ACFN CEO, Jeff Kerr, discusses ACFN growth and franchising with Bloomberg.

Problem

Millions of Americans have little free time outside of work for family and leisure, and yet not enough pay to live comfortably in the face of inflation and skyrocketing costs of living.

An increasing number of entrepreneurial spirits are looking for a smarter, more sustainable way to work and live. Starting your own business is one way to achieve that but comes with substantial risks…

Solution

ACFN (The American Consumer Financial Network) offers prospective entrepreneurs a unique part-time, low-cost, low-risk high-reward opportunity. With minimal investment and overhead, our members are able to provide turnkey services for ATMs, charging stations & more to thousands of corporate clients.

ACFN franchisees benefit from 19 years of corporate relationship building and a reputation for excellence. Franchisees enjoy semi-passive residual income, earned on flexible, part-time work hours — all owner-operated from home with no overhead costs.

Product

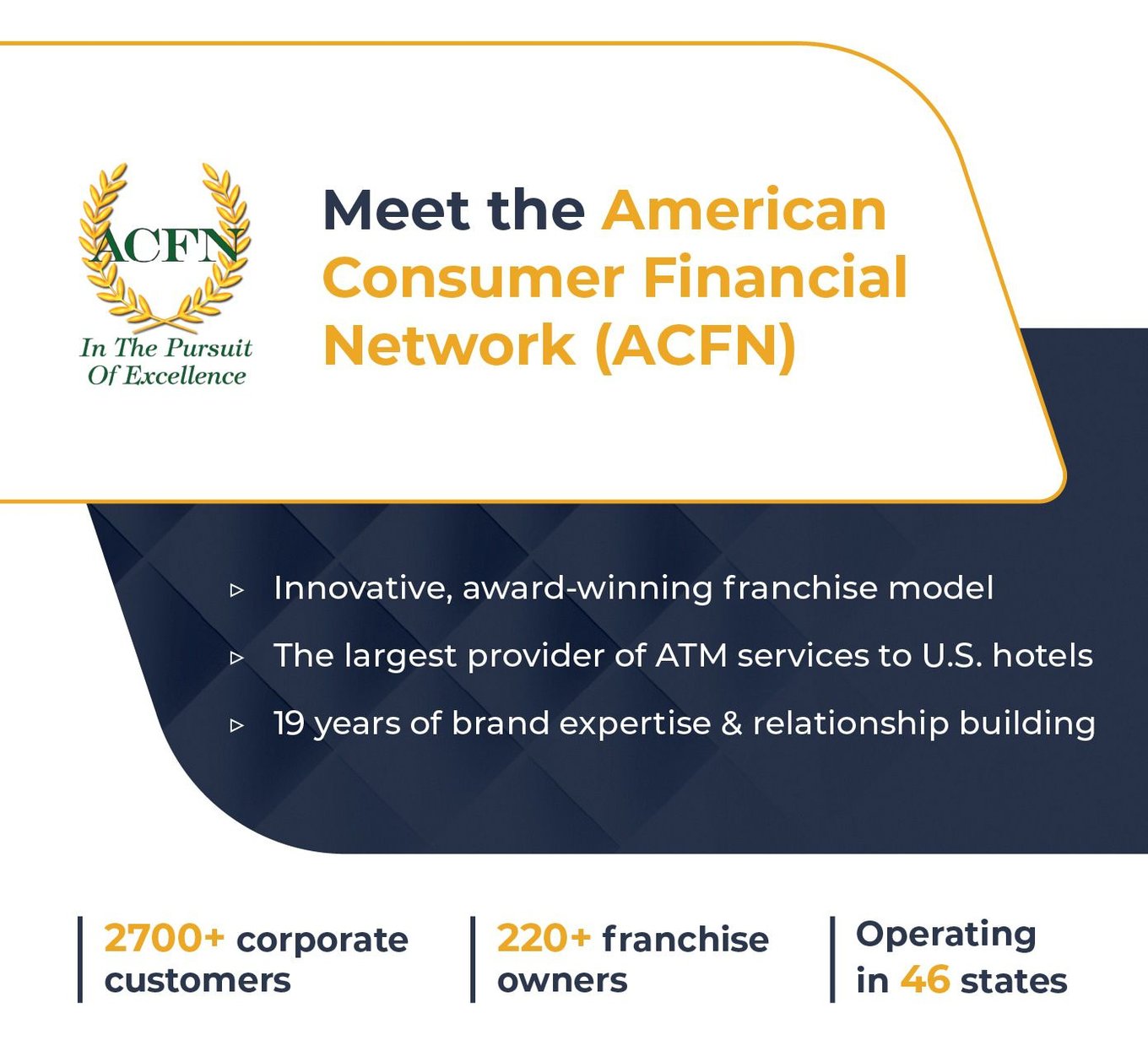

Founded in 1996 and franchised in 2003, ACFN Franchised Inc. (“ACFN”) provides services to 2,700+ businesses in 46 states in collaboration with our network of 220+ franchise owners.

Since inception, ACFN has provided a cumulative $5,000,000,000 of spending power to support and increase sales for our partner businesses. In just the last 12 months a total of $367,566,000 was dispensed through our network, generating more than $14,500,000 in fee revenue for ACFN.

For ACFN’s corporate customers, the value of our turnkey and hassle-free ATM services cannot be overstated.

Traction

With over 26 years of industry experience providing turnkey ATM services and 19 years of franchising, ACFN has a well-deserved reputation for excellence amongst both our corporate partners and our franchisees.

Entrepreneur Magazine distinctions:

- Top Part-Time Franchise, 2021

- Top Low-Cost Franchise, 2020

- Fastest Growing Franchise, 2020

- #1 Franchise in category, 2018 & 2019

- Ranked Franchise 500 listing, 2020 & 2019

- Top Franchise for Veterans, 2018 & 2017

Customers

As the largest ATM provider to U.S. hotels, ACFN’s product suite of turnkey ATM services—plus our recently expanded offerings of cell phone charging stations, and pharmacy vending machines—helps our business clients increase sales, add new revenue streams, and better serve their customers.

Since our inception in 2002, ACFN has provided a cumulative $5 billion in on-property spending power to support and increase sales for our partner businesses, which include hotels, malls, hospitals, universities, entertainment venues, and other travel and entertainment businesses.

Business model

In just the last 12 months, over $360,000,000 in cash was dispensed through our ATM network, generating more than $14,500,000 in annual revenue for ACFN.

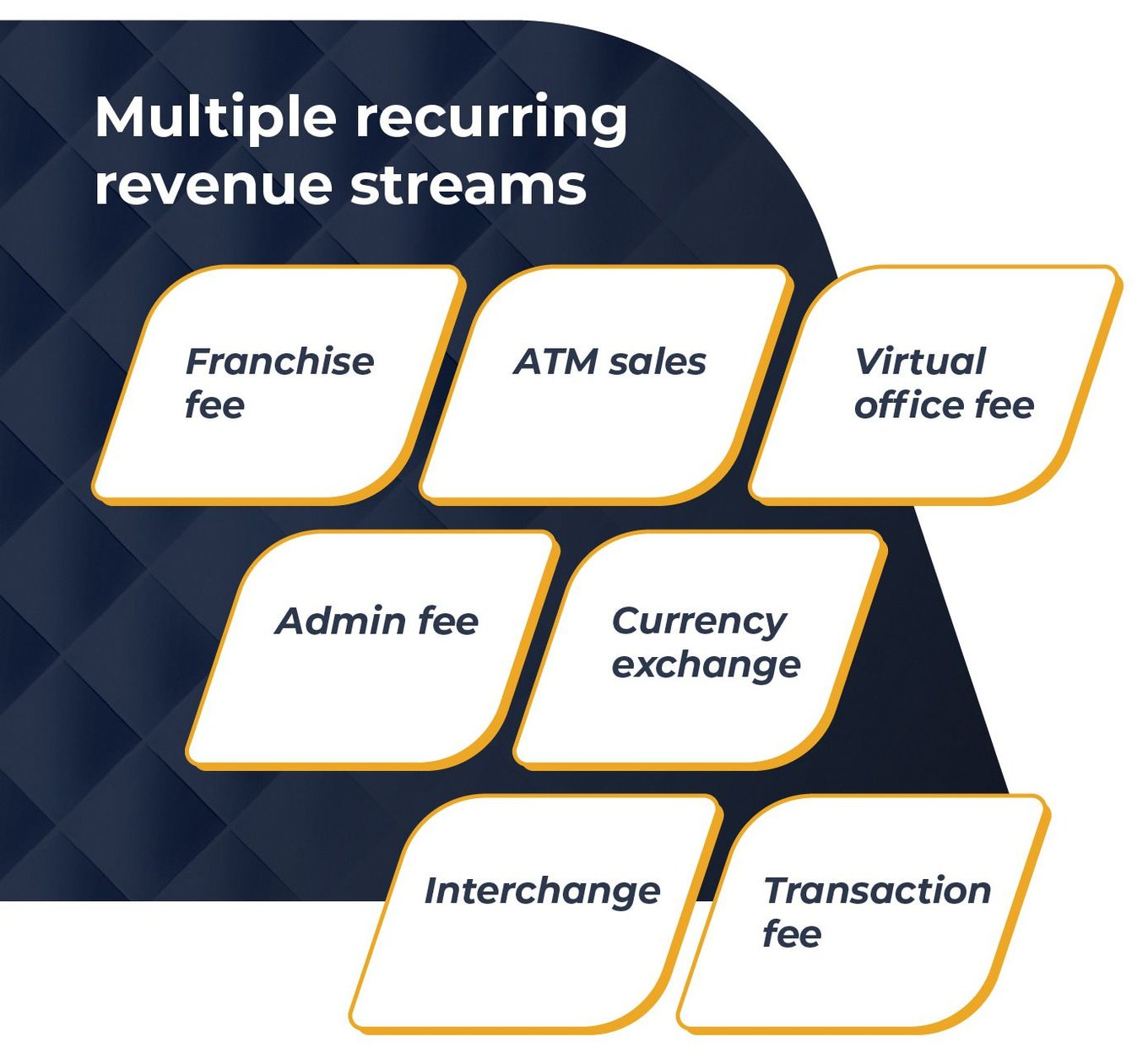

Our business model features several recurring revenue streams:

Interchange, earned from each transaction

Admin fees, paid from each ATM location each month

Transaction fees, paid from each surcharge transaction

Virtual office fee, paid from each franchisee each month

Currency exchange, earned from withdrawals by international card holders

Franchise fees, paid by each new franchisee joining our network

Equipment sales, earned from each ATM purchased by franchise owners

Market

ACFN started in 2002 and franchised in 2003—which means we’ve survived the 2000 dot-com bubble burst, 9/11, the 2008 financial recession, and most recently, the last two years of a global pandemic.

While other business models are bracing for tough times in the current economic climate, global inflation and high fuel costs actually favor ACFN’s low-cost franchise model that requires little to no overhead, staffing, or operational costs.

Competition

ACFN is the only franchise model in our industry. Our competitors operate a traditional corporate structure and outsource to third parties. Record increases in wages and fuel expenses have increased costs and reduced margins for competitors. Our model enables franchisees to serve customers much more efficiently. With relatively limited expenses and close proximity to business clients (which limits the impact of fuel costs), ACFN is well positioned to benefit from current market conditions…

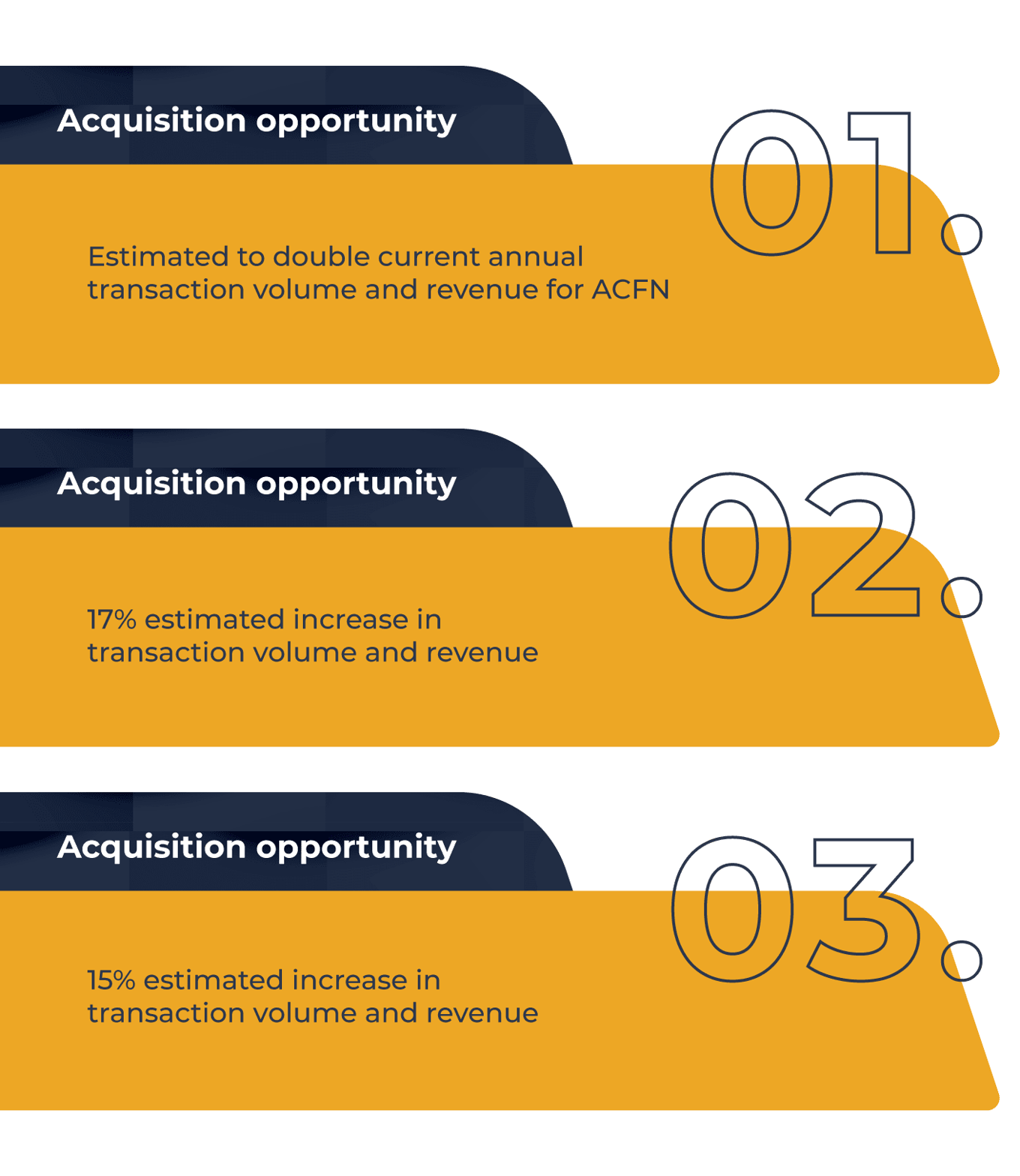

We believe this “perfect storm” of wage increases and high fuel costs will drive competitors to look for an exit. With these acquisition opportunities, ACFN will consolidate the industry, scale our business, reduce competition, and improve margins.

Vision and strategy

Our mission is to achieve rapid growth via acquisitions to expand our corporate relationships, increase the size of our franchise network, and increase transaction volume.

ACFN has already completed two acquisitions in 2018 and 2020. Both were funded privately with debt and resulted in a 26.5% increase in transaction volume.

Acquisitions are the primary reason for our capital raise and a key component of ACFN’s strategy to grow revenue via economies of scale, operational efficiencies, and reduced competition.

Diversification:

ACFN is diversifying with two new products: cell phone charging stations and digital pharmacies. These new offerings will leverage our network to better serve our corporate partners and create cross-selling opportunities.

Funding

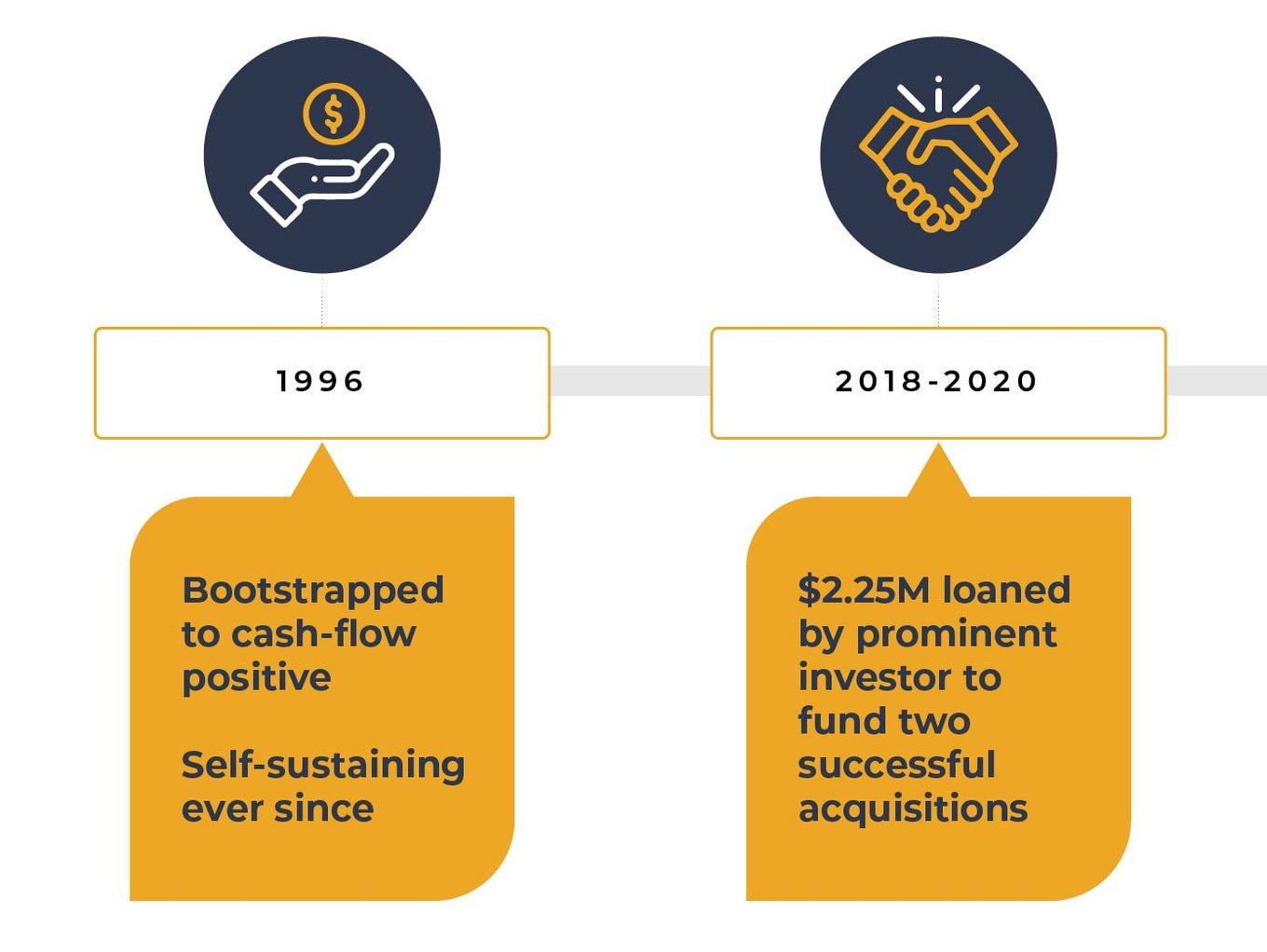

Through founder Jeff Kerr’s personal capital and prior business income, ACFN was successfully bootstrapped to a self-sustaining revenue model early on.

In 2018, ACFN accepted outside investment for the first time, loaning $2.25M from a noted investor to finance two successful acquisitions for $3.5M and $2.95M.

The rest came from personal savings, modest friends and family loans, and ACFN’s corporate resources. All principle and interest has since been paid back in full.

Founders

In the 1990s, ACFN founder Jeff Kerr was running a successful business, but working very long hours. With a desire to have both financial success and a good quality of life, he began investigating opportunities to build semi-passive income.

In 1996, Jeff found himself in the audience at a conference presentation for a new business opportunity: to own and operate private ATMs. Regulations governing ATM transactions had just changed to allow surcharging and for Jeff, it was love at first sight: the inception of private ATM ownership. 53 ATMs later, his side venture outpaced his main earnings with only a fraction of demand on his time.

Summary

ACFN is an innovative franchise model for entrepreneurial individuals interested in owning a franchise, but not interested in the typical retail franchise with long hours, high capital investment, and high risk associated with high overhead. Our innovative franchise model is part time with flexible hours, low capital requirements, and stable recurring revenue streams.

As the only franchisor in our industry, ACFN is the low-cost leader with multiple sustainable competitive advantages. Our experienced team oversees a proven business model with targeted plans to scale: ACFN has already completed two acquisitions with three more distinct opportunities for substantial revenue growth currently in various stages of discussion.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...