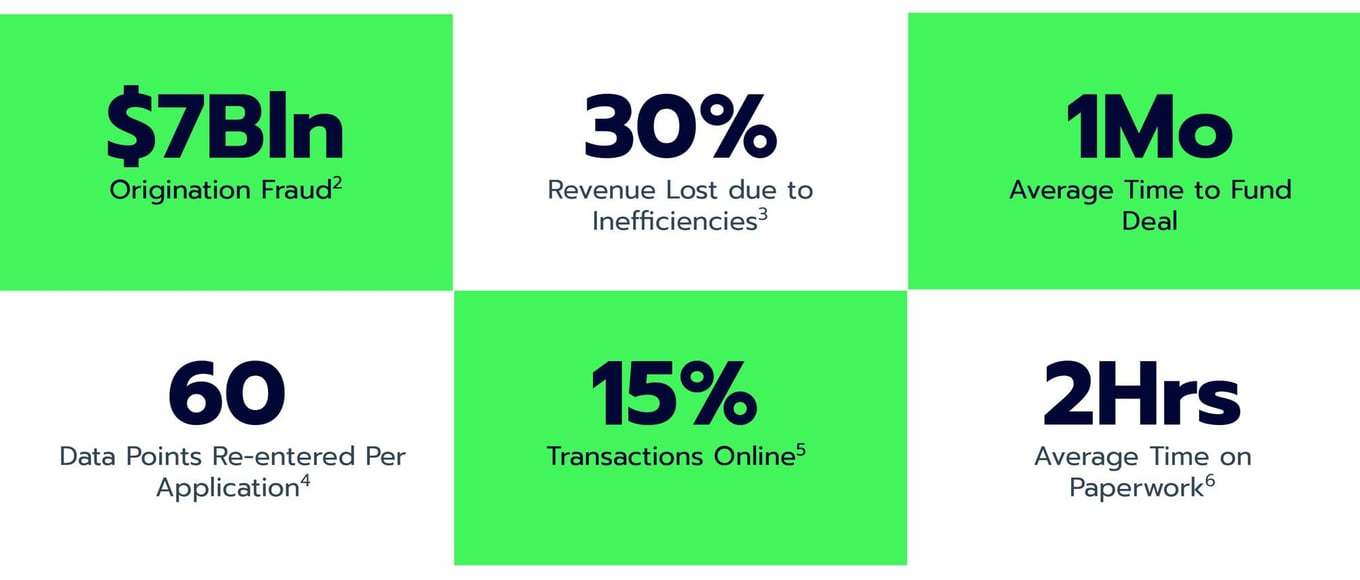

Problem

Auto financing is a $1.3 Trillion industry...

...that stopped evolving in 2004:

—

Market gaps for used independent dealers

An underserved market of 55,000 dealerships nationwide

Solution

A digital platform connecting independent dealers, lenders, and investors

with transparency and trust.

Our mission is to bring underserved independent dealers to traditional and alternative lenders in the auto ecosystem through the most trusted fintech platform.

