NEW YORK, Aug. 16, 2022 (GLOBE NEWSWIRE) -- Today, Inc. revealed that Unbanked, a blockchain-enabled fintech company well...

Problem

Banking technology is decades out of date

Solution

A global neo-bank platform built on blockchain

Introducing a new kind of banking experience that empowers everyone to participate in the financial system—whether they choose to work with a legacy institution, or take complete control by becoming their own custodian of blockchain-based assets.

Our platform puts mobile digital banking first; and, with blockchain technology, we're able to provide a better, cheaper, faster experience.

Choose your own financial experience

Go beyond the traditional “off the shelf” approach to modern banking, and take advantage of a suite of crypto-enabled financial products and features that meet (and exceed) the needs of your life.

Modern solutions for modern problems

Blockchain is more than just a buzzword—it’s a real solution for an outdated system of fees and slow payments that impact each consumer. By utilizing this cutting-edge technology, Unbanked is able to help you reduce processing times and keep more of your money.

Use digital currency in real-time

From depositing and spending your digital currencies, to sending payments anywhere in the world, Unbanked puts the control back in your hands—without the need for an intermediary.

Seamlessly convert fiat to crypto

Want to buy crypto? Simply send USD to your Unbanked bank account via wire, ACH, or credit card. You can then purchase currencies like Bitcoin and Ethereum and settle to your self-custodial wallet. Your keys, your crypto!

Product

Get Unbanked

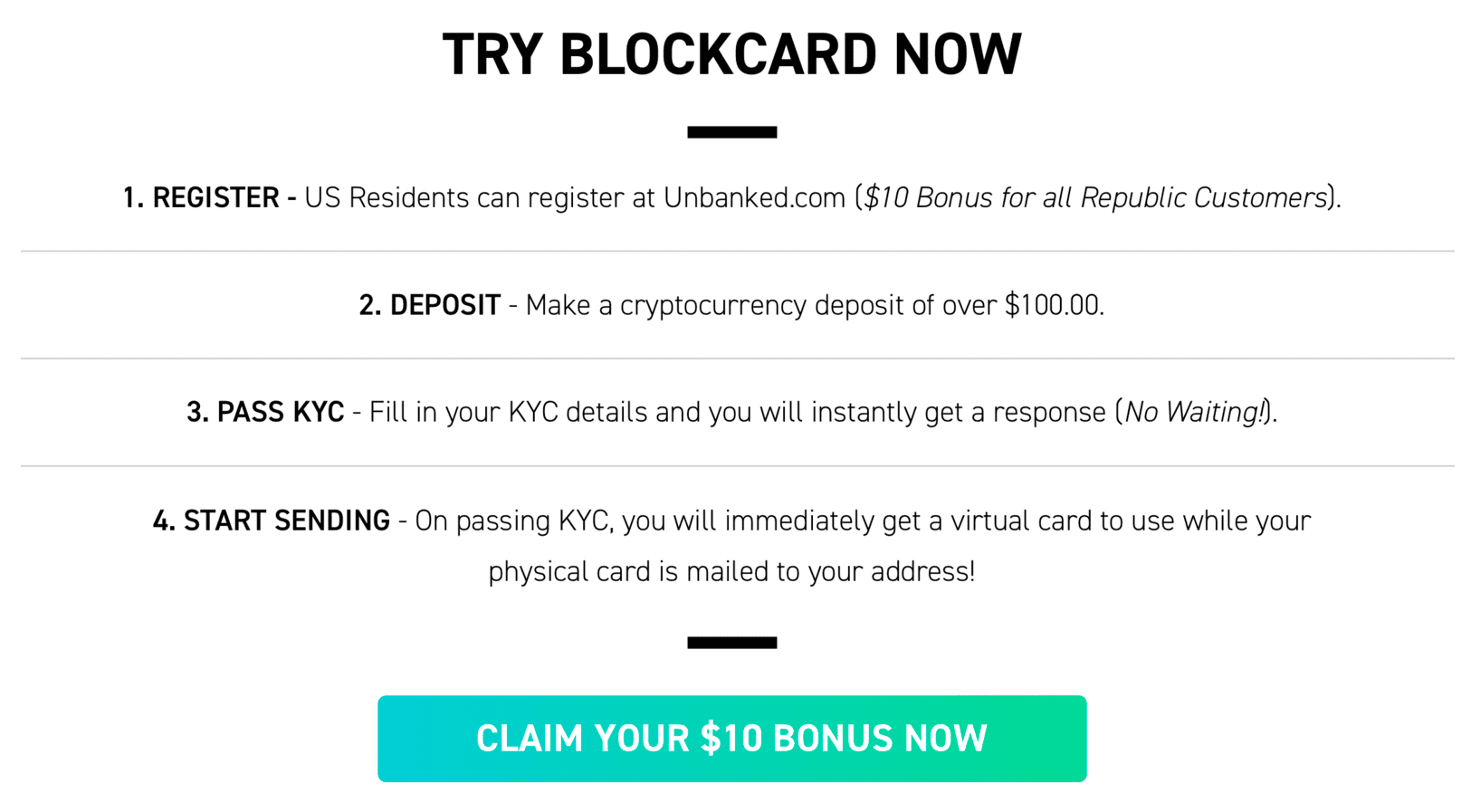

Unbanked offers a suite of financial products designed to give your cryptocurrency real-world utility. Whether pairing with one of today’s leading payment digital payment platforms like Apple Pay, or swiping your card in person at one of the millions of supported locations worldwide, Unbanked puts your money back in your hands.

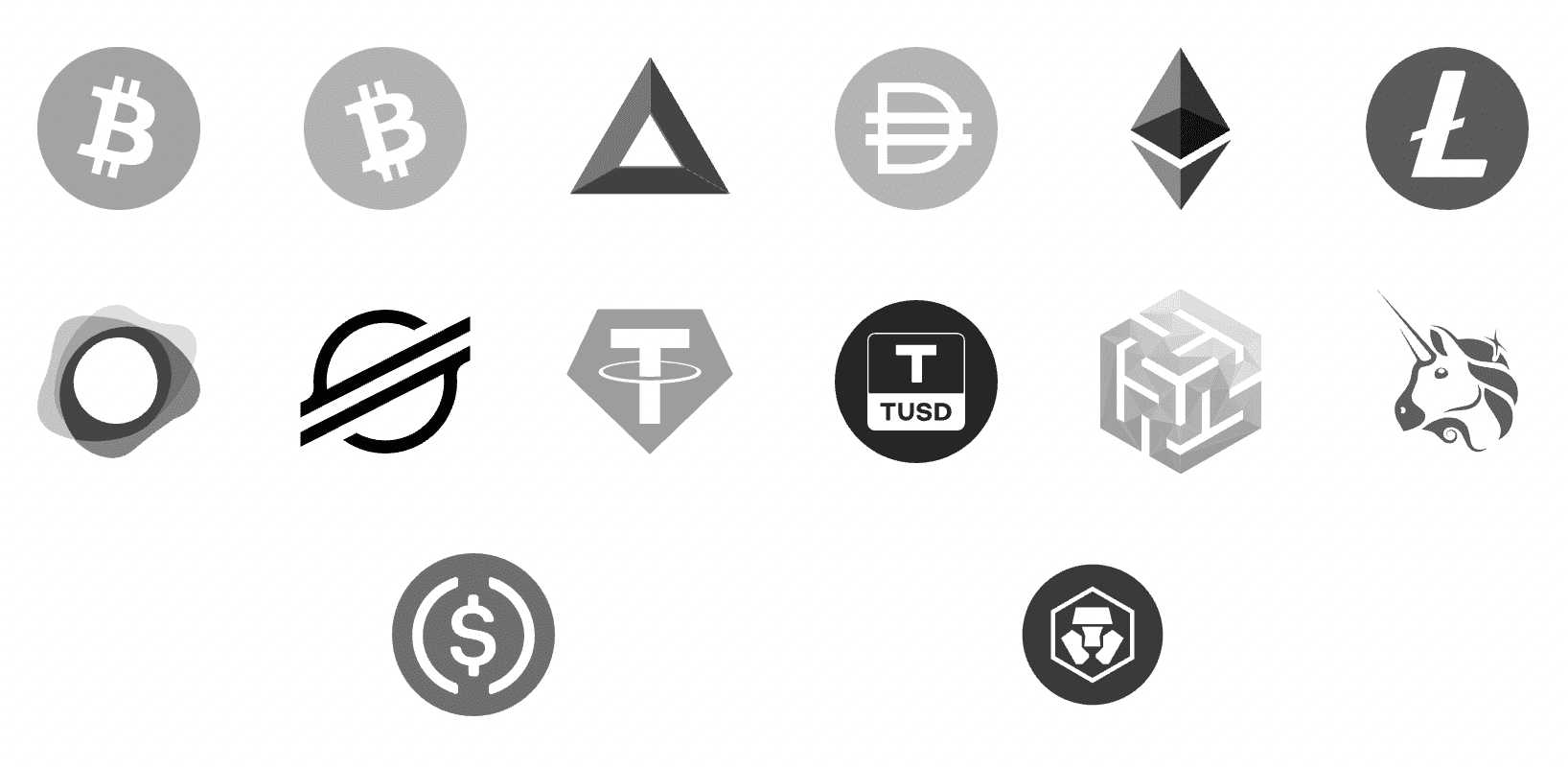

Blockchain- and token-agnostic

Fund in multiple currencies

Integrated with

How the Unbanked

BlockCard works

You can pair your card with Apple, Google, or Samsung Pay to make payments or swipe normally. You can also fund your card with cryptocurrency, an Unbanked bank account, or at thousands of retailers worldwide like Walmart, Walgreens, and 7-11.

Unbanked's Intuitive

Bank Accounts

A better kind of financial experience

Unbanked’s Intuitive Bank Accounts empower global citizens with a globally-supported, crypto-friendly financial instrument that tracks everything from spending and purchasing to transfers and beyond.

Borderless transfers

No matter if you’re sending money to a friend across the city or someone across the world, Unbanked makes it better, faster, and cheaper to send money whenever (and whenever) you need it.

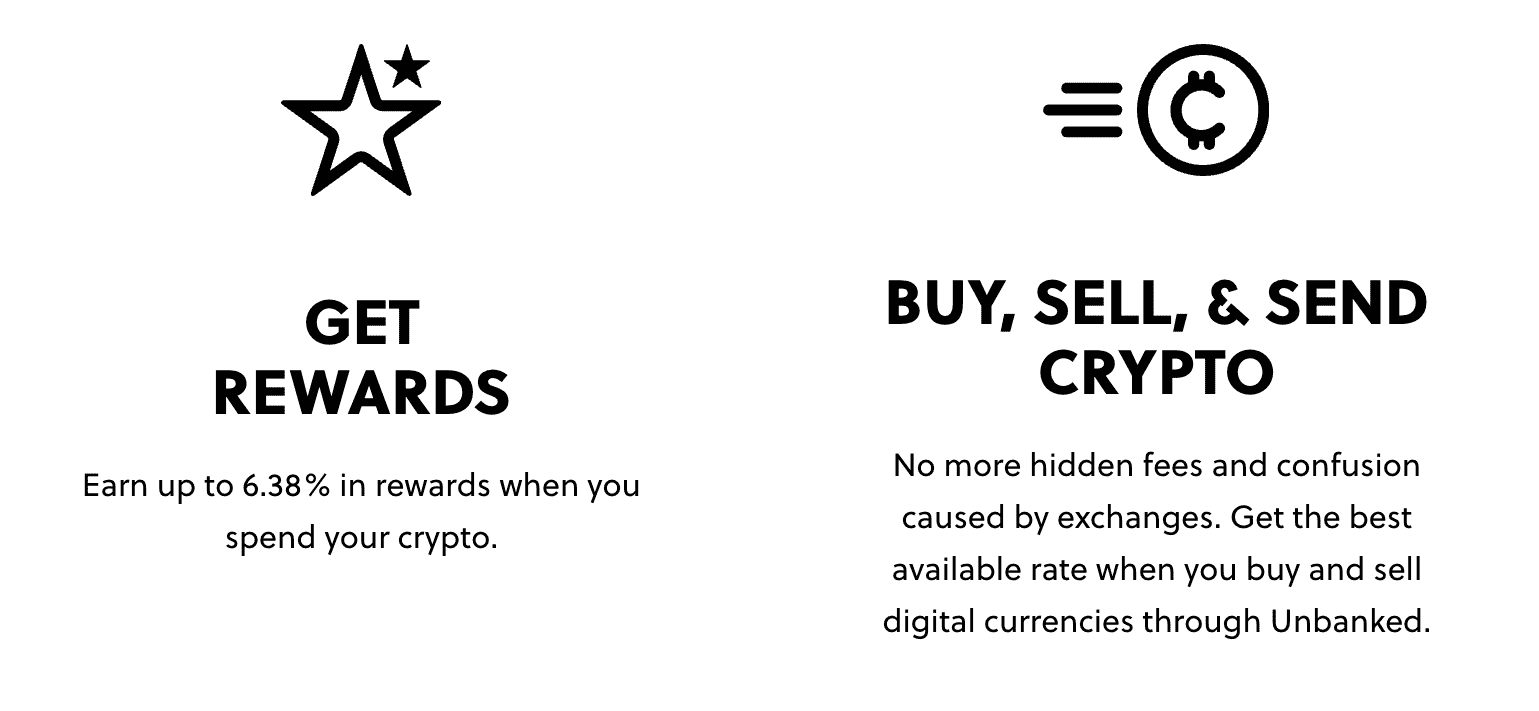

Link with your BlockCard

Whether you’re transacting online or offline at one of the millions of locations around the world, the Unbanked Bank Account gets even more powerful when you link it with the BlockCard. You can even get up to 6.38% on all your purchases.

Crypto purchases, done better

Purchase BTC, ETH, and TERN directly from your bank account to your self-custodial wallet with no hassle. We will even aggregate prices across multiple exchanges to help you find the best price. Most important, we settle the purchase to your self-custodial wallet so you're always in control.

Your currency when you need it

Unlike other platforms that make you wait days or weeks for access to your crypto purchases, Unbanked offers near-instant settlements of them to your self-custodial wallet.

Traction

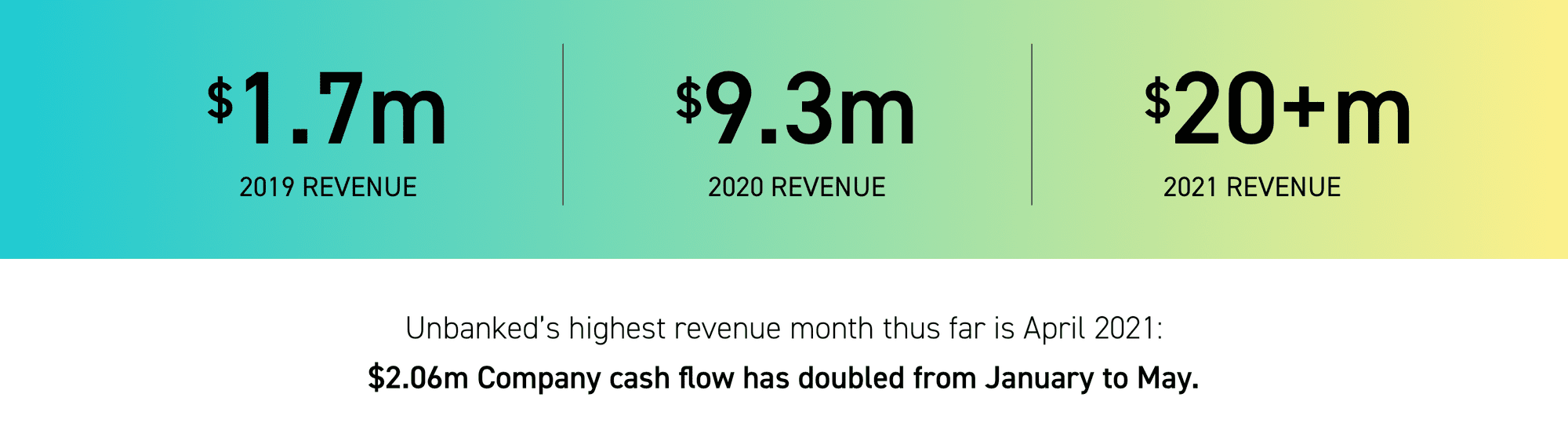

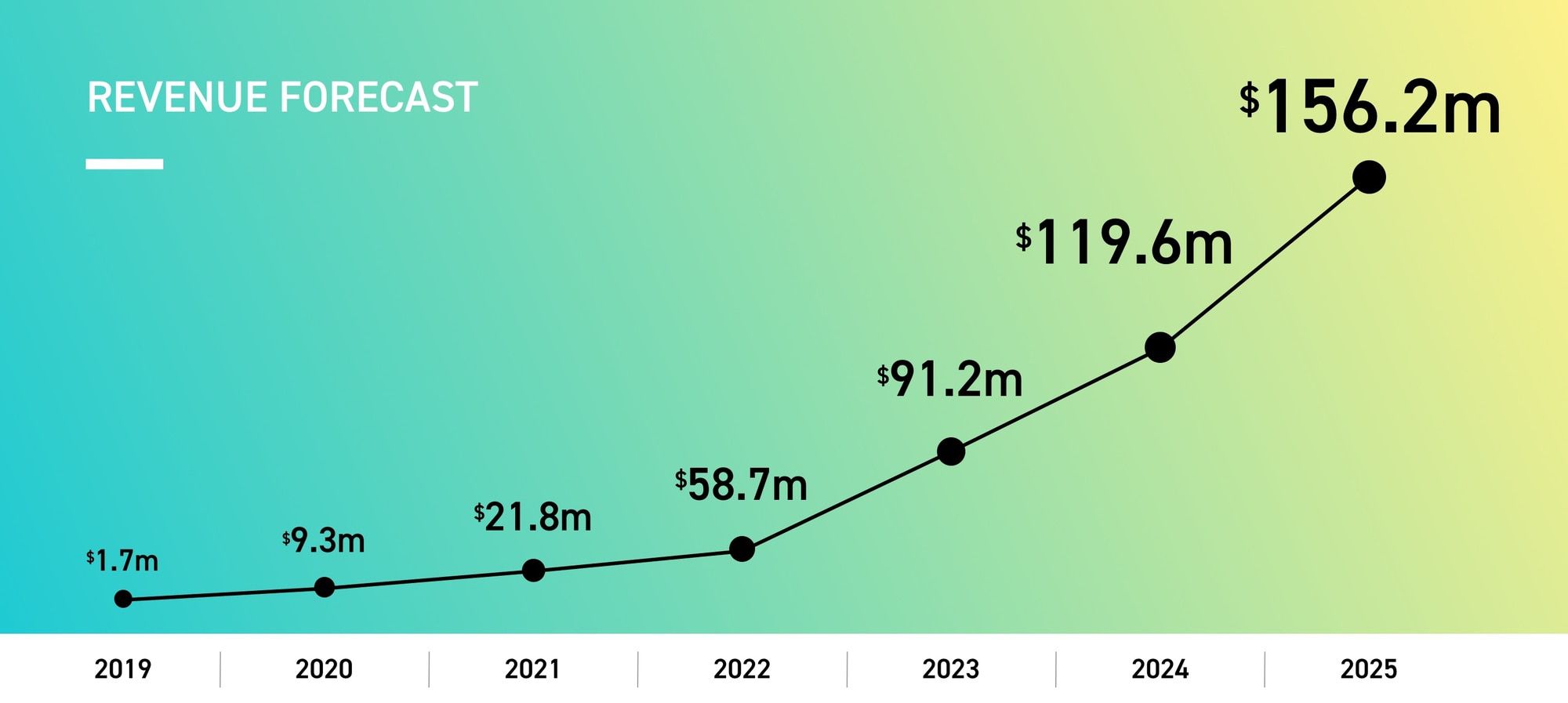

5x YoY revenue growth

Operational milestones

—

- Debit card issuance is live in all 50 states, 31 countries in EEA (imminent) as well as LATAM.

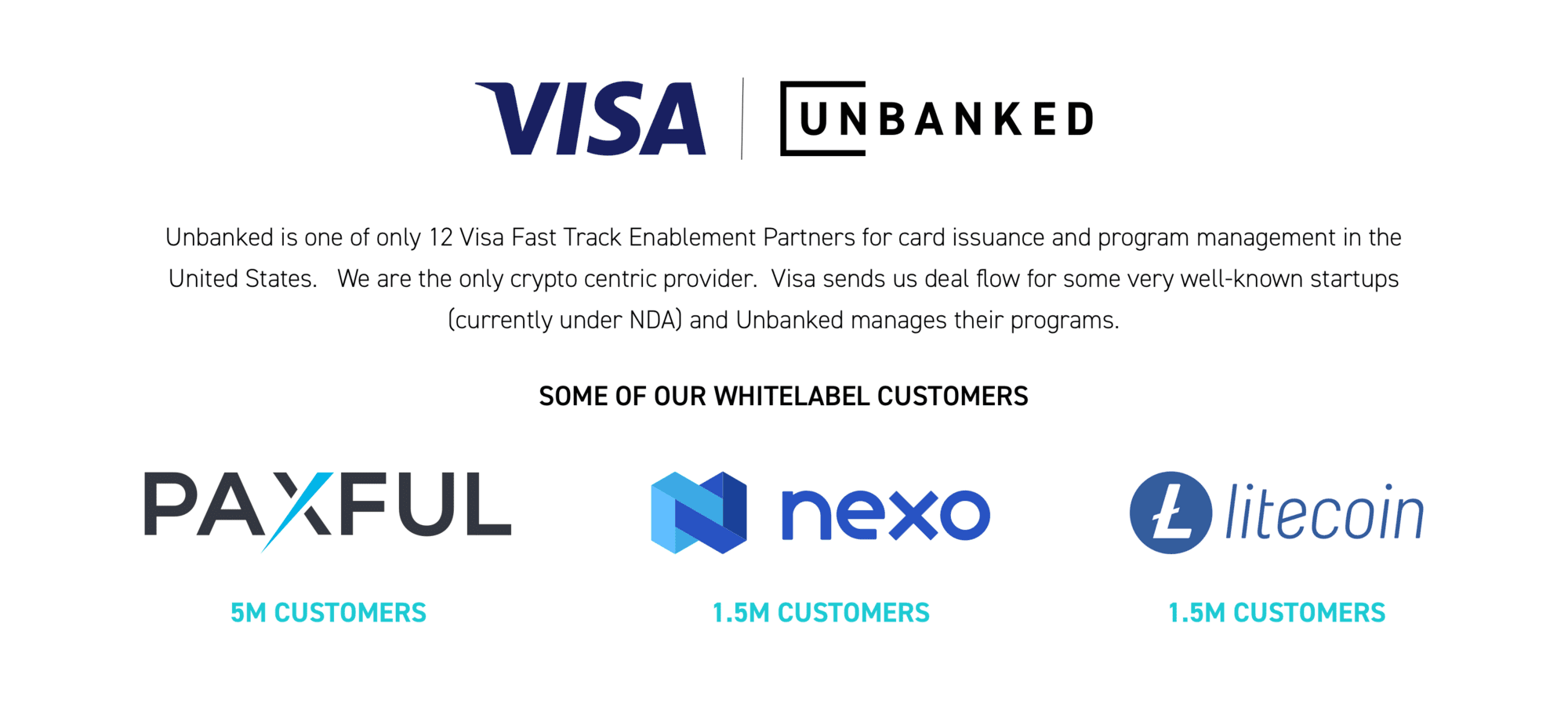

- 1 of only 12 VISA Fast Track Enablement Partner for Card Issuance and Program Management. Only one with a crypto focus.

- Global crypto wallet services enabled, accepting 14 cryptocurrencies

- FDIC insured global bank accounts with wire, ACH, and Plaid integration. Supporting over 200+ countries/territories.

- More than 10 organizations are white-labeling our platform.

Notable customers & partners

Revenue

Unbanked’s highest revenue month thus far is April 2021, at $2.06M. Our company cash flow doubled from January 2021 to May 2021. At this pace, we are forecasting $20M+ for EOY 2021.

Customers

Scaling to support

millions of customers

Our team is planning to scale Unbanked significantly in the coming years, and be able to support tens of millions of customers globally. This will be through a combination of direct-to-consumer programs and business-to-business programs.

—

Consumers

—

—

B2B partners

—

We work with some of the leading blockchain-based companies in the industry including the Litecoin Foundation, Paxful, Nexo, StormX, and many others. Enabling these great organizations to white-label our platform gives their customers real-world utility over digital assets.

Charlie Lee is the founder of Litecoin. You can listen to him talk about the Unbanked powered Litecoin Card here:

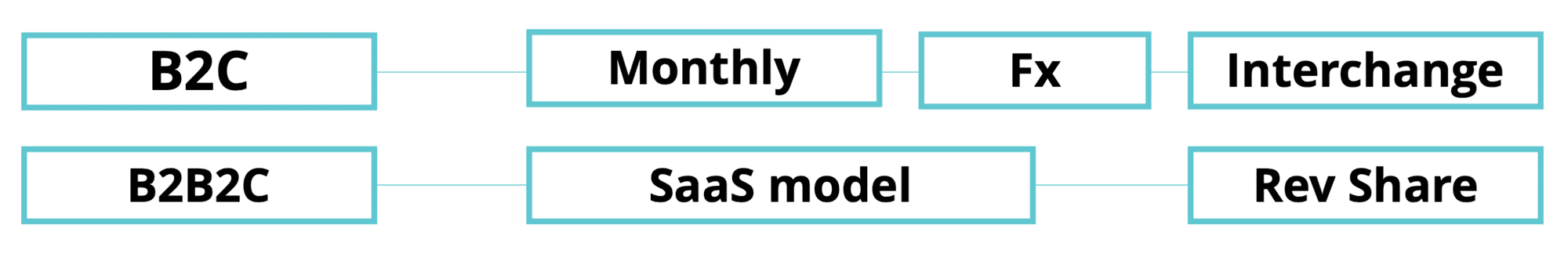

Business model

Using economies of scale to fuel revenue growth

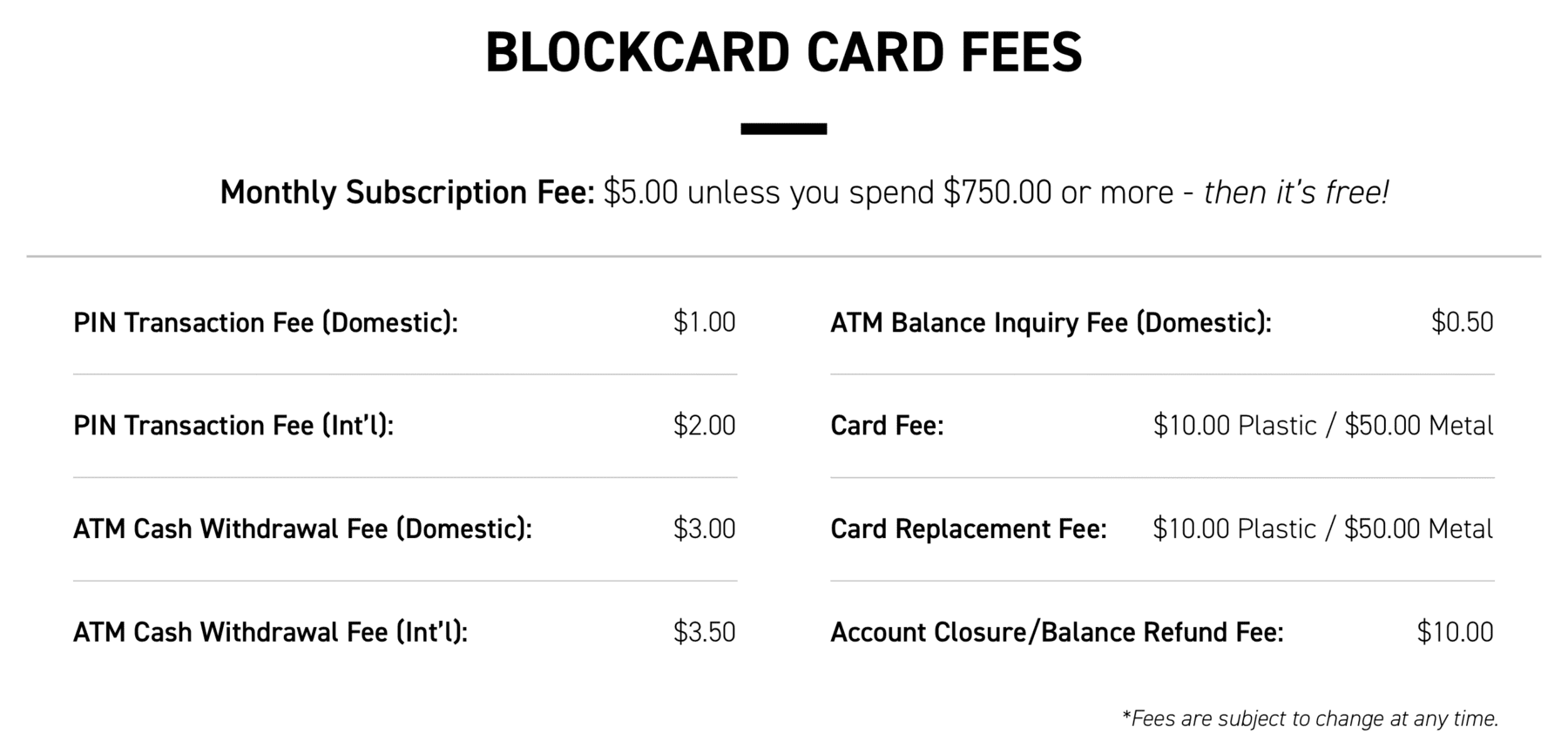

Unbanked shares in all fees generated from the users who interact with our platform either through our card programs, bank accounts, or our white-label partnerships who pay a licensing fee in addition to the sources below. Typically it is a combination of factors.

While fees help us make money, we want to keep them low—and rather use economies of scale to make money from our customers. Our philosophy is: a smaller piece of a bigger pie.

Interchange fees

Credit card companies like VISA have negotiated interchange fees with merchants. These typically range between 1–3% of the consumer’s purchase. Unbanked shares in these interchange fees that the merchants pay; so, as the spend increases on the platform, the total revenue generated from fees does as well.

Purchase crypto spread

When users convert dollars to cryptocurrency we don't charge fees but can make money on the spread, between 0.5%–3% depending on the asset. We can achieve this through the aggregation of multiple markets while keeping the customer's price competitive.

Future fees

We expect to have other revenue streams as part of our roadmap as we release products such as remittances, borrowing, and lending, as well as larger margins that come with scale. We plan to focus on marketing our product innovation, user experience, and competitive pricing to drive growth and profitability.

