Before July 1, Jon Seaton was an obscure 285-pound offensive lineman at FCS Elon University. But since the birth of the N...

Problem

Video creators aren’t making real money

Video is one of the only content types where creators do not own how they make their money, forcing them to miss revenue from platforms like YouTube or Facebook Watch because of 70% ad skip rates. Video creators care about owning how they make their money just as much as podcasters, newsletter creators, or bloggers who have full ownership over their content. And on the flip side of the same coin, brands care that target audiences are listening to their product messaging and not skipping through it.

Solution

Curastory takes video businesses to the next level

Curastory allows creators to easily make, edit, monetize and share their videos to all of their video channels — just with one click. It’s one of the only all-in-one platforms for creating, monetizing and managing quality video content without compromise, and it’s 100% free for creators.

Through native, creator-recorded ads as our first monetization model for our users, creators are raking in $5,000 per video on average and brands are seeing a 2-3x in return on spend all because audiences are 61% more likely to listen to native ads from the creator they tuned in to watch.

Our creator Tyreek Hill inserted his native ad at 00:17 above.

Product

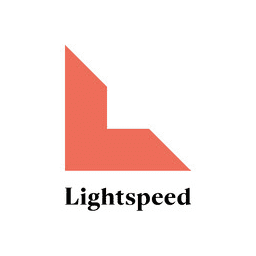

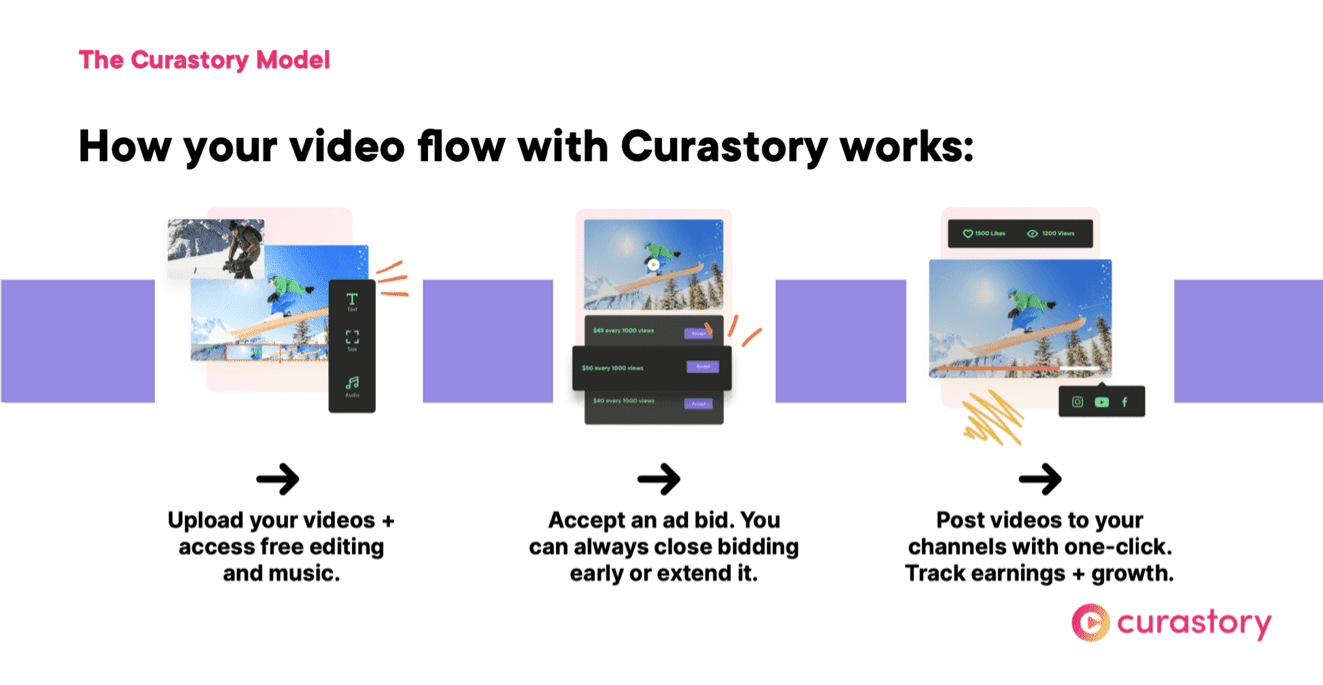

Create, distribute, and monetize your videos — all for free

From making to sharing, Curastory provides its video creators what they need every step of the way. Content creators upload videos within our platform to finalize editing and music through an easy drag + drop process. Users then match the videos to brand advertisers for monetization through native, creator-recorded video ad spots before they distribute the final video to all of their video channels.

