Crowditz: Equity Crowdfunding Data, Analytics, and Insights Momentum: HOT Likelihood of Reaching Max: LIKELY

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

R3 Printing

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

- R3 Printer is the key to enabling mass customization at prices that can compete with mass production

- Patent-pending systems remove the barriers to running a scalable on-demand manufacturing business

- Allows on-demand manufacturers to operate more 3D printers with the same staff by virtually eliminating downtime, cutting the cost of custom 3D-printed products

- Breakthrough printhead design unlocks faster print speeds and larger print sizes, boosting revenue and increasing the addressable market

- VC-backed, and a recipient of federal grant funding from the U.S. Air Force

- Targeting the $15.8B Additive Manufacturing (3D Printing) market sector

- Industry growth is projected to $23.9B in revenue by 2022, and $35.6B by 2024

Mass production isn't personal

Manufacturing techniques like injection molding are the reason we have access to so many affordable products that make our lives comfortable and convenient. By standardizing the size and shape of a product and manufacturing it by the millions, the price becomes sufficiently low that most people can afford to buy it. That’s a win, right?

But there’s a downside: for the things in our lives that we wear, touch, or hold - usually the things that we interact with most - a standard size and shape means an imperfect fit for basically everyone.

Think about it: does it make sense that an insole that provides arch support has the same amount of arch for everyone? Of course not. But the only way around this is to manufacture using a different technology that introduces a whole new problem: cost.

Custom 3D-printed products are priced out of reach

The solution seems so simple: with enough 3D printers, one could build a business offering customized products that capture market share away from their mass-produced counterparts. But a look at the custom, 3D-printed products on the market today quickly reveals the issue:

While it’s clear that there’s a demand for products that are custom-made to fit the buyer, the unexpected outcome is that these are premium products available only to those who can afford them.

Why is this happening?

3D printers are too expensive to run

Manual labor is the silent killer that keeps custom, 3D-printed products priced out-of-reach in a premium product tier and away from the mainstream market.

On-demand manufacturing businesses operating 3D printers find themselves in a bind: cheap 3D printers require lots of setup, manual labor, and expertise to run while enterprise-grade 3D printers are expensive and are locked into overpriced proprietary materials that destroy margins.

The end result, no matter which class of 3D printer is used, is that the cost of 3D printing is currently too high, so custom 3D-printed products are expensive and priced out of the mainstream market.

Say hello to R3 Printer

R3 Printer is the additive manufacturing workhorse that businesses have been waiting for.

It’s designed from the inside-out to be the ultimate platform for running a scalable on-demand manufacturing service.

Radically re-engineered for performance

Patent-pending innovations on multiple key components make R3 Printer a purpose-built powerhouse for manufacturing.

On-demand manufacturers run 3D printers for a living, so we made sure that R3 Printer not only stands up to 24x7 duty cycles, but also outperforms current market offerings.

Unrestricted long-term value

R3 Printer is an unlocked product that gives our customers a competitive advantage.

With R3 Printer, on-demand manufacturers can print with experimental thermoplastics to serve customers they would otherwise be forced to turn away if they were locked into a competitor’s material ecosystem.

For government agencies with strict security requirements, or businesses with very specific software workflow needs, R3 Printer is the solution. Our customers have the power to disable cloud connectivity yet still retain access to all operations and monitoring features over a local network.

With R3 Printer, businesses get both long-term value and out-of-the-box functionality:

As seen in:

