A fintech startup is giving cash rewards for consumers who sign up for its account and then take active steps to improve ...

Problem

People don’t talk about money

75% of American’s don’t get help when managing their finances. Financial advisors cost thousands of dollars per year and talking about money with friends, family, and colleagues is taboo. Yet financial advice, even from friends or peers, is critical to making smart decisions and achieving financial freedom.

Solution

Status Money: the social network for your finances

Status is a hybrid budgeting app and social network. It privately connects members with peers so they can share financial tips and insights, compare financial stats, and find ways to intelligently manage their money. As a bonus, it gives members cash rewards when they refer friends and act on personalized recommendations.

Product

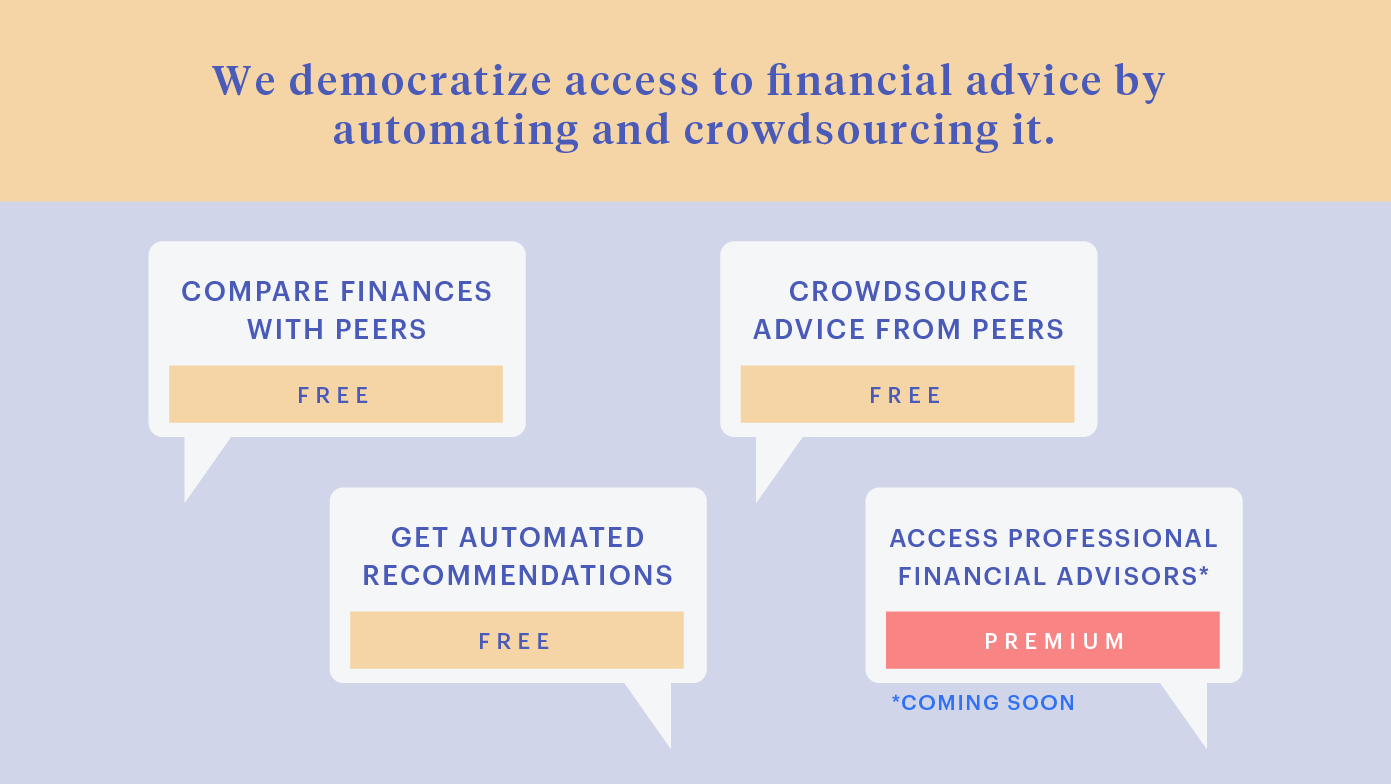

Making financial advice accessible to all

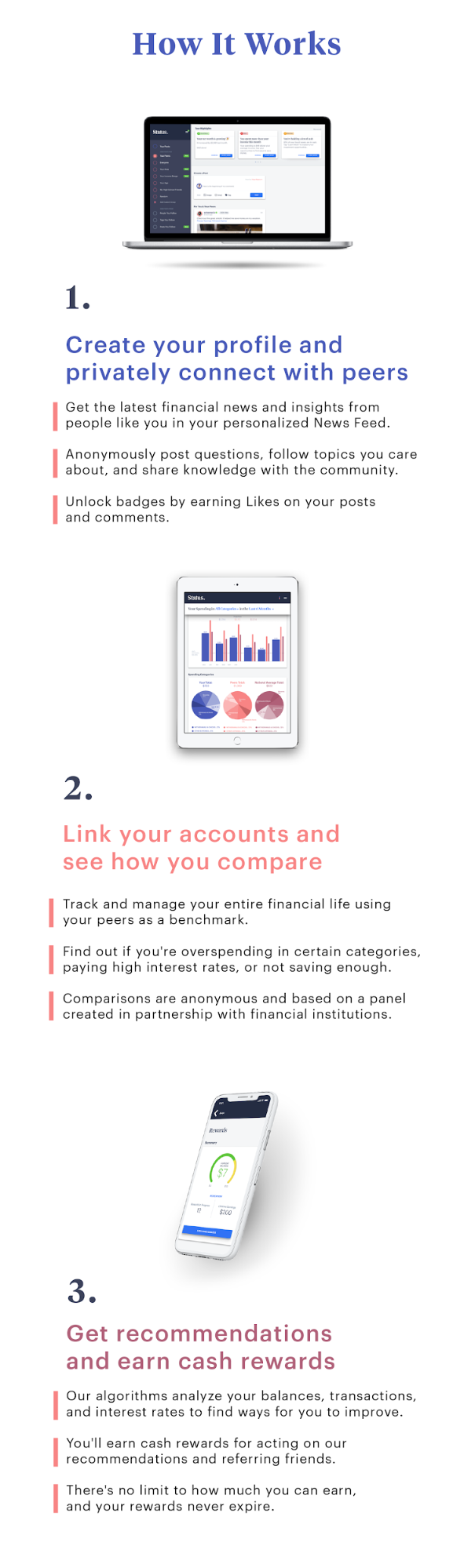

Status Money’s free app delivers personalized recommendations and enables members to crowdsource advice from each other.

The app enables members to compare finances with more than 2.5 million peer groups - defined by dimensions such as age, income, location, and credit score.

Its algorithms then analyze each member’s finances and make money-saving recommendations which may carry cash rewards.

For more specific questions, the social feed enables members to anonymously share knowledge and advice.

The app also delivers the budgeting features that people have come to expect and love.

Our members’ privacy and security our top priority. Member data is protected with bank-grade encryption and never sold to anyone.

Traction

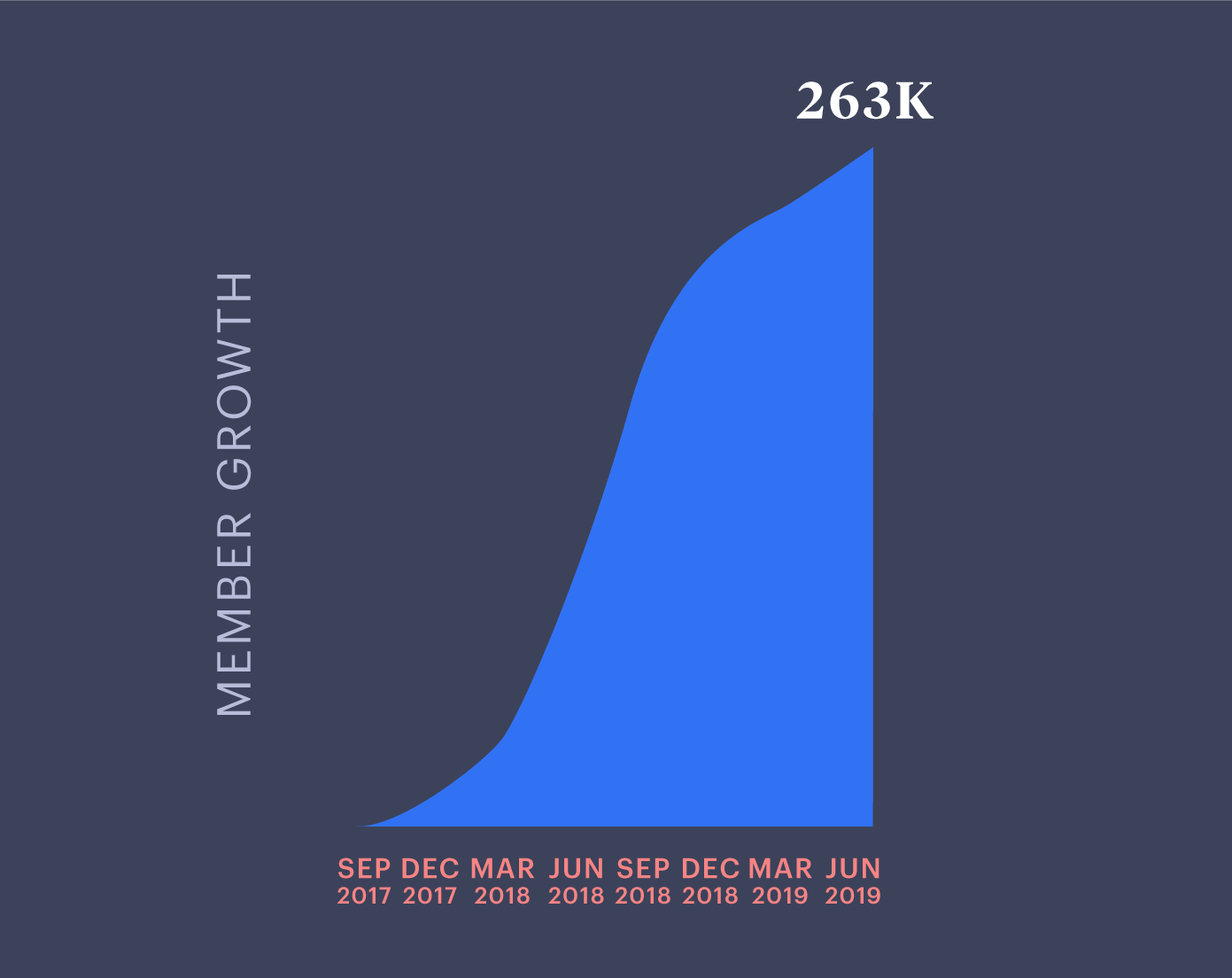

263,000+ members to date

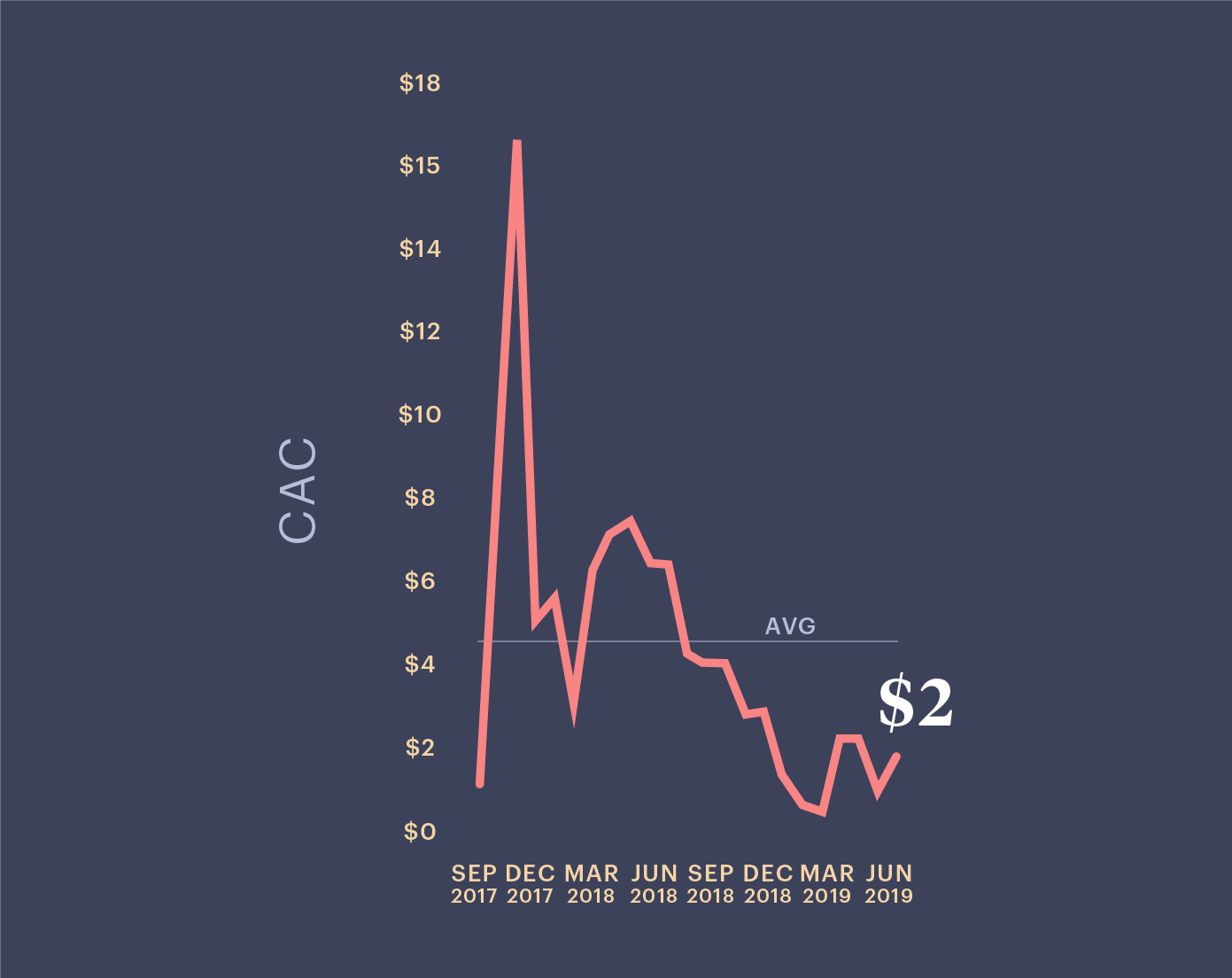

More than 263K members have joined Status Money and the cost of member acquisition has declined to $2 from a historical average of $4.5.

93% retention rate since inception

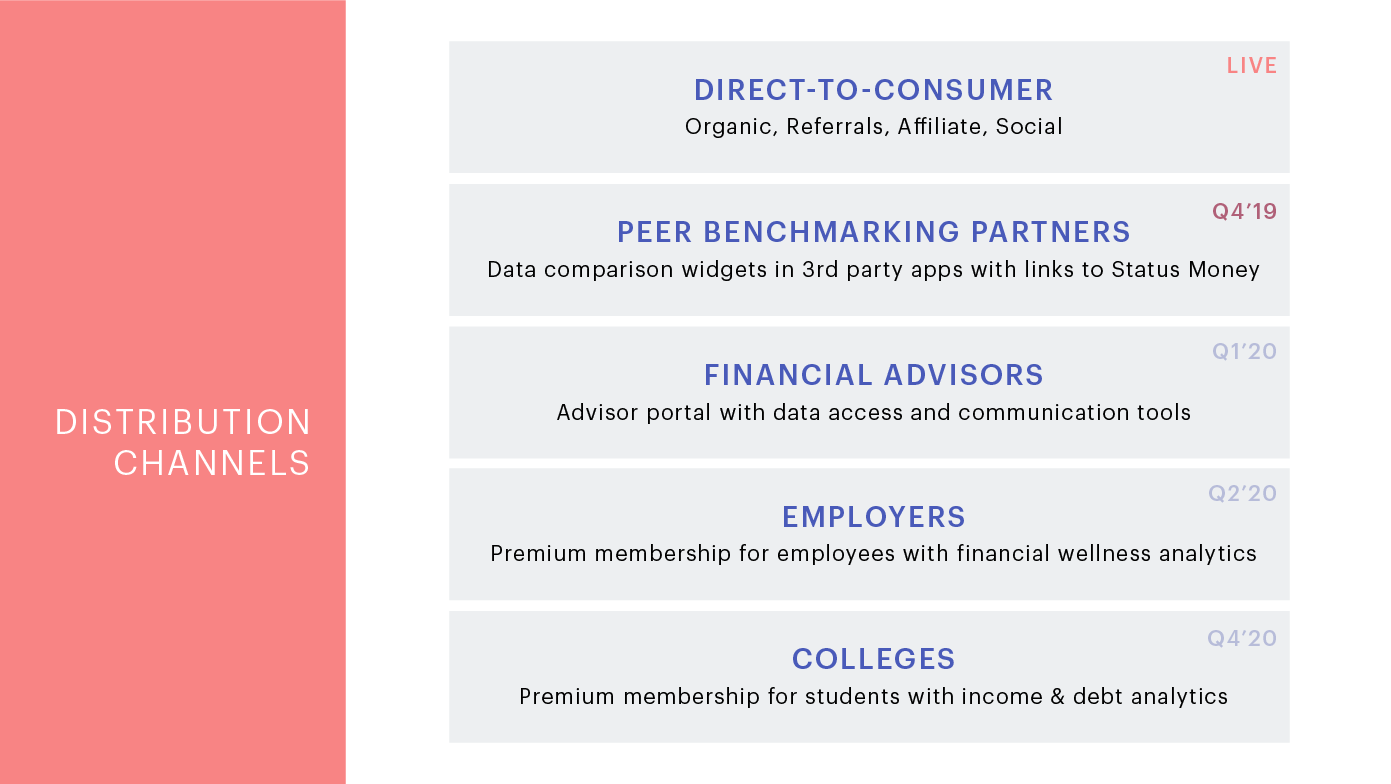

New distribution channels will fuel additional growth

Customers

Our advertisers include 100+ top brands

Business model

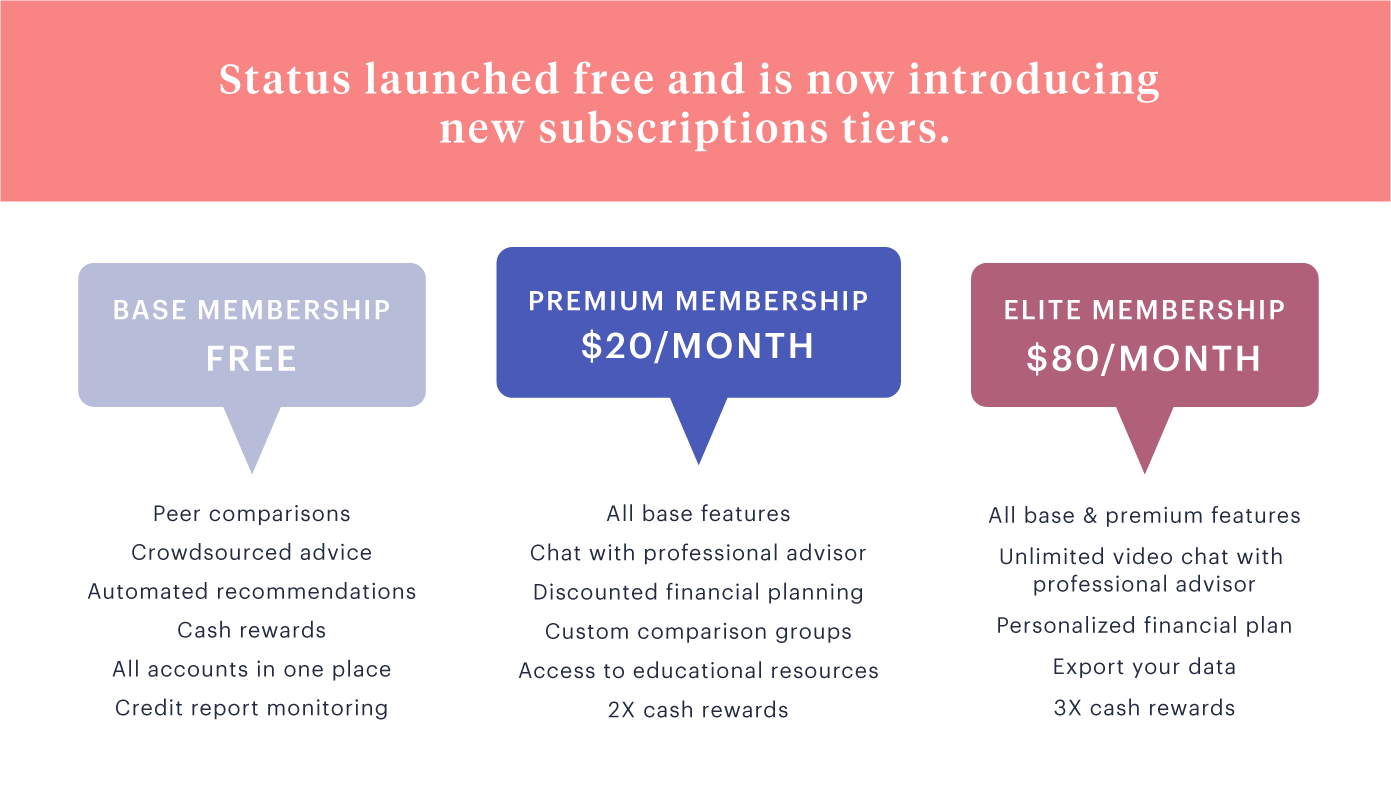

We adopted a freemium business model

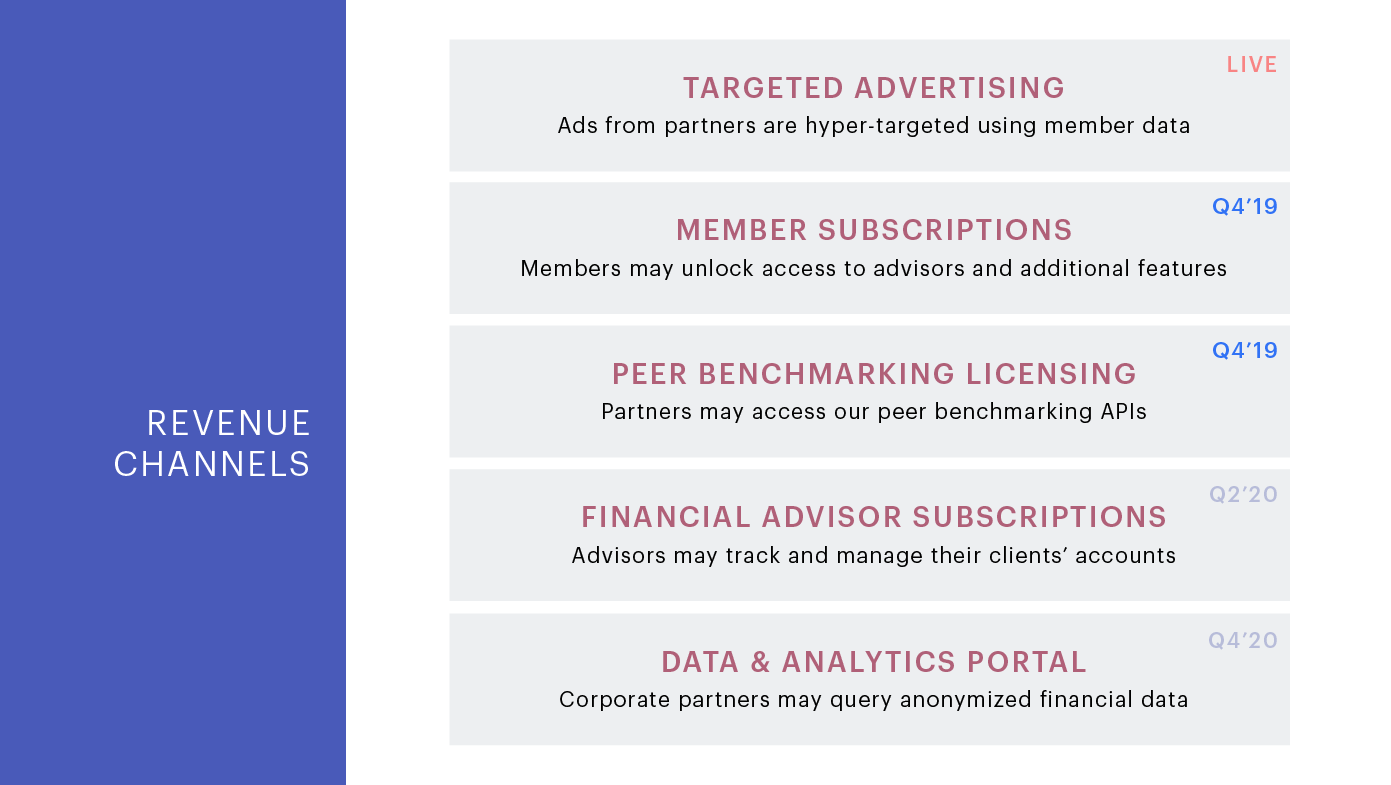

Status Money uses an ad-supported business model to provide members with free access to financial advice. It makes money from targeted ads and will soon be adding a new revenue stream from member subscriptions.

Later this year, we will begin providing partner financial institutions with access to our peer benchmarking data panel - enabling them to display peer comparisons to their customers. Access will carry a licensing fee and require prominent attribution to Status Money.

Next year, we plan to introduce an advisor-facing app and a data analytics portal which will further diversify our revenue streams.

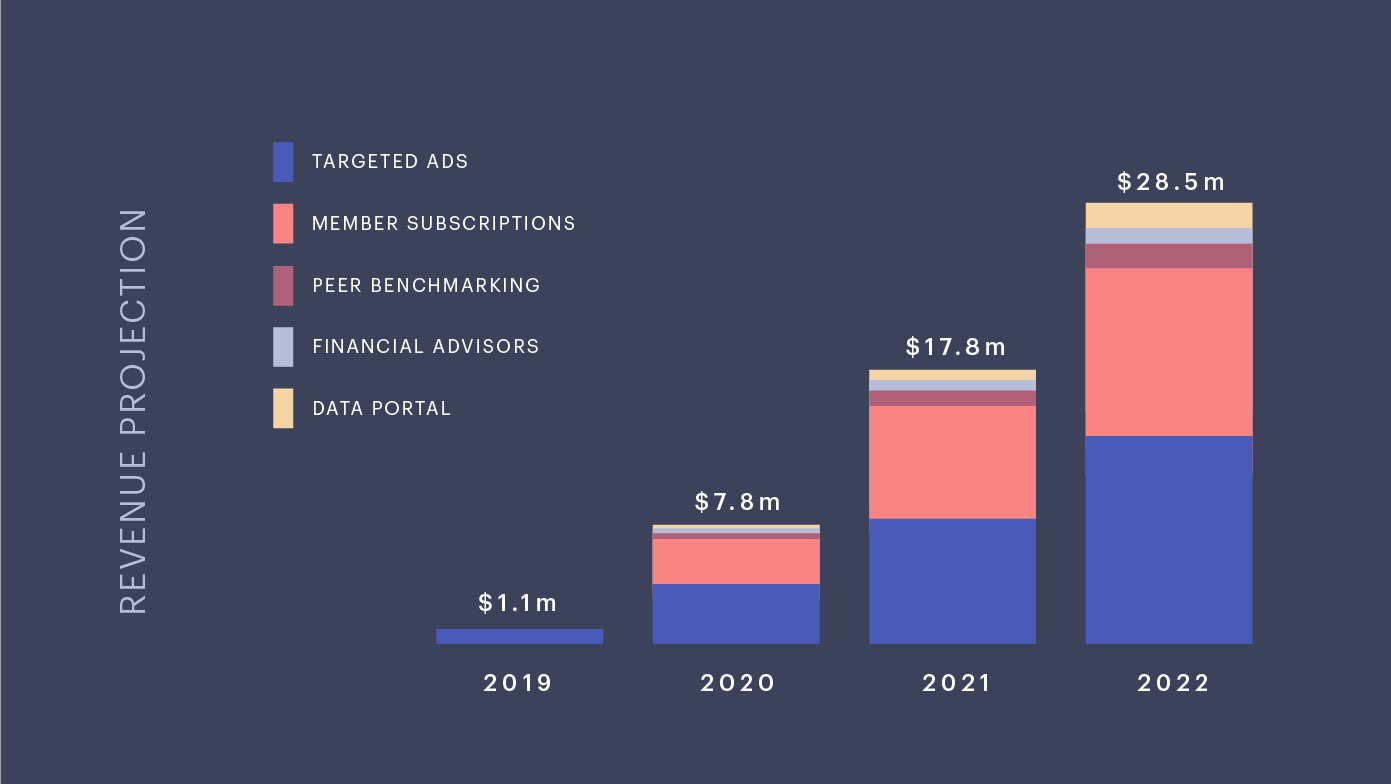

Projected revenue is $1.1M this year and $7.8M for 2020

Market

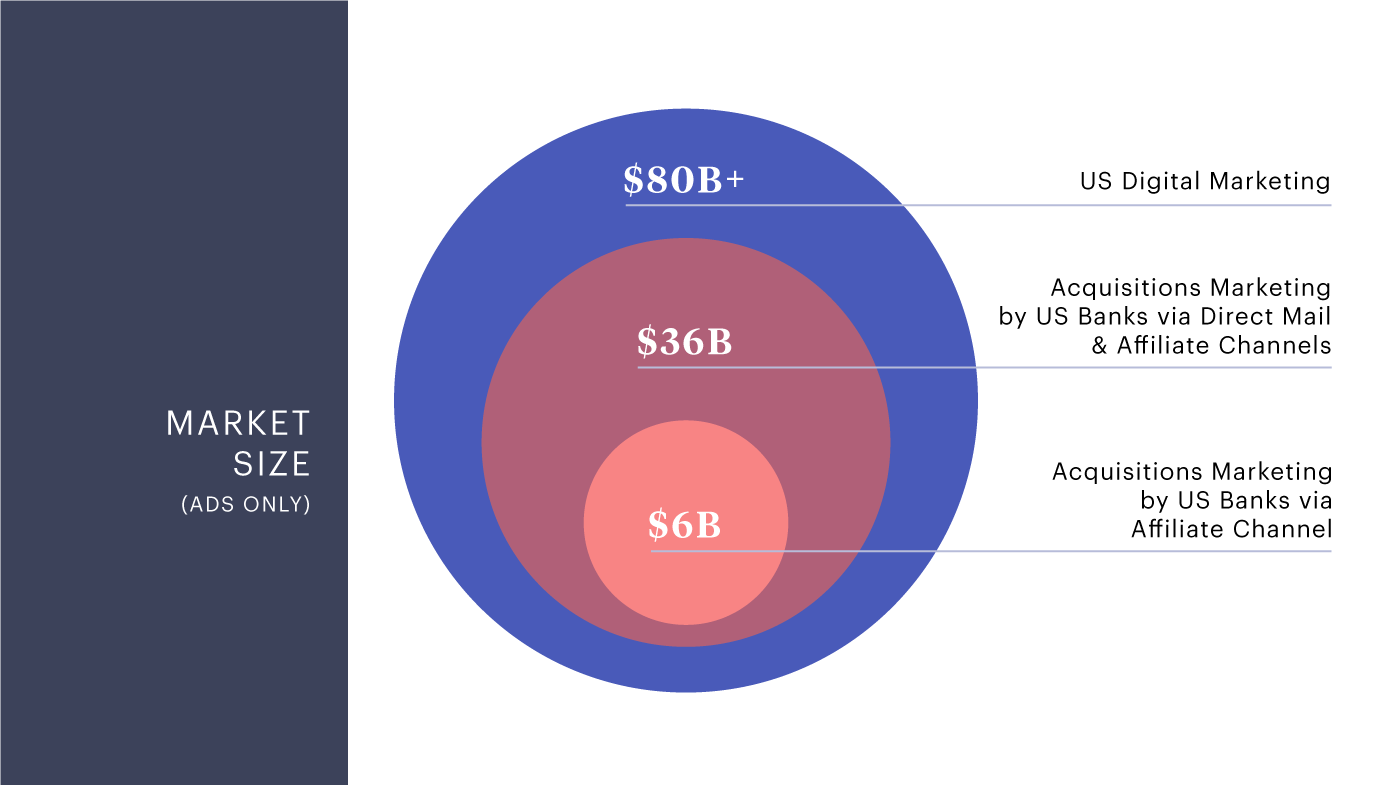

We address a $36B market

US financial institutions spend an estimated $36B on direct-response acquisitions marketing annually. This market is largely confined to offline marketing channels such as direct mail because digital marketing platforms (including Facebook and Google) don't have the verified financial data needed to target consumers.

Our ad platform combines industry-leading targeting capabilities with individual-level personalization and cash rewards. This proprietary technology enables banks and financial institutions to efficiently deliver the right offer to the right person through Status Money.

Competition

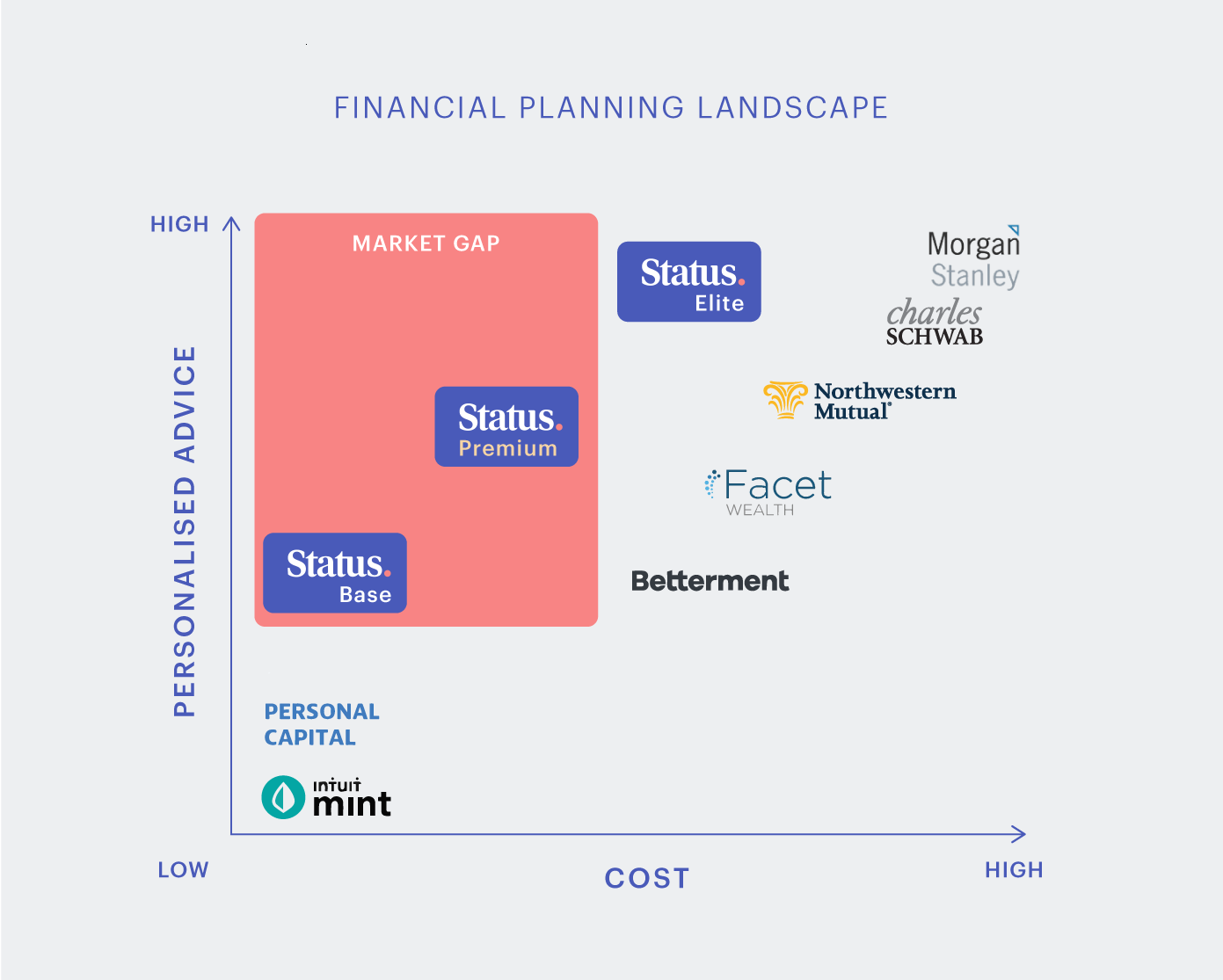

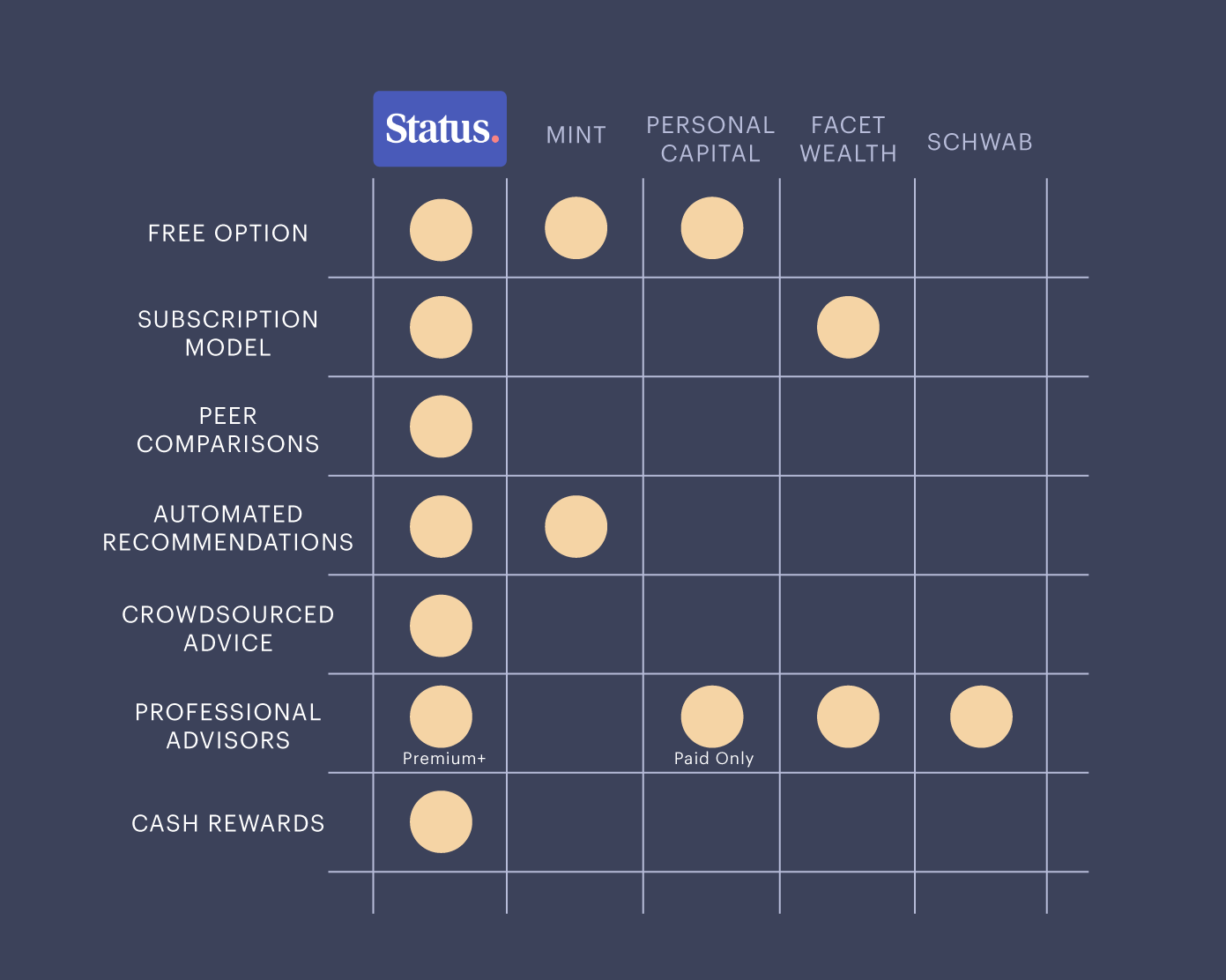

We address a market gap for low-cost financial advice

Our business model and features are unique among competitors

Vision and strategy

Empowering people to achieve financial prosperity

It is our goal to give everyone the information they need to make the best of their financial situation – especially those of us who don't have the means to access professional financial advice today.

Our unique business model enables us to provide members with free access to financial data and advice - and our platform will continue to improve with the help of our growing community.

Beyond our platform, we will advocate for greater transparency in the financial services industry. We will work with policy-makers, economists, and researchers to drive financial inclusion initiatives and fight economic inequality.

Funding

We've raised $9M to date

We recently completed the Plug & Play Accelerator program in Silicon Valley and have raised $9M in funding from Altpoint Capital and Ally Ventures.

Founders

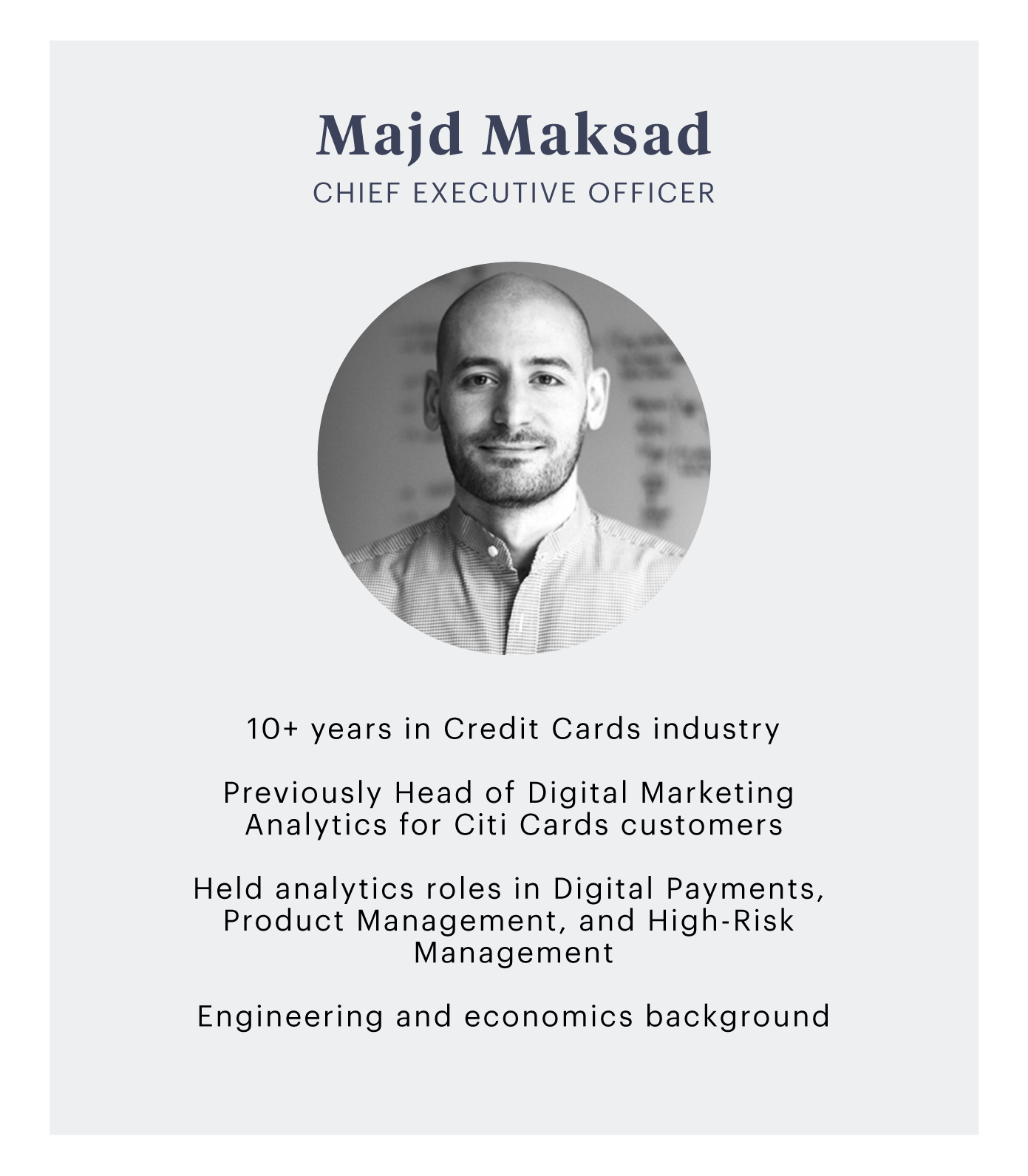

Analytics executives from Citi and Goldman Sachs

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...