Problem

What people want to drink has changed but the industry hasn't kept up

The majority of the existing options in the soda & mixer category have 50% more sugar than your entire recommended daily intake

What’s wrong with current options?

- Full of added sugar or fake sweeteners: most have close to or more than your entire daily sugar intake, those that don’t have equally bad fake sweeteners.

- Made with nasties: brands use all sorts of beverage hacks from artificial sweeteners to coloring agents to not so "natural" flavors.

- Outdated: where is the fun? We have a whole world of flavors to play with.

Why hasn't someone fixed it? Big Beverage has too much riding on its overly sweet flavors to disrupt itself. So we’re doing it for them.

Solution

AVEC re-thinking the category from scratch — with the modern drinker in mind

Making soda & mixers that are:

Full flavored, dramatically less sugar: we use balance not sugar to create flavor. Our drinks are >80-90% less sugar/ calories than mainstream alternatives

- Inspired by flavors from around the world: we bring the best ingredients the world has to offer to re-invent old classics and create new ones.

100% all natural: we use just juice, natural botanicals, spices, and the occasional drop of agave.

Versatile: We work well by ourselves as an NA treat - or when mixed with alcohol.

Turns out that when your drinks are made from quality ingredients, you don’t actually need all that sugar!

Product

We spend a ton of time balancing natural ingredients to create flavor

Instead of using a ton of sugar, or other beverage hacks like “natural flavor,” dodgy sweeteners like stevia, monk fruit or erythritol. This means we can create great tasting products without the usual downsides.

They are tasty and healthy

We have six flavors, all aimed at replacing a different favorite American flavor profile.

Traction

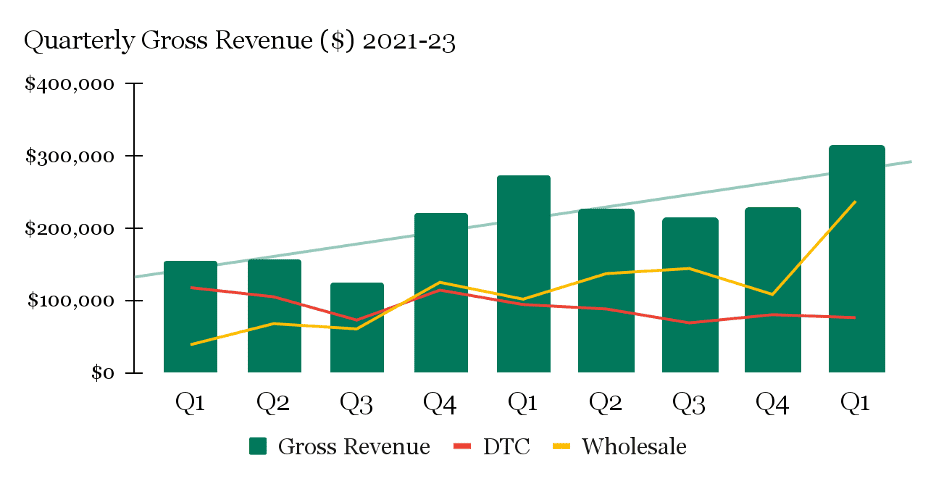

Exciting early sales, with multiple proven channels

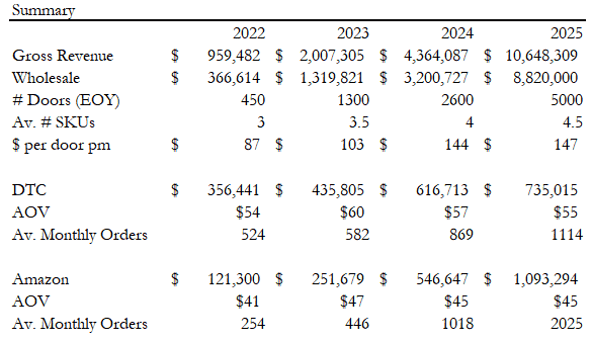

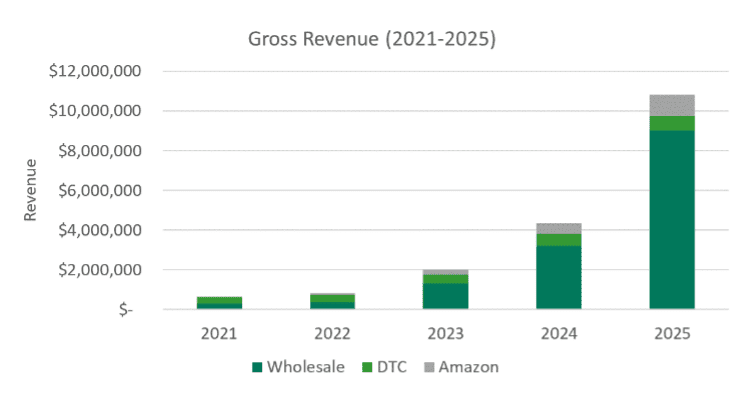

- $620k in 2021 (first year); $950k revenue in 2022; predicted to do ~$2m in 2023