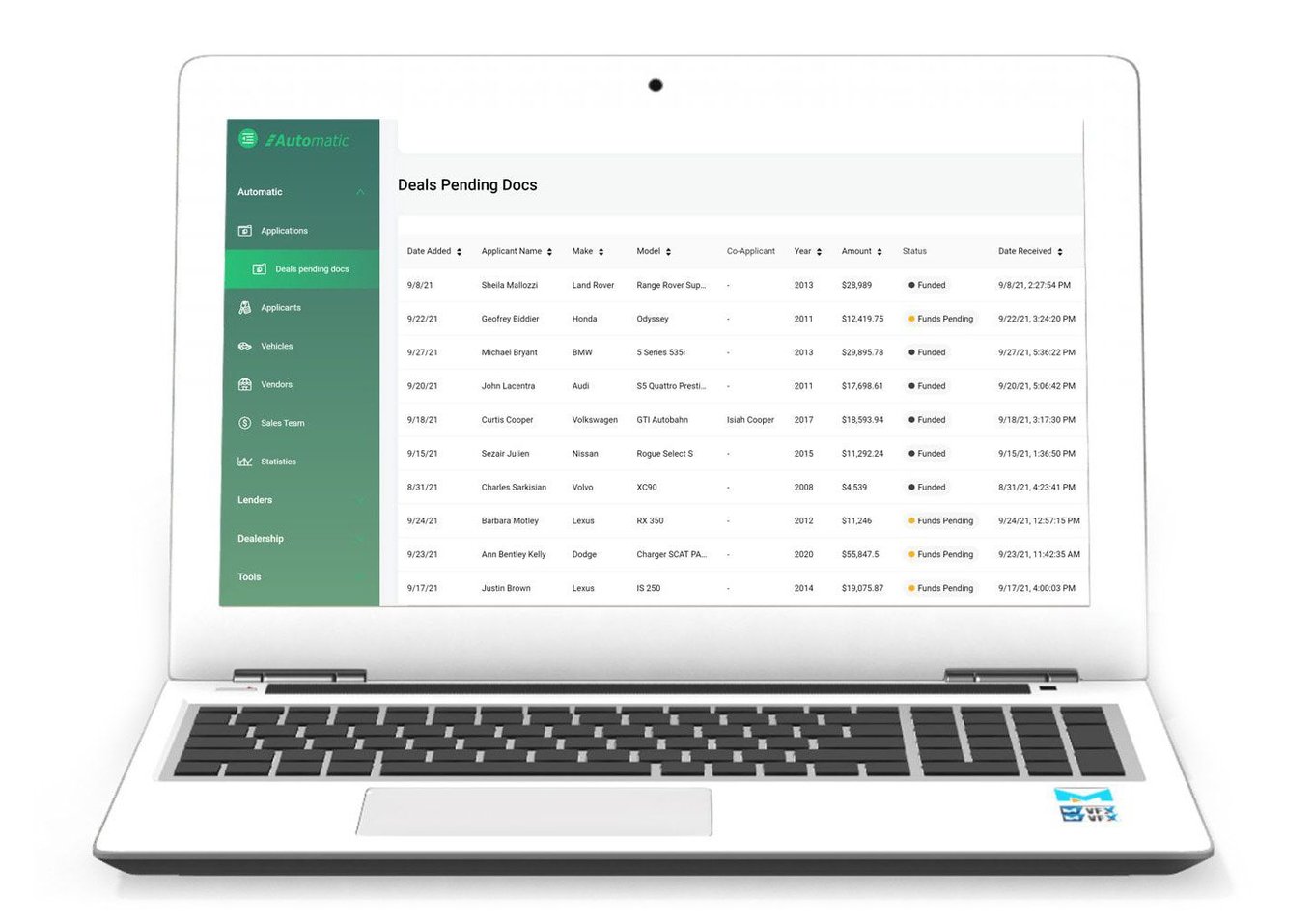

Product

Take full control of your business

Automatic is a paradigm shift for used car financing companies and auto dealerships. Our next-generation platform streamlines the entire loan process, helps dealerships boost vehicle sales by reducing the funding and titling, and maintains transparency at every step. The result is enhanced buyer trust and satisfaction.

Automatic’s loan syndication process

The value proposition

- Access to liquidity,

- Instant lender decisioning

- Ability to add multiple ancillary products to financial application

- Cost Efficient

- Integration with DMS’s and CRM’s

—

- Vetted dealerships

- Big data analysis on loans

- Criteria driven rate cards, only Pre-qualified applications

- Correspondent lending

- LOS friendly (Fiserv, TCI, Meridian Link)

