In today's episode, you'll hear from Hemant Chavan of Brik and Clik, an idea that's meant to unite the online and offline...

Problem

20% of all US retail space is vacant—and E-commerce advertising is more expensive than retail rent

Today's retail landscape

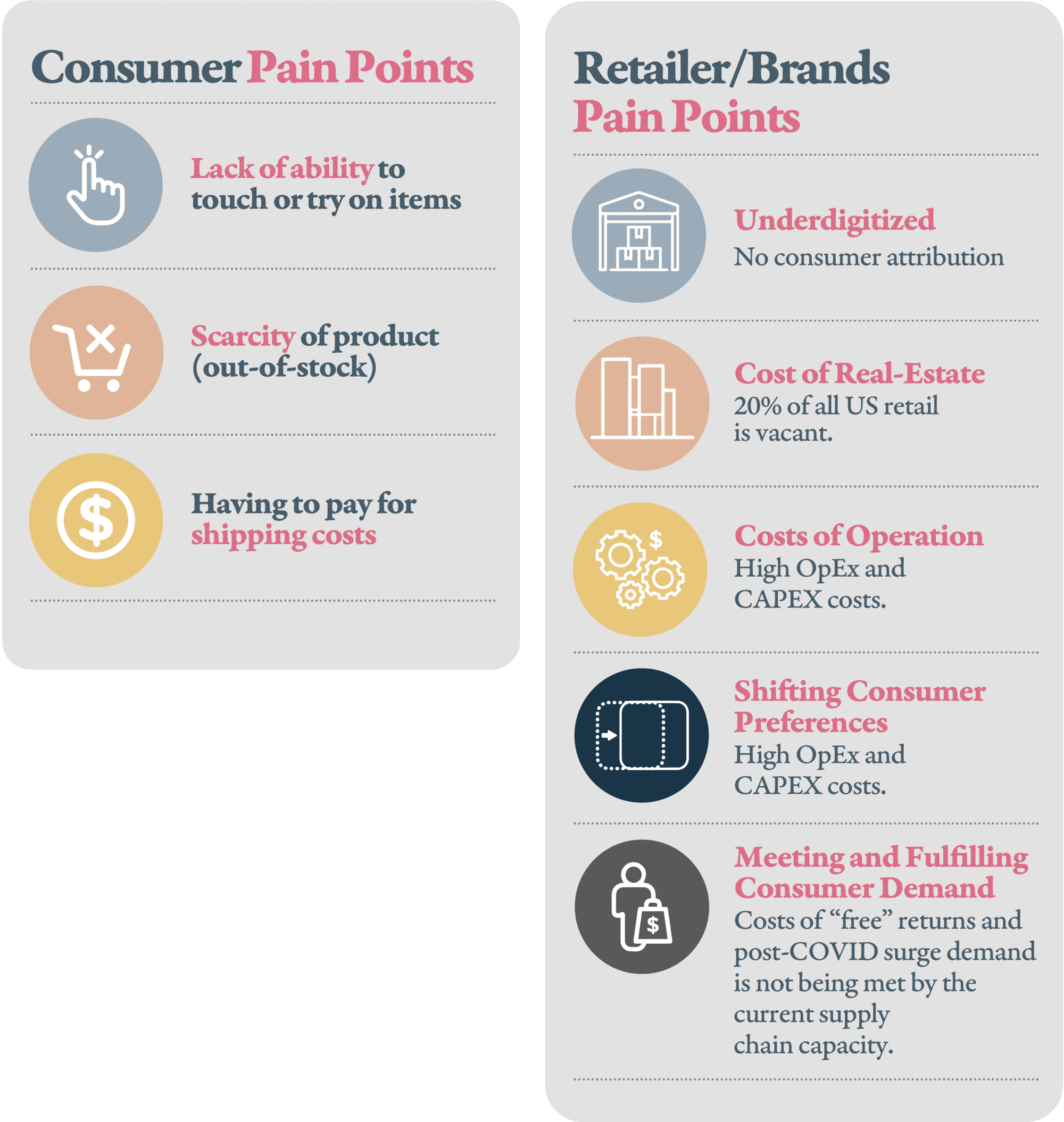

In today's retail environment, and within the industry, we've discovered that the biggest pain points are:

E-commerce costs are unsustainable

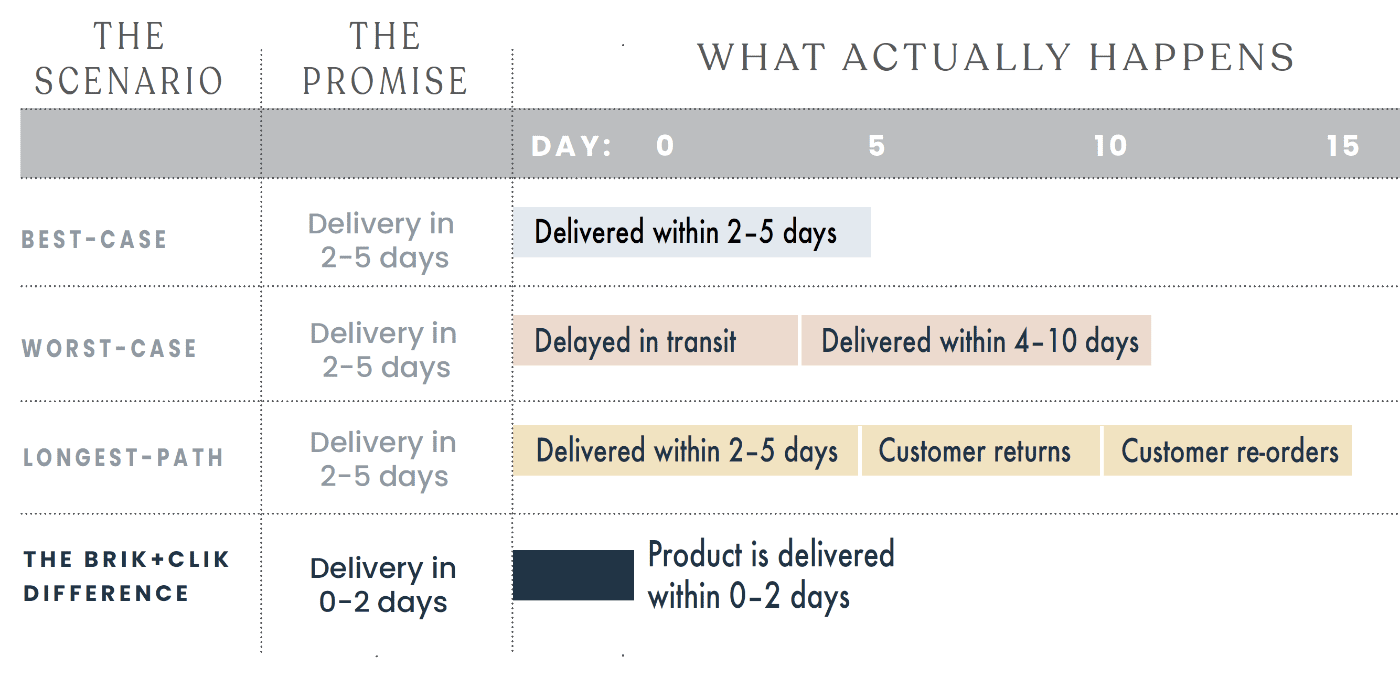

Shipping Delays: Current delivery services are not built to handle the increase in online demand:

Source: Retail Dive

Source: Retail Dive

Digital Only Unfeasible: Online advertising are more expensive than store rent and 15 min delivery apps in dense cities are not sustainable and logistically impossible in the non-coastal cities, towns, and suburbs:

Solution

Technology centered solution that solves the problems of:

1. Customers looking for value, convenience and quality

2. Brands/Retailers from whom these customers purchase

3. Landlords who are leasing spaces to the brands/retailers

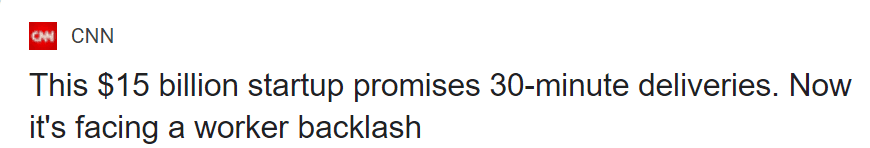

Online | Offline | Virtual

Our turnkey retail spaces, online marketplace, and a unique checkout-enabled VR store enable Direct to Consumer (DTC) sales seamlessly integrated with the latest commerce trends—while leveraging retail storefronts to double up for e-commerce services. Our scalable omni-channel model is at the confluence of trendy brands, retail, creators, and fulfillment.

What are we solving for consumers?

Their three biggest pain points:

- Ability to touch or try on the item

- The product being out of stock

- Shipping cost and delays

What are we solving for brands/retailers?

Our target brands:

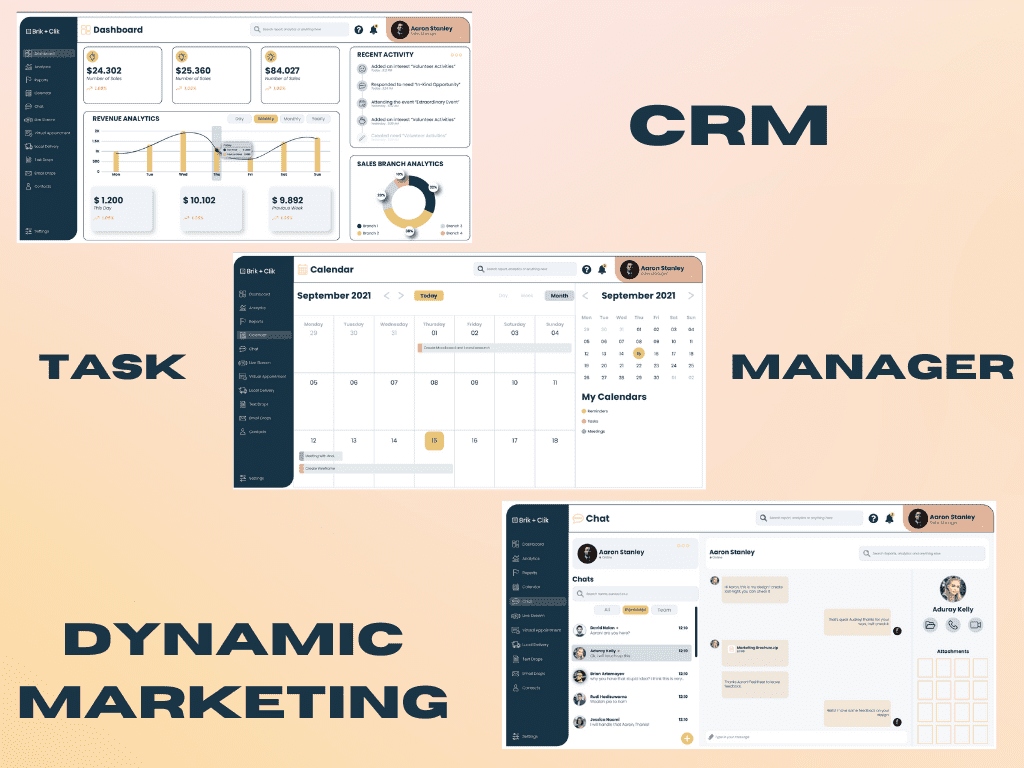

How is our tech different?

As a retailer, we have a deeper understanding of retail products that allow us to build better retail tech products —products that are more than advanced than our competitors. Our software enables independent retailers to digitize stores while increasing foot traffic and revenue.

1. Tech tools empowering retail staff to increase omnichannel sales

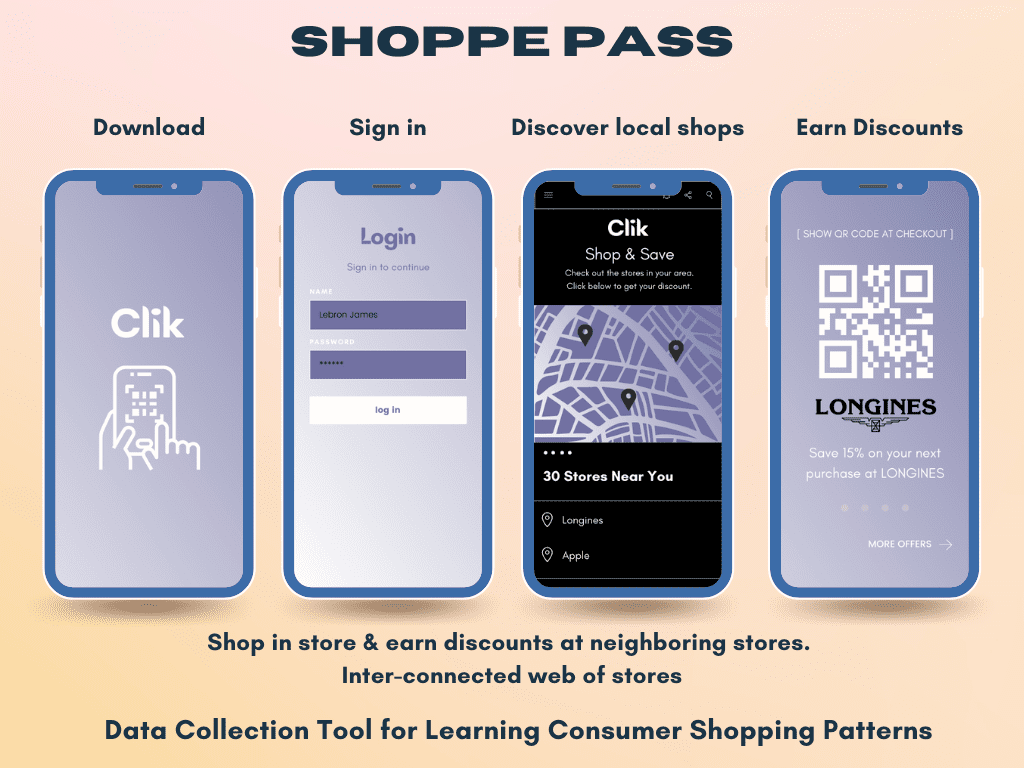

2. Network of retailers that drive traffic to each other, while learning about consumer shopping patterns

Product

An integrated commerce platform

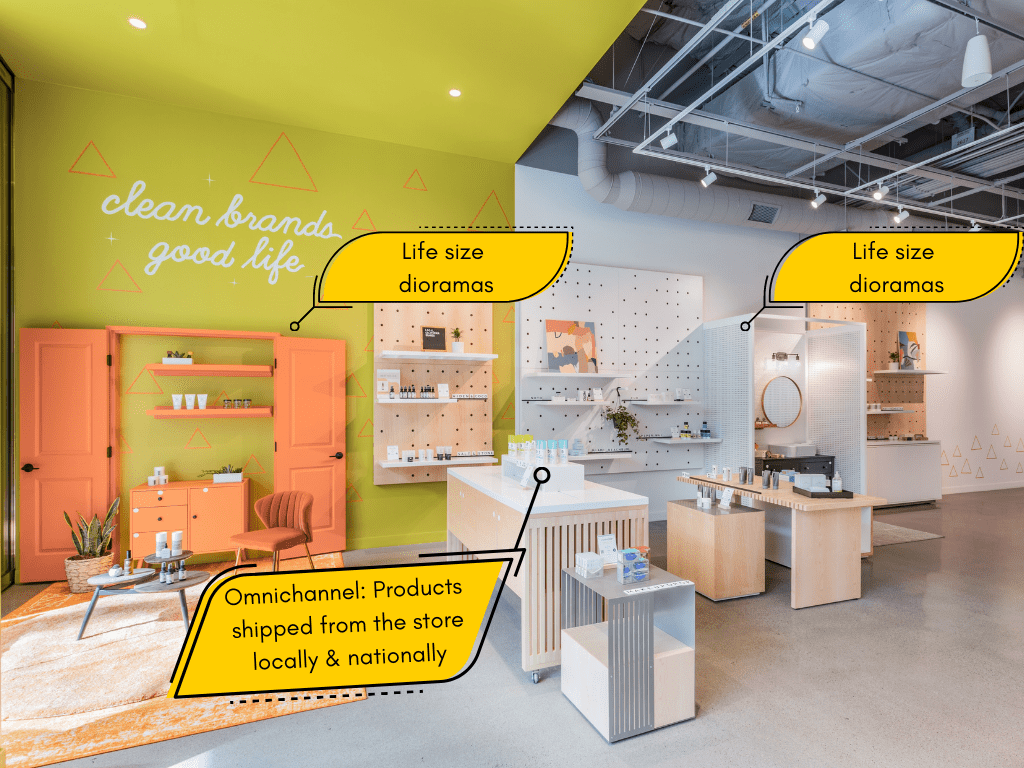

Digitized and Experiential Stores

Our multi-brand stores are curated with best in class store design and digitized to replicate online shopping.

Profitable Stores

- Micro stores that are cost-efficient and can be deployed in weeks. Payback in a few months instead of years.

- Shop in Shop stores with established chain retailers.

- Large scale holiday markets.

In-store tech

We integrate technology and use our unique checkout-enabled VR platform to connect the offline and online retail worlds. Try it yourself, CLIK HERE.

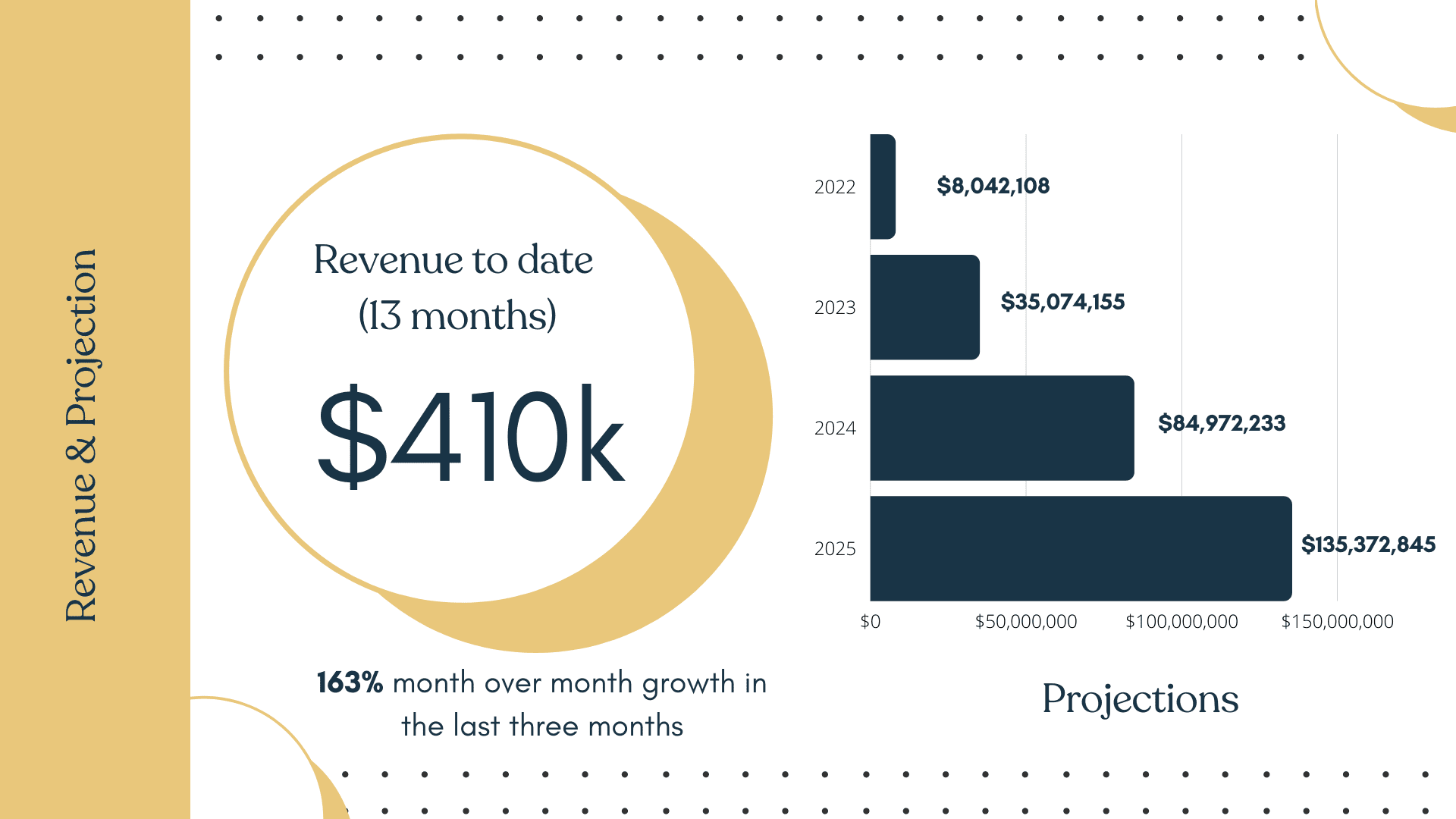

Traction

Bicoastal locations and increasing revenue streams

Bay Area

Westfield Valley Fair, Santa Clara

Landlord Partner: Westfield (Unibail-Westfield-Radamco) which has locations a 14 countries across North America, Europe and Australia. Opened on October 10, 2020 with a $29K buildout cost (market cost $80k) and 3-week construction schedule. In the heart of Silicon Valley and with a median income of $135,000.

New York

The Oculus, New York City

Opened on November 15, 2020 with a $0 buildout cost and just 2 weeks from lease to opening. Oculus is next to the World Trade Center and 9/11 Memorial. W have a prime location in the shopping center next to luxury retailers like Mont Blanc, Longines, Apple with 20,000 - 40,000 daily foot traffic passing through our store. In addition to being a major tourist attraction, it is in the heart of New York's financial district and next to prime neighborhoods like Tribeca and Soho.

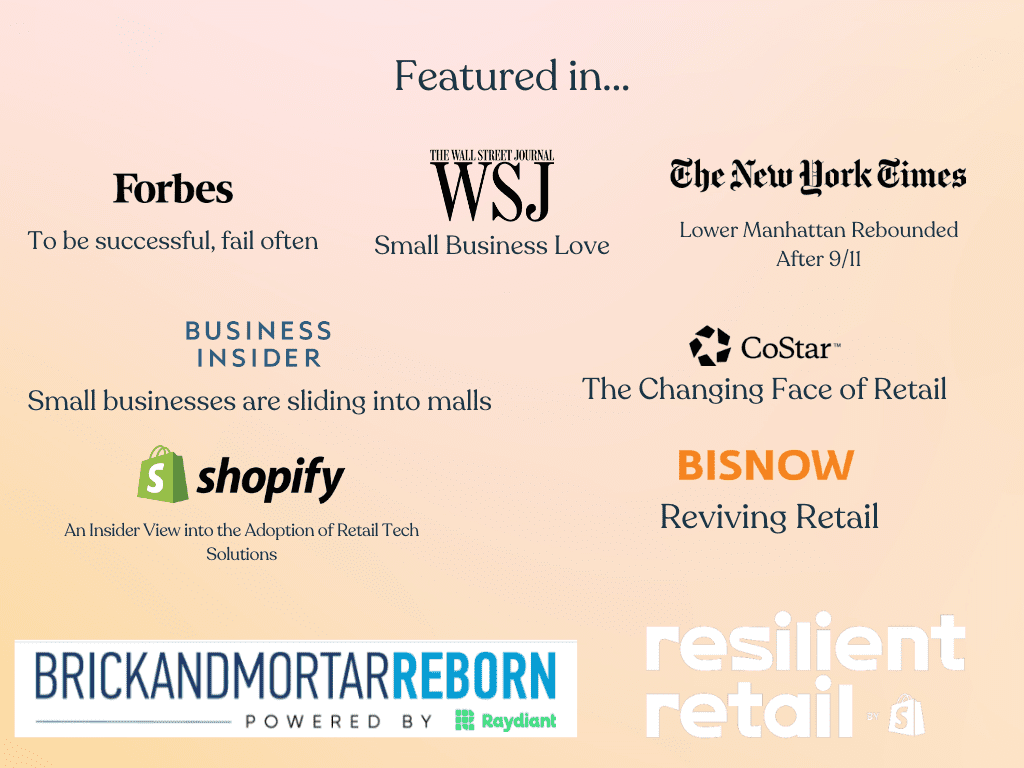

Major PR

Within a short period, we have generated organic PR with the biggest publications in the world including the public radio from France RFI coming to interview us from Paris.

We predicted the return of retail before the experts!

Customers

Brand partners

Our stores carry 100+ DTC (Direct-to-Consumer) brands and 10% subscriber brands, all within the wellness, home goods, clean beauty, and F&B verticals.

70% of the brands we partner with are female- or minority-founded. This is a pure meritocratic process rather than a marketing strategy. We find mission-driven brands that are high quality and then they happen to be either female or minority-owned.

Customers

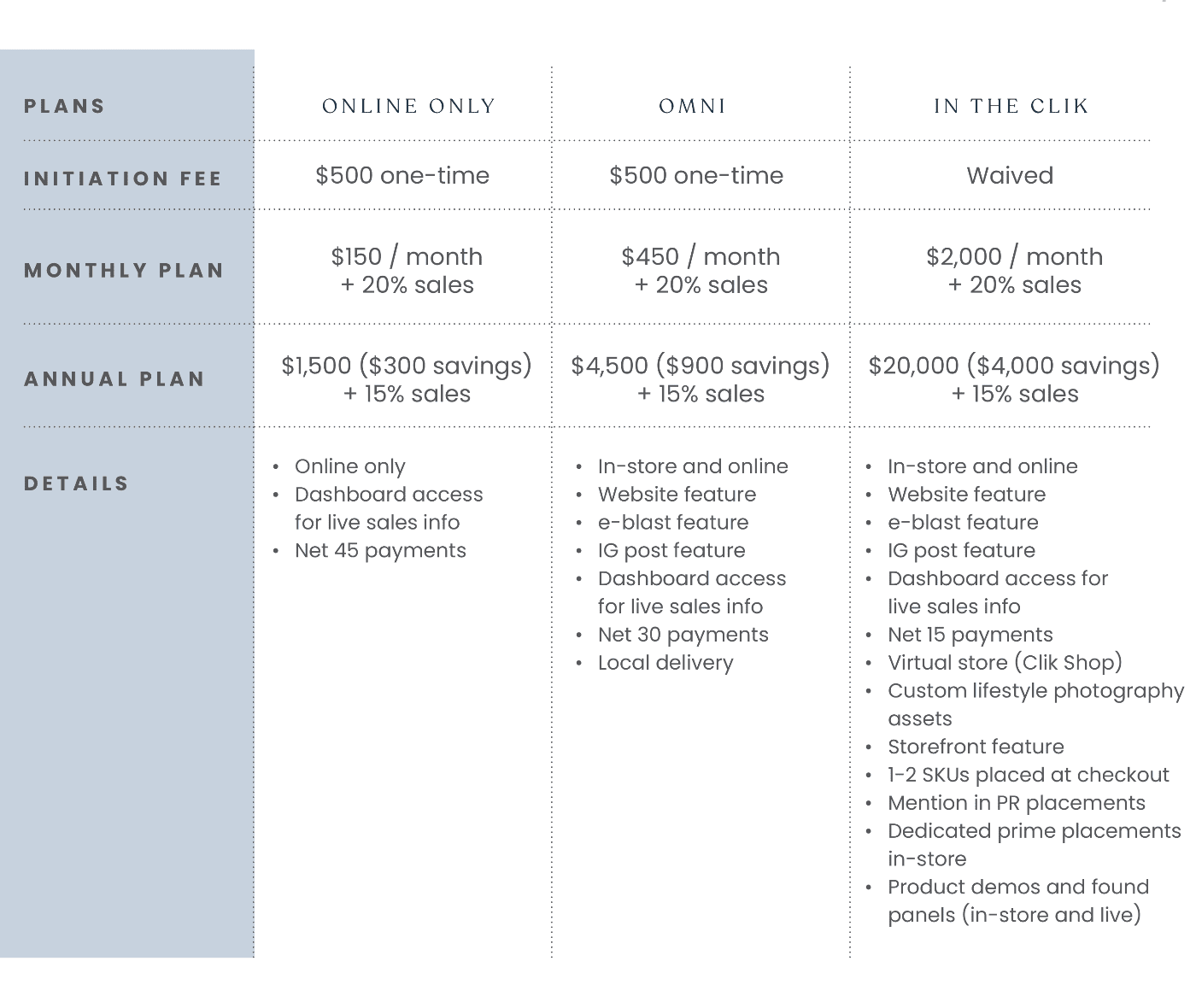

Business model

Multi-channel and scalable subscription model

Pandemic, digital disruptions, and foot traffic independent revenue streams.

Our business model

Beyond in-store sales, we have de-risked the traditional sales model with an innovative way to monetize retail spaces. Due to vertical integration, our services are best in class and lowest in cost.

Revenue streams

- Subscription brands: Brands pay us to be in store through our limited brand assortment, which makes the store a marketing channel for emerging brands along with providing turnkey operations.

- Live stream shopping: During low traffic periods, we produce high-quality live shopping episodes from the store—using the store to sell across the country beyond the local foot traffic.

- Virtual Appointments: During low traffic periods, we schedule one on one appointments with new and existing customers for an intimate shopping experience.

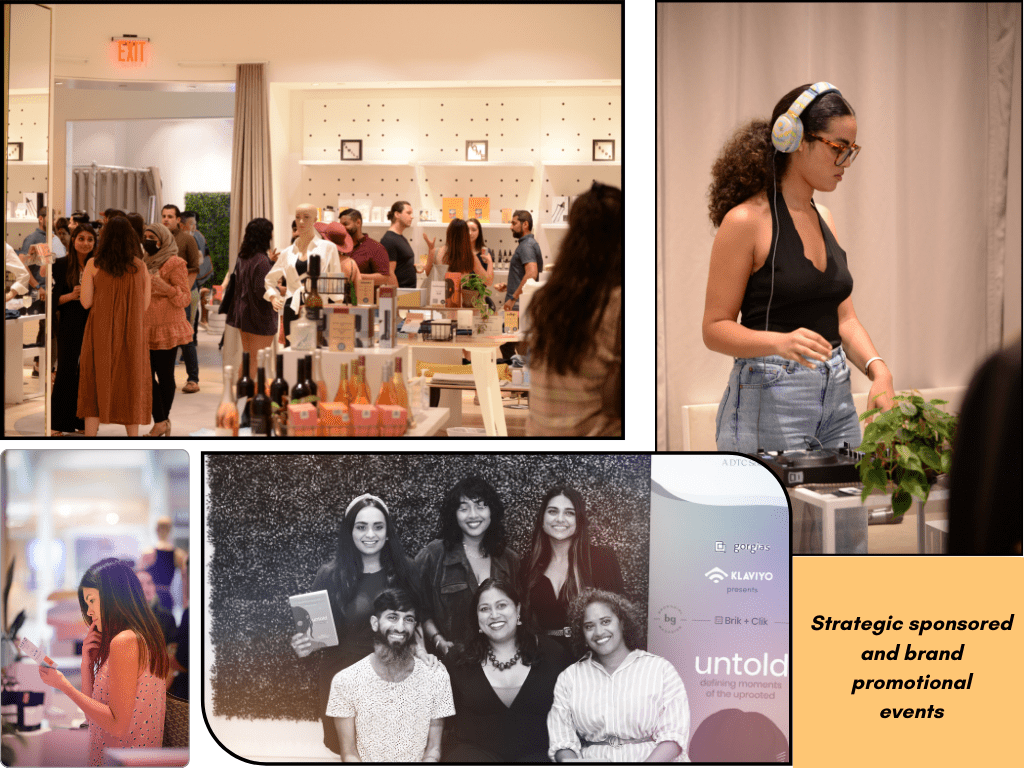

- Event Sponsorships and Tickets: Through highly produced exclusive events, we generate sponsorship revenue and ticket sales.

