Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Cloudastructure

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

- Cloud-based video surveillance and access control

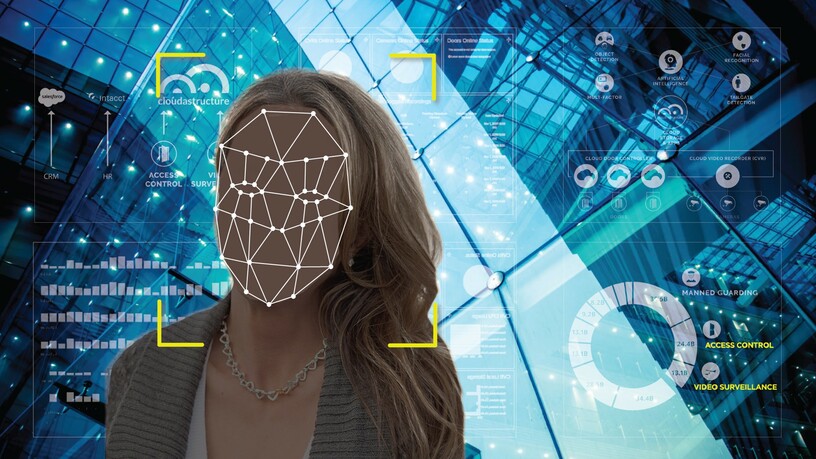

- Uses artificial intelligence for face recognition, object detection, and more

- $10,000 monthly recurring revenue

- Over $1.4M raised from strategic investors

- Co-founder Rick Bentley’s previous company acquired by Uber in 2015. Co-founder Gregory Rayzman was CTO at a company acquired by Facebook in 2015.

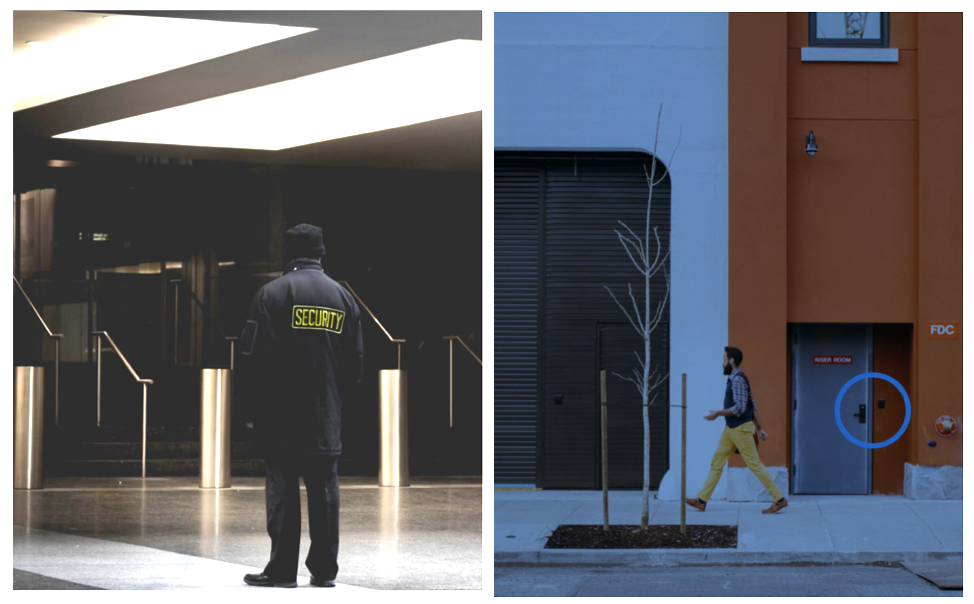

Breaking into modern security is trivial

That Radio Frequency Identification Card (RFID) that everyone carries in every modern office building can be copied, from a few feet away, without it ever coming out of a pocket or bag. That means that your sophisticated RFID card is less secure than a regular old metal key--at least no one can copy your key when it’s in your pocket.

Companies around the world know this, but have limited ability to do anything about it. They try to put guards up in lobbies, with two basic functions:

- Make sure a person’s face matches their badge, and

- When someone walks in with their badge, make sure no one walks in behind them without a badge.

Even the most sophisticated companies on the planet are stuck with this terrible security, and they come up with crazy ways to try to make it better. When our Founder/CEO was at Google they had the “Tailgator”, a guy dressed up in an alligator suit who would try to walk in behind you (“tailgate”) when you badged in. At the weekly all-hands meeting, security would play the video of everyone who let in the Tailgator this week. A very low tech solution from a high tech company.

Security more intelligent than a human

Cloudastructure centralizes the management of access control with video monitoring and allows customers to scale geographically to multiple locations. The Cloudastructure solution delivers the intelligence online while it puts the data safely offsite.

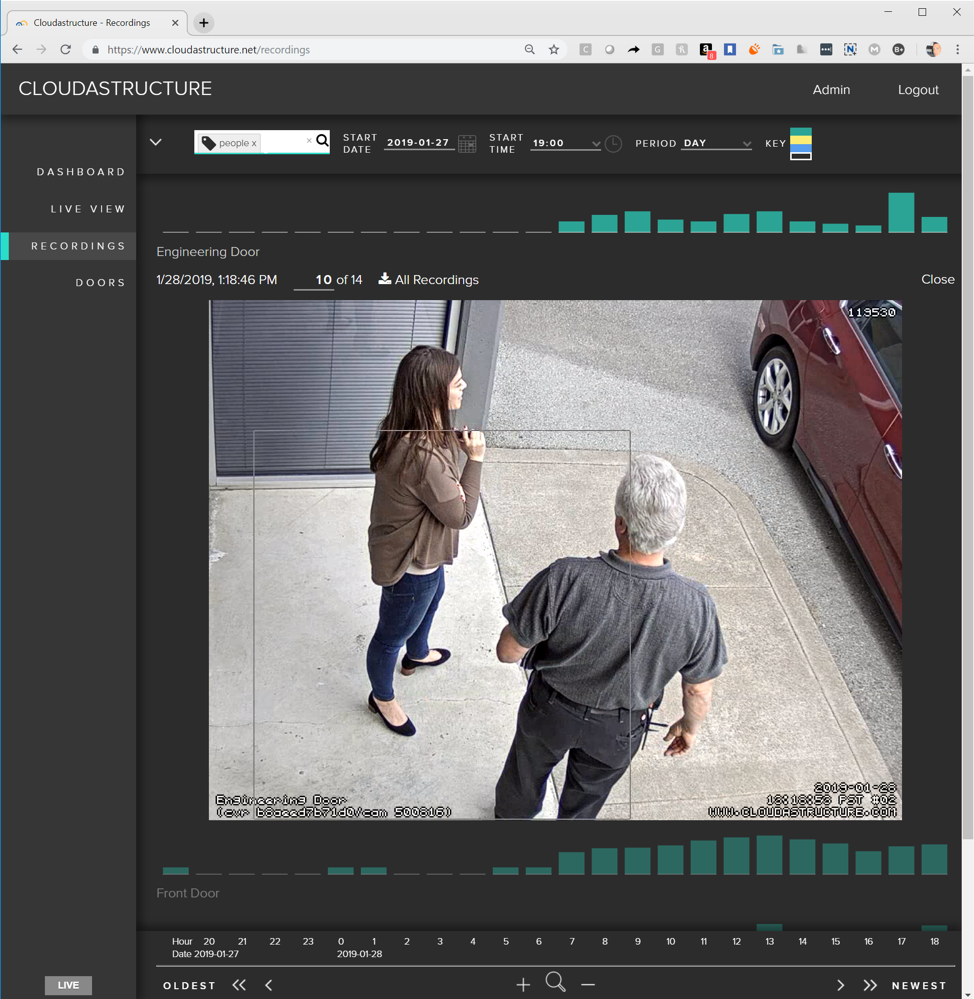

We index all the objects and faces in the video, just like Google indexed the web. This means you can search through all your videos by tag: person, animal, vehicle, etc. and even individual faces -- just like you can search the web. Instantly see all the video with the object you’re looking for in it. For example, here is all the video, by hour, with people in it: the higher the bar the more video of people:

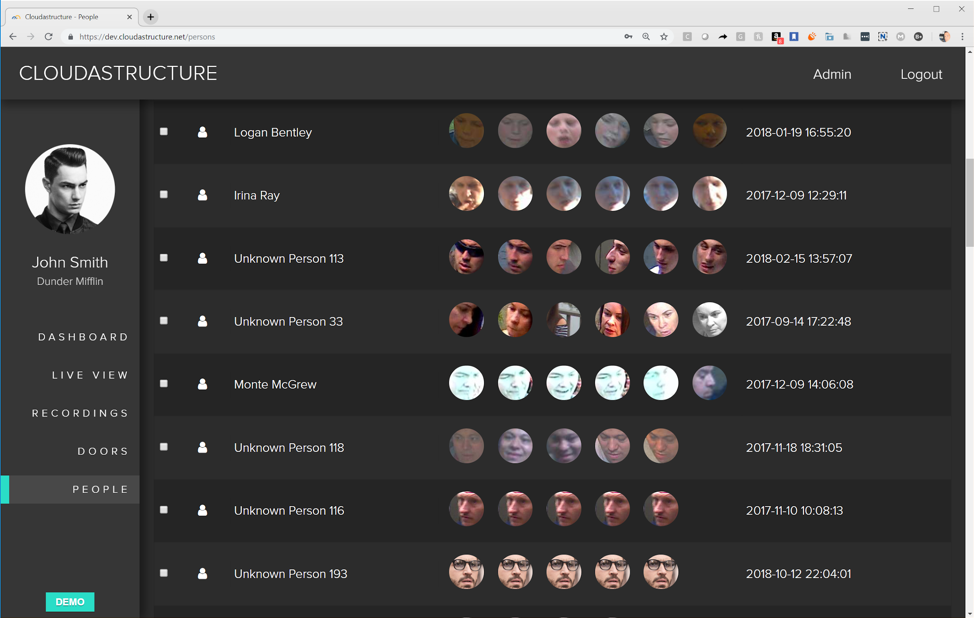

The future is more intelligent. Because we manage the door system, we know who badged in where and when. This means that when you swipe your badge we see your face. From real cameras under actual lighting conditions. We are constantly training the system to know what badge holders look like, even as they change makeup, facial hair, glasses, etc. over days, months or years. We can match faces to badges more accurately than any guard.

