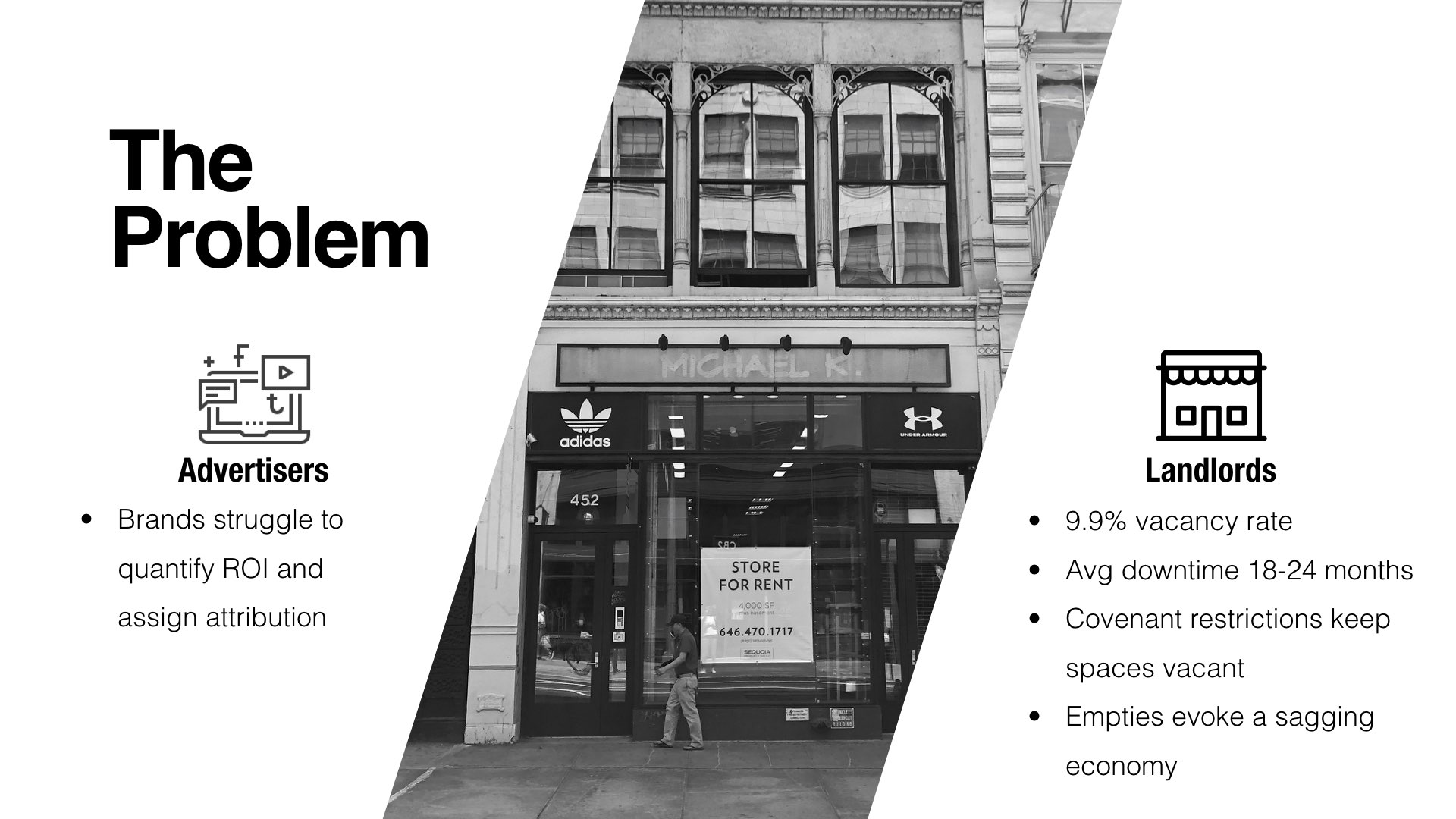

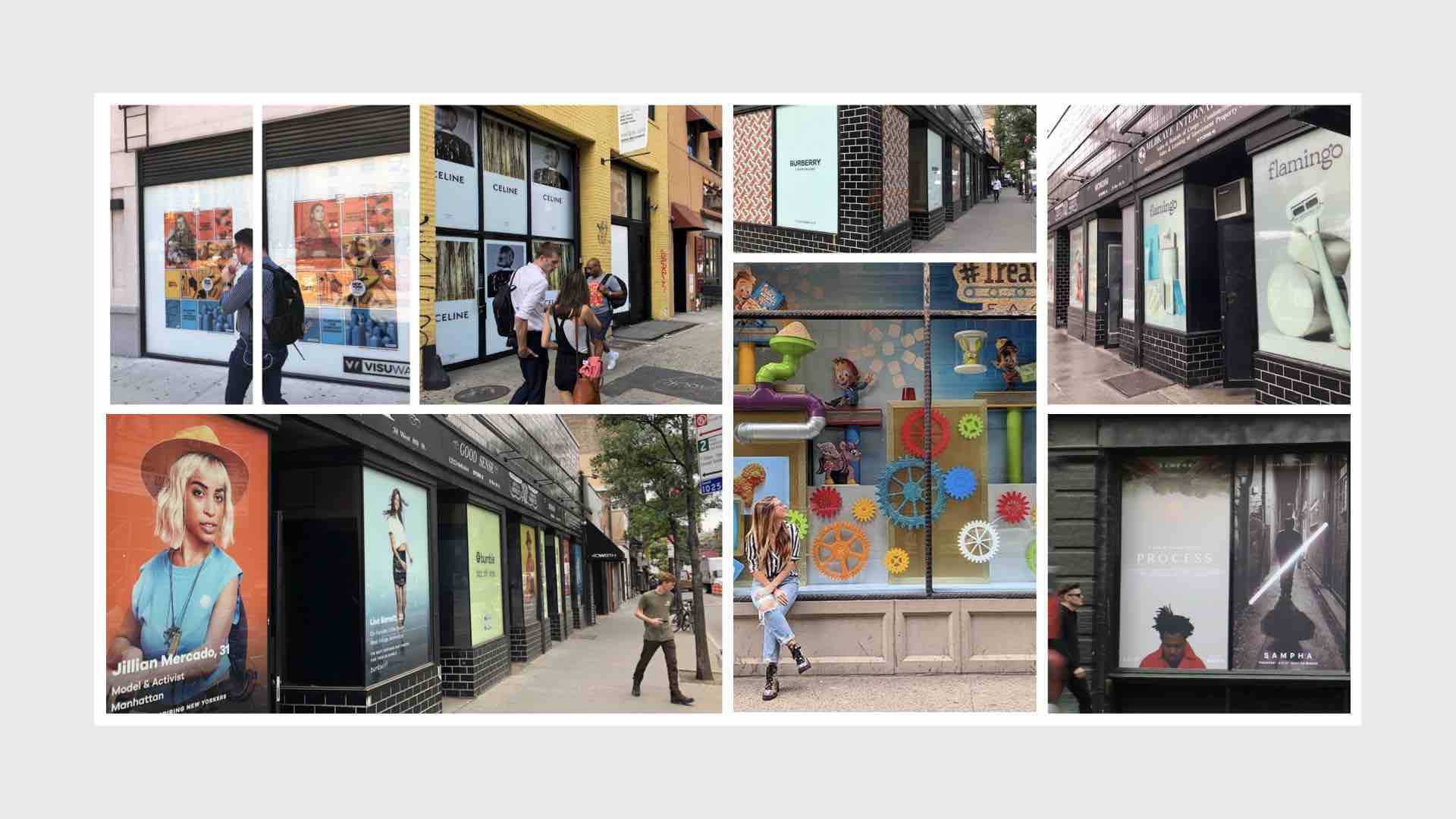

Vacant storefronts are everywhere. Churn in the real estate market means there will always be a number of vacant properti...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

VisuWall

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

- Marketplace technology that leverages storefront windows for traditional and programmatic media

- Client’s average campaign size: $35,000 per 4 weeks

- The founder has 18 years of marketing and advertising experience, having worked with Google, Nike, Spotify, Cîroc, and others

- $550k raised to date from XRC Labs, New Age Capital, and private investors

- Brand clients include Apple Music, Celine, Burberry, CFDA, Harry’s, Bumble, Google

- Real Estate clients include: Acadia Realty, Extell, 101 Holdings, Rockpoint

- XRC Labs Cohort 6

- Goldman Sachs 10k Small Business Cohort XXIII, New York

- Goldman Sachs 100 Most Intriguing Entrepreneurs 2017 and 2018

$9.2bn is left on the table every year

Vacant storefronts are rampant throughout the U.S. Regulatory restrictions actually prohibit landlords from reducing rents far enough so these vacancies persist for on average 18-24 months, costing the industry $9.2bn in revenue annually.