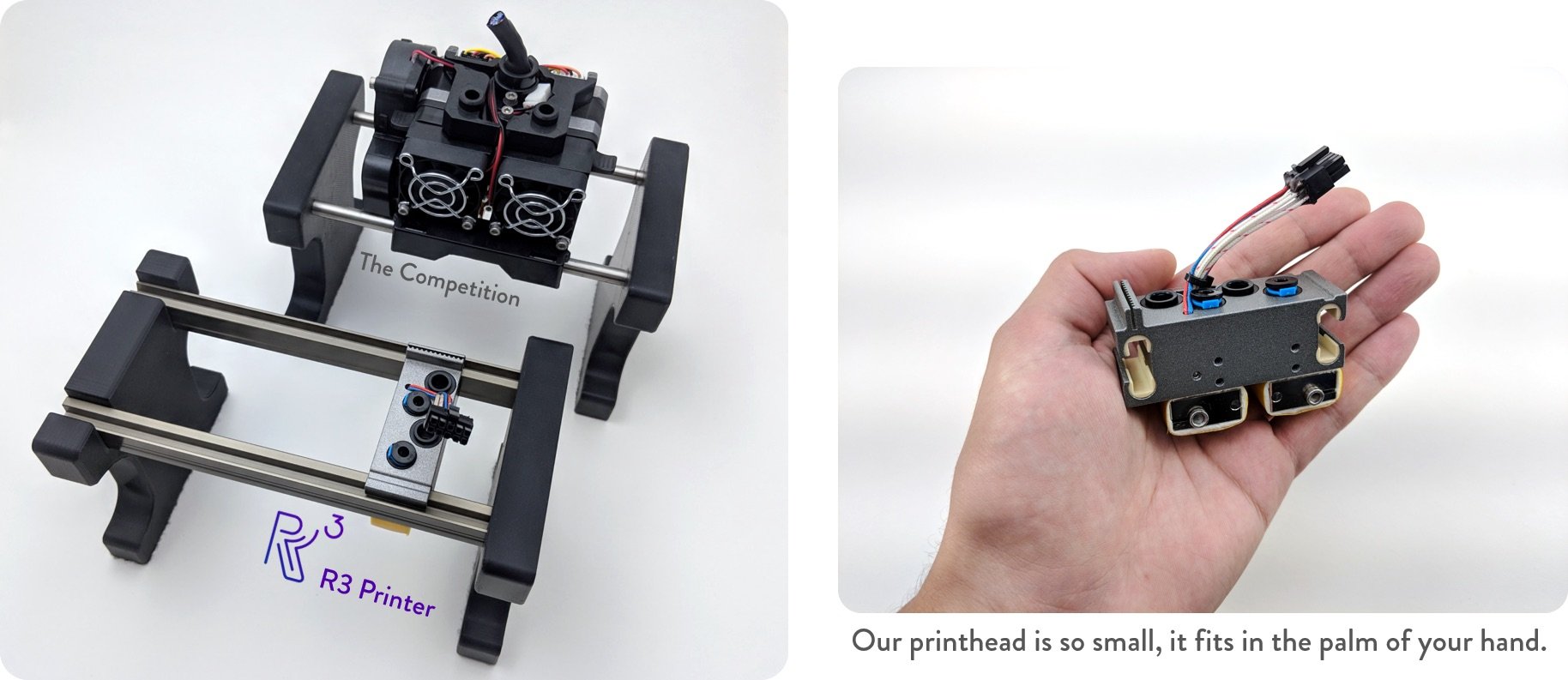

Lighter printhead = faster print speeds

You can’t beat the laws of physics: a lighter printhead can accelerate and decelerate faster than a heavy one.

In the case of R3 Printer, by shedding over 80% of the weight off the printhead, combined with other optimizations, R3 Printer can achieve print speeds that are 90% faster than competing extrusion-based 3D printers.

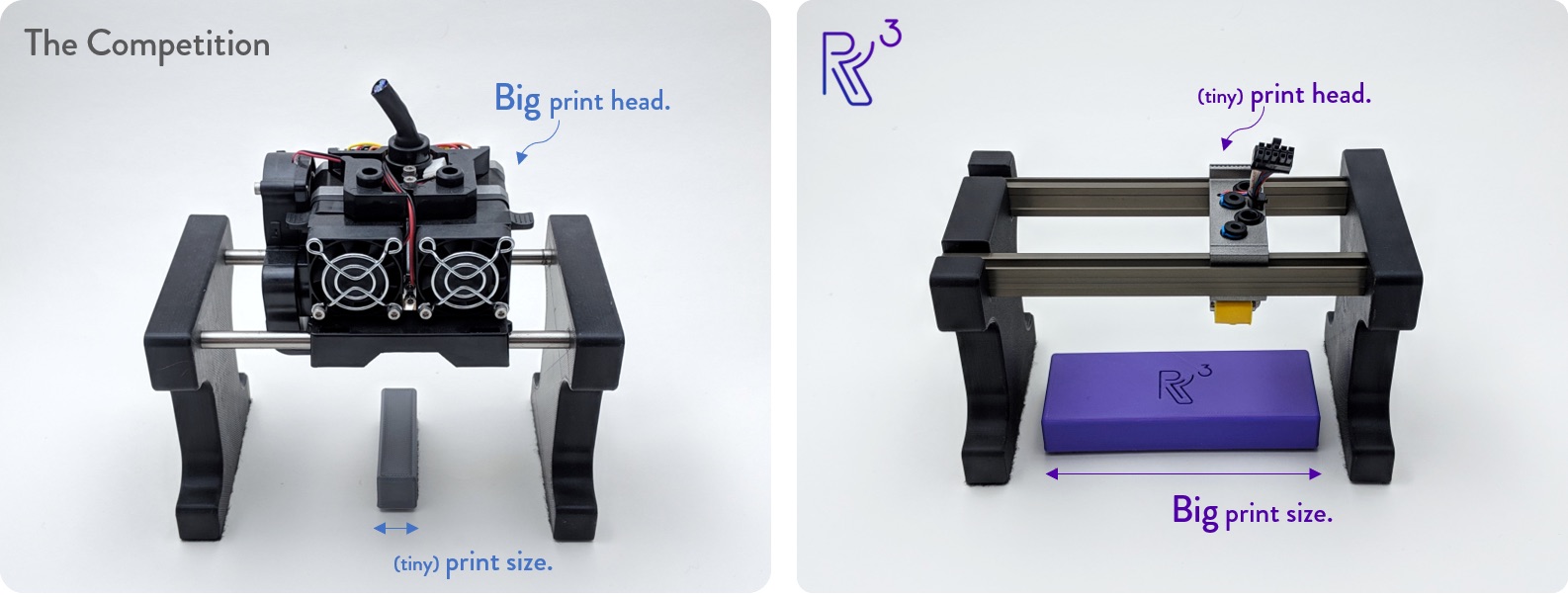

Smaller printhead = larger print sizes

R3 Printer has a 200% larger build area than competing extrusion-based 3D printers, even though it has the same exact footprint:

A smaller printhead can utilize the full length and width of a printer’s internal volume. Unlike the competition, whose relatively large printers have very limited print sizes, R3 Printer can produce parts almost as big as itself.

Active Overheat Prevention™ virtually eliminates jams

Active Overheat Prevention™ uses an additional sensor in the printhead to monitor heat absorption and trigger a pause in printing if a critical threshold is reached:

Common thermally-induced jams take about 45 minutes of trained labor to fix, and introduce the opportunity for operators to get burned or injured. These jams happen without warning and usually go undetected for a long time, often after back-to-back print jobs.

By virtually eliminating the need to repair thermally-induced printer failures, Active Overheat Prevention™ allows on-demand manufacturing businesses to operate more 3D printers with the same staff, eliminating a major cost driver of 3D-printed goods.

Please note: The above statements are the estimates of the Company based on the Company’s understanding of the market, all statements made are the opinion of the Company and have not been validated by any third party.

Multi-billion dollar market

R3 Printing is addressing the multi-billion dollar additive manufacturing (AM) market sector, forecasted to reach $15.8 billion in revenue by the end of the year:

The revenue forecast is expected to climb to $23.9 billion in 2022, and $35.6 billion in 2024.

Sources: Wohlers Associates, Wohlers Report “3D Printing and Additive Manufacturing State of the Industry” 2017, 2018, 2019 and Forbes, Significant 3D Printing Forecast Surges To $35.6 Billion

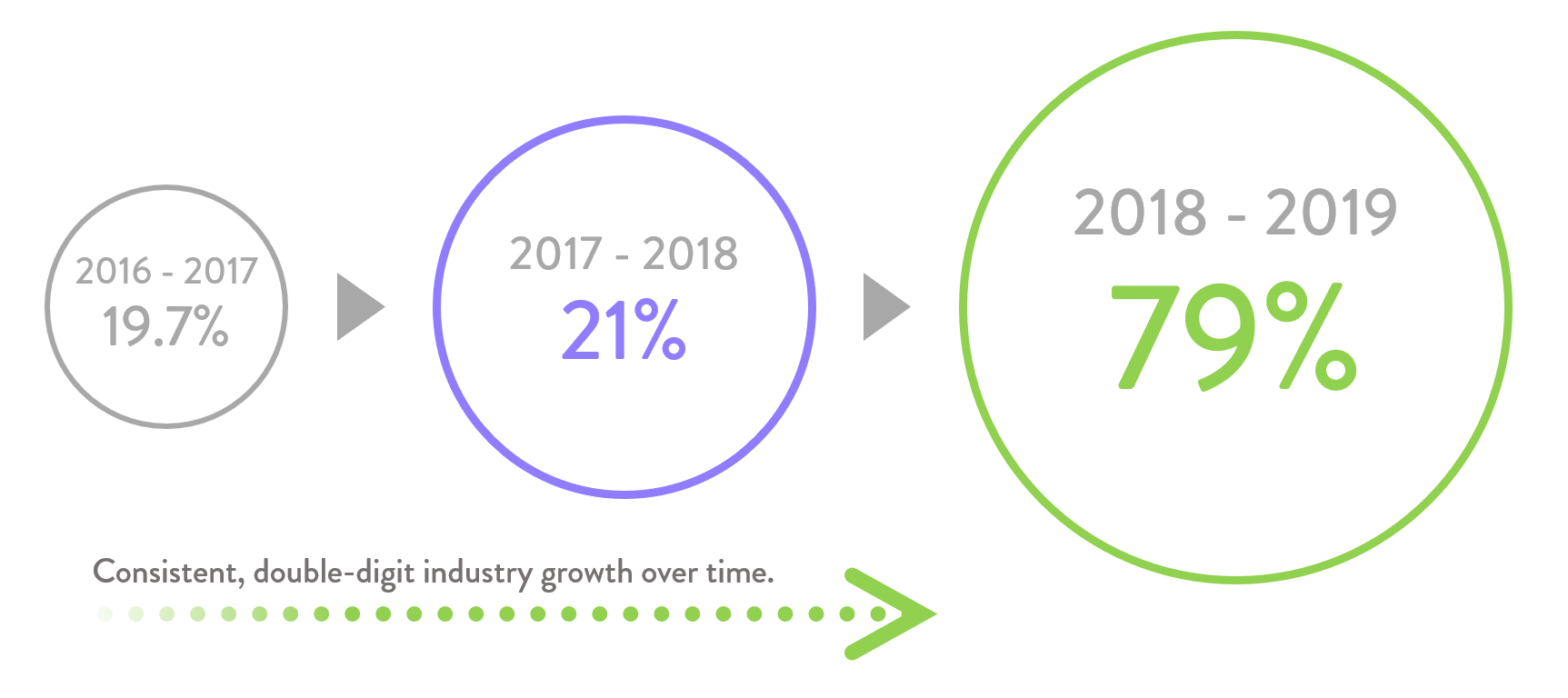

Double-digit growth rates

Forbes cited Wohlers Associates, the preeminent research and consulting firm, saying that for 2017 “investors will appreciate the solid 21 percent growth as the industry exceeds $7.3 billion.”

Historical data confirms that year-to-year growth has consistently been in the double digits.

Early-stage investments surpass $1 billion

Our target industry invests heavily in early-stage startups that develop disruptive technology. In 2018, there were 107 early-stage investments valued at nearly $1.3 billion.

Notable events in this space also include acquisitions, where established players from related industries acquire startups as part of their strategy for entering the lucrative, but competitive, additive manufacturing industry.

Intellectual property

We have four (4) utility patent applications pending on all of the core features and mechanisms that make R3 Printer the ultimate platform for additive manufacturing.

In addition, we have registered trademarks for all of the core elements of our brand. We see this as a key investment in solidifying and protecting R3 Printing’s presence as a recognizable standard-bearer for on-demand manufacturing technology.

Testing partners

We’re excited to be partnered with companies that are eager to test the next generation of on-demand manufacturing hardware and provide us with the valuable feedback we need to optimize our product for a full-scale launch:

Li-Leger Creative | Vancouver, BC | Product design and manufacturing.

Obsessively Geek | New York, NY | On-demand manufacturing.

Forge Manufacturing | Jacksonville, FL | On-demand manufacturing and digital design.

Halo Aerospace | West Palm Beach, FL | Aerospace R&D.

Additional testing partners are in our pipeline.

We have also received federal funding to assist us in finding test partners within the United States Air Force (USAF).

Venture capital

R3 Printing is a proud alumnus of Ocean Accelerator Class IV, a highly selective Cincinnati-based technology accelerator that only accepts up to 10 startups in its annual cohort.

Ocean deploys seed-stage capital to each of its portfolio companies.

Previous equity crowdfunding

Our previous round on Republic was funded at 390% of our initial goal. The funds were used to complete R&D on various technology components, with the additional funds allowing us to do so in an accelerated timeline while also enabling the pursuit of high-value partnership opportunities.

Our current funding round will be allocated towards completing Design for Manufacture (DFM) / Design for Assembly (DFA) optimizations and purchasing the first factory run of R3 Printer units. DFM/DFA optimizations are small tweaks to our hardware component designs that lower our factory costs and help ensure that we can scale efficiently.

Government grant funding

R3 Printing is a proud recipient of a Small Business Innovation Research (SBIR) Phase I government grant, in partnership with AFWERX and the United States Air Force (USAF).

As part of this grant, R3 Printing is undertaking several initiatives:

We’re engaging with the USAF and other military/defense end-users to gain a deep understanding of their pain points as they move to adopt additive manufacturing technology.

We’re connecting with USAF and other Department of Defense (DoD) stakeholders to pursue additional prospective partnership opportunities.

If awarded a SBIR Phase II grant, we’ll begin drafting work plans for bespoke product development to fit USAF/defense-specific requirements.

Please note: The appearance of U.S. Department of Defense (DoD) visual information does not imply or constitute DoD endorsement.

Incubation

R3 Printing is a current incubee and resident at NYDesigns, located in Long Island City, NY. NYDesigns provides us with office space, access to a network of mentors and advisors, and a secure 5,000 square-foot fabrication lab.

Other incubation programs we’ve had the pleasure to partner and grow with include Fordham Foundry and FutureWorks, a hardware and advanced manufacturing incubator funded by the New York City Economic Development Corporation (NYCEDC).

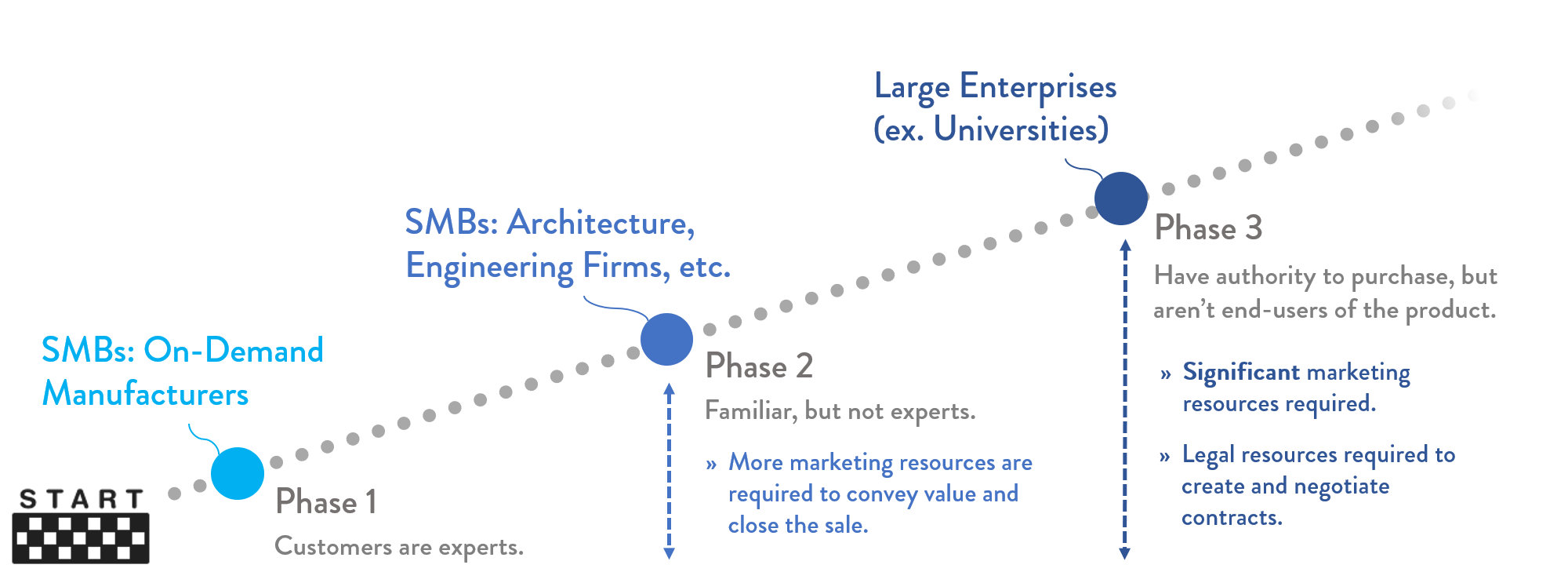

We know the importance of having a clearly-defined target market and a focused approach to capturing it. To achieve this, we’ve segmented our go-to-market strategy into three phases:

By systematically entering and saturating a market segment before progressing to the next one, we operate efficiently and avoid wasting valuable resources pursuing high-lift relationships prematurely.