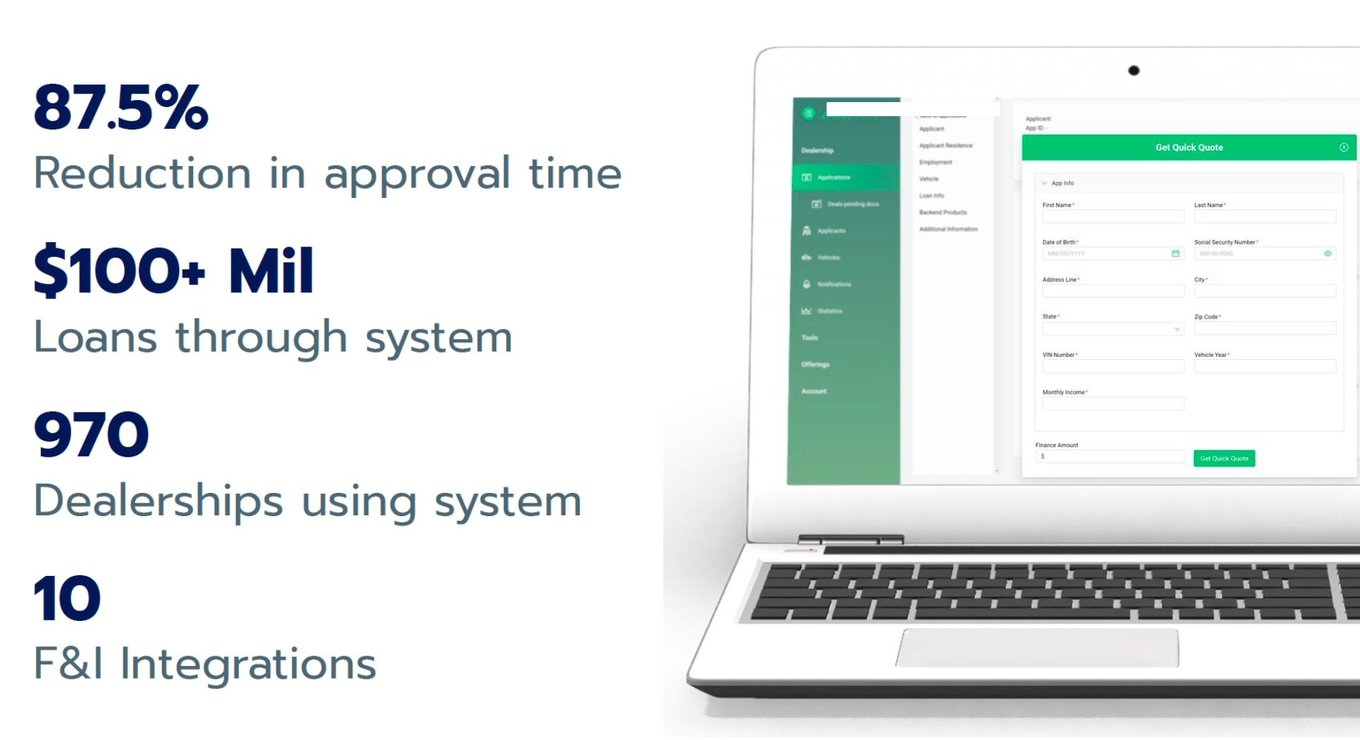

Traction

Automatic: A working platform making an impact

—

Financials + net income achieved by end of year 1

209.59%CAGR Loans | 215.5%CAGR Gross Revenue | 92% CAGR Expense |

—

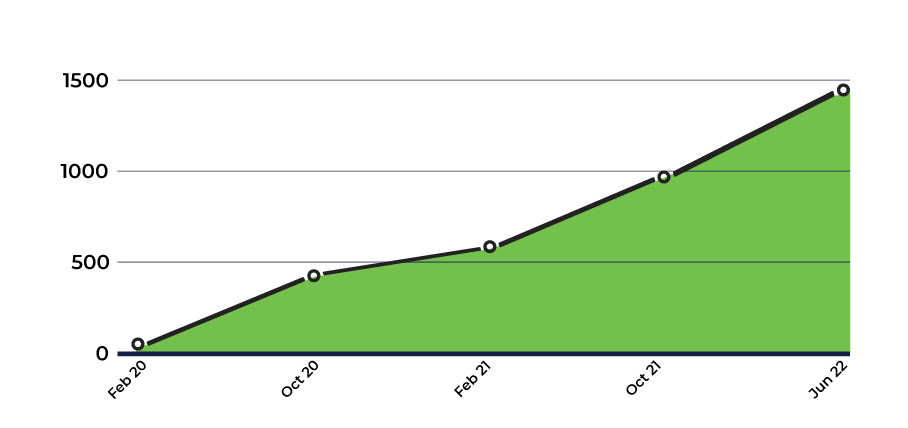

Automatic dealerships to-date

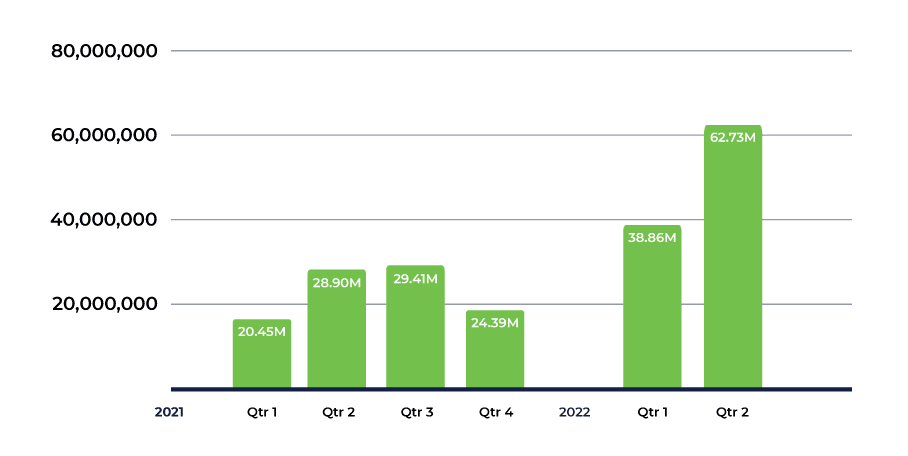

Automatic quarterly deal flow 2021-2022

Customers

Used independent dealers:

An underserved market

• 5 5,000 independent dealerships nationwide

5,000 independent dealerships nationwide

• I ndependent dealers lack the financing support that Franchise dealers receive from their manufacturing arm

ndependent dealers lack the financing support that Franchise dealers receive from their manufacturing arm

• $ 228B in originated serviceable loans coming from the independent space

228B in originated serviceable loans coming from the independent space

• 3 9.3 Million used auto units sold in 2020

9.3 Million used auto units sold in 2020

• The lack of new car inventory due to industry shortages lead to an average used auto transaction price of $26,457 in June of 2021, 27% increase YoY

Strategic customer acquisition

Dealership Headstart

Through Eric Burney, CEO and his 20+ years industry experience and a personal network of 1300 independent dealerships.

Strategic Vendor Partnerships

Over 75+ Finance & Insurance agents will shortly begin signing up dealerships on Automatic’s behalf

DMS Integrations

Currently in talks with multiple Dealer Management Systems to unlock networks of 1000s dealerships per system.