It's difficult to measure how effective traditional advertising really is. And today, brands are rushing to digital marketing, causing it to become overcrowded and expensive. As a result, ad buyers are unconfident in existing advertising channels and how much to spend on them.

Eye level media and metrics that matter

Monetizing empty storefronts with advertising revenue.

Each storefront powered with our technology captures foot traffic, demographics and even sentiment. With our technology, brands can even tell if viewers are smiling or sad, exposing invaluable data and insights.

We are delivering eye level media and metrics that matter through a vast medium that has literally been hiding in plain sight – until now.

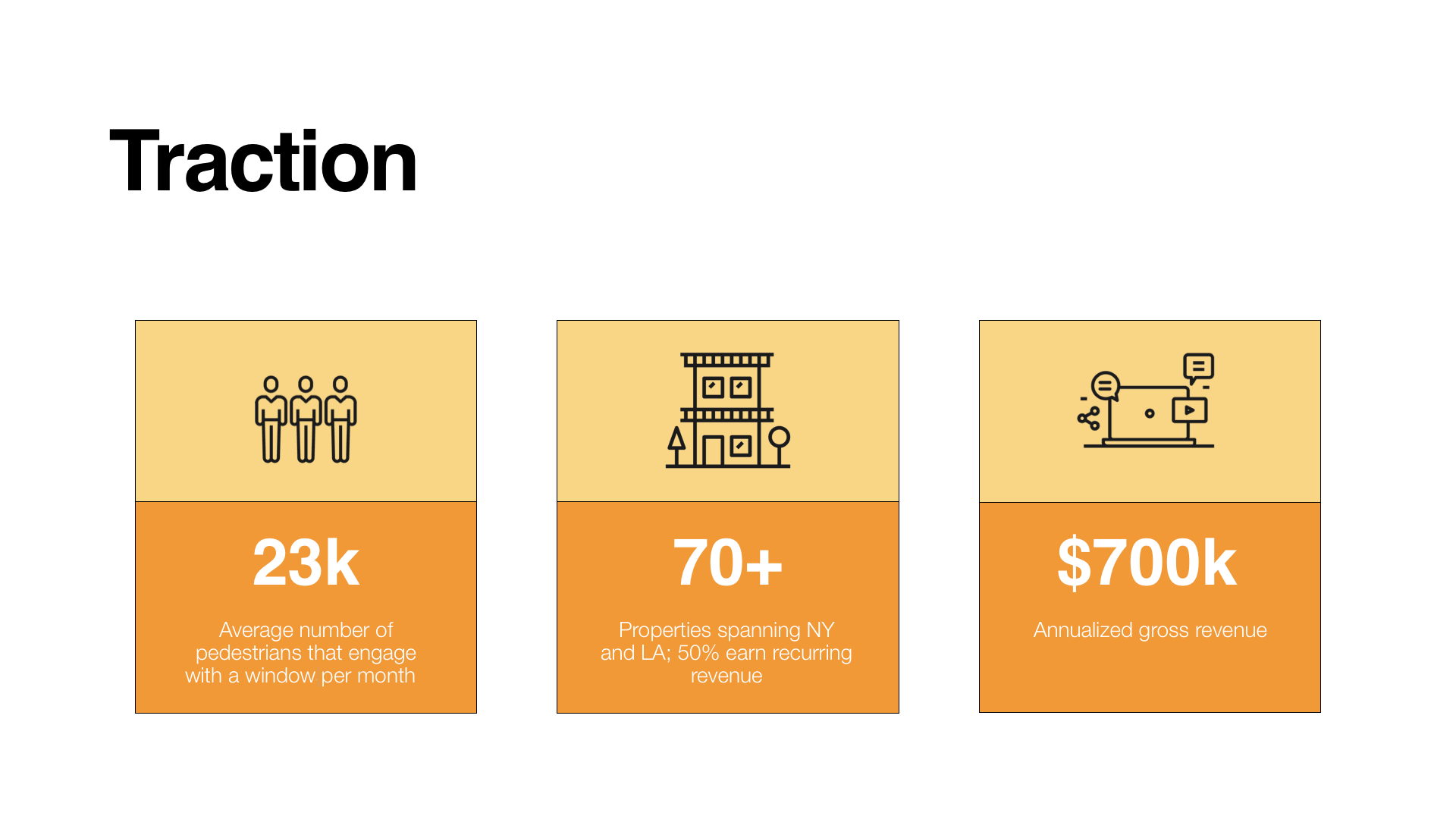

$700k annualized gross revenue

*As estimated by company.