- 100% wholesale sales growth YoY (Q1 2022 vs Q1 2023)

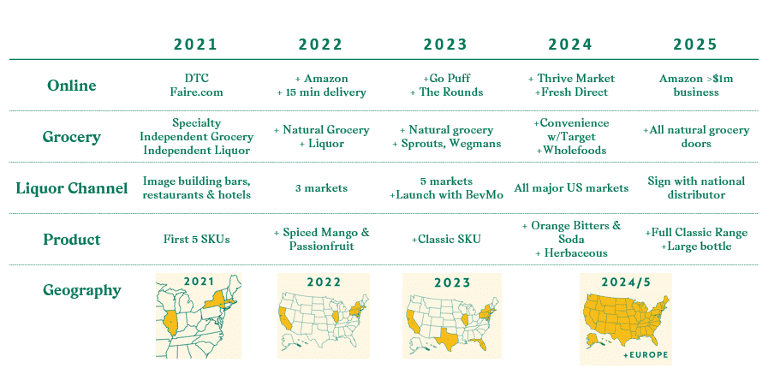

We’ve launched at Wegman’s & BevMo with Sprouts planned for launch in July. This will take us from ~600 to 1200 locations

With potential for more: in conversation with 2 more large retail chains totaling >1000 more locations for

Proven love from chefs and bartenders in the on-premise with over 100 menu placements, including multiple Michelin-star restaurants serving AVEC!

Truly omni-channel with 50% of sales from offline & 50% online (DTC, Amazon, Faire.com)

Over 50% growth YoY, Wholesale growth >100%

Exciting & growing customer base

* Click here for important information regarding Financial Projections which are not guaranteed.

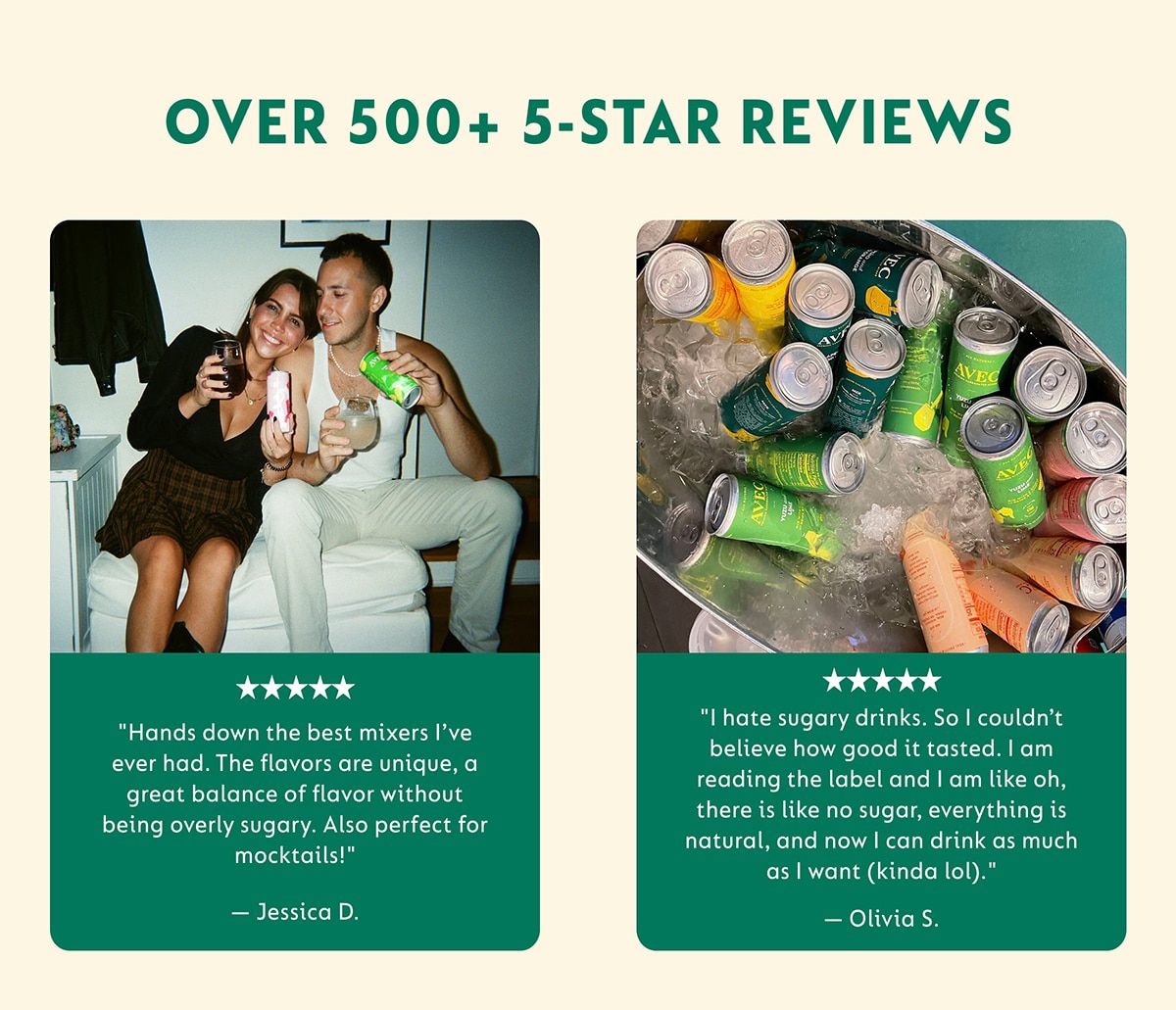

Customers

AVEC is for the mindful drinker, who is making conscious choices about what they drink.

There are three major & overlapping customers:

- Health-Conscious Drinker: those who are conscious about both the sugar content and quality of what they drink

- The Sober-Curious Customer: people who are looking to moderate or restrict their consumption of alcohol

- The Foodie: people who deeply care about flavors and ingredients

They are giving AVEC rave reviews.

Business model

We sell through retail (grocery and liquor), on premise (restaurants & hotels) & online (DTC & Amazon)

We are focused on launching at major grocery & liquor retailers and building out distribution around them through local wine & spirits distributors.

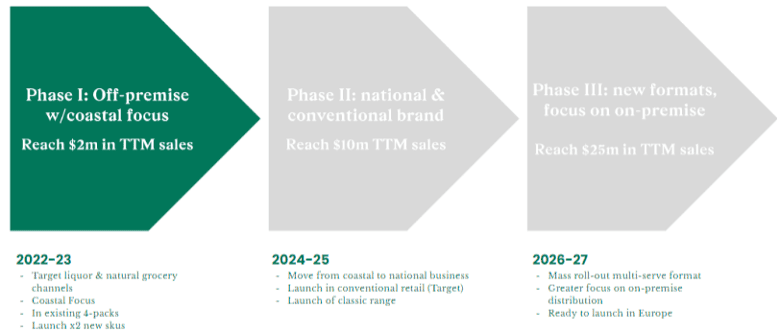

How we get to $10m revenue <3 years

Our road map

Our north star for what is possible is Fever Tree with a market cap of $2bn

Revenue multipliers tend to be 4-8x revenue and can be much higher

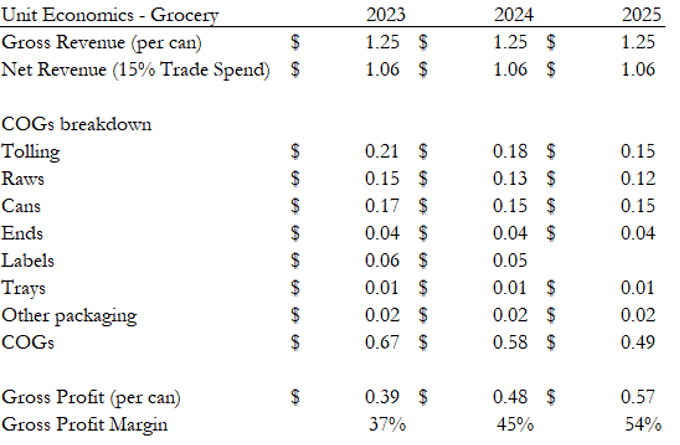

Gross Margins improve quickly with scale - the easiest way to show these is by breaking down our economics in grocery

*In 2025 we would move to printed cans

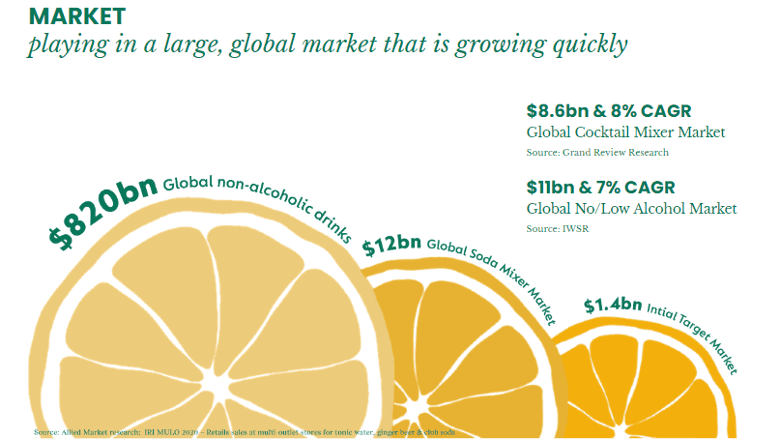

Market

Both the cocktail mixer & no/low alcohol market are huge and growing quickly

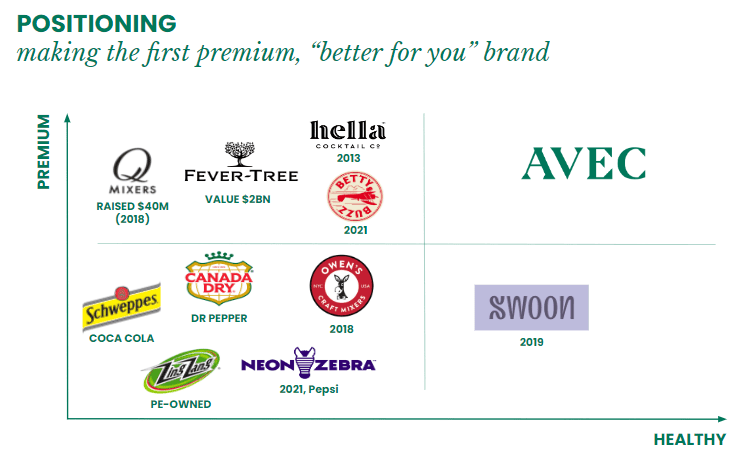

Competition

We are creating a new category of better for you & ingredient focused sparkling drinks

Vision and strategy

We are creating a global "better for you" soda & mixer brand on mission to help us drink better!

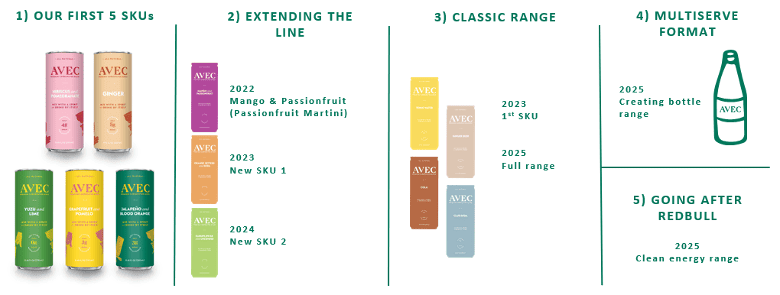

With an epic product pipeline

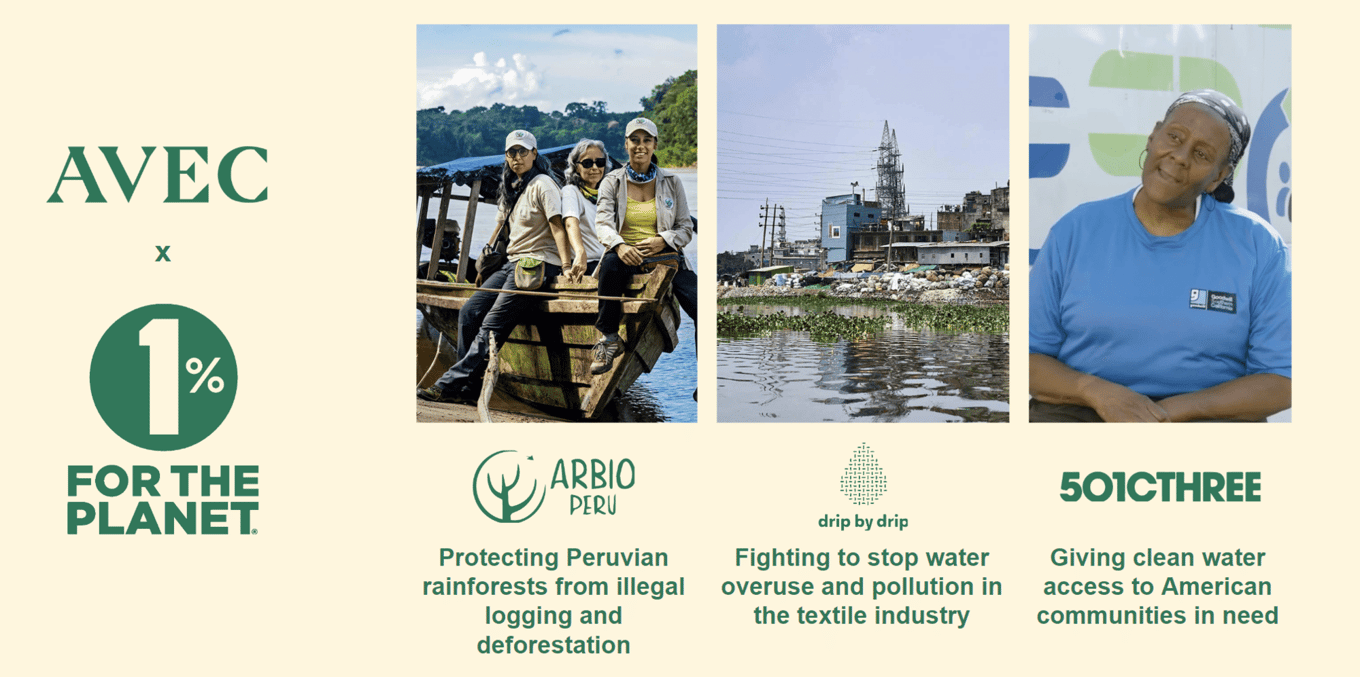

Impact

We are committed to doing a better job for the environment

Funding

Investors & advisors

Raising money to nail our retail roll out!

Use of funds

- Hire a sales & merchandising team

- Provide marketing budget for in-store promotional activity

- Manufacture more inventory

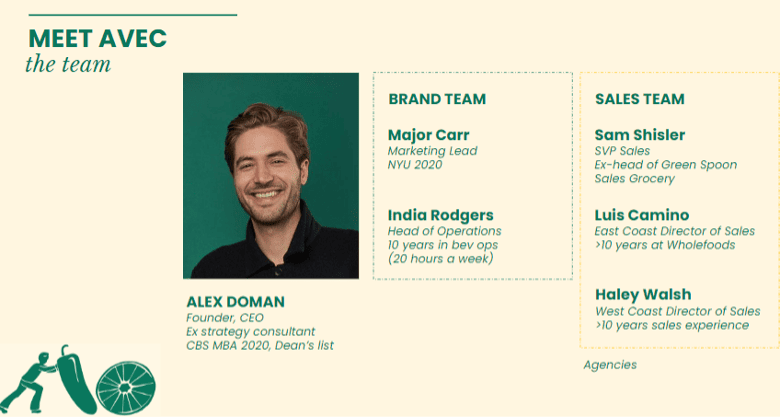

Founders

A young team paired with deep experience in F&B

Summary

Come join us disrupt the world of big beverage and help us on our mission to re-create the category along modern, healthier lines. It's about time!

Why invest?

- The time is now. Customer tastes are changing too quickly for large industry players to keep up. We can take a large slice of the pie in the meantime.

- We’re growing quickly with new retailers locked in – we just need the cash to fund it

- Our biggest tail-winds are that people want to drink less and are looking for more non-alcoholic soft drink options & when they do drink - they are drinking higher quality spirits and so are looking for higher quality mixers. AVEC is purpose built to take advantage of these trends

- Come help us change our small part of the world & help reduce sugar consumption! We are showing that you can have delicious drinks that aren't packed full of sugar or nasties. Let's prove it to the WORLD.

- We are hustlers to the extreme. Alex, the founder, hand sold and delivered to our first 30 accounts... in 95' Chevy Van. For almost a year. Crazy, maybe.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...