How sustainable altcoins aim to challenge Bitcoin’s dominance

Problem

The $50 Trillion Question

How can we prevent irreversible damage related to climate change? The UN Sustainable Development Plan calls for $50 Trillion in new funding by 2030 -- an astounding amount.

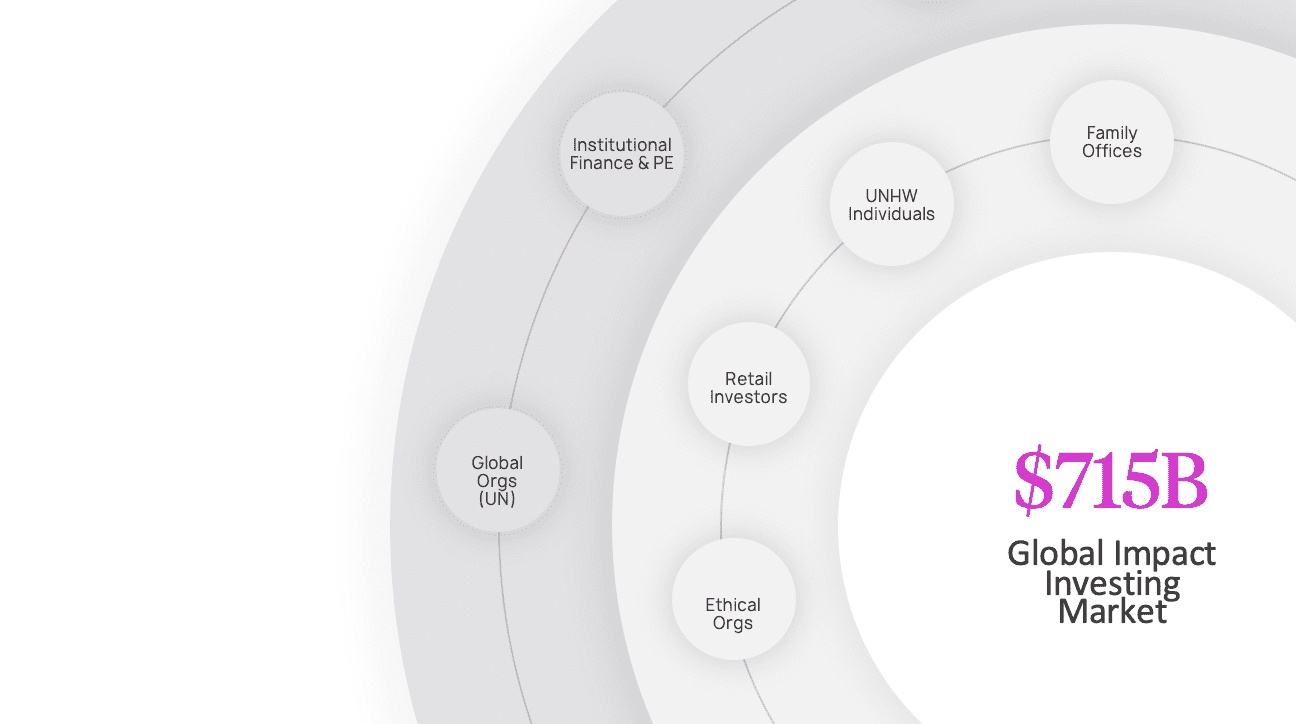

This sector, known as Impact Investing, crossed $715 Billion in 2020. It includes spending on Infrastructure (Energy, Retrofits), Development (Microfinance, Social Investing), Adaptation (Drought, Rising Seas), and more.

But this $715B is far less than the $4 Trillion annual need. How will we fill the gap?

Solution

Why is this problem

solvable now?

Climate action has been hard to fund, as it's mainly been stuck in government spending and large asset managers. Crypto can change that.

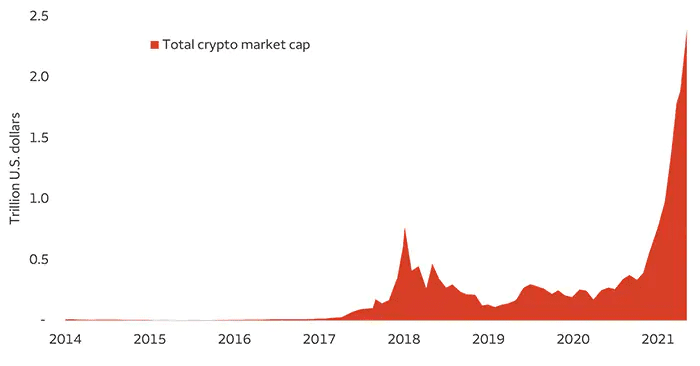

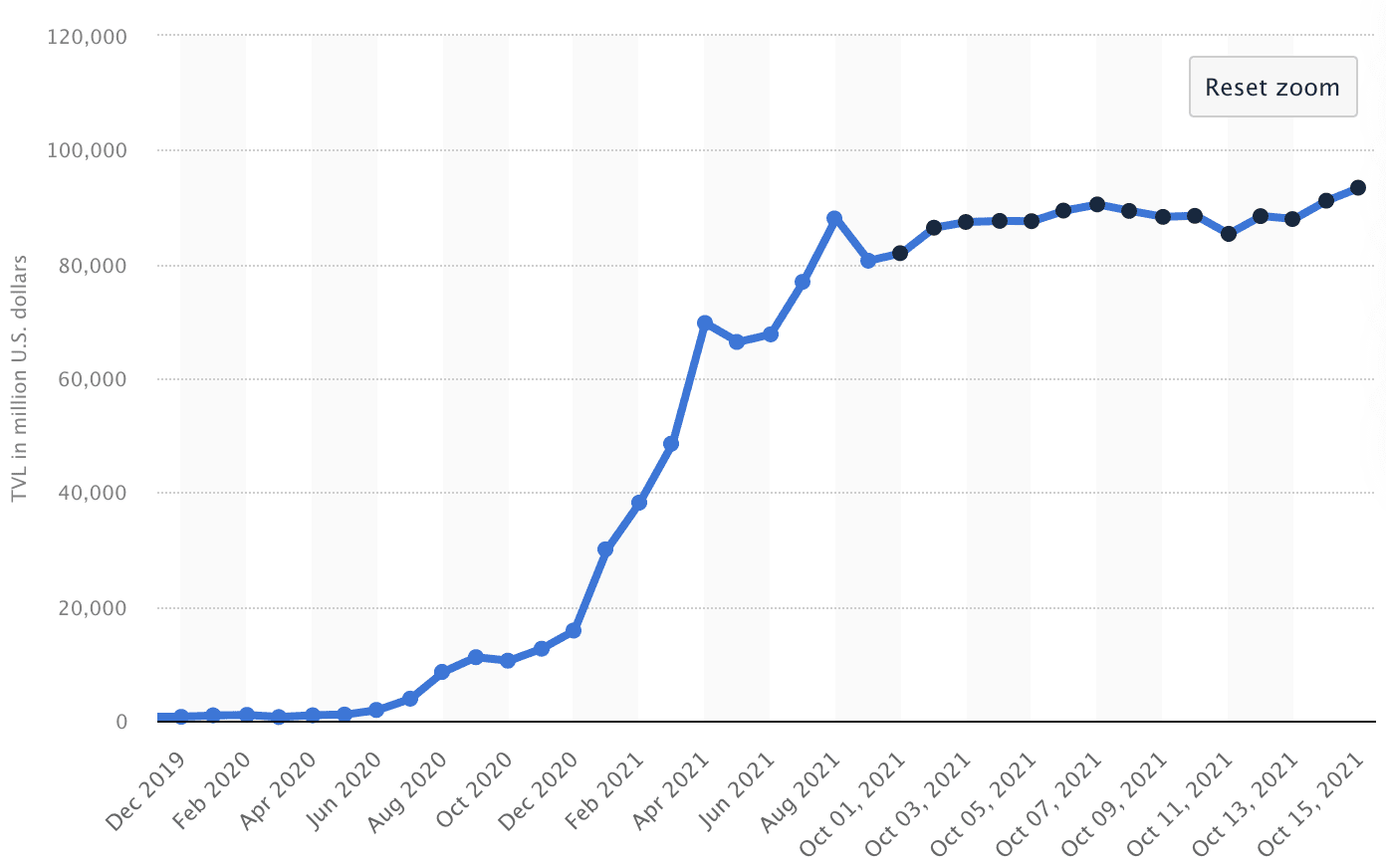

Cryptocurrency already boasts a $2.5 Trillion market cap and $100 Billion TVL in Decentralized Finance (DeFi) as of Oct 25, 2021. Inexpensive, efficient, immutable, auditable, transparent global transacting are accelerants to multiplying impact investing.

At the same time, green products now lead multiple consumer categories, ESG (Environmental and Social Governance) spending is at an all-time high, and the US and EU are negotiating trillion-dollar infrastructure packages.

Product

Presenting BitGreen: A Blockchain Protocol Uniquely Built For Impact

Many environmental and social initiatives work differently, but share the same goals. Their supply chains, customer bases, value propositions, and regulatory frameworks overlap. We aim to coalesce all of these to create efficiencies and develop vast network effects.

BitGreen on Polkadot

BitGreen is built using the Substrate SDK, a product developed by Parity ... the team behind Polkadot. Substrate enables developers to create application-specific blockchains tailored for specific purposes, for instance ESG and DeFi. Our development began months ago, and we are preparing for a 2022 launch.

Building Our Network Through Mobile

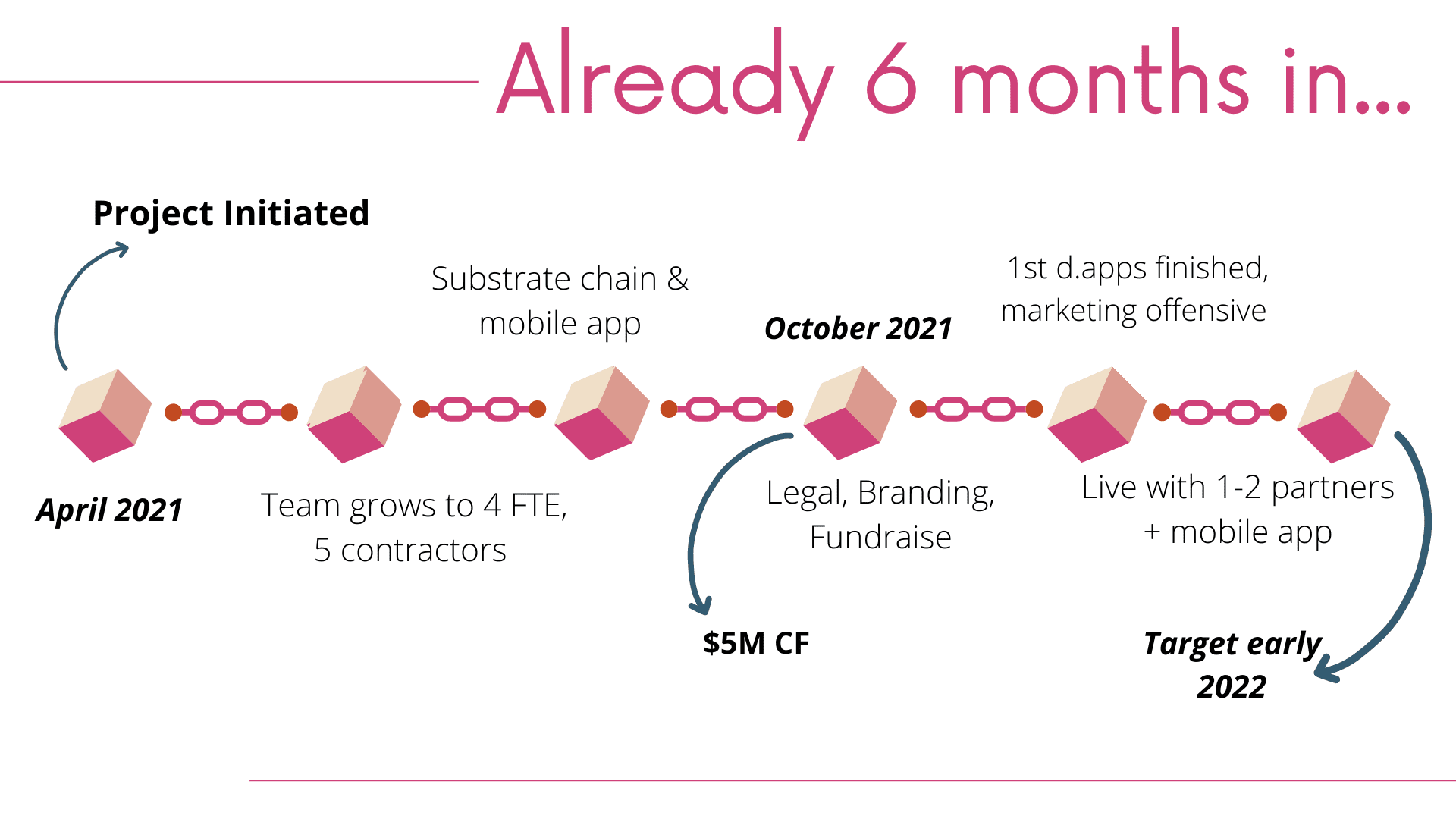

Traction

We started BitGreen in Spring 2021 through bootstrapping and sweat equity. To date, we've developed a prototype Substrate blockchain and mobile app, both of which are in internal test-net. We've also signed MOUs with 5 external clients and continue to add to our business development pipeline.

Customers

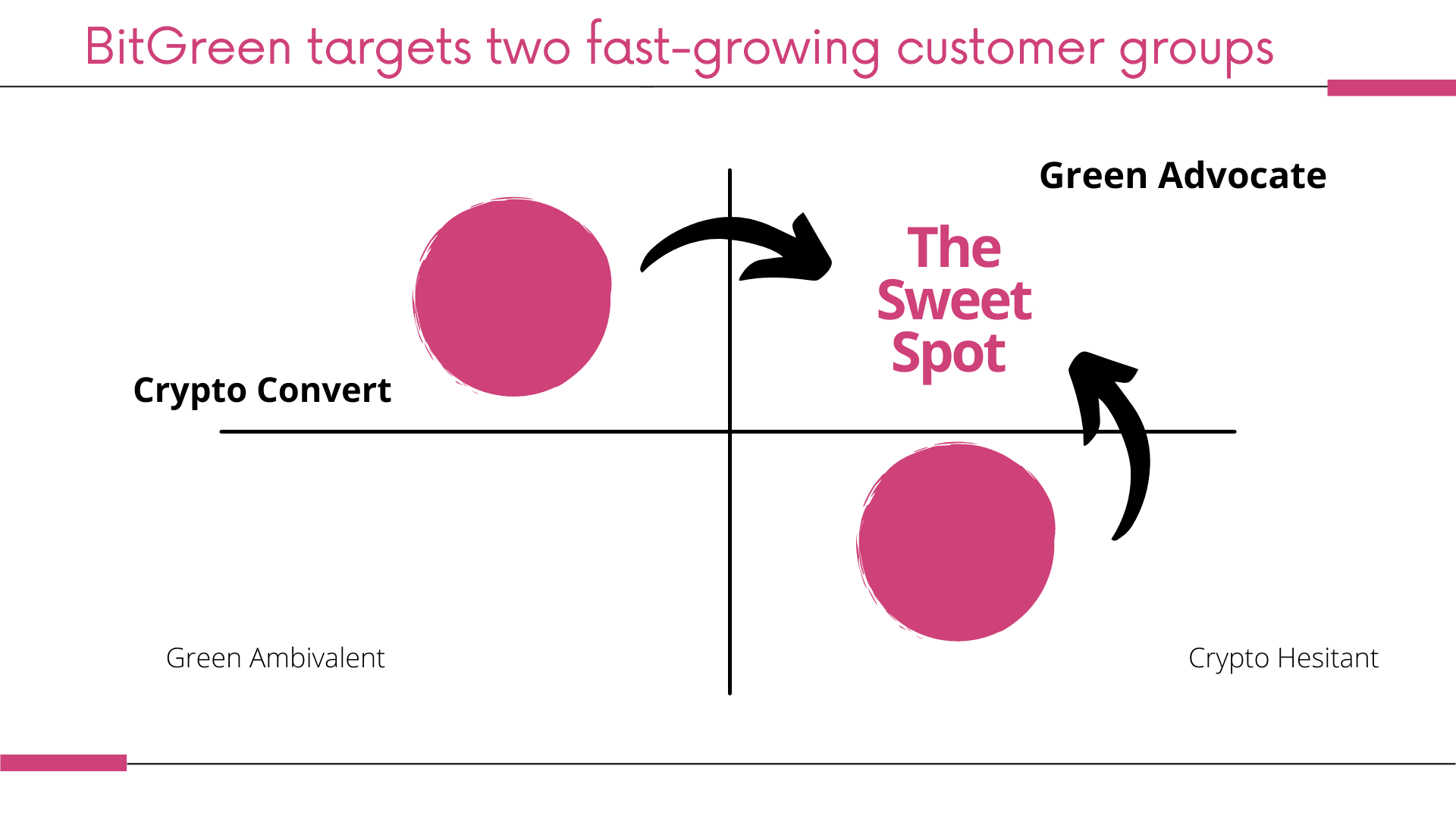

BitGreen Targets Two Fast-Growing Customer Groups

Crypto 💸 + Eco-Friendly 🌿

We categorize our first adopter user groups into Crypto Converts and Green Advocates.

The former includes coin holders who already own crypto and do not require onboarding. Research suggests this is 100 million people globally and approximately 15% of the US adult population.

The latter are consumers who read labels at supermarkets, own Teslas and gladly pay premiums for organic. This demographic ranges from 60% of Gen Z to 40% of Baby Boomers.

Business model

B2B and B2B2C

BitGreen generates value for the protocol network through transaction fees and scale of usage by third-party and external applications. BitGreen has no plans to sell any specific products by itself, but rather develops, maintains, and earns consideration for providing the basic framework and operating system for decentralized apps on its blockchain. We believe as network usage scales, so too will the network's intrinsic value grow.

Market

Impact Investing crossed $715B in 2020. While this total is still small relative to the $50 Trillion needed, the sector has been growing at a 20% CAGR. Most investments originate with Asset Managers and PE. Our target audience (inner circle below) has been largely frozen out from participating.

Source: Global Impact Investing Network (GIIN) surveys 2020 and 2019

Our second target market, Crypto and DeFi, has been on fire since March 2020. Its growth is being aided by new institutional investment and the SEC approving the first Bitcoin ETF in Oct-21.

Crypto market cap, 2014 - Oct 2021

DeFi Total Value Locked (TVL) has rocketed from nearly $0 in early 2020 to over $100B in 18 months. This is our target first adopter user base.