—

Estimate of adding 2-3K+ dealerships by EOY 2022

for 122%-233% Growth

—

Business model

Transactional revenue model

- 35bps of loan market value

- $3002 per lead closed to F&I/Ancillary products

- $25 per Aftermarket product lead

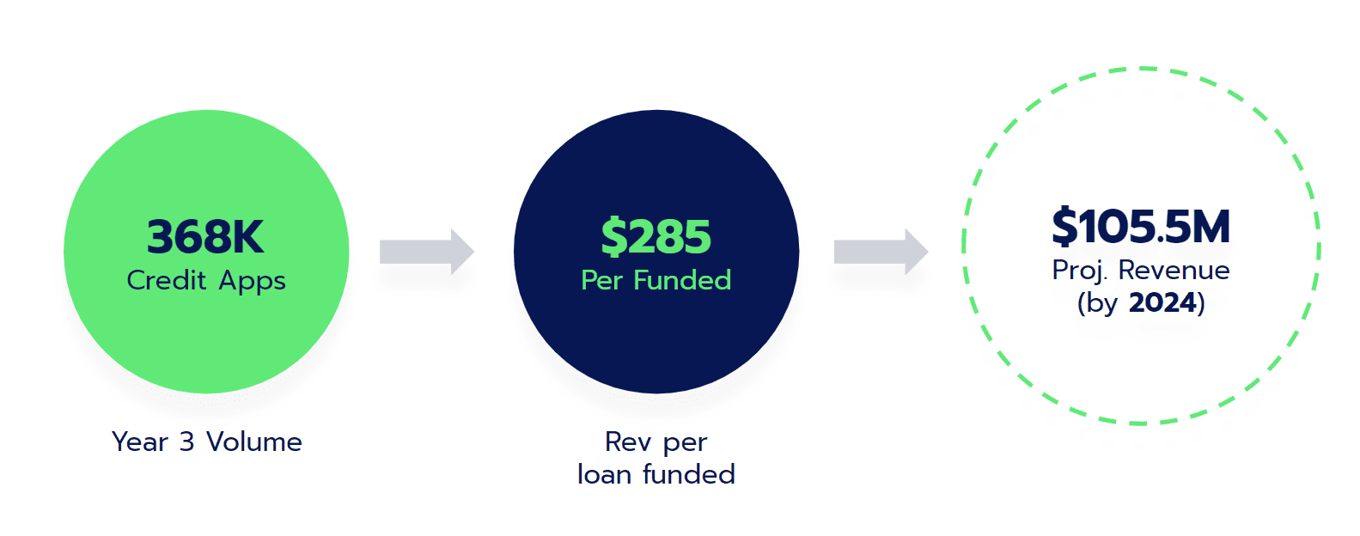

3-year revenue projections*

* Click here for important information regarding Financial Projections which are not guaranteed.