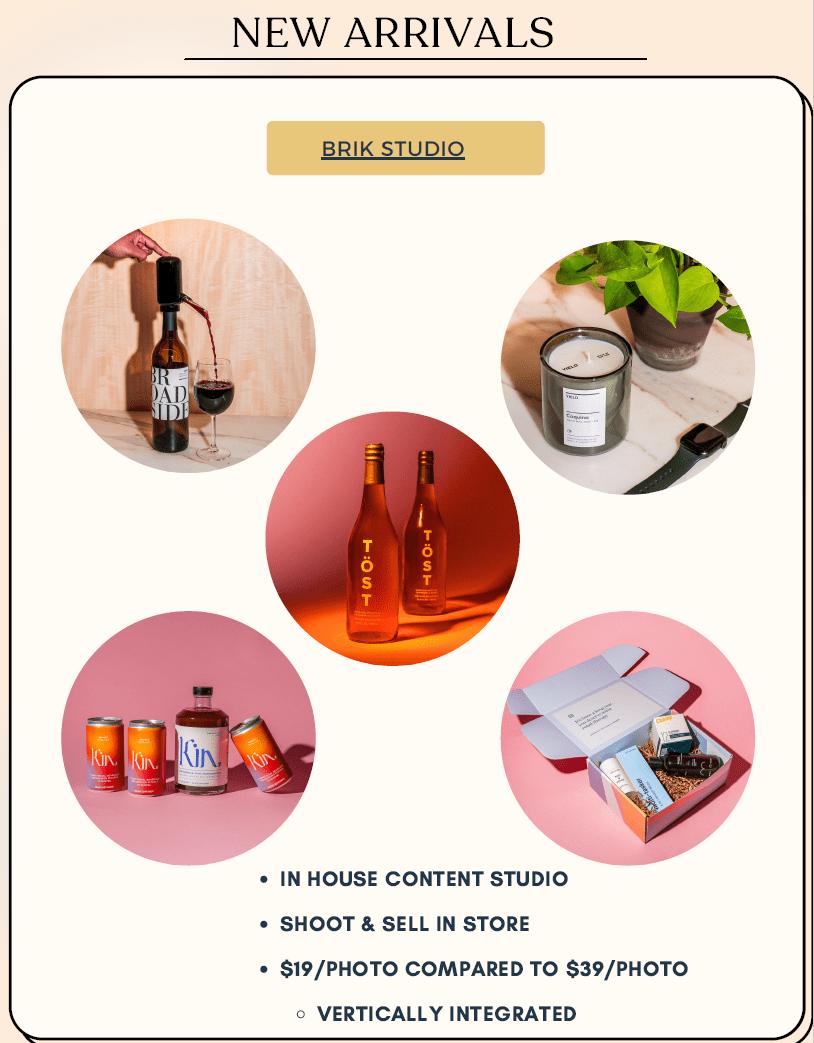

- Brik Studio: Another use of our flexible store format is converting a dedicated space into a content studio, where brands pay us to produce high-quality e-commerce images and videos of products already in the store.

- Brik Returns and Local Delivery: To bring more brands in our funnel, we will be launching these high-demand services due to the intrinsic issues with e-commerce: high return rate and delivery times.

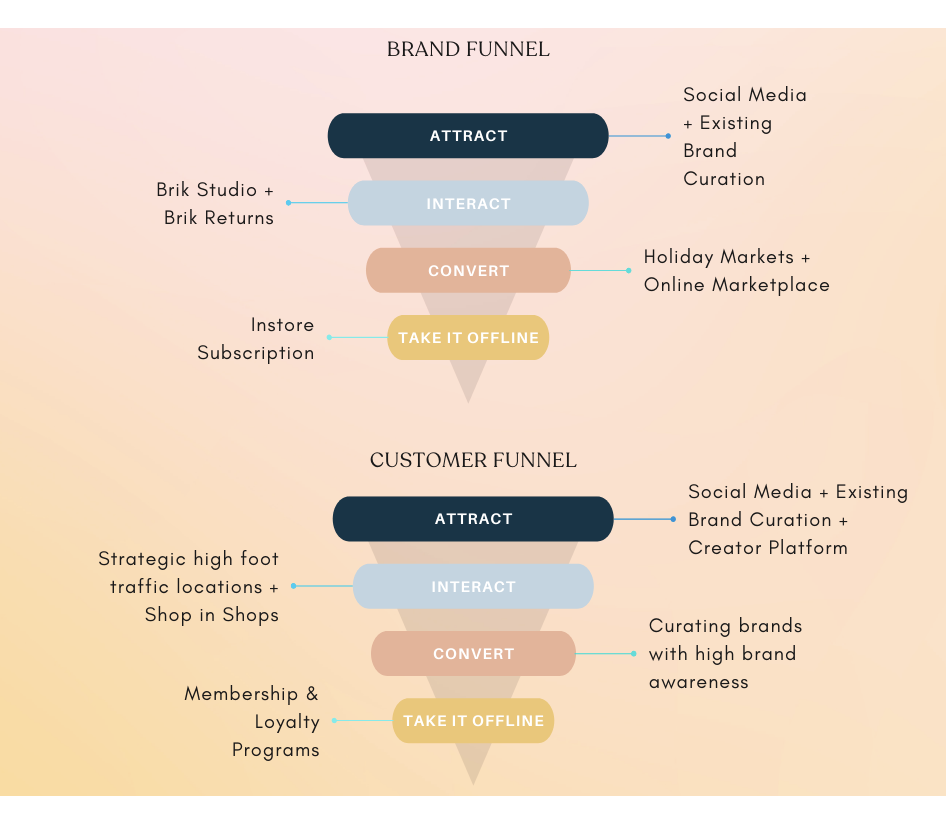

Acquisition Strategy

Brands prefer proximity to peer brands and customers want to be introduced to the trendiest brands. Our multi-level strategy has enabled us to onboard 100+ brands and 3,000 orders in the middle of the pandemic.

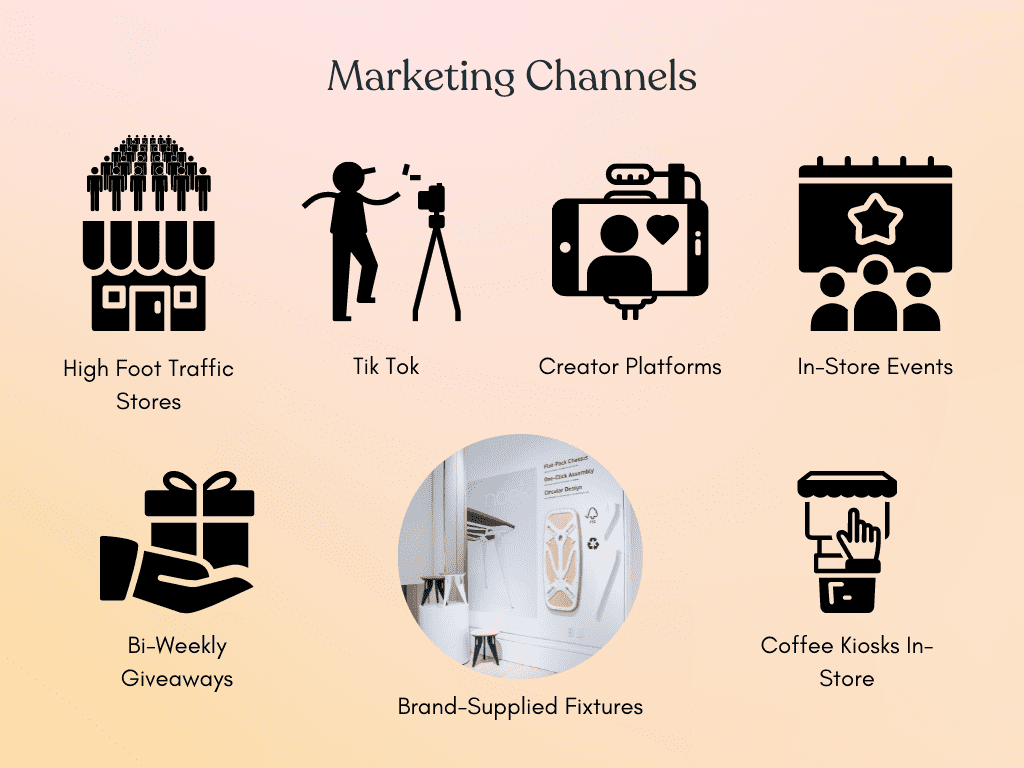

Acquisition Channels

With the exponential increase in paid online advertisement costs which have become a pure pay-for-play, it has become uneconomical for emerging brands to generate meaningful brand awareness. We are targeting low-cost but high-engagement channels.