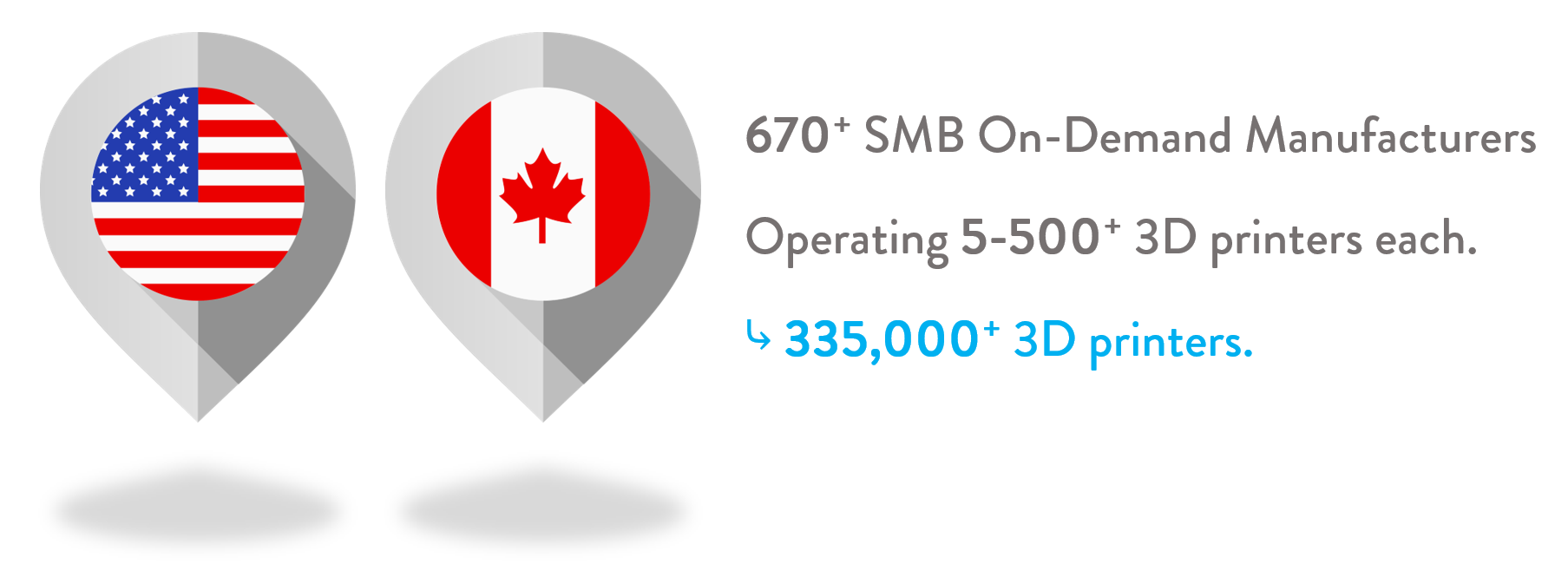

Initial target market

Our path to capturing market share starts with the 670 small and medium-sized businesses (SMBs) we’ve identified that provide on-demand manufacturing (ODM) services within the US and Canada:

The definition of ‘SMB’ in this case is specifically those ODMs with between 5 and 500 3D printers each. These businesses are eager to lower their overhead labor costs, and because of their small size there’s minimal bureaucracy and sales are closed quickly.

Subsequent target markets

After sufficiently saturating our initial target market, we’ll expand our sales coverage to include other SMB entities such as engineering, architecture, and product design firms. These businesses don’t solely rely on profits from selling manufacturing services, and they will likely require more marketing resources to convert into closed sales.

Up next are large enterprises, including universities. These entities typically enter complex, multi-year relationships with their technology partners. Although lucrative, the high-lift process to getting a signed contract requires significant sales, legal, and customer success teams to meet the support requirements of these agreements.

Premium cloud features

As we progress through the stages of our market capture strategy and pursue contracts with larger enterprises, we anticipate a need for cloud features that go beyond what we would offer as a default suite of functionality.

To fill this need, we plan to build and offer premium cloud features on a subscription basis.

Note: We stand by our pledge to never force our customers to pay for the ability to manage or query data from their products, either via cloud or via local network. These premium cloud features are for larger enterprises that would rather subscribe to an additional service than invest in the software engineering required to build the features they need in-house.

Future products

We have big plans for R3 Printing, and our roadmap goes far beyond our launch product.

We didn’t just design a better 3D printer, we developed a future-focused platform for the ultimate additive manufacturing ecosystem:

R3 PrintGrid™ is the solution for customers with extreme manufacturing capacity needs. By stacking R3 Printer units vertically and connecting them to a shared water cooling loop and power delivery system, these customers can operate even more efficiently by manufacturing more parts per square foot in their factories than ever before.

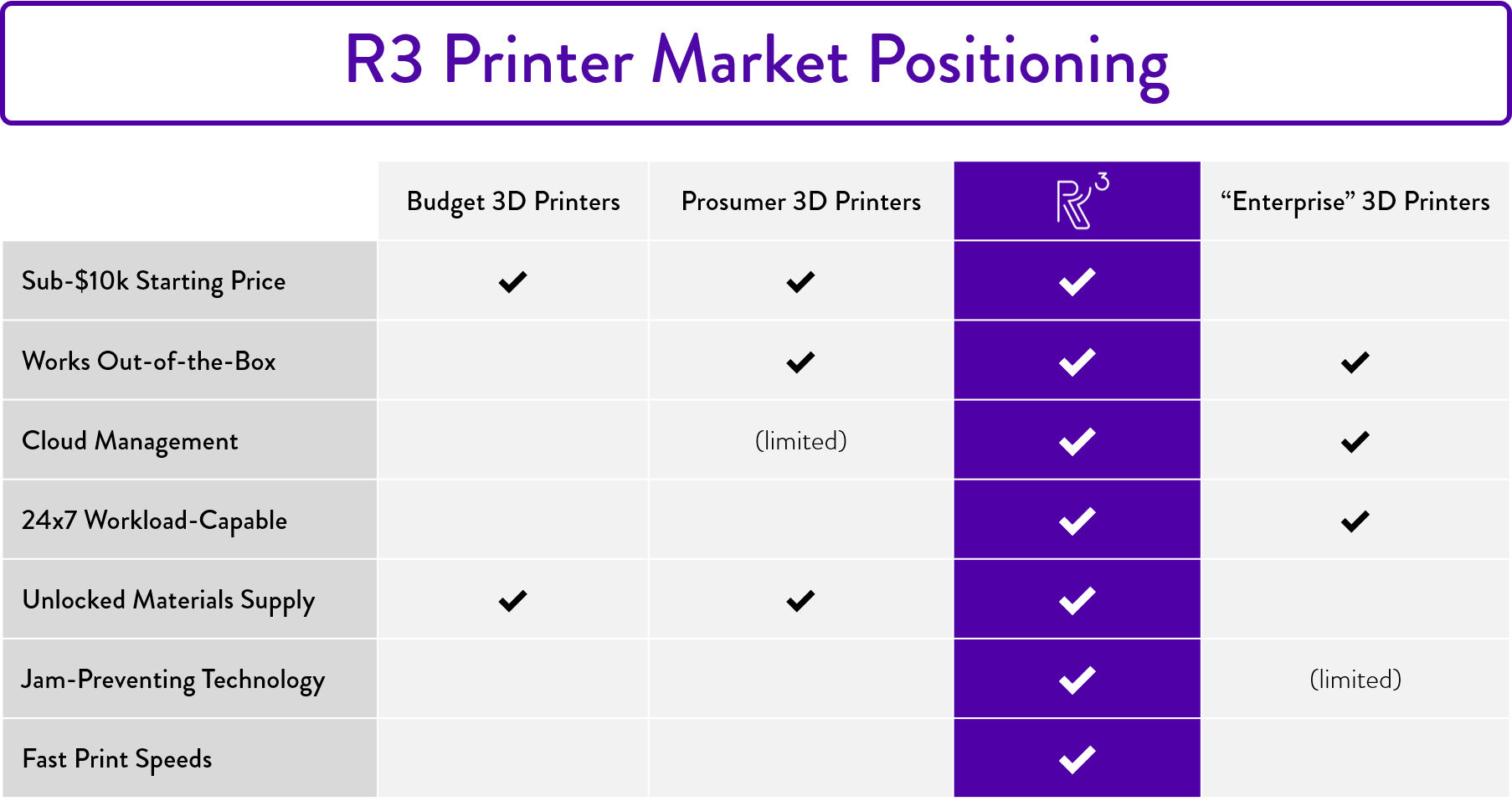

We’re not the first to introduce an enterprise-grade 3D printer to the market, but we are the first to introduce a 3D printer that’s designed from the inside out for businesses that operate on-demand manufacturing services.

R3 Printer is the only product that checks all the boxes for our target market:

On-demand manufacturers operating a fleet of 3D printers currently have three tiers of products to choose from, none of which are optimized for running a profitable business:

Budget 3D Printers

This is a popular starting point, and the route that co-founders Dan and Paul took when starting their own 3D printing service. The main benefit is that one can start their business with a lower upfront investment, but the operators are permanently left with limited print sizes and slow print speeds. Out-of-the-box, this tier of 3D printer requires either lots of maintenance or heavy modifications that need real engineering knowledge to implement.

By operating a fleet of budget-tier 3D printers, businesses are left with a limited customer base and potentially high overhead labor costs.

