Problem

Video monetization is still a missed opportunity

Solution

Rich returns for video content

To unlock the dormant value that exists in every single video view to create new audience experiences, engagements, data, revenues, and opportunities for content owners. Transforming video from being a marketing cost into a rich source of revenue and ethical data insights.

Our shared purpose – we have widespread support from the music industry for our landmark go-to-market project to build FOMO - “The Great Music Video Project.”

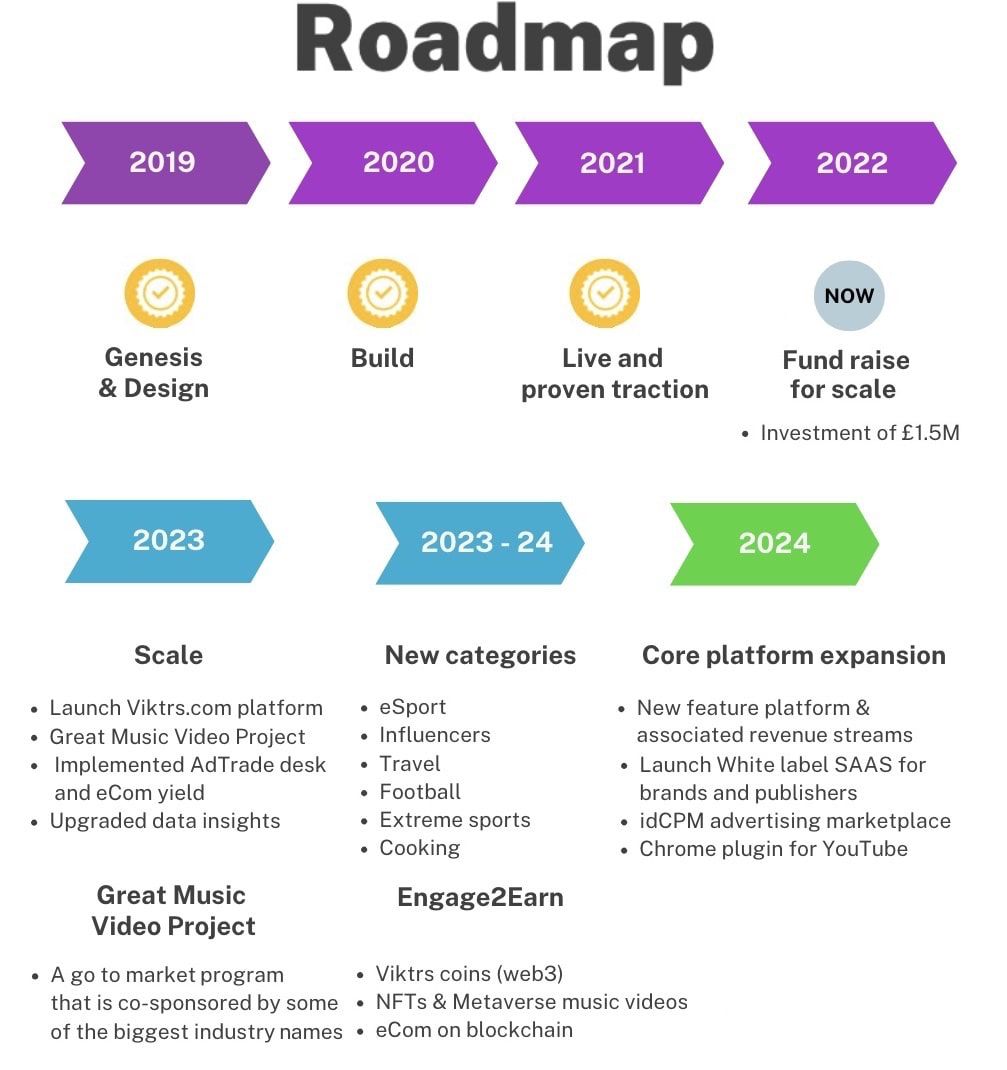

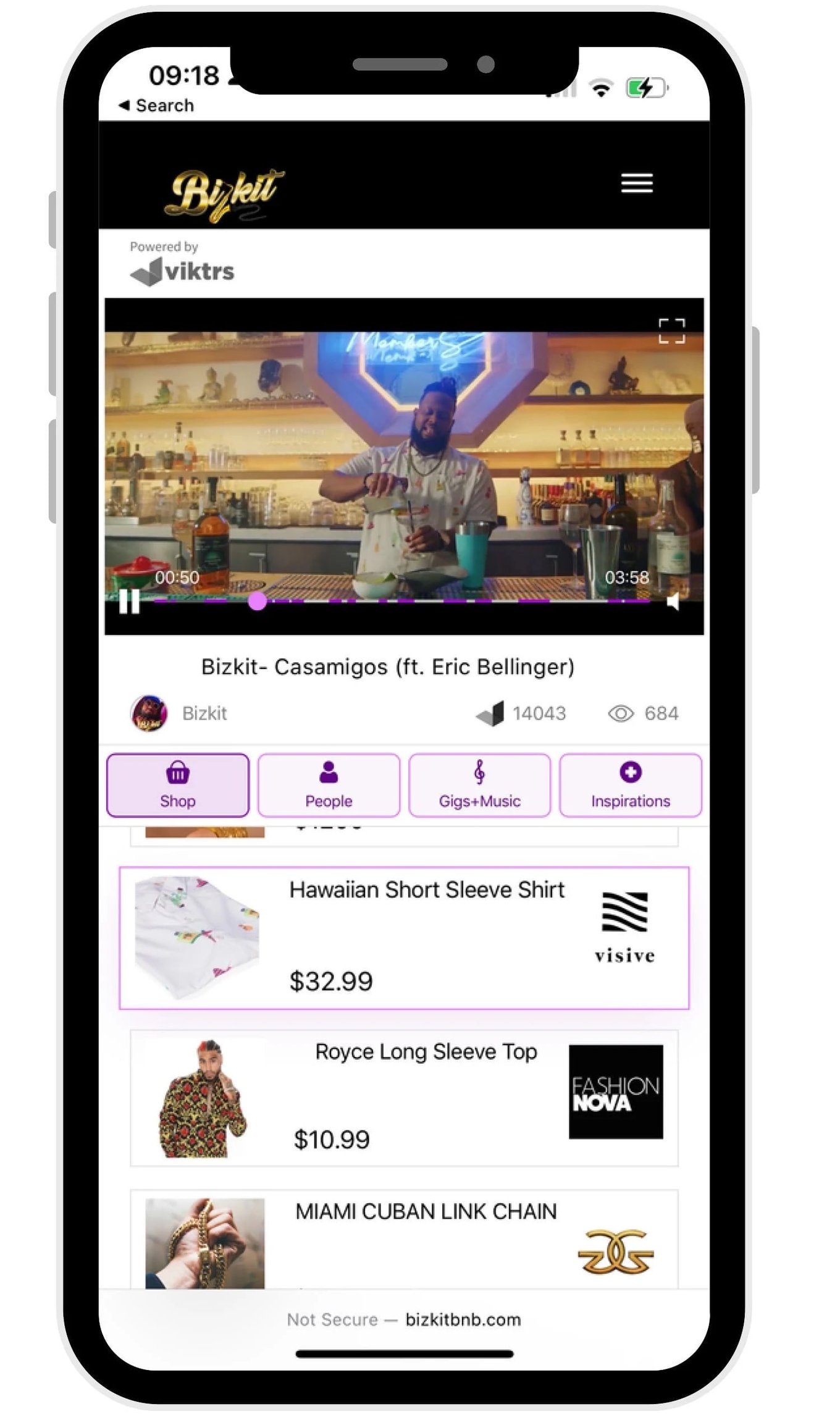

We are LIVE and have delivered 15 live pilot projects to date.

Check out all of our live pilot projects at www.viktrs.com

Check out the live Cassamigos video at www.bizkitbnb.com

We help artists make more money, create new fan experiences, and develop more rewarding brand partnerships.

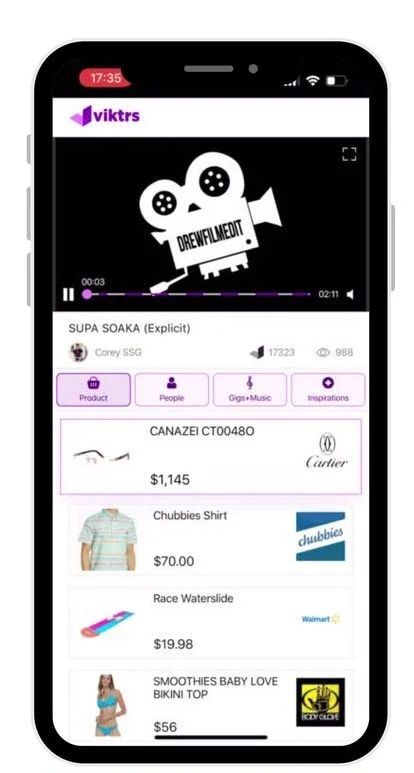

Enabling fans to connect, discover and engage with:

- Product

The brands, products, services and places they love - People

The people behind the music & video - Gigs & Music

The events, tickets, festivals & other content - Inspirations

The stories behind the artists/content, the charities and social impact they want to create, and the inspirations behind the art

Product

Revenue and data from every video view

... and new experiences for audiences.

Data solution

- Measuring brand ROI in video

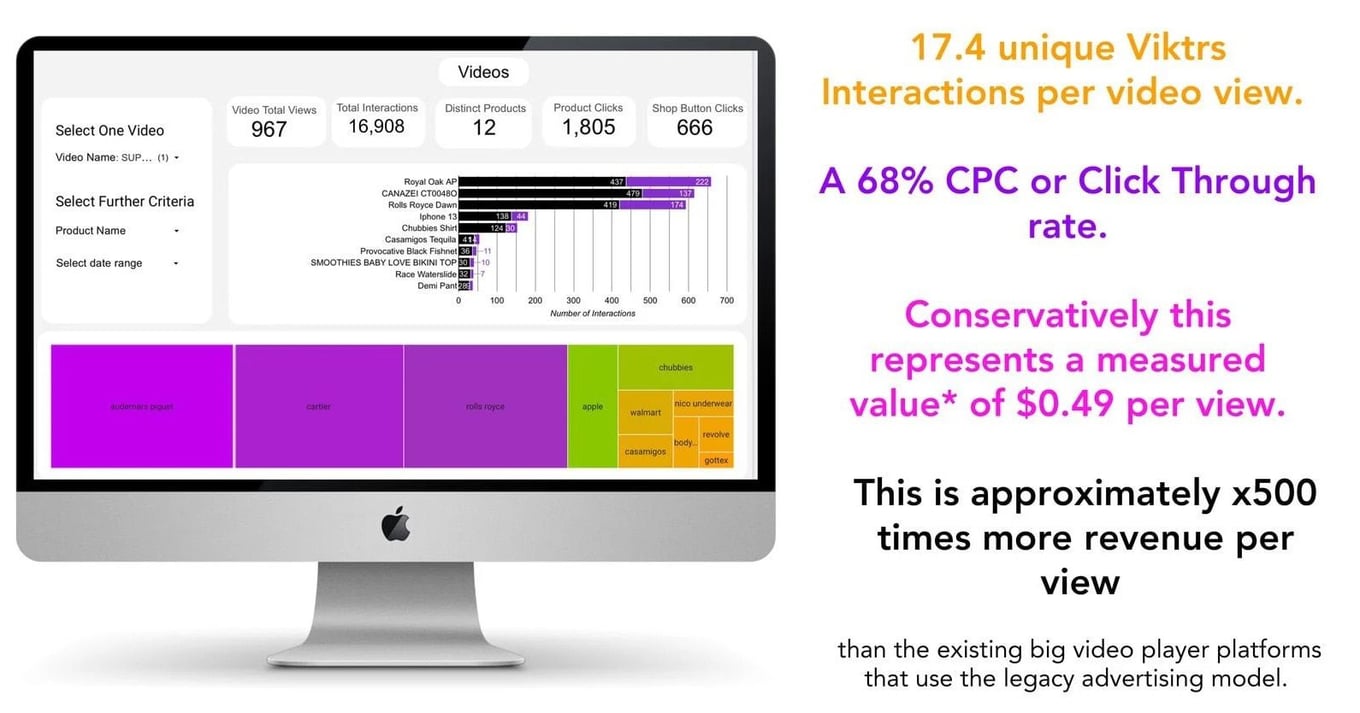

We measure a dozen types of audience interactions with the products, brands, people, events, stories and inspirations inside a video. This unique and proprietary brand performance data is the foundation of Viktrs business. - Video engagement data is like gold dust

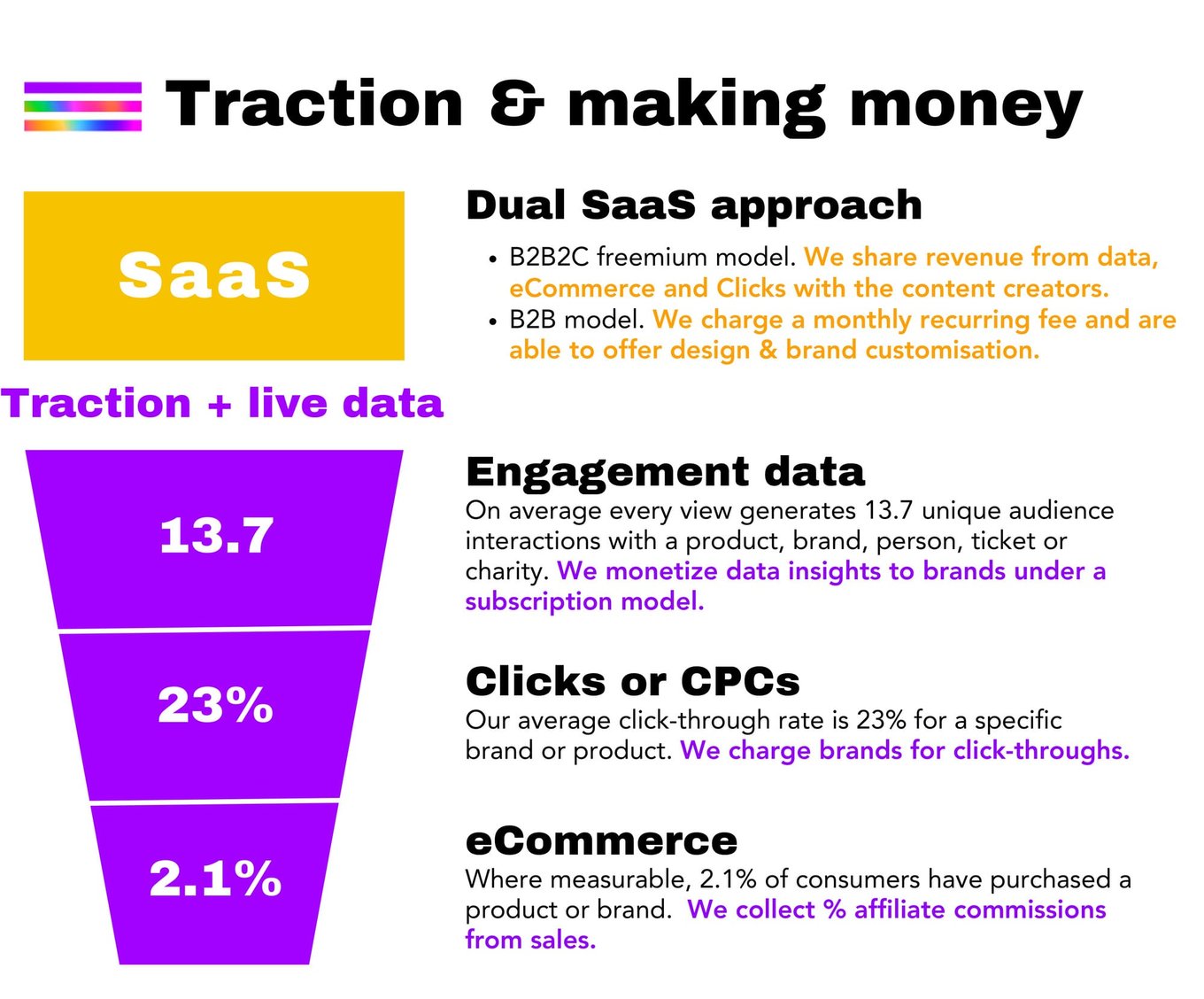

We are currently measuring an average of 13.7 unique interactions per view with products, brands, people, events, inspirations and charities inside a video.

- Monetizing Viktrs data

This data is unique to Viktrs and our approach is to charge brands a monthly subscription to access their own dedicated brand dashboards. - Data ‘fuel’ for AI platforms

This engagement data can be sold to powerful AI platforms that are desperate for video engagement data to teach them what is in video and how much engagement is happening.

Creative solution

Viktrs' interactive interface allows users to browse anything they may be curious about across our 4 tabs. This enables us to effectively solve curiosity with anything inside a video.

Products Authenticity is key – so creators identify the specific products, brands, merchandise and services they think their fans would be curious about within the video. This enables audiences to discover, share and shop them.

Authenticity is key – so creators identify the specific products, brands, merchandise and services they think their fans would be curious about within the video. This enables audiences to discover, share and shop them.

People

Giving ‘credit where credit is due’ to the entire creator and technical community, allowing fans to easily connect with and support the team behind the content.

Gigs & music

Connecting fans to live events and other creative content to build a closer and richer relationship between creators and their fans.

Inspirations

Drive social impact by sharing what excites and motivates creators, the charities and causes they support, and the backstory to their creativity.

—

Coming up next:

Any rich video content

—

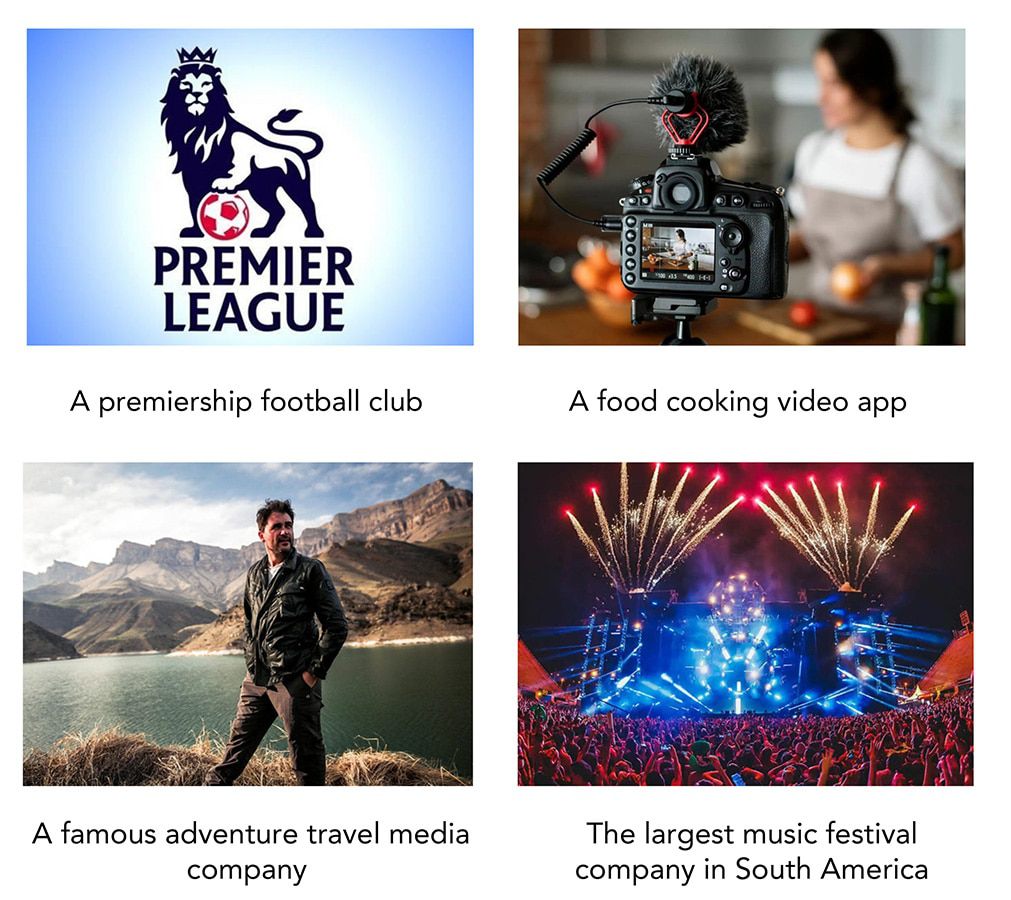

Viktrs is now live with multiple music video projects, but Viktrs can apply our technology to any rich video content.

The potential is colossal.

Traction

180 million followers!

Ready to rock & roll for 2023 with LOI’s in place with 63 artists with huge following and social reach

We have broad support from the music industry. These music partners have confirmed 'in principle' to help drive marketing and artist pipeline for our landmark go-to-market program, the Great Music Video Project (GMV) with independent artists.

The GMV's obiective is to demonstrate that videos can be a rich source of revenue and data for artists. It is designed to be delivered as a competition for independent artists (rights free) where the winners are awarded funds to make, release and promote their music videos.

In 2023, we have started to take enquiries from any content category to deliver our B2B SaaS offerings. We already have letters of intent / active projects with:

Customers

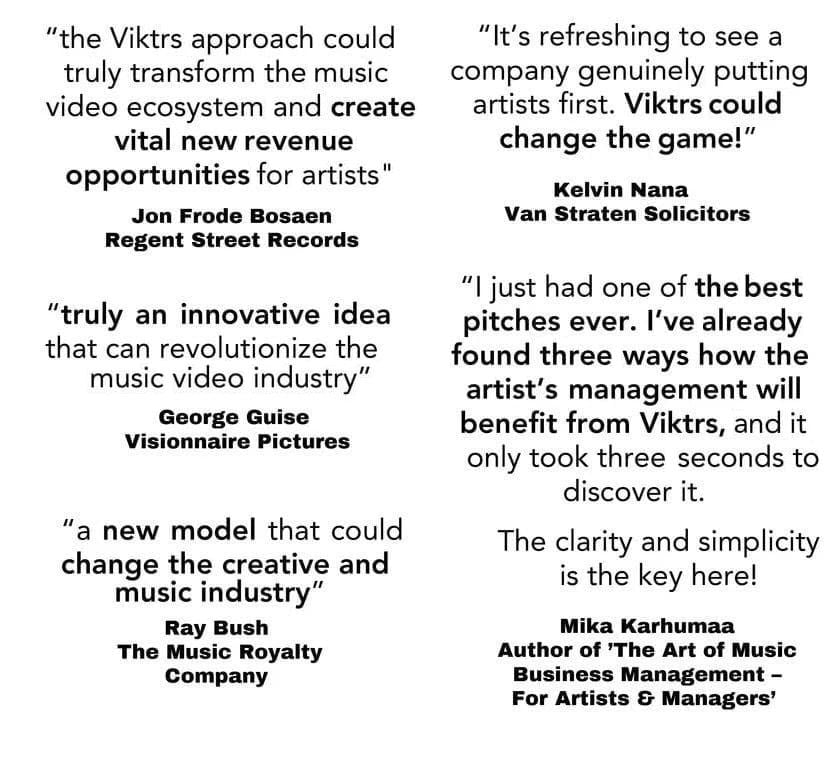

Music industry validation

"Viktrs is the perfect solution for artists to really connect with their fans. Through the data Viktrs provides, it educates and inspires the artist to get to know their fans on a more meaningful level. In a generation where DIY is of paramount importance to artists. Viktrs can be a real gamechanger!"

— Kieran Spooner, Dreamlife Records / Sony

"Tileyard is all about encouraging a fearless mindset that provokes positive disruption. Mark and the Viktrs team are certainly doing this with their ground-breaking music video model. We always support platforms where the 'artist comes first' so we are are advocates of the value that the Viktrs approach brings to the artist and the music industry as a whole."

— Nick Keyes, The Tileyard Music Community London

"Many artists never received the value of the cultural impact they created. By helping realize the true commercial value and impact of their creativity on society, culture and fashion, Viktrs enables artists & their communities to finally generate the rewards they deserve."

— Paul Pacifico, Association of Independent Musicians

Brand insights team from a major music label in the UK, Oct '22

Brand insights team from a major music label in the UK, Oct '22

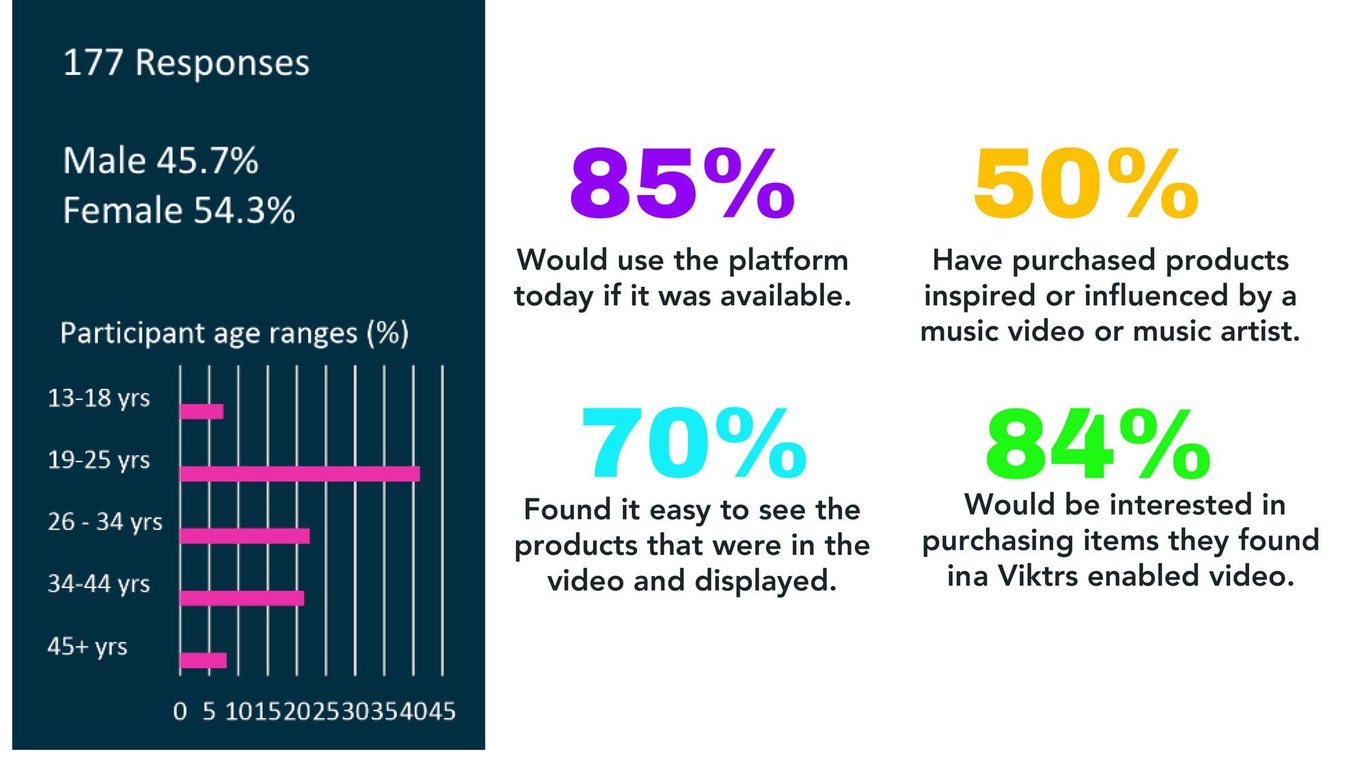

Audience validation

Business model

—

Check out the video on

Corey SSG's website

—

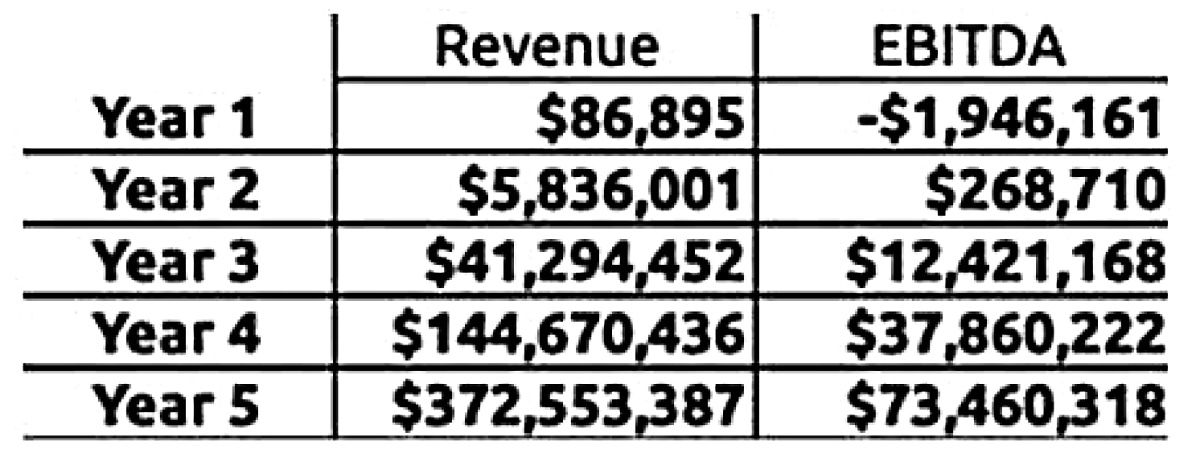

- In our financial model, we have taken a conservative view of industry assumptions

- Avg CPC on Facebook in the product categories relevant to Viktrs in 2022 was USD $1.01. In our financial models, we halved this to an avg price of only $0.50. Industry report: What is the price of a CPC?

- We measured all purchases, and a Viktrs-enabled video had a CPA of 2.1%. We halved this and assumed a CPA of 1%

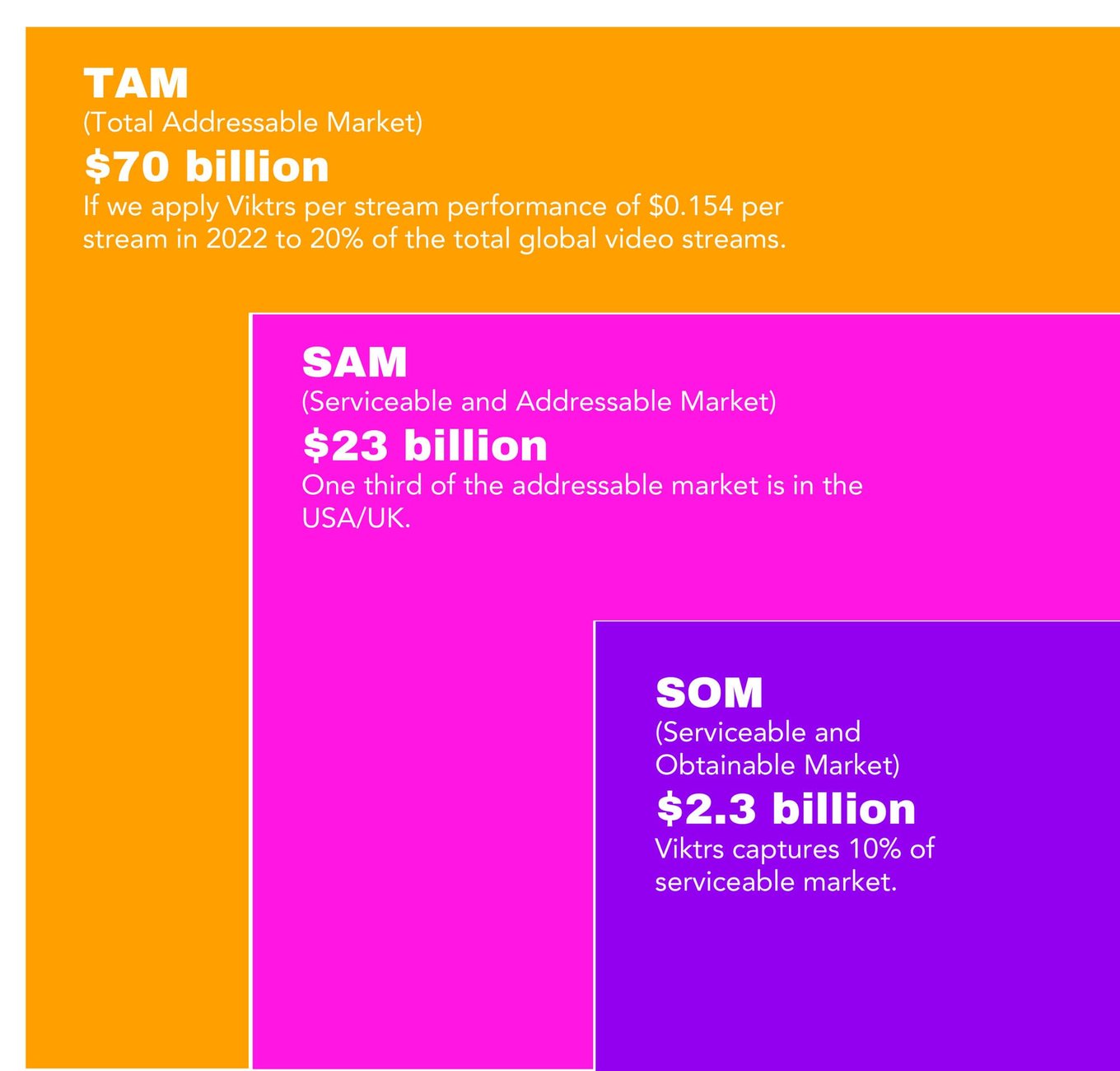

Market

$2.3B by 2030

Assumptions |

|---|

*Music streaming market CAGR |

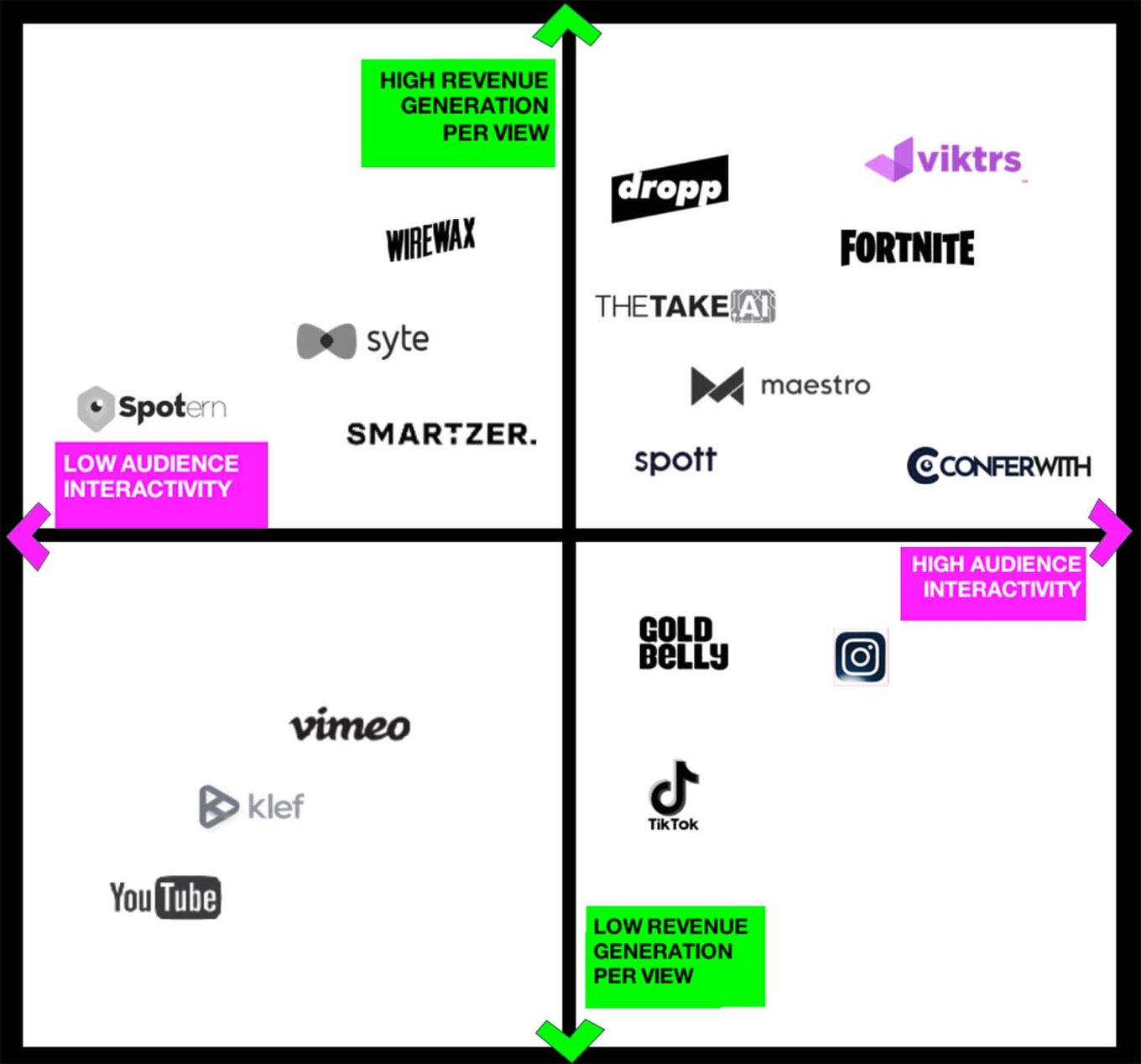

Competition

What makes Viktrs unique?

- Every click is monetized

- No ads

- 120x more revenue per view to creators than existing video platforms

- Engagement beats views: 12 different types of audience engagement measured within every single video view

- Invaluable data insights to brands

- 50-50 split with creators

- Better value proposition for creators to onboard with Viktrs than any competitor

Vision and strategy

Founders

Mark Bamford

CEO & Founder

"We believe the current advertising-driven video marketplace model that requires high volume viewership is broken. Our approach can make the commercial cake bigger by making every single video view valuable.

"We believe the current advertising-driven video marketplace model that requires high volume viewership is broken. Our approach can make the commercial cake bigger by making every single video view valuable.

Viktrs believes in a better, fairer, and more ethical future for audiences and creative communities, because without them — art, culture, entertainment and creativity die.

For the brave and bold amongst you... join us on our journey!"

Summary

Why Viktrs?

Status

Live BETA, pre-revenue — but already creating measurable value which we will now monetize.

Traction

Viktrs has data that shows the potential to deliver up to 120x more revenue per view than existing video platforms.

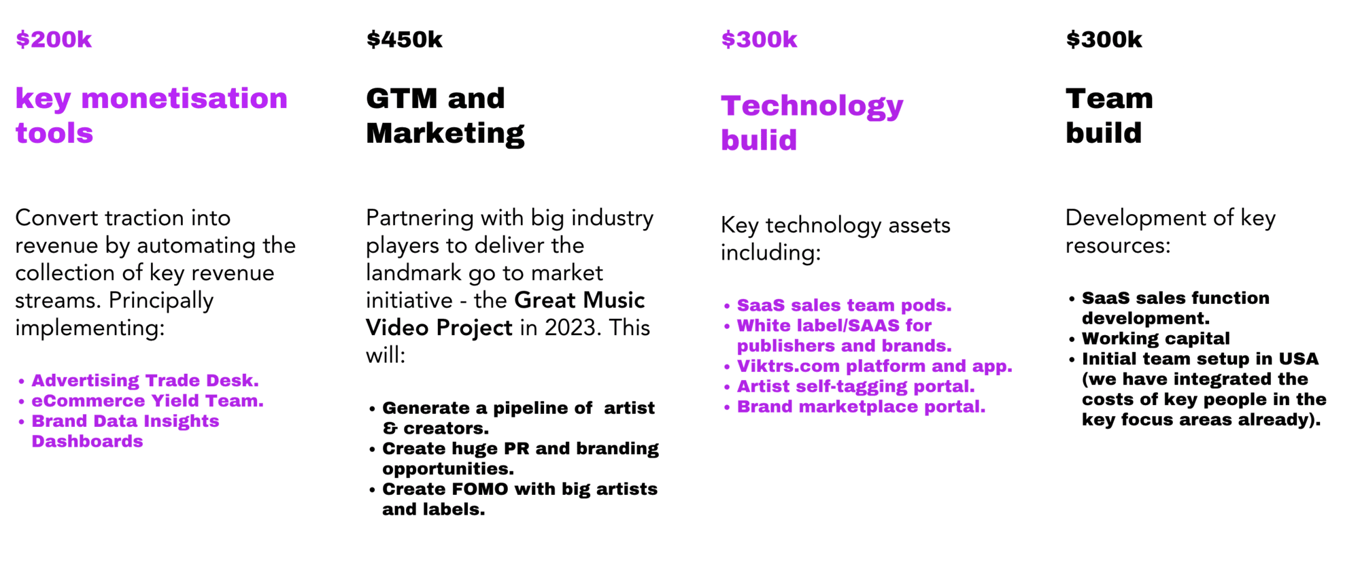

Business Model

1. B2B then B2B2C in 2023

2. Monetize data insights

3. eCommerce

4. PC's (advertising clicks)

Data Ownership

All measured engagement, audience interactions, and brand data we collect is 100% the proprietary property of Viktrs.

Video Market Opportunity by 2030

- $71B global market

- $24B addressable in US & UK

- $2.4B Viktrs market

Exit Scenarios

Year 3 or 4:

Exit to strategic media platform at a valuation of $570m.

Year 5:

Exit to large venture entity at a valuation of a minimum of $1.2b.

The above valuations are based on a 15-17x EBITDA that is also considered a fast growth company seeing 200-300% growth per year.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...