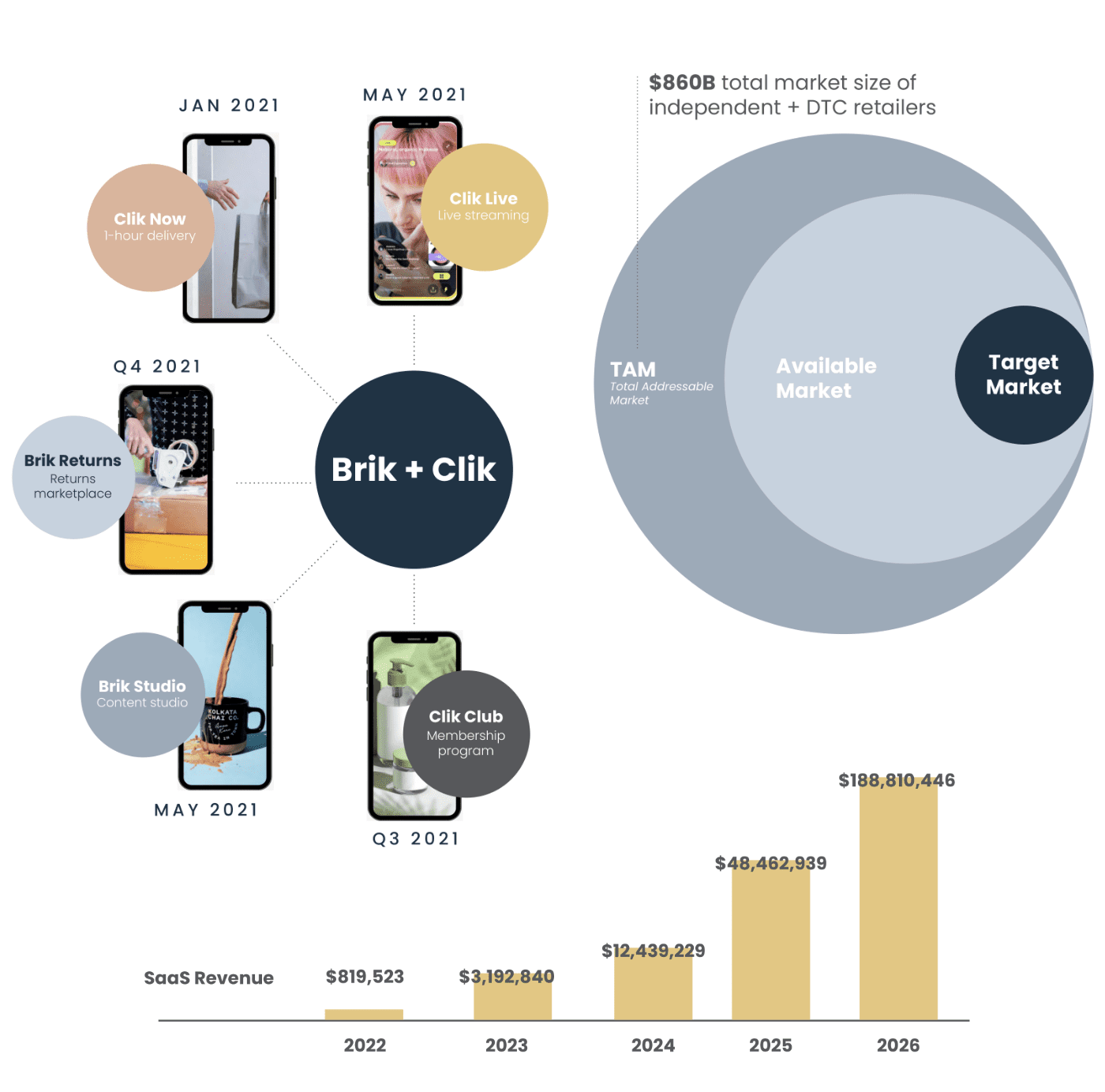

Market

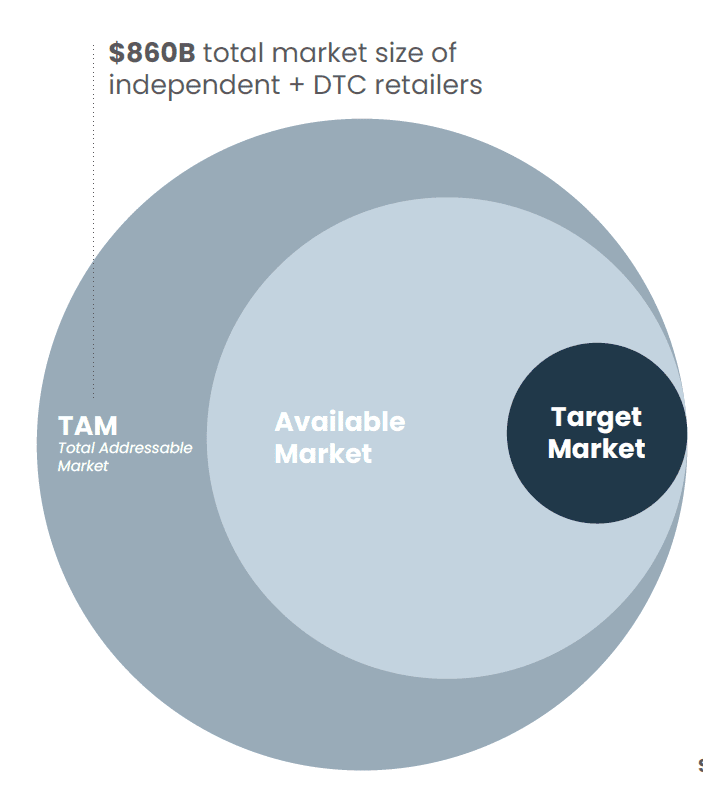

Retail is a $5.4T market, representing 12% of the US GDP

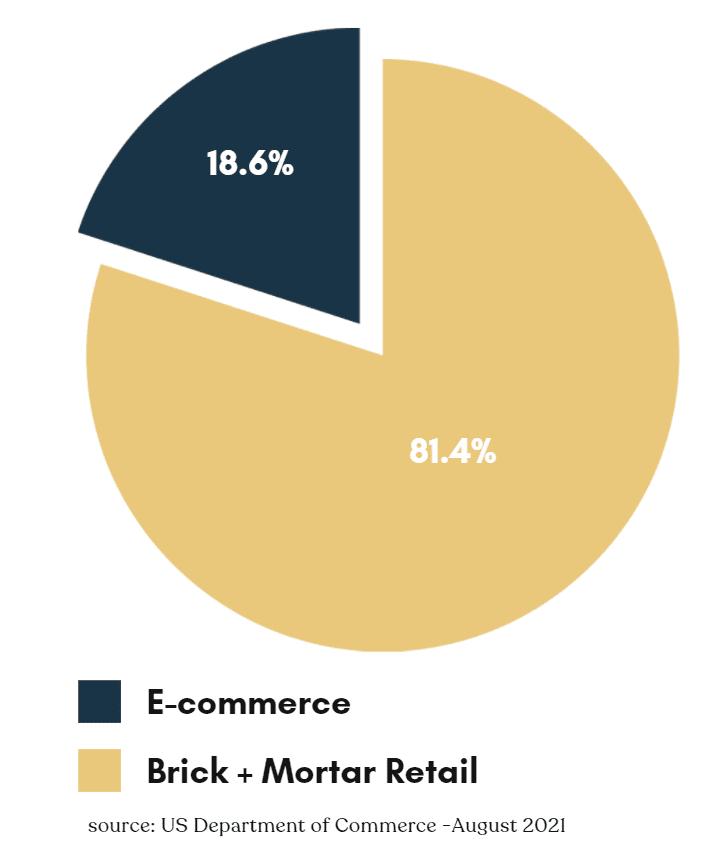

81.4% of all retail sales take place in physical stores, while e-commerce represents only 18.6%.

Deducting the grocery component, Brik + Clik has identified an addressable market of $860B which represents the market for independent retail.

Post-Covid retail market

With the re-opening of retail and pent-up demand for in-store shopping, there has been seen a surge since late Q2 2021—with major retailers showing an uptick in-store sales. The following represent retailer sentiment for Brick and Mortar Retail:

ONLINE BRANDS ENTERING RETAIL

Even a major DTC brand, Warby Parker, recently disclosed in their S-1 that 2/3rd of its sales in 2018 and 2019 came from their brick and mortar stores before Covid caused a shut down of their stores in 2020. However, they are set to open 35 locations in 2021. As their CEO stated, "we're still big believers in physical retail. Even though we had fewer people coming in [to visit stores], there was a much higher conversion rate compared to pre-pandemic, because there is more intent to purchase."

Why now?

- Availability of prime retail spaces

- Percentage of rent and short-term leases

- Lower CAPEX costs due to abandoned spaces in good conditions and overall reduced construction activity

- Liquidation of incumbent retailers

- Competitors locked in pre-COVID base rent and long-term leases with major business interruptions

- We are launching post-COVID with settlers prosper proposition

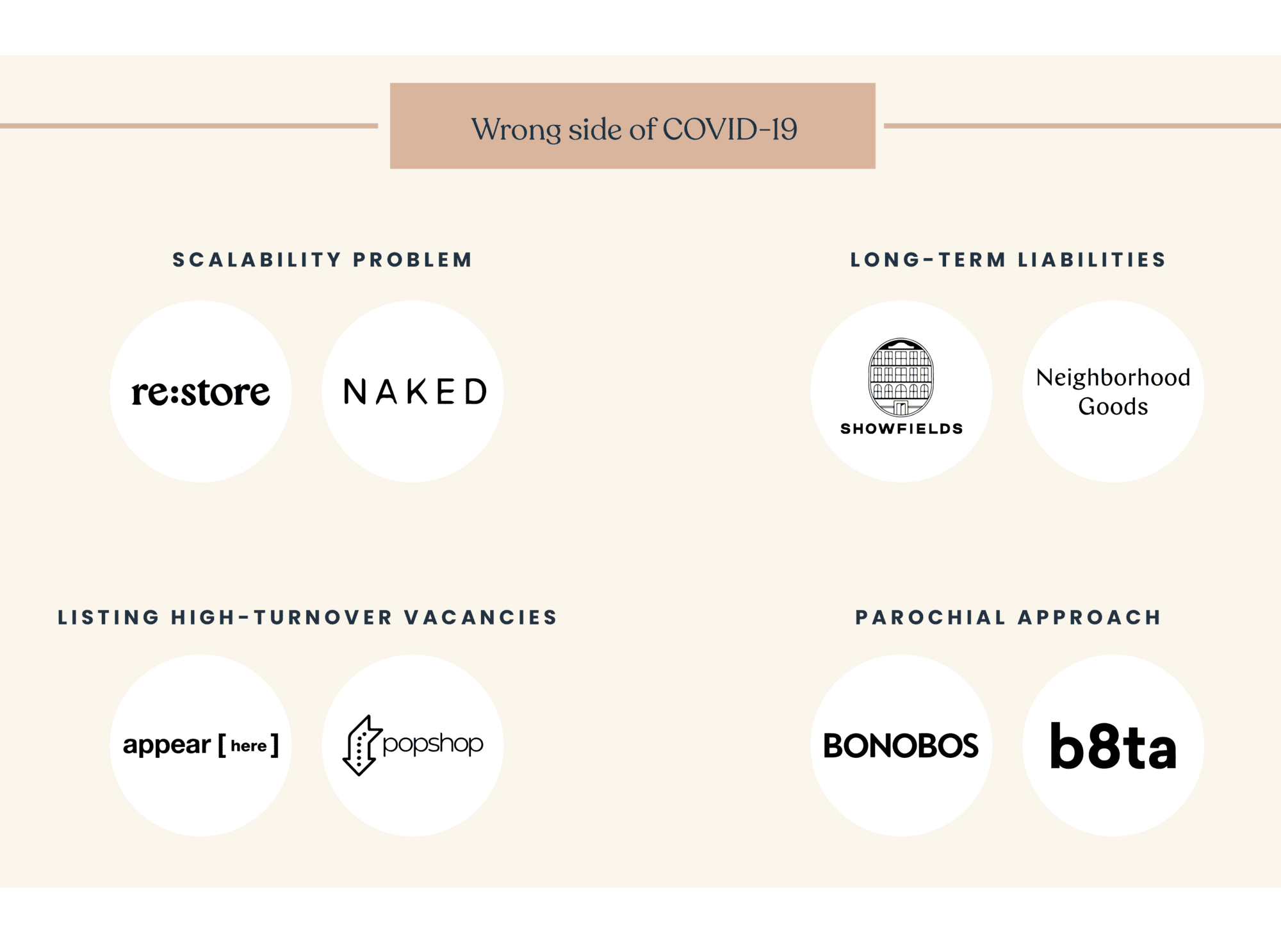

Competition

A full-stack and tech-enabled retail solution

- A unique full-stack commerce solution, whereas our competitors are running stores and e-commerce website.

- Our micro-store model enables us to scale at a rapid pace. We have launched stores within weeks unlike our competitors which take multiple months or years.

- Our unique design built with the expertise of the biggest retail architect (CallisonRTKL) avoids any turnover costs with curating new brands.

- The store acts as a testbed to identify real problems and deploy tech solutions for other retailers.

- We have built institutional relationships with a roadmap to scale our solution internationally.

- Importantly, our competitors launched pre-covid and are stuck in long-term leases and high fixed rents which are difficult and costly to negotiate.

Vision and strategy

SaaS platform and profitable stores will lead to multiple exit options

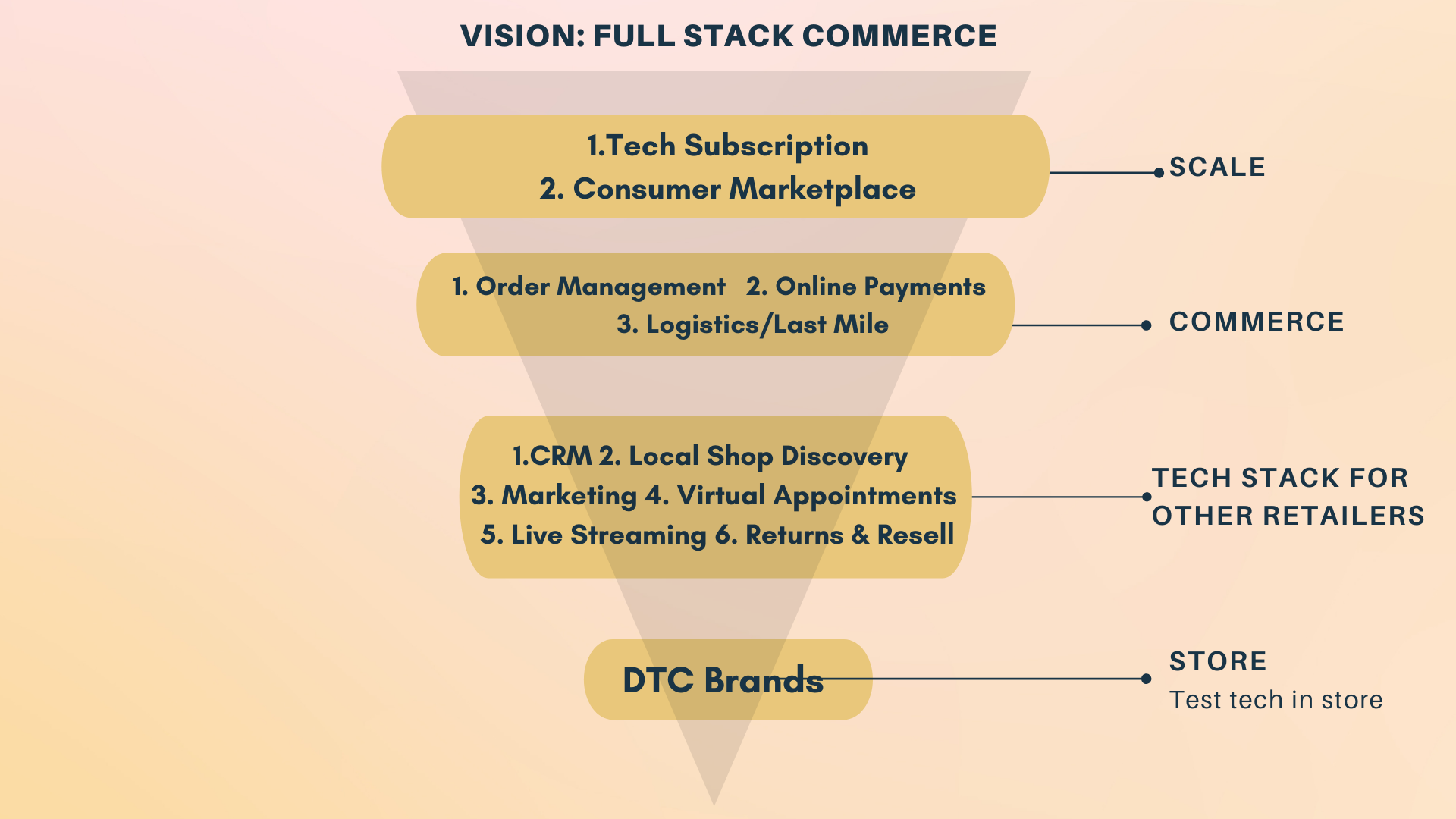

End to End E-commerce

Our long term vision is using our stores to test and deploy tech and commerce solutions for independent retailers, an underdigitized and untapped market of $860B.

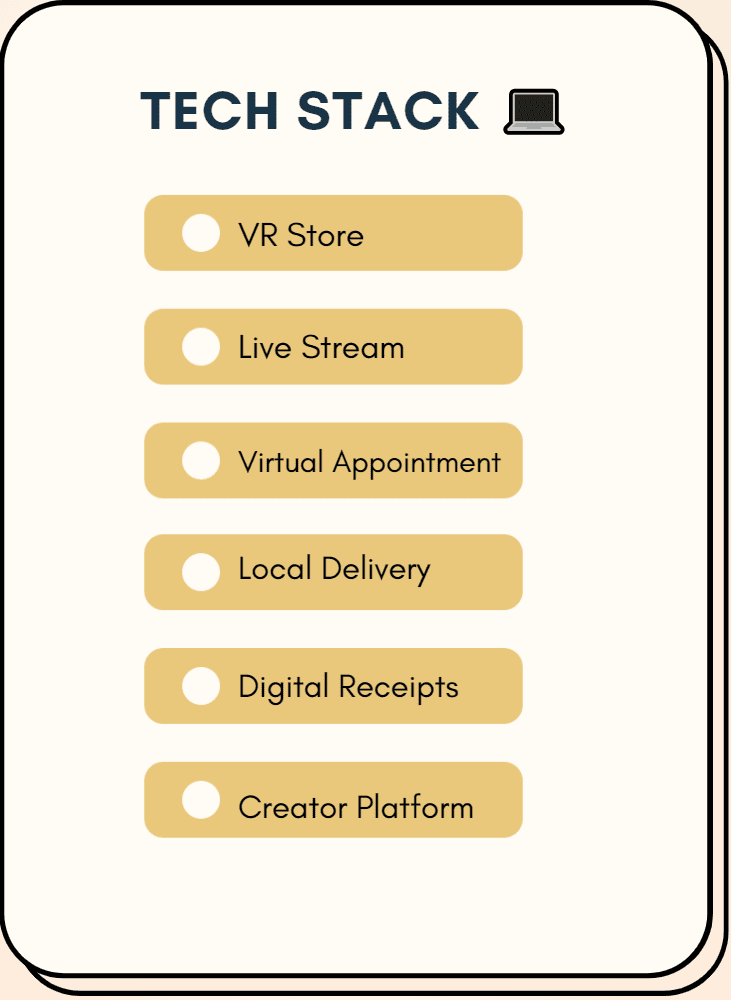

Tech Stack

The store acts as a testbed to identify real problems and deploy tech solutions for other retailers. This is a custom SaaS solution that allows retailers to pick and choose the components that would work for their customer base.

- Test in Brik + Clik stores, and power other stores.

- SaaS platform to digitize independent retailers and local shop discovery.

Scalability

Shop-in-shop (SIS) partnerships and holiday market eliminate:

- Build-out costs

- Construction time

- Fixed rent

- Staff cost & management

Shop in Shop

Charming Charlie is a chain retailer with 50+ locations across the US. It has an engaged customer base of millennial and Gen-X women, which overlaps with ours. This enables us to test demand for our curation in important markets in the Midwest, Southeast, and the South without any CAPEX or OpEx investments.

Holiday Markets

Brik + Clik concept but at the market level during the most active shopping period: Thanksgiving to Christmas. This is a first-in-kind DTC shopping festival made for a post-covid shopping experience.

We are innovating this holiday market through same/next day local deliveries, a dedicated online marketplace, events, shoppable VR and live streaming, driving incremental sales beyond just shopping in the market. Also, it's in Hollywood so watch out for some MAJOR glitz and glam!

Funding

Founder backed business

We have invested $90k to showcase how efficient our store deployment execution is. Investors have the unique opportunity to join a startup with six figure revenues with institutional partnerships and significant organic PR, a clean cap table and the ability to maximize their upside.

Founders

Meet our team

Hemant Chavan

Co-Founder and CEO

Mr. Chavan leads Brik + Clik operations, marketing, and PR efforts. Within a short span of time, he has established Brik + Clik as one of the most innovative retail concepts by synergizing their B+M and online operations. Additionally, pioneered the first-in-kind checkout-enabled VR store for a multi-brand retailer.

Prior to launching Brik + Clik, Hemant has over twelve (12) years experience of working in real estate development. He worked on a portfolio of $4.1 Billion which includes high rise condominium & multifamily residential, commercial office, retail, industrial & infrastructure projects in the North East, California and Seattle. He is also involved in sourcing, underwriting & structuring real estate deals. He is involved in the pre-construction, construction and close-out phases including marketing & sales.

Eric Hirani

Co-Founder and COO

Mr. Hirani received his bachelors of engineering degree with a minor in entrepeneurship from Columbia University in New York City. He is involved with the accounting, culture, fundraising, and operations within the business, as well as assisting Hemant Chavan in executing the Brik + Clik vision.

Prior to launching Brik + Clik, Eric has over ten (10) years of experience as an entrepreneur in the engineering, construction, and real estate world. He has overseen and participated on projects worth over $10 Billion dollars in various sectors, including Retail, Healthcare, Residential, Commercial, Hospitality, Infrastructure, Education, mixed-use, Water/Waste Water, Utilities, Transportations, and more. His true skills are in operating and scaling business—he has founded and grown several small businesses which continue to operate and thrive.

Lastly, Mr. Hirani is avid philanthropist and volunteer donating to dozens of causes every year, and founding two yearly scholarships for high school and college students.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...