Market

Lasting market changes

De-urbanization and economic macro-conditions increase purchases of used cars

—

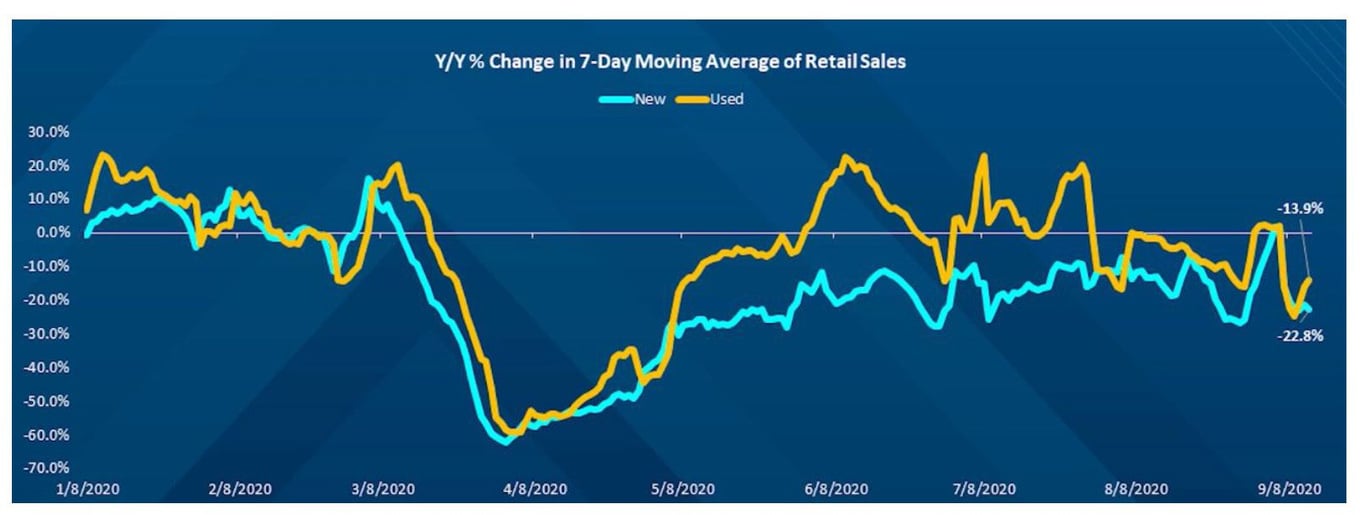

Used car purchases rebound sharply and outperform:

—

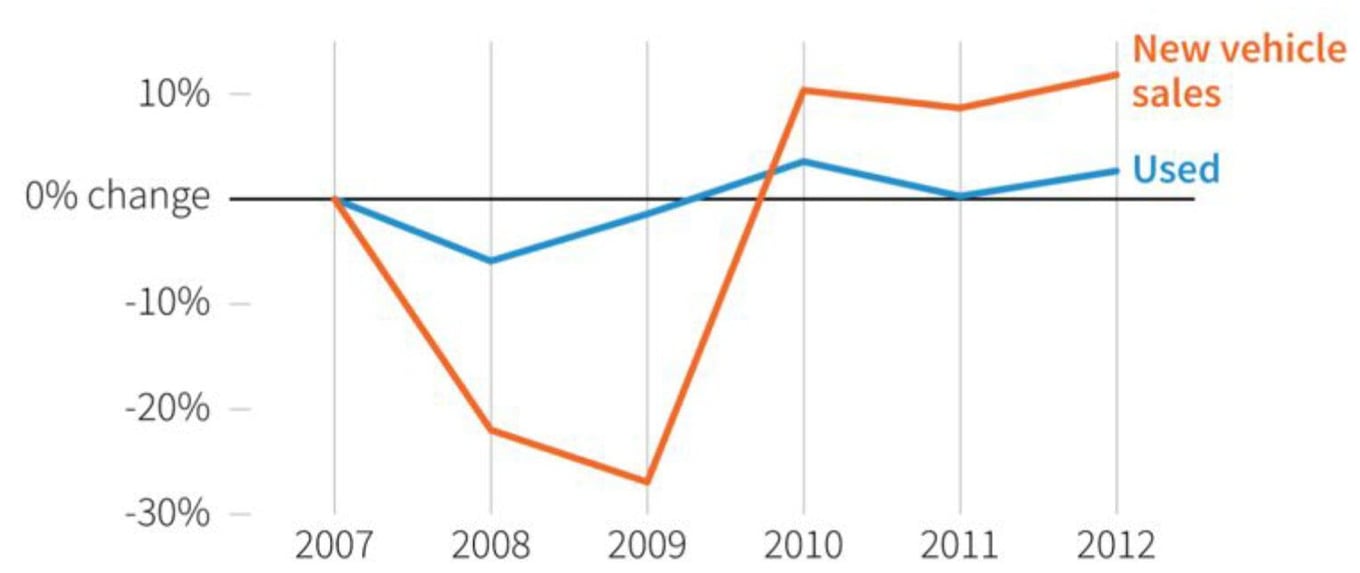

Used car purchases outperform

in tough times:

Big picture

Competition

The new dealership model

- Carvana: 750,000 unit transactions since Jan. 2013

Last quarter: 107,815 units sold

Q2 revenue: $3.3B - Independent Dealers will be able to leverage Automatic SaaS to stay competitive

- While the consumer journey may begin digitally, 61.4% of customers still prefer to buy from the dealership