Moreover, again because we manage both doors and cameras, we know when someone badged in, when the door opened, any more badge swipes, and when the door closed. If we see on camera someone following someone in through a door, without swiping a badge, we will detect that as a tailgating event. Better than a guy in an alligator suit.

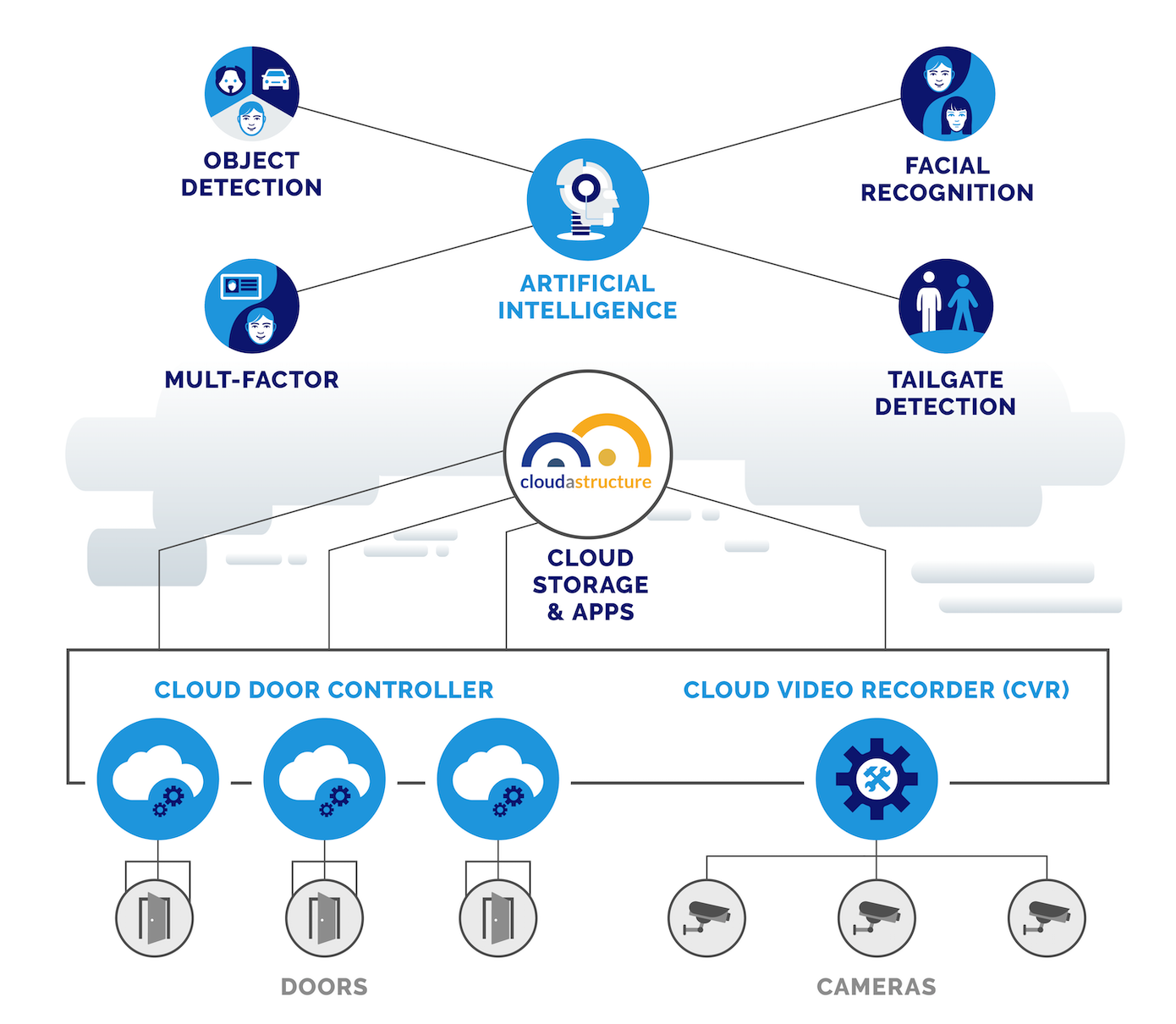

How it works:

