Early Bird Special: The Crowd SAFE offered in this offering has a Valuation Cap of $30M; however for investors whose investment commitments are part of the first $250K accepted by the company, the Valuation Cap is $25M.

Problem

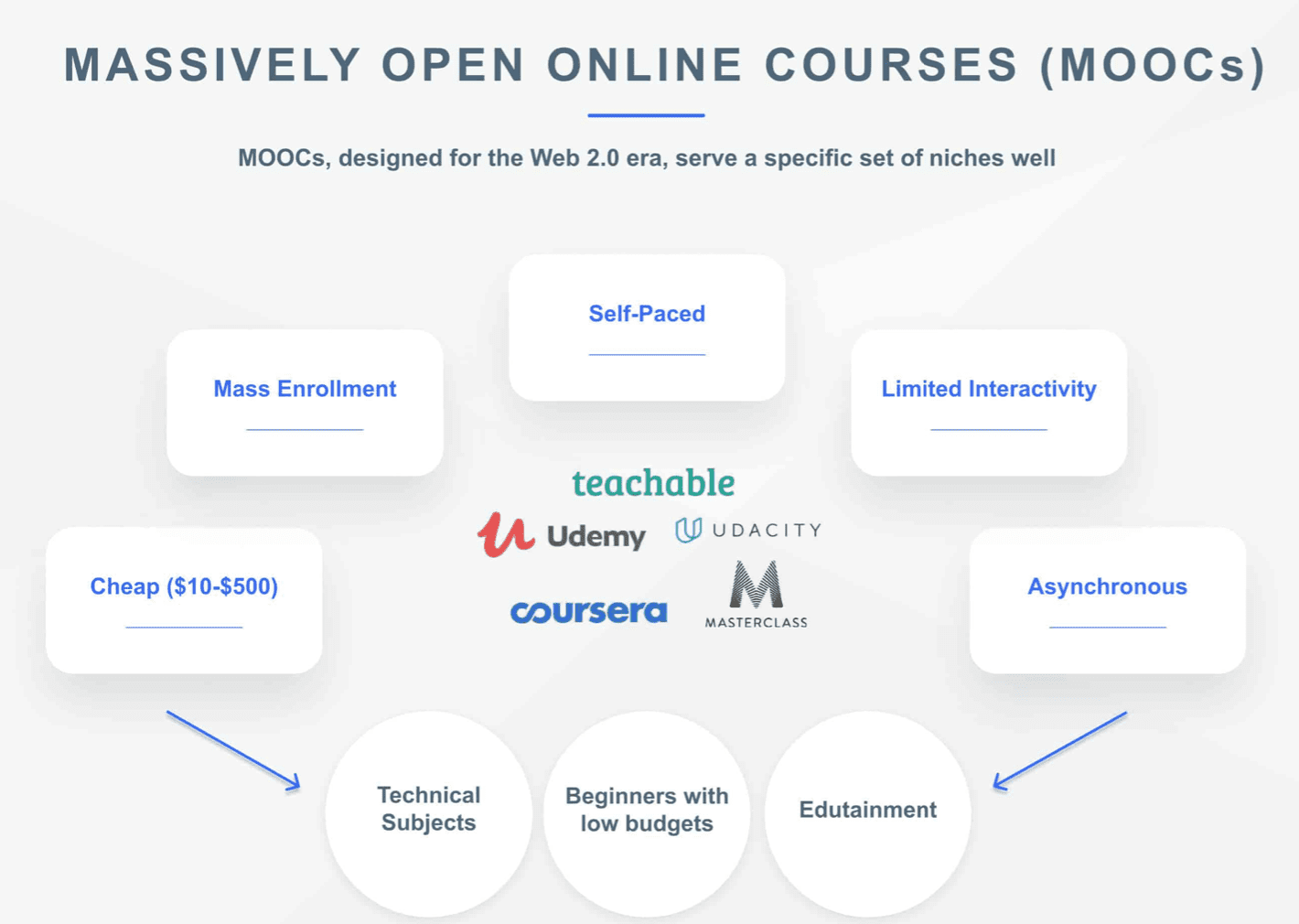

It’s a new era of online learning, but MOOCs need to catch up

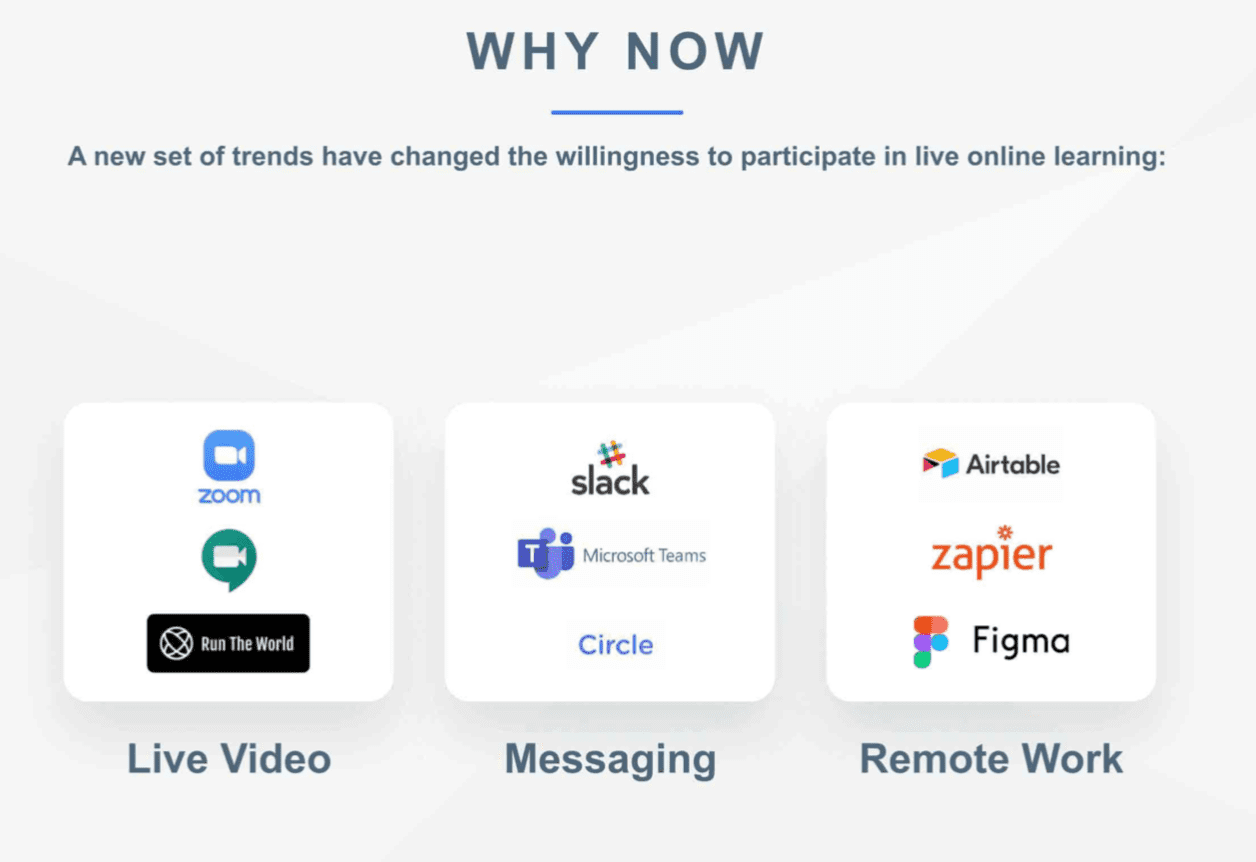

MOOCs – Massively Open Online Courses – are experiencing something of a revolution in the COVID-19 era. However, there are some fundamental flaws in the system. While great for some subjects, such as simple ‘how-tos,’ most MOOCs are highly flawed for others. They're not helpful for complex topics such as management training and advanced professional development. Plus, they're self-paced, which means completion rates are 7-10%. Finally, they're seen as second class qualifications – the prices are low, which has alienated many potential instructors and learners.

Solution

Maven brings a new formula to create high-end, effective online education

Maven is the brainchild of two of the biggest names in EdTech: the co-founders of Udemy and altMBA. We're establishing a new online learning platform that uses cohort-based courses to build the next generation of internet academies. With Maven, learners will be able to take critical thinking courses with their peers, driving not only their knowledge, but also enabling professionals to build out new and more exciting educational programming.

Product

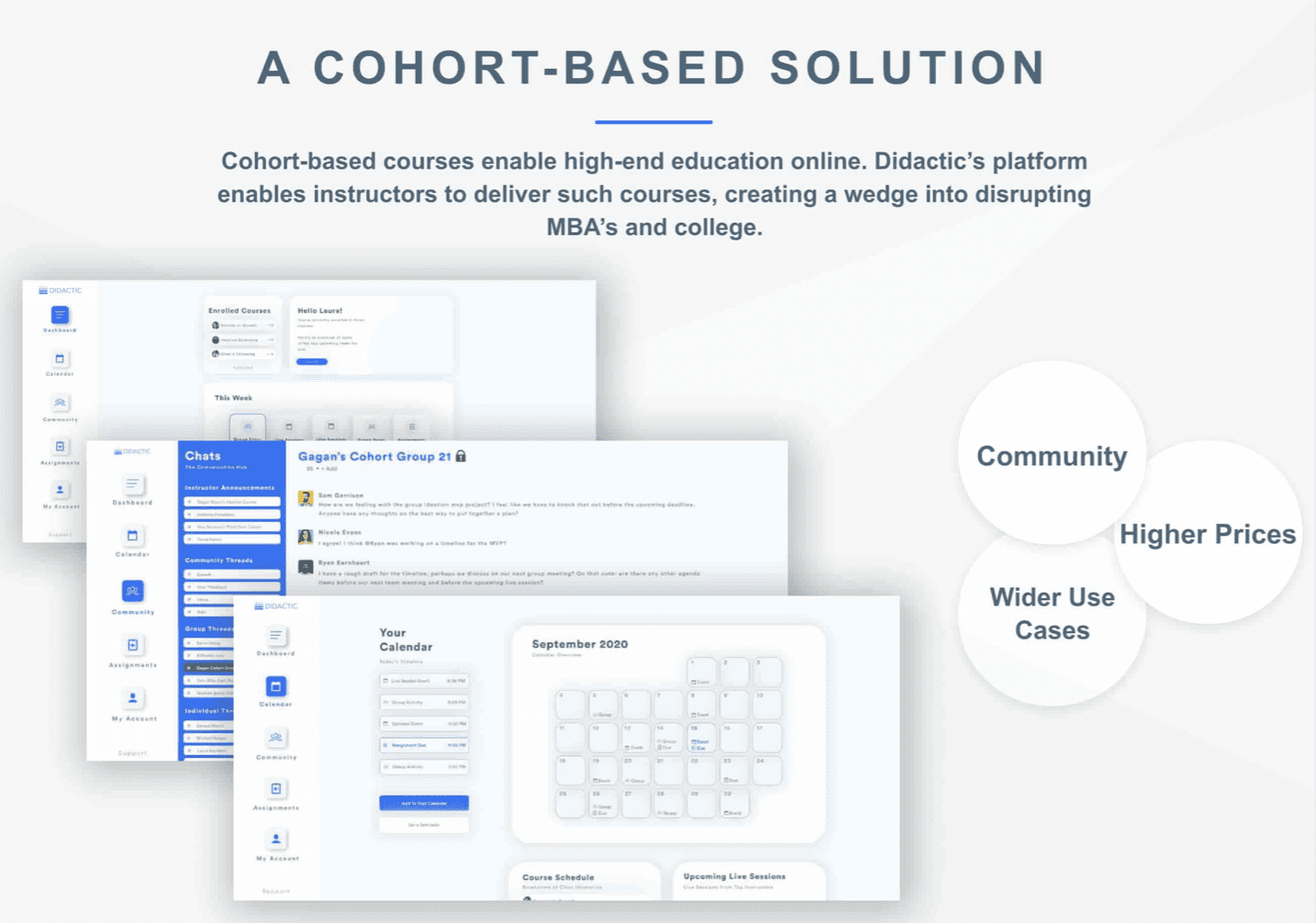

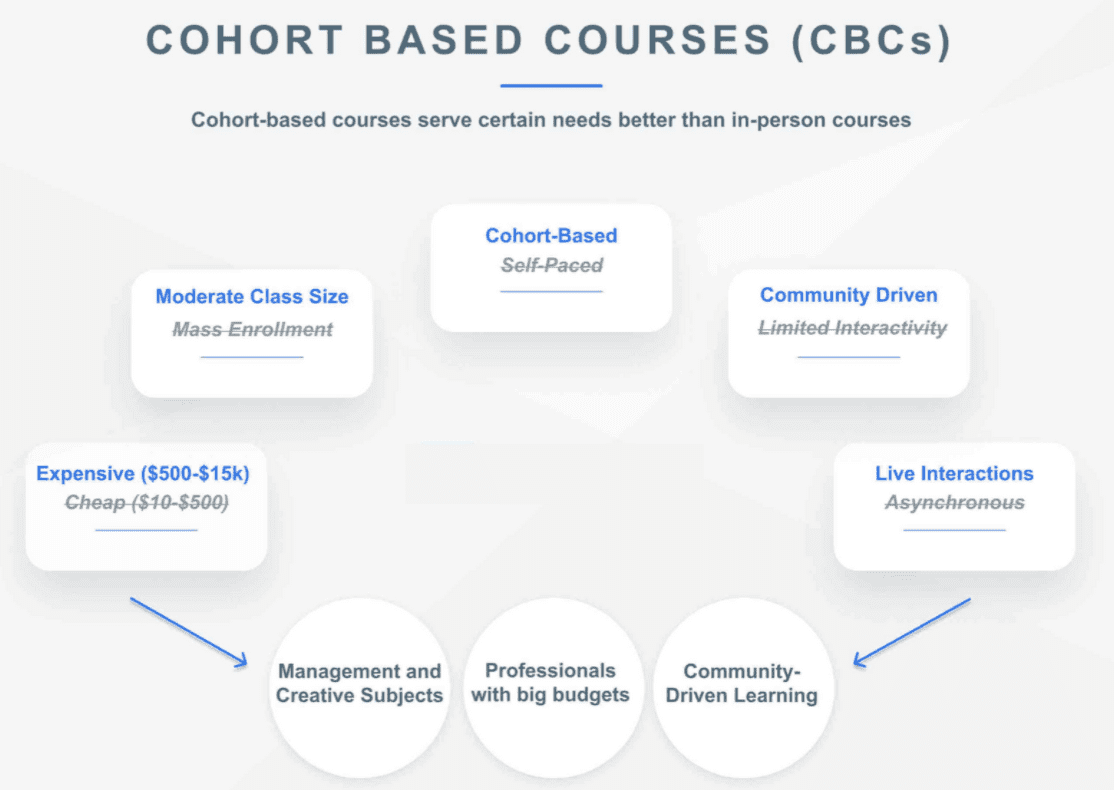

Cohort-based courses build community, optimization, and effective programs

Students take the course – any course – in a group. It doesn’t mean that everyone is on live video at the same time; it simply means that everyone is taking a course over the same time frame.

With this, students can build relationships and communities with their professors and each other. These courses can cover more nuanced and complex topics because students can ask questions, interact, and work on projects with peers. Working together encourages higher graduation rates and greater interactions.

Because of the cohort model, instructors can charge more, which will enable them to deliver the best online courses possible.

Traction

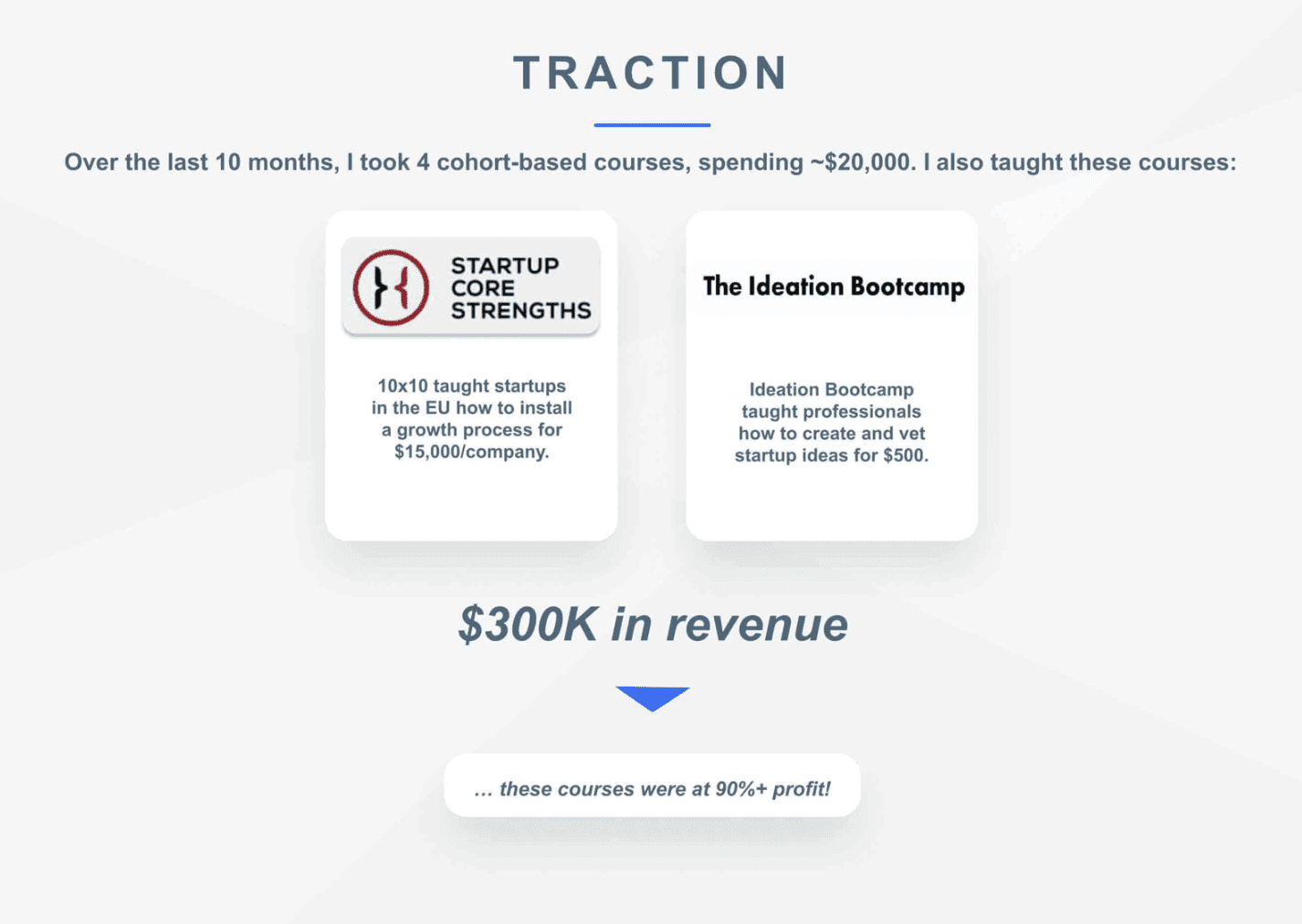

Proven traction and success of the cohort-based educational model

Gagan Biyani, one of the co-founders of Maven, has conducted 9 months of research across 4 cohort-based courses. Prior to Maven, he taught 2 courses that gained $300K in revenue. His courses, both taken and taught, were all at 80%+ profit.

Customers

Built for anyone interested in learning

Maven appeals not only to those interested in furthering their education online, but also to those reluctant to take online courses. The teacher-student interactions, group discussions, and the paced class schedules mean that our model isn’t as overwhelming as self-paced online courses.

Business model

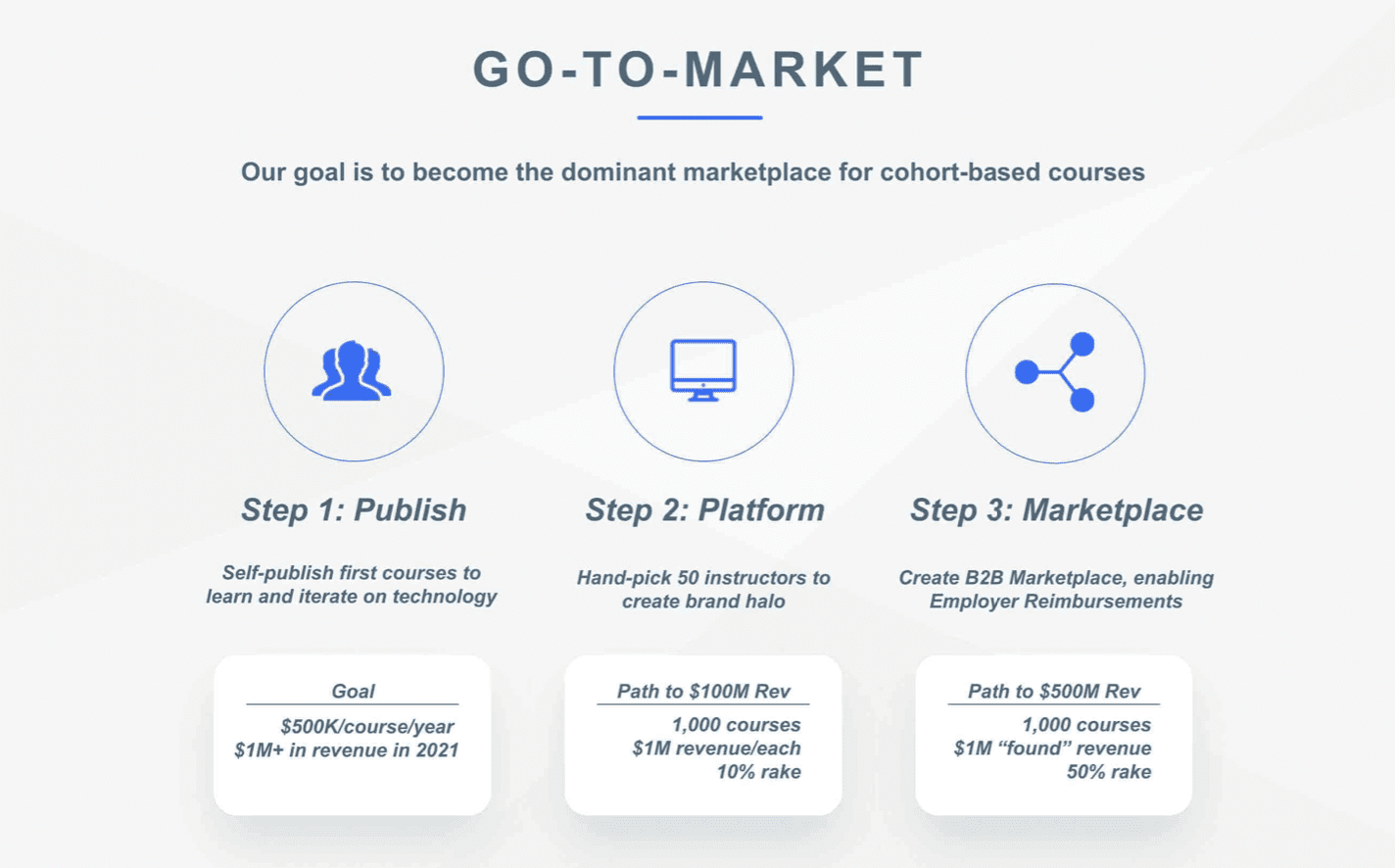

Courses can generate millions in revenue

We will publish the first 1-5 courses with handpicked partners that provide us with a strong brand halo and enable us to learn quickly while making revenue. We think each course can generate $100-500K/year in 2021, of which Maven will receive a % of revenue. In addition to this course revenue, we'll also build a platform that enables anyone to build a cohort-based course. We'll take a small rake to encourage everyone to join the platform.

Market

The global online education market will be worth $247B by 2024

Maven is targeting the global online education market, which will be valued at $247B+ by 2024. With our current business model and prior founder success, we project that we can achieve $100M+ in revenue by Year 10. For context, Udemy and Coursera are significantly bigger than that.

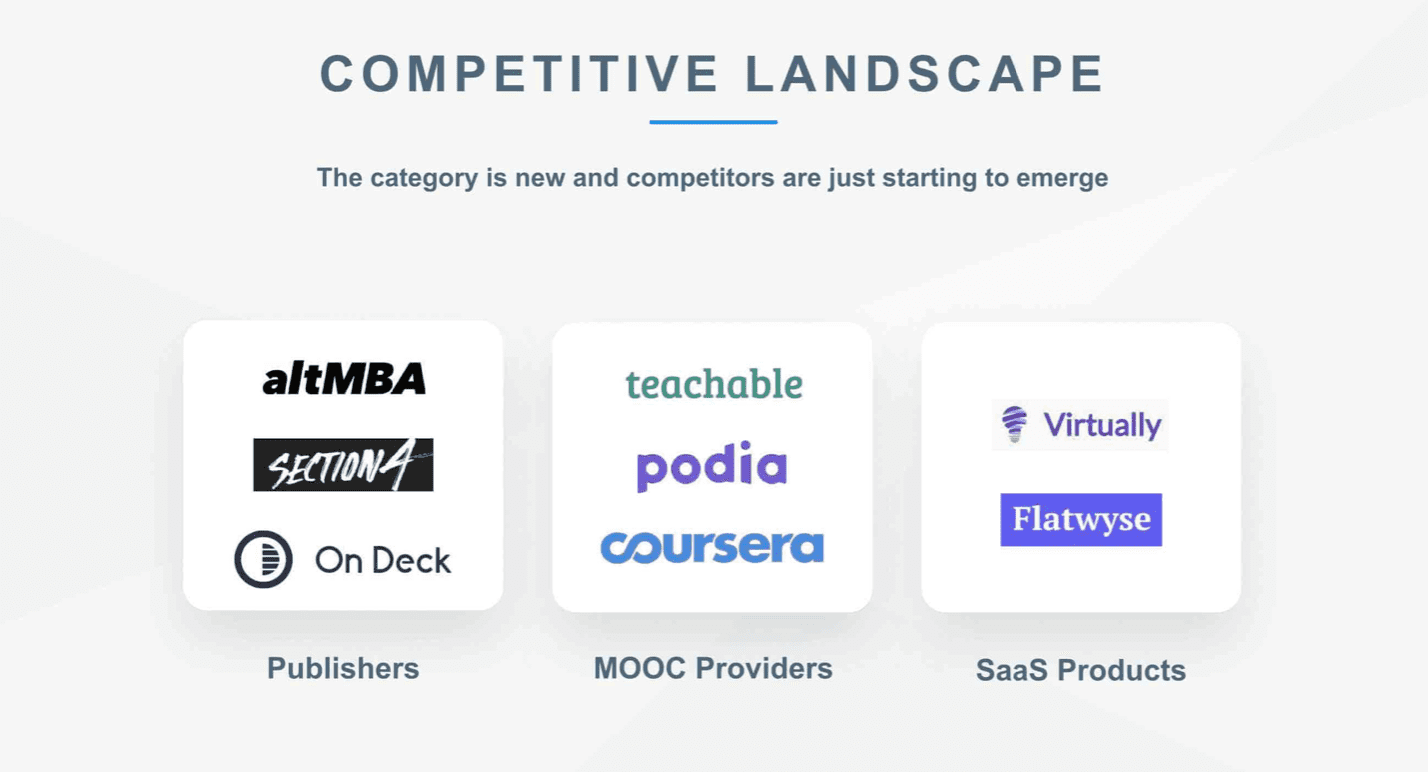

Competition

While the category is new, there are many potential threats

Maven's immediate threat are self-publishers. As our platform will allow anyone to create their own courses, self-publishing educators are our nearest immediate competitors. However, it's difficult for self-publishers to scale their courses to student interest. We have the ability to win over this competition with our advanced community building and scaling features. There are also the other MOOC platforms, which could expand to include cohort-based learning. However, their management is a mess and innovation has slowed dramatically for these companies. We also plan to offer our technology for near free, so we can corner the market and take oxygen from SaaS products.

Vision and strategy

Enabling access to the highest-end education online

Maven intends to create a new platform for the highest-end education online. Our platform will enable the best instructors to deliver community centered learning, creating competition with the traditional college system.

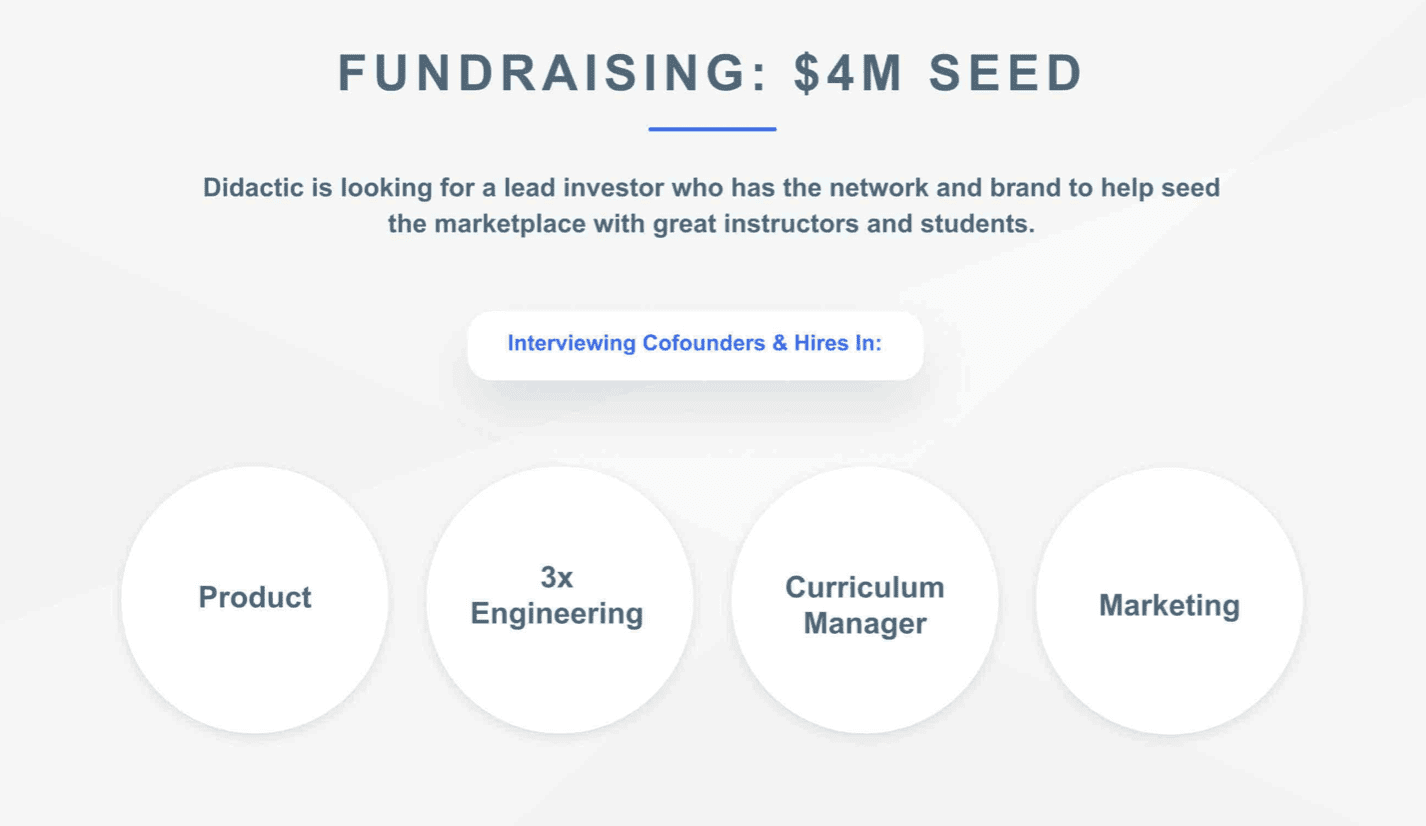

Funding

Raised over $4M+ in seed financing led by First Round Capital’s Bill Trenchard

Maven has raised $4.3 million in a round led by First Round Capital. Other investors include Naval Ravikant, Sahil Lavingia, Li Jin, Arlan Hamilton and co-founders from Lambda School, Outschool, Superhuman, and Udemy. Funding will immediately go towards recruiting co-founders or first hires. We plan to bring on several more key positions and have enough funds left to sustain 18 months of growth post-launch until Series A.

Founders

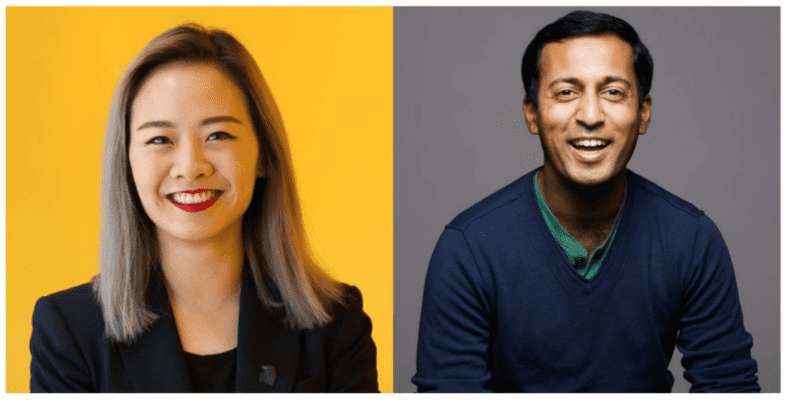

Meet our Founders

Wes Kao (@wes_kao)

- Co-founder, altMBA

- Advisor and consultant for online cohort-based courses. Clients included Professor Scott Galloway (Section4), David Perell, Outlier.org (co-founder of MasterClass), and Morning Brew

Writing:

- Unbundling course communities

- Spiky point of view

- Brand vs Performance Marketing Spectrum

- Designing courses with a 96% completion rate

- Analyzing cults to build edtech communities

Gagan Biyani (@gaganbiyani)

- Co-founder and President, Udemy

- Growth Advisor to Lyft

- Founder and CEO, Sprig

Writing:

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...