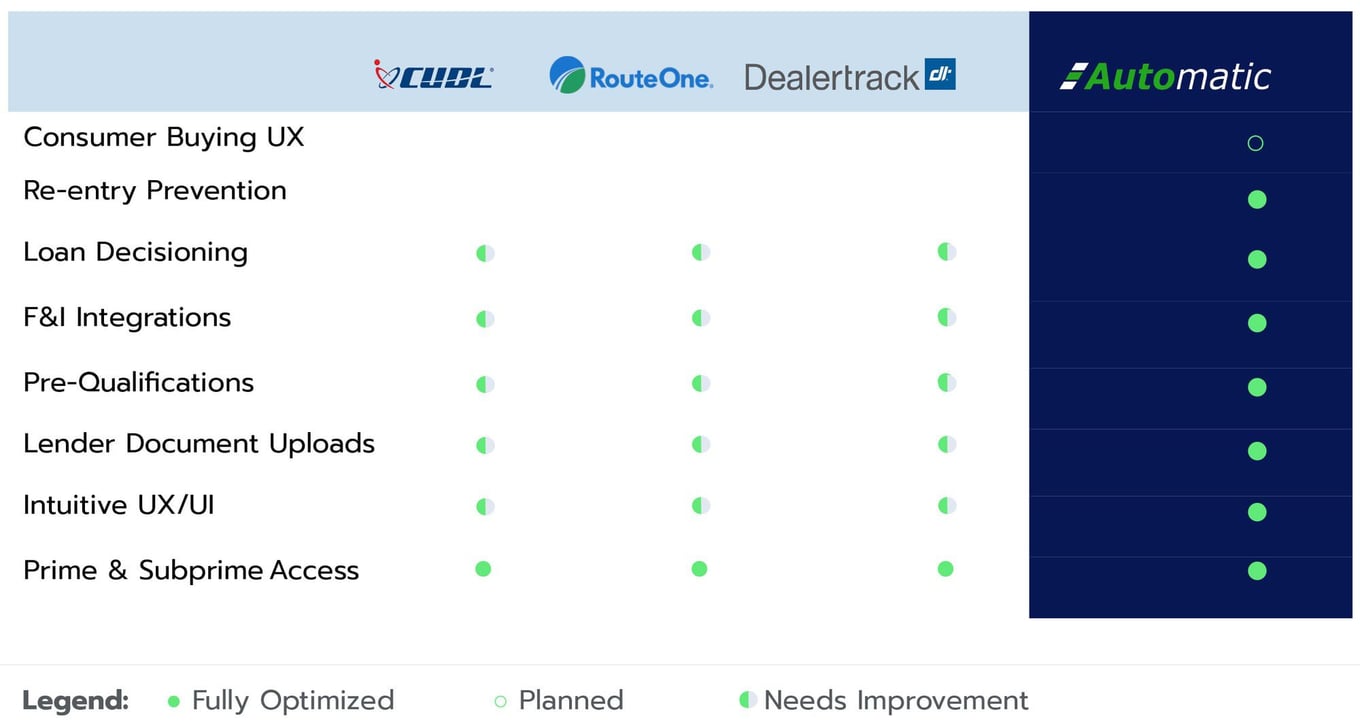

Competitive advantage vs other financing platforms

Vision and strategy

Additional revenue opportunities

—

Resale

Credit Bureau, CARFAX

—

Aftermarket Products

WeatherTech, Sirius XM

—

White-Labeling

Foreign markets, small national lenders

—

Data

Stratified reporting, industry insights

—

LOS Integration

Receiving turn down loans passed though automatic lending network

Use of funds

Founders

Eric Burney

Eric Burney

CEO, Co-Founder

20+ yrs. auto lender and broker

Max Kane

Max Kane

CFO, Co-Founder

20+ yrs. MBS market.

John Liu

Co-Founder

19+ yrs. strategy and fintech

Alex Egan

Marketing Advisor, Co-Founder

10 yrs. marketing and fintech

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...