High-End Consumer (“Prosumer”) 3D Printers

An upgrade to higher-end consumer (or “prosumer”) 3D printers doesn’t yield many more benefits, especially given the larger initial investment. For the most part, these printers offer slightly improved (but still limited) print sizes, improved out-of-the-box reliability, and some convenience features like network connectivity- though not necessarily cloud-based fleet management. At the end of the day, the upfront investment in these 3D printers compared to their ability to generate more revenue isn’t that great.

Therefore, most on-demand manufacturing services still opt for budget-tier 3D printers and simply put up with their shortcomings and/or invest in their modification.

(Current) Enterprise-Grade 3D Printers

Current enterprise-grade 3D printers typically begin above the $10k price point, offer larger print sizes, and additional software management features. At first glance, they seem like a great platform for running an on-demand manufacturing service. Unfortunately, customers of these products are typically locked into proprietary material supplies controlled by the manufacturer that strip away profits in the long-term, and stretches out the timeline to recoup the large initial investment.

By operating a fleet of (current) enterprise-grade 3D printers, businesses are left with a high initial investment to recoup and often a locked materials supply that limits their ability to price themselves competitively.

The case for an unlocked materials supply

Many enterprise-grade 3D printers lock their customers into a proprietary material supply. This has major ramifications for the businesses that operate them. Not only are the proprietary materials priced far above market rate, they also prevent the operators from using new and experimental materials from other suppliers, further hurting their businesses by limiting their addressable market.

R3 Printing pledges to never lock its products to a particular material or software ecosystem. Instead, we plan on building additional streams of revenue by allowing our customers to opt-in to additional services and features that add value to their businesses, but they will never be forced to do so (or unable to build it themselves if they don’t subscribe).

Our market research shows that this is a key part of long-term customer retention, and we’re making it a big part of our strategy for capturing market share from the incumbent enterprise-grade 3D printer manufacturers as well.

Meet the founders

Dan and Paul are passionate entrepreneurs with track records in sales and technology.

After a successful exit from a Manhattan commercial real estate firm, Dan ran the day-to-day operations of a 3D printing service alongside Paul. With his background in business development and sales strategy, he found untapped markets where additive manufacturing was the perfect disruptor. He has since been key in R3 Printing’s fundraising and investment strategy that fuels the product development and intellectual property pursuits of the company.

After a successful exit from a Manhattan commercial real estate firm, Dan ran the day-to-day operations of a 3D printing service alongside Paul. With his background in business development and sales strategy, he found untapped markets where additive manufacturing was the perfect disruptor. He has since been key in R3 Printing’s fundraising and investment strategy that fuels the product development and intellectual property pursuits of the company.

Paul grew up with a passion for invention and automation with Thomas Edison as his role model. At Morgan Stanley, he was instrumental in developing macros that cross-checked his entire team’s work in an otherwise manual and error-prone environment. He was then recruited to work in the technology division of the world’s largest hedge fund, where he was the architect behind a firm-wide overhaul of automated alerting capabilities.

Paul is the inventor behind the patent-pending features that make R3 Printer the on-demand manufacturing platform of the future.

Join us.

Together, we’ll disrupt a $15.8 billion-dollar industry and usher in a new era of customized goods that are manufactured on-demand, just for you.

Deal terms

$7,500,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

18%

If a trigger event for R3 Printing occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$435K

R3 Printing must achieve its minimum goal of $25K before the deadline. The maximum amount the offering can raise is $435K.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- Silver Tier: We’ll feature your name on the Investors page of the R3 Printing website (you can opt-out), so everyone can know that you got in early!

- Gold Tier: Get all the above! Plus:

- Limited edition R3 Printing Early Investor mugs that reflect the signature design of our launch product, R3 Printer.

- Platinum Tier: Get all the above! Plus:

- Get a feel for what R3 Printer can do: we’ll send you a customized R3 Printing Early Investor mini sculpture, made with carbon fiber, fresh off an R3 Printer pre-production unit!

- Diamond Tier: Get all the above! Plus:

- Get to know the R3 Printing team and our launch product, R3 Printer! The founders will be hosting an event in the NYC area, and your name will be on the VIP list.

Why others invested

See all reviews (0) See all (0)I am an industrial designer from heart. I love 3d printing and this investment goes to help bring 3d printing to more people and for a better future.

I invested because I've personally worked with an enterprise 3D printer while in the US Navy. It cost 75K, the print material was costly, and it took too long to print 1 item. This industry could use a disruptor. I believe in you R3!!!

I am already familiar with additive manufacturing in my day job. It is very expensive and demand in ever increasing. This is a great idea and I am looking forward to watching the growth explosion. Wish I could put more into it!

About R3 Printing

R3 Printing Team

Everyone helping build R3 Printing, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC