In this episode, Matt Bennett and I talk about the fear that comes along with chasing your dreams and the process of over...

Problem

Consumers are changing, brands are not

When walking into any store in any city, people are not excited about the salsa selections they see on the shelf. From the lack of loyalty to the misses on marketing, salsa brands are "stale." And while the industry continues to grow, it's also slow to diversify its approach and ripe for someone to "dip in!"

Not one salsa brand in recent history has revolutionized one of the largest consumer product markets in the world. There's never been a "Red Bull x Ben & Jerry's x Apple" of salsa — from making it bigger than the product by marketing lifestyle (energy drinks) to creating community-inspired flavors and change through causes (ice cream) to thinking differently through design (tech) — these three companies completely changed the way people experience billion-dollar brands.

Solution

Build the first lifestyle salsa brand

Brand identity

Dreams Aren't This Good (DATG) is a lifestyle brand that leads our own unique style and is purposefully designed to create energetic and emotional connections with our consumers. We are viewed as a clean x cool, modern x minimalistic brand that fits artistic, active, and aspirational cultures.

Brand position

DATG positions itself as one that encompasses urban city life to coastal-chillin, and outdoor adventures to on-the-go.

Brand execution

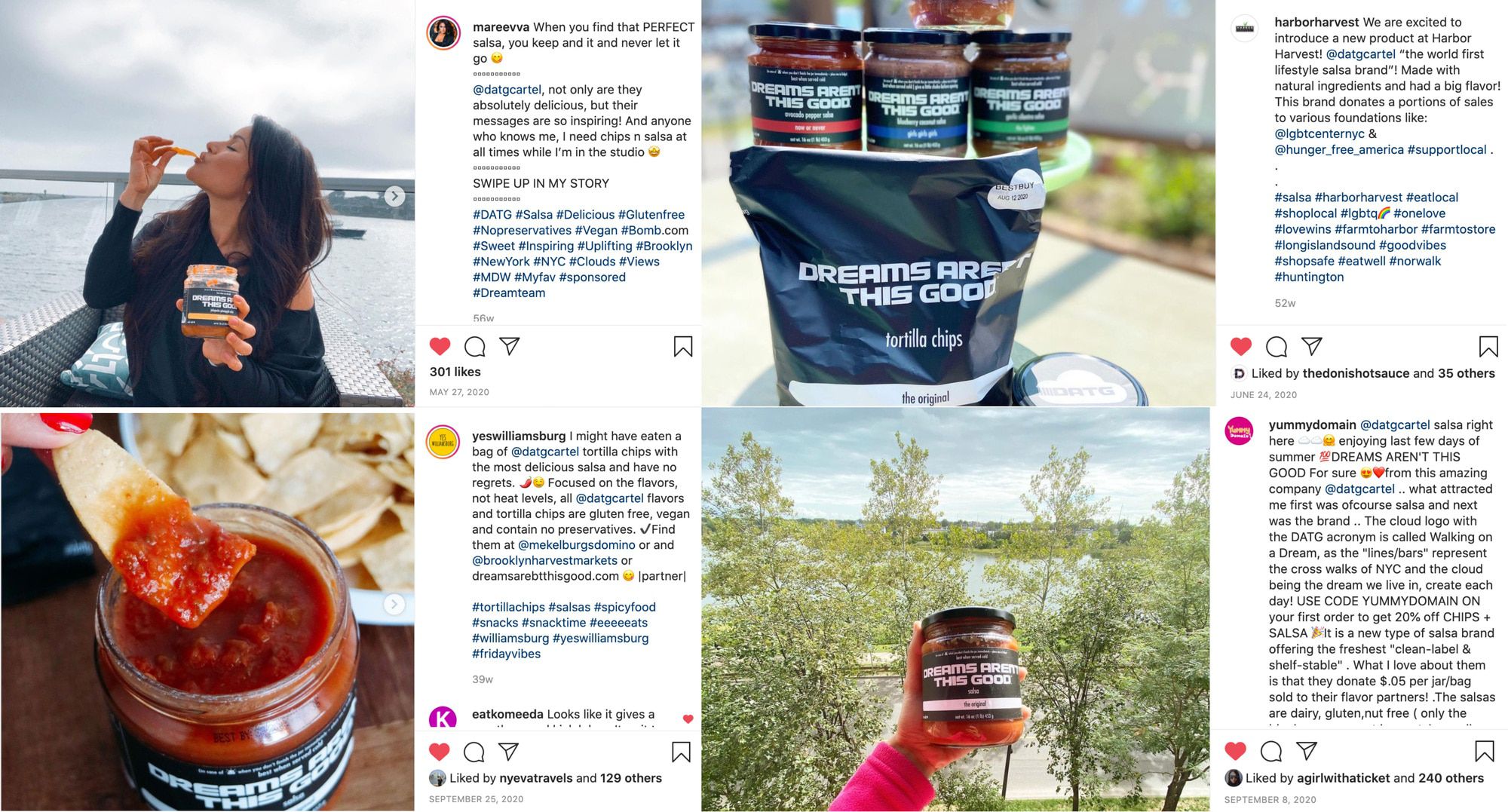

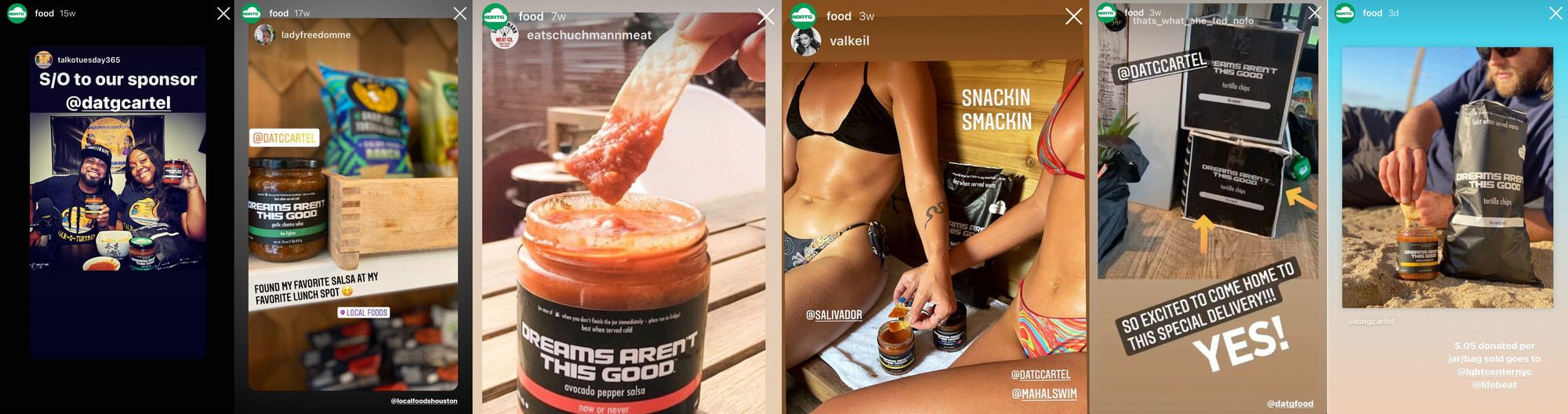

DATG uses local relationship building, guerrilla marketing, and compelling content as our main source of marketing. In addition, we drive our in-store presence with primed and unparalleled POS. We also support with limited flavor “drops,” further driving our brand forward!

Brand system

DATG products are firstly designed to match the needs of the target market and produced in low quantities. The latest flavors are then promoted and released to drive awareness, sales, and brand “buy-in.” Once the new flavor is on track to sell out, we move into launch mode, making it a full on “Fantasy Flavor” available everywhere.

Brand leverage

DATG has successfully expanded our brand by creating complementary lifestyle products. We design “fresh” apparel, produce pulse-pounding parties, create content that connects with our community, and donate dollars to make a difference for our flavor partners.

Brand tracking

DATG brand equity and loyalty of our customers is shown by the fact that we have created a “cartel-like" following with our consumers (cartel = community for good).

Brand responsibility

DATG ensures that the connection between the brand and the consumer is strong by leading our own style and adopting it with artistic, active and aspirational cultures. We do not follow the conventional rules, therefore making us unique in comparison to mainstream brands. Along with this, our products are infused & inspired by culture that creates a bond between the consumer and the brand.

Brand investment

DATG has invested heavily in the brand by betting on creative, clean content and packaging, fresh flavors and top level talent to execute on the DATG vision.

The Original Race

The Original Race

Product

Born on the Bayou, perfected in the Big Apple, we combine flavors of the South with sounds & styles of the city that never sleeps

We pour our passion into creating the best products on the planet. Focused on flavors, not heat levels, we start everything with a feeling...inspired by NYC musicians' songs bumping in our earbuds mixed with the colors that connect NYC's subways. We then combine the inspiration with fresh and clean ingredients that free your mind and feed your tastebuds. Lastly, with each flavor created as an experience, we pair it with philanthropy that embodies the "spirit" of the flavor and donate $.05 per jar/bag sold.

Our salsas are the stars of the show and perfectly partnered by our authentic Mexican-style tortilla chips, with black magic bagging. And now, with a one-of-a-kind ovenable chip bag, everyone can enjoy the ultimate DATG experience: fresh, warm restaurant-style chips and chilled salsa!

Traction

Secured 300+ partnerships in 2 years

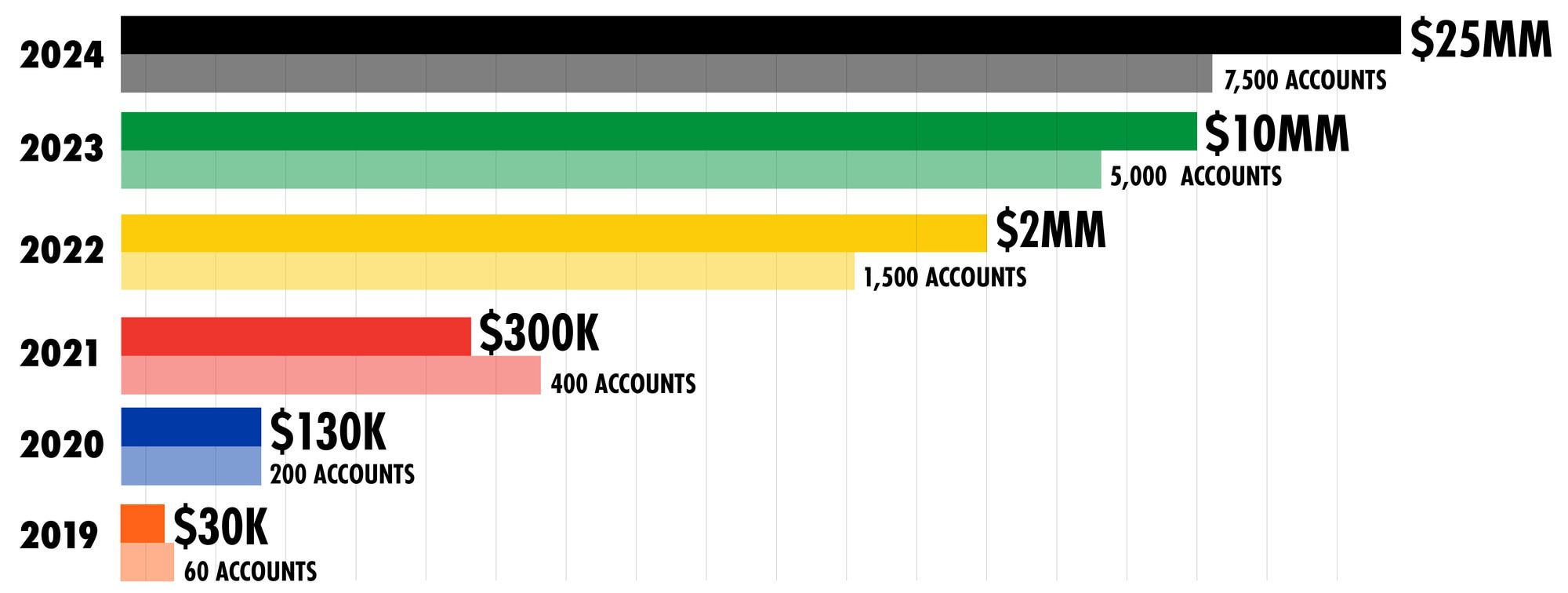

Our main footprint focus has been to grow with brand-depth deep in our backyard (the Northeast) before hitting other parts of the country/world. We currently have partnerships with ShopRite, Fairway Market, Westside Market, Key Food, Foodtown, Brooklyn Harvest, Foragers, and many more. In addition to our own website, we've added wholesale and DTC online partnerships with companies such as Amazon, Faire, and SnackMagic. Our revenue has grown from $30K (2019) to $130K (*2020).

*Covid-resilient

Customers

When the Cartel speaks, we listen

Demographic

DATG’s target consumer is 25-45 years old, values quality, experiences, making a difference, and lives an aspirational lifestyle.

Psychographic

DATG’s target consumer has interests in everything — from food to fashion, art to adventure, and tech to travel, while very much sharing inspiration via social media.

Geographic

DATG’s target consumer lives everywhere from urban cities to under-the-radar coastal towns, and outside the city lines to outdoor mountain tops.

Buying behavior

DATG’s target consumers want to appear in-the-know and inclusive, while maintaining individual style. People buy from DATG as a form of fulfillment, self-accomplishment, and personal growth because they believe that purchasing a product from an inclusive, inspirational, and impacting brand gives them the opportunity to be part of something bigger than themselves.

Best, Freshest Salsa!

Best, Freshest Salsa!

By far the BEST salsa I’ve ever had. It amazes me how FRESH, and light this tastes, out of a jar — it tastes and feels like it was just made in the kitchen. The original is my favorite, although I’ve tried 3 flavors and they are all amazing.

I had the opportunity to try this for the first time, as a taste test in a small grocery store in Williamsburg, Brooklyn. The owner himself was giving out samples, and I just planned to stop in for something quick in the store and run out. The owner got my attention for a taste test, and I was like, “yeah, sure, I’ll try a bite of your salsa,” but really expected to just have a taste and continue in my way. I literally stopped in my tracks and decided to buy 3 jars — it was SO good!

I can promise you won’t be disappointed. So happy to see they sell it on Amazon now, it can be hard to find in grocery stores.

Five Stars!

Five Stars!

The creative label sold me. I purchased this as a gift for somebody who loves salsa, and knowing they are extremely picky I decided to just go with a cute label in case they hated it. However the recipient said it was one of the best salsas they’ve ever had!

Among the best!

Among the best!

Hands down among the best salsa I've tasted right out of a jar! Definitely has a kick, but it's just right. My wife, who admits to having a low threshold for spice, loves this brand as much as I do. I've given away a few jars to friends, and also served the salsa at gatherings, and everyone is super impressed and always going back for more! I've read some reviews calling this a bland salsa; we all have different tastes, but I can say for sure that's the last word I'd use for this superb and tasty salsa! Nicely done, DATG!

So Amazing!

So Amazing!

The blueberry coconut has a slightly gritty texture, despite how strange it sounds it tastes incredible. The jalapeño pineapple flavor was a thinner salsa...similar to restaurant style. I absolutely loved them both. Neither were overly spicy...and were empty within 24 hours of opening.

Only read if you are looking for the best salsa ever...

Only read if you are looking for the best salsa ever...

I had received a jar of this in a gift package earlier this year and found it to be the best salsa I have ever had out of a jar and even most Mexican or Tex-Mex restaurants I have eaten at. I was elated to find out that this salsa was available through Amazon....and a three pack to boot! If you are a foodie like I am always looking for the best taste, please give this salsa a try. It is so good. I see that there are other varieties and maybe one day I will try them, but The Original is so tasty. Also read the label of ingredients....no preservatives or words that you cannot pronounce. I am addicted to it and use it with chips, vegetables, tacos, on top of a hamburger, and on and on. The jars of deliciousness are shipped in a well-protected attractive looking box, so nice that it would make a great gift. I also want to make it very clear that I did not receive this as a promotion (although I would be more than happy to become an official taste tester!!!), I paid for this product because I love salsa and I have finally found the perfect salsa. Thank you Dreams Aren’t This Good!

Must buy!!!

Must buy!!!

The best salsa you will ever have!!! This is truly authentic!! I have searched everywhere for this salsa and I’m so glad I found it. Definitely a must buy!! Trust me you won’t regret it!

Thank you!

Thank you!

Thank you guys as always, best salsa in the world, can’t even eat anything else. Had to order the NYC Pack!

Simply the best!

Simply the best!

These are the best chips I have ever had! Hands down. Popped them in the oven too! The salsa is crazy good also.

These are GREAT chips!

These are GREAT chips!

If you miss getting fresh chips from the local Mexican restaurant because of COVID, stop reading and get these. These are ridiculously great restaurant style chips. The flavor, salt and texture are spot on. If you go to a Mexican place that has thin chips that they serve for an appetizer and thicker chips that they use for nachos, these are the thicker chips. I don't know if the packaging (which was bags with padding in a cardboard box) or the thickness kept the chips intact but they were surprisingly not crushed. The instructions suggest an oven for the best possible chips. Do it....I just ordered the salsa to go with these. I am such a happy customer.

Business model

Focus on flavors and philanthropy drive brand difference through experience

The "Four Ps" create our baseline (Place, Price, Product, Promotion); but it's our music-inspired Fantasy Flavors that make the headlines. We offer one of the freshest "clean-label + shelf-stable" chips and salsa on the market, create content and packaging that connects with consumers, and donate $.05 per jar/bag sold to our flavor partners. Between stores, wholesale, and DTC online (plus events), we hit margins of 20%-70% depending on the channels connecting us to consumers.

$.05 donated per jar/bag sold goes to our flavor partners

We partner with leading philanthropies that pair well with our products, company, community, and brand. We do this by amplifying their message, encouraging others to get involved, and even “recycling customer's money to make a difference” through our give-back programs.

We also donate through apparel sales, events, and combined marketing efforts. We believe that with our shared DNA and drive to always be part of the solution that fuels us moving forward, there are limitless possibilities in bringing our brands together!

Just Dance "The Party"

Just Dance "The Party"

Market

Infuse ourselves into industries where no other brands can play, due to lack of sharing "Brand DNA"

We operate in the categories of pre-made salsa ($1.4B) and tortilla chips ($22B). And with salsa being the #1 condiment in the US, we are flipping the model by focusing on our "display where consumers play" approach, creating strategic and authentic growth opportunities through out-of-the-box verticals — everywhere from craft beer breweries to boutique hotels, music-making recording studios to fashion-forward runway shows, and sunburnt surf shops to snow-covered ski slopes and sold-out soccer stadiums.

These are our current partners, and we're just getting started...

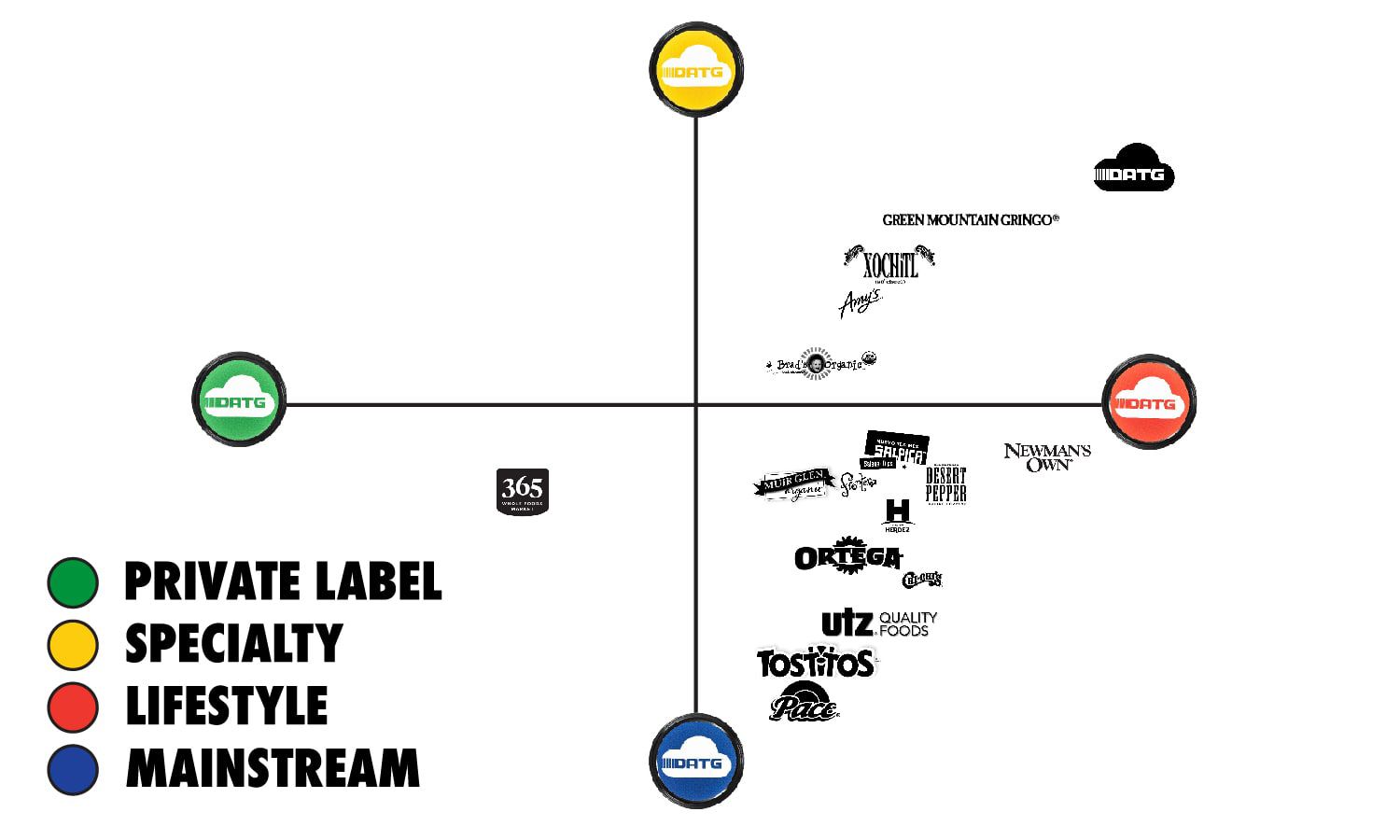

Competition

Innovation & inspiration create unwavering connection with consumers

We deliver our products to market through creative content, custom packaging, and unparalleled POS. Whether it's our epic and emotion-creating flavor composites, our ovenable chip bag, or our one-of-a-kind marketing, we have unique, creative, and cost-effective ways to connect with consumers and communities seeking something great than just a product — a lifestyle.

DATG Dream Machine + DATG Cloud Car: the beginning of branded salsa slinging vehicles is here. Whether it's scouring the streets hitting stores, setting up at sud-soaked beer/music festivals, or dropping product to our partners, our fleet of Dream Machines (Jeep) and Cloud Cars (VW) gives us the opportunity to deliver in style!

It's Now or Never

It's Now or Never

Vision and strategy

To be the most preferred, most famous salsa in the world

We'll accomplish our incredible vision by increasing our distribution and sales channels across regions worldwide and expanding online availability, enabling consumers to more easily purchase the products they desire. We also plan to heavily invest in our people and production (both on content and product sides) to increase awareness and create connections with our community through our group of company pillars: DATG Food, DATG Fashion, DATG Festival, DATG Films, and the DATG Foundation. All of this will further enable greater brand differentiation as we continue our takeover!

Funding

From bootstrapping to breaking through the clutter, raised $300K to date

Your investment will be invested into growing our team, increasing our product inventory to meet demand, elevating marketing efforts, creating more effective and efficient operations, driving deeper brand growth in our backyard, and starting the expansion of our footprint into strategic markets (cities) across the country. As of July 2021, funding to date ($300K) has come from friends, family, and our Founder.

Our small, yet super smart and scrappy team has been built strategically and for scale — focused on talent, awareness, teamwork, and adaptability. We always bet on creativity first, to clearly differentiate our forward-thinking take on our brand, and then support growth with streamlined sales technology and transparency throughout our team, partners, and now, you.

We believe in each other, we challenge each other, and we support each other. We move fast and make things happen. We help people. We work our a**** off and we play our a**** off! We create and build. We love what we do and that it's not easy. We serve our community. And, we know that dreams aren't this good.

Founders

Matt "Beniteaux" Bennett

From the great state of Texas, where salsa is king, to the bright lights of the big city, I am taking a dip into the salsa space, starting in the most unlikely of places: New York City!

Having been the founder or core team member of three previous startups, I have decided to take on my next venture — one that has been burning inside me since my college days at LSU — with a laser-focused relentlessness. Being half dreamer, half doer, I have the uncanny ability to manifest things into reality, as if the road to success were already paved.

The ultimate connector, creator and believer in anything is possible, I maintain awareness of what I am great at and what I am not, bringing together top talent to execute the DATG vision.

My life experiences of travel, business and relationships paired with my passion for products and people come together here, where I lead the way to create a new type of salsa brand!

For further insight, we invite you to visit us at dreamsarentthisgood.com and @datgcartel.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...