Partnership expands financing options for African SMEs through Smart Asset Financing™ (Kampala, Uganda, February 2021) Un...

Problem

Traditional finance in Africa isn’t serving everyone

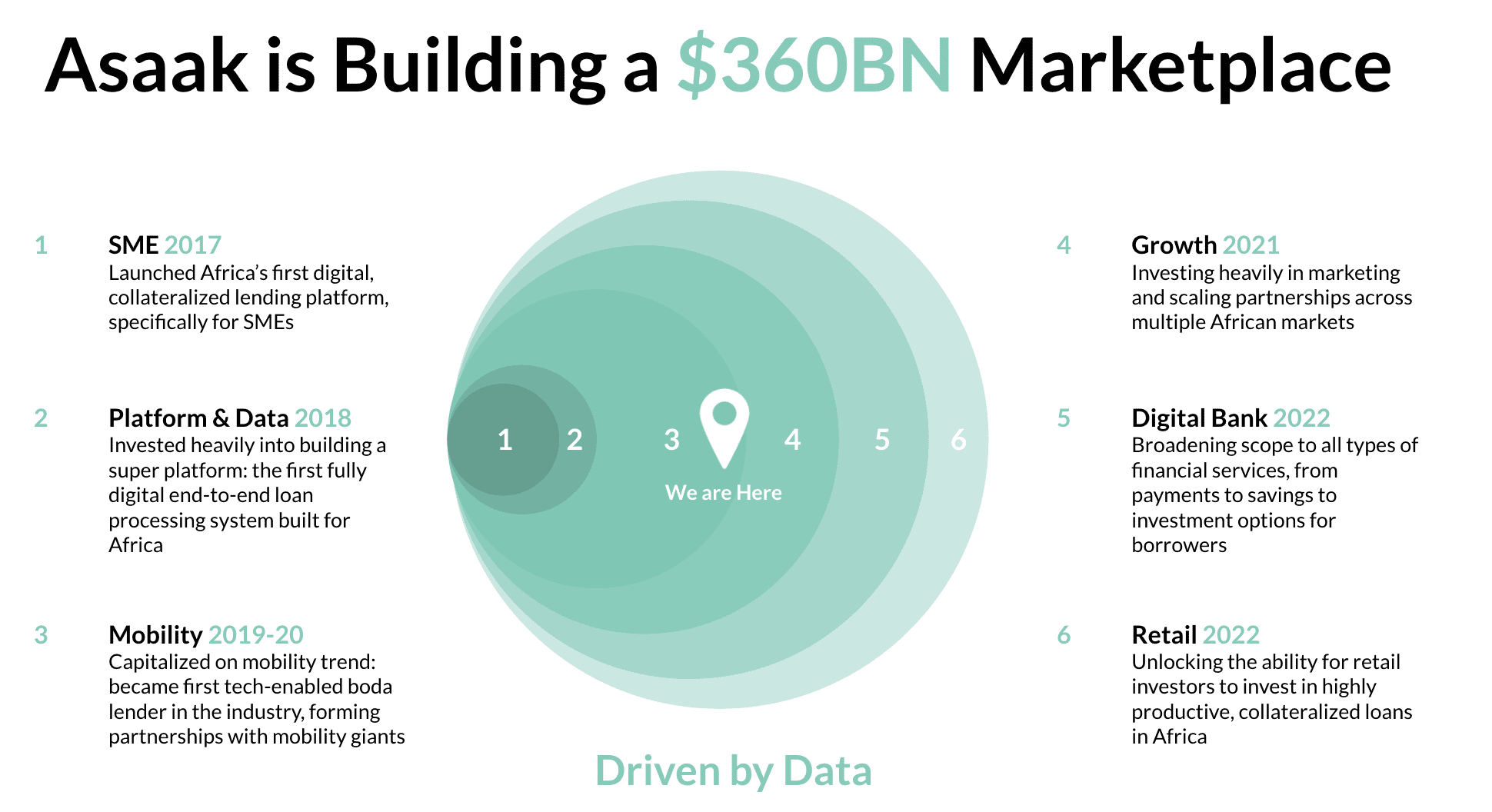

2.5B+ people across the world lack access to formal credit and face financial exclusion, which has created a $360B credit gap in Africa alone. Traditional lenders cannot scale SME lending due to poor customer experiences, poor credit capabilities and overall limited reach. There is now a massive opportunity for developments in mobile technology to improve financial inclusion in Africa.

Asaak discovered a unique initial foothold in the mobility sector: gig workers, in particular ride hailing app drivers. In Africa, these drivers operate motorcycle taxis (known locally as boda bodas) rather than cars. Despite having steady work, they cannot access capital to purchase a motorcycle or even to pay for everyday expenses. This group represents the fastest growing demographic in Africa today with a $50B unmet need for capital.

Solution

Asaak: Africa's Digital Bank

Asaak was founded with the mission to unlock financial services for all Africans. Our first product is credit, strategically starting with the idea that we can meet a person's immediate need for capital today and help them save and invest tomorrow.

Asaak has created a completely digital end-to-end lending marketplace, enabling Africans to access financial services and investors to invest directly into Asaak's loans.

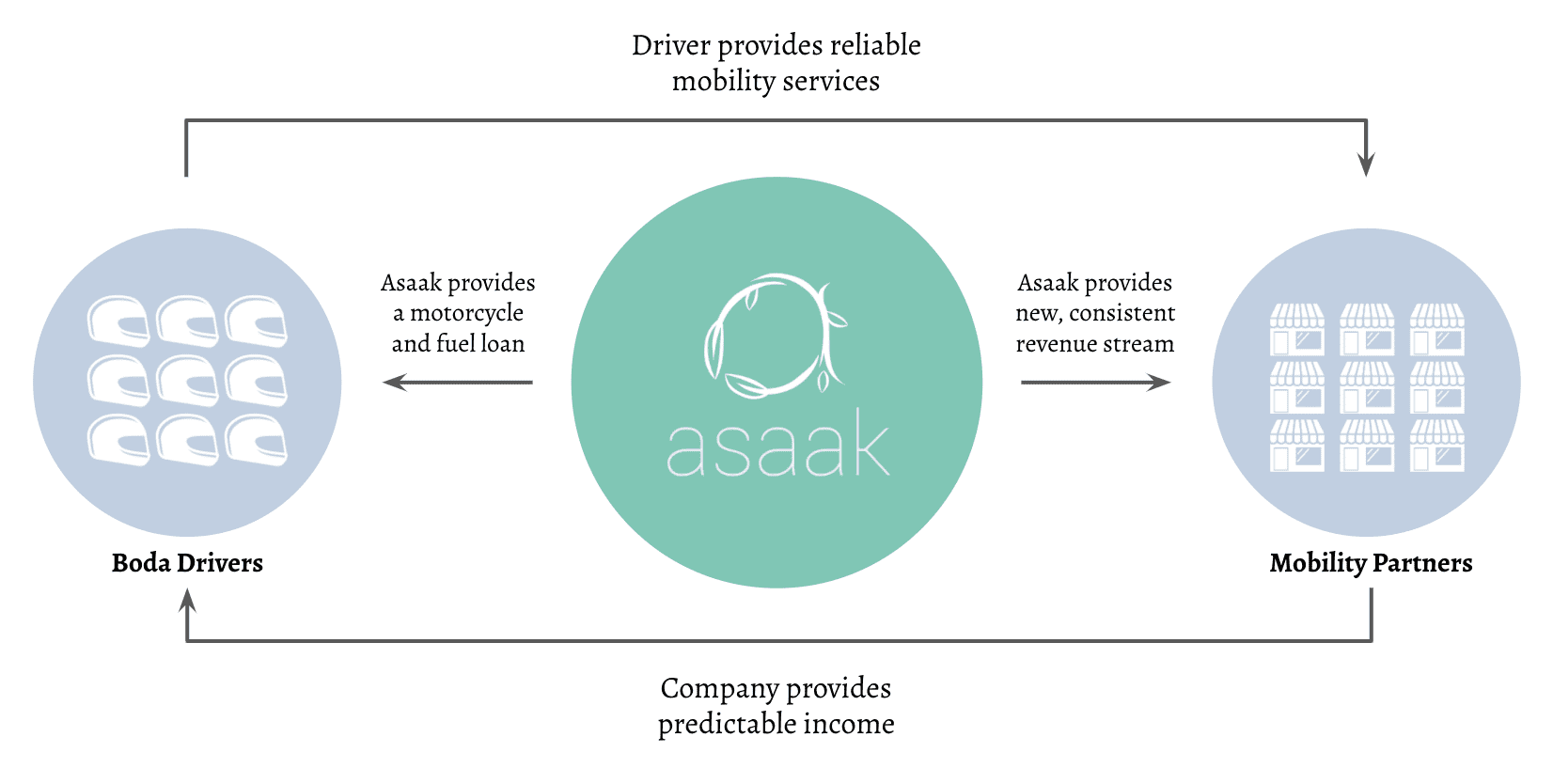

Within our first target market of mobility, customers typically come to Asaak for a loan to buy a motorcycle to support their work as a ride hailing driver. By working with Asaak, drivers no longer have to lease motorcycles thereby doubling their earning potential. Each loan is backed by the motorcycle itself, a highly liquid asset with slow depreciation.

Our approach is built for scale: B2B2C. We look to partner directly with gig economy companies like Uber, Jumia, SafeBoda, etc. to finance their drivers' purchases of motorcycles. In exchange we receive data about applicants such as their customer ratings, trips completed, and money earned which helps us understand their creditworthiness. All of our partners operate in multiple markets across Africa, ensuring we'll be able to scale cost effectively.

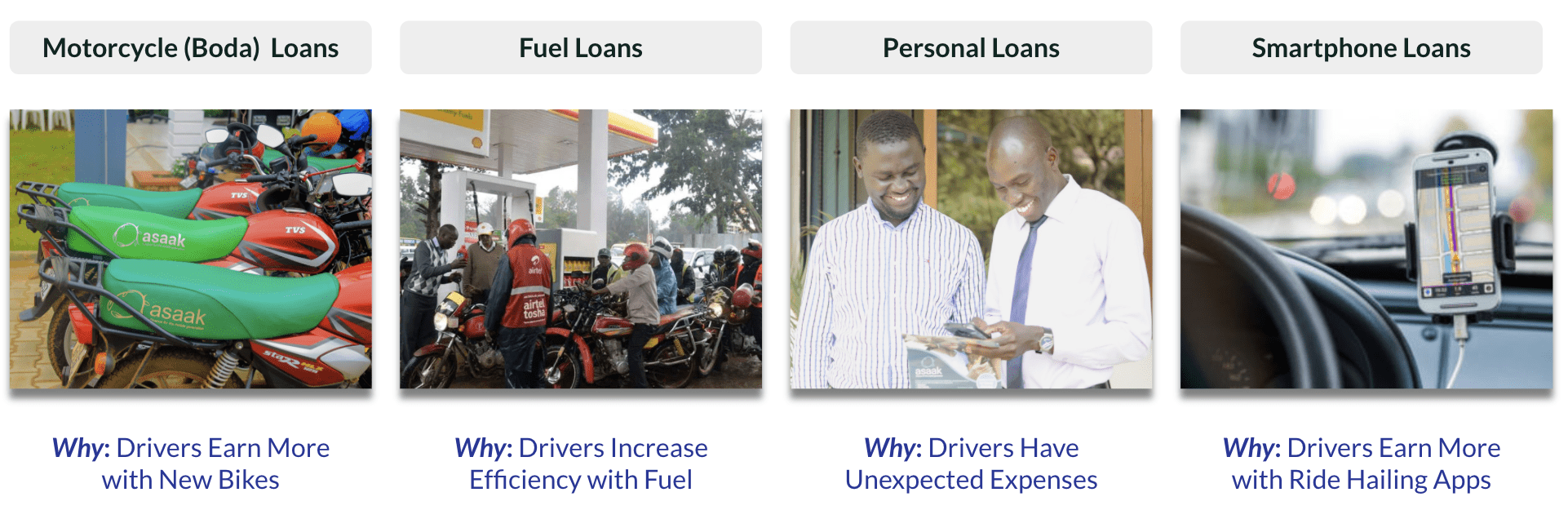

We hook customers through the initial loan and as they start to pay down their loan, building equity in their motorcycle, we offer them additional products like buying fuel on credit, smartphone financing, and personal loans.

We hook customers through the initial loan and as they start to pay down their loan, building equity in their motorcycle, we offer them additional products like buying fuel on credit, smartphone financing, and personal loans.

Asset financing is the most critically unmet need of Africa’s two biggest demographics: informal and formal workers. We are starting with credit now and will offer insurance and savings in the future as we become Africa’s premier full stack digital bank.

Product

Data-driven lending

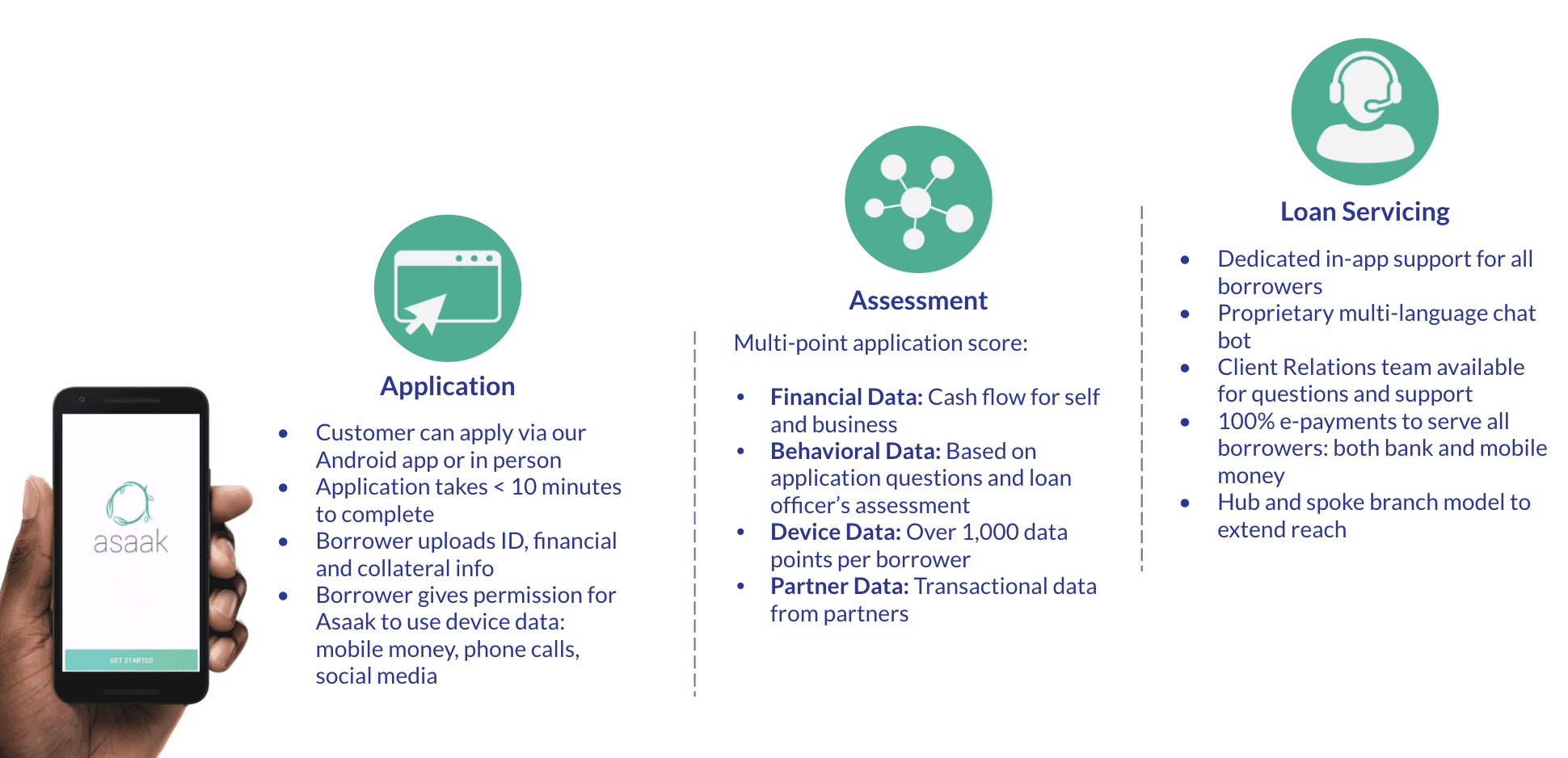

Asaak has created a proprietary end-to-end digital lending platform that allows individuals and SMEs to receive loans and build credit. When a borrower applies for a loan, we capture hundreds of data points and apply machine learning to formulate our proprietary credit score - Asaak Credit Score (ACS) - a FICO replacement in a continent where standardized credit scores don't exist. Digital verification means we onboard with less friction, streamlining the application process and reducing fraud. Our highly integrated assessment tools mean we can easily collect repayments and reduce loan risk.

So, how does Asaak work?

The entire Asaak experience is digital. Potential borrowers fill out an application using our mobile app, get credit scored instantly and can receive their loan in days, not weeks like traditional African commercial banks.

Asaak Admin Panel

Asaak's core platform, the Admin Panel, is a core banking system we built from scratch. It streamlines the entire customer experience, allowing us to quickly provide multiple financial products and manage a rapidly growing loan portfolio. After attracting the attention of Africa's largest commercial bank we've explored the possibility of licensing Admin Panel, a potential multimillion dollar revenue stream.

Lending Offerings

Asaak is building solutions to meet all of its customers financial needs. As borrowers increase their ACS and proves creditworthiness, they can tap into additional products, driving a 38.5% higher customer LTV ($1,680) than traditional competition.

Traction

1.3K loans, $2.2M deployed with 95% repayment rate

We are currently partnered with three of the four of the largest mobility companies in Africa to provide their drivers with financial services: SafeBoda, Bolt, and Jumia. This provides us with cost efficient access to tens of thousands of borrowers in multiple markets.

For our smartphone financing product, we're working with Samsung, using their proprietary locking technology Knox Guard, becoming one of the very first smartphone financiers in Africa. Knox allows us to remotely lock borrowers' smartphones in case they stop paying - a great risk management tool.

We have given out 1.3K+ total loans, worth $2.2M and maintained a 95% payment collection rate. Since 2016, we have amassed a wealth of data that has enabled us to automate credit scoring and recovery processes - giving us a significant advantage vis a vis competitors.

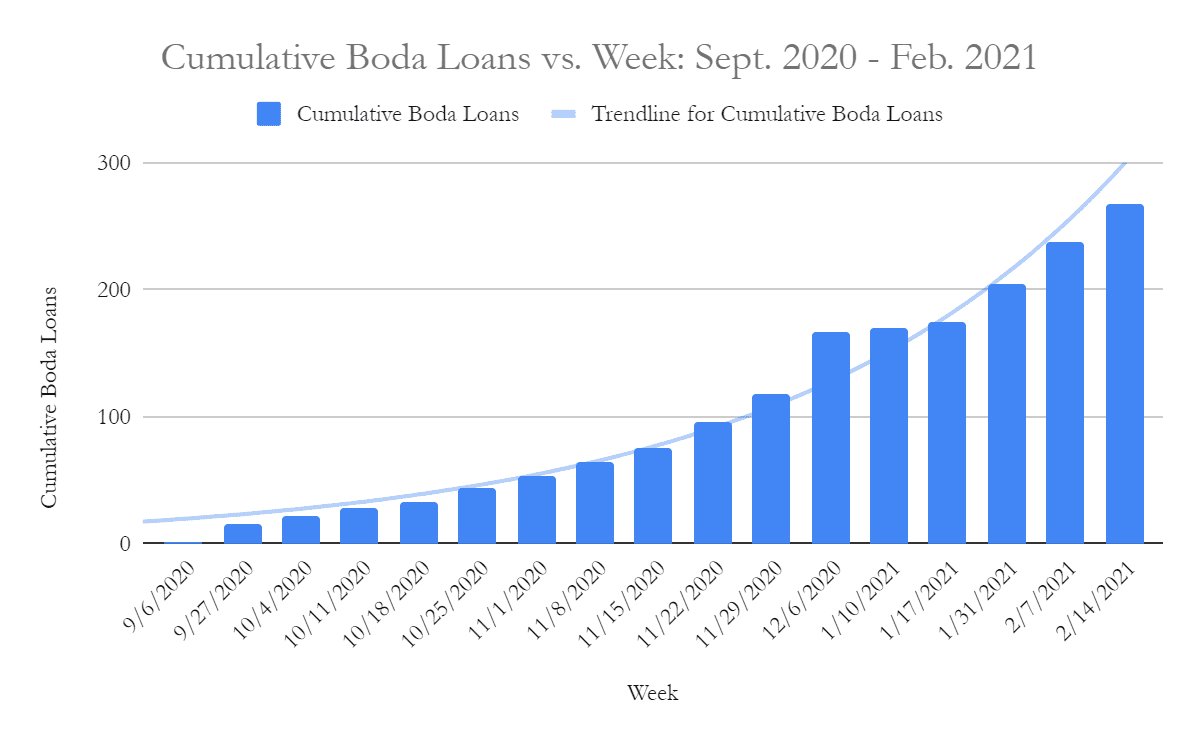

After pausing lending to focus on hiring and building additional product features during the COVID-19 lockdown, we resumed lending in October and achieved 97% MoM revenue growth for 6 months in a row.

In Q4 2020, Asaak was selected by the IFC, Visa, MetLife and BlackRock to be a part of the Inclusive Fintech 50, an initiative that identifies, assesses, and elevates the most promising early-stage inclusive fintechs in the world.

Customers

Serving a unique market not met by traditional financial lenders

A customer comes to Asaak for a motorcycle (boda) loan to help their business flourish, but they stay for the additional products that they are able to tap into. As a borrower builds equity into their motorcycle loan, they can tap into analogous products.

Meet John Bosco, one of Asaak’s very first drivers:

Before coming to Asaak, John Bosco rented a motorcycle from a “boss,” a common practice in Uganda. Every day, he’d have to pick up and drop off the bike at the owner’s house - a 45 minute commute each way via bus. The bike was old and constantly needed repairs, which John Bosco couldn’t afford. He typically earned $65 per week. John Bosco first came to Asaak after being referred by a friend. We helped him buy his first motorcycle on credit in 3 days, making him a business owner. In his first 2 weeks with Asaak he drove over 1,100 KM, increasing his weekly income by 50%. He quickly became one of Asaak’s best clients, helping us to reach new drivers and piloting our fuel loan product.

Business model

Low CAC, Exceedingly High Margins

Asaak operates a B2B2C business model. We partner directly with rapidly scaling businesses like ride hailing companies to offer their customers financial services. This approach has drastically lowered our customer acquisition cost ($25) and enabled us to focus more on the core functions of our business: software development, underwriting, and portfolio monitoring. By focusing deeply on these three areas, we are creating a larger moat around our business and truly differentiating ourselves from competition in terms of turnaround time, price, and available financial products.

On our motorcycle loans, we charge an average interest rate of 34% per year depending on the borrower's Asaak Credit Score. These rates are competitive with commercial banks and 50% cheaper than loan shark alternatives.This approach has allowed us to maintain 39% gross margins and 17% profit margins.

As we continue to expand our product offering beyond motorcycles and into other assets, we will realize margin expansion. Certain products like fuel financing are automated with margins as high as 72%. Our brick-and-mortar competitors are unable to offer such small loans because of the administrative cost. With our fintech lending approach we have seized this opportunity to solve our customers' additional financial challenges and earn more revenue. We expect to roll out other products fully in the next 3-6 months due to our expertise in underwriting, credit scoring and automation.

To fund our loans, we partner directly with institutional investors, mostly based in the U.S., investing on USD terms. We're in the process now of building a retail platform, enabling all investors to tap into this burgeoning asset class which is growing at 16% per year. We expect to launch this in the next 12 months.

Given our revenue model and strong unit economics, we have been profitable for the last 4 months and will remain profitable going forward.

Market

An untapped African market

Africa has a large entrepreneurial community, but lacks capital to scale, totaling a $360B credit gap. Despite this, it has the highest rate of self-employment in the world, meaning there are 350M unbanked individuals looking for capital to grow their business.

We address two major markets: the mobility market and Africa itself. Through our motorcycle loans, we are well positioned to be the dominant asset lender in Africa, offering an initial productive asset to ride-hailing workers, which helps them build credit and unlock additional financial services with Asaak, from personal loans to insurance to savings products.

Beyond the gig economy and motorcycle loans, we are planning an expansion of our asset financing offering, adding cars and trucks to our portfolio.

By becoming a customer's one-stop-shop for all their financial services needs, we will become Africa’s premier full-stack digital bank.

Competition

Disrupting traditional competition

Asaak primarily competes with traditional commercial banks in providing loans to borrowers. These firms typically have a network of brick & mortar branches but no material technology component. Our key differentiators today include:

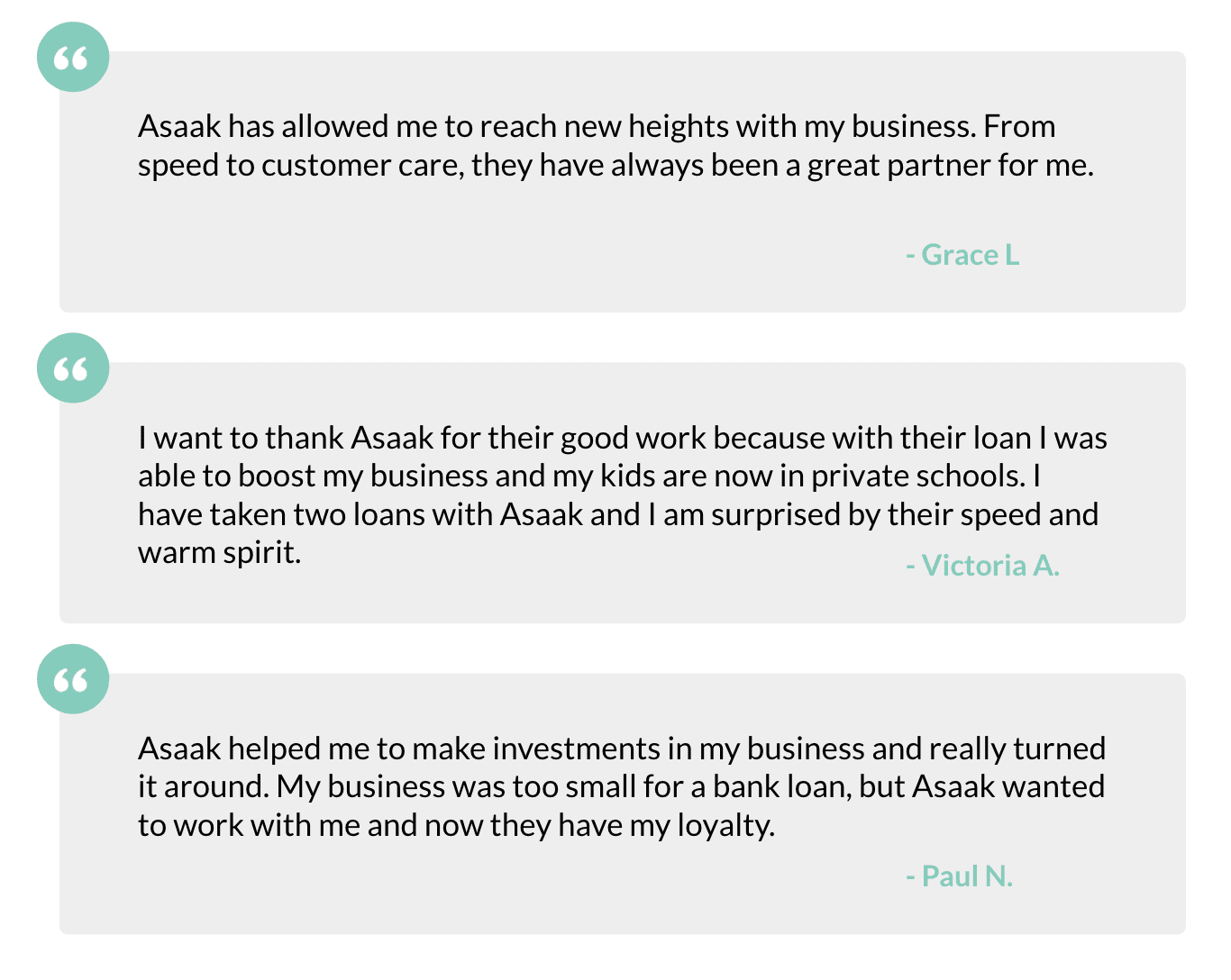

- Speed: Asaak provides instant feedback via our proprietary software and usually funds a loan in less than 4 days. Traditional banks take on average 40 days because of manual processes.

- Collateralized: All of Asaak's loans are backed by liquid assets, ensuring ability to recover in case of default scenario.

- Technology: We combine the latest in AI & machine learning with simple user interfaces to create the cheapest and fastest solutions for our customers.

Furthermore, being early has allowed us to build an accumulating data advantage, and we’ve grown a data set on our asset class that is already one of the biggest in Africa. Our strategy is to lead with an asset loan (e.g. motorcycle) which allows us to quickly and securely amass data about a borrower's creditworthiness, then use this data to underwrite him for additional financial products (e.g. smartphone loan, fuel loan). This is how we are able to capture up to 38.5% more revenue per customer.

Vision and strategy

Creating a new asset class

By unlocking credit access for African SMEs, we're making Africa investable to the outside world.

Funding

$4.4M raised to date

Equity Financing

Asaak has received funding from notable investors such as Resolute Ventures, 500 Startups, The Catalyst Fund, HOF Capital, and Social Capital. We have raised a total of $4.4M in equity, debt, and grant capital. By unlocking credit access for African SMEs, we have made Africa investable to the outside world.

Previous Financing

- Q1 2018 Seed Round: $1.5M, largest ever in Uganda

- Q4 2020 Seed Extension Round: $750K

Debt Financing

On the debt side, we've raised $2.2M to fund our loan book mostly from institutional investors and family offices. We recently received a $10M term sheet from a private credit fund for a draw-down debt facility, ensuring we have the capital to scale.

In Q4 2020, we started working with Untapped, an institutional lender focused on Africa. Untapped purchases whole loans from Asaak, paying Asaak servicing and origination fees and splitting the upside. This type of off-balance-sheet lending enables us to de-risk our business and diversify our capital base.

Founders

Leadership Team

Kaivan Sattar: As CEO, Kaivan is responsible for Asaak's strategy and identifying, establishing, and scaling partnerships. Kaivan most recently worked as a Data Scientist at LendingHome and previously as a quant at the Federal Reserve Bank of New York for 3.5 years, where he valuated loans in the Discount Window’s $2 trillion portfolio and was the lead developer of two risk models for the Fed’s annual stress test of “Too Big to Fail” banks. In university, Kaivan conducted field research in Ghana, Bangladesh, and India to better understand how the poor save and borrow money without access to banks. This early research informed Kaivan’s mission to redefine finance in emerging markets. He holds a masters in Operations Research from Columbia University and a bachelors in Mathematics-Economics from New York University.

Edward Egwalu: As COO, Eddie is focused on managing Asaak's sales, underwriting and loan servicing teams. Eddie was most recently the Head of IT and Operations at Pilgrim Africa, an international public health-focused NGO. Before Pilgrim, Eddie consulted with various companies and government agencies including the Ministry of Agriculture and the Ministry of Finance on how to better improve their digital offerings and presence. Eddie holds a masters in Monitoring & Evaluation from UMI and a bachelors in Information Technology from Uganda Christian University.

Edward Egwalu: As COO, Eddie is focused on managing Asaak's sales, underwriting and loan servicing teams. Eddie was most recently the Head of IT and Operations at Pilgrim Africa, an international public health-focused NGO. Before Pilgrim, Eddie consulted with various companies and government agencies including the Ministry of Agriculture and the Ministry of Finance on how to better improve their digital offerings and presence. Eddie holds a masters in Monitoring & Evaluation from UMI and a bachelors in Information Technology from Uganda Christian University.

Anthony Leontiev: As CTO, Anthony is responsible for all of Asaak's technology. Anthony most recently was a Senior Architect at AltSchool, where he was a team lead on front and back-end development projects. He was previously a software engineer at Honest Buildings and has worn various hats at early to mid-stage startups. Anthony is building Asaak’s mobile platform and automating the loan origination process. Anthony holds a bachelors in Computer Science from Carnegie Mellon University.

Anthony Leontiev: As CTO, Anthony is responsible for all of Asaak's technology. Anthony most recently was a Senior Architect at AltSchool, where he was a team lead on front and back-end development projects. He was previously a software engineer at Honest Buildings and has worn various hats at early to mid-stage startups. Anthony is building Asaak’s mobile platform and automating the loan origination process. Anthony holds a bachelors in Computer Science from Carnegie Mellon University.

Dylan Terrill As CBO, Dylan is responsible for overseeing Asaak's capital markets, finance and marketing teams. Prior to Asaak, Dylan worked on the Business Operations team at LendingHome, where he was for 2 years. At LendingHome, Dylan scaled the loan servicing/customer experience team from 2 individuals to over 50, helping lead teams like investor reporting, treasury, customer service and portfolio management. Prior to LendingHome, Dylan was an investment banker at William Blair & Company where he focused on M&A in the Consumer Retail space. He has held positions in venture capital, private equity, business development and capital markets in 8 different locations including Latin America and Africa. Dylan holds a bachelors degree in Finance and African American Studies from the University of Massachusetts Amherst.

Dylan Terrill As CBO, Dylan is responsible for overseeing Asaak's capital markets, finance and marketing teams. Prior to Asaak, Dylan worked on the Business Operations team at LendingHome, where he was for 2 years. At LendingHome, Dylan scaled the loan servicing/customer experience team from 2 individuals to over 50, helping lead teams like investor reporting, treasury, customer service and portfolio management. Prior to LendingHome, Dylan was an investment banker at William Blair & Company where he focused on M&A in the Consumer Retail space. He has held positions in venture capital, private equity, business development and capital markets in 8 different locations including Latin America and Africa. Dylan holds a bachelors degree in Finance and African American Studies from the University of Massachusetts Amherst.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...