Market

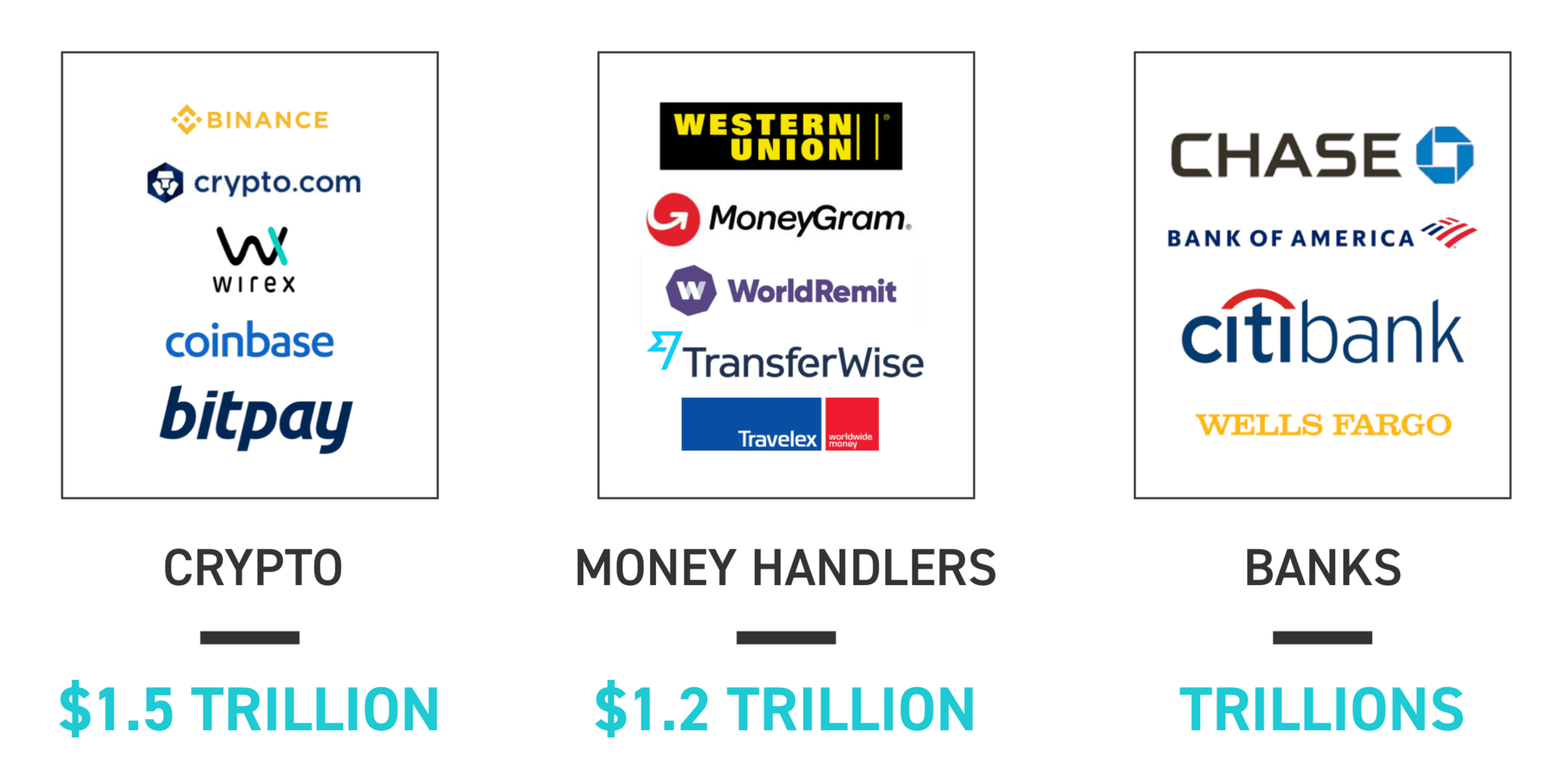

This is asymmetrical warfare—and the opportunity size is in the trillions

We are taking the antiquated ACH and Wire payment system that is closed-loop and opening it up to the blockchain rails—where payments are cheap and fast.

Cryptocurrency adoption is rapidly increasing (hitting a market cap over $2T dollars and forecasting 221M users this year), but the market is still in its infancy. In order to get the next 500M people interacting with crypto, they need tools they're familiar with—like bank accounts and debit cards.

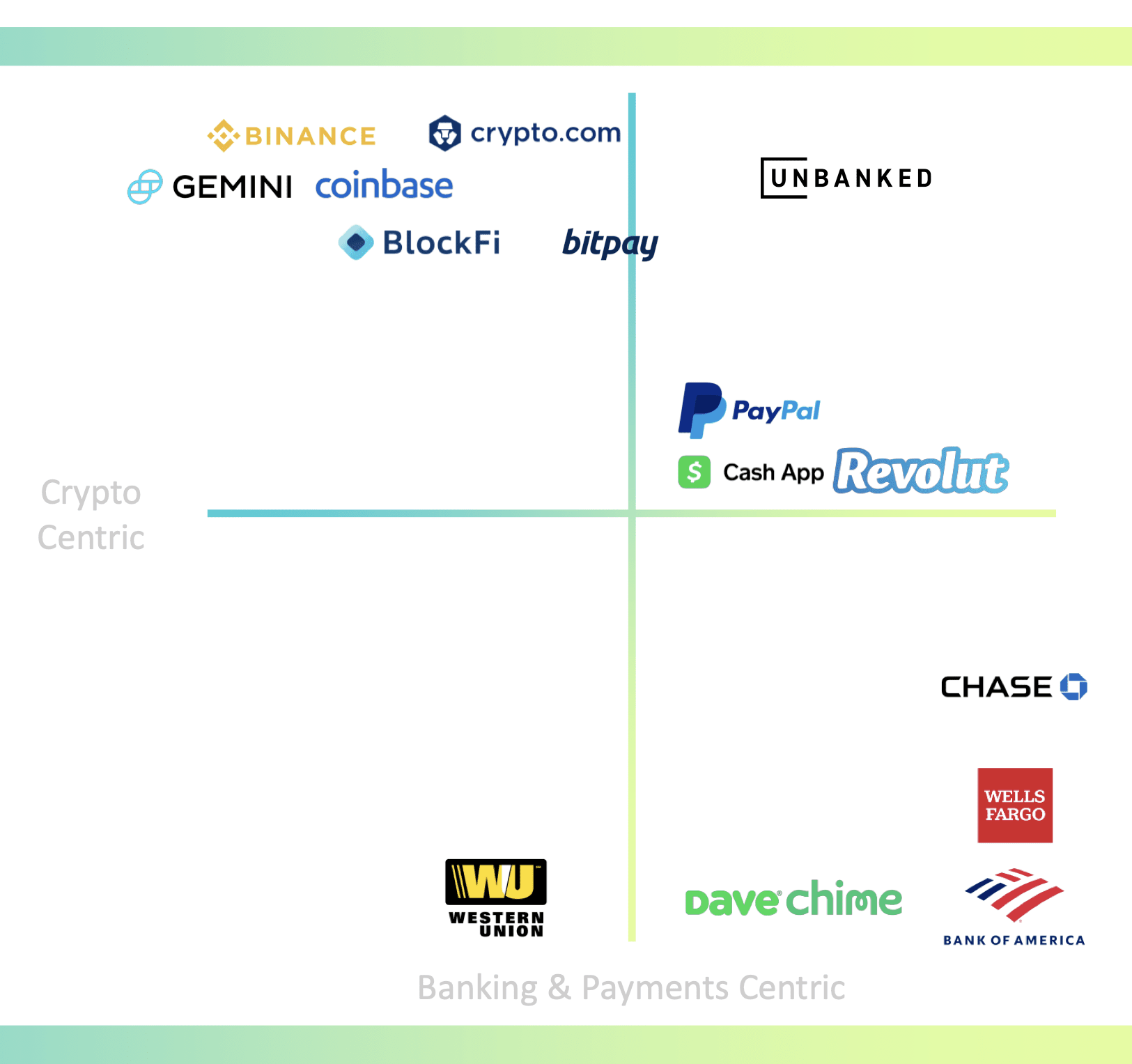

Competition

Competitive analysis

Unbanked is often compared to other crypto card companies, but our product is so much more than that.

Like traditional banks, we offer bank accounts that hold cash and debit cars for spending; but like crypto companies, we enable those bank accounts to buy and withdraw crypto, or to use that crypto and spend it on a debit card.

Our long-term vision is more competitive with Revolut or Coinbase, but with a B2B focus: enabling other companies to have their own crypto-friendly fintech offerings to their customers, including cards and bank accounts.

Revolut raised $880M at a $33B valuation in July of 2021. Coinbase did a direct listing on NASDAQ in 2021 at a valuation of $85B. Both are strong in their industry focus, but each have built walled gardens and do not have the white-label flexibility that Unbanked has built.

Vision and strategy

Planning for the future

With a successful raise, we will increase our marketing spend and aggressively grow our customer base. We will also enter into as many global markets as possible. This includes EU, LATAM, APAC, EMEA, Canada, and others. Doing it properly means collaborating with regulators and ensuring we adhere to local laws.

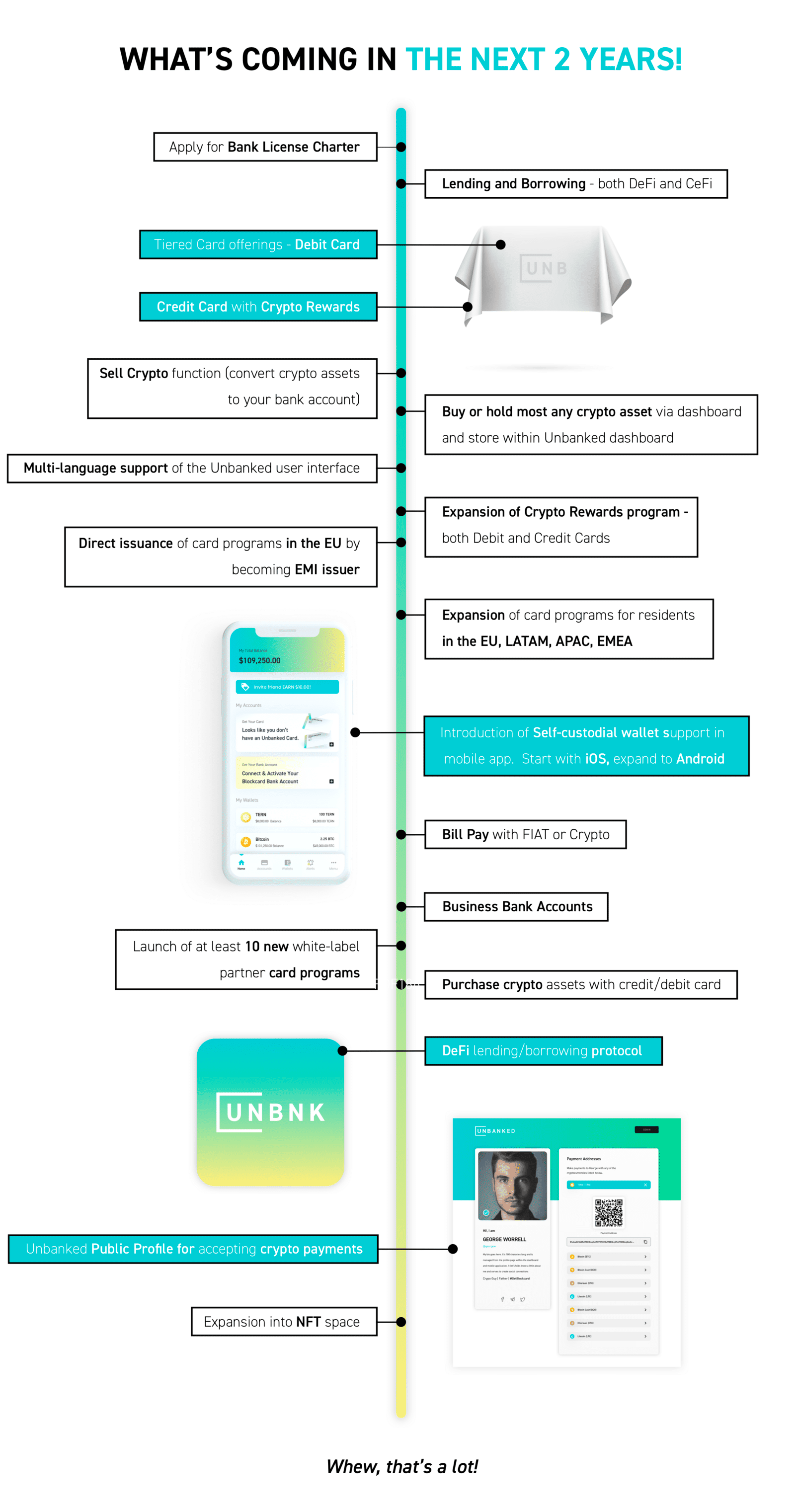

Roadmap

We also have an ambitious roadmap of new products and services we intend to bring to the marketplace. Some of these include:

Use of company funds

- Marketing

- New hires

- Regulatory/Legal

- Building new products/services

- Expanding geographic reach

Funding

$1.4M raised to date

Unbanked has raised approximately $1.4M to date. Both of our previous rounds have been oversubscribed. Our last round was held on Republic where it hit the cap of $1,070,000 from over 3,700 investors.

Hear from previous investors!

Founders

A mission to transform financial access and control

Unbanked was founded in 2018 by Ian Kane and Daniel Gouldman with a simple mission: Give customers a better, faster, and cheaper way to transact value with one another, no matter if they were across the street or across the world. The founder’s belief that financial access and control is a human right that can be enabled through the blockchain led them to rebel against the status quo which has plagued traditional banking for years.

Ian Kane

📺 Watch: Ian Kane, How does Unbanked make money?

📺 Watch: Ian Kane, What do the next 3 years look like?

Daniel Gouldman

📺 Watch: Daniel Gouldman, What have the last 3 years looked like?

📺 Watch: Daniel Gouldman, Who are we? What is our mission?

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...