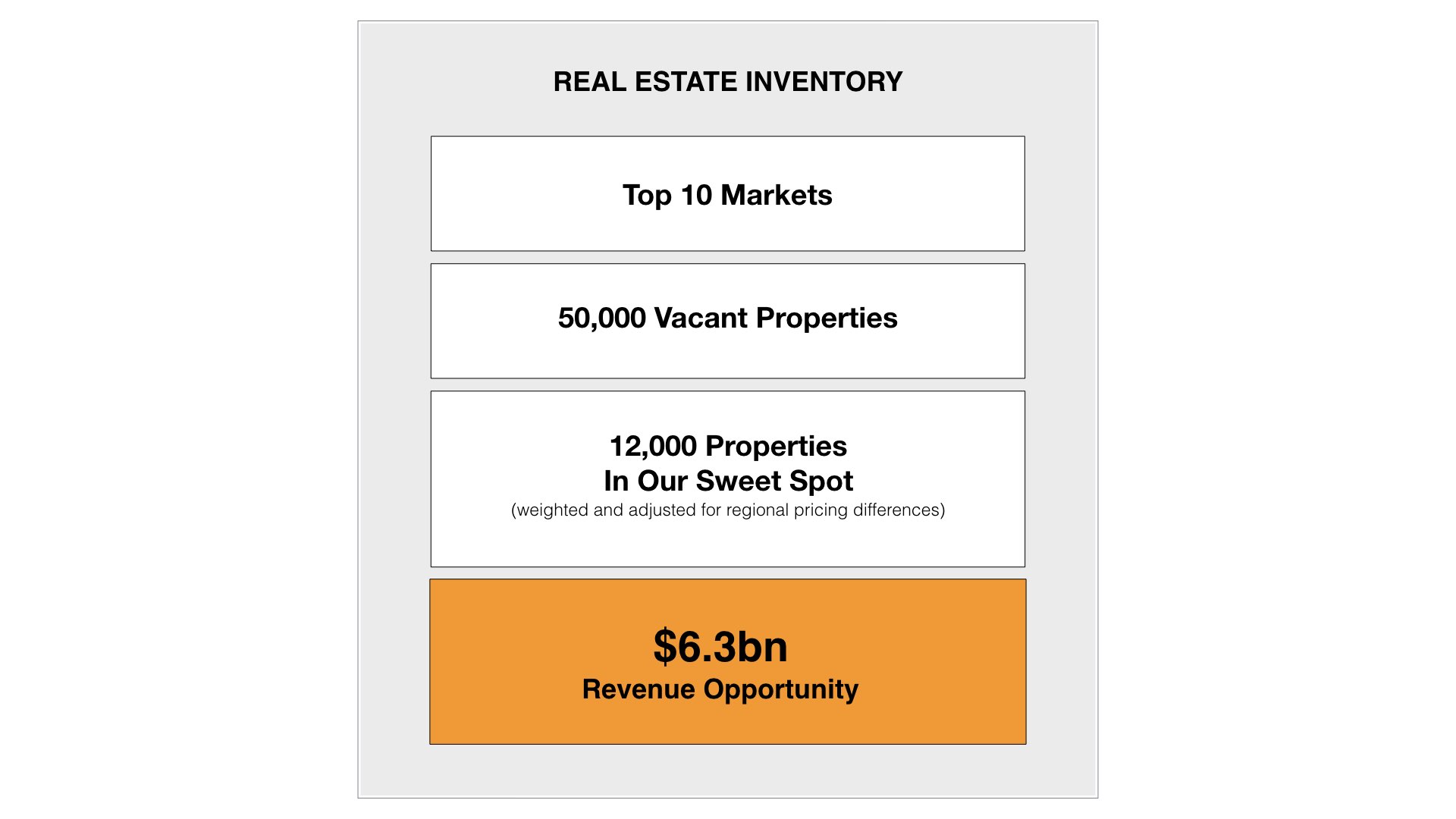

We are working with the best brands in the world and the biggest names in real estate. We’re currently active in NY and LA and we are on the fast track to growing to 4 markets by the end of 2019 and then growing to 10 markets by the end of 2020.

