Problem

The crypto industry is increasingly complex, vast, and underserved

The crypto industry exploded from a market cap of under $150B to over $3T at its peak. There have been over 60 exchange hacks, which has resulted in over $60B in stolen crypto to date.

Unfortunately, the crypto industry has very few regulated insurance solutions to protect both consumers and institutions from these types of events. The Ronin Network, host of the popular crypto-gaming network Axie Infinity, became victim of one of the largest crypto heists in history in March after $600 million was stolen.

Solution

Breach is addressing the crypto insurance gap

Breach has created one of the first regulated insurance solutions to serve retail investors, institutional investors and crypto custodians.

Breach insurance is looking to fill this massive gap in the space by becoming one of the first full stack, regulated insurance solutions for the crypto industry.

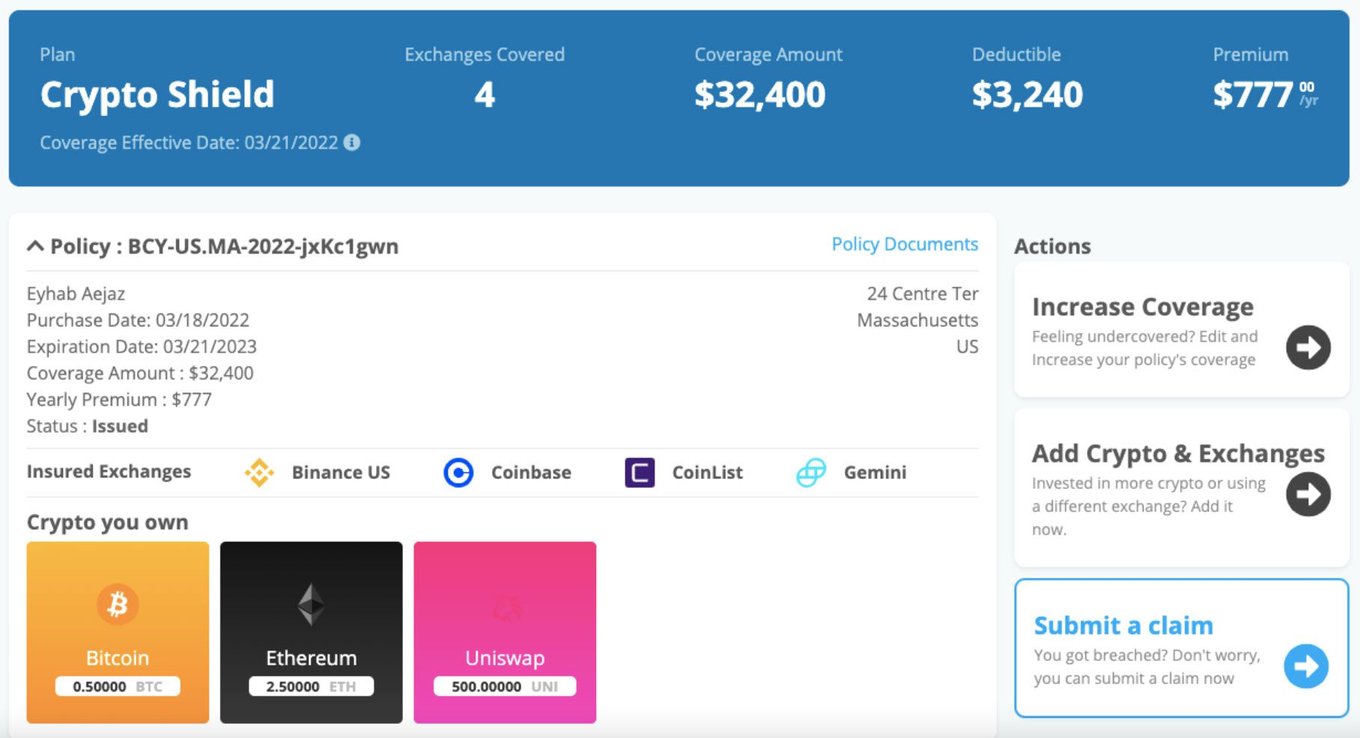

Breach Insurance's Crypto Shield provides up to $1M in coverage for exchange-wallet hacks and social engineering events caused by exchange hacks. On top of that, the premium version of the product, Crypto Shield+, provides additional coverage for up to a 50% appreciation of crypto value lost in a hack.

