO) and Startup Chile.

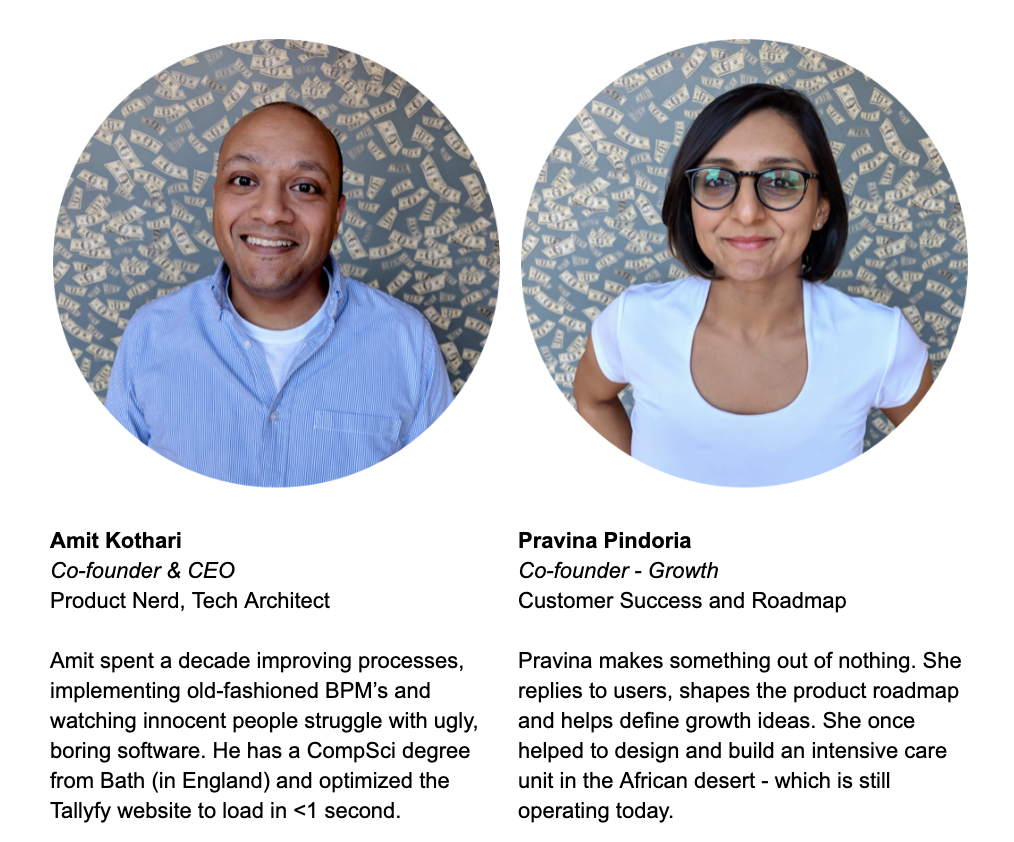

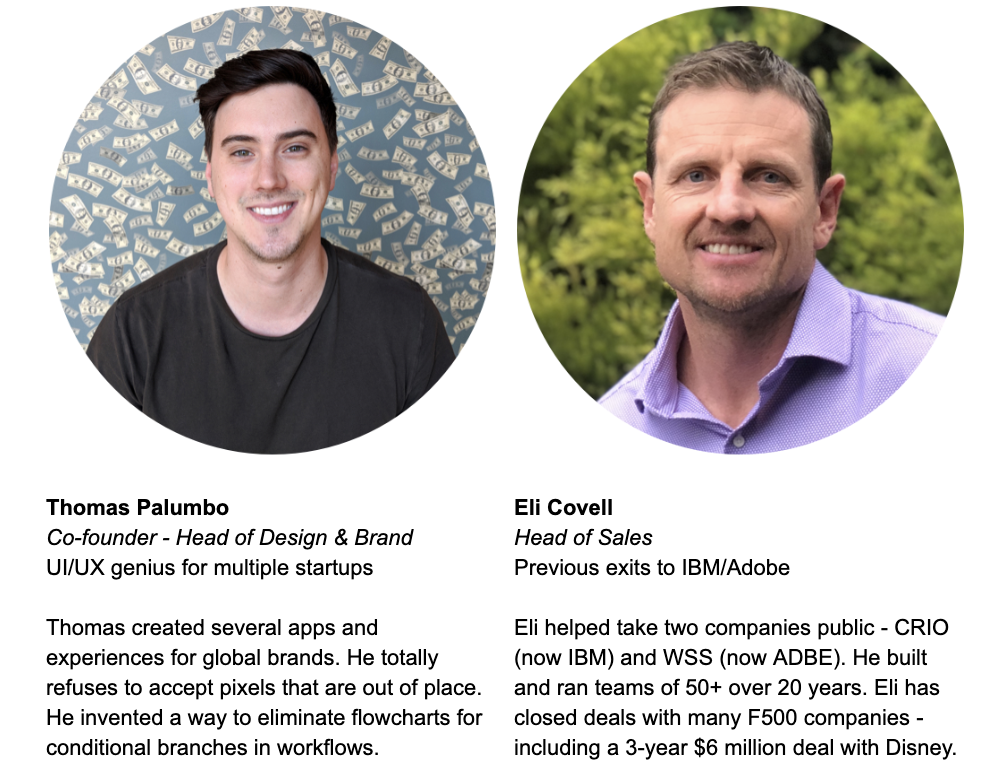

Founders

Decades of hard experience in design thinking, grit and exits (with scars)

Fortune favors the brave.

Believe it!

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...