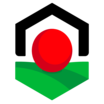

Problem

The problem: Growers are in desperate need of cost-effective technologies that increase productivity and reduce costs. Agriculture has lagged behind other industries in terms of automation. As a result, increasing worker shortages have led to squeezed margins. The UK alone was short of c.90,000 harvesters in 2020.

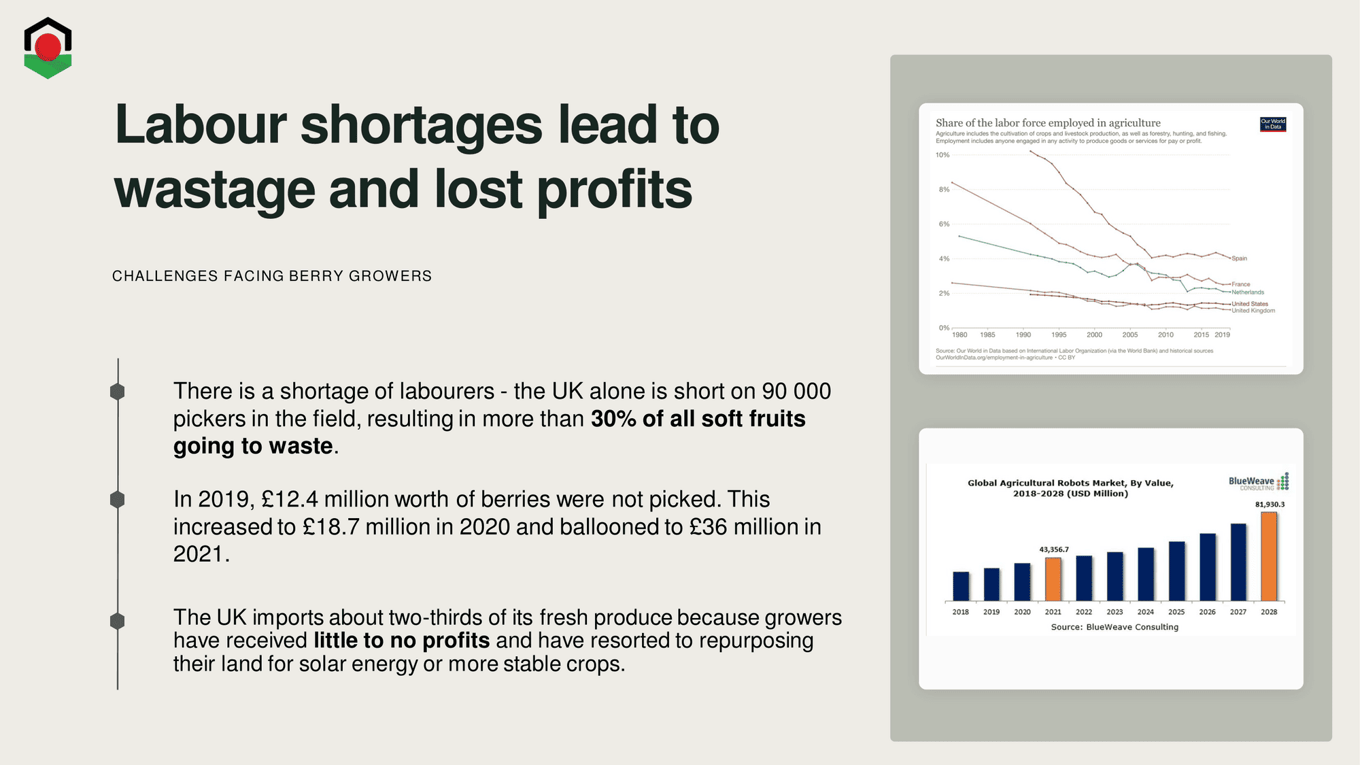

Solution

Selective and autonomous harvesting robots for raspberry and multi-crop applications

Fieldwork Robotics has developed both vertical and horizontal harvesting systems.

- Vertical Harvesting

The harvesting height can be adjusted for a variety of picking circumstances, by adjusting the vertical position of the arm, the picking can be done no matter how tall or low the crops are.

These systems are being offered directly to farmers by subscription, and are facilitating Harvesting-as-a-Service solutions.

Traction

Commercial picking underway

Fieldwork's harvesting systems were deployed in January 2022 with Harvesting-as-a-Service.

- First robot in field Jan 2022

First robot is in field generating real world harvesting information and picking commercially to customer specifications - Second robot in field March 2022

Improved design to deliver faster harvesting.

Robot carrying out Harvesting-as-a-Service in Portugal

Robot carrying out Harvesting-as-a-Service in Portugal

Customers

Existing customer agreements in place for significant sales in the raspberry market

- The Summer Berry Company

Lead raspberry partner, signed option agreement to buy first 100 robots. Single Portuguese facility requires 600 – 800 pickers.

- Pipeline:

Agreements signed with Hall Hunter Partnership and ongoing discussions with other raspberry growers. In discussions with Driscoll's.

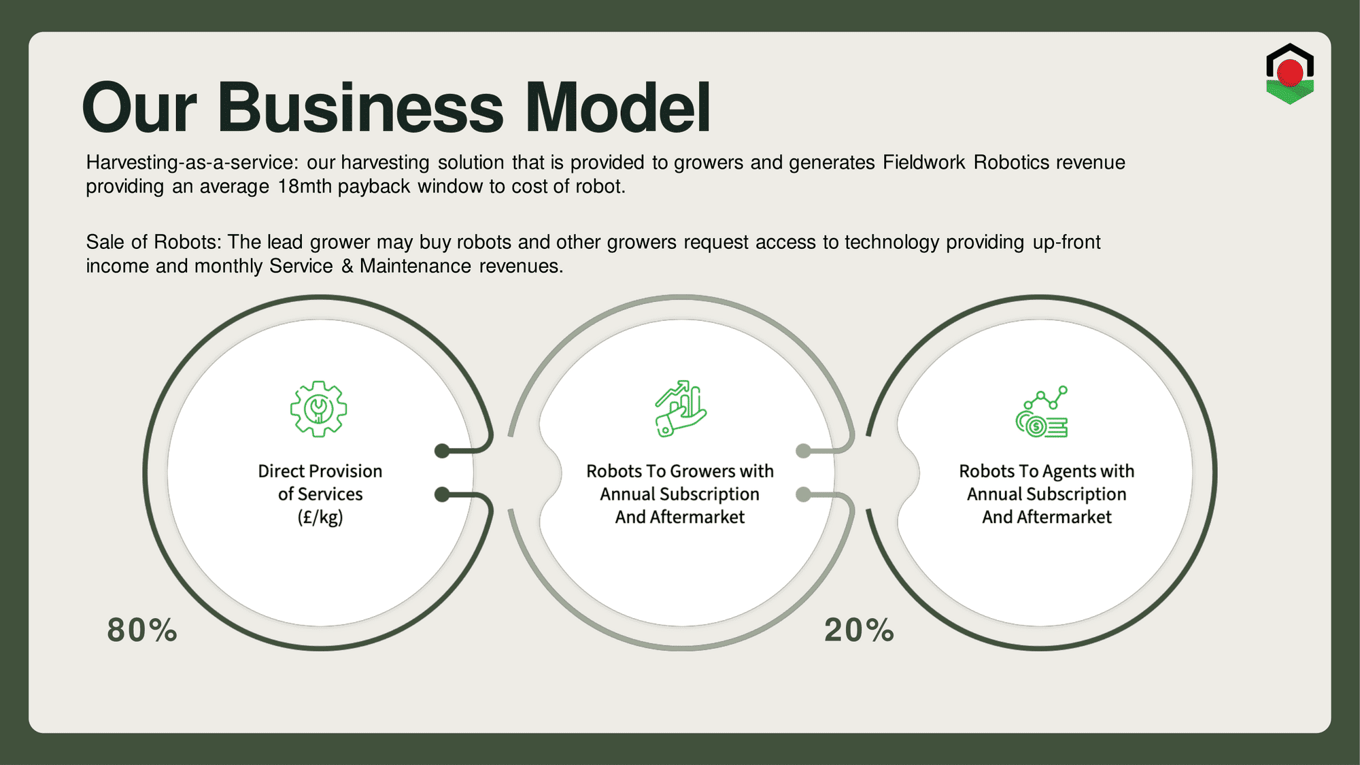

Business model

Monetization Strategy

Fieldwork Robotics plan to generate revenue through three core channels:

1. Harvesting-as-a-Service (HaaS)

Robot ownership will be retained by Fieldwork Robotics, the Robots will be provided to growers for a periodic charge based on the number of berries picked over that

period.The robots will require an operator provided by Fieldwork.

Presently 30% of the growers crop remains unharvested going to waste. The robot will initially pick at the same rate a typical picker can harvest, however operate on 3x shifts, providing 6 days a week harvesting capabilities.

2. Robot Sales + Maintenance

The customer gets the same product output as with the HaaS structure except the customer has ownership of the robot in this model, the benefit to both the customer; Fieldwork Robotics is long-term savings short-term cash injections respectively. Fieldwork Robotics will continue to earn recurring revenue in the form of robot maintenance.

3. Data Collection & Analysis

All Fieldwork Robotics units will continuously collect data from the crop, enabling customers to receive detailed reports on yield projections and crop maturity percentages.

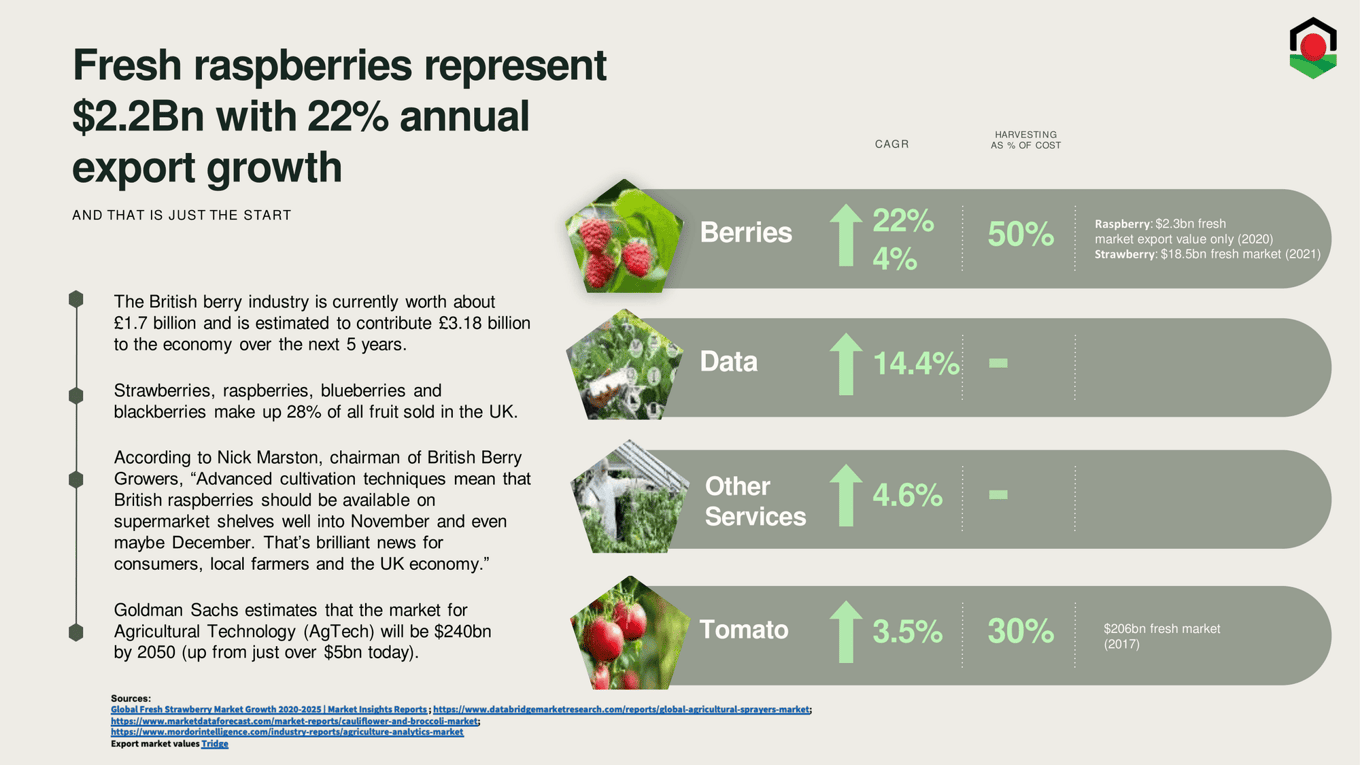

Market

Multi-billion initial addressable market with significant further potential

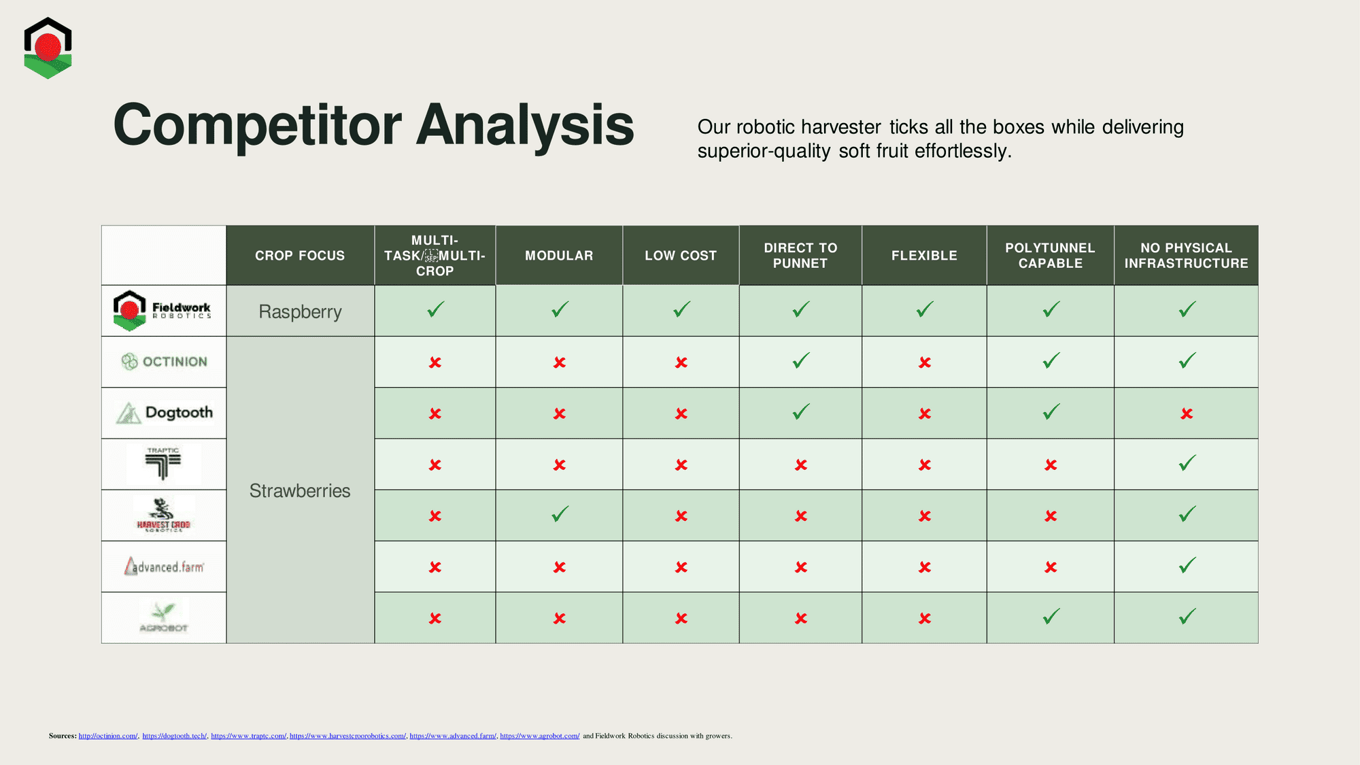

Competition

Focused on delivering cost-effective real-world solutions to grower challenges

Vision and strategy

Fieldwork is raising up to $2.4M to achieve development & team growth milestones

The company's stated use of funds includes:

Team Expansion:

- Hire a part-time/fractional CFO

- Increase engineering capability by hiring a team of engineers

Technology Development:

- Expand Client Offering (incl. data collection and analysis)

- Enhancement of existing technology

- Business Development Costs/Travel Costs

Potential exit routes

Fieldwork considers a trade sale to be their most likely exit strategy, but are also planning for other contingencies.

Trade Sale to Automotive OEM

- Players entering the agritech space

- Denso acquisition of Certhon in April 2020 (undisclosed amount)

Trade Sale to Tractor Manufacturer

- Several players active in the field

- Kubota investment in apple harvesting companies Abundant Robotics (2020) and Tevel (2021)

- John Deere acquisition of Blue River Technology for $305m (2017)

Listing

- List on AIM or NASDAQ

- Possible but less likely, no agritech robotics companies have listed to date

Leadership

Martin Stoelen

Martin Stoelen

Founder, Director and CSO

Dr. Martin Stoelen is the academic Founder and Chief Scientific Officer of Fieldwork Robotics Ltd. The company was setup in 2016 based on his research on robust and selective robotic systems for harvesting in horticulture. He has an academic position with the Western Norway University of Applied Sciences, which collaborates closely with the company, and where he helps lead an advanced robotics laboratory. He has extensive experience in RD&I from the US, Spain, UK and Norway, and has secured significant grant and private funding for his work. He has multiple engineering degrees across aerospace, electronics and robotics, and lectures at Bachelor, Master and PhD level robotics engineering. He is a former Fulbright Scholarship recipient, and a Marie Curie Fellow.

Summary

Why Invest?

- Focused on initial launch in the raspberry market with $1bn of picking costs to address, grower-centric solution targeting lower costs than human picking

- Significant commercial raspberry partner already engaged — sufficient scale to underpin activities for the next 3 years

- Robot is already picking raspberries to commercial standards

- Potential competitors are focused on less challenging crops

- Multi-task robot aims to be able to provide other value-added services and expand into other crops at minimal cost/high ROIC

- Potential to deliver significant revenues and compelling value creation

Disclaimer

In addition to the carried interest Republic Deal Room Advisor LLC is entitled to for the syndicated investments it organizes, certain principals of Republic Deal Room Advisor LLC may have a personal interests in these investments, as disclosed below. When making an investment decision please review any applicable disclosures as they represent pre-existing financial interests held by those principals of Republic Deal Room Advisor LLC.

We do not represent that the information contained herein is accurate or complete, and it should not be relied upon as such. Opinions expressed herein are subject to change without notice. Certain information contained herein (including any forward-looking statements and economic and market information) has been obtained from and/or prepared by the Company or other third-party sources and in certain cases has not been updated through the date hereof. While such sources are believed to be reliable, Republic Deal Room Advisor LLC does not assume any responsibility for the accuracy or completeness of such information. Republic Deal Room Advisor LLC does not undertake any obligation to update the information contained herein as of any future date.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...