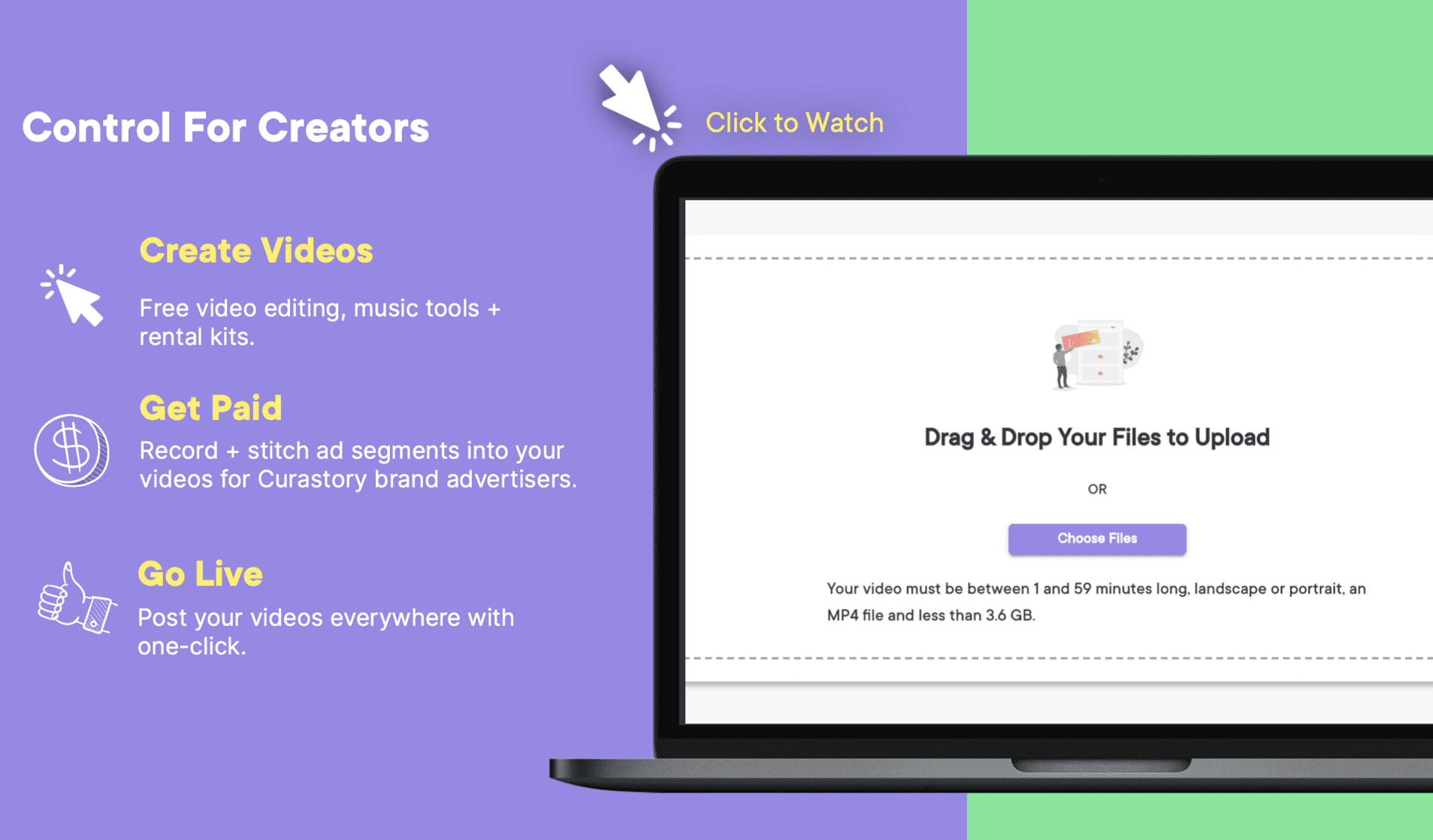

Brands create + run ad campaigns based on audience targeting preferences within our self-serving ad platform, where we automatically bid on matched videos for them to market their products through native, creator-recorded video ad segments.

Traction

Our user retention rate is 82%

Curastory has made $85K in gross revenue over 3 months with a $1.02M run rate. In addition to our financial traction, we’ve successfully engaged multiple professional league association partnerships with the NBA, and student athletes with the NCAA solidifying access to more than 150,000 video creators.

We have over 1,000 user sign-ups with a user retention rate of 82%. Some of our creator users include Isaiah Thomas, Tyreek Hill, and AJ Andrews, and have been featured for the resources we offer our creators from top news publications.

*Gross revenue & run rate from Feb~May 2021. Retention rate & user signups as of June 2021.

Customers

We've given creators control and allow automation for brands

With our native, creator-recorded ads, everybody wins. Our model puts video creators in the driver’s seat allowing them to first control video monetization from their own ads, returning $5,000 per video on average. Brands are also reaping the benefits because of our automated model, allowing them to stop managing creators in Google Sheets, but rather run streamlined advertisement campaigns returning 2-3x in spend.