Seen in:

“We tapped VisuWall for our New York Fashion Week out of home branding campaign because of the innovative technology and analytics as well as their thoughtful use of vacant storefronts. The end results delivered on all levels.”

- Mark Beckham, Council of Fashion Designers of America (NYC)

VisuWall is brand category agnostic and can support most brand categories with strategic support. Our successes include brands in the following categories: consumer products, fashion, retail, e-commerce, technology, and entertainment. In our purview, we will ramp to include spirits, automotive, finance, government elections tentpole event activity and more.

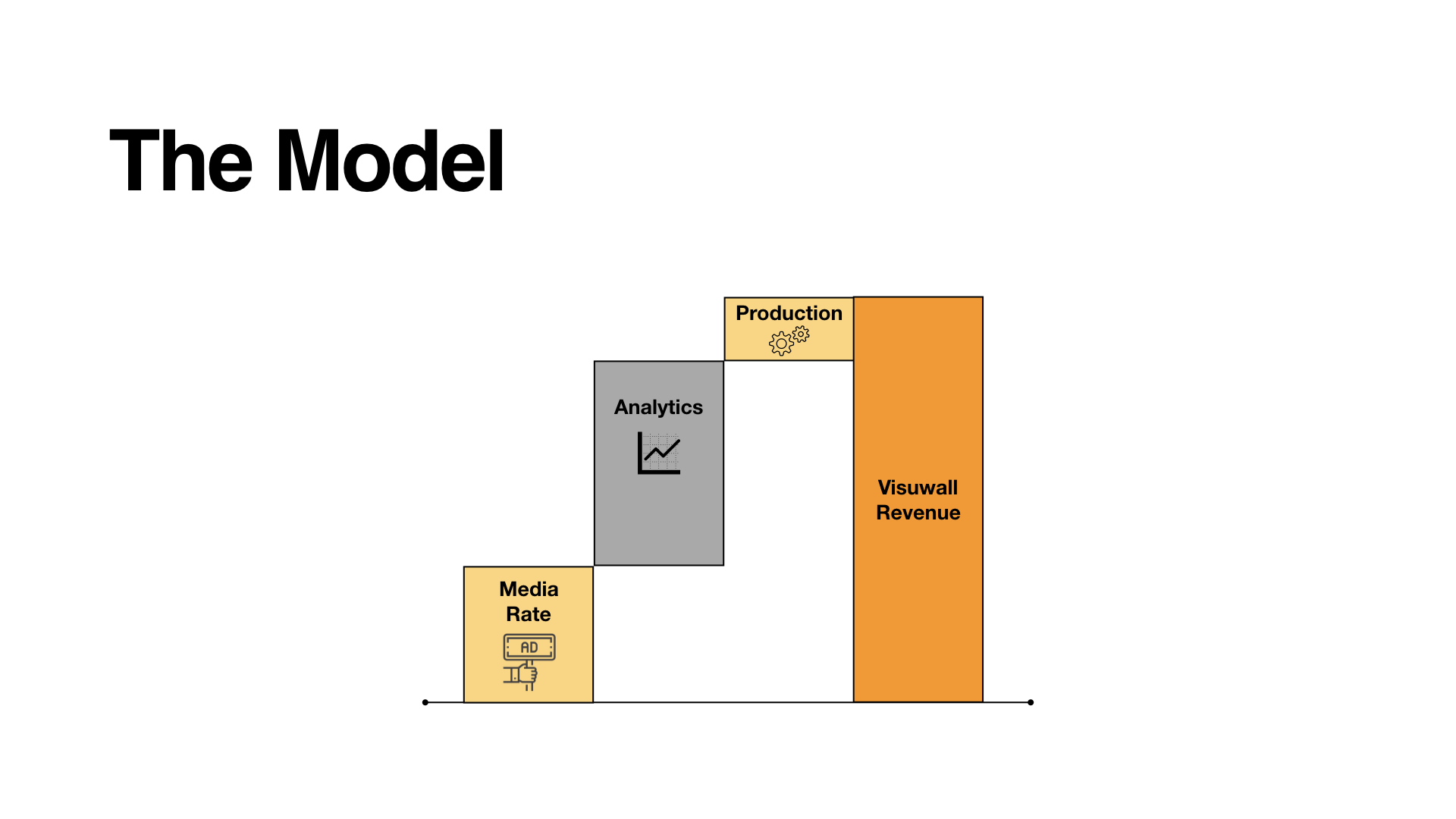

Pricing for each window is set by an algorithm informed by location, visibility, size plus attributes set by a host of variables common in media.

- Media Sales: Revenue shared with landlords

- Production Mark-Up: Standard rate on production costs

- Analytics: SaaS-based subscription model

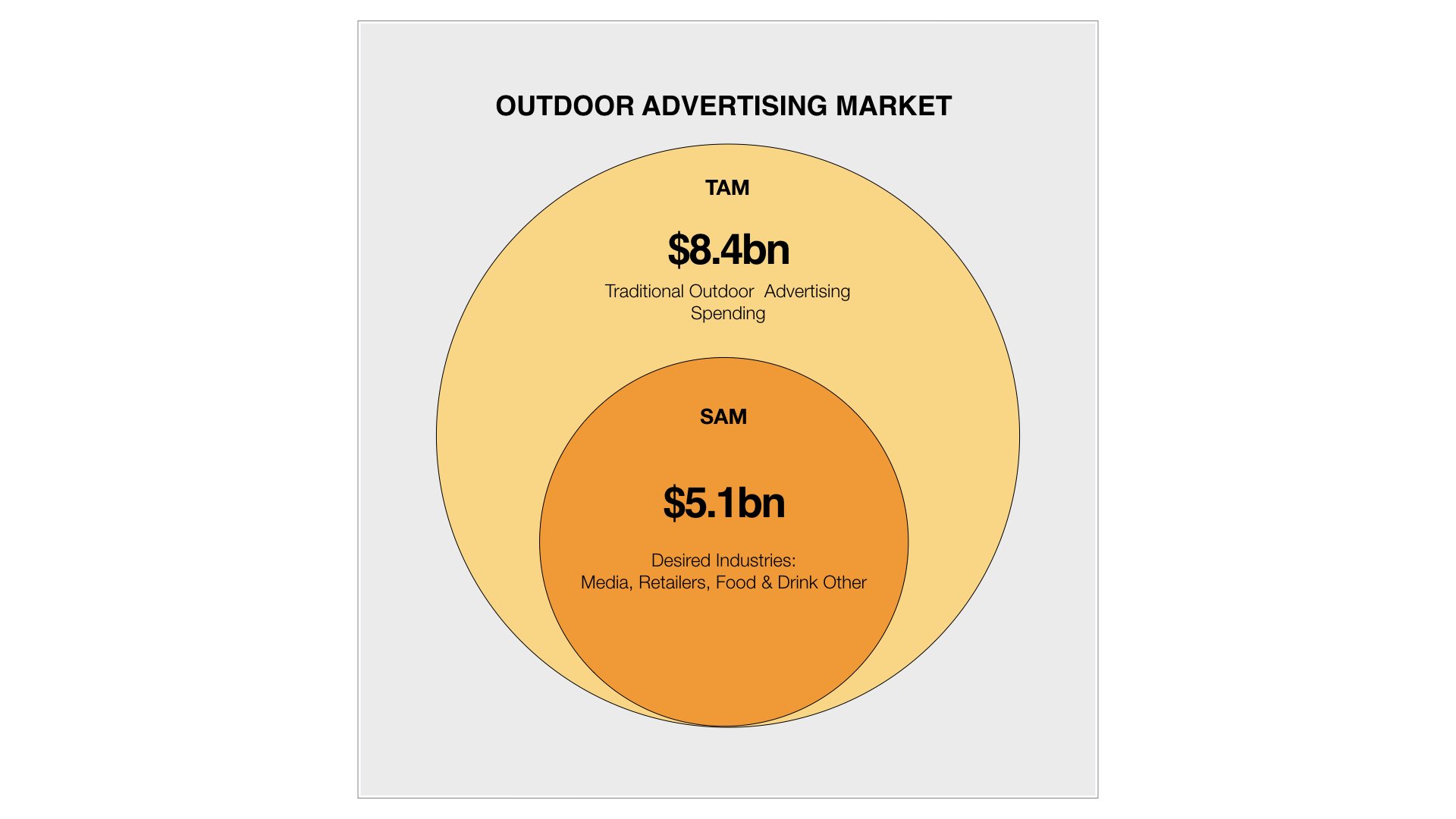

Programmatic opportunity: $49.5bn

Programmatic spending is on the rise

VisuWall's focus is on the advertisers who account for 60% of the $8.4bn market including media, retailers, consumer products and fashion & beauty.

Our strategy is to integrate and streamline the processes of buying traditional outdoor and the rising trend of buying programmatic outdoor and the same categories mentioned above account for $49.5bn in digital spending annually.

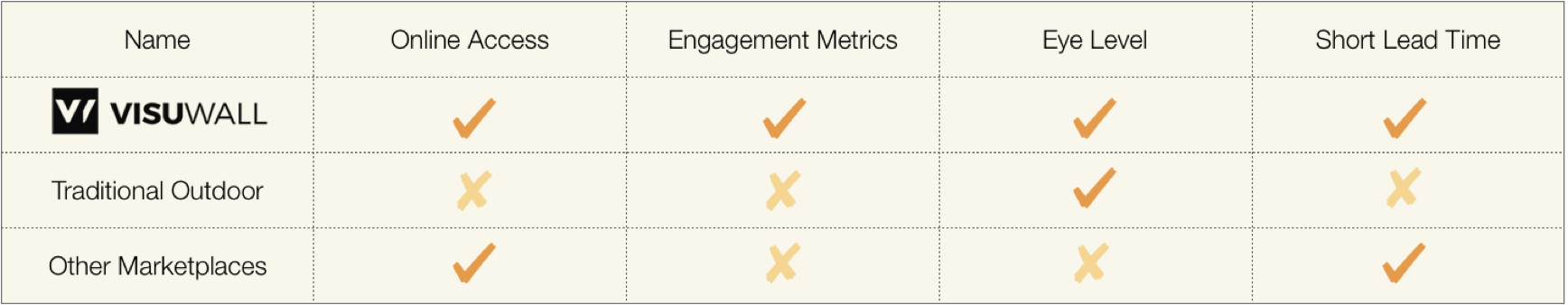

Competition

Raised $550K to date

VisuWall has raised $550,000 pre-seed round from XRC Labs, New Age Capital, and private angels.

On track to launch VisuWall 2.0 and expand to 4 markets

Our version 1 was a success: we’ve collected valuable customer feedback and implemented it in to version 2 due to launch next year. We will utilize funds to hire sales teams, and technology lead, so that we can speed the development of the VisuWall product and accelerate our growth (sales) in 2019.

Kobi has 18 plus years marketing and advertising experience. A former music industry executive, Kobi has worked with brands to create strategies that make cool and meaningful connections with consumers for national and global initiatives. She has produced consumer experiences, brand strategies, content and media plans for the likes of Nike, Spotify, Smirnoff, Johnnie Walker, Cîroc Vodka, Google, JetBlue and a host of others. Prior to VisuWall, Kobi was the SVP of Strategy and Creative for Combs Enterprises where she led strategy for the chairman's portfolio of brands.

Kevin Tung, Co-Founder & Partner, has enjoyed two exits and is now an angel investor and partner at Interplay. His operational prowess informs VisuWall’s path to growth.

Thanks for taking the time to get to know VisuWall. We hope you'll join us on our journey!

Deal terms

$5,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

20%

If a trigger event for VisuWall occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

VisuWall must achieve its minimum goal of $25K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- Thank you note from the VisuWall Team

- All of the above + VisuWall swag

- All of the above + an invitation to a NY Happy Hour (transportation not included)

- All of the above + name and brand mention for your brand or company logo (with your permission) as an investor (supporter) on our site and social media channels.

-

All of the above + an invitation to have coffee and breakfast with our founder and executive team in New York City (transportation not included)

Limited (5 left of 5)

- All of the above + 15% discount on any VisuWall campaigns booked on the platform (honored for 2 years)

- All of the above + board observer seat for 2 years

About VisuWall

VisuWall Team

Everyone helping build VisuWall, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC