The contents of this article are for informational purposes only and do not constitute financial or investment advice. It...

Problem

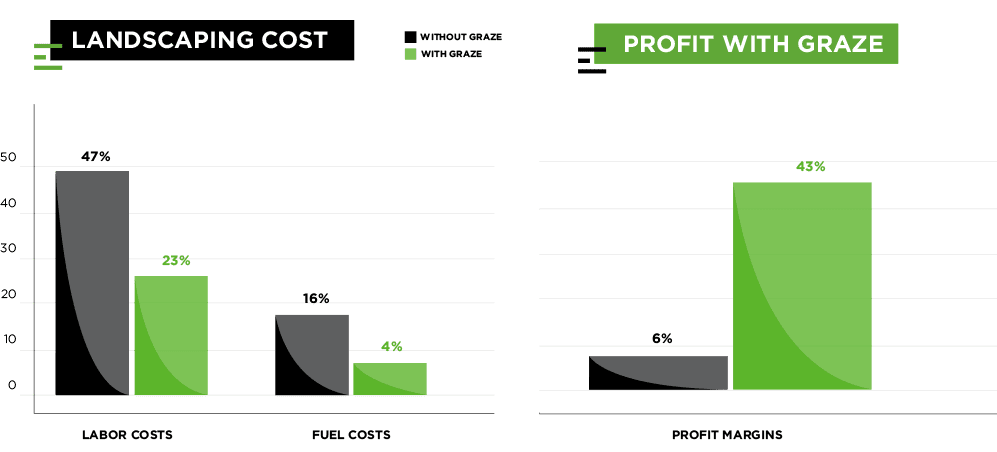

Mowing segment has historically low margins

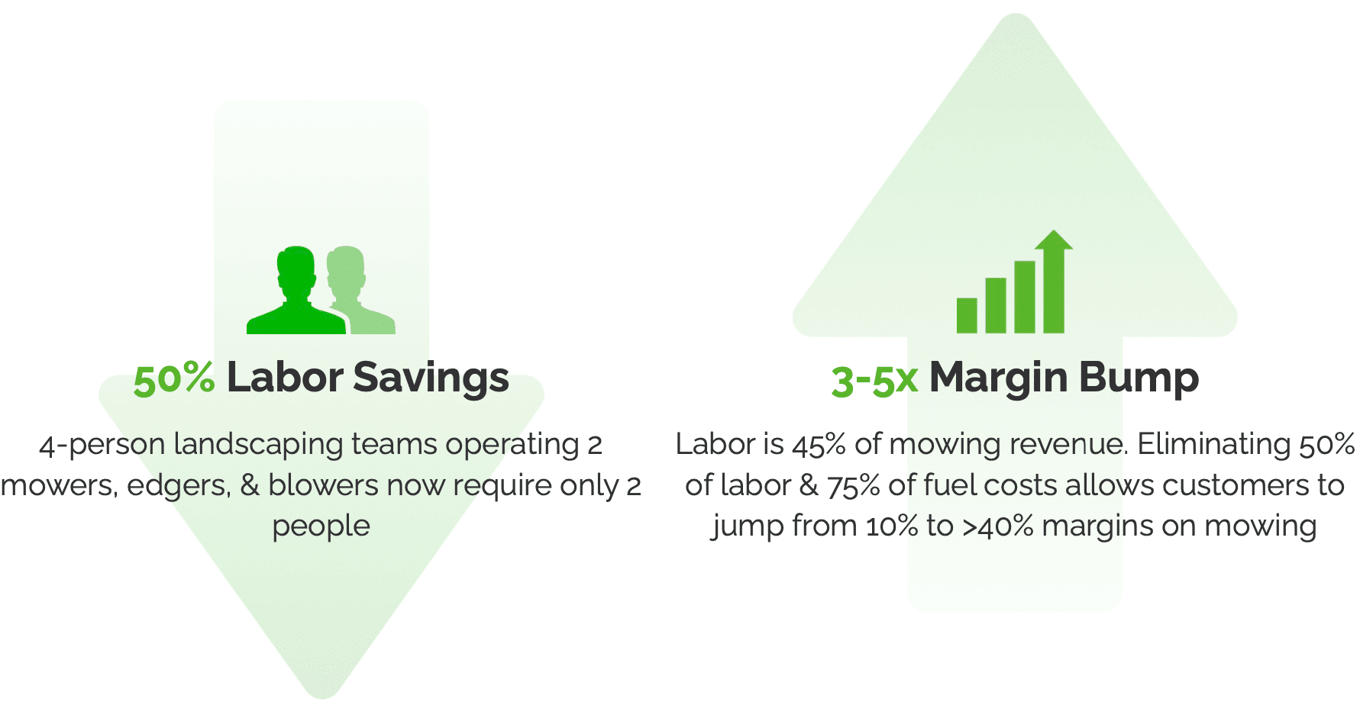

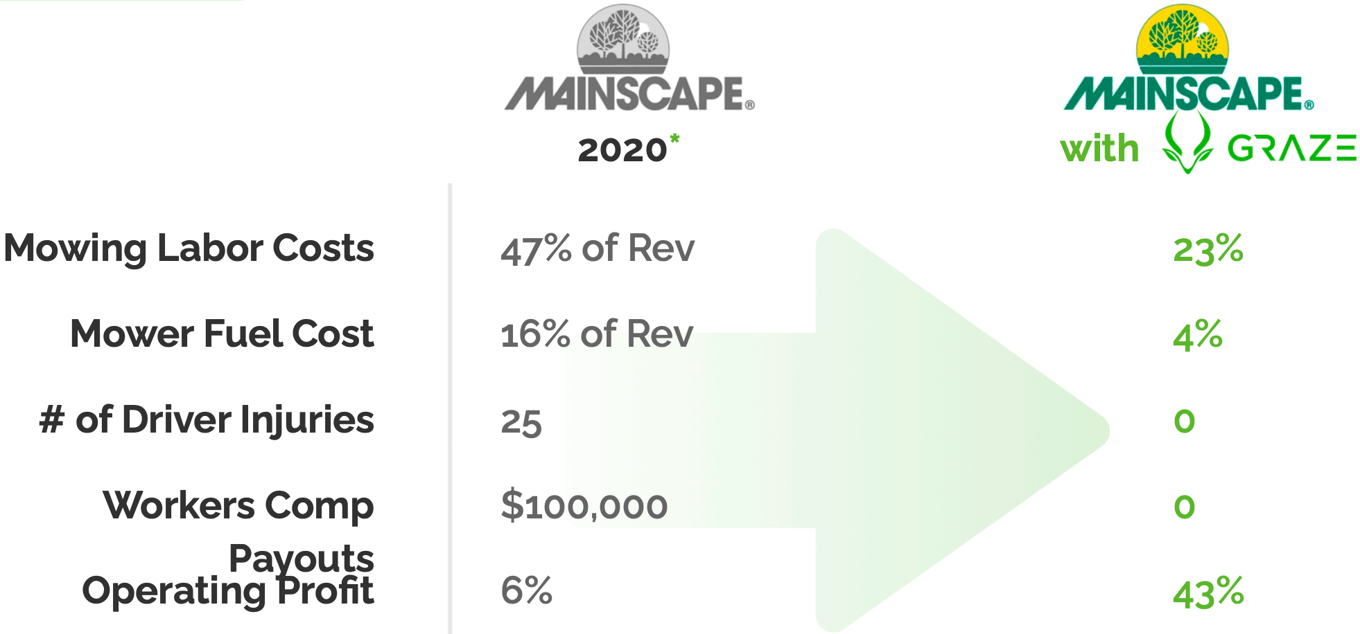

Due to high labor and maintenance costs, Mowing is a loss leader for commercial landscapers and is one of their lowest margin services offered.

- Labor accounts for 45% of gross revenue

- Companies receive just <0-10% profit margins

- Heavy competition drives prices down

Stats & charts above based on comparisons to Mainscape only.

Solution

Graze is building electric, fully autonomous mowers

for commercial landscaping companies

The Graze difference

Product

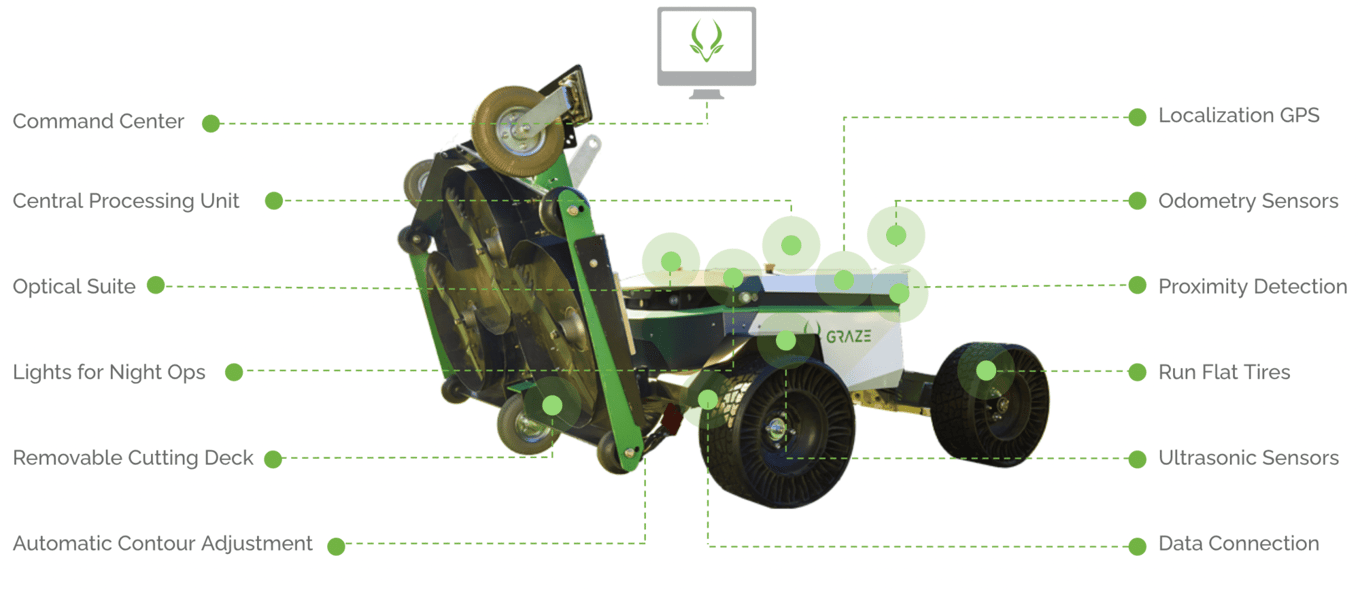

Production model capabilities

Graze Version 3

—

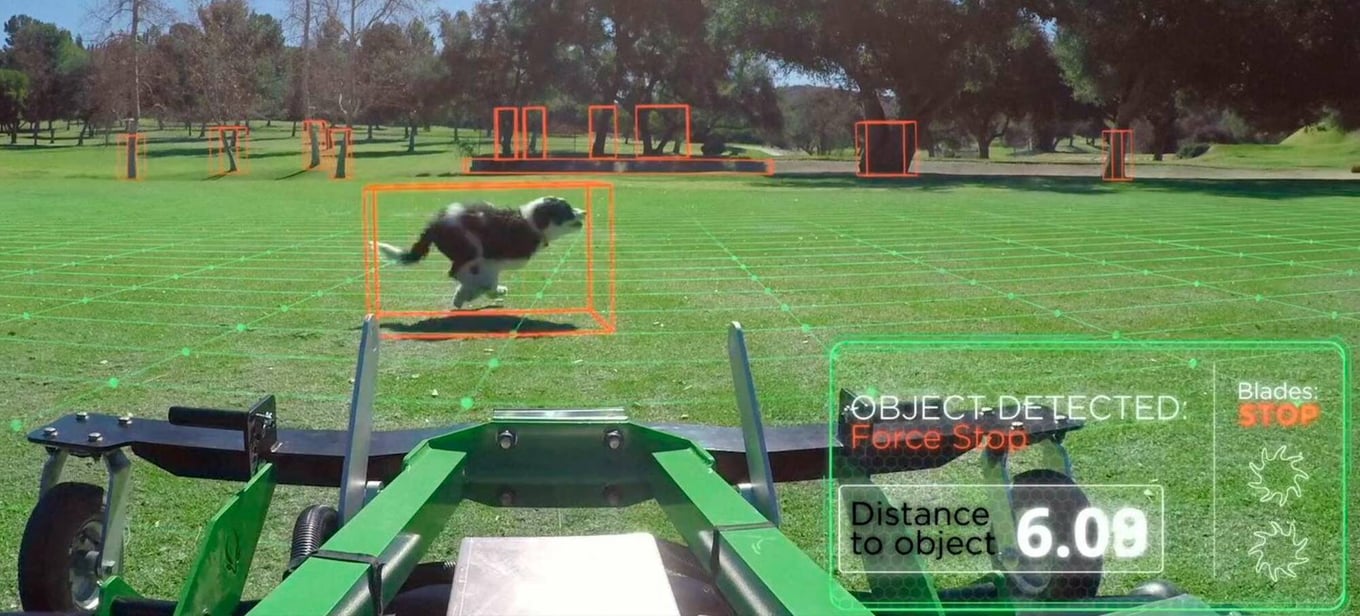

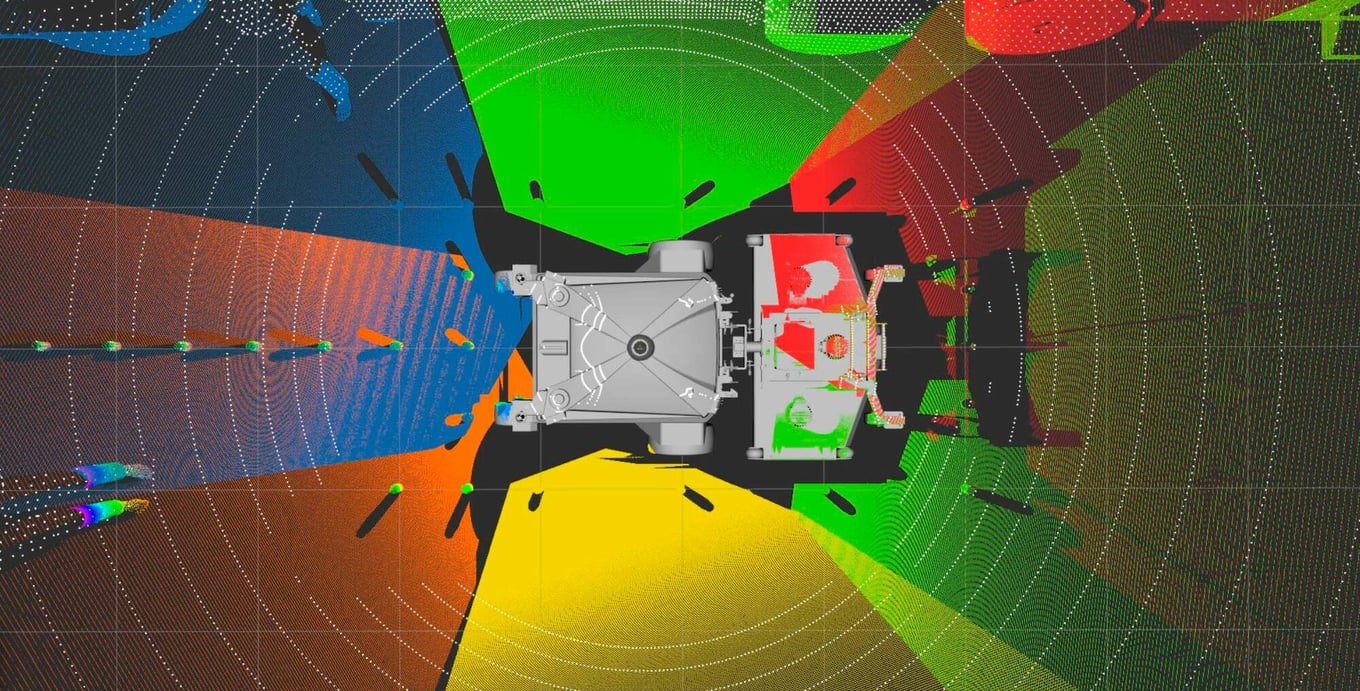

Graze Vision

Enhanced by computer-generated VFX

Enhanced by computer-generated VFX

—

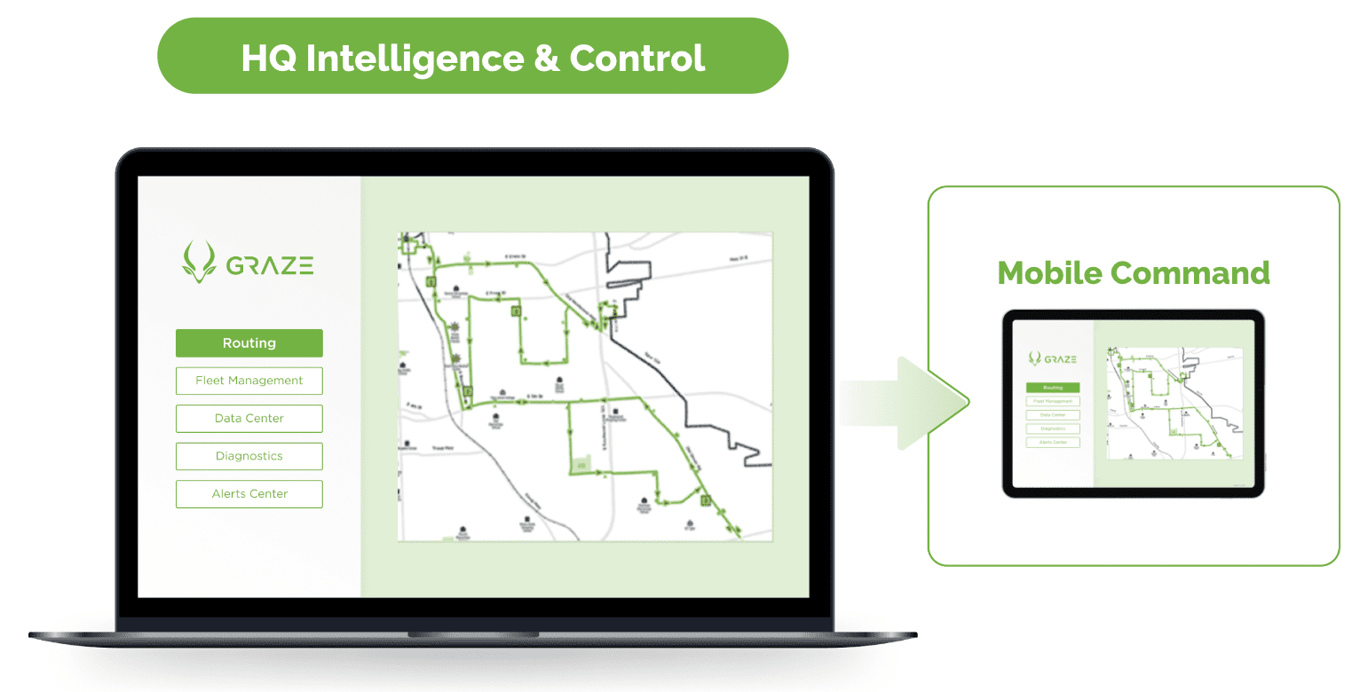

Fleet Command Center

- Scheduling

- Demand Forecasting

- Data Capture

- Unit Diagnostics

- Fleet Management

- Service Check-Ins

- Weather Alerts

—

Mobile Sensor Platform

Traction

Pilot programs

currently in progress

Product scheduled for release in 2022

Customers

How we transform our customers’ P&L

* based on estimates, net gain for Mainscape could be 4-6x EBITDA per year. Estimates may vary depending on multiple factors.