Competition

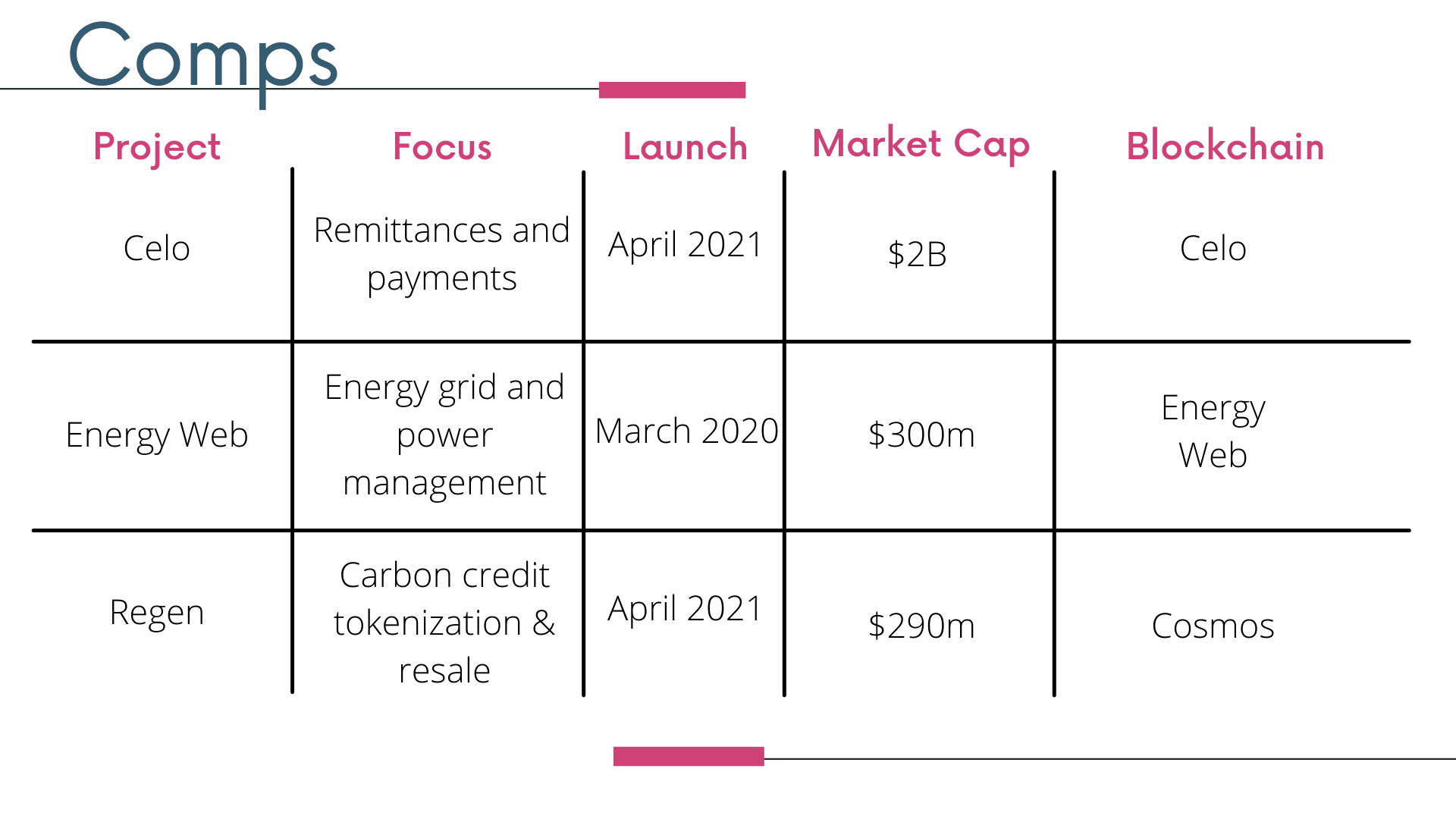

BitGreen has a few competitors who also leverage blockchain technology to develop ESG solutions. However we view them less as adversaries than collaborators to grow this burgeoning market.

Other companies in our sphere include Goldfinch (microfinance), Nori and MoSS Earth (carbon credits).

Other companies in our sphere include Goldfinch (microfinance), Nori and MoSS Earth (carbon credits).

Vision and strategy

Global Change

Our higher objective is positive global change, and seizing the present market opportunity to catalyze this movement.

We believe crypto can be the spark. That's why our business aims to introduce durable and innovative incentive structures to shape human behavior at a collective level. 75% of Americans want to protect the environment in their daily lives, yet only 20% do so. That gap, between intention and incentive, is our opportunity.

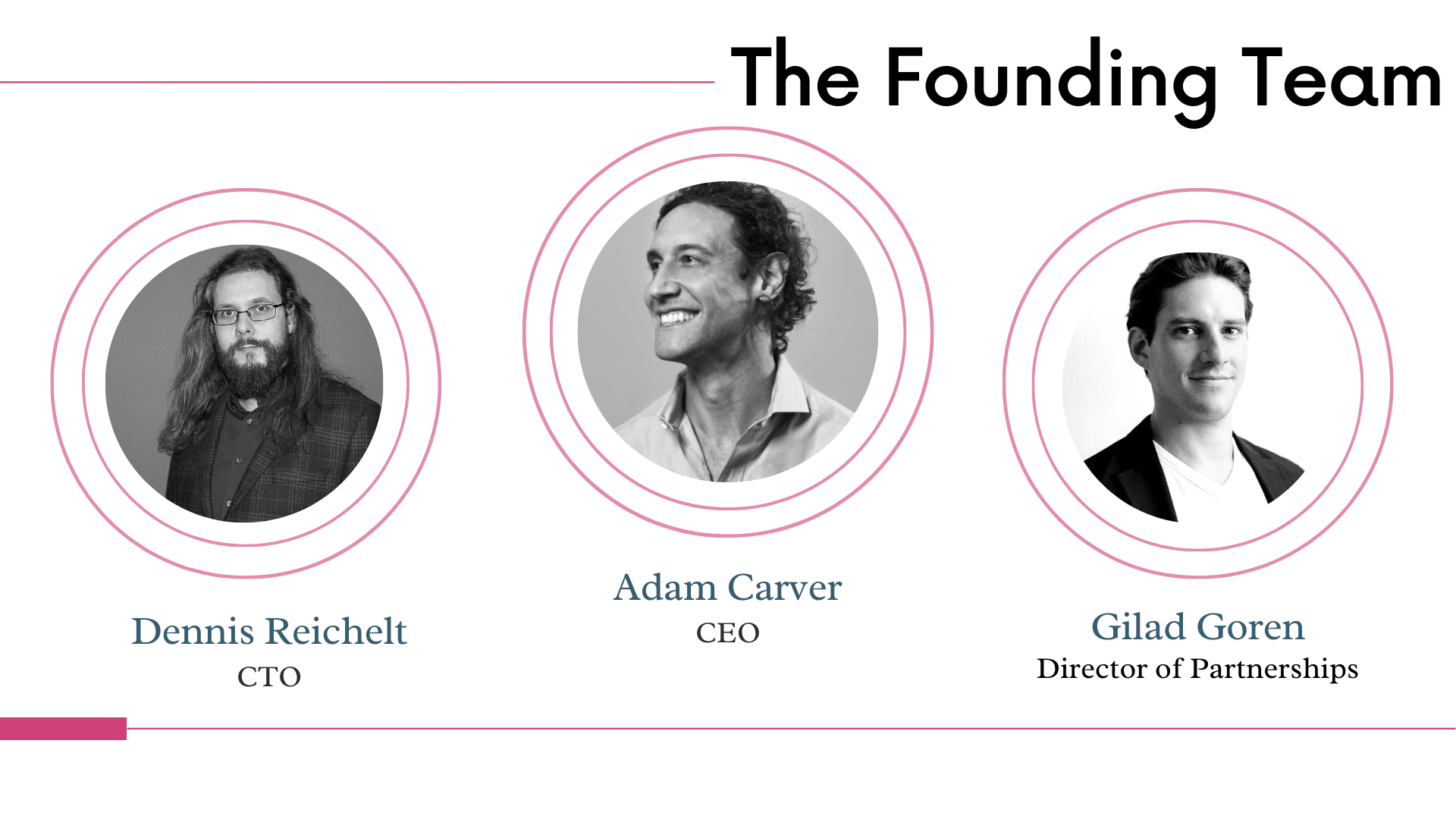

Founders

BitGreen's team has years experience founding and investing in early stage companies and share a common venture that achieved an exit.

Adam Carver, CEO

Cofounder Battlestar/KeyFi (sold to Celsius Network), Cofounder Managing Director TheFund.vc, Director at AngelList, Corporate Credit at Morgan Stanley. M.S. Sustainable Systems, University of Michigan

Dennis Reichelt, CTO

Cofounder KeyFi (sold to Celsius Network), Cofounder 0xb1 ($900B wallet on Ethereum for DeFi), Lead Developer at Visualisierungslösungen GmbH. B.S Information Technology, University of Goethe, Germany

Gilad Goren, Director of Partnerships

Cofounder Raleigh & Drake, Cofounder Only Six Degrees. Executive MSc Social Business & Entrepreneurship, London School of Economics

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...