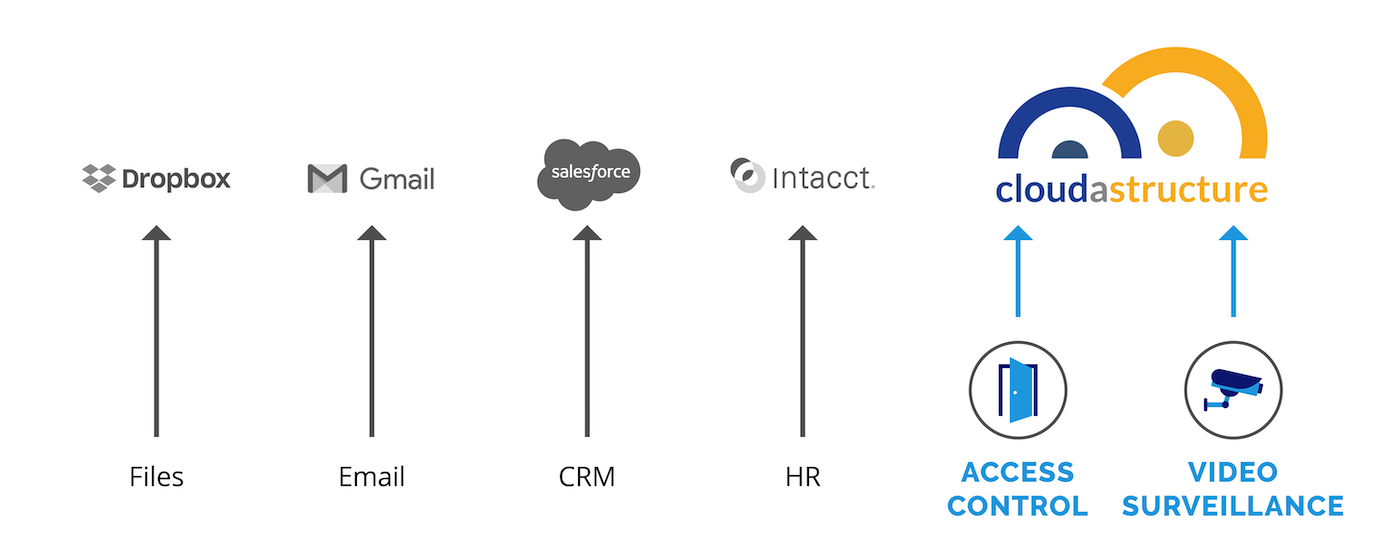

In order to perform these AI features, the information first needs to be in the Cloud. Cloudastructure is doing what Dropbox did for files and Salesforce did for CRM: moving the data to the cloud. As opposed to having data located at the site being secured, security data is stored online and can be accessed from anywhere, and is not at risk itself.

Every company used to have an IT closet full of servers. Those servers have been moving to the cloud, and making these new SaaS providers billions of dollars in the process. Every building of every company has two servers still left in that closet: access control and video surveillance. Cloudastructure is moving these last two to the cloud. Once the data is in the cloud, we can perform our AI functions.

