Until a few months ago, debt for home flippers was cheap and abundant. Now higher interest rates have forced fix-and-flip...

Problem

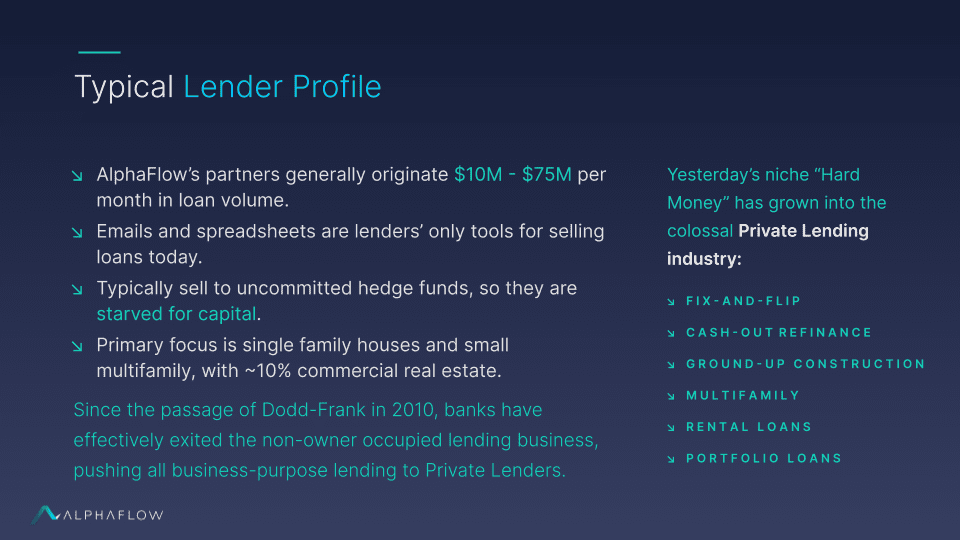

There is a $600B non-bank real estate lending market but it is starved for capital. Banks have narrowed to only focusing on the type of owner-occupied mortgages you or I get when buying a house, so a tidal wave of demand from real estate developers hit the private lending market. These are borrowers who need loans to build new houses, do a fix & flip, renovate an apartment building, or build a portfolio of rental homes — all absolutely critical with today's severe housing shortage. The problem is massive lender fragmentation.

It's simply too hard for large institutions to work with these small local lenders. For the lenders, it means that they cannot connect to the capital markets and so they do not have the liquidity they need. For investors, it means they are largely left out of this asset class and can only work with a handful of large lenders who produce higher defaults and lower returns.

Solution

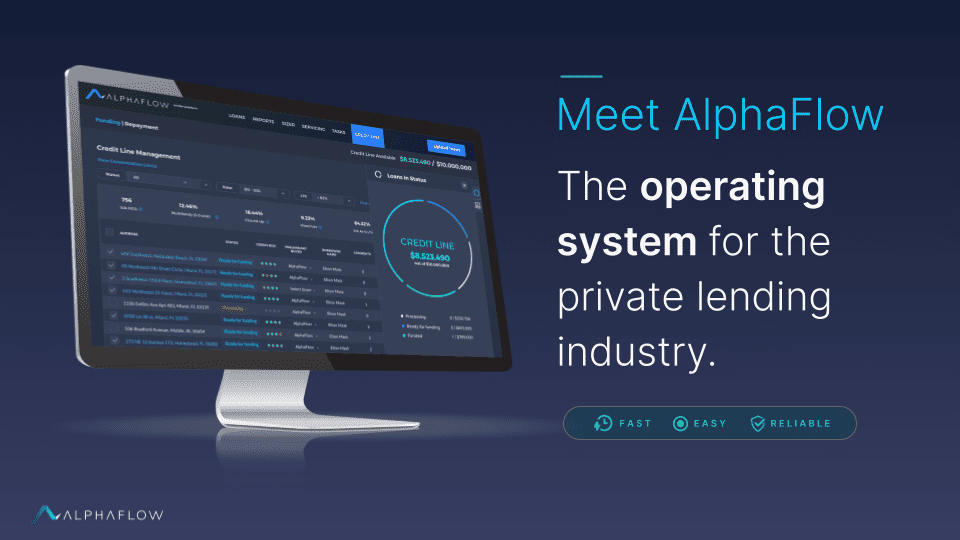

AlphaFlow connects two of the largest industries on the planet: real estate debt and the world's capital markets. Our platform enables real estate lenders to quickly and easily sell their loans and recycle their capital, helping them (1) grow their businesses and (2) access investors otherwise unavailable to them.

Lenders no longer need to reinvent the same wheel again and again. Instead of building an expensive capital markets team and being distracted from what they do best – finding and serving great borrowers! – lenders can now make AlphaFlow part of their business plumbing and stay focused on growing their businesses.

What used to be expensive, complicated, and risky is now fast, easy, and reliable with AlphaFlow. With our new products, our platform is expanding to now help lenders manage the entire loan lifecycle.

Product

Building the industry operating system

Today, AlphaFlow is one of the top buyers of private real estate loans. No competitor comes close our ease of process and speed.

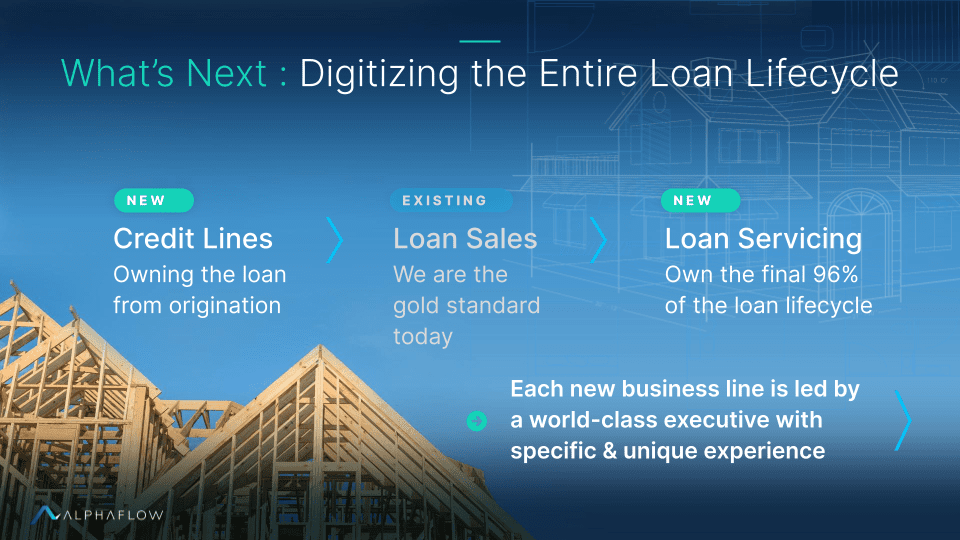

With AlphaFlow having set the standard for selling loans, we are now digitizing the entire loan lifecycle to deliver the operating system for the private lending industry.

Building the operating system means delivering software that (1) is used daily for mission-critical business processes, and (2) serves as the source of truth. With Credit Lines and Loan Servicing, we are now capturing the entire life of a loan from origination to payoff.

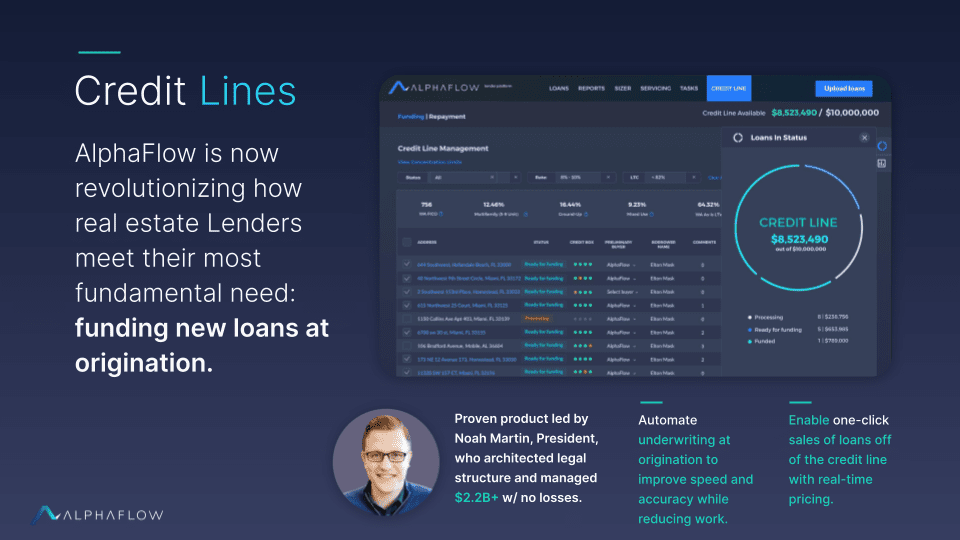

Lenders need a credit line to originate loans and have limited options, most of which are expensive and clumsy. AlphaFlow is revolutionizing the entire experience through software, which (1) automates underwriting steps and thereby reduces work and time for lenders, and (2) makes selling loans to AlphaFlow as simple as one click. This product will absolutely redefine the entire private lending industry and we have a massive backlog of lenders seeking a credit line from us.

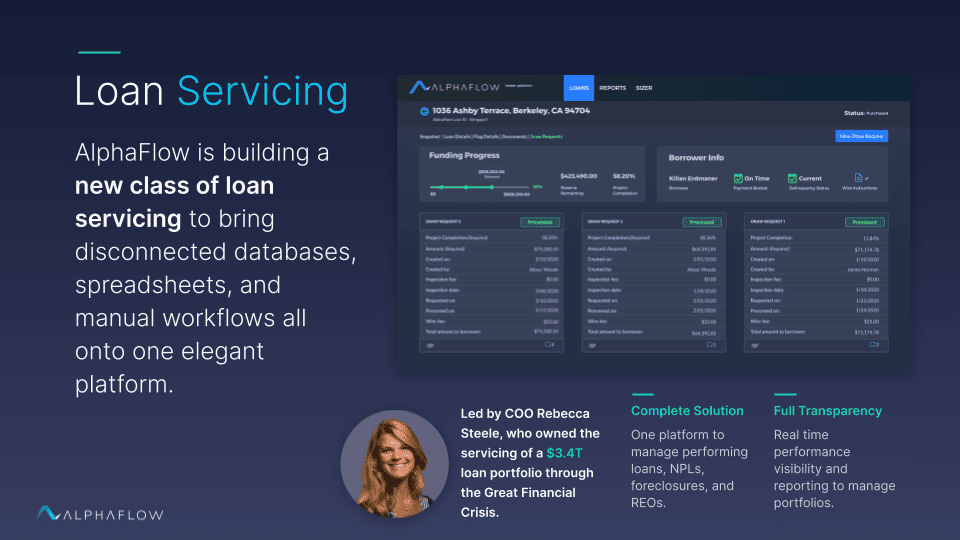

Once a loan is originated, every payment, construction draw, and performance issue needs to be managed for the investor. AlphaFlow brings together these fragmented data sources all into one beautiful platform. Led by COO Rebecca Steele who managed a $3.4T portfolio through the Great Financial Crisis, AlphaFlow's servicing platform gives investors a complete solution unlike anything available today.

Traction

Quickly scaling

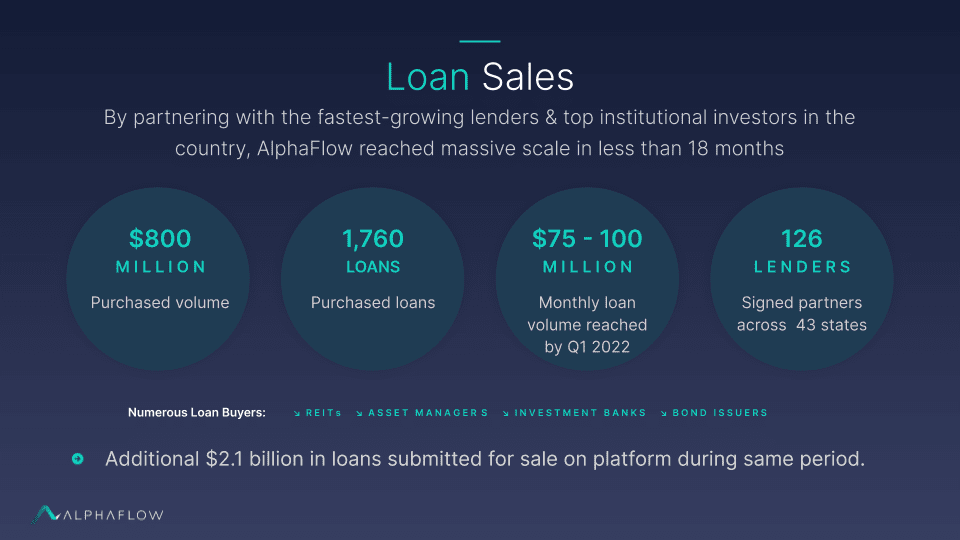

AlphaFlow has built a massive business in the last 18 months. Our unparalleled software platform has been the driver. Lenders sold over $800 million in loans on AlphaFlow since January 2021, while presenting an addition $2.1 billion+ of loans for sale.

By leading with technology, AlphaFlow has been able to hit these enormous numbers with fewer than 45 people in the entire company today. With our new Credit Line platform, we go earlier into the loan life cycle and expect to capture a greater share of each lender's business by (1) seeing every loan, and (2) making sales to us as simple as clicking a button.

Customers

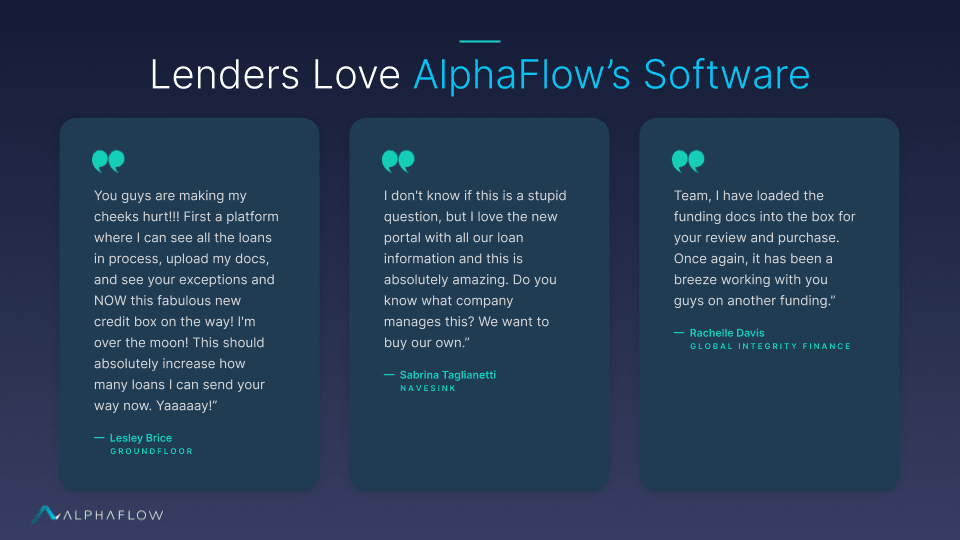

Lenders love

AlphaFlow's software

AlphaFlow's clients make up the U.S. private lending industry. These local lenders are the lifeblood of the real estate investment industry, funding contractors and developers in every part of the country.

They are often incredible entrepreneurs and the best developers have loudly shown that this is where they want to go to fund their projects.

AlphaFlow is here to make sure they have all of the capital they need.

Behind our platform you'll find some of the world's biggest and most sophisticated investors. Today we count REITs, asset managers, investment banks, bond issuers, and hedge funds as our clients. We expect to add new types of partners, like pensions and insurance companies, in the next 12 months.

Unfortunately, as is typical in the institutional investing world, we are prohibited by confidentiality agreements from disclosing any investor names.

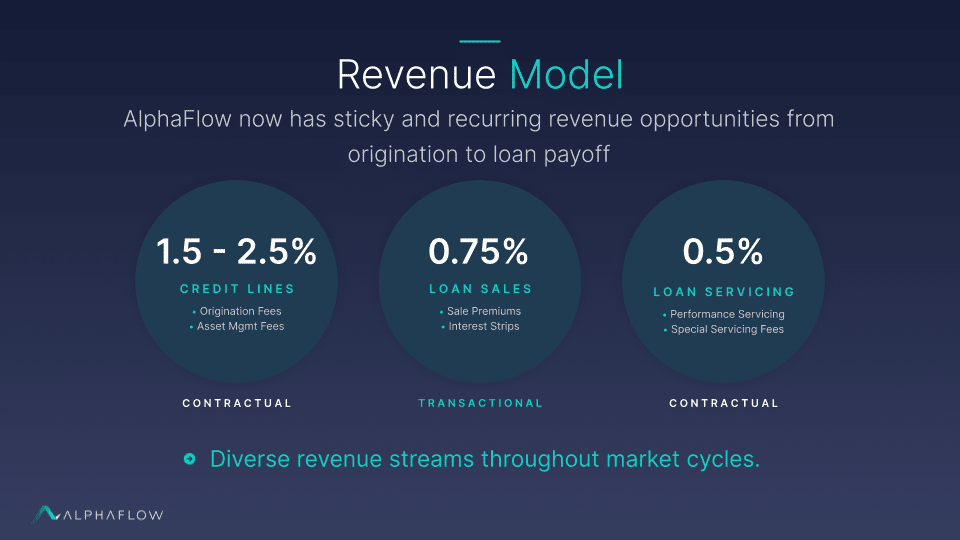

Business model

Strong unit economics

AlphaFlow's new business lines transform our transactional revenue model into recurring, sticky contractual revenue. By going beyond just loan trades and into daily lender needs, we are expanding our revenue opportunity and building a larger business that is stable through economic cycles.

With our new business lines and commitment to technology over headcount, we expect to achieve profitability within 12 months.

Market

Powering the U.S.

housing market

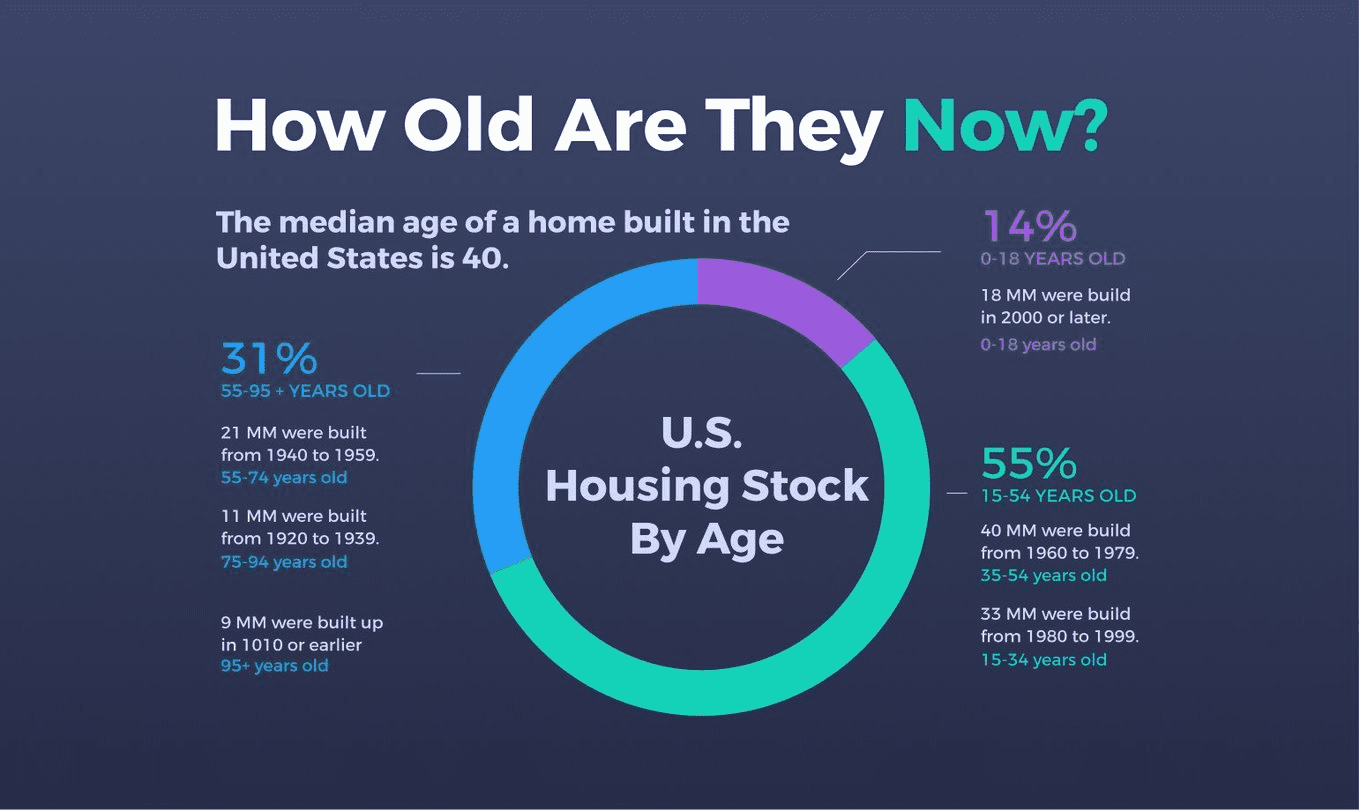

Over the last 15 years, as banks narrowed the types of loans they provide, the private lending industry has exploded in size and demand. The lenders are where real estate developers go to finance their projects with construction and bridge loans.

Real estate bridge loans are forms of short term financing, usually on single family homes or small apartment buildings. These groups used to be called "hard money lenders" but the average FICO for their borrowers today is often above 725. The industry is dominated by small local firms who know their neighborhoods and move fast for their borrowers, which on a short term project is critical.

20 years ago, these lenders only provided high-interest, short-term fix & flip loans but today they also offer: ground-up construction loans, multifamily loans, rental loans, portfolio loans, and cash-out refinances. The type and size of loans they offer is growing with help from groups like AlphaFlow and the market is exploding!

The industry is too fragmented for institutional investors to access, and so these lenders are starved for capital. With the U.S. desperately in need of more homes and the age of our current housing stock, this industry (and AlphaFlow!) is only becoming more critical.

Competition

Disrupting traditional competition

AlphaFlow primarily competes with traditional hedge funds in buying loans from local lenders. These firms typically have experienced wall street leadership but are stuck in yesterday's emails and spreadsheets. Our key differentiators today include:

- Speed: AlphaFlow provides instant feedback via our proprietary software and usually buys in less than 5 days. Traditional funds often take weeks because of manual processes.

- Transparency: AlphaFlow shares underwriting insights via our Platform, giving lenders access to our big data infrastructure.

- Reliability: Diverse capital sources, including both institutional investors and our January 2021 securitization, empower us to be a uniquely reliable partner for lenders.

Furthermore, being early has allowed us to build an accumulating data advantage, and we’ve grown a data set on our asset class that is already one of the biggest in the U.S.

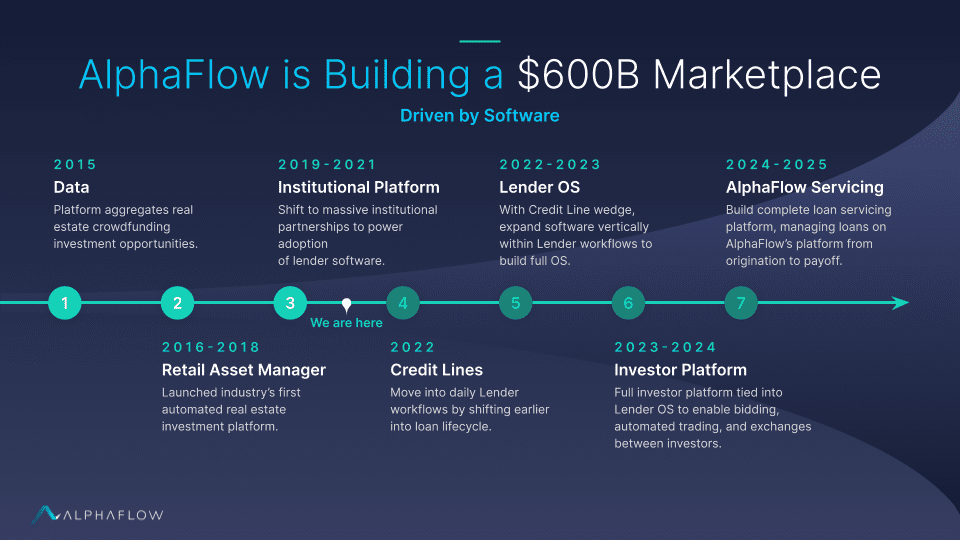

Vision and strategy

Building a $600B marketplace

AlphaFlow's vision is to seamlessly connect to of the largest industries on the planet: real estate debt and the world's capital markets.

Over the last 18 months, we have built a great way for lenders to sell their loans. We're now expanding how we serve lenders by delivering software to that manages the entire lifecycle of the loan from origination to payoff. The result in the Lender Operating System.

By digitizing loans in our platform from the earliest stages, we capture the atomic unit of the industry: loan activity. With mission-critical information all in one place, AlphaFlow becomes the industry source of truth. The result is a platform that both (1) empower investors with a dedicated platform driven by real-time data and increased liquidity, and (2) integrates the industry's best vendors and third parties into one elegant solution.

We're bringing to of the largest industries in the world together through an elegant software platform. We have a large head start and the support of some of the biggest investors on the planet. And we're just getting going. Join us!

Funding

Previous financing of ~$23M across 4 rounds of funding

We've already raised over $20M in financing to date from investors like Y Combinator, Point72, Social Capital, and Saluda Grade. We plan to use additional funding to expand our platform across the entire loan lifecycle and entrench our software as the industry operating system.

We are accepting investments here to accelerate AlphaFlow's growth ahead of a planned Q1 2023 Series B. In addition, we quickly closed a strategic investment in Q1 2022 and were not able to include our Republic family in that raise and are excited to do so here.

Previous Financing

- Q3 2015 Angel Round: $520k

- Q3 2016 Seed Round: $1.6 million (YC W16 batch)

- Q3 2017 Seed Extension Round: $2.5 million

- Q4 2020 Series A: $10M, including SAFEs secured over previous 24 months

- Q1 2022 Strategic Investment: $7M on SAFE, with New York Mortgage Trust (publicly-traded REIT) and Point72 participating

Founders and leadership team

Unlocking the world’s

opaque markets

As founder and CEO of AlphaFlow, Ray is obsessed with building technology to redefine the world of real estate investing. Ray is a leading entrepreneur in financial technology (FinTech). Prior to launching AlphaFlow, he founded RealtyShares, one of the industry's first and biggest platforms for real estate investing. His early career in finance included investment banking at Bear Stearns and Lazard Frères and private equity at CCMP Capital. Ray has a BBA-Finance from the University of Notre Dame and a JD/MBA from the University of Chicago.

Noah Martin, President

Noah Martin is the President of AlphaFlow. He is focused on the strategy and execution of Company’s Capital Markets Strategies. Previously, Noah founded and served as CIO for Direct Access Capital in 2016, a Multi-Family Office asset manager with $1B in AUM. Noah served as CIO for Highbury Capital Management, a Pine River Capital Management portfolio company, where he focused on specialty finance and technology strategy. Before that, Noah served as the SVP of Business Development for Jordan Capital Finance, a portfolio company of Garrison Investment Group, a $6B credit focused private equity group. Noah was a founder of Matt Martin Real Estate Management (dba Chronos Solutions) where he served for five years as the Chief Business Development Officer. The company was ranked for two consecutive years in the Inc. 500 fastest growing companies in the country. Noah studied finance in the MBA program at Cox School of Business at SMU. Noah has studied for multiple degrees including a BA in Mathematics from SUNY, and both an MA and BA in philosophy from Messiah College.

Rebecca Steele, COO

Rebecca is the COO of AlphaFlow, and has spent the last 25 years in the mortgage and consumer finance industries. Rebecca has experience managing some of the nation’s largest and complex residential mortgage banking businesses, spending much of her career at both JPMorgan Chase and Bank of America. This includes experience in both retail mortgage originations, and servicing portfolios. .She managed a $2+ trillion-dollar servicing portfolio within home loans servicing, with over 10,000 employees. She has led multiple mortgage process improvements and projects related to controls, risk, regulatory and compliance. She also has significant experience in the default servicing industry, managing some of the largest volumes of modifications and foreclosures across the nation during 2009-2014. She earned a BS in Chemical Engineering from Drexel University, and an MBA from Villanova University.

Gabe Rinaldi, CTO

Gabriel is AlphaFlow’s CTO. He is an expert on building teams and creating technology solutions to solve industry problems. Prior to AlphaFlow Gabriel developed Aero’s (Semi-private travel company) reservation system to allow for a customized customer experience while complying with all FAA and EASA regulations. Gabriel is also a pioneer in mobile development, creating the second largest mobile company in Brazil with clients ranging from leading publishers like Abril and Saraiva, to industry leaders as Unilever and TAM.

Dana Georgiou, SVP of Lender Partnerships

Dana is a seasoned mortgage professional with nearly 30 years of mortgage lending experience and is AlphaFlow’s SVP of Lender Partners, having most recently led sales at PeerStreet. Her career spans roles as a senior/executive manager in sales, marketing and lending operations for the last 15 years. Her expertise includes development of high performing teams, creating sales growth and strategy, perfecting and implementing solutions to streamline new loan production, new program and product development as well as managing large scale mortgage operations. She has worked in all channels of the mortgage business with the last few years focused on the Private Lending/Business Purpose Entity lending space.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...