Product

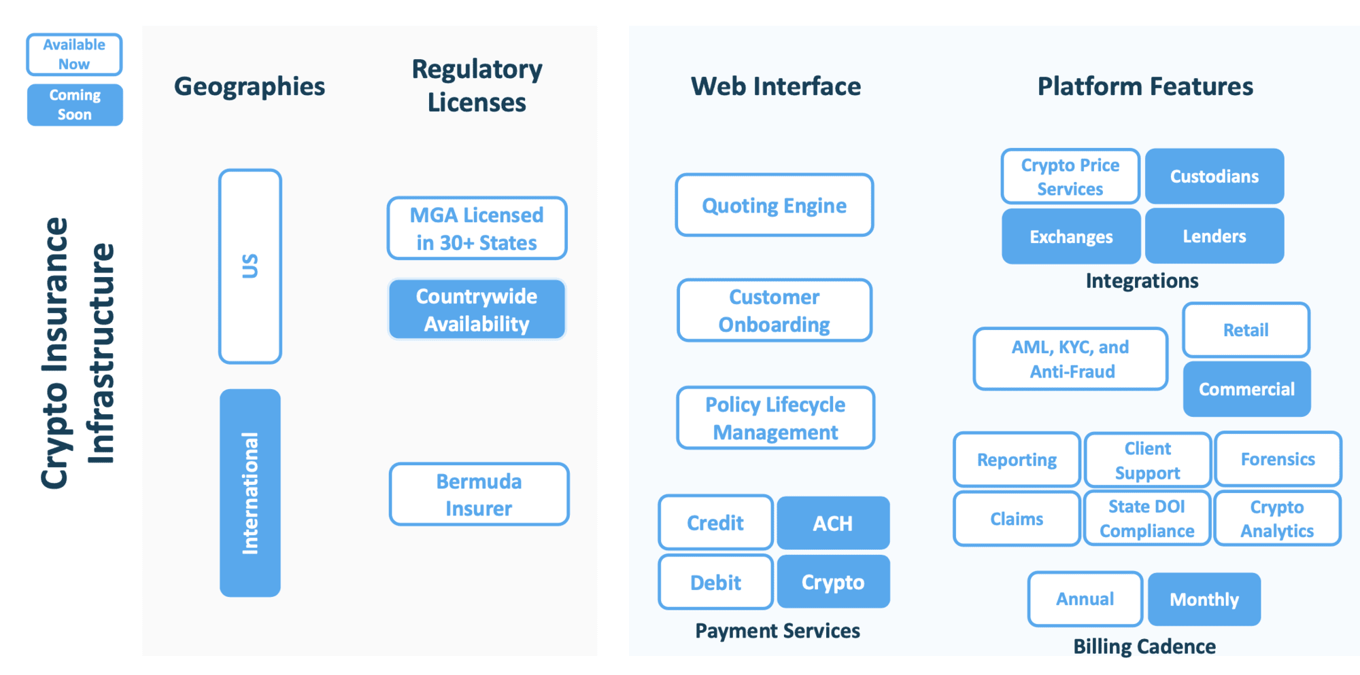

Comprehensive infrastructure for full-stack crypto insurance

Breach develops, underwrites, and distributes insurance solutions for the crypto industry. The company insures the loss of crypto assets due to cryptocurrency exchange hacks. It creates an intuitive dashboard that allows users to easily set up their policy, customize policy notifications, and submit a claim. Breach takes on the risk of exchange hacks with their product Crypto Shield, so users can confidently invest in crypto with insurance coverage.

Solid infrastructure is vital for new product development and will be the foundation for future product releases.

Traction

Attracting major insurance partnerships

Breach has been driving an active plan to form key relationships with insurance carriers, brokers, major insurtech, and institutional crypto companies who are looking to gain exposure to the crypto insurance space.

"For a market as large as crypto, there is a huge gap in availability of insurance for both retail and commercial customers. Crypto Shield is an innovative, first-of-its-kind product that directly addresses this market gap. CoinList is proud to be in the launch cohort alongside other trusted exchanges like Coinbase, Gemini, and Binance US," said Scott Keto, COO of CoinList.

Business model

Simple and scalable business model

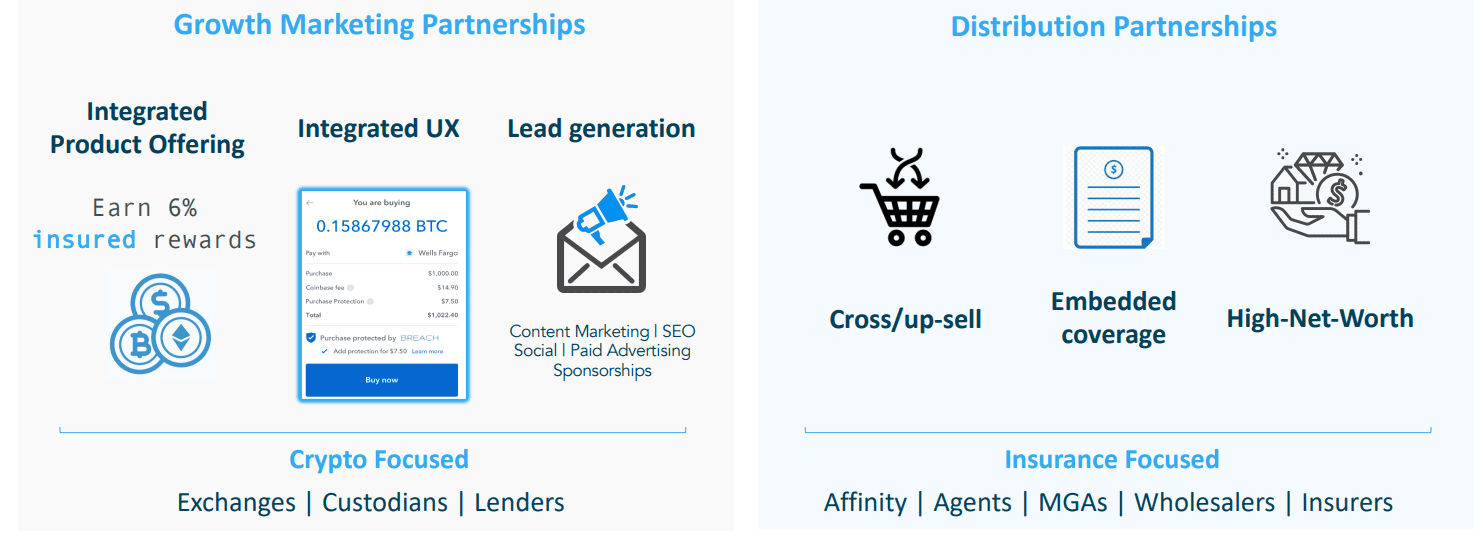

Breach will grow its market share in the industry by partnering with exchanges and crypto custodians to offer their insurance products to both their retail and institutional customers.

A critical component to Breach's future success will come from capitalizing on the ability to uniquely underwrite the crypto industry and build on its proprietary technology, data, and risk models.

Market

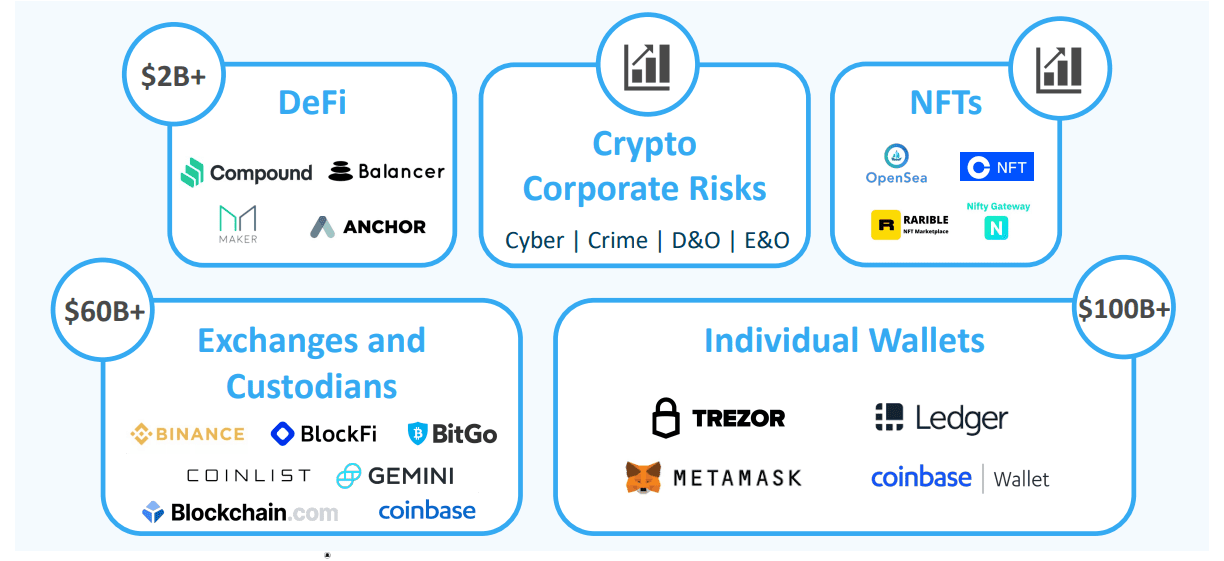

First-mover advantage on a rare greenfield opportunity

As the entire crypto market continues to grow and mature, the demand for crypto insurance products will follow suit.

The total addressable market size for the crypto insurance market is estimated to be around $100 billion to date, which represents an increase from $1 billion in 2017. The crypto insurance market is expected to grow at a CAGR of over 30%.

Competition

The crypto insurance industry is green-fields

Breach is poised to have first mover advantage

Currently there are very few players focused on creating regulated crypto insurance solutions for the industry. Future competitors to Breach could be existing insurance companies or DeFi insurance solutions.

Vision and strategy

A full-stack insurer structure and technology

Breach is poised to become a top down insurance solution for the crypto space

Insurance currently covers all aspects of our lives, however crypto remains to be underserved by the insurance industry. Breach will help the growth and development of the crypto industry by serving as a core pillar to the space, increasing mass adoption.

Exit scenario

We see the opportunity for Breach to become a successful stand alone insurance company in the crypto space and potentially IPO. Other possible exit scenarios could be an exit to a traditional insurance company looking to gain entry into the crypto industry. It is also possible that a large institutional crypto company (exchange, custodian) to acquire Breach and gain exposure into the crypto insurance space.

Funding

Raising a $5M

Seed+ round

- Valuation: $25M Pre $30M Post

- Current Round Investors: Raptor Group, Lightshed Ventures, Foundation Capital, Road Capital

- Previous Investors: GFC, Goodwater Capital

- Reason for fundraise: $2.5M to fund and capitalize the Breach Insurance underwriting entity. The other $2.5M will be used to fund operations and marketing. This capital will give the company between 30-36 months of runway.

Founders

Native experience in both crypto & insurance

The team at Breach Insurance has a combined 50+ years of experience in the insurance and blockchain space. Eyhab Aejaz, Co-Founder and CEO, had served 10+ years in the leadership role of a Fortune 100 global insurer and risk management services before starting the company.

Disclaimers

In addition to the carried interest Republic Deal Room Advisor LLC is entitled to for the syndicated investments it organizes, certain principals of Republic Deal Room Advisor LLC may have a personal interests in these investments, as disclosed below. When making an investment decision please review any applicable disclosures as they represent pre-existing financial interests held by those principals of Republic Deal Room Advisor LLC.

We do not represent that the information contained herein is accurate or complete, and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. Certain information contained herein (including any forward-looking statements and economic and market information) has been obtained from and/or prepared by the Company or other third-party sources and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, Republic Deal Room Advisor LLC does not assume any responsibility for the accuracy or completeness of such information. Republic Deal Room Advisor LLC does not undertake any obligation to update the information contained herein as of any future date.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...