In today's digital/mobile world, most of the purchase transactions we perform are done in a modern, convenient fashion. M...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

SimpleShowing

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

- Online real estate startup disrupting the traditional real estate brokerage model by making it easier and more affordable to view and buy a home

- 67% of users who book a home tour buy a home through SimpleShowing

- $80K+/month revenue with 15% MoM growth and proven unit economics

- Future monetization opportunities include homeowners insurance, mortgage, and title services

- Raised $500K to date from strategic investors; backed by CEO of Shipt.com and Velocity Accelerator

- Partnerships with igloohome™ Smart Locks, Lemonade Insurance and Divvy Homes

The problem

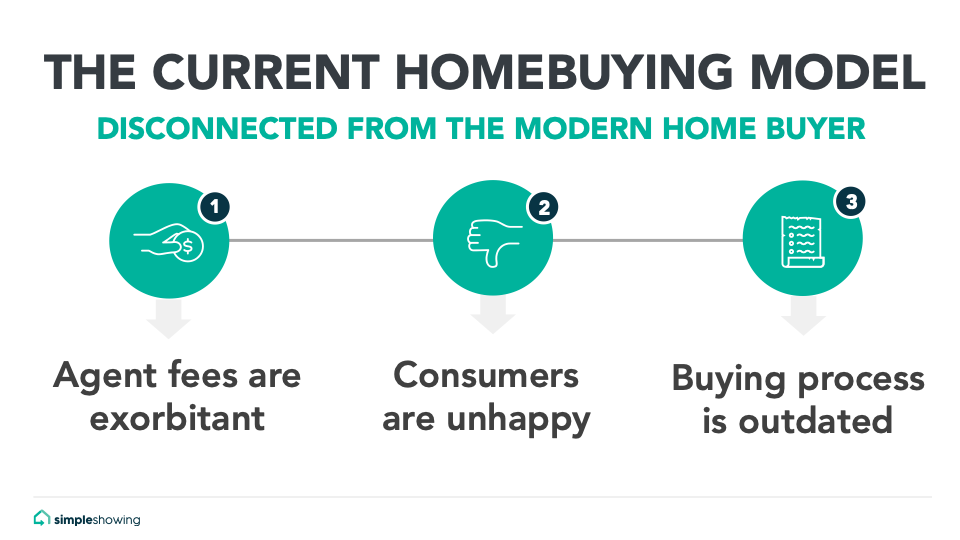

Home buying is stuck in the 1980s

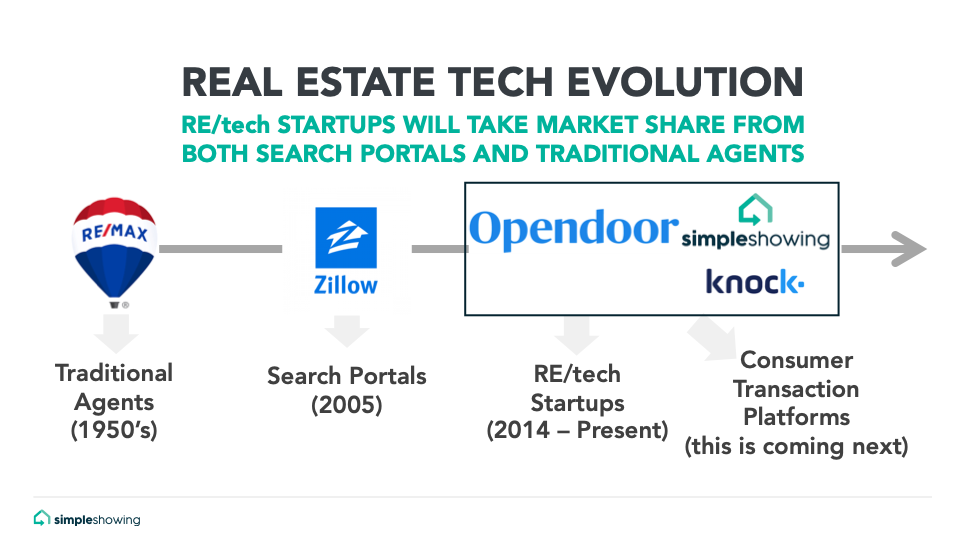

Technology and the internet have changed how people buy and sell almost everything. With the advent of the mobile era and the democratization of property data via online sources like Zillow, homebuyers have access to information today that has historically been available only to real estate agents. But despite having access to more tools and resources, consumers are largely unhappy with the home buying process and frequently dissatisfied with their agent.

The home-buying process is disconnected from the modern consumer and in desperate need of innovation.

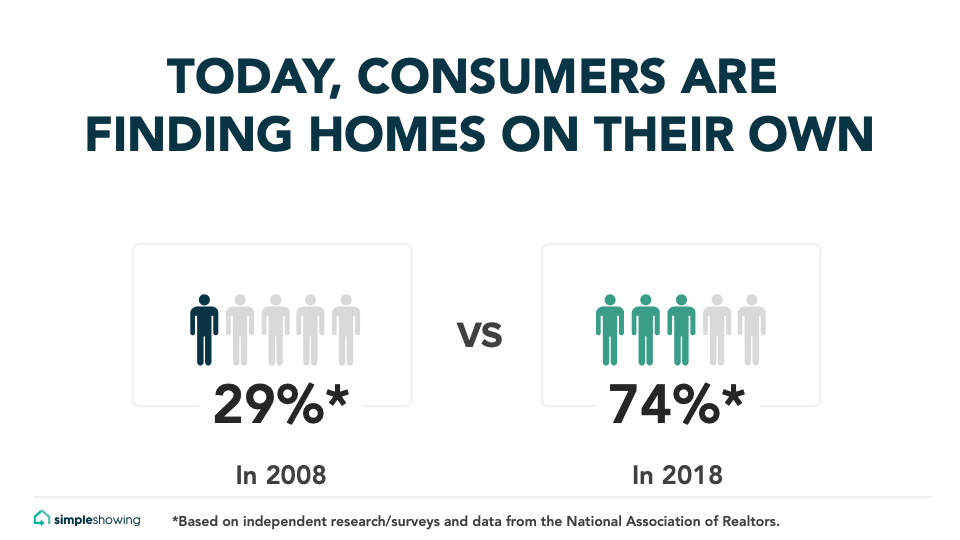

Consumers have access to more tools and data than ever before. They're taking on much of the work in the home buying and selling process, because in today’s world, simply put, they can. Finding homes online is easier than it’s ever been, accessing property data is faster and more accurate than ever before and writing an offer on a home can now be done electronically.

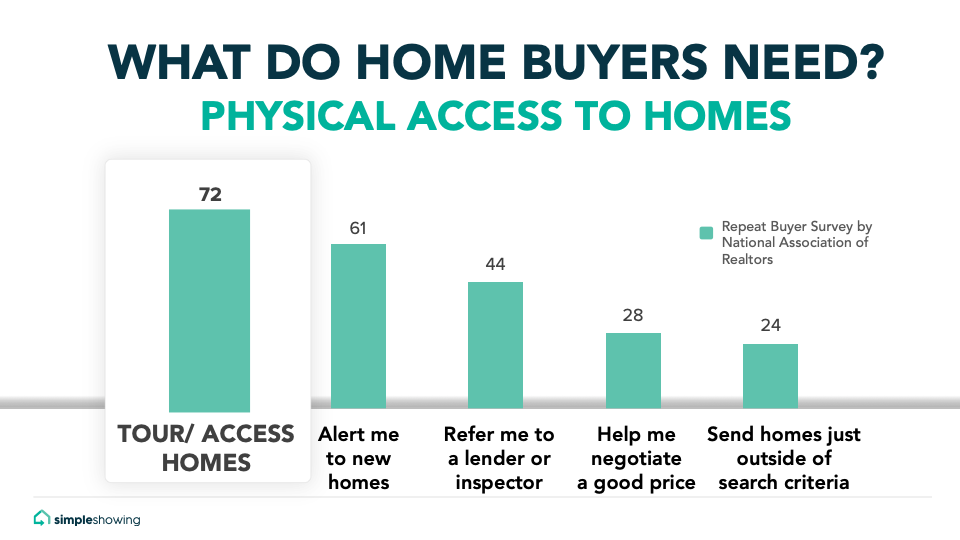

As consumers are taking on more of the heavy lifting in the home search process, they’re relying less and less on real estate agents to help them find homes. Historically, the most critical role of the real estate agent has been to find suitable properties for the home buyer. This is no longer the case. According to the National Association of Realtors, modern consumers now cite property access as the most critical reason they hire an agent.

Home buyers are chained to a slow, expensive process that doesn’t work for them. They have great tools for researching and discovering properties, but lack options to view/tour the homes in person. With the exception of “open houses”, the only way for consumers to tour homes is to hire an agent. Home buyers have been forced into this option for too long. It’s time for a new way.

The solution

SimpleShowing, real estate for the modern world

Utilizing real estate services (eg. listing agent or buyer’s agent) is exorbitantly expensive for consumers and yet no great alternatives exist. Agents are actually doing less work per transaction than ever before, but getting paid the same commission rates as they did 40 years ago. Meanwhile, home prices continue to increase. This is the reason we created SimpleShowing.

