Problem

Performing arts organizations have growing, complex, and unique needs

Performing arts organizations of all sizes — from 50-seat playhouses to 3,000+ seat performing arts centers — need ticketing, marketing, fundraising, patron management, and reporting tools to help them manage their growing and complex organizations. The issue is that the majority of solutions on the market are outdated, too expensive, and lack ease-of-use due to failure of adapting to the market's needs after years of little innovation.

As thousands of arts organizations are coming out of a pandemic, they are in need of something that reduces costs, removes complexities in their existing structures, and allows them to rebuild through flexible, easy-to-learn tools.

Solution

Web-based software for the performing arts that simply works

Built from the ground up for a director, Ludus is now trusted daily by 10,000+ directors, box office managers, and patrons across K-12, Colleges, Community Theatres, Non-Profits, and Performing Arts Centers of all sizes (as of April 2022).

Ludus creates web-based tools that allows arts organizations to manage their ticketing, marketing, fundraising, and more — the product thinks like its users, leading to ease-of-use and flexibility that grows with their organizations. Through our free pricing model, we are able to completely remove an expense from their income statement, allowing them to put that money toward growth and creative innovation (benefiting Ludus more and more over time).

Product

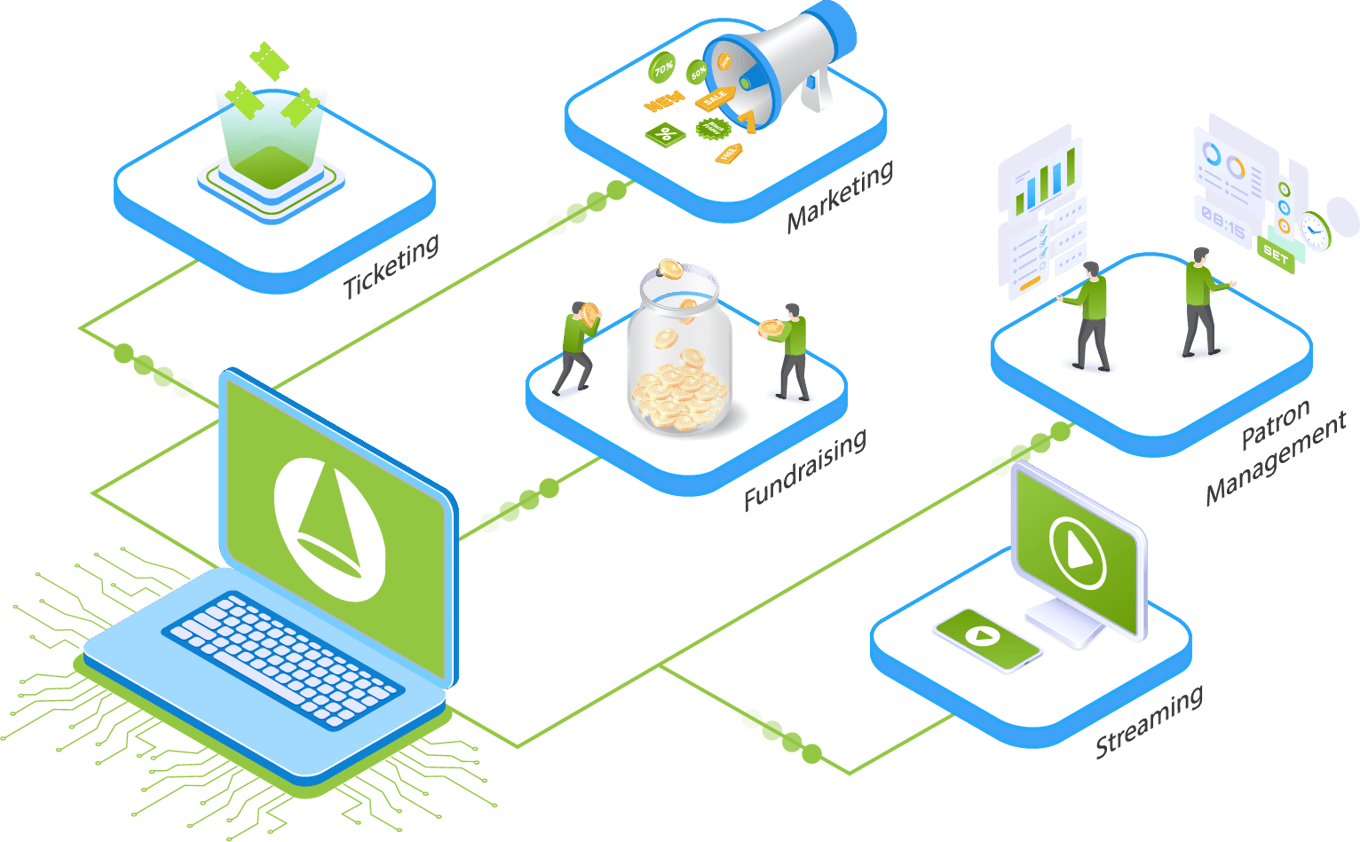

How it works

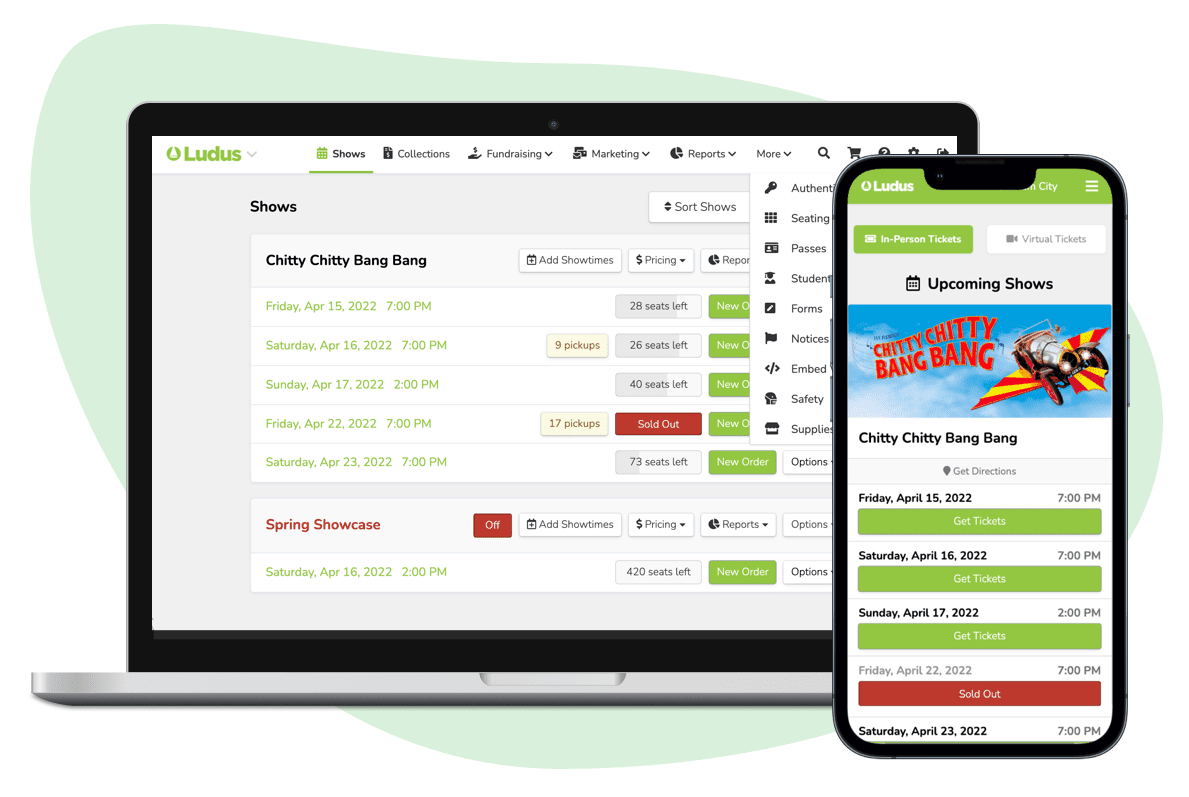

Ticketing

Ludus started as a ticketing platform and continues to provide the best tools to manage online and in-person ticket sales. This includes a modern ticket buying/selling process, simple exchanges/refunds, box office point-of-sale features, activity logging for patron support, and much more.

Marketing

Organizations can stay in touch with their patrons through our premium Marketing suite, giving them tools to craft beautiful emails using our drag-and-drop email designer and the ability to filter patrons into custom audiences based on dozens of parameters.

Fundraising

Organizations can collect donations at checkout when patrons are buying tickets or any time via the Donate tab on their Ludus page. Fundraising tools include Fundraisers (custom campaign pages with goals), Levels for managing donor tiers, and recurring donations.

Collections

Collections allows organizations to collect payments for things beyond ticket sales such as member dues, registrations, trips, venue rentals, and practically anything else.

Patron Management (CRM)

Whether a patron buys tickets, makes a donation, or buys a season pass, they'll have a profile filled with all of their information and activity. Ludus customers can quickly see who their top patrons are, what types of shows they like, and categorize them into Groups for easy organization.

Reporting

All reports in Ludus are real-time and flexible, giving organizations full insight into their sales, patron data, and more using our powerful (yet simple) browser-based spreadsheets.

Customization

Customization and branding is important to organizations, so we give them the tools to design their Ludus pages using our designer or custom CSS. Going beyond, organizations can upgrade to our premium Embed Widget to embed Ludus right into their own websites for an extra fee.

COVID and safety

Organizations are still feeling the negative effects of the pandemic and the challenges it has brought to the performing arts community. Ludus offers safety features to help host safe, socially distant shows in-person including Seat Buffering for automatic social distancing and Arrival Times for staggered arrival.

Streaming

Organizations can reach a new audience far and wide with our streaming platform, AnywhereSeat, allowing an organization to sell virtual tickets to virtual events (such as live streams and pre-recorded videos).

Fast and friendly support

Oftentimes it's nice to talk to a real person who understands what your job consists of. At Ludus, we offer real-time support through our chat widget, step-by-step guides, videos, help articles, and our 888 phone number.

Traction

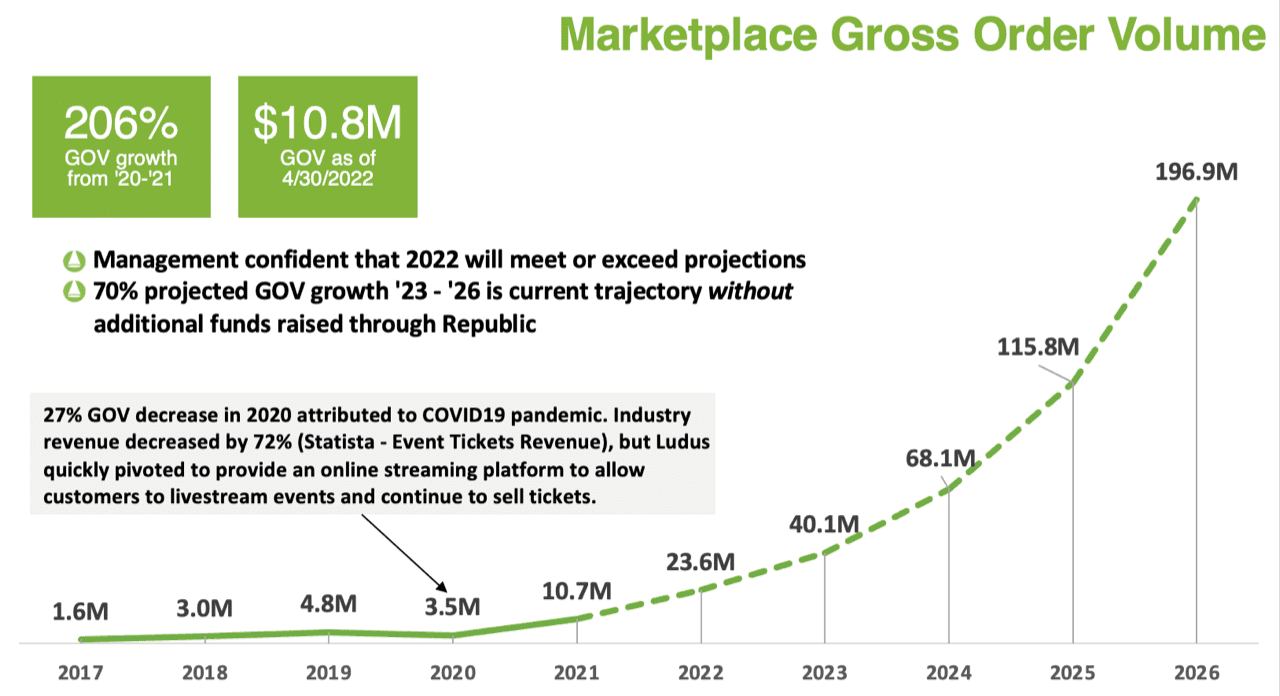

206% increase in Marketplace GOV compared to 2020

In 2021, Ludus processed over $10.7 million in Marketplace Gross Order Value ("Marketplace GOV"). This is a 206% increase in Marketplace GOV compared to 2020.

As of 4/30/2022 Ludus has processed $10.8 million in Marketplace Gross Order Value.

—

70% projected GOV growth '23–'26

Click here for important information regarding Financial Projections which are not guaranteed.

Customers

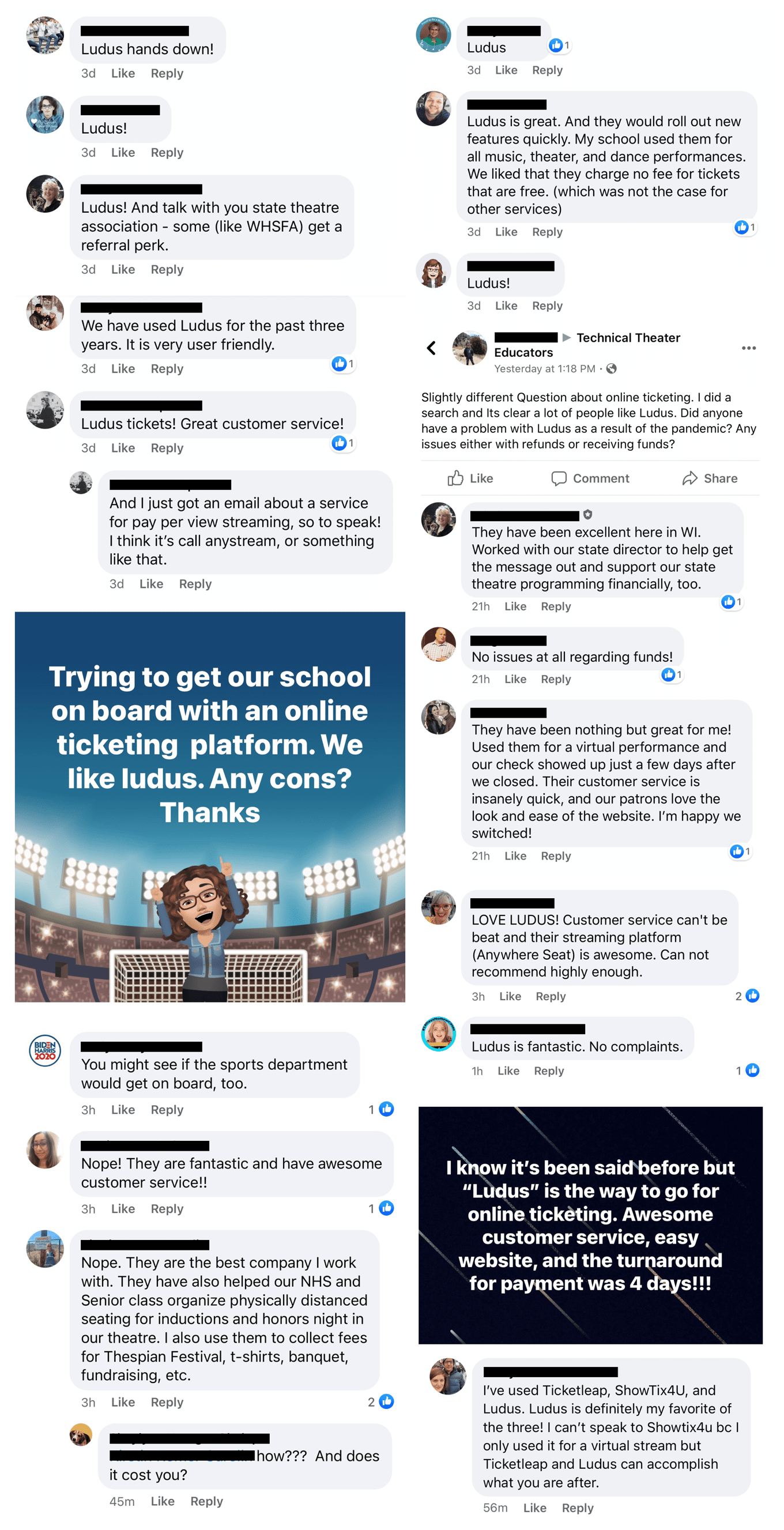

Army of Advocates

Why we are set to win

We have built a strong community of advocates (we commonly refer to them as our “Army of Advocates”) that recommend and fight for Ludus within their circles. This is due to offering a product that is beyond what is currently offered within our market, with the perfect business model, and a focus on next-level customer support.

But donʼt just take our word for it:

A collection of screenshots gathered from Facebook, showing advocacy for Ludus among our customers. Ludus has taken over comment threads in our market's Facebook Groups when ticketing is brought up.

A collection of screenshots gathered from Facebook, showing advocacy for Ludus among our customers. Ludus has taken over comment threads in our market's Facebook Groups when ticketing is brought up.

Based on reviews given by our customers through Capterra.com, common themes were ease-of-use, customer support, and simple pricing that doesn't break the budget.

Based on reviews given by our customers through Capterra.com, common themes were ease-of-use, customer support, and simple pricing that doesn't break the budget.

Business model

How we make money

Ludus operates based on a convenience fee model with additional premium add-on features available to customers. Our main source of revenue is through the ticketing fee which makes up 89% of our revenue, with the other 11% being multiple complementary revenue streams (as of 12/31/2021).

Breakdown of revenue streams

Ticketing | 5% + $0.75/ticket when a patron pays using a card. |

Marketing | $99/yr OR an additional $0.05 added onto ticketing fees |

Embed Widget | $99/yr OR an additional $0.05 added onto ticketing fees |

Fundraising | 3.5% + $0.50/donation |

Collections | 5% + $0.75/collection registration |

Add-Ons | 5% + $0.75/item |

AnywhereSeat (Streaming) | 5% + $0.75/virtual ticket |

Mailed Tickets | $3.50 extra to receive thermal tickets in the mail |

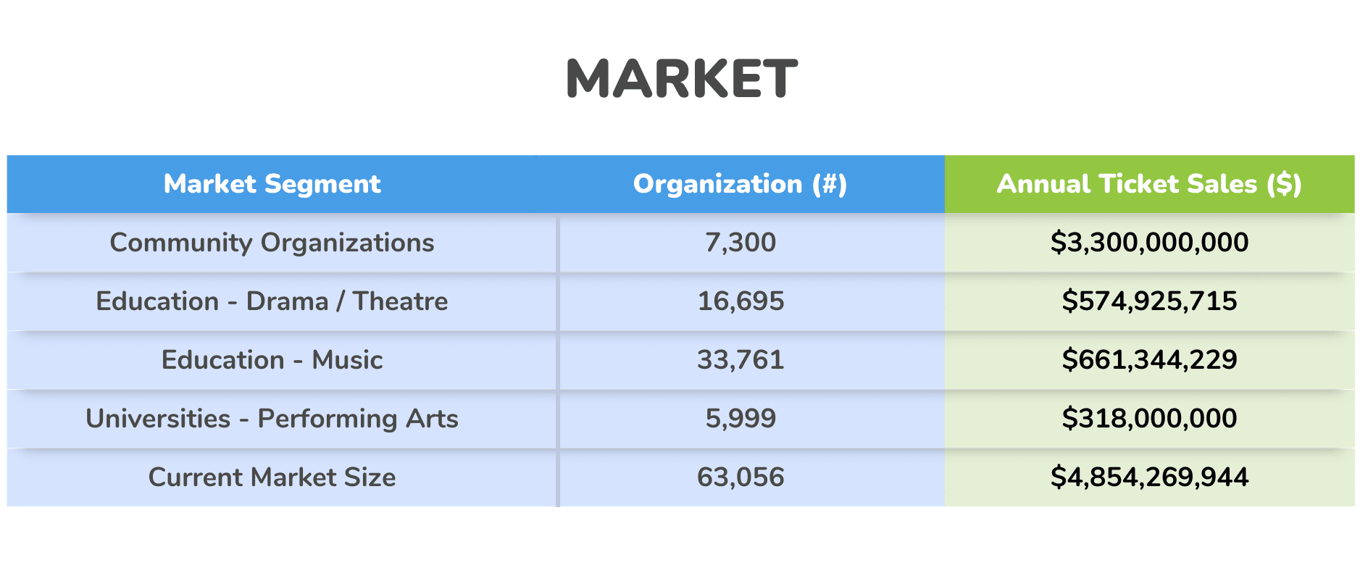

Market

Estimated $4.8B+ market

in ticketing for education and community organizations

Below are our estimates based on public figures and internal sales data (the market we operate in does not make finding exact figures easy, especially within the K-12 education world):

As of 12/31/2021

As of 12/31/2021

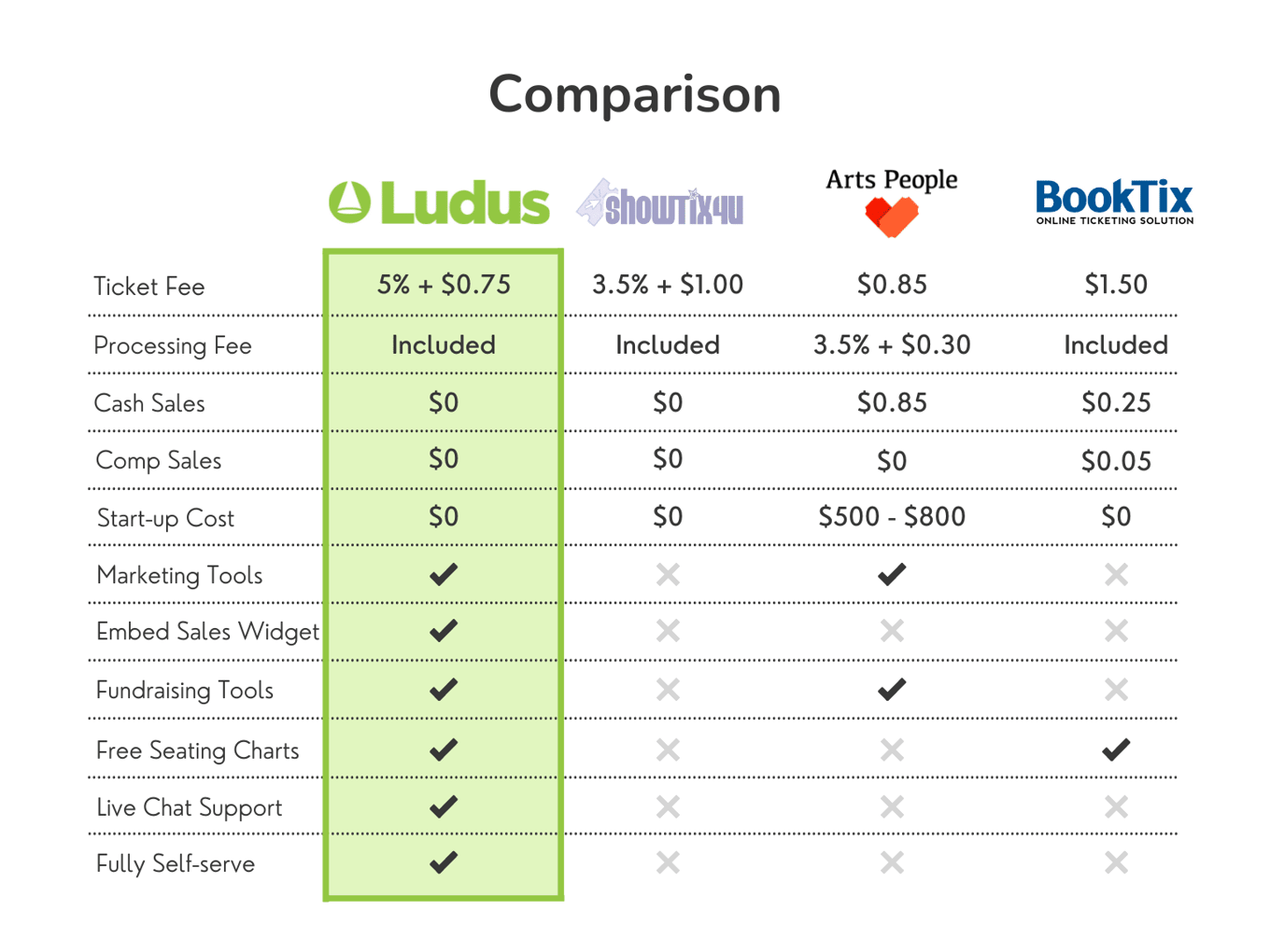

Competition

More than just ticketing

Ticketing is a saturated market, which is why we have a focus on being more than ticketing—turning our competitors into features.

Our main competitors include BookTix, ShowTix4U, ThunderTix, SeatYourself, and ArtsPeople. A common theme within their names is they are stuck on ticketing ("Tix")—while we envision building tools to run performing arts organizations end-to-end (ticketing, marketing, fundraising, collections, patron/volunteer management, and streaming).

Based on publicly accessible or provided information

Based on publicly accessible or provided information

Vision and strategy

Where we are heading

Ludus is in a unique financial position to not require outside capital to fund day-to-day operations. All outside capital will directly go into further accelerating growth and increasing the gap between our product's offerings and the competition.

We are partnered with a number of state and national associations within our market, positioning Ludus as a leader.

Investment utilization

- Increase team size — with the additional outside capital, we plan on hiring an additional 5 employees focused in product development and sales to accelerate our product's offerings.

- Partnerships — with increased resources, we will focus on putting effort into partnering with more state and national associations which lead to increased growth.

Founders

Zachary Collins : Co-Founder & CEO

Zachary taught himself web development at the age of 12. He was named a Teen Entrepreneur to Watch by TechCrunch and a Top Young Web Developer by .net Magazine. He help cofound a startup in Portland, OR at 17 and started Ludus a few years later in his college dorm room.

—

Kevin Schneider : Co-Founder & President

Kevin is an award-winning theatre director with over 32 years of teaching and directing experience. Previous winner of Michigan Theatre Teacher of the Year, member of the Speeches Coaches Hall of Fame, director of 24 state title-winning theatre productions and current president of the state speech and theatre association.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...