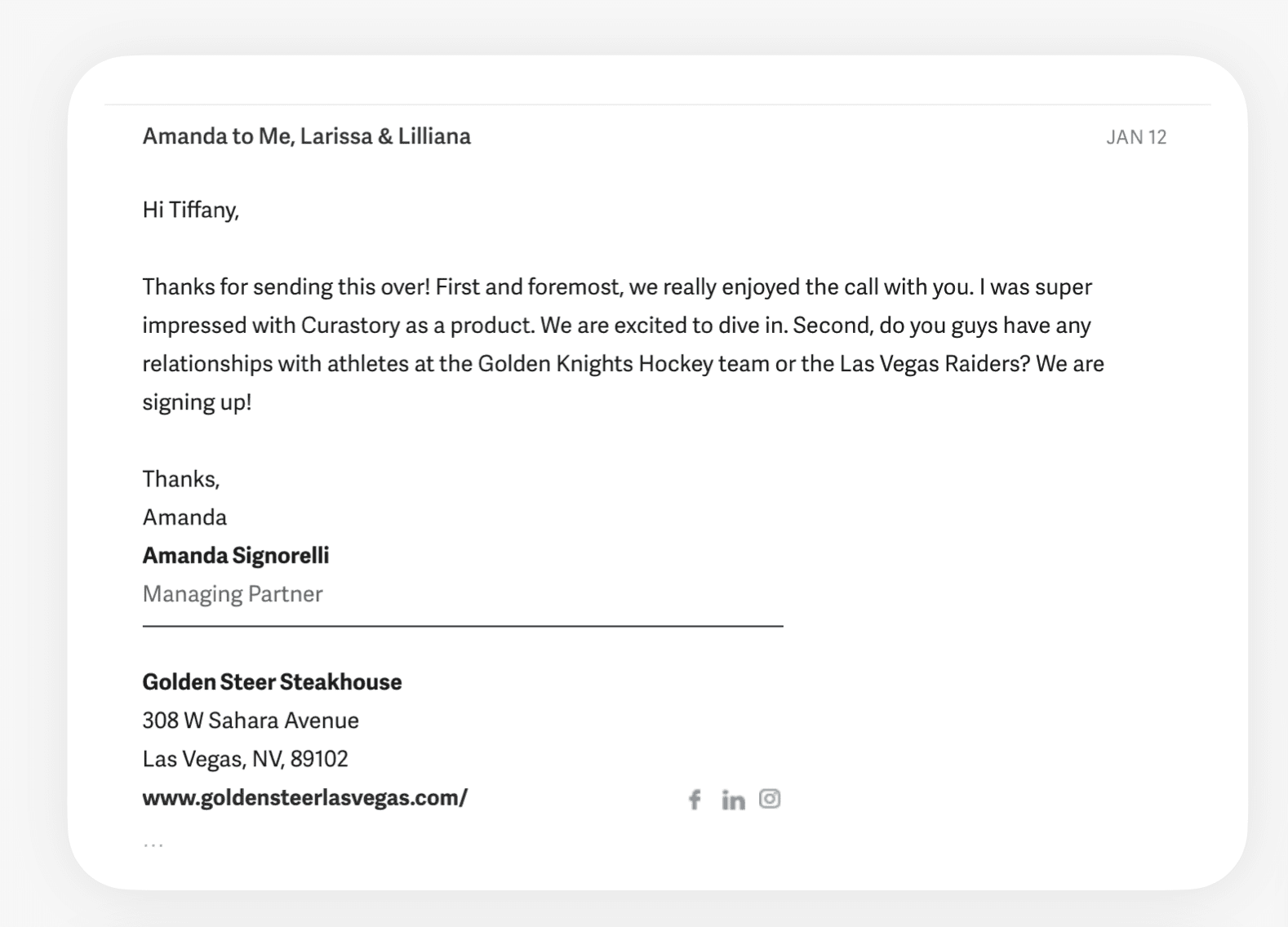

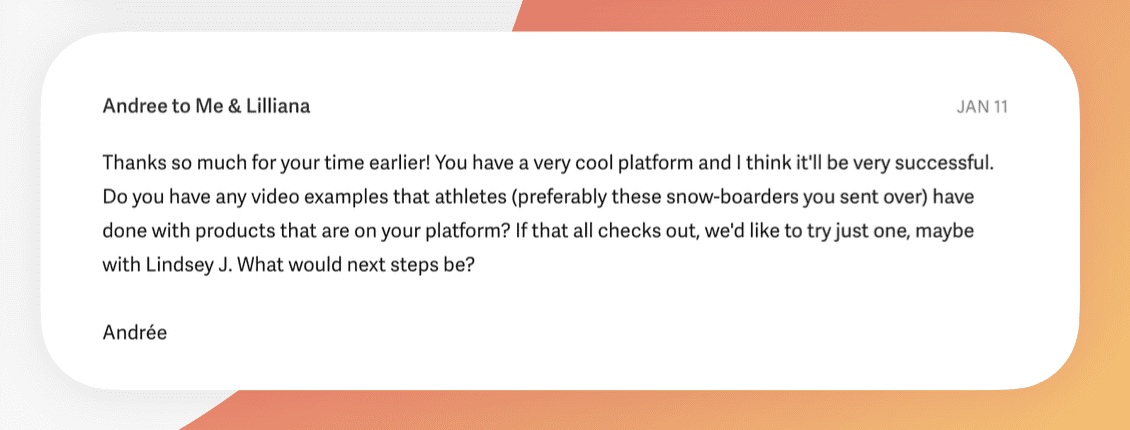

Our users, like Chloe Kim's agency, and CPG brand partners love Curastory just as much as they love sharing that with our customer support team.

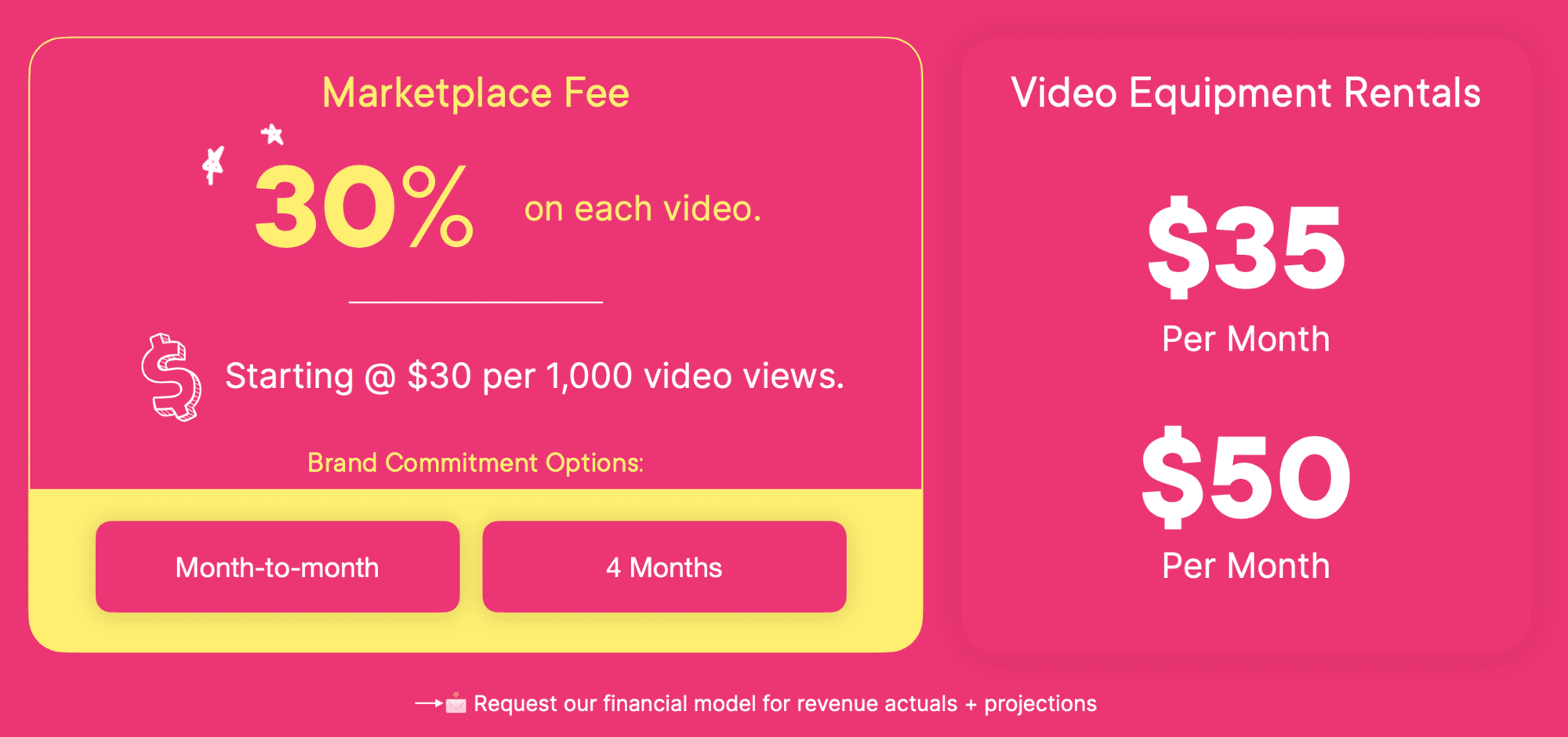

Business model

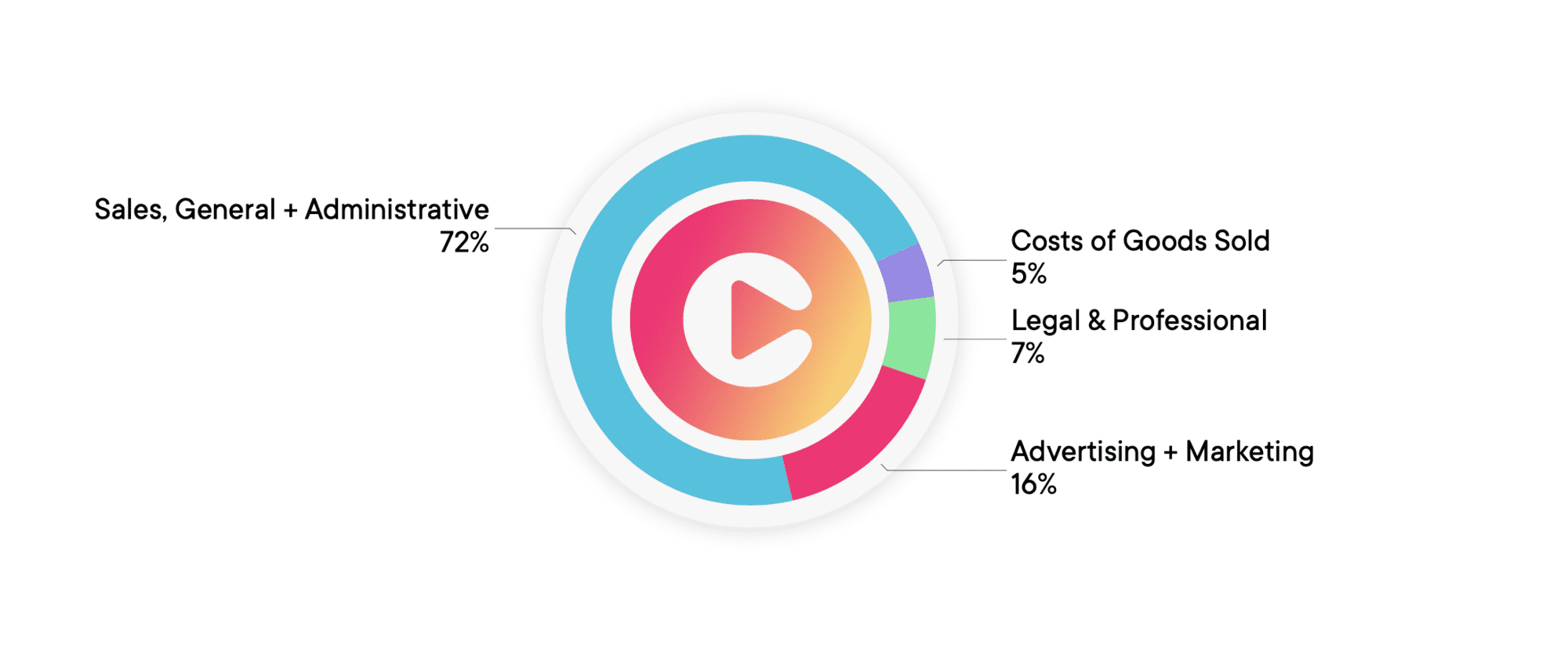

Majority of our revenue is from marketplace fees

Creators upload their video shows to Curastory to become discoverable to advertisers for native, ad spot placements before going live to their YouTube, IGTV, and Facebook Watch channels with one-click.

We charge our brand partners a minimum of $30 per 1,000 native ad spot views only taking a 30% cut per video and paying the rest to our creators. For context, competitors providing the same service take 45-50%. The majority of our revenue comes from this marketplace fee, but we also accrue capital through video equipment rental subscriptions, which are between $35-$50/mo. As of now, our total GMV has seen $85K+ in 3 months.

*GMV from Feb~May 2021

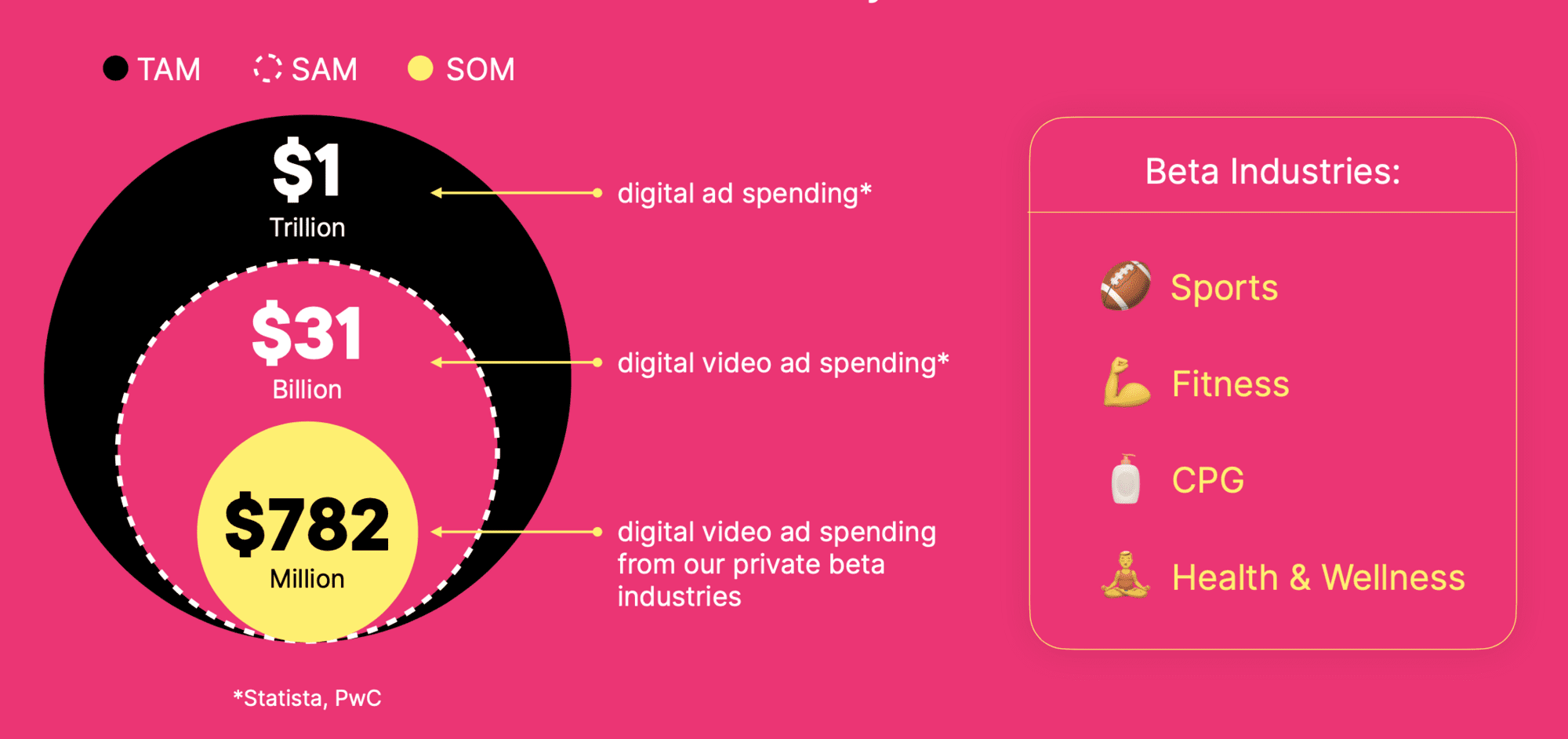

Market

Growth of the creator economy is massive, and favors video creation

There has been a 17% YoY increase in content creators since 2017, and $990M+ in revenue has been generated from these new content creators alone.

There has been a 17% YoY increase in content creators since 2017, and $990M+ in revenue has been generated from these new content creators alone.

Over $1T is spent on digital ads annually and our initial target industries of e-commerce sports, fitness, CPG, and health + wellness brands spend $782M+ on digital video ads every year. And brands favor video spends because 95% of ad messages are viewed in video, compared to only 10% when reading.

*$31B digital video ad spending market is a calculated round-up

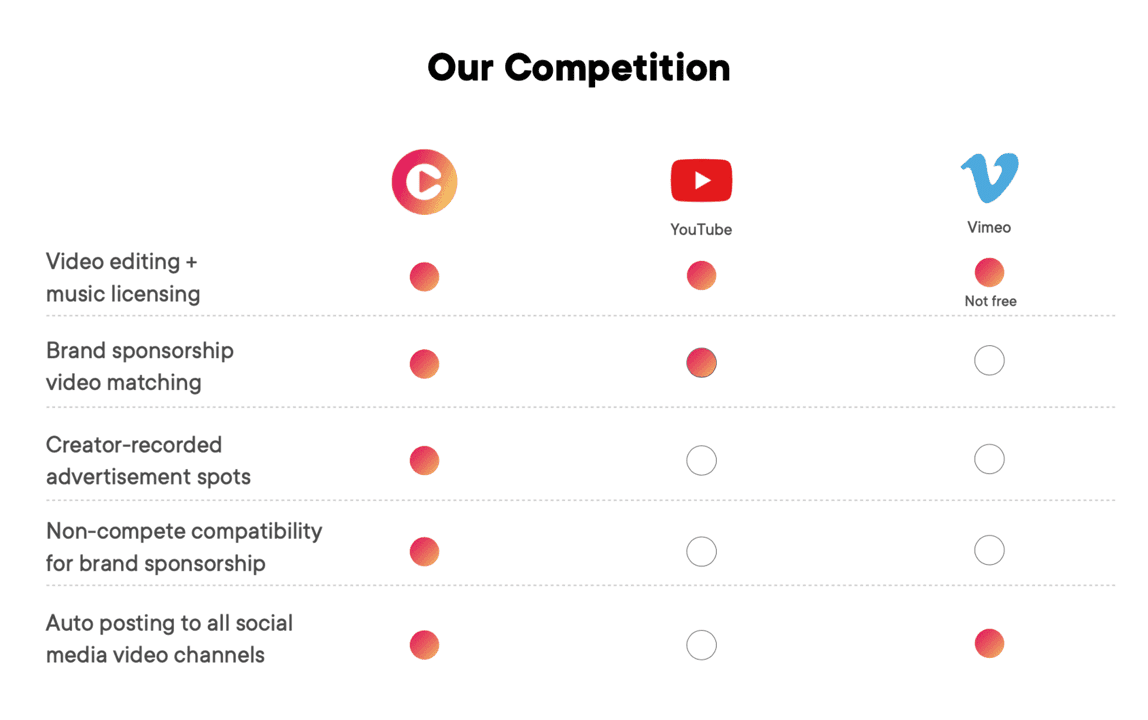

Competition

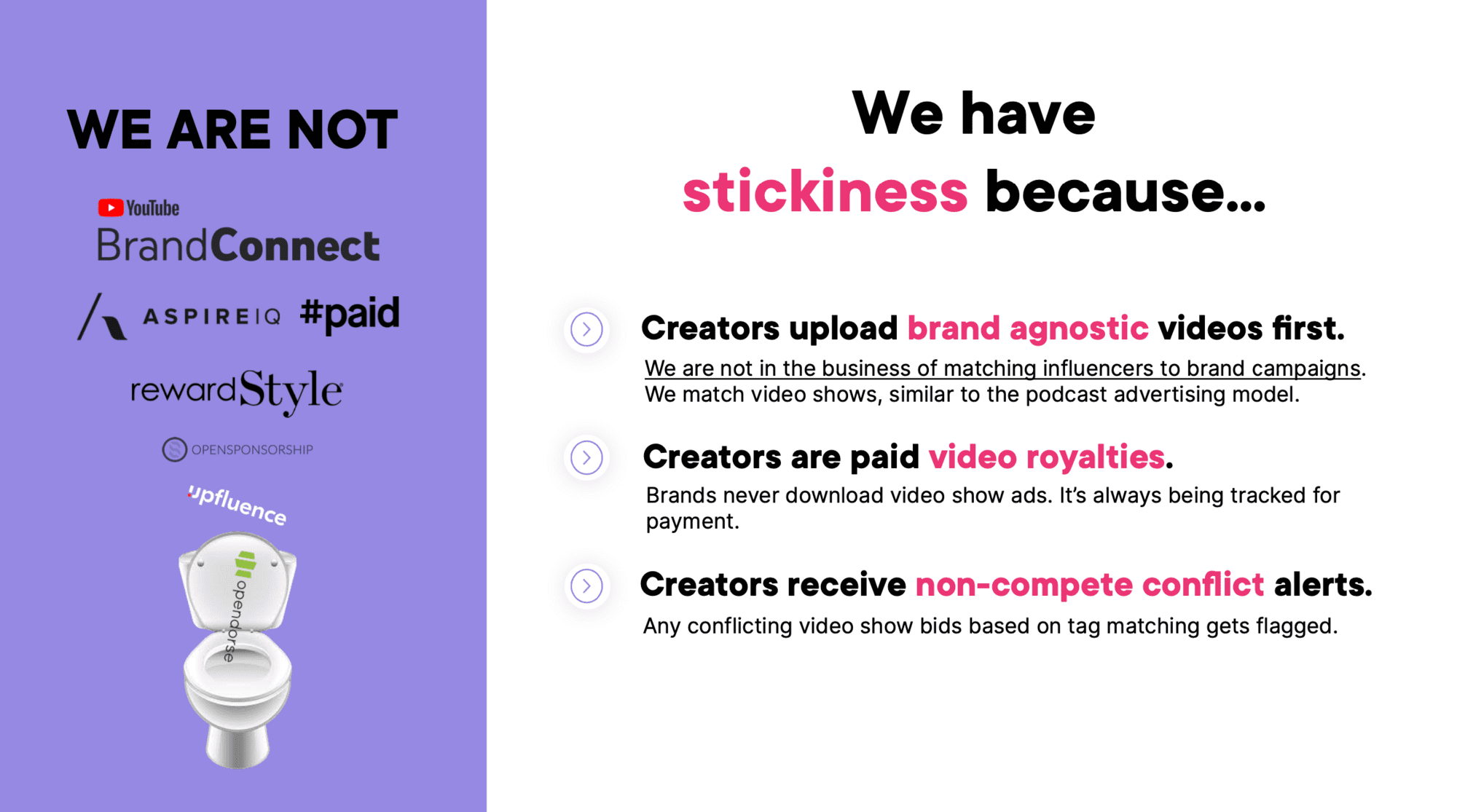

Early to market for all-in-one video for creators and brands

Curastory is the one of the only platforms that offers video tools, brand campaign video matching, creator-recorded advertisement spots, non-compete compatibility for brand campaigns, and auto posting to all social media video channels.

We are not an influencer marketplace. We are more similar to an Anchor, Red Circle, or MidRoll for podcasters if it existed for video creators.

Vision and strategy

To power videos everywhere

Curastory is currently building trust with video creators and meeting them where they're at — their social media video channels. We plan to grow our platform to power videos for audiences everywhere through continued native, creator-recorded ad segments on all video channels, a platform for creators to gate their video content through pay-per-view + subscriptions, and themed content houses around the world, first starting with sports + fitness.

Funding

Join the early investors of Cameo, Snapchat, and Giphy

We are backed by Techstars, Lightspeed Venture Partners, and The W Fund, to name a few of our strategic investors that believe in the future of video through Curastory.

We want to bring the opportunity of investing in Curastory not just to our accredited investor funds, but to our community, future users, and video fanatics like yourself. We’re raising funds to build requested features, a mobile app, and scale our team to be able to service over 3,000+ users with 10,000+ sign-ups.

Founders

The perfect team to win in a noisy, creator economy market

As founder and CEO of Curastory, Tiffany Kelly first noticed how the creator economy changed traditional media forever from her time at ESPN. While working with athletes, talent, and going on the air herself, she uncovered the need to create + bring a streamlined process of the content funnel like the well-oiled, media conglomerate machine down to the individual, creator level all within a tech platform.

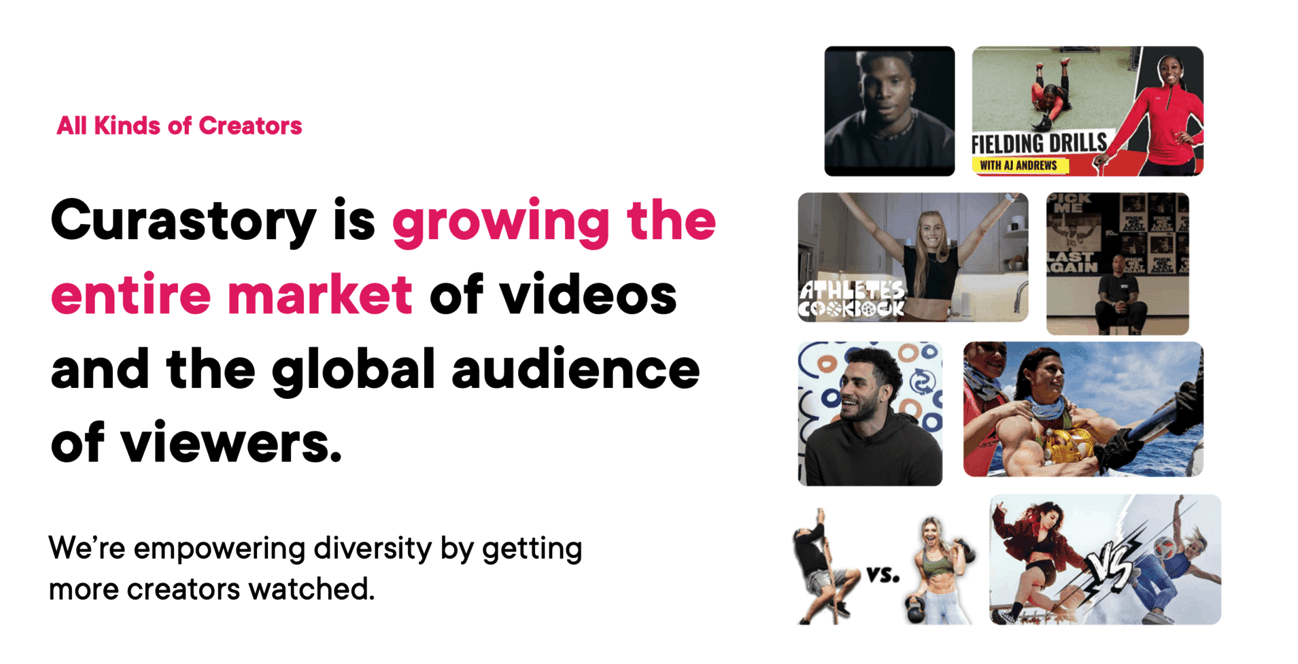

The Curastory team has exclusive access to some of the most sought after sports and fitness focused video creators before tapping into other markets such as beauty, cooking, and educational.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...