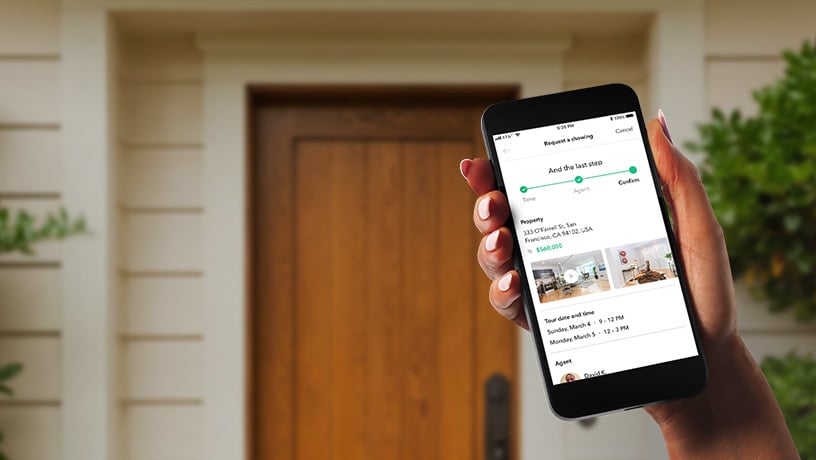

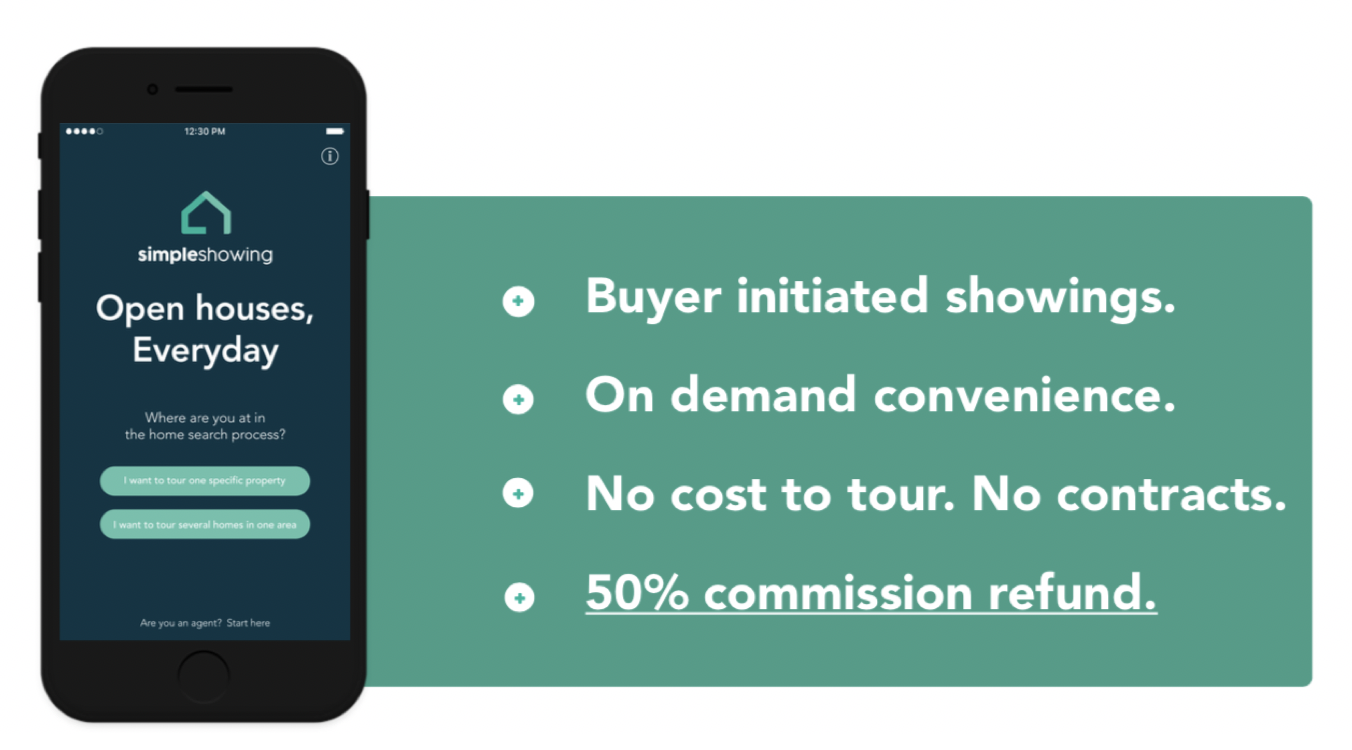

SimpleShowing empowers home buyers to drive the home buying process on their own, schedule tours themselves and get rewarded for their hard work with a commission refund that equals 1.5% of the home price. It’s real estate for today’s consumer and it’s about time.

How it works

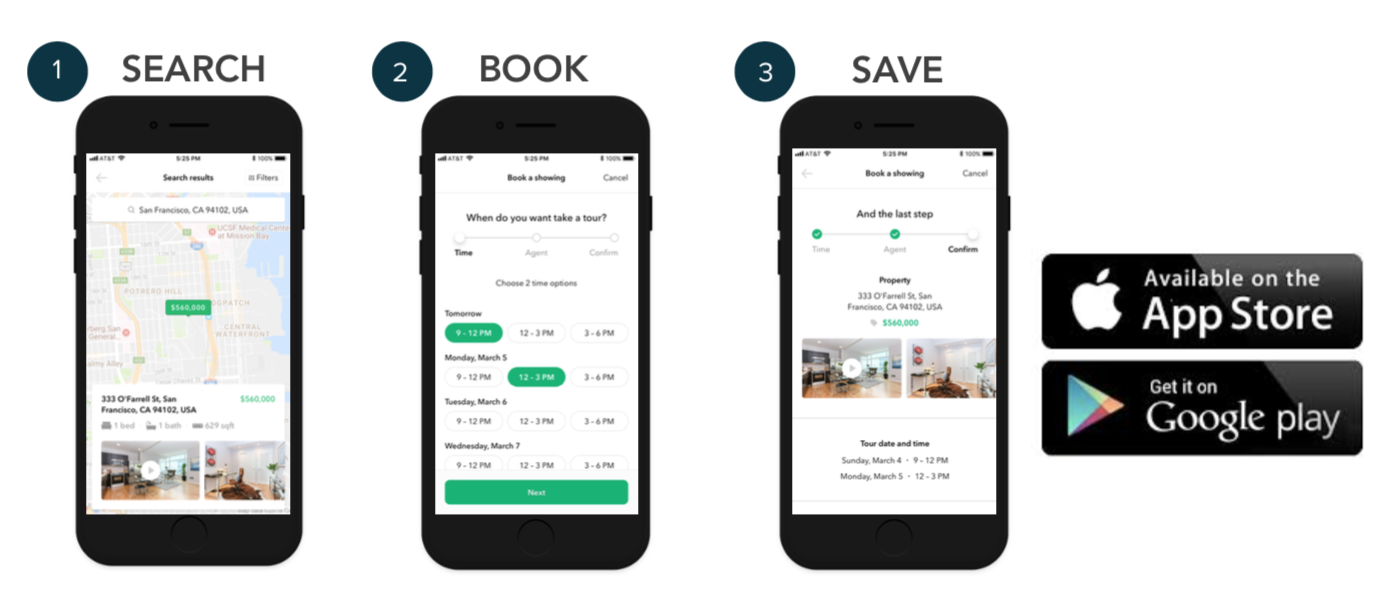

Buy any home through SimpleShowing and, we'll share up to half our commission with you. Buying through SimpleShowing is easy as 1-2-3:

- Search for any home, no matter which brokerage it’s listed with.

- Select a day and time for your showing or create a “tour” of multiple showings.

- If it’s a SimpleShowing property, your showing will be confirmed instantly by the homeowner and you can view the property without an agent.

Consumers who purchase a home through SimpleShowing receive a 1.5% commission refund, or about $5,037 on average.

Using an agent is not free when you buy a home.

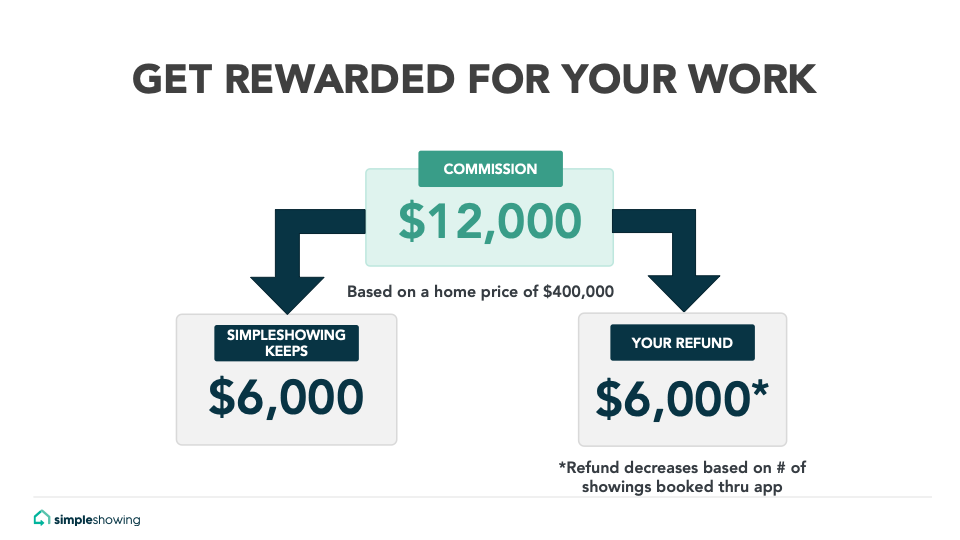

Most consumers believe that there is no cost to use a buyer’s agent because the home buyer never writes a check to the buyer’s agent. However, the commission expense (normally 3% of the home price) is baked into the price of the home, and that cost is passed onto the home buyer at closing. Explained another way, a consumer would be able to purchase a home for 3% less than the contract price if the transaction did not involve a buyer’s agent.

Traction

Over 1,000 home showings booked through our platform

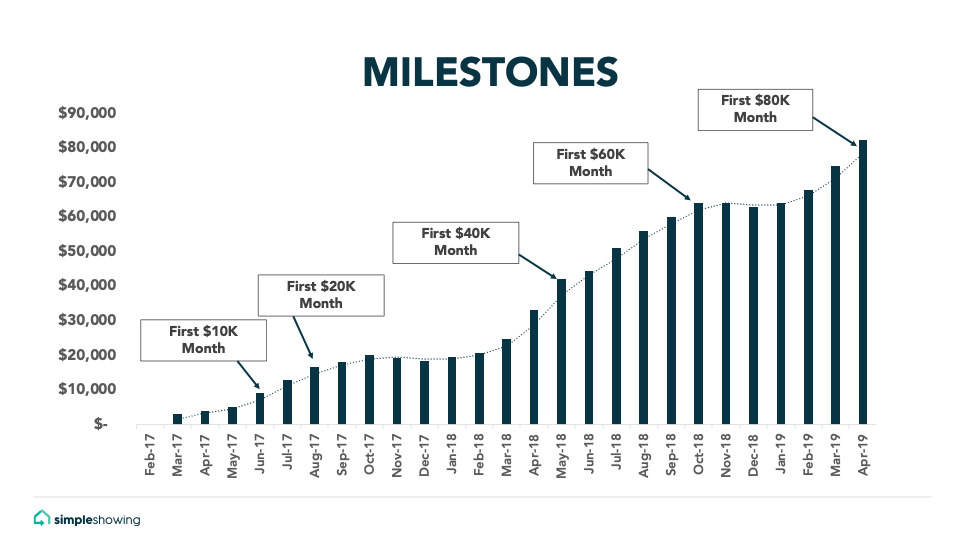

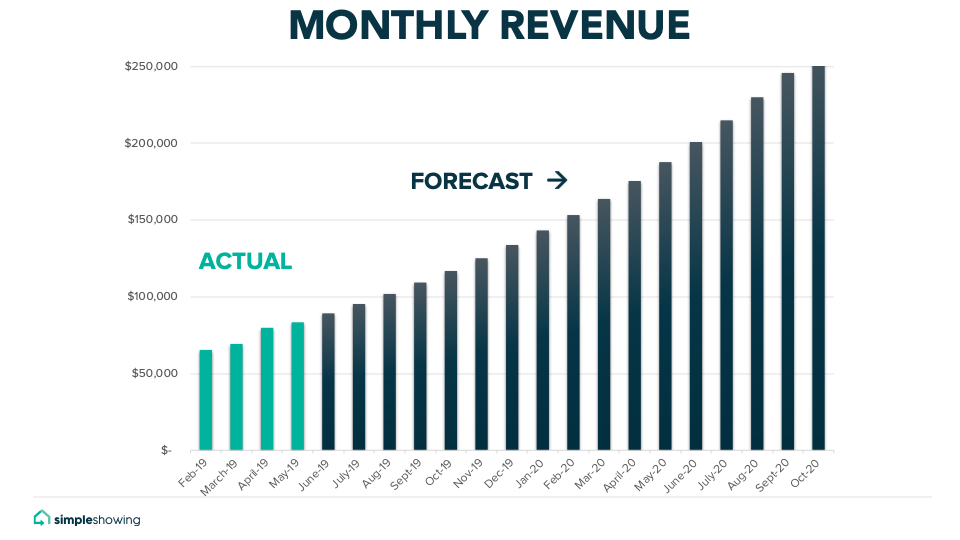

Our early traction has been exciting. With $80K+/month in monthly revenues, we currently have a $1M+ annual run rate and expect to exceed $2.5M in revenue in 2020.

We have some great ways to grow

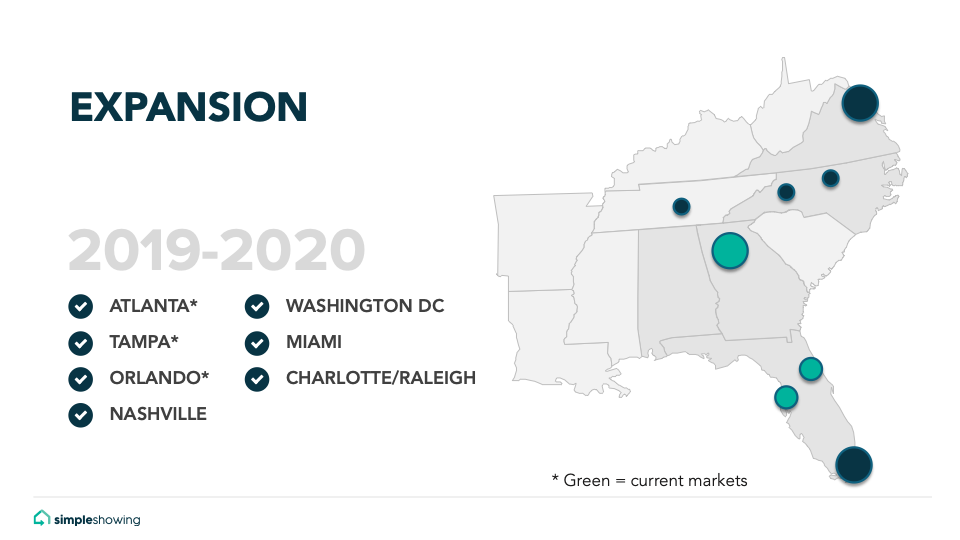

The exciting thing is that only one city (Atlanta) has been serviced by SimpleShowing for longer than 15 months. Our two newer markets (Tampa and Orlando) are just now beginning to heat up. We intend to expand throughout the Southeastern US initially and then across the country as revenue and funding permit.

The time is right now. 2016 was too early and 2021 will be too late.

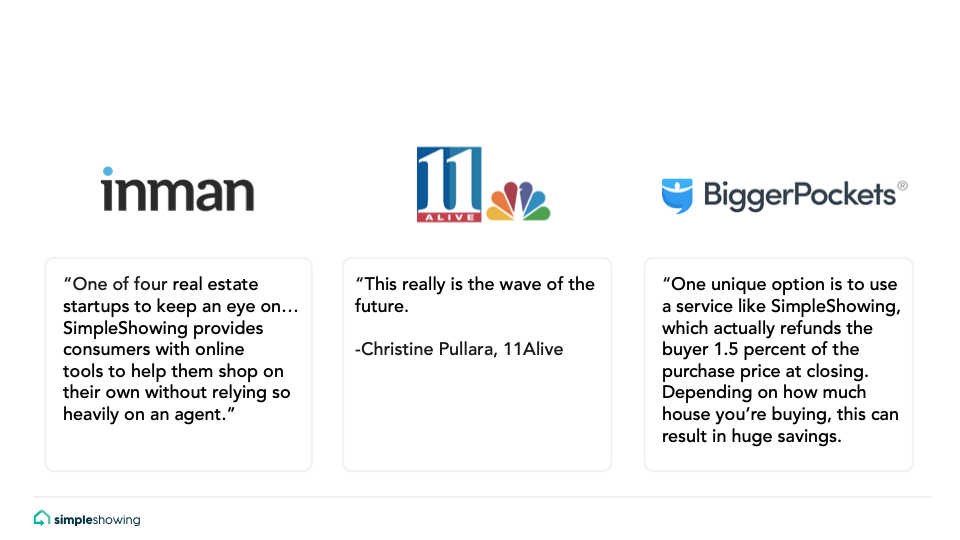

Press

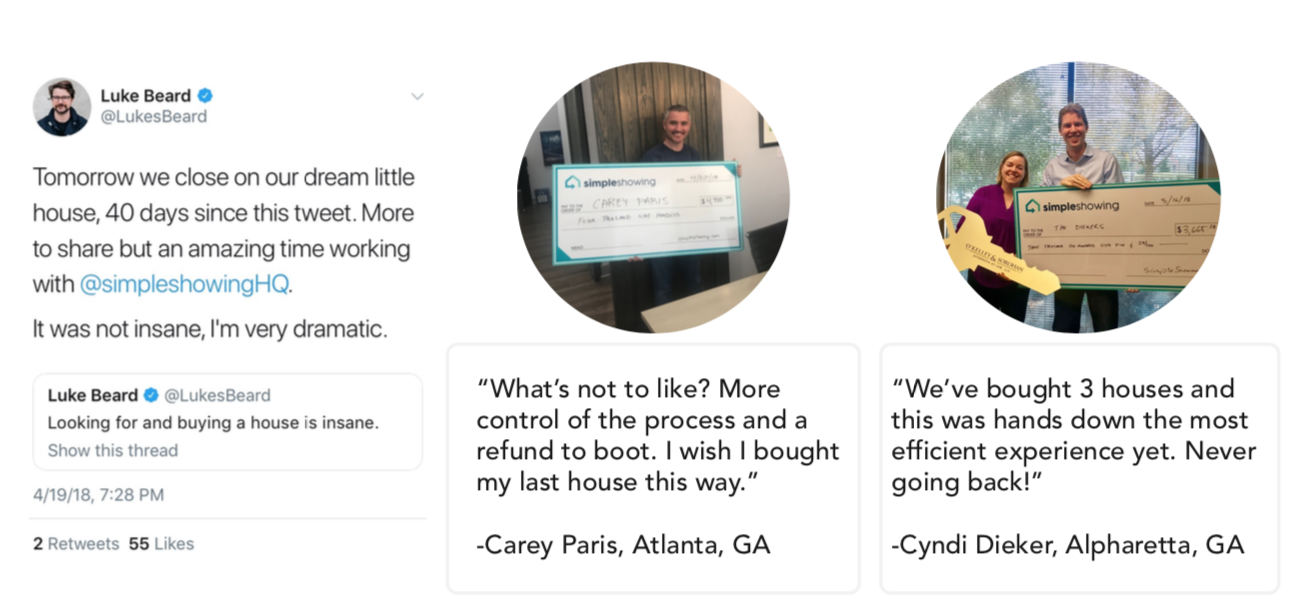

Our customers love us

Business model

Three key revenue sources

We keep at least half of the ordinary 3% buyer’s agent fee. The commission refund that is paid to our customers is reduced based on the number of showings booked through our platform. The more showings booked means that the customer will receive a lower refund and, SimpleShowing will earn more revenue. The average refund paid is typically about 1.25% of the home’s purchase price.

We earn $5,000 (or 1% in some cases) from each seller for managing their listing.

We earn channel revenue from sources such as homeowners insurance and mortgage referral leads.

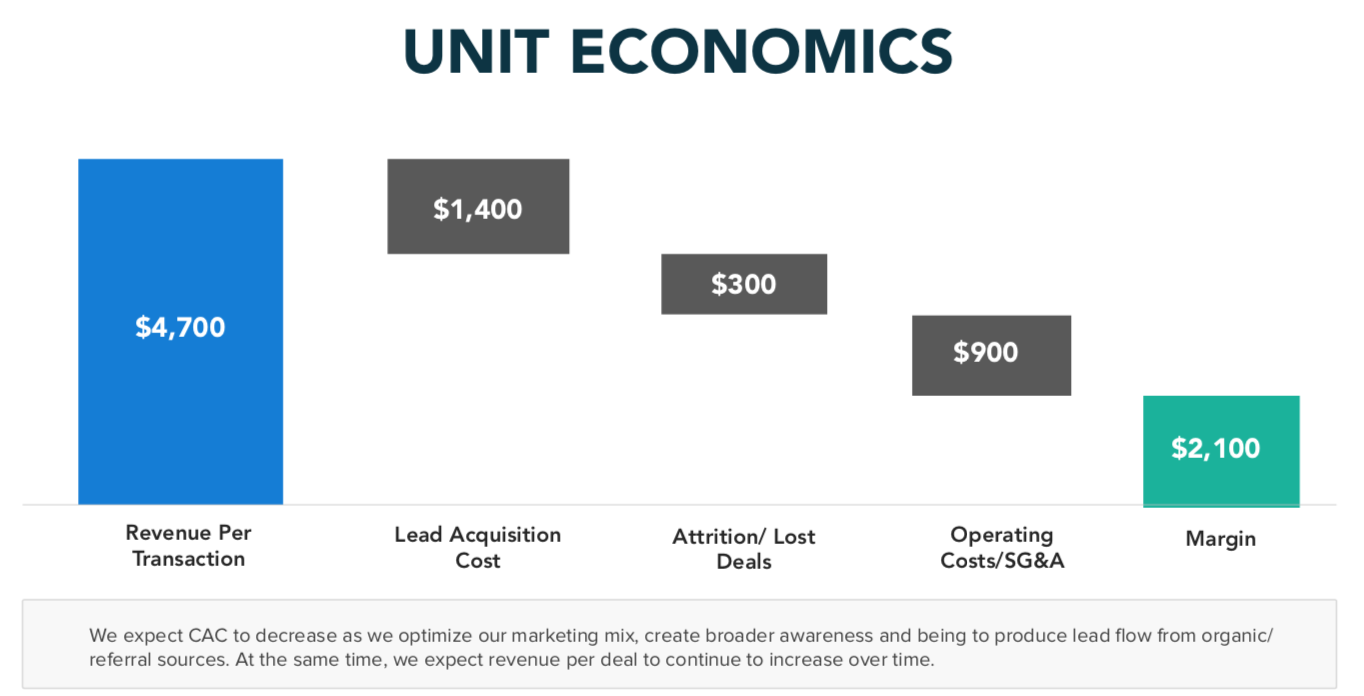

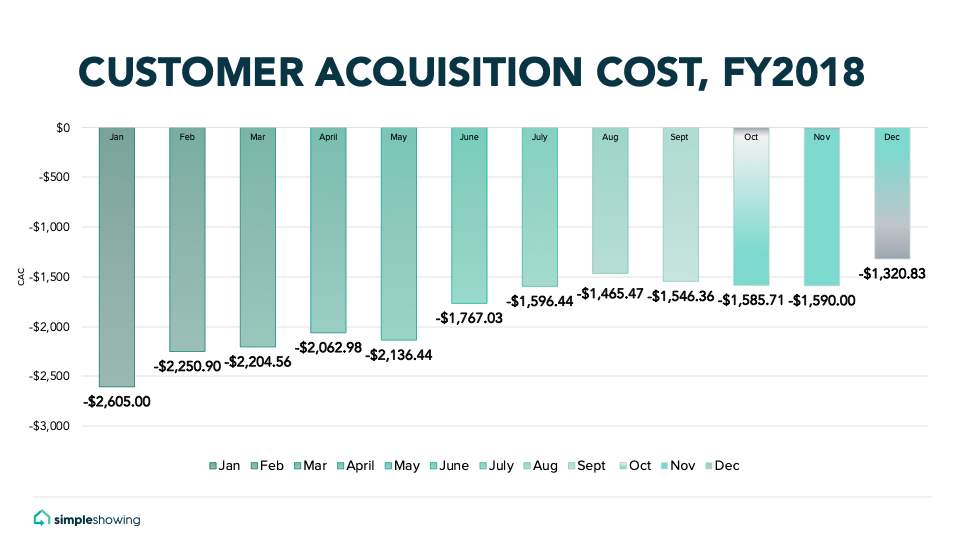

As we continue to optimize our marketing mix, create broader awareness, and begin to generate leads from organic sources, we expect to decrease our customer acquisition costs.

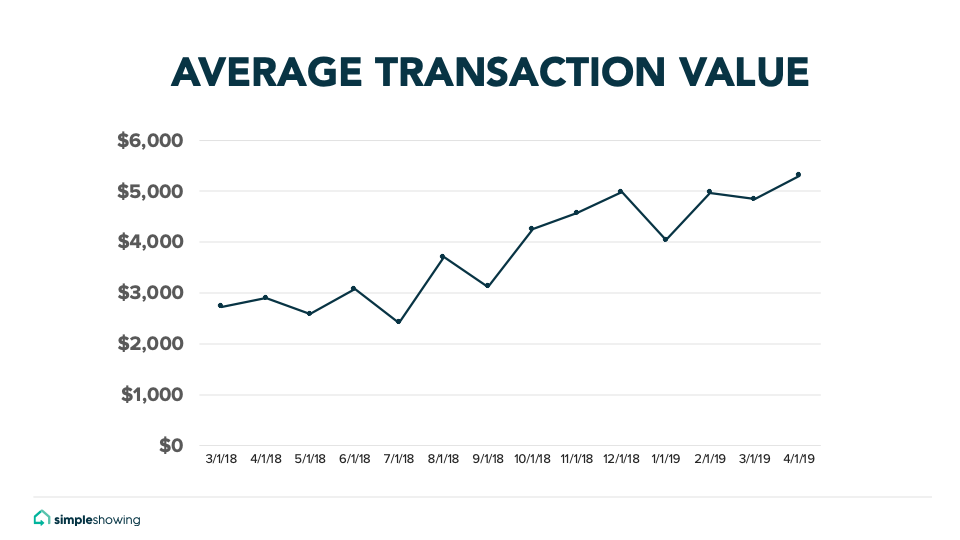

At the same time, we expect revenue per deal to continue to increase over time. In addition to increasing the number of transactions, we’ve also continued to increase our average transaction value per customer.

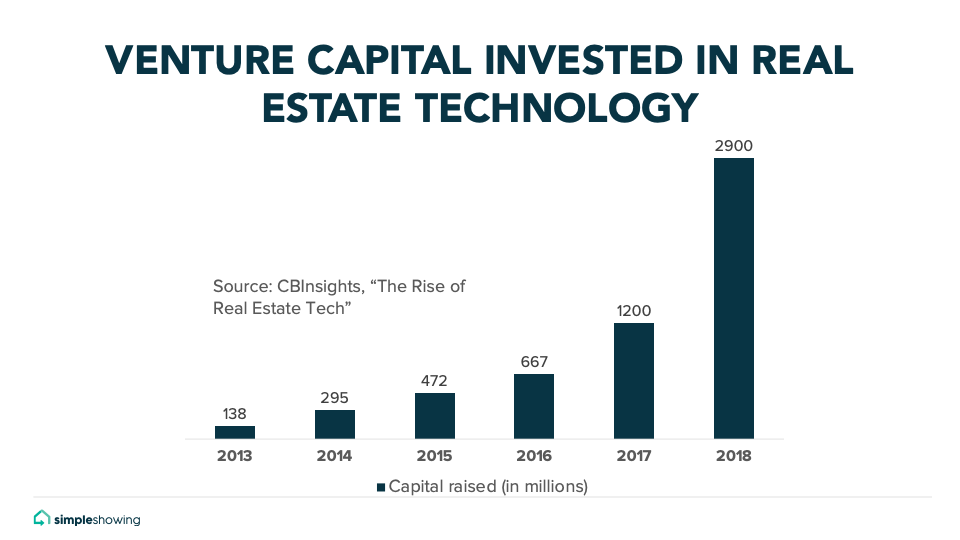

VC interest in real estate tech is growing rapidly

In the last five years, venture capital groups and Wall Street have come to the firm conclusion that technology is going to change how people buy and sell homes. The private capital invested in real estate technology companies increased from $138 million in 2013 to nearly $3 billion in 2018.

With the surplus of capital flowing into the real estate tech space, it’s clear that the stronghold of older, established real estate brands is diminishing and the emergence of tech-enabled startups has begun.

Competition

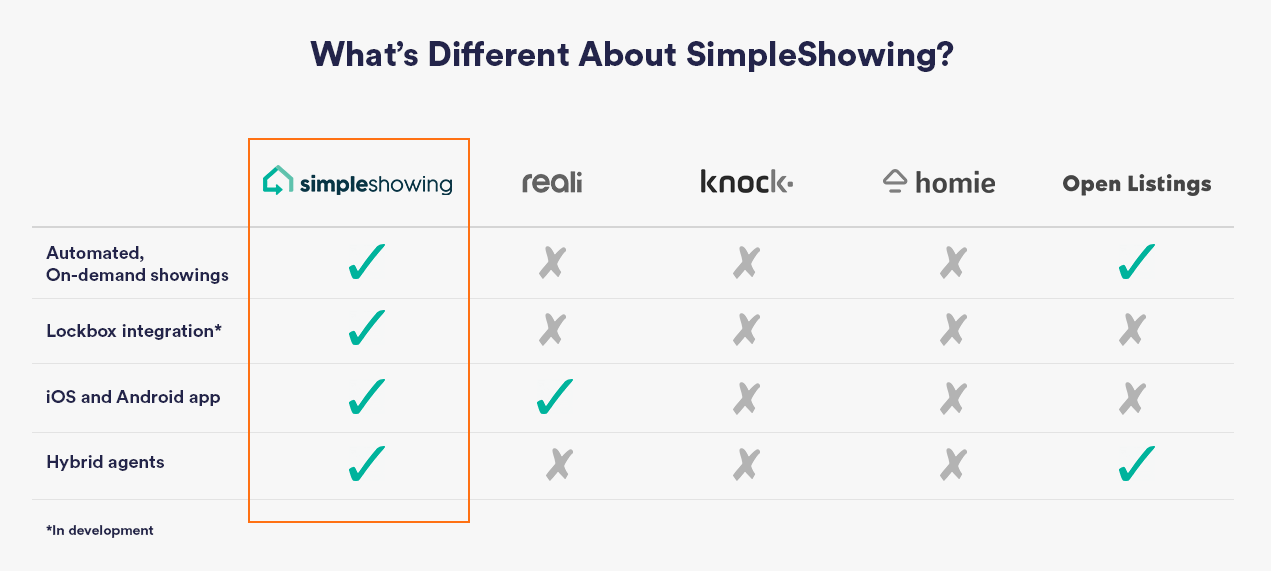

Currently, our primary competitors are traditional brokerages, who charge 5-6 percent per transaction (typically 3% for the listing or “selling” agent and 3% for the Buyer’s agent). These companies and their model make up the vast majority of residential real estate transactions.

There are also about a dozen relevant real estate startups in the residential space and about 2-3 which are similar to SimpleShowing, offering a “hybrid-tech” model. This is a new category that largely did not exist until the last 2-3 years. These brokerages take advantage of technology and changes in consumer behavior to offer services more in line with a traditional brokerage to consumers who are willing to do more of the work themselves, but for a lower fee than traditional brokerages.

Investors and partners

Raised $500K to date

And accepted into Launch's Founder University (2019) and 500 Startup's Founder Bootcamp (2018). Participated in Velocity Accelerator (Birmingham, AL) and Wave Accelerator (Tampa, FL), both part of GAN.co (Global Accelerator Network).

What's next

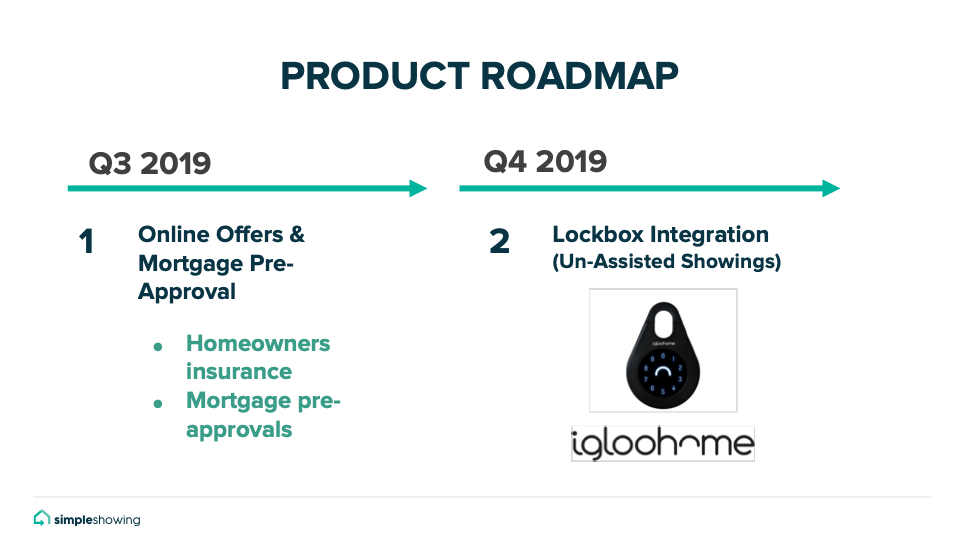

After launching the company in March 2017, the SimpleShowing mobile app was released in January, 2018. Initial functionality allowed Buyers to book tours on demand for any home, regardless of which brokerage the home is being sold through. The app now allows the prospective homebuyer to select a day/time that is convenient to their schedule and eliminates the back and forth exchange of coordinating schedules between agents and sellers. This app (and our website) have become a massive source of lead generation, far outstripping the lead volume of a traditional brokerage by about 10 to 1.

Our brand continues to gain traction in our current markets and we expect to eclipse the $100K/month run rate mark this Summer. We project revenues exceeding $1M in 2019 and over $2.5M in 2020.

In only our second full year as a company, our hybrid brokerage model is rapidly gaining traction. We believe this is only the beginning. Our long term vision is to deploy technology which will put home buyers and sellers in direct contact with one another and effectively disintermediate the Buyer’s agent in many real estate transactions. Consumers have already demonstrated a willingness and even desire to do more of the work themselves. While great tools exist to find a home (ie, Zillow, Realtor.com), no real solution exists for gaining access to see the home, other than using an agent.

This is the secondary problem that we intend to solve. Home buyers can now target, search and identify properties online up to the point where they’re ready to make an offer, but should not be beholden to a real estate agent in order to physically enter and view a property. With the advent of services like Airbnb, it is clear that homeowners are comfortable allowing complete strangers into their homes -- provided there is a layer of safety. We feel that in many cases, it is unnecessary for consumers to hire an Agent in order to physically access a home.

We believe our business model is well positioned to exploit of a number of different monetization opportunities. The larger opportunity that is exists is to verticalize the home buying experience. In this scenario, a consumer will book a showing on our site/app, then create an offer online (we will support this process with a human), then the home buyer will obtain mortgage pre-approval via one of our partners.

Right team. Right time.

Our team is lean, mean and scrappy. We have extensive backgrounds in startups and deep experience in tech and digital marketing. Our team also has a combined 25+ years in real estate.

Co-Founder Fred McGill has an MBA from Georgia Tech and has held various sales and marketing management positions with Fortune 500 companies (Salesforce.com, Johnson & Johnson). He was previously VP Marketing and employee #17 at Redox, a health tech startup before SimpleShowing. Fred built the sales/marketing team from 3 people to 12 people and ramped sales from $20K MRR to $90K MRR in 1 year. Redox has since raised $40M from Battery Ventures and RRE Ventures.

Co-Founder Jeremy Gamble has an MBA from the University of Florida. He brings 15+ years of operations experience to SimpleShowing. Jeremy also holds a real estate license and has an extensive background in property management, finance and analytics.

Director of Engineering Taylor Hayduk served as an Engineering lead for local startup Gather, a restaurant software provider, which was acquired by Vista Equity in 2018. Taylor was also an instructor for Hack Reactor in San Francisco. Hack Reactor is recognized as the most competitive “code academy” for software developers.

Join us in transforming residential real estate

Home buyers and sellers deserve better. We’re simplifying the home-buying process, fixing a broken system and making it more affordable to buy a home.

Deal terms

$8,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

20%

If a trigger event for SimpleShowing occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

SimpleShowing must achieve its minimum goal of $25K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

-

SimpleShowing t-shirt and laptop sticker

Sold out (0 left of 75)

-

1:1 Q&A call with one of the SimpleShowing Co-Founders to discuss roadmap, metrics, etc.

Sold out (0 left of 20)

Why others invested

See all reviews (0) See all (0)I believe that the current real estate industry is in need of tools and services, like Simple Showing, to make a better consumer experience.

I believe it's time to change the antiquated way we do so many things, and real estate transactions is one. Things in the 21st Century should be getting easier for consumers and Simple Showing is working to make that happen.

Great concept! Will save the buyer and seller a lot. I see your company going far. Looking forward to taking the journey with you.

About SimpleShowing

SimpleShowing Team

Everyone helping build SimpleShowing, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC