Oracle Health is part of a group of exclusive medical technology startup companies that were selected by Johnson & Johnson Innovation to join their global network of med tech ecosystem. Companies in this program create life-saving, life-enhancing health and wellness solutions to patients around the world.

Problem

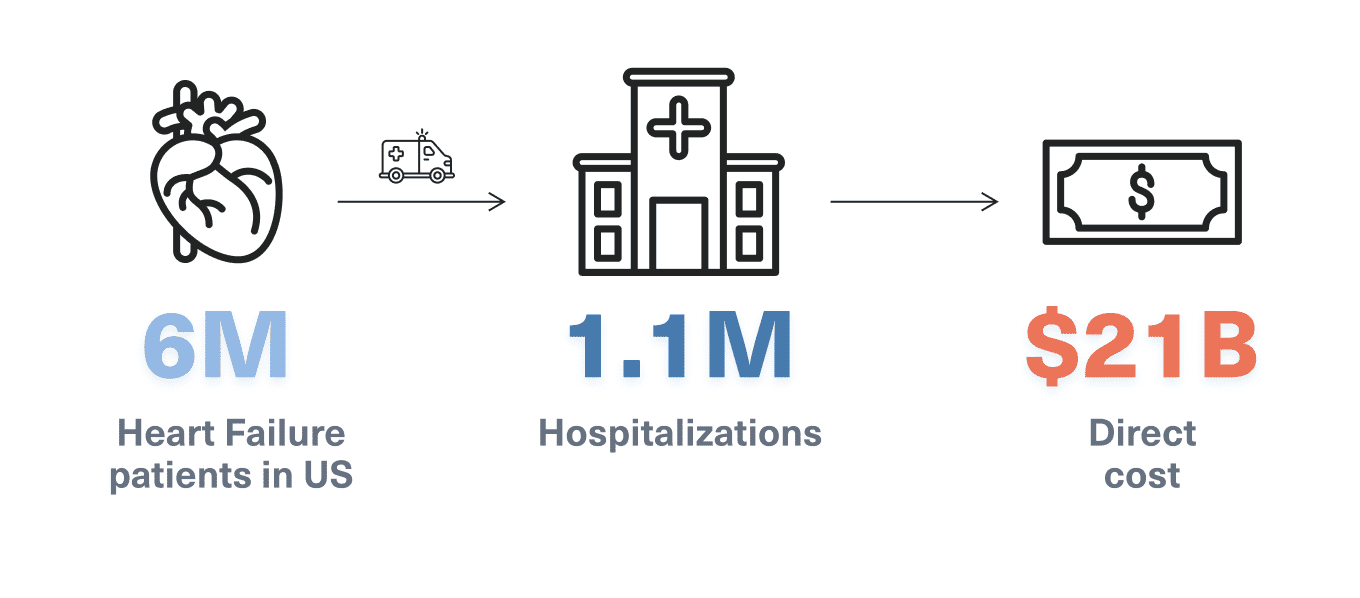

Heart Failure emergencies are a $21B problem

A lack of remote Heart Failure monitoring solutions make it difficult for heart failure patients and healthcare providers to address emergencies.

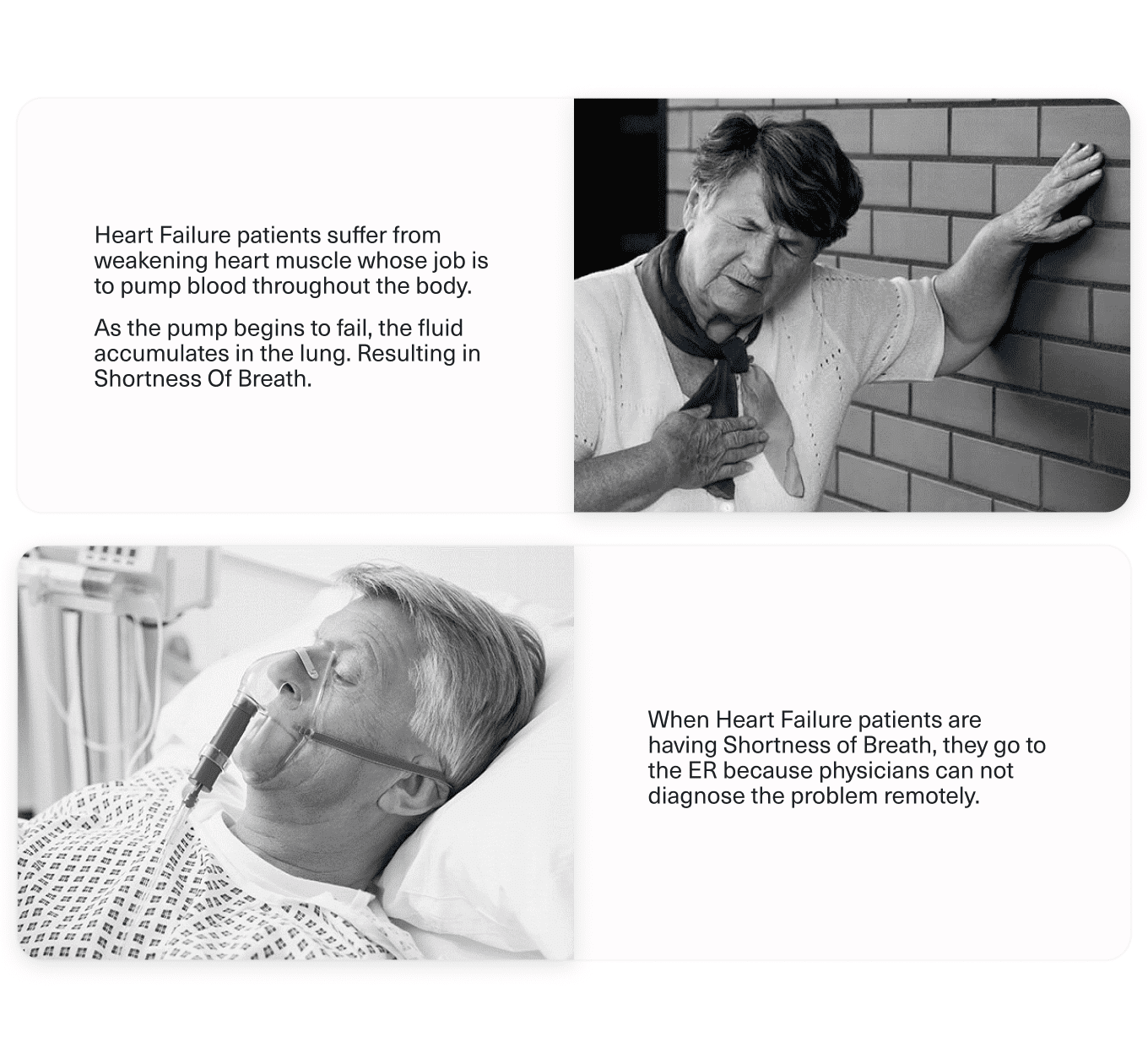

Heart failure is a cardiac condition that often results in breathing problems and frequent hospitalizations.

Heart Failure patients have weakened heart muscles. As the heart begins to fail, fluid slowly accumulates in the lungs, which can lead to sudden and severe breathing problems.

In the US alone, 6M patients suffer from Heart Failure. Canada and Europe are facing the same problem. Because of the lack of a remote monitoring solution for Heart Failure, patients are referred to the ER and subsequently hospitalized, even if it is a false alarm.

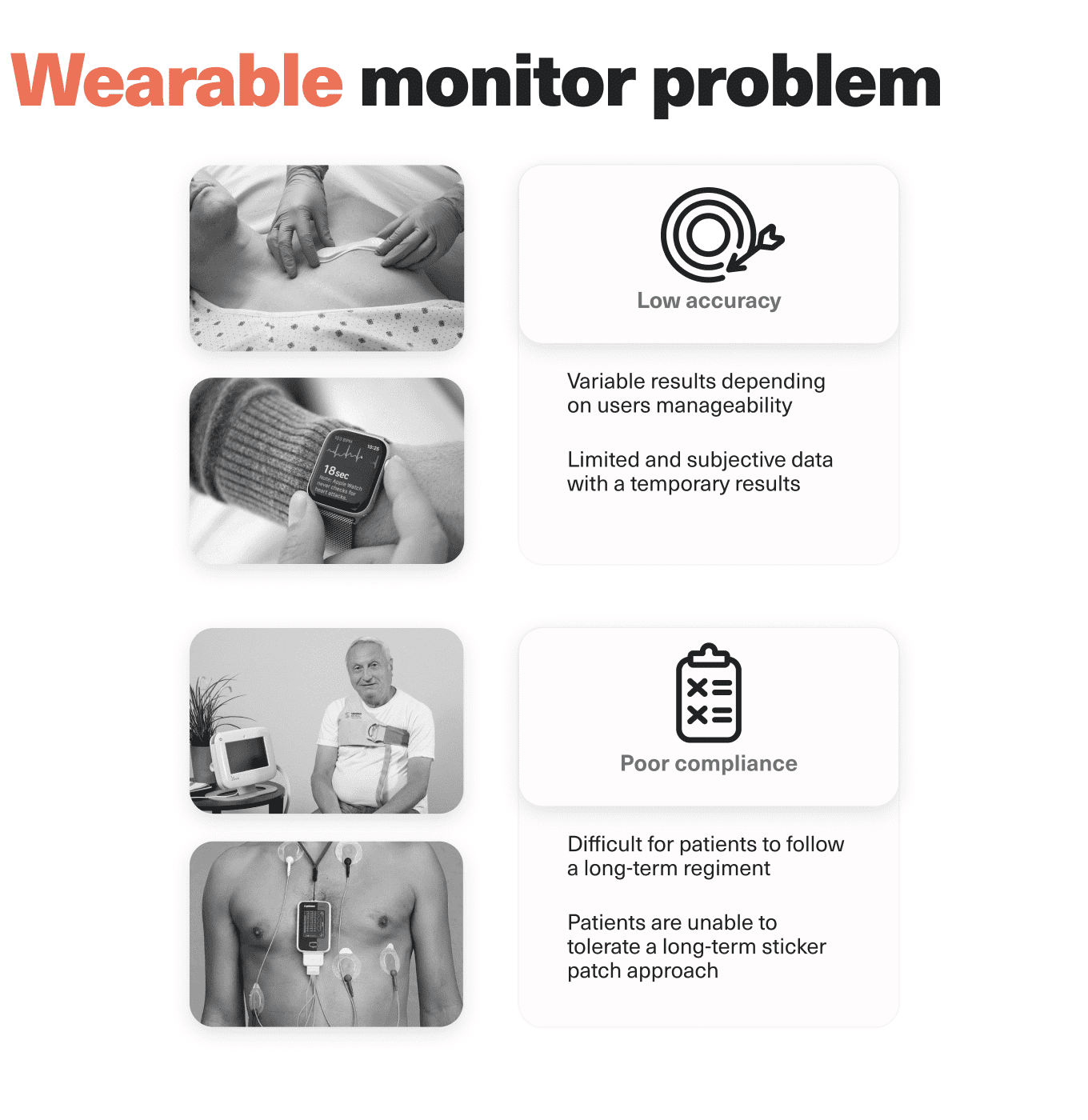

Wearable monitors suffer from low accuracy, patient non-compliance, and limited data. Therefore, they are not used when it comes to long- term Heart Failure monitoring.

Invasive heart procedure devices that are surgically placed inside or around the heart are accurate. However, they are expensive, complex and are not the ideal solution for all patients.

Solution

A Cardiac Monitor using remote tech and AI

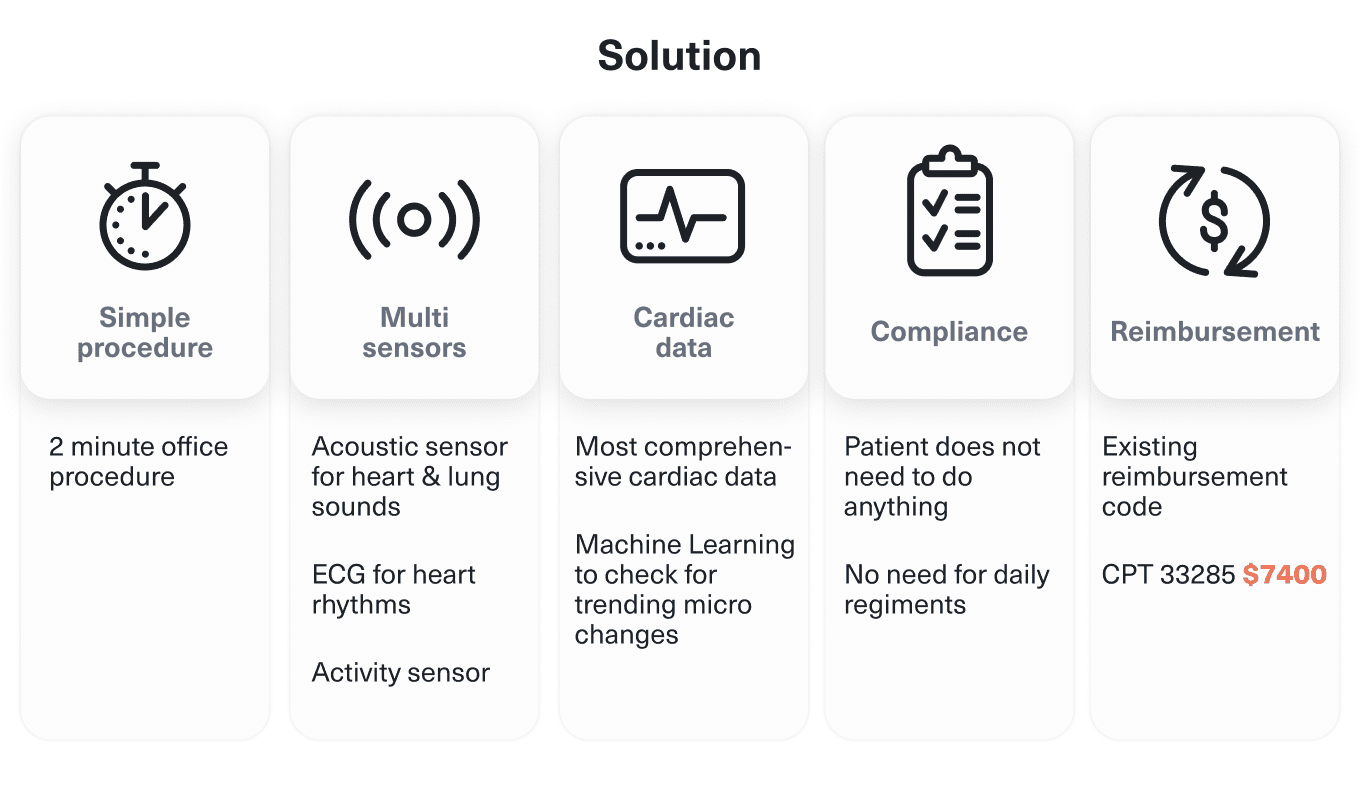

Oracle Health is developing a tiny, insertable cardiac device to monitor Heart Failure and reduce unnecessary hospitalizations. The device utilizes multi-sensors, remote monitoring technology and cloud based Artificial Intelligence for long term comprehensive cardiac monitoring.

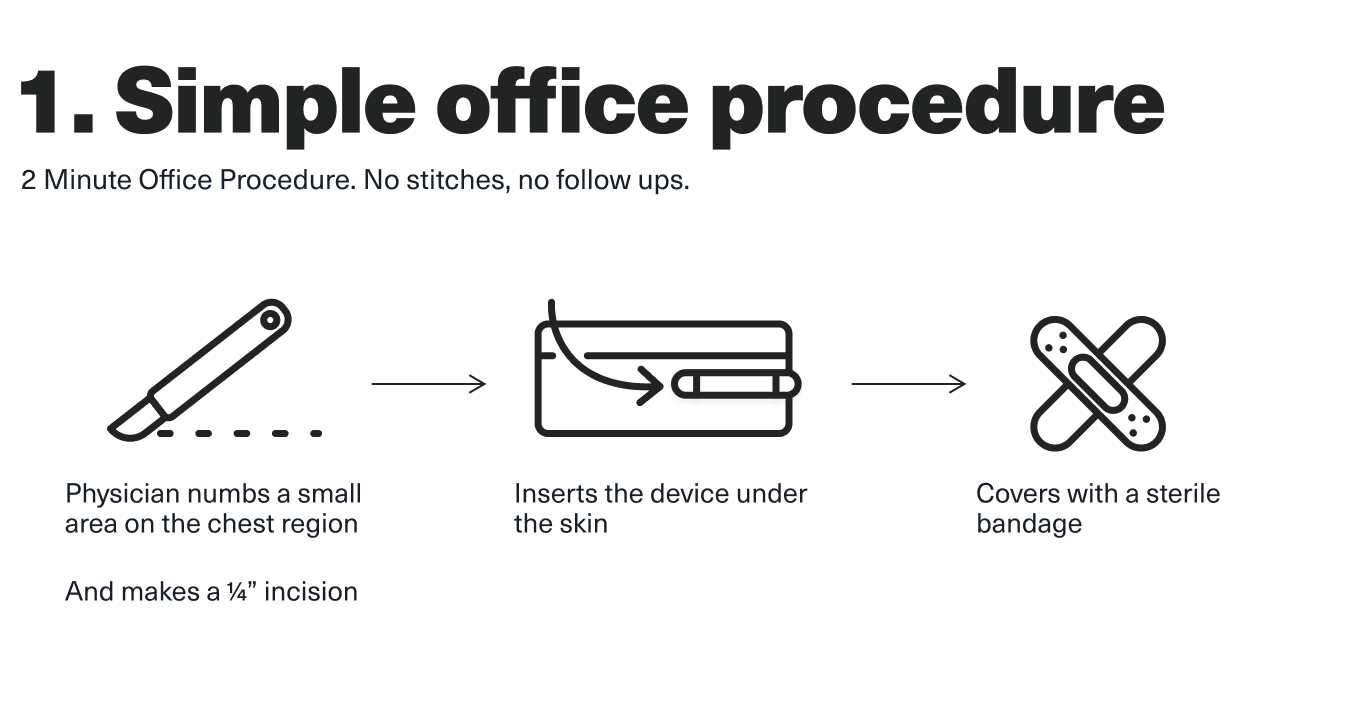

Implantation a simple 2-minute office procedure that does not require a follow up, saving time for both patients and cardiologists. The device is inserted under the skin for improved accuracy, and does not require invasive surgery that other implanted devices do.

By tracking trends in ECG and Heart Sounds readings, physicians can detect heart failure decompensation before the onset of symptoms. This gives them actionable data to steer the patient away from further complication.

Product

Billions of data points for a comprehensive long term cardiac monitoring solution

Oracle Health is developing a compact cardiac device that is inserted subcutaneously (under the skin) in a two-minute office procedure. Once administered, each device yields billions of data points, allowing healthcare providers to compare trending changes over 2-3 years for continuous cardiac monitoring. As Oracle collects more data, the analysis will improve through the use of machine learning and AI.

Our product relies on three main features: an acoustic sensor, an ECG, and a 3-Axis Accelerometer. The acoustic sensor listens to heart and lung sounds, while the Electrocardiogram (ECG) records heart rhythms and 3-Axis Accelerometer records activity, posture and body orientation.

Our device encourages patient compliance over the long-term, because patients do not need to follow a complex process to monitor their cardiac health.

Recorded cardiac data is securely transmitted to a smartphone, then to a cloud-based Artificial Intelligence algorithm for analysis, which the cardiologist can then review and take action.

By analyzing electrical and physiological trends, Oracle Health detects early signs of cardiac decline even before symptoms appear. This allows clinicians to prioritize at-risk patients, implement therapeutic interventions, and prevent hospitalizations.

Traction

Oracle Health is a part of exclusive medical technology startup companies that was selected by Johnson & Johnson Innovation to join their global network of med tech ecosystem to create life-saving, life-enhancing health and wellness solutions to patients around the world.

Oracle Health is a part of exclusive medical technology startup companies that was selected by Johnson & Johnson Innovation to join their global network of med tech ecosystem to create life-saving, life-enhancing health and wellness solutions to patients around the world.

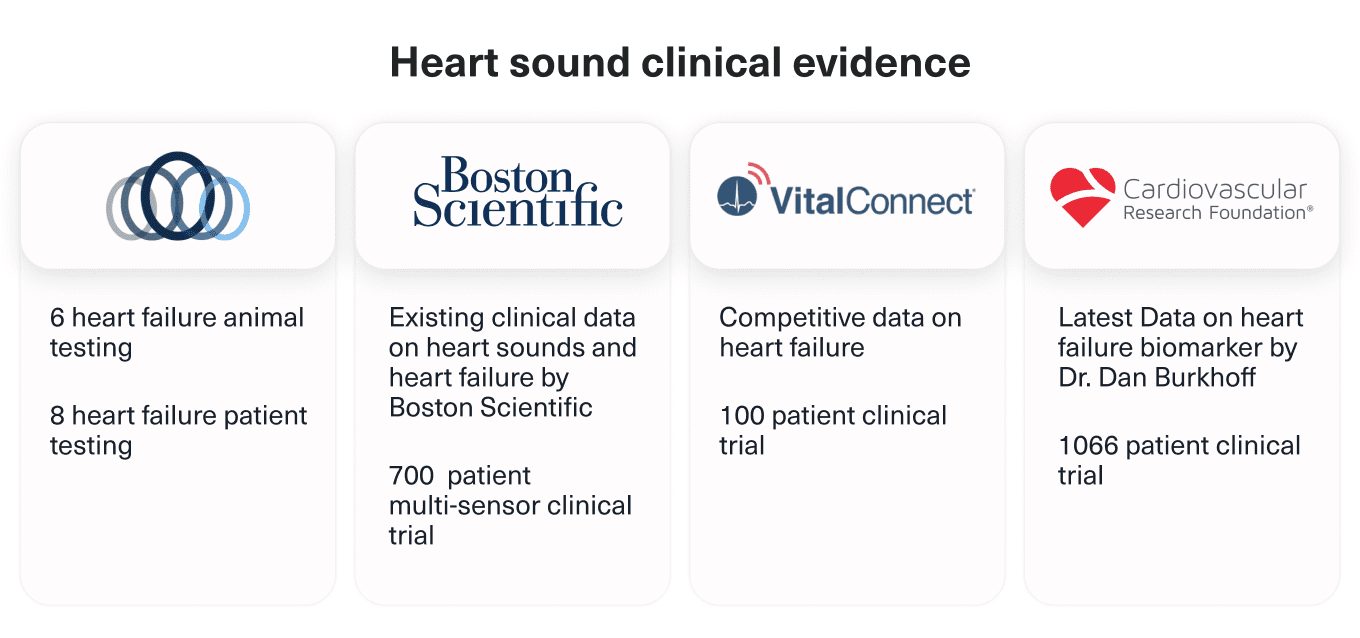

Strong clinical evidence for Cardiac Bio-Marker

There are clear physiological changes preceding acute cardiac events, but detection has traditionally required invasive implants inside the heart. Oracle Health detects early signs of cardiac decline before any symptoms appear by utilizing Heart Sounds clinical findings to the next level of analysis, using remote monitoring technology and artificial intelligence.

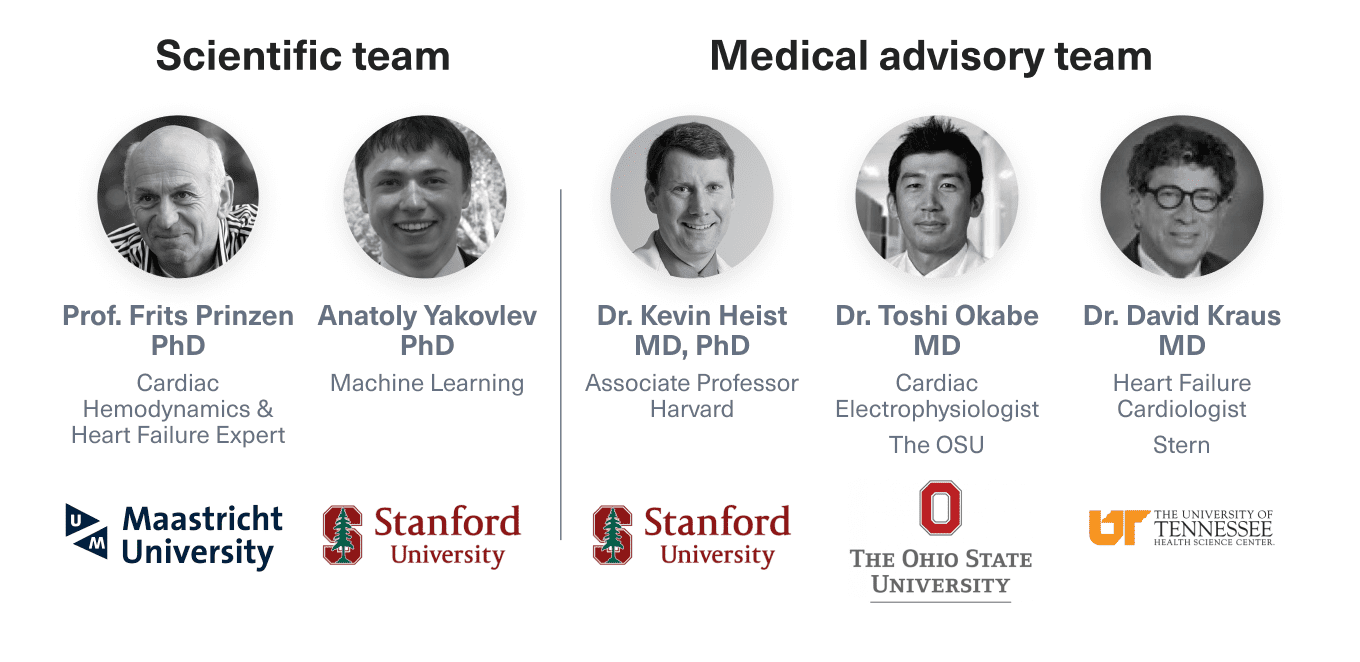

Since our inception, we've attracted world-renowned heart failure physicians, scientists and engineers. We currently have an NDA with top medical centers for a human implant clinical trial, as well as a strategic partnership for implantable batteries.

We are currently conducting human testing at world renowned Maastricht University.

We were also accepted to JLABS at Texas Medical Center .

Customers

6M patients suffer from Heart Failure in US

Oracle Health was created for the sole purpose of offering comfort to 6M+ patients, family members, and care providers in the form of comprehensive heart failure management. As such, our customers are not only those who suffer from heart failure but those who treat it as well. Our device allows physicians to see trending changes in each individual patient, meaning both patients and physicians act with the most-informed medical agency at all times.

Business model

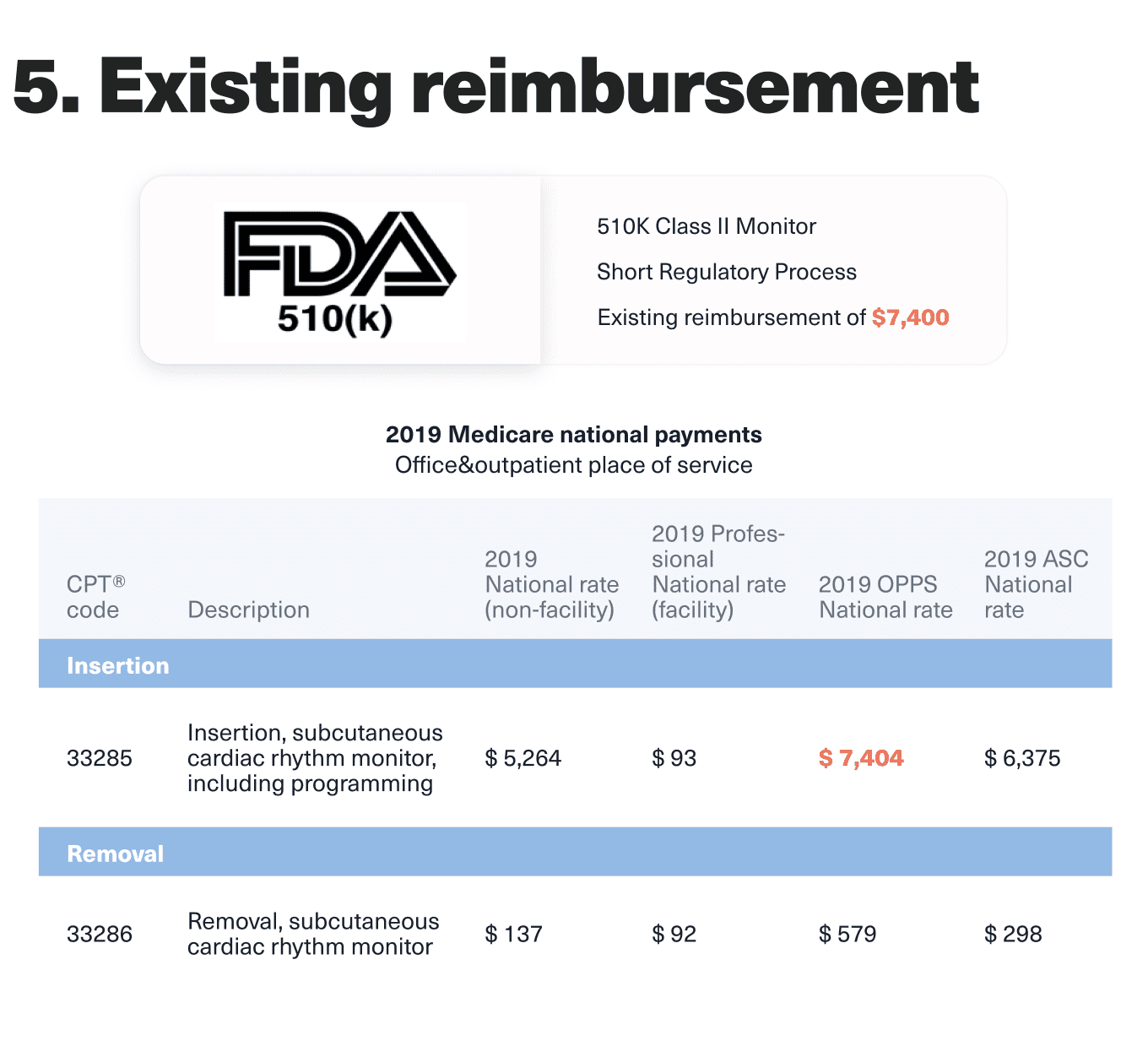

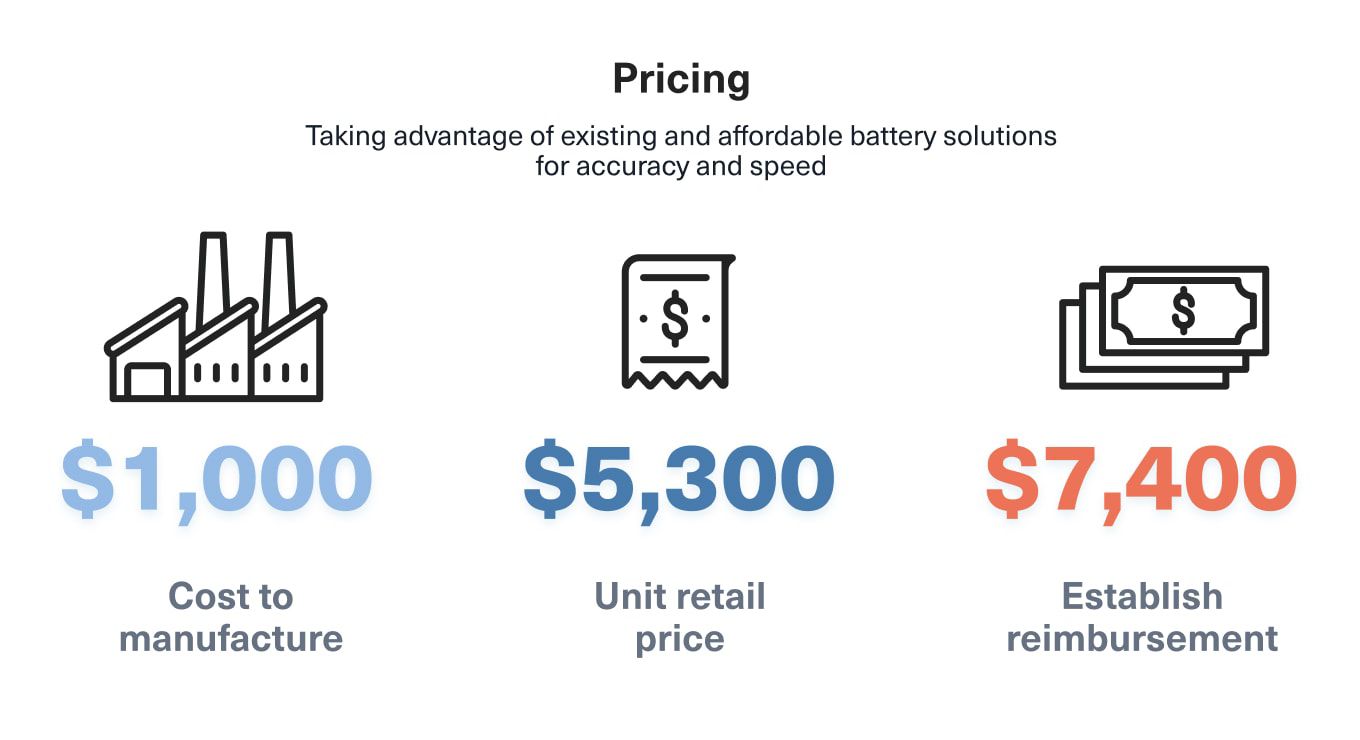

Short Regulatory Path with existing Insurance Coverage of $7400 / device for commercialization

Oracle Health has a simple go-to-market plan.

Oracle Health has a simple go-to-market plan.

First, we will focus on two highest volume regions, Texas and Florida. We expect Texas and Florida to generate $5.5M within two years of launch. Each unit will retail for $5,300/unit with an established reimbursement of $7,400. With this business model, we project that our first 5K implants will generate $26M in revenue within 4 years.

Second, we will obtain the most comprehensive, long-term cardiac data to date. This will allow Oracle Health to venture into predictions for cardiac events, and human longevity study.

Market

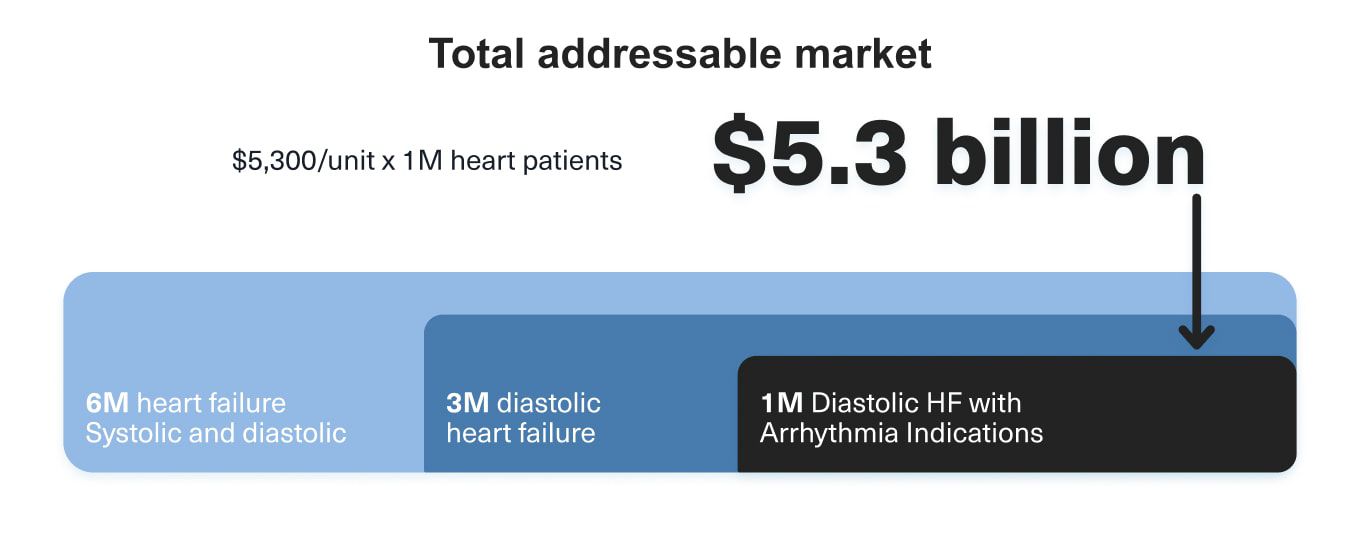

$5B Total Addressable Market opportunity

Initially, Oracle Health will focus on the 1M of heart failure patients who are in immediate need of remote monitoring solutions. Eventually we hope to reach all 6M Americans who suffer from heart failure.

Competition

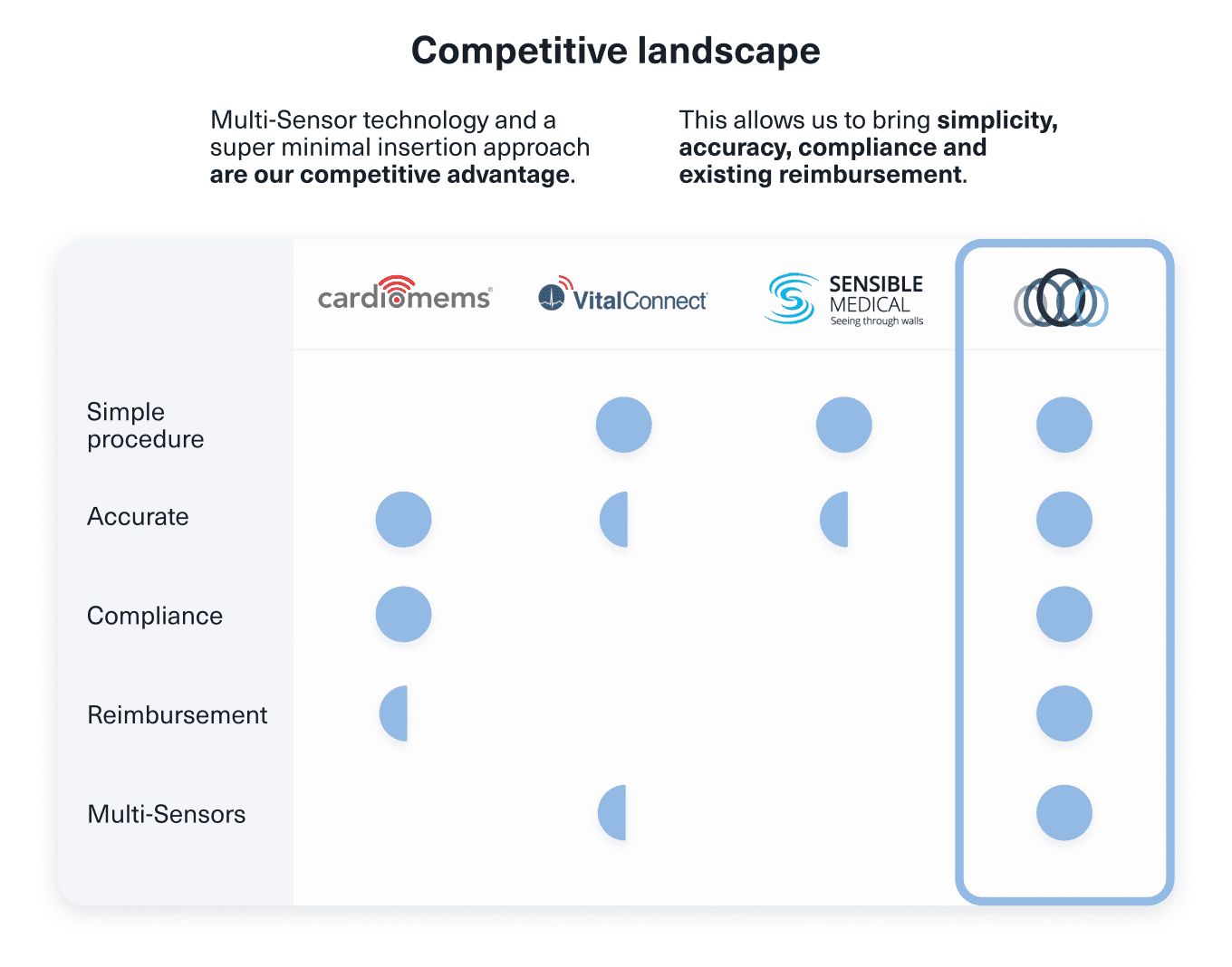

Complete solution for Heart Failure using remote monitoring technology with Multi-Sensors and A/I

Multi-sensor technology and a super minimal insertion approach are our competitive advantages. This allows us to bring simplicity, accuracy and compliance never before seen in telemedicine or a heart failure monitor. Our simple office procedure, accurate data and comprehensive diagnostics, and existing reimbursement means we outperform competitors across the board.

Vision and strategy

Long term solution for chronic patients using remote monitoring technology

With your investment, Oracle Health will make an everlasting impact on heart failure patients and our health care system. We will develop a long-term monitoring solution for patients to help prevent and reduce heart failure hospitalization. Along the way we aim to build the largest database of detailed heart data in the world.

With your investment, Oracle Health will make an everlasting impact on heart failure patients and our health care system. We will develop a long-term monitoring solution for patients to help prevent and reduce heart failure hospitalization. Along the way we aim to build the largest database of detailed heart data in the world.

Founders

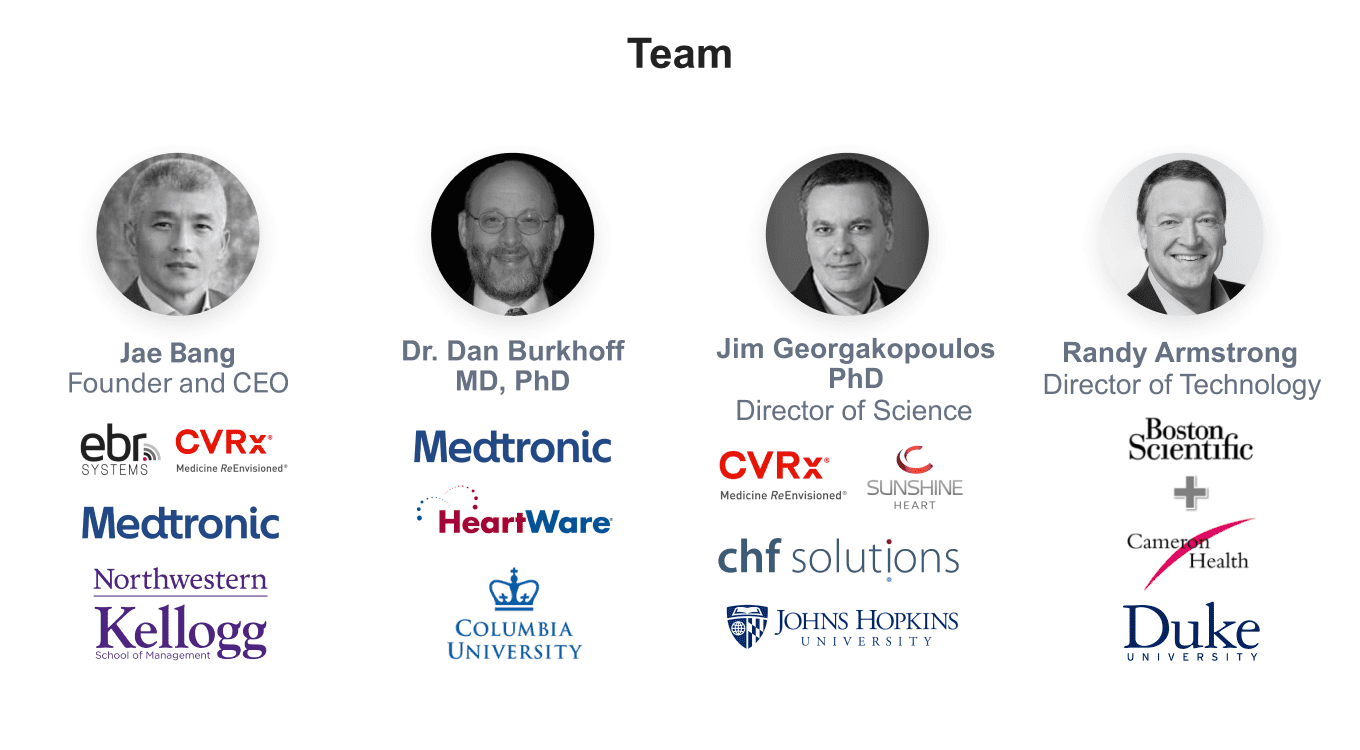

Team of cardiologists, scientists, engineers and entrepreneurs with over 180 years of combined expertise

Funding

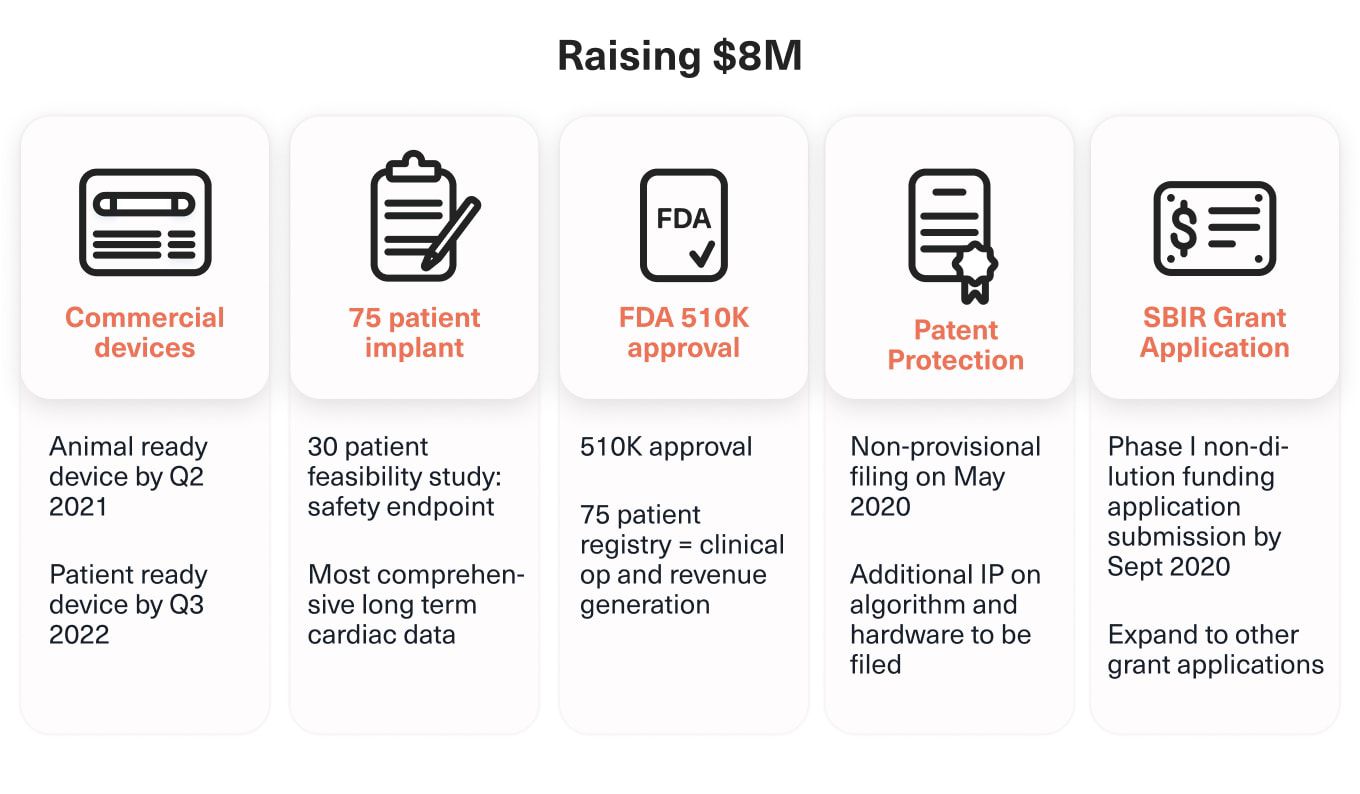

Raising $8M

Oracle Health is looking to raise $8M. Funding will go towards developing a commercially competitive device within 2 years to go after $5.3B market.

Disclaimers

Your investment is binding and irrevocable, although we reserve the right to reject it for any reason or no reason at all. Funds committed will remain in an escrow account maintained by Prime Trust, LLC until such time as a closing occurs. We will not be issuing share certificates; your investment will be solely recorded in book-entry electronic form by Vstock Transfer, LLC. our transfer agent and registrar. Investors will be to purchase shares of shares of our Common Stock through OpenDeal Broker LLC. We will pay, OpenDeal Broker LLC, a registered broker-dealer – a 6% cash commission on any plus a certain offering costs. Please review OpenDeal Broker LLC’s Form CRS. OpenDeal Broker LLC may require additional documents or information from you to complete your purchase, you will be contacted by a registered representative in this event.

An offering statement relating to Oracle Health, Inc.’s Common Stock has been filed with the Securities and Exchange Commission and became qualified on January 13, 2021. Prior to any investment Oracle Health, Inc.’s Common Stock, you should review a copy of the offering circular, or by contacting Oracle Health, Inc. by phone at (727) 470-3466 or writing at 910 Woodbridge Court Safety Harbor, FL 34695. No offer to sell any securities, and no solicitation of an offer to buy any securities, is being made in any jurisdiction in which such offer, sale or solicitation would not be permitted by applicable law.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...