How often have you heard the phrase, "We can't pay you, but think about the exposure?" Creatives often hear this when bra...

Problem

Fans are treated as an afterthought

Creators dictate the price, duration, and the frequency of their content. Fans are 'left in the comments & DMs' with a "take it or leave it" deal. Fans have no leverage. Imagine if fans could collectively come together and request content they actually wanted! #PowerToTheFans

The creator economy is also overlooking diverse Creators of color

The creator economy has overlooked valuable and influential segments of the marketplace (particularly Black and Brown Creators) who drive culture on social media & over-index from a usage perspective. These Creators are taken for granted by incumbent platforms which are slow to activate subscription monetization and often do not offer ad revenue splits.

Solution

Platform that promises Equity to Creators and Fans alike

TipPools mission is to be the platform of choice Fans looking to dictate the Content THEY want to see from Creators through the power of Crowdfunding.

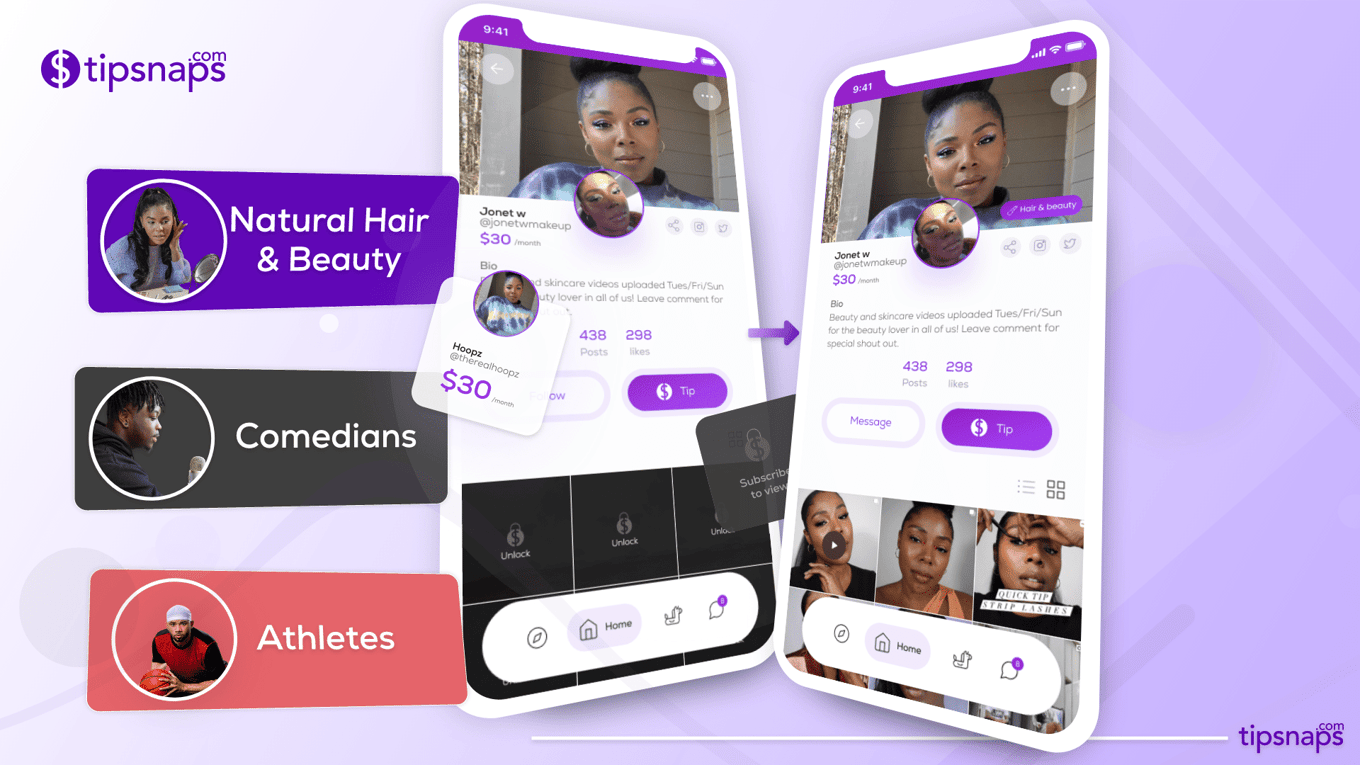

1. Service overlooked niches with a focused experience

2. Enable Fans to collectively have a voice by crowdfunding for content #PowerToTheFans

Product

Creators & Fans first

Promoting Creators of color who are overlooked by incumbent platforms | Empowering Fans to request the content they ACTUALLY want!

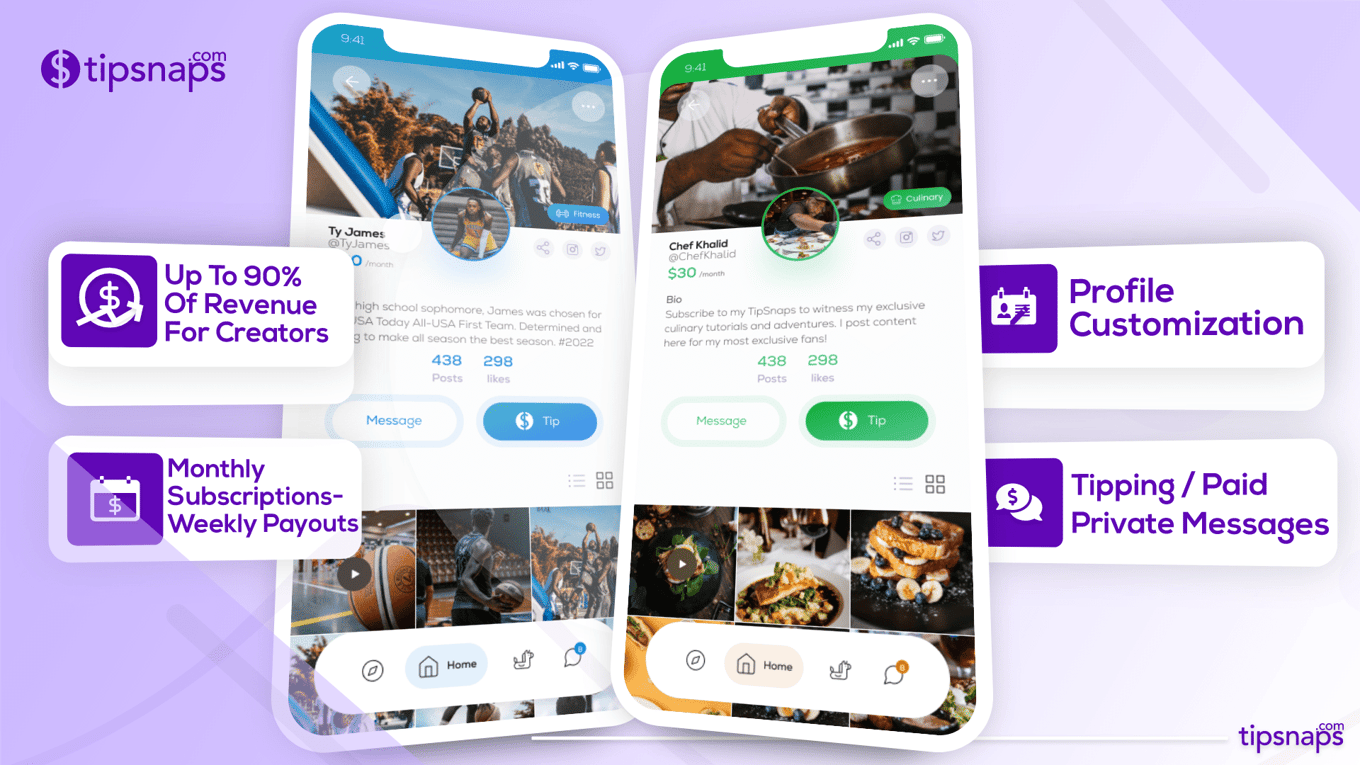

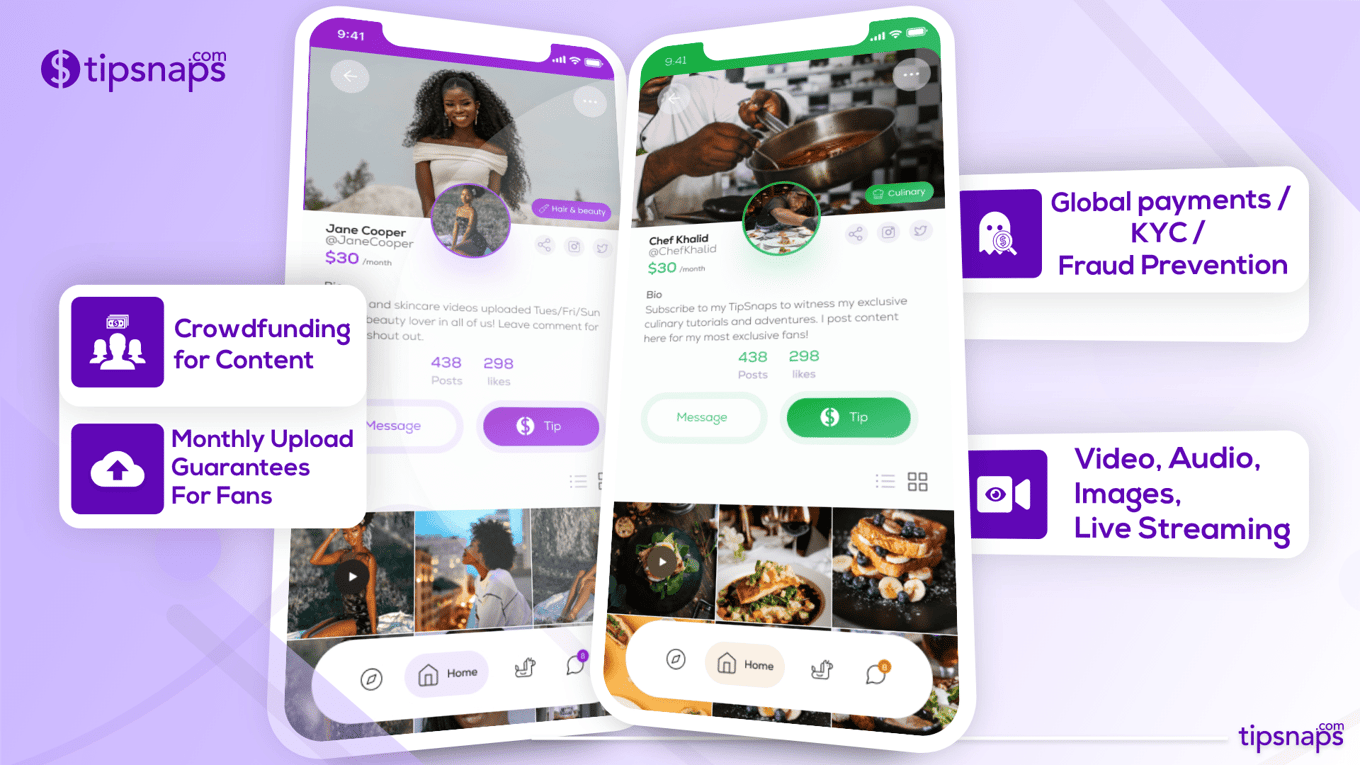

TipSnaps - Product Features

Capabilities

|

|

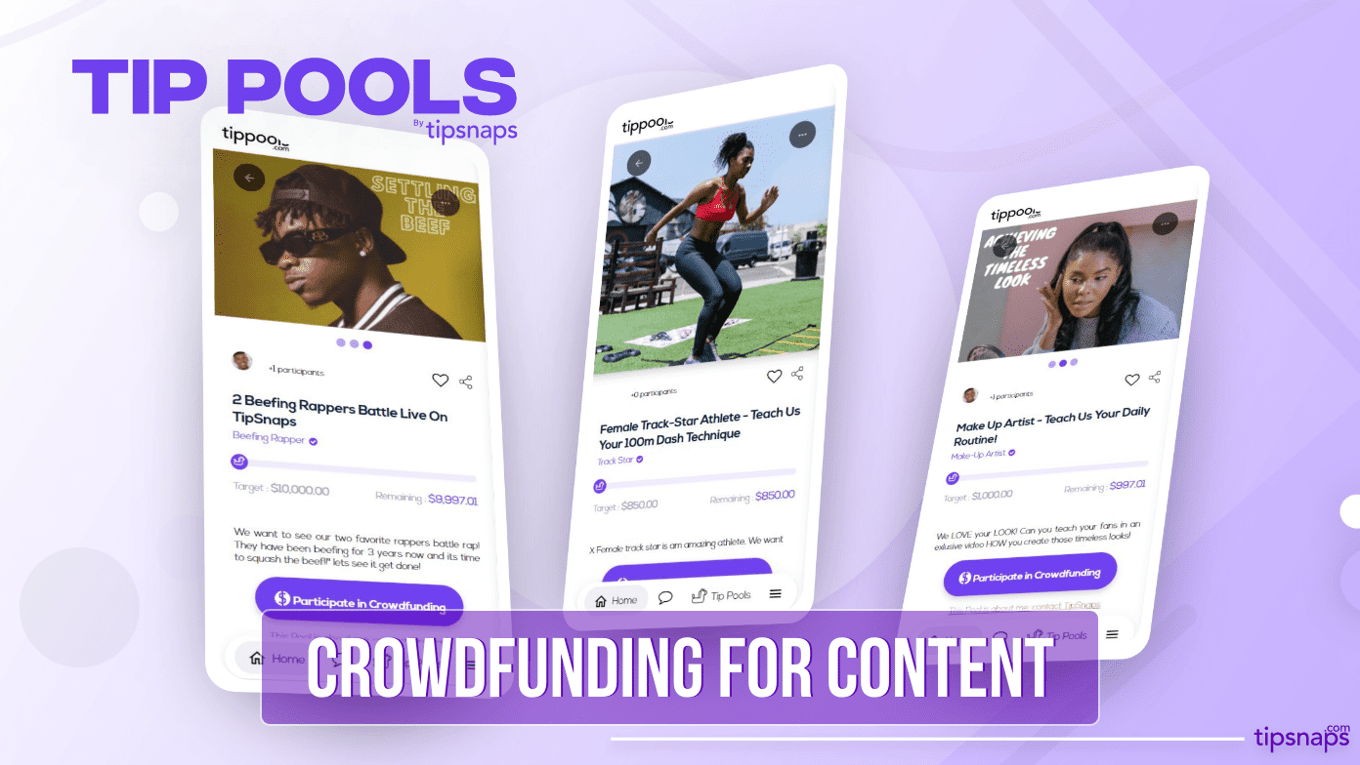

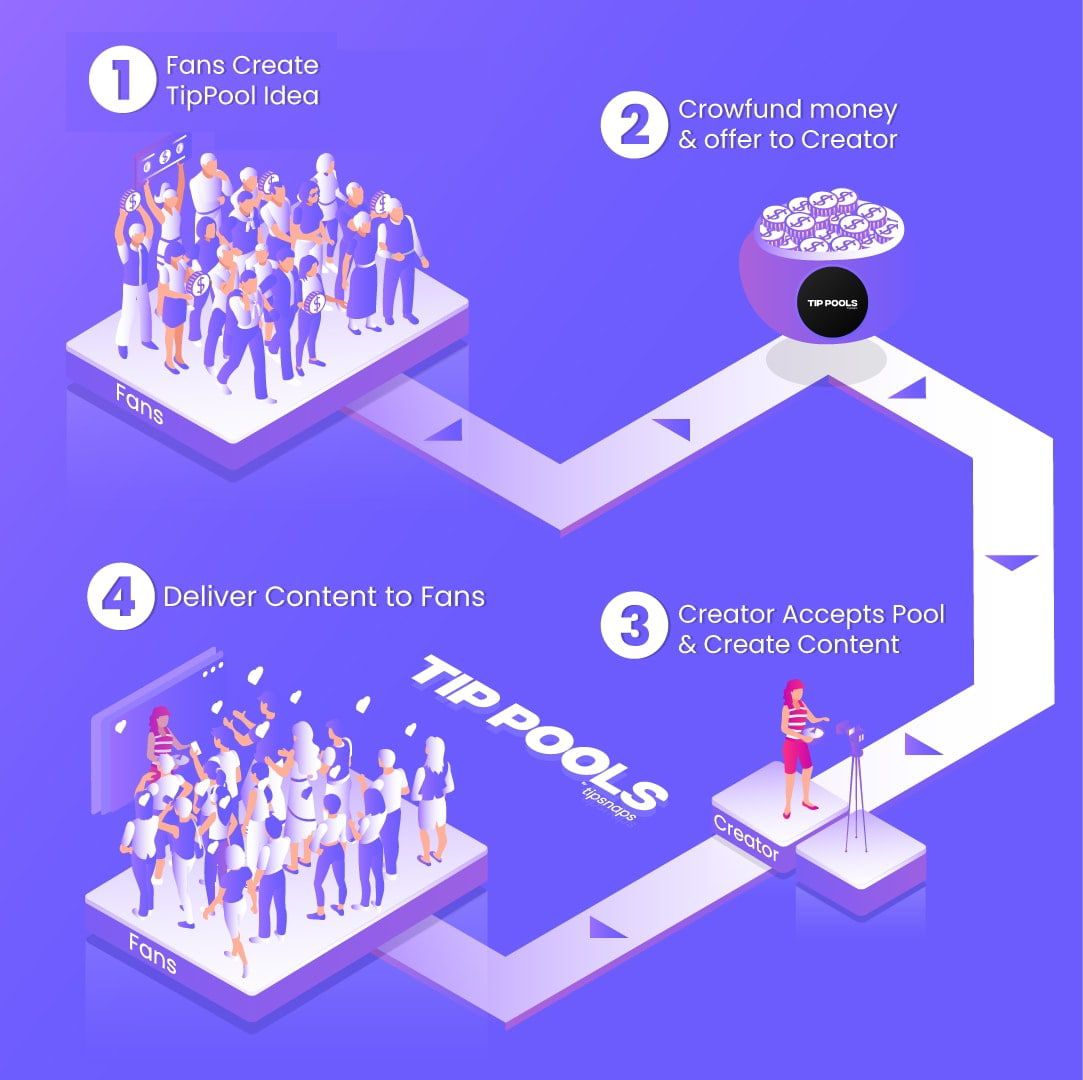

TipPools - How it works?

Trailblazing a 'new category' within the Creator Economy. Think Change.org or GoFundMe—for social media & the Creator Economy! Gives fans the power to rally together for content they actually want to see.

- High virality component, fueled by trending and culture-shifting topics and content. Platform switching opportunity from incumbent platforms.

- Low fan risk. No credit card transaction unless the creator accepts the offer! Only contributors get to see the content if fulfilled.

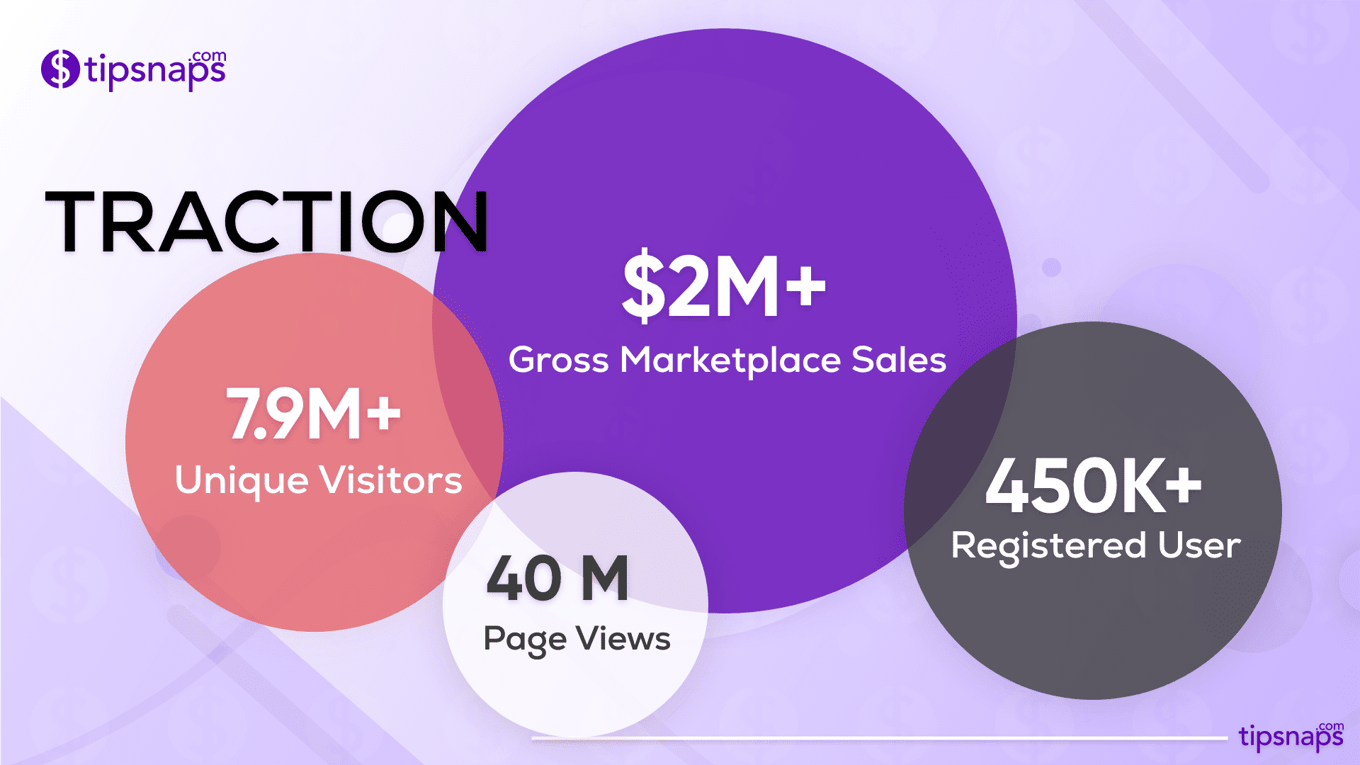

Traction

Not a theory, we have traction

Early Traction

- TipPools Launched in 2021 | Creator Economy Pioneers

- Capital-Efficient: 100% bootstrappeduntil Jan 2021

- Developed, Launched, Go-to-Market in 2017 - organically grew to 300k+ Registered users with ZERO FUNDING. Fully bootstrapped.

2021 Traction

- 663k Unique Visitors to site in 2021

- 2M+ Pageviews

- 25k Registered Users in 2021

- ~4k Registered Creators in 2021

- $172k in Gross Marketplace Volume 2021

In 2020, TipSnaps recognized massive inequities within the Creator Economy where content Creators of Color were being undervalued and mistreated on social media platforms. Thus, we decided to pivot our focus to highlight content Creators of Color and ensure that they had a platform that valued and supported their creativity.

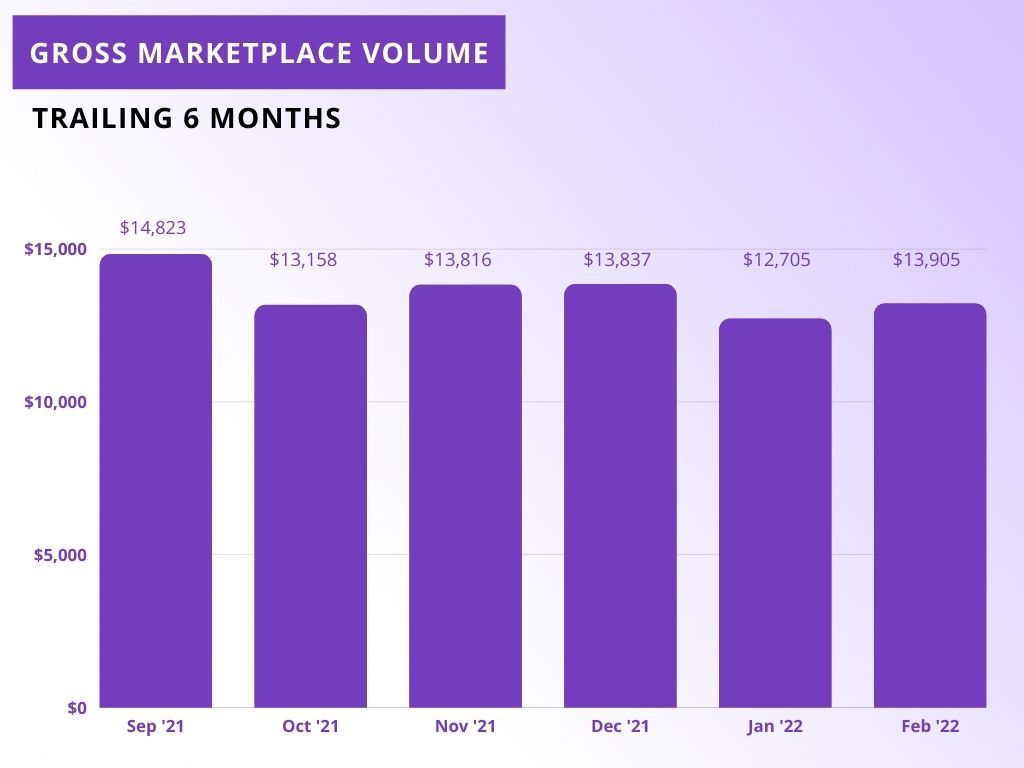

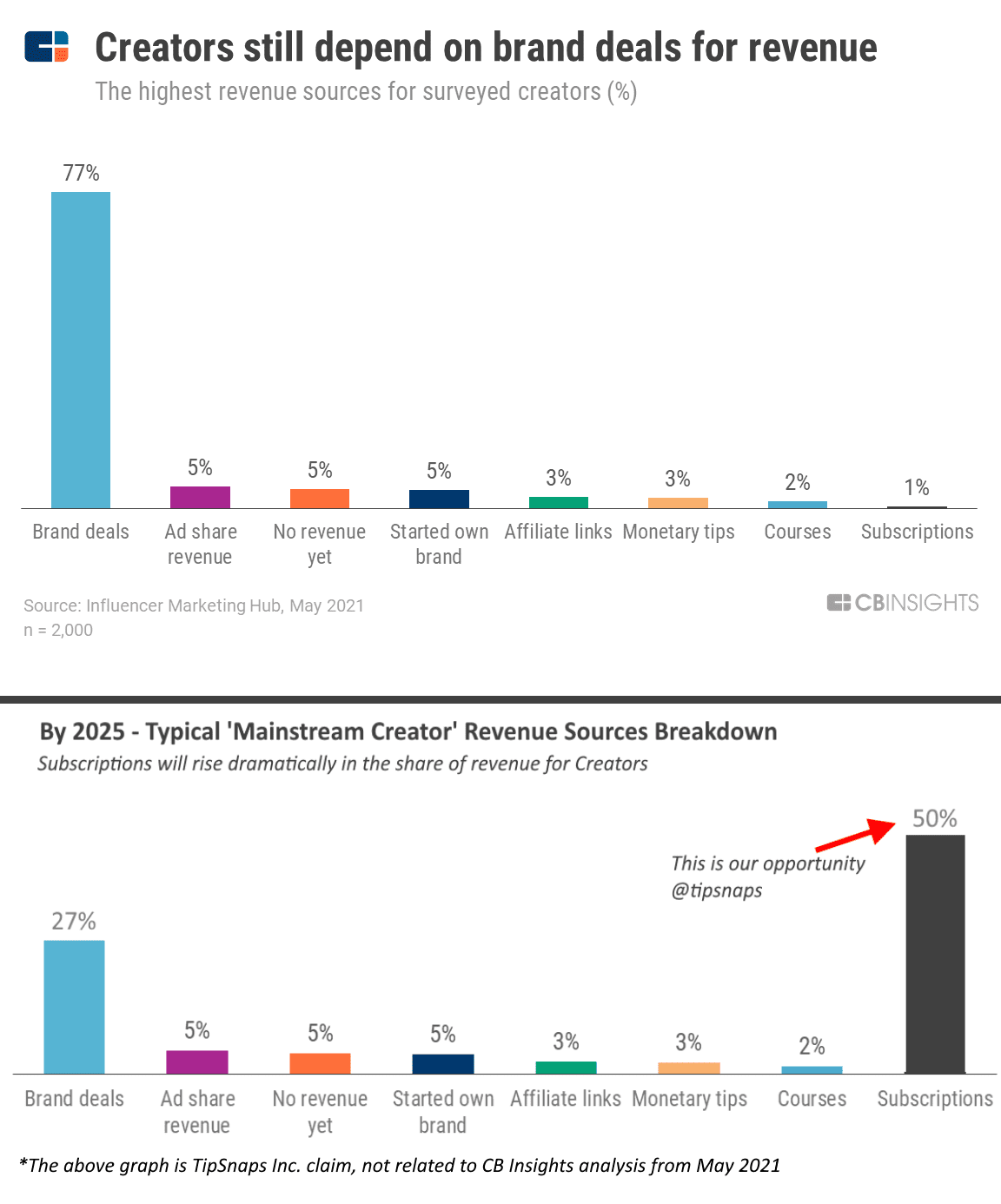

Utilizing growth hacks, direct outreach, and our creator ambassadorship program, TipSnaps has helped Creators of Color truly recognize the value of direct monetization. Using our subscription-based model, creators have successfully optimized their monthly revenue streams. Our revenue over the last 6 months has remained steady, as we continue to onboard many diverse creators, all while creators become less reliant on brand deals and begin to fully utilize the direct monetization.

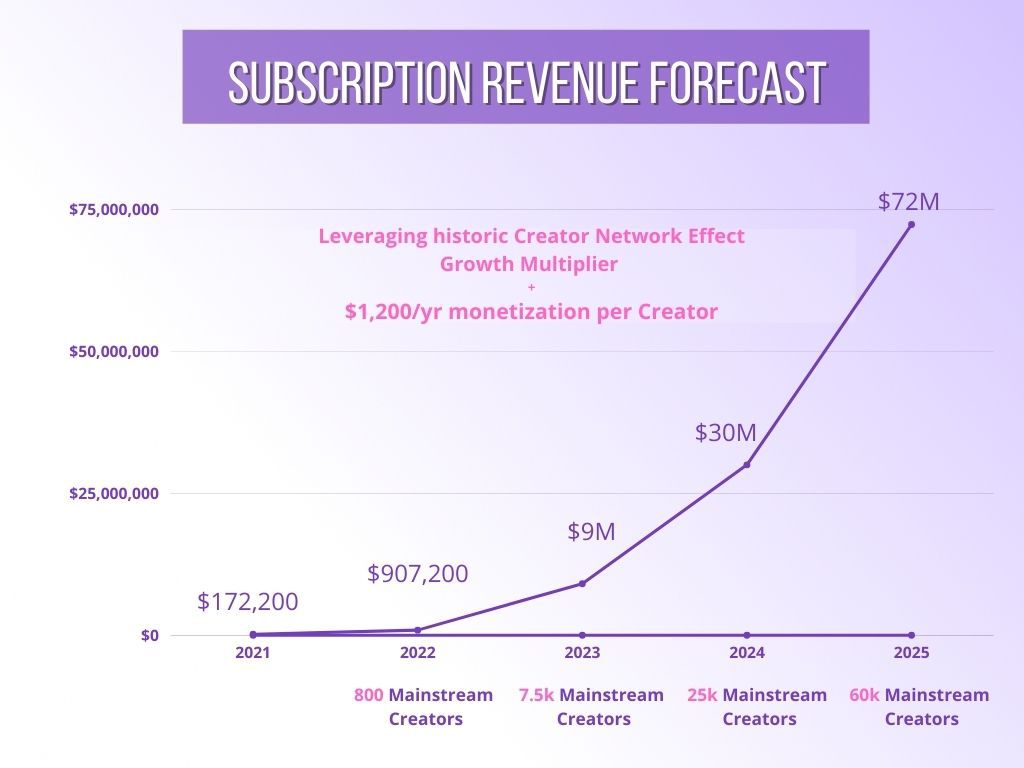

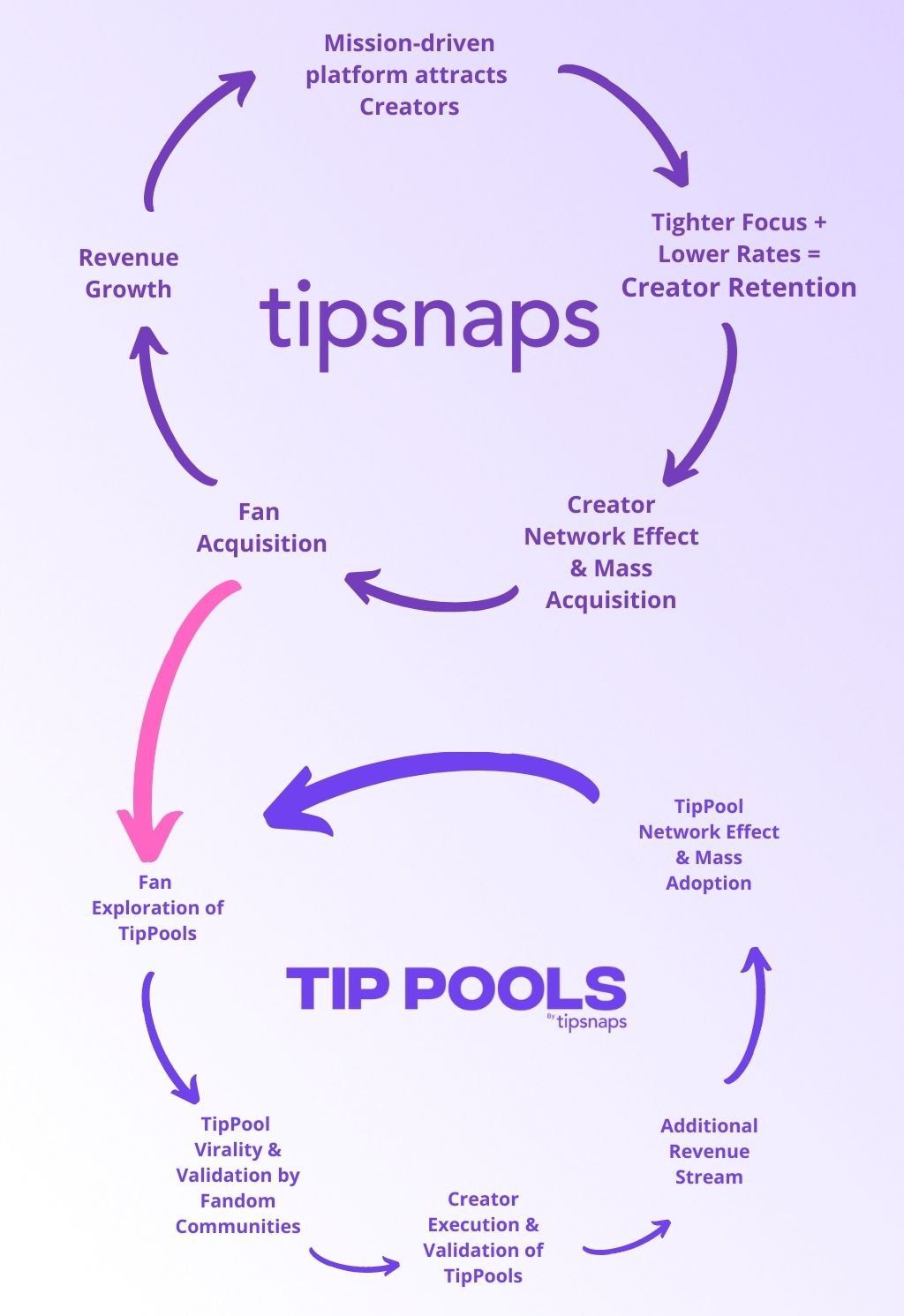

We are positioned to experience exponential growth, as we expect a massive network effect within our target niches. Since these are untapped markets, when 10-20 large creators within the niche adopt TipSnaps, the adoption will rapidly and broadly spread amongst the niche. The Revenue forecasts visualized below demonstrates this growth as we continue to onboard diverse creators who have yet to begin directly monetizing their content. Conservatively estimating $1,200/year per creator, we expect to see substantial year-over-year growth.

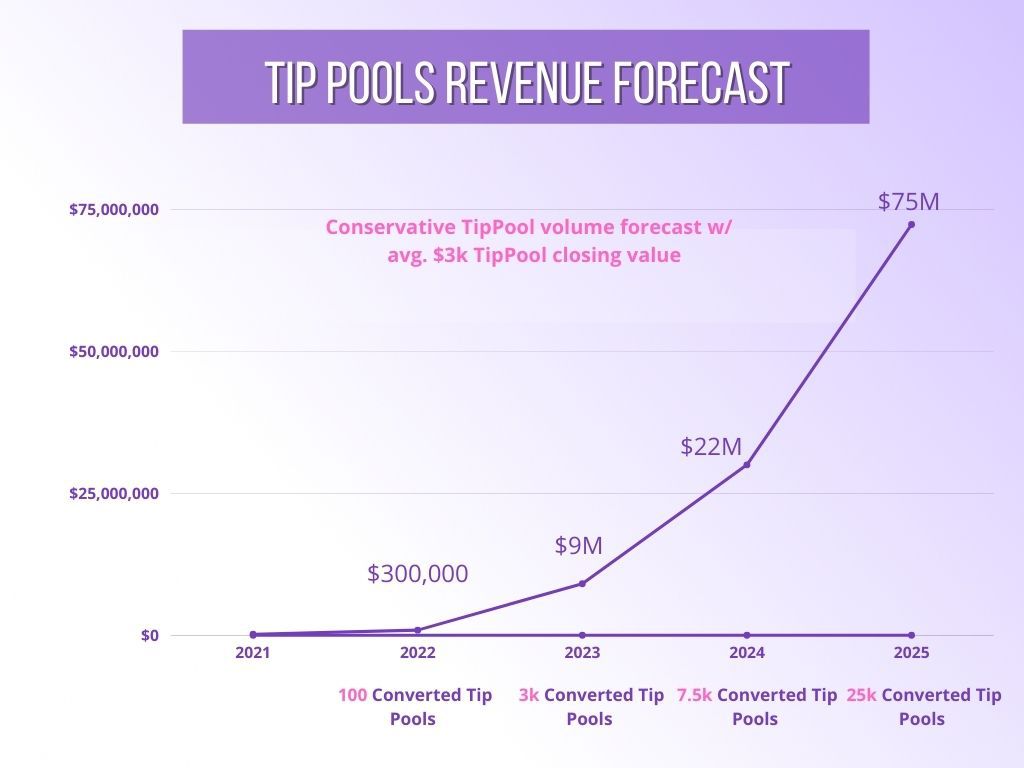

As an additional revenue opportunity for the company; TipPools is a completely untapped market with massive growth potential and we anticipate full adoption of this concept across all content niches by 2025. We conservatively project 100 TipPools to be converted and executed by the end of 2022 and we are forecasting that over the next 3 years TipPools will gain broad adoption across all online fan communities. We estimate very conservatively that there will be 25K TipPools in the calendar year 2025, with a conservative TipPool value of $3,000. You can imagine TipPools for large celebrities which run into the hundreds of thousands or millions of dollars.

Customers

Fans yearn to Crowdfund for content

but do not know it yet...

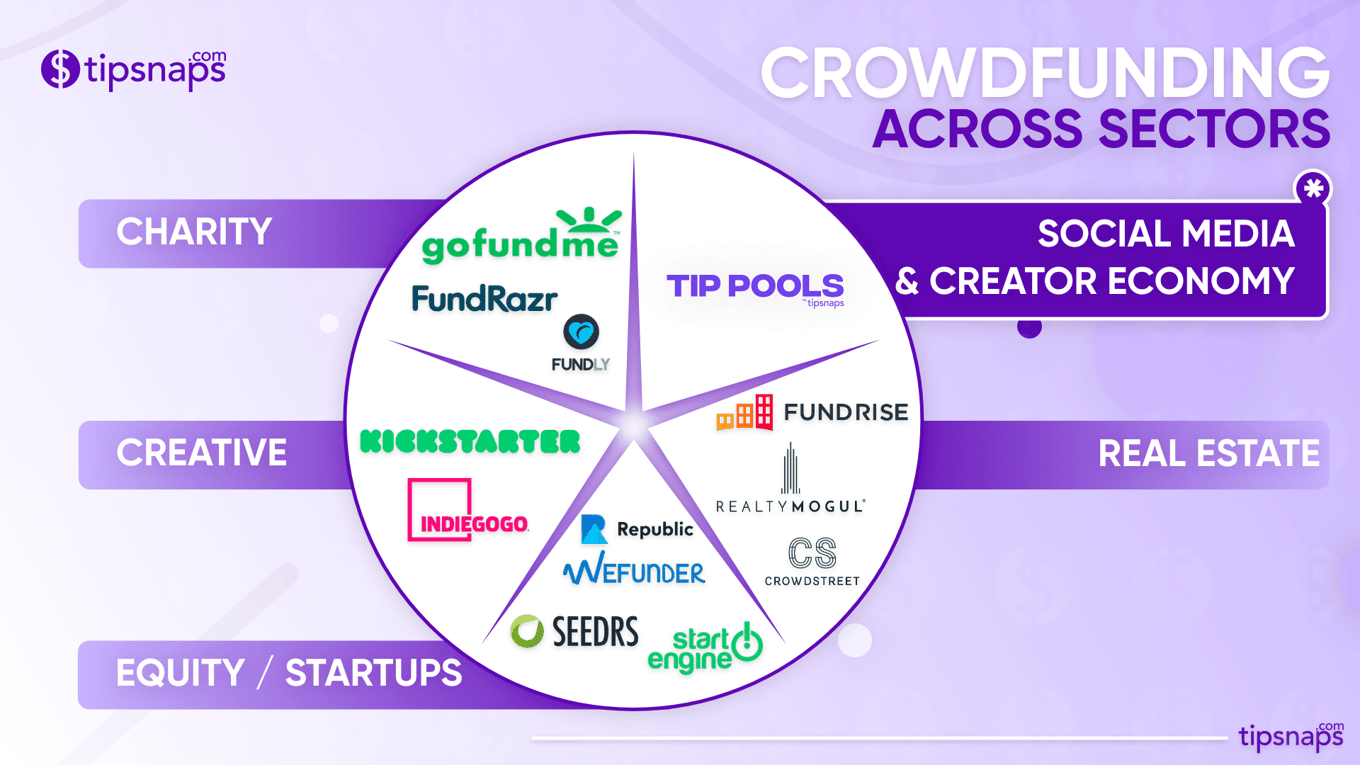

Crowdfunding has penetrated almost every area of the internet, except for social media content. The Creator Economy is the next breakthrough sector for crowdfunding. Every fan community can and will leverage TipPools to pool money together and offer it to their favorite creator in exchange for content they actually want to see! And it's ALL Fan-Initiated! The Fans do not need the permission of a creator to start a TipPool and there are zero-risks, as NO credit cards are charged unless the creator accepts the TipPool challenge!

Fans now have input on the content THEY want to see - This is REVOLUTIONARY!

The case for direct monetization for Creators

Opportunity: Every creator niche needs a HOME to directly monetize! Green open fields of untapped niches!

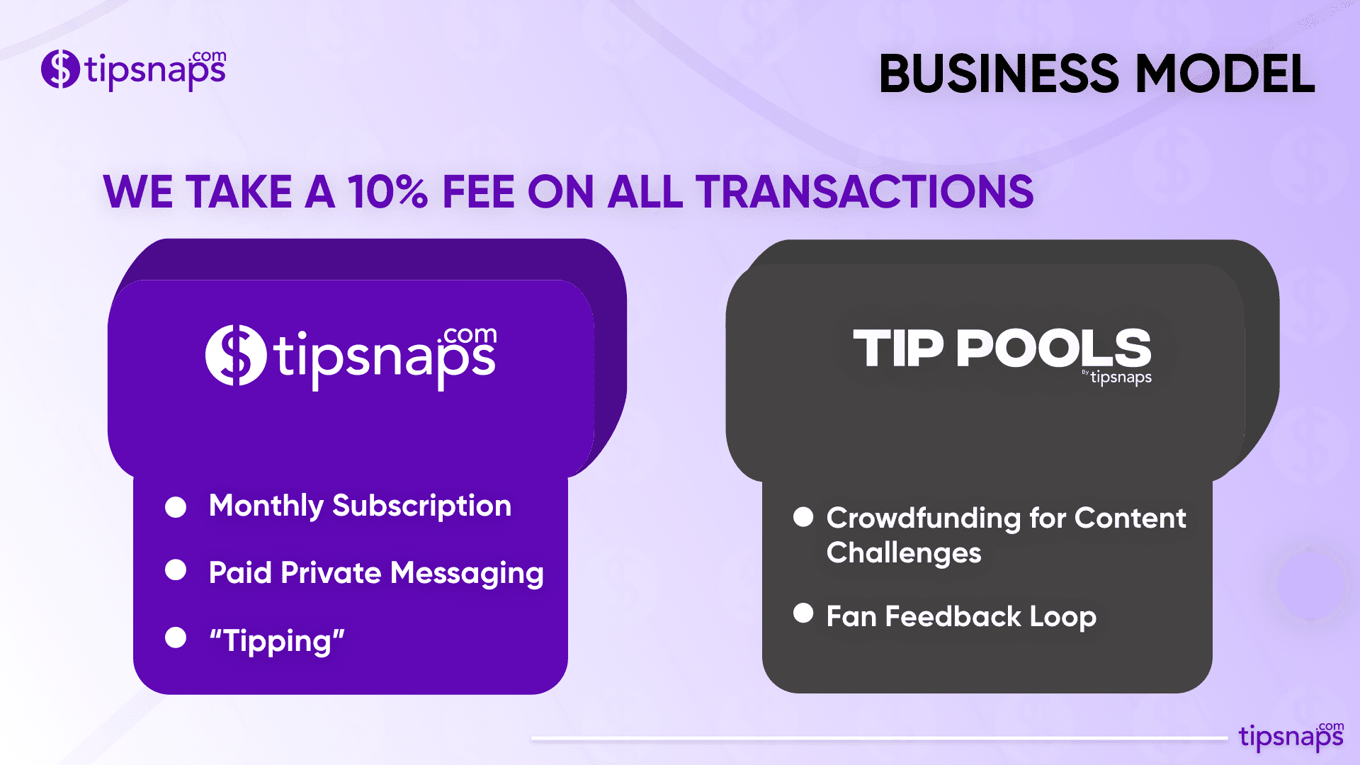

Business model

“With the internet and YouTube, there’s always the concern of being demonetized and having your channel canceled, so people are always looking for alternative ways to earn money,” YouTuber Joshua Wanders said in an interview with New York Times. “You never know where the platforms are going to take you at the end of the day.”

Market

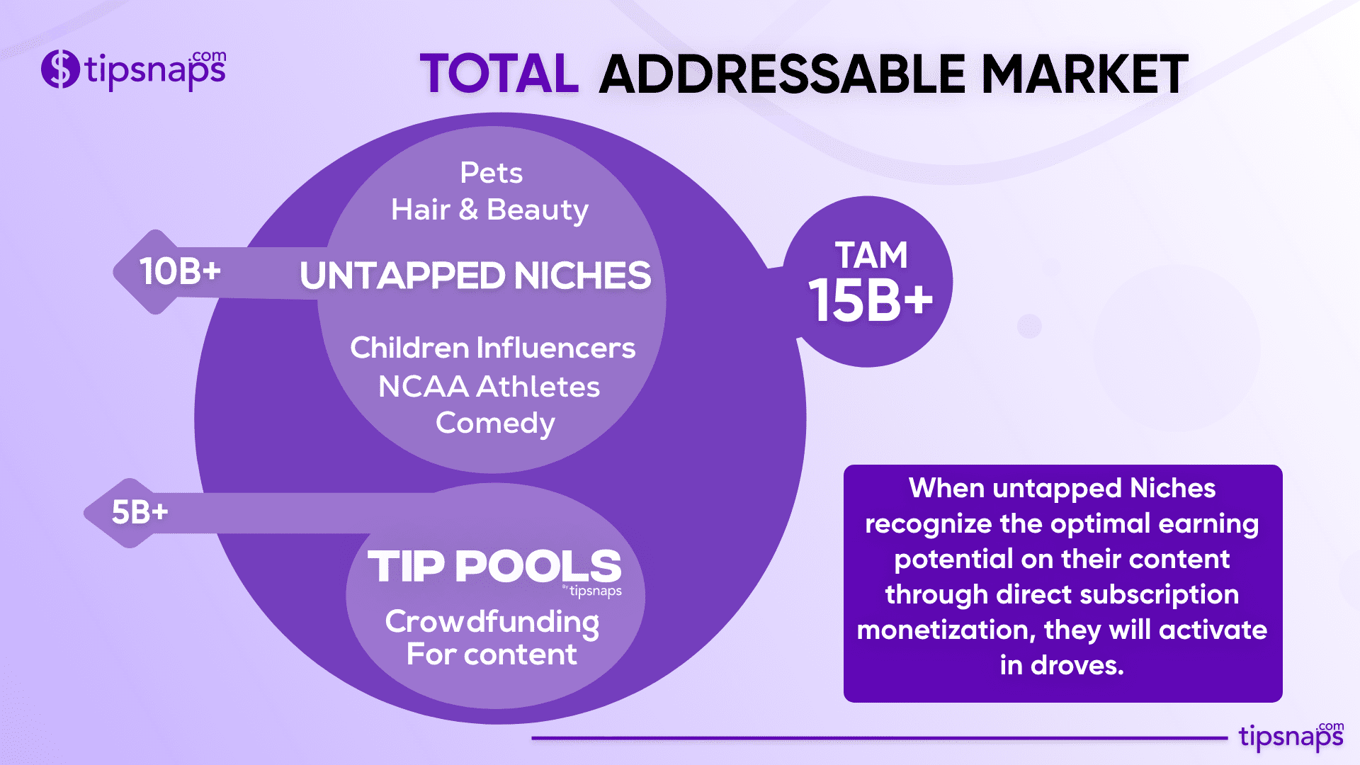

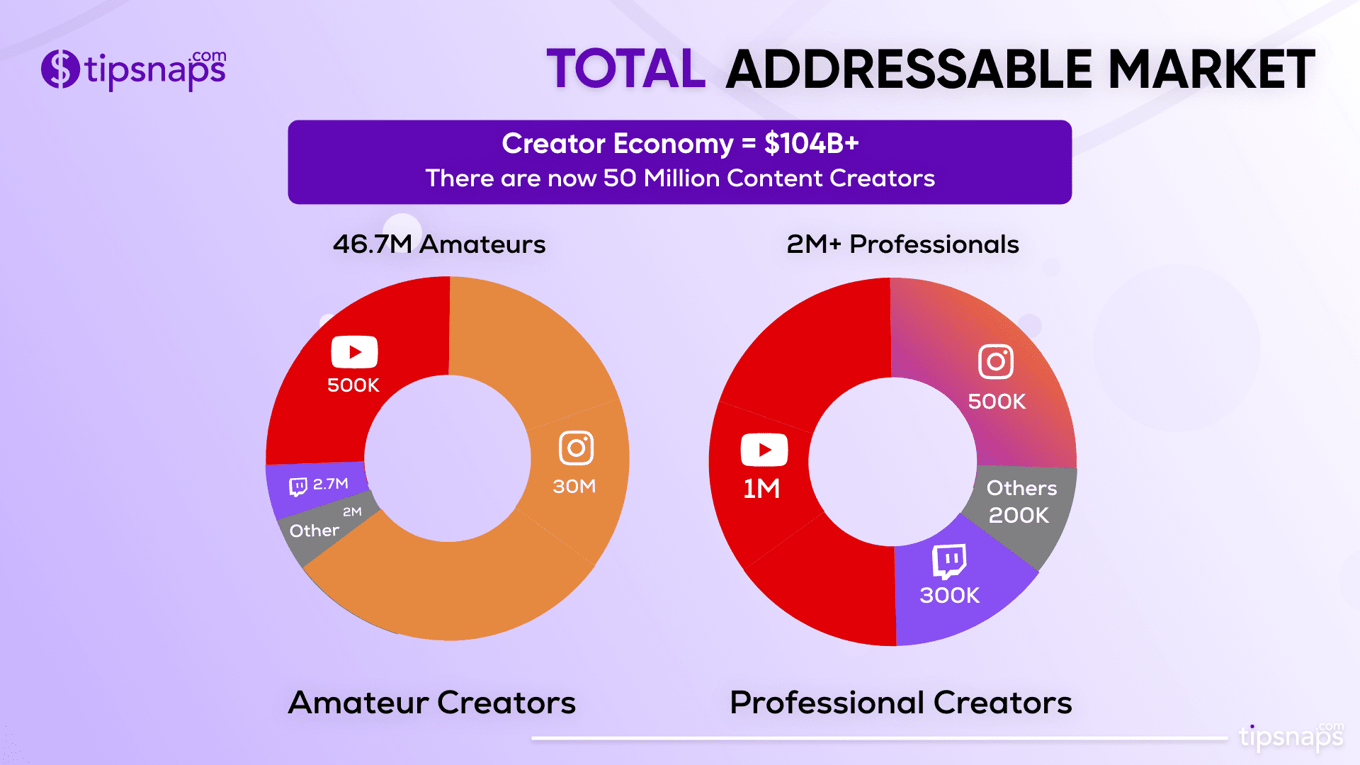

$15B+ TAM

Mainstream, untapped niches of Creators will lean into direct subscription monetization over the next 5 years. Currently Creators simply associate a platform to the action "I do YouTube." "I do Instagram." Soon they will say "I create and sell content for a living". They will favor and be loyal to the platforms that optimally enable them to monetize and best aligns with their personal brands. We will see a shift in Revenue sources for creators to primarily be powered by their Subscription paywalls.

Mainstream, untapped niches of Creators will lean into direct subscription monetization over the next 5 years. Currently Creators simply associate a platform to the action "I do YouTube." "I do Instagram." Soon they will say "I create and sell content for a living". They will favor and be loyal to the platforms that optimally enable them to monetize and best aligns with their personal brands. We will see a shift in Revenue sources for creators to primarily be powered by their Subscription paywalls.

—

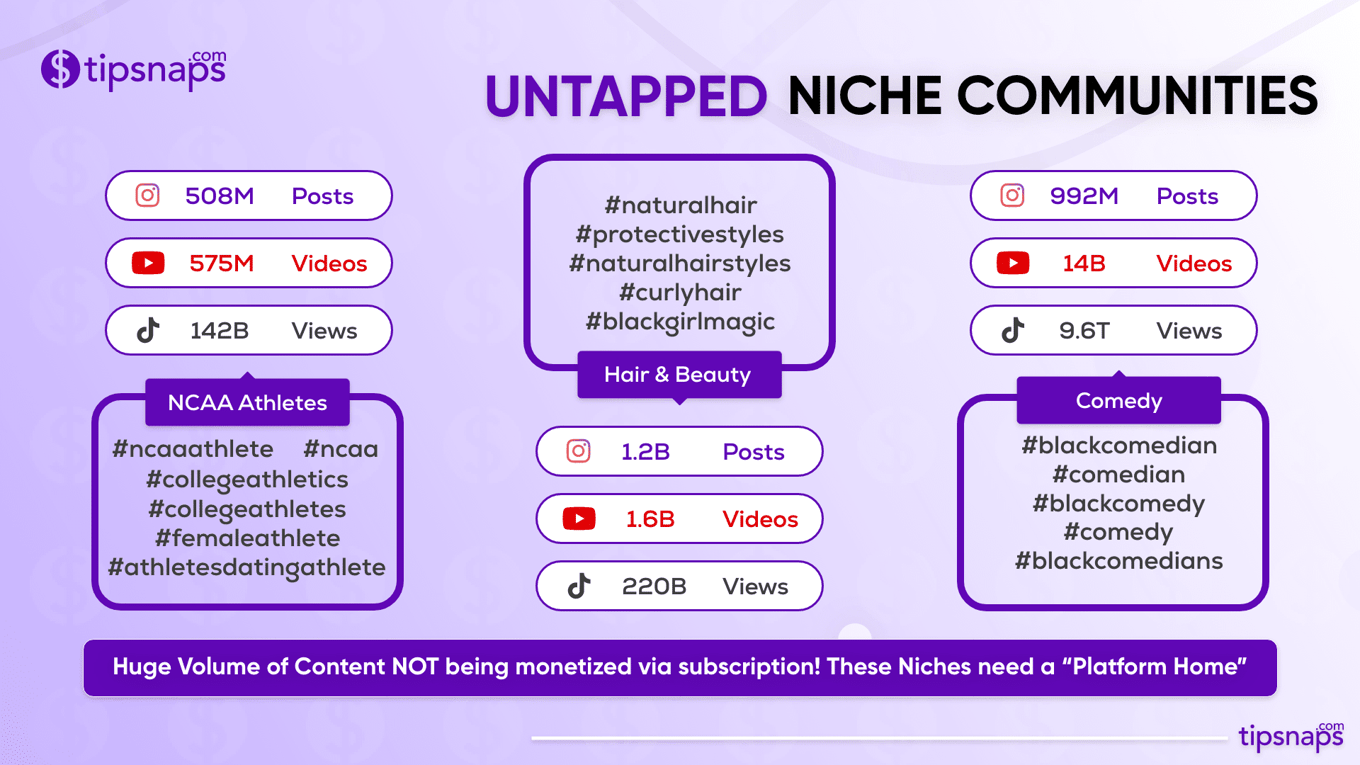

Scraped data on incumbent platforms proves the opportunity

We scraped incumbent platforms via hashtags such as #blackhair #ncaaathlete #blackcomedian and the results were staggering, but expected by us.

Fan Initiated TipPools = $5B Market by 2023

Conservatively estimating that “Crowdfunding for Content” is worth 10% of the volume from Onlyfans + Patreon alone—let alone the broader creator economy.

$10B+ per year by 2023

Considering the broad application of tip pools and fan driven crowdfunding for content; tip pools will span across all social networks and all niches. Natural evolution for the creator economy.

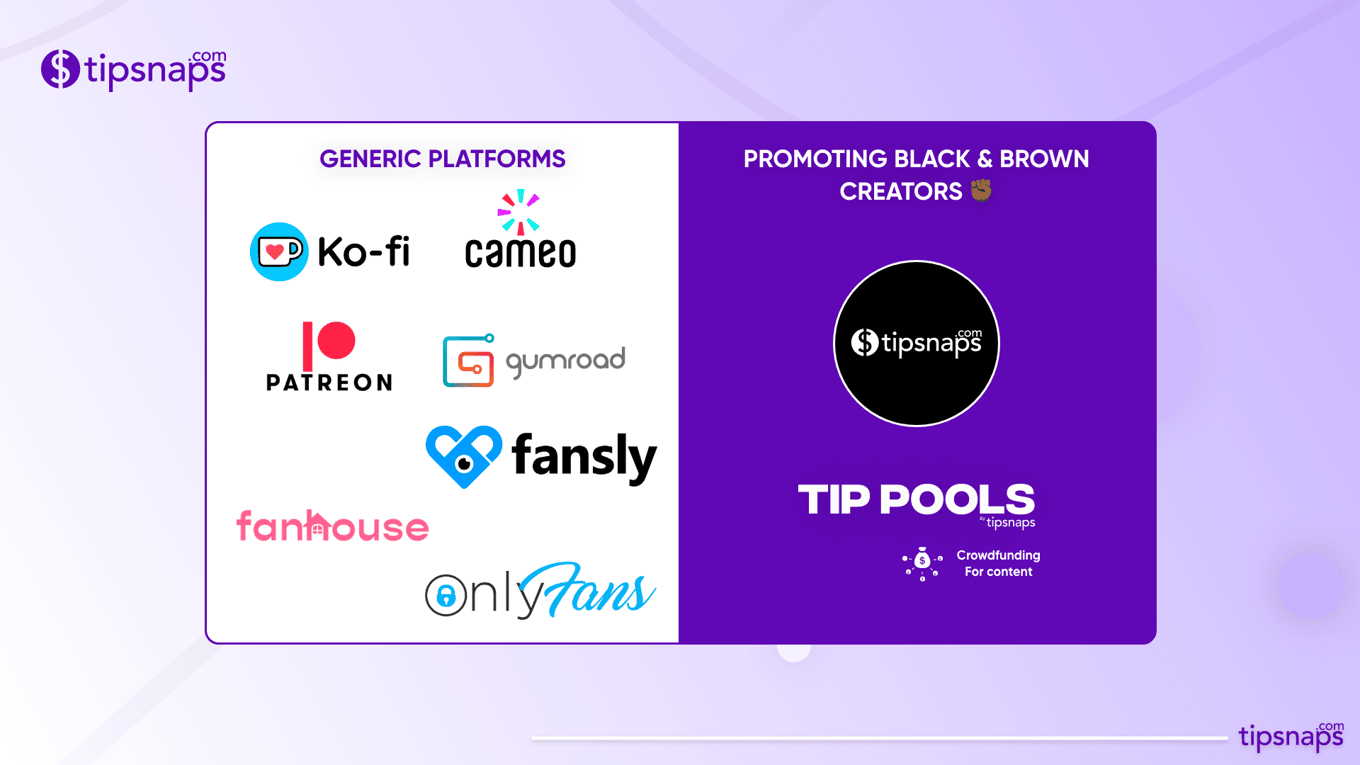

Competition

TipSnaps value proposition

- TipSnaps offers a tighter focus, greater customization, and a better rate for Creators to set up a subscription business.

- TipSnaps offers the first Fan feedback loop through TipPools for Fans to crowdfund for content!

Vision and strategy

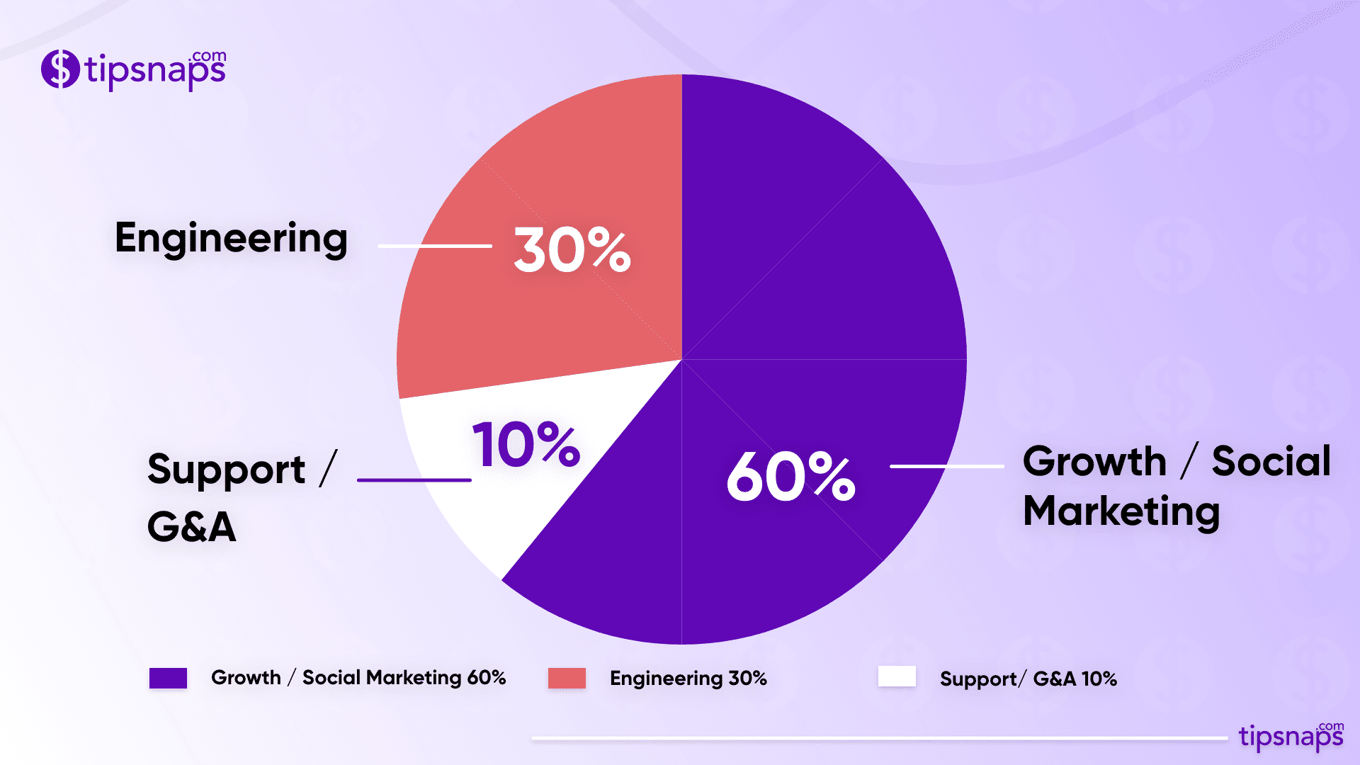

Use of funds

Focusing on capturing untapped niches and TipPool adoption

Our primary objective is community growth. We have 3 amazing Gen Z growth managers we're ready to hire to help us drive growth in building community and capturing the niches we care about. The platform is LIVE and scale-ready now!

1-2x Growth Managers to focus on target niches:

- Black / Natural Hair & Beauty

- Athletes

- Instagram Comedians

Q2 '22

Laser focus on driving adoption of TipPools within valuable Fandom/communities.

- TikTok fashion & beauty fans

- TikTok comedian fans

- Instagram models fans

- Instagram & TikTok NCAA athletes fans

- Mega celebs/TMZ style fans

Q3’22

Focus on strategic partnerships, Creator Education and “White Glove” Creator support.

Target key strategic partnerships:

- Black/Natural beauty brand

- Comedy brand partnership

- NCAA Collegiate Program Partnership

Q4 '22

Key feature rollouts:

- Domain Registrar - Enable Creator Domain Registration within App

- Creator Monthly Asset Upload Minimums

- Brand Affiliate program

- NFTs -

Live Events & Partnerships:

- "TipSnaps: For the Culture” Creator Conferences —NYC/LA/ATL/Houston

- TipSnaps Producer Program (linking up Creators with local Videographers/Photographers)

- Creator Meet & Greets (Facilitating Fan Meet & Greets in major metros within the US)

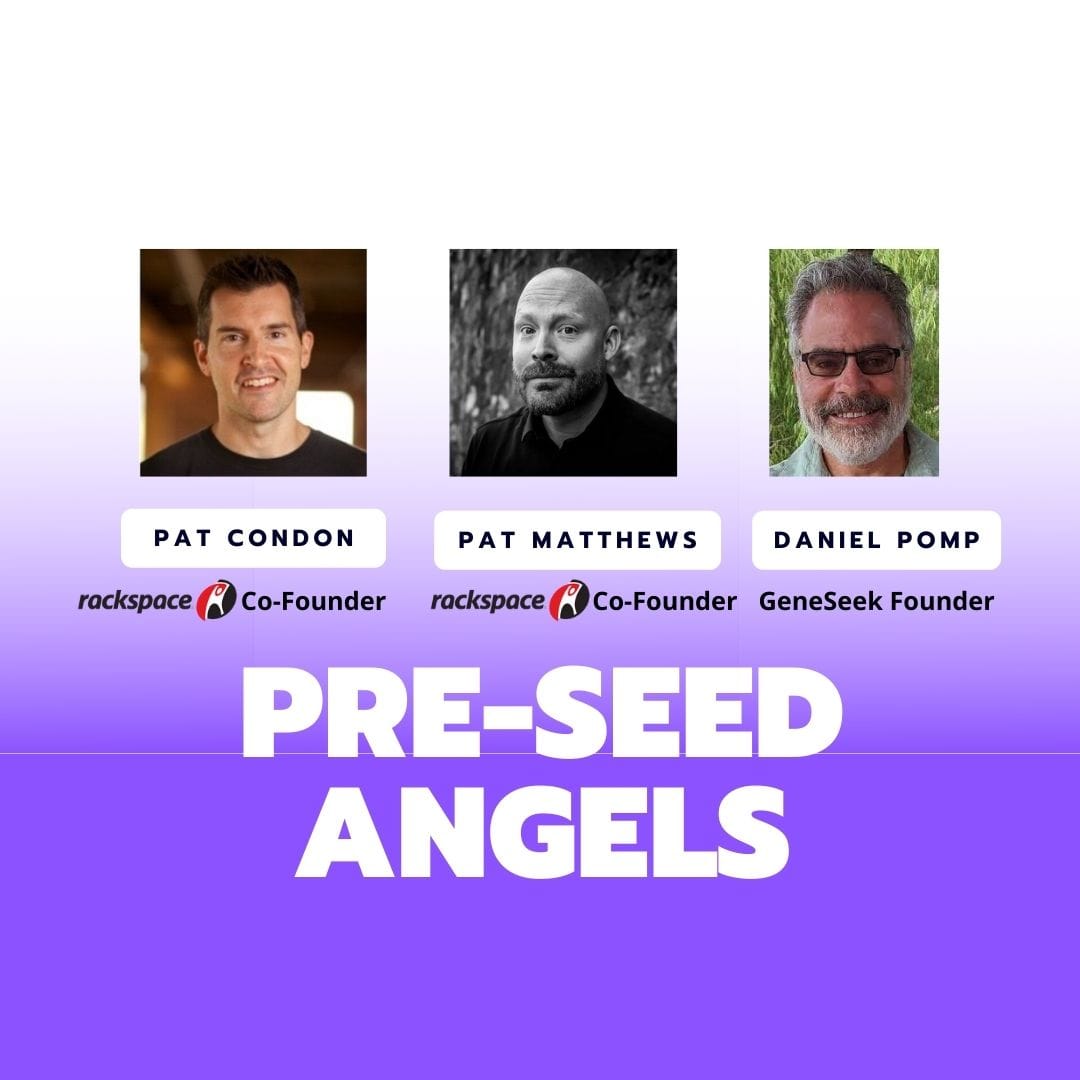

Funding

Founders

Lyonel Dougé

Lyonel Dougé

CEO/CTO

University of Pittsburgh - BS in Computer Engineering/Science

12+ years experience in enterprise IT/software engineering - with a proven track record of delivering digital products for Fortune 500 companies.

Background. Digital Product Management | Johnson & Johnson,

Managed web platform where 500+ J&J Consumer websites hosted (including listerine.com, johnsonsbaby.com & aveeno.com)

Software Engineer @ Sony Music & ViacomCBS & NFL

Lyonel personally developed and launched TipSnaps v1 single-handedly while holding a full time Product Manager job @Johnson and Johnson.

Forced to moonlight nights and weekends because of no access to venture capital. Bootstrapped from 2017-2021 without any angel funding.

Vic Boddie Ph.D.

COO

HBCU Graduate - Hampton University (B.S.) and Howard University - Microbiology (Ph.D.)

FDA - 9+ years | Supervisor - Science, Policy, and Consumer Health Expert

Chairman of the Diversity, Equity, and Inclusion (DEI) council at the FDA

Consulted in Business Development & Growth Marketing for several startups prior to joining TipSnaps in 2021 as a Co-Founder

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...