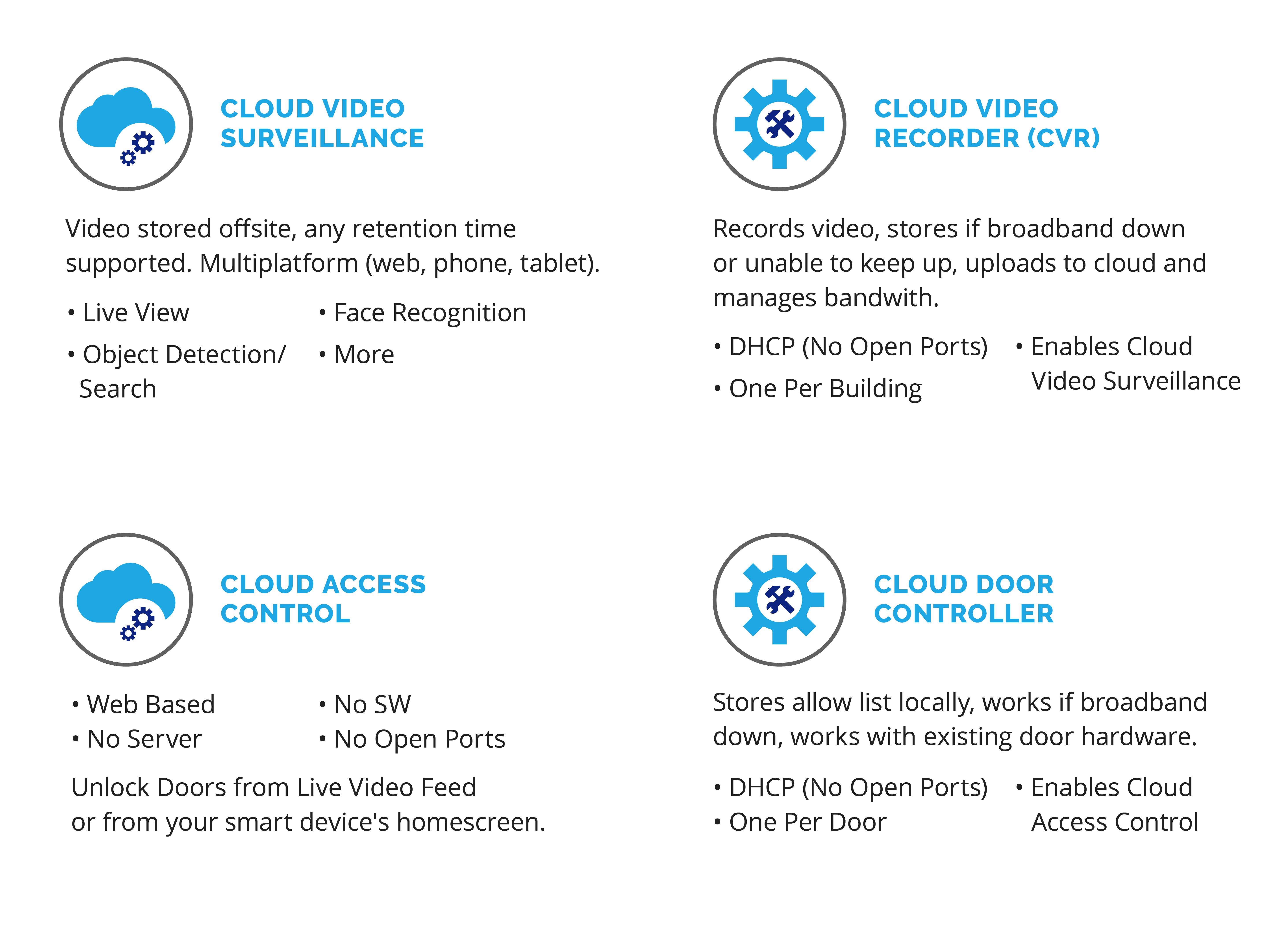

Cloudastructure also offers a variety of artificial intelligence features not found in traditional systems.

- Tagger generates tags for every object it sees in the video. Things like “animal” or “person” or “vehicle”...Then, we let you search by tag. No more watching branches blow or cars drive by for an hour, just search by "person" and see only videos that have people in them.

- Smartkey. Use your phone to open your door. It's more secure and you always have your phone with you. Likewise you can see someone live on video and unlock the door for them if they're locked out, dropping off a package, etc.

- Face Recognition. Already working in development, Face Recognition tags all videos with faces recognized in them. You can search by known person (e.g. Patrick) or unknown person (e.g. Unknown123). "Hey, that guy right there who attacked that other person ... where else has he been on my campuses?" (in development)

- Multifactor. The guard at the front desk does two things, one of which is make sure your face matches your badge. We can do it automatically. We can also let you use your phone as a credential, even passively (e.g. phone in pocket, but GPS/LBS says it's near the door and/or the phone is on the right WiFi AP). (in development)

- Tailgate/Piggyback prevention is the front desk guard's other function, they're just making sure no one “tailgates” in behind someone else who is badging in. Again, we can do this better with computer vision. On all the doors (side door, back door, document room, etc.) and not just the main lobby door. For a lot less than it takes to pay guards. (in development)

As seen in

Traction

We've gotten to $10,000 monthly recurring revenue. We not only have a low churn rate at less than 5%, but we’re also gaining many new customers thanks to referrals.

“With Cloudastructure we no longer have to run on-premises web servers. There are no holes in our firewall or port forwarding in our router. There is no reason why your physical security should weaken your digital security, but that’s exactly what our last system from a major manufacturer did”.

“Watching hours and hours of video to find the event we’re looking for is no longer a thing. We just search by tag and get the video we need right away. Video Surveillance is useful again!”

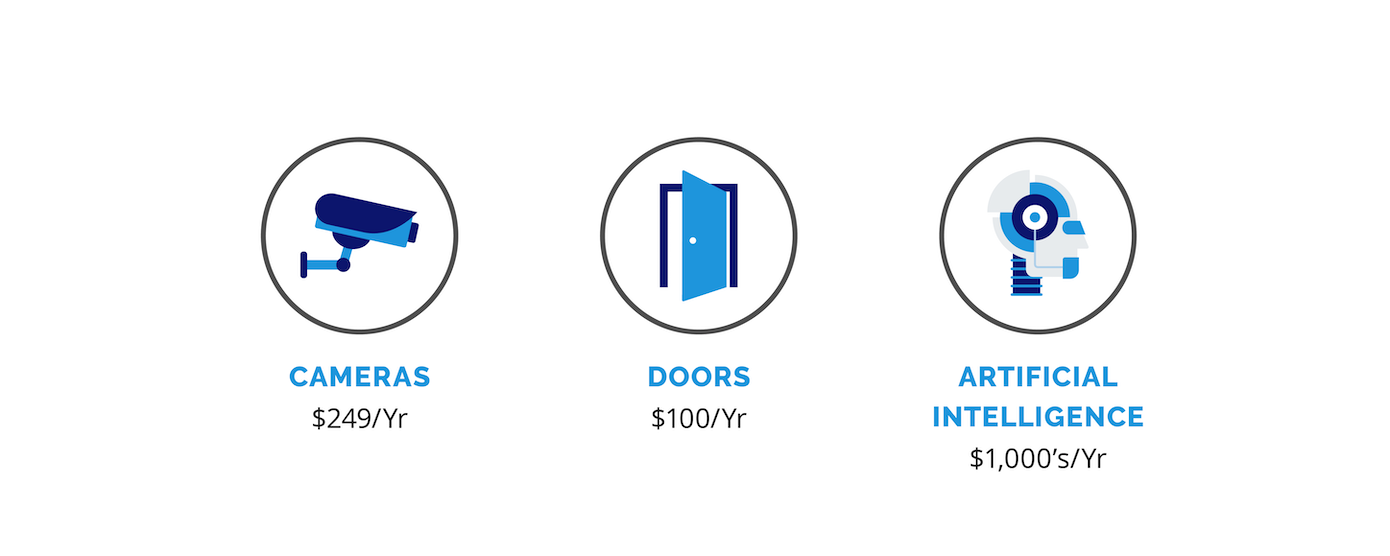

Business model

We found that we can compete with the incumbents by pricing by the door and camera per year. We make more recurring revenue than they do while still providing a lower TCO (Total Cost of Ownership) to our customers. However, we believe our higher level AI features will allow us to achieve security guard level pricing -- which is much higher than what we charge now. We intend to benefit from this price elasticity.