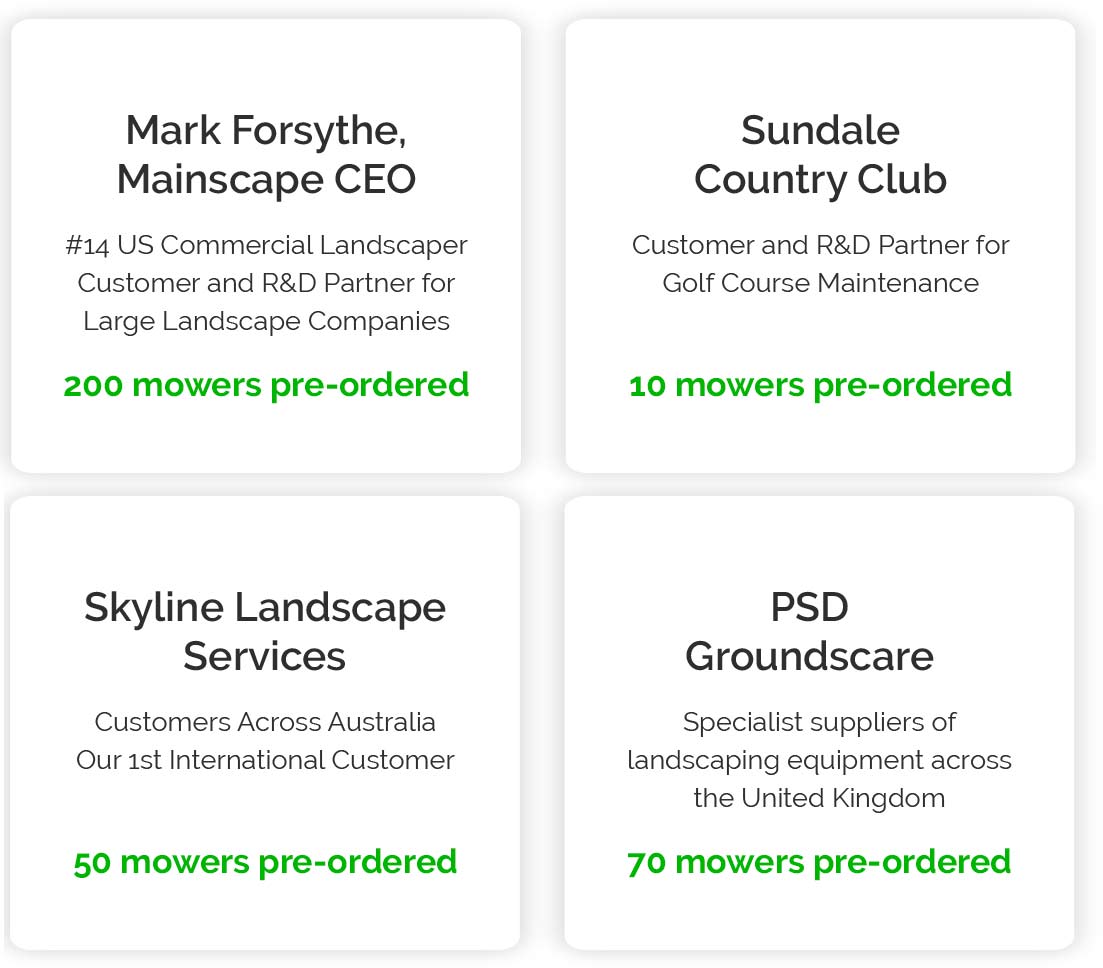

Our first customers

358 mowers pre-ordered represents at least $23M in potential revenue

Market

$115B lawn & landscaping industry

Vision

Product pipeline & go-to-market strategy

Bulk mowing

2023

Deliver 250+ Graze mowers to existing early stage partners with signed LOIs. Expansion geographically focused in California.

—

Swappable decks

2024

Additional decks and attachments expand our ability to increase usage with existing customers and grow addressable market.

—

Mobile sensor platform

2025

Similarly increase existing customer usage by providing sensor and software upgrades allowing for inspection, monitoring, and tasks supported by data collection.

Funding

Graze has raised ~$15M to date

via the crowd and traditional investors.

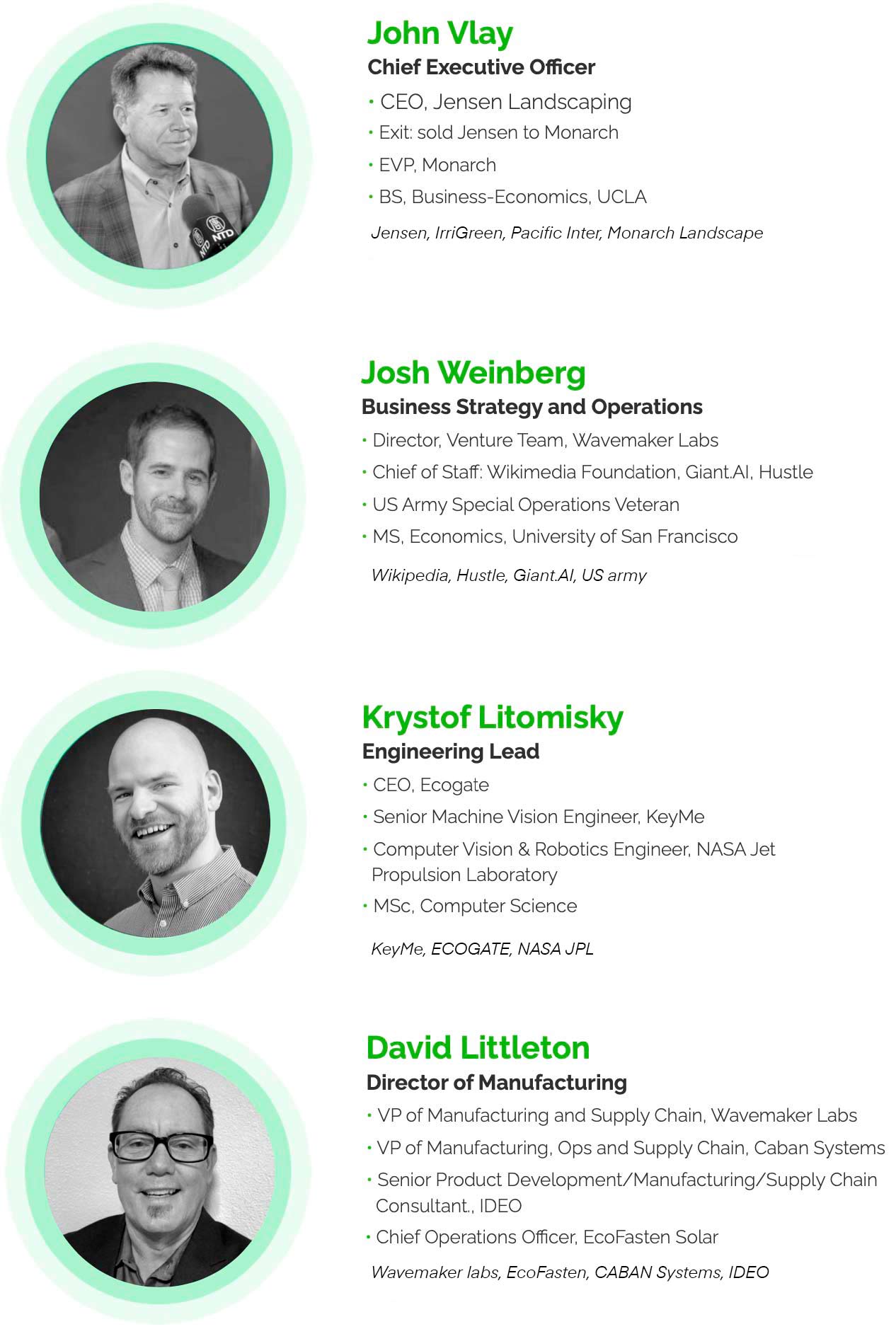

Leadership

Leadership Team

Summary

- $23,000,000

in potential revenue from industry-leaders - A proven team

With deep industry & robotics expertise - Robust prototype

Built by experienced technical team - Wavemaker advantage

From lead investor with unique value-adds - Raised $15 million

Series A round closed in April 2022

Thank you

Disclaimers

Risks of early stage investment. Not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC or SiPC insured.

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 335 Madison Avenue, 16th Floor, New York, NY 10017, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck. Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest. Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the OpenDeal Portal’s Terms of Use and Privacy Policy and/or OpenDeal Broker’s Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures.

Investors should verify any issuer information they consider important before making an investment.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...