The Cloudastructure hardware utilizes state of the art technology, delivered at a very competitive price that beats the industry standards and comes with zero maintenance or replacement costs with a lifetime warranty. Cloudastructure solution centralizes the management of access control with video monitoring and allows customers to scale geographically to multiple locations.

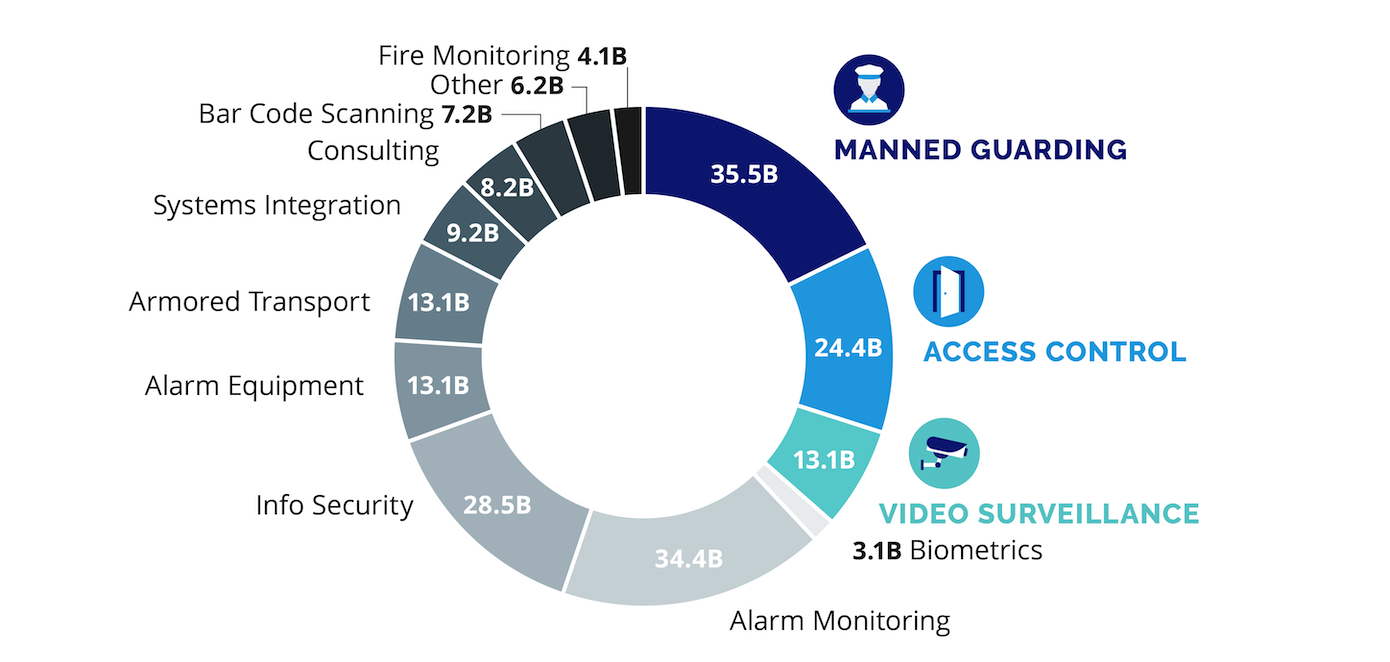

Security is a $200B+ industry

We are using Access Control and Video Surveillance to perform many Manned Guarding duties better than humans can--nearly ⅓ of the $205B security market is addressable by us.

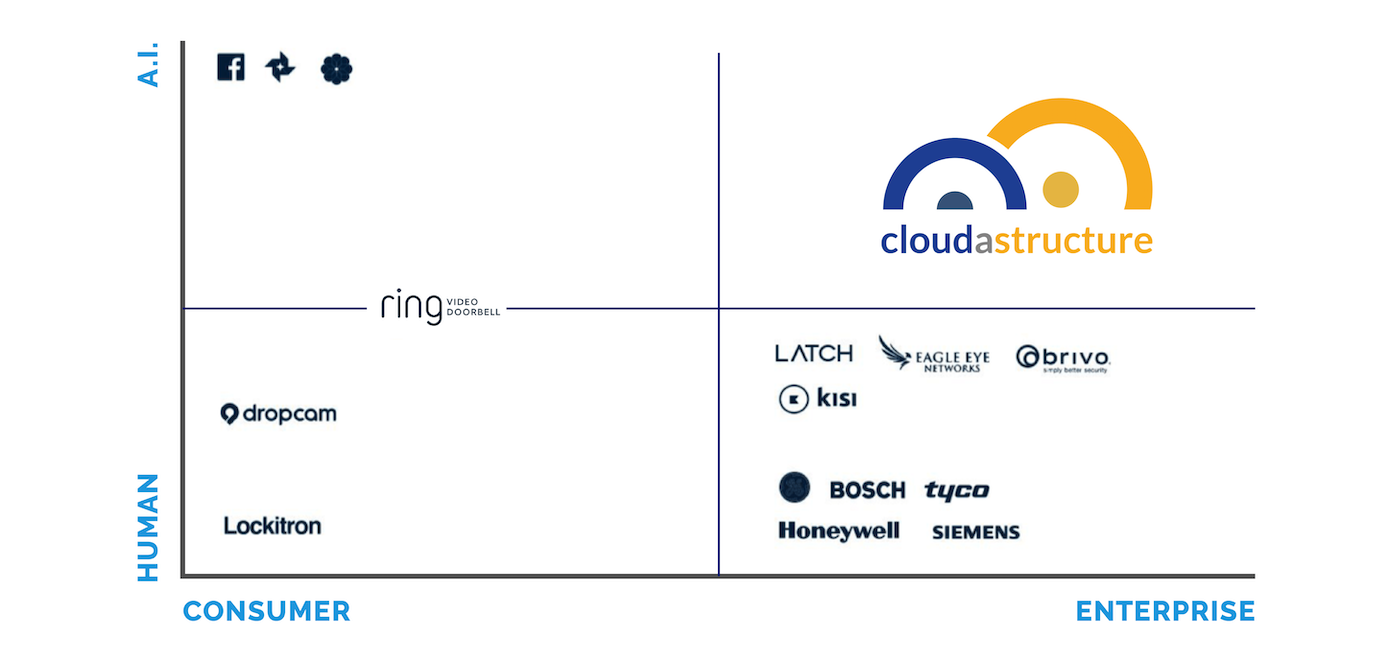

We're bringing AI for security to enterprise customers

$1.3M raised to date from strategic investors

Other notable investors include Ralph Eschenbach and Eric Chen.

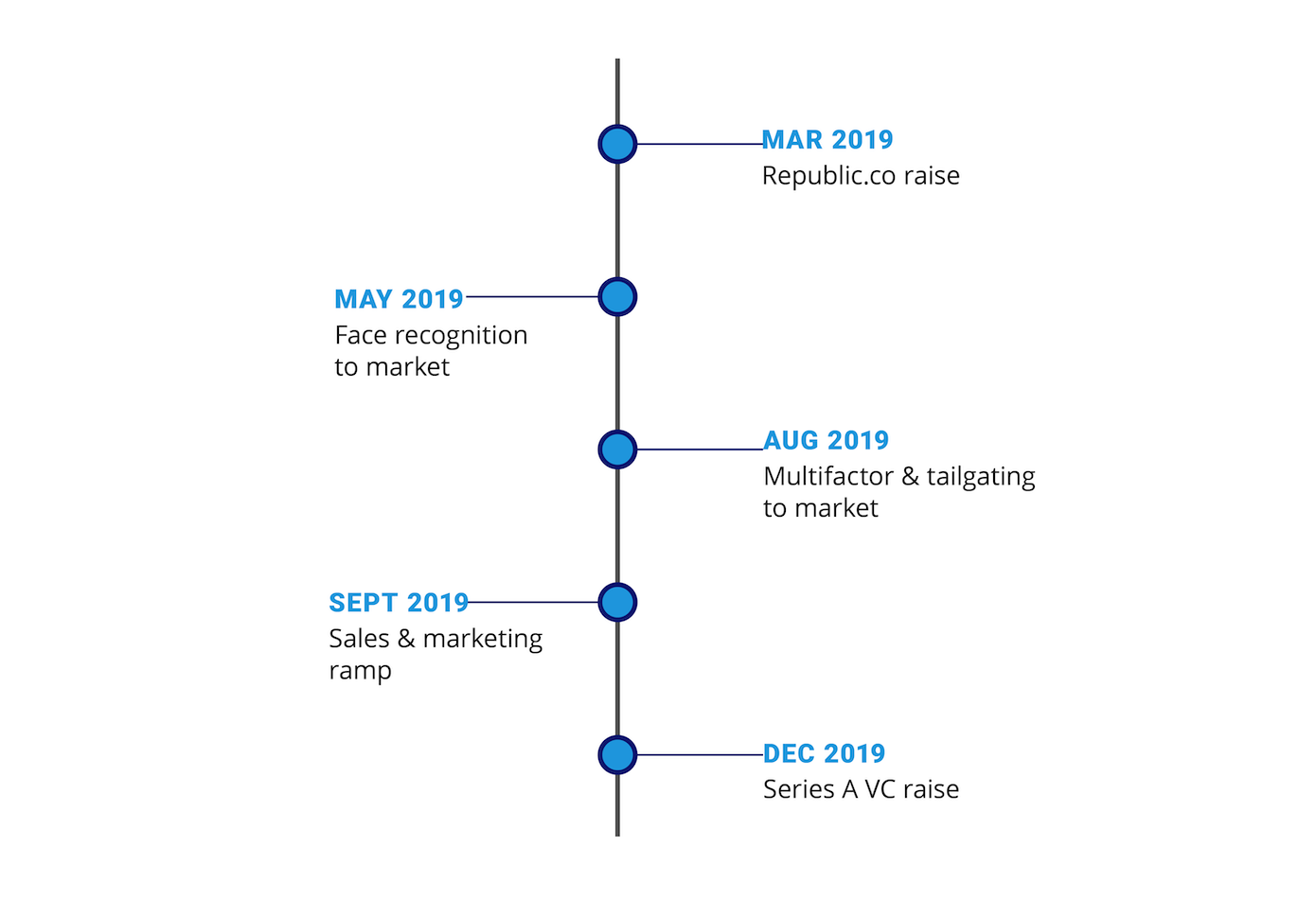

What's next

Founders & team

Rick Bentley - Founder, Chief Executive Officer

Rick Bentley has over 20 years of Silicon Valley startup and technology experience. He was founder and CEO of Televoke Inc. (became deCarta, bought by Uber) where he raised eight figures of Venture Capital from VC’s including Softbank and WI Harper. Mr. Bentley has been a full time Advisor to Google X. He was a direct report to Andy Grove for half a decade. Investors have brought him in for interim-CEO roles at early stage companies. He was a Senior Consultant at Bearing Point Inc., which included two assignments in Baghdad. At General Magic he managed the “Portico” program, derivatives of which served over a million subscribers. He was Director of Business Development for Machina, a design and engineering house that developed consumer electronics products, some of which sold over 10MM units. He was also Director of Product Development for Sensory Inc, which at one point had the largest installed base of speech recognition systems in the world. Mr. Bentley is the author of multiple patents and patent filings, many of which were bought by Samsung in 2014. He received his BA in Physics and MS in Engineering from UC Berkeley.

Gregory Rayzman - Technology Advisor

Seasoned technologist and well recognized name in Silicon Valley. His expertise in Big Data and database architecture is sought by several emerging and well established companies like Apple, where he provided pivotal leadership in designing and developing massively scalable and database backed infrastructures. Most recently, Mr. Rayzman had a great stint at TheFind shopping search engine with relevancy and popularity algorithm instead of the ordinary pay-for-placement. TheFind was acquired by Facebook in 2015. Prior to that, as Chief architect of a forward-looking company NebuAd, in 2007 he developed behavior targeting advertising systems based on the aggregate data, which everyone from Google and Yahoo to Facebook and Plaxo is looking into only now – for better targeted, more relevant advertising. He was previously a founding engineer and Chief architect for ITM Software, acquired by BMC. Mr. Rayzman also served as CTO for Claridyne Inc., an IT infrastructure and integration company. Mr. Rayzman was founding engineer and Director of Software Engineering for Annuncio Inc., acquired by PeopleSoft (now Oracle).

Craig Johnson - Vice President, Sales

Over 20 years of experience in a variety of Sales, Sales Management, Marketing, Operations, and General Management positions with his last assignment being COO of a digital signage startup. Prior to that he was a Honeywell General Manager, running a 100+ person organization with $27m in revenues, that consulted, sold, installed, and maintained HVAC systems, Fire Alarm, and Security systems in large, commercial buildings. Mr. Johnson also has extensive experience in the marketing and sales of electronic components to OEM and Distributor channels, both through direct salesforces and independent rep organizations. At the customer enterprise level, Mr. Johnson managed the sales and service teams for process automation platforms that monitor and control refineries, power generation plants, and manufacturing sites. He is Six Sigma certified and served as a Reserve Officer in the Armed Forces.

If you believe in the future of AI, join us as we take it to a huge market: surveillance and security

Deal terms

$7,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

20%

If a trigger event for Cloudastructure occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$100

The smallest investment amount

that Cloudastructure is

accepting.

Learn more

$1.07M

Cloudastructure must achieve its minimum goal of $25K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

-

We'll send you a few of our window stickers to keep the bad guys away.

Sold out (0 left of 46)

-

Get free lifetime service on one camera or door (hardware/installation not included)

Limited (2 left of 3)

-

Dinner with the team in Silicon Valley, including a ride in the Founder/CEO's Mystery Machine (www.scoobymobile.com)

Limited (3 left of 3)

- Crowd SAFE includes pro rata participation rights in future funding rounds

Why others invested

See all reviews (0) See all (0)AI in security is here to stay. It's been leveraged very well in cyber, and applying it to Enterprise Physical Security has tremendous promise. Paired with the ability to streamline operations with the cloud component, this is very interesting.

I invested because, I strongly believe that Cloudastructure can create a secured and safe workplace !

There is an enormous market opportunity for cloud-based video surveillance & access control. The founders of Cloudastructure know what it takes to run a successful startup. They will make Cloudastructure a tremendous success.

About Cloudastructure

Cloudastructure Team

Everyone helping build Cloudastructure, not limited to employees

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC