Problem

Current financial planning leads to missed goals and undue stress for young professionals

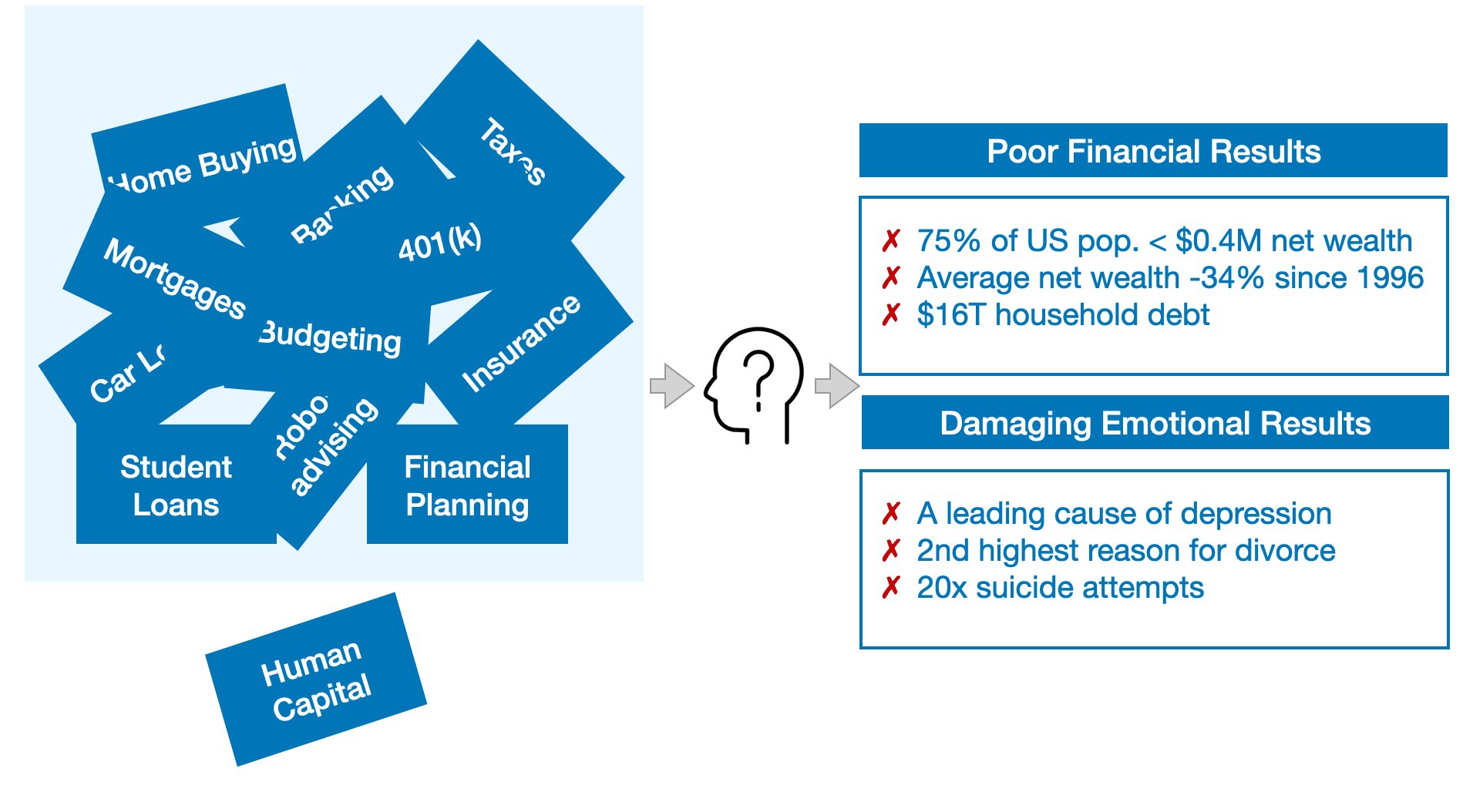

Current financial planning approaches are not suited for young professionals for 2 primary reasons:

- There is no easy way to create an actionable and seamless financial "big picture." While you can aggregate your online accounts using third-party sites, the picture remains fragmented under the fancy user interfaces. For instance, there is no way to model how putting an extra $50 a month towards your student debt would impact your ability to save for retirement or how much home you could afford in 5 years.

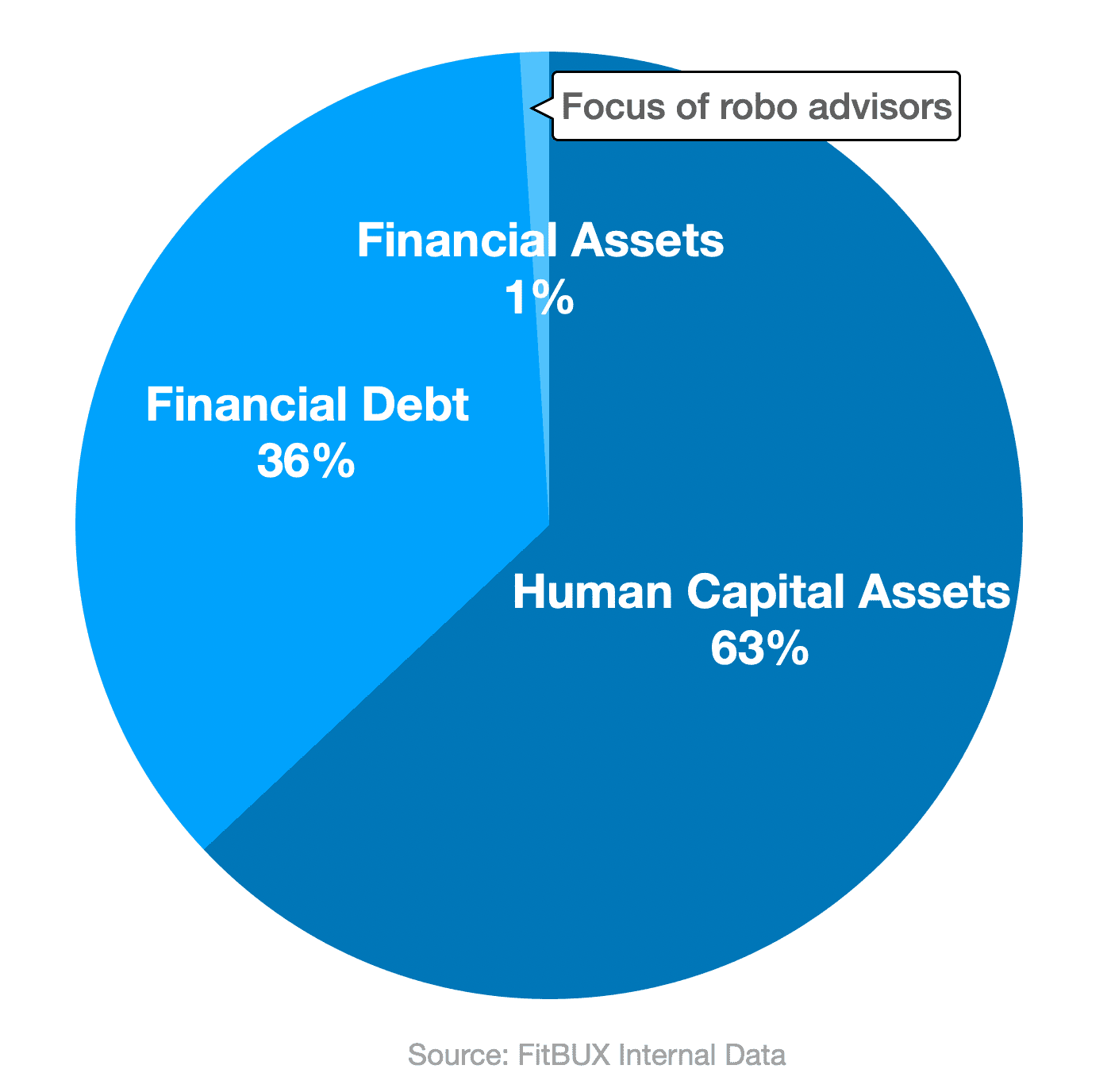

- Current financial planning ignores the most valuable type of assets for young professionals: Human Capital assets. Not only is the traditional "big picture" fragmented, it is also incomplete.

Relying on a fragmented and incomplete picture can have disastrous consequences for young professionals:

- The average net worth of individuals age 18-35 has decreased 34% since 1996 per The Washington Post.

- In a recent article, CNBC outlined that "over a third of millennials believe they’ll never be able to stop working".

- Worse yet, a 2020 study published in The American Journal of Epidemiology showed financial hardship can make people up to 20x more likely to make (or take) an attempt on their lives.

Solution

We make financial planning easy thanks to human capital analytics

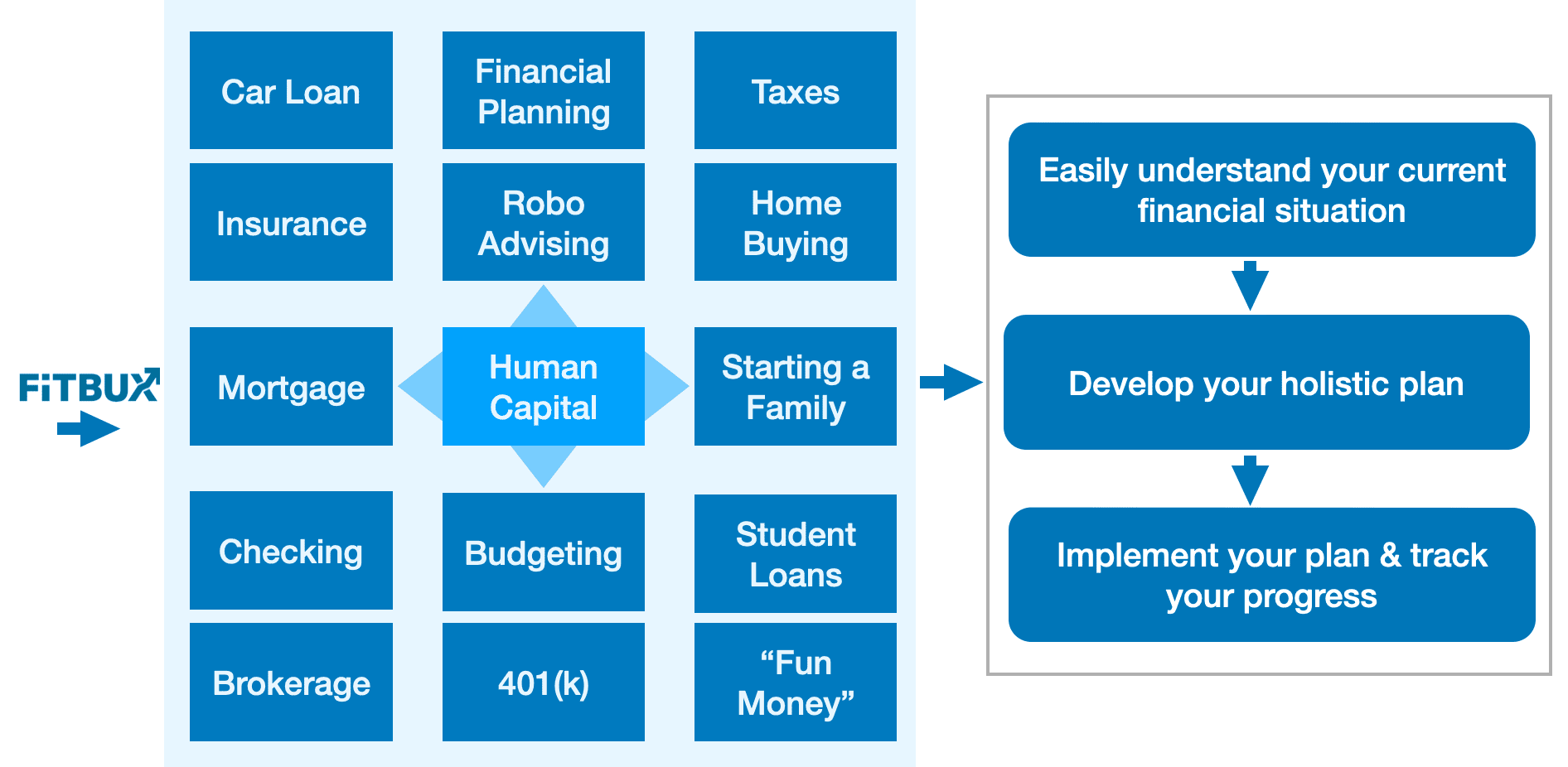

We've built a financial planning platform based on human capital analytics and AI. We automate fully customized financial planning by integrating both tangible assets (i.e. financial assets and debts) and intangible assets (i.e. human capital assets).

In addition, we've made financial planning easy to understand with a consumer-friendly score, The FitBUX Score.

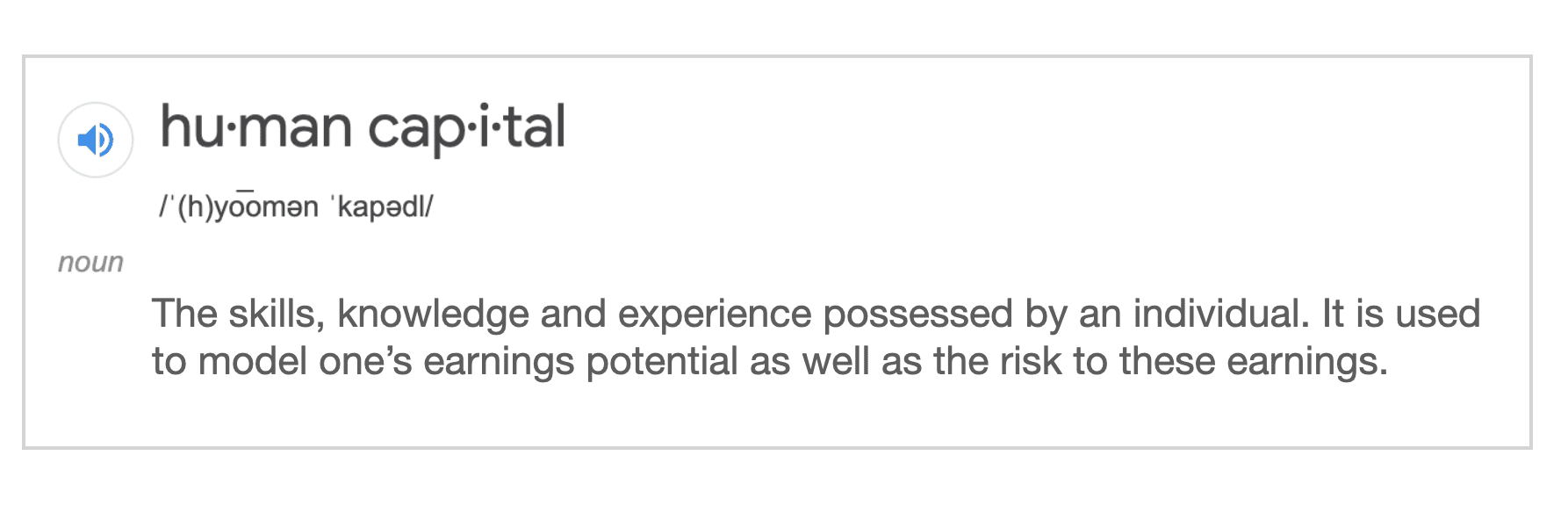

Human Capital definition

Human Capital is what differentiates you from your peers in terms of income potential and the risk to your income: what degree(s) did you obtain and how quickly, do you speak a foreign language, do you run marathons (a sign of discipline and commitment), etc.? Over time, human capital assets are converted into tangible financial assets in the form of higher wages and other financial benefits.

Human Capital is what differentiates you from your peers in terms of income potential and the risk to your income: what degree(s) did you obtain and how quickly, do you speak a foreign language, do you run marathons (a sign of discipline and commitment), etc.? Over time, human capital assets are converted into tangible financial assets in the form of higher wages and other financial benefits.

How we utilize Human Capital

Human Capital is key to model your income potential and the associated risk to that income. For instance, all else equal, the optimal financial plan for a stock broker (potentially high but risky income) should look a lot different from the financial plan for dentist with a lower-risk income source.

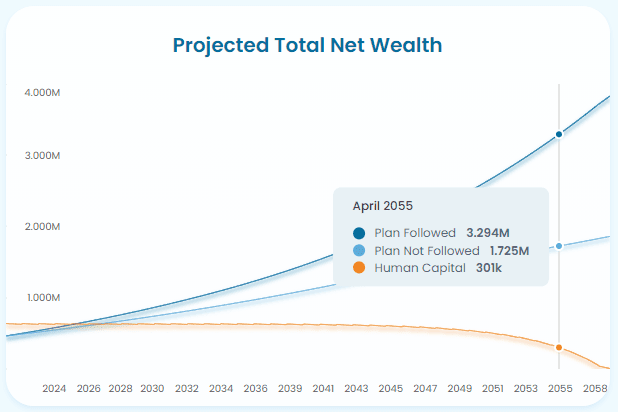

Our technology values your Human Capital and integrates it into your overall financial picture. We will then model how it will convert from an intangible asset to tangible financial assets over time as you build different financial plans for easy comparison.

Benefits of Human Capital

By adding this highly valuable, yet ignored, asset category, you can now build, implement, and track your optimal financial plan based on your overall net wealth.

Product

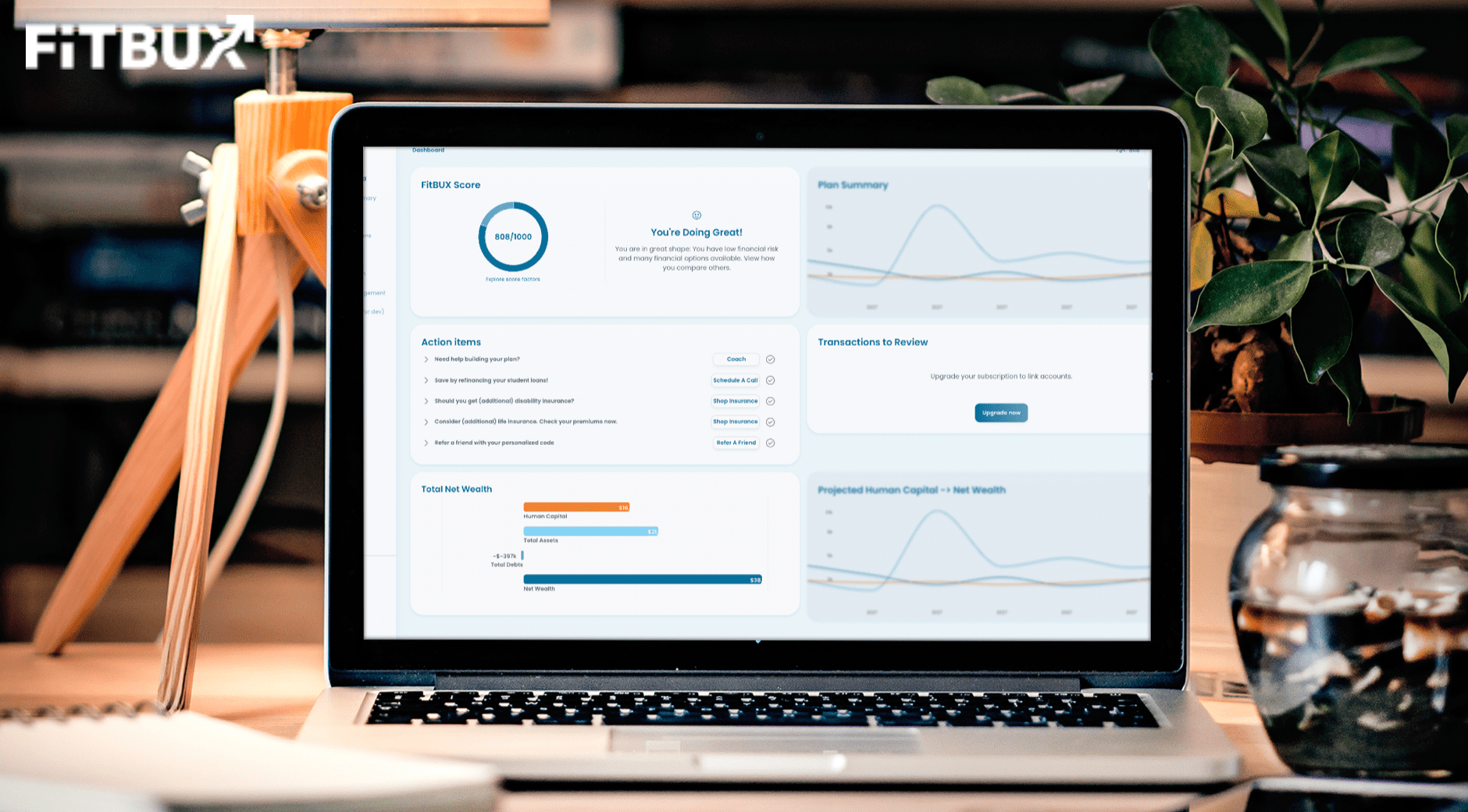

The FitBUX platform: GPS for your money

Our online platform makes it easy to:

- Understand your starting point. Based on the profile you create, we'll analyze and incorporate your human capital asset to create your financial "big picture."

- Select a route. You'll then build and compare different plans. You can include life events, such as buying a home, etc., and visualize the impact on your financial picture over time.

- Start your journey and track your progress. Once you implement your plan, you can automatically track your progress, receive recommendations and step-by-step guidance as you progress in order to reach your goals.

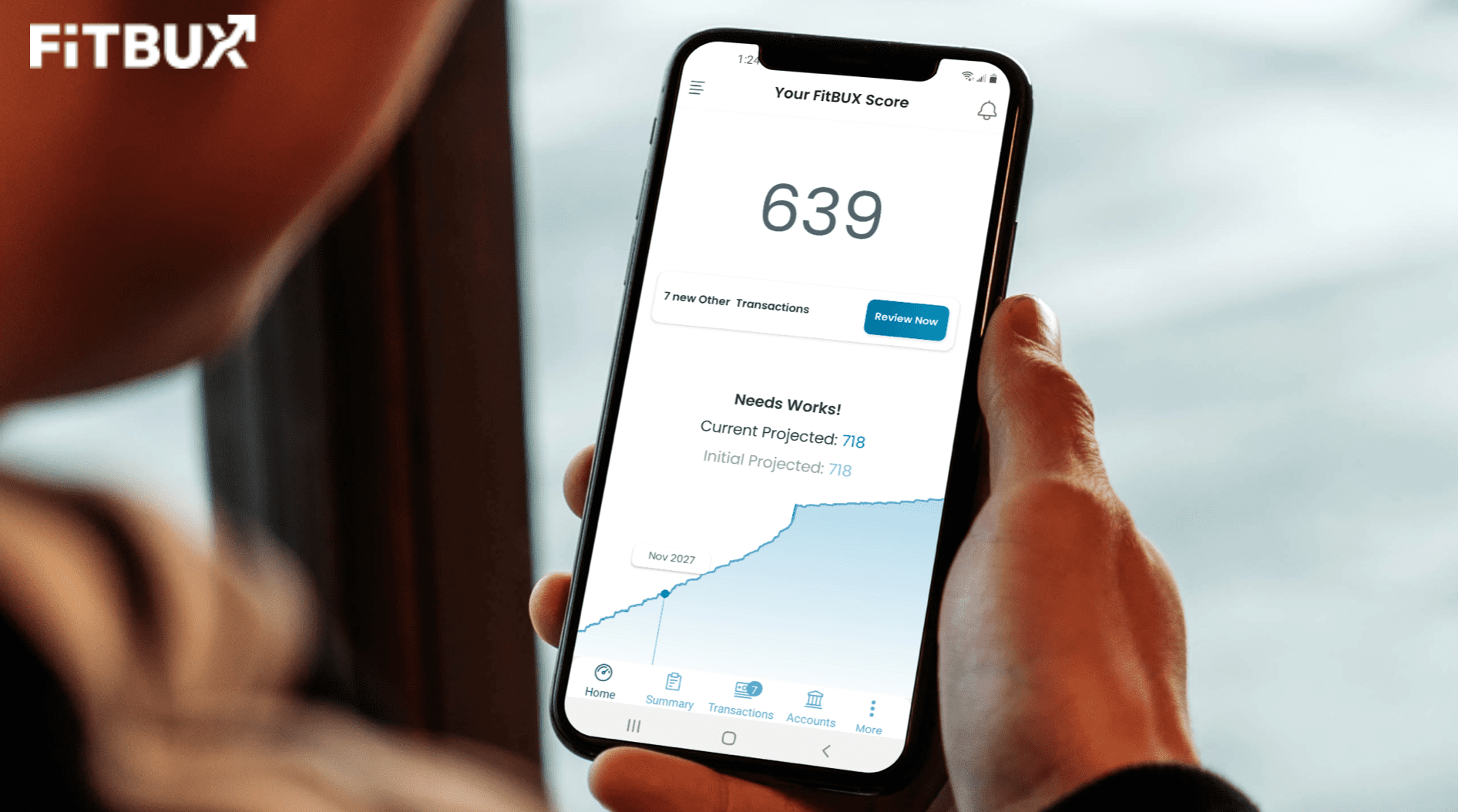

The FitBUX score: turn-by-turn directions

- Our proprietary technology combines over 1,000 data points and the FitBUX Score summarizes it all.

- The FitBUX score gamifies financial planning as it provides real-time visual feedback and also allows you to compare your progress versus other FitBUX members, encouraging positive behaviors

- The FitBUX Score provides directions throughout your financial life:

For younger individuals, The FitBUX Score highlights:

- The level of risk associated with your plan

- The financial options available to you

- How costly mistakes would be

- Your ability to take investment risk

At retirement age, the FitBUX Score highlights:

- The probability of running out of money

- The optimal withdrawal strategies available to you

- And more

Traction

Exiting successful beta, we're ready to expand

Focus

Focus

In order to validate both our technology and business model, we focused our beta on:

- A single industry: Recent graduates with a doctorate in physical therapy, and

- A single financial event: Planning and implementing a student debt repayment strategy.

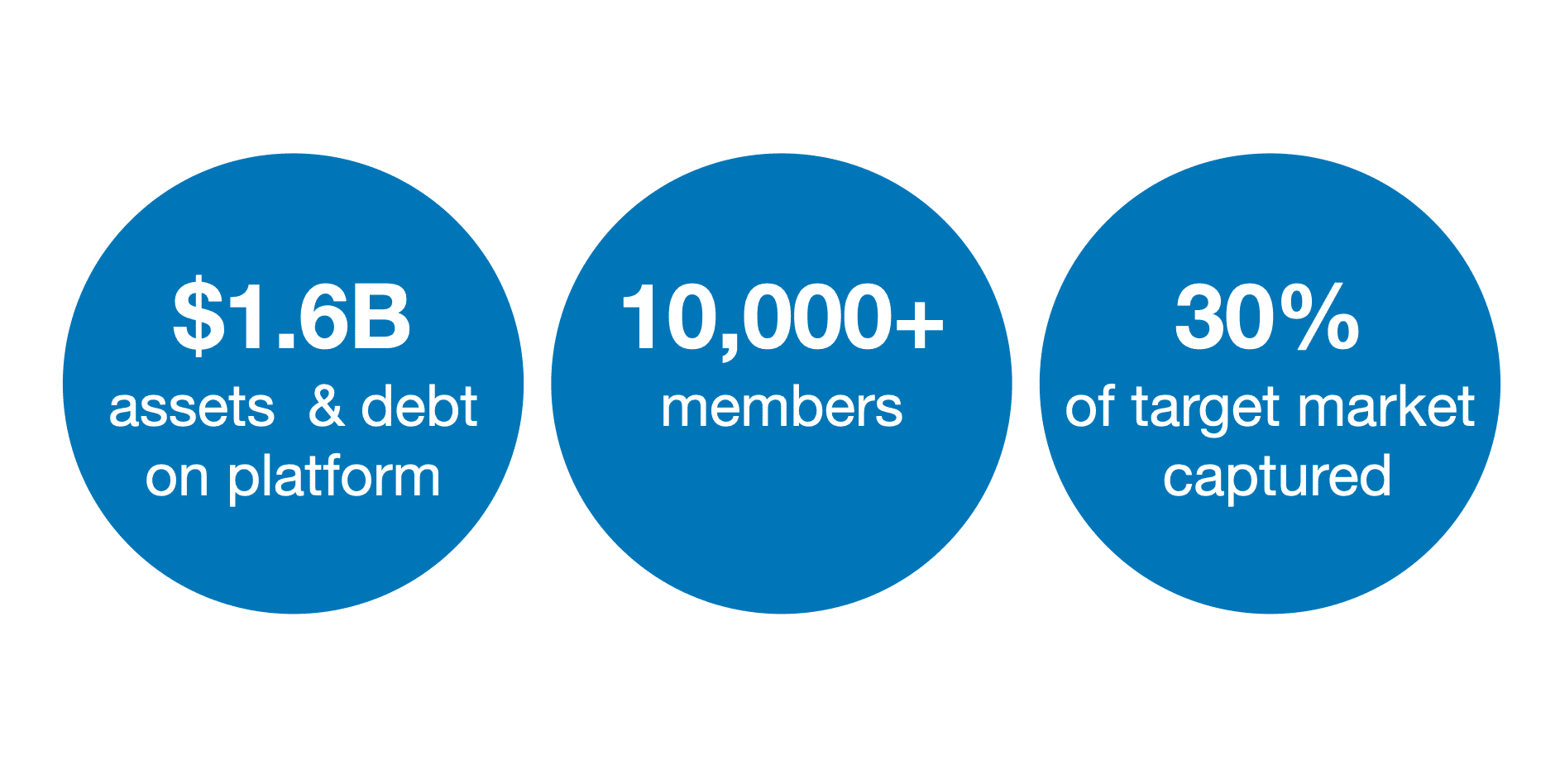

Results

With more than $1.6B in assets and debts on the platform, from 10K+ FitBUX Members, the results exceeded our expectations.

Our user-acquisition strategy was online and organic. For instance, we've created industry-specific Facebook groups with 31K+ members. This yielded an average user acquisition cost of ~$6.50.

We were able to mostly self-fund the company as we generated over $900K in revenue since inception.

Ready to expand

We've reached a point where we are ready to enter new industries.

We've recently secured an agreement with an industry-specific association which will give us direct access to over 130,000 young professionals.

Customers

Young professionals, age18-35 to start

Initially, we're focused on the 76M young professionals between the age of 18 and 35 in the US (often referred to as the "younger millennials + the older Gen Z-ers" category). Their Human Capital asset is their most valuable asset and totally ignored by legacy financial planning approaches.

Our plan is to expend to current students as their Human Capital asset represents an even higher percentage of their total assets. The sooner they can comprehend the value of that asset and how to maximize it, the better.

Business model

Multiple revenue sources today, more to come

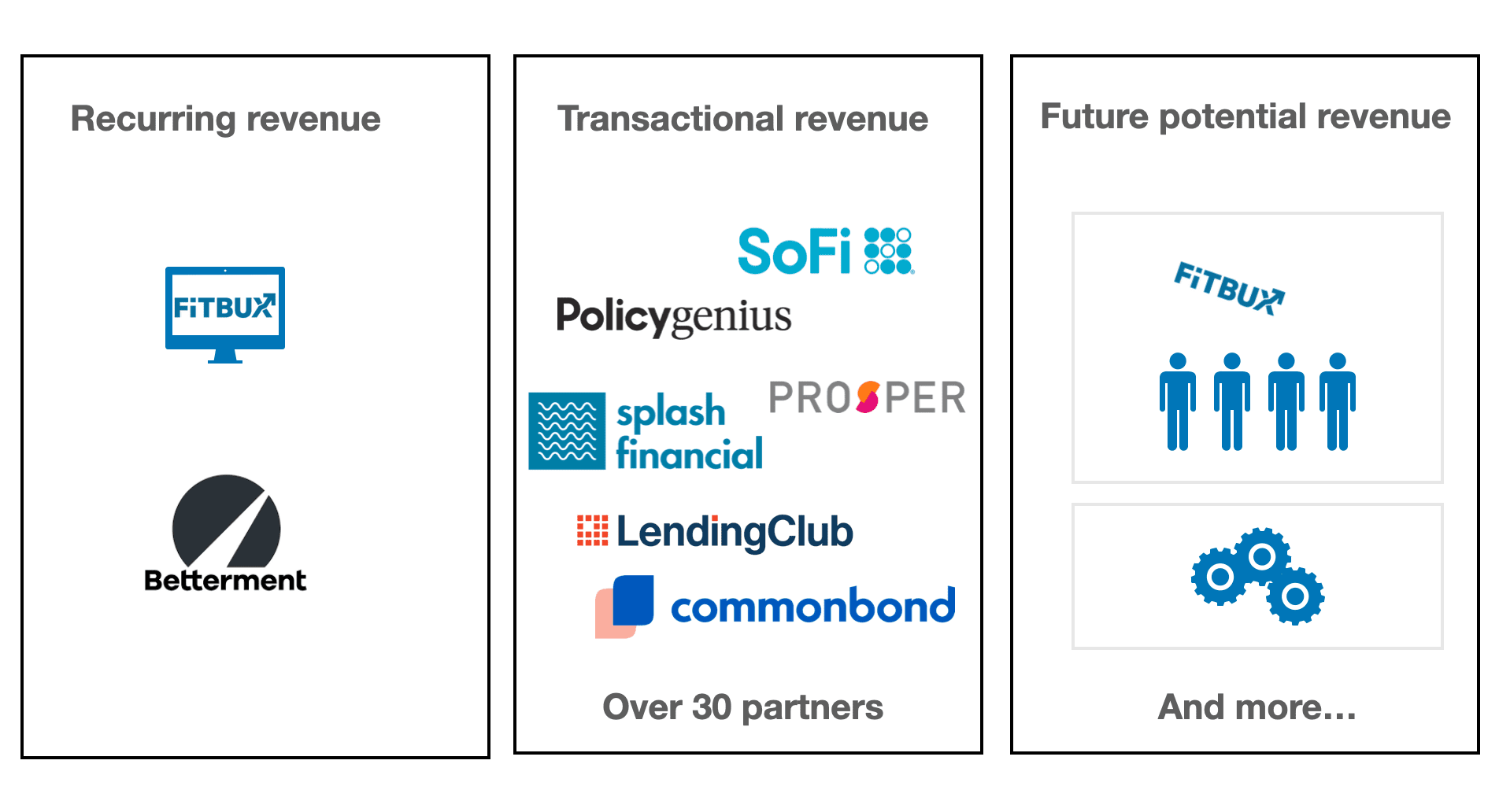

Recurring revenue

- Access to the FitBUX platform

- Members can build a financial plan and get their FitBUX Score for free.

- A monthly subscription fee is charged to implement a financial plan, track progress, and receive real-time recommendations.

- Investment Management fees for diverse asset accounts.

- Monthly investment management fees collected via our partnership with Betterment.

Transactional revenue

- Partnerships with industry leaders

- We provide financial products via our 30+ partners to meet our members' need as they implement their plan: student loans and credit card refinancing products, insurance products, and more. We collect a fee when our members select a product.

Future revenue opportunities

- Proprietary financial products: We'll develop proprietary financial products based on our FitBUX algorithm and our AI capabilities.

- Data: We can sell our data to third-party financial product companies, such as lenders, to make their products better.

- Platform white-labeling: We will soon license our product to financial planners.

Market

Young professionals represent $5.8T in financial assets and debts

The 76M young professionals between the age of 18 and 35 hold a total of $2.6T of financial debts and $3.2T of financial assets.

On average, this translates into $34K in financial debts and $42K in financial assets, i.e. an average financial net wealth of only $8K.

By incorporating this demographics' most valuable asset as part of our financial planning platform, we're uniquely positioned to capture this opportunity.

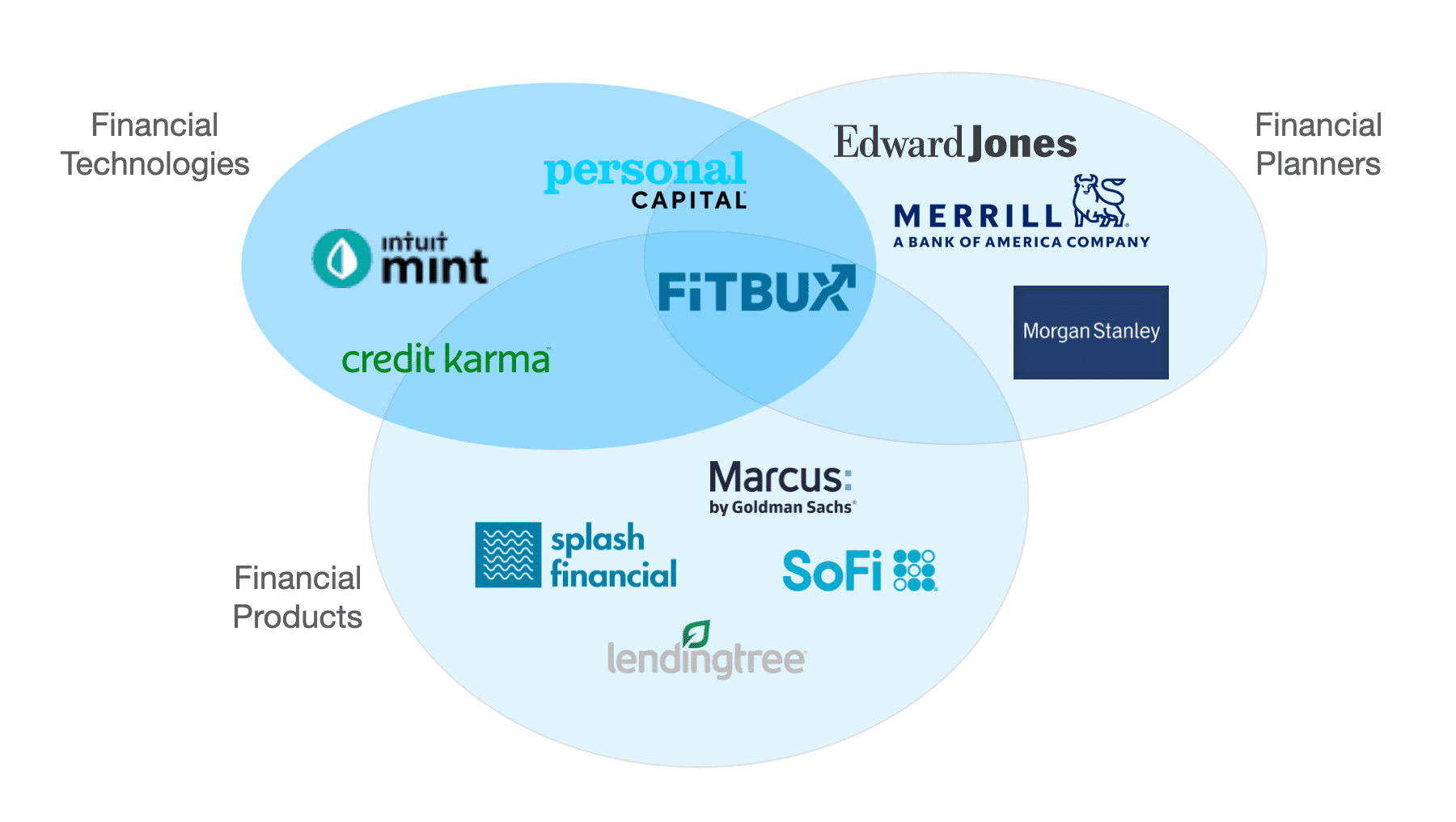

Competition

No one is integrating human capital assets in their financial planning approach

Financial planners offer a very hands-on approach primarily focused on investable assets and designed for older, higher net-worth individuals. They are ill-equipped to provide a truly comprehensive financial planning solution for younger individuals as they don't account for human capital assets.

Financial planners offer a very hands-on approach primarily focused on investable assets and designed for older, higher net-worth individuals. They are ill-equipped to provide a truly comprehensive financial planning solution for younger individuals as they don't account for human capital assets.

FinTech "point solutions" focus on one narrow piece of the overall picture. While they have built solid technology, they do not provide a holistic approach. The result is that their users cannot model comprehensive financial plans that incorporate human capital assets.

Financial products companies successfully focus on specific products, and are great partners of ours. We complement their offering as our platform make it easy to model and visualize the impact of those products on one's overall financial picture.

Vision and strategy

FitBUX is building the family office for young professionals

FitBUX's vision is to automate financial planning and offer a technology-based "family office"-like experience to young professionals. Affordable, comprehensive and seamless.

The funds raised on Republic will be used to, among other things:

- Continue to build-up and further automate our platform

- Increase our marketing spend to support:

- Our new partnership targeting over 130,000 young professionals

- Our expansion into the "current student" segment

- Our entry into new industries.

Funding

We've done a lot with only $225K

We've been able to primarily self-fund the business to date and relied on very little external capital. We're ready to take the next step.

We've raised:

- Friends and family round: $125K

- Outside investors: $100K

Founders

Meet Joseph Reinke, CFA, founder and CEO

Having grown up in Silicon Valley, I've seen first-hand how dreams become reality. Inventions, created by young adults, have changed the world we live in forever. Their creativity and passion have no bounds.

I was a "numbers guy" early on (I started investing at age 12...) and going into finance was a natural path.

The idea of FitBUX matured over time throughout my journey in the world of finance.

Having started in wealth management, I experienced first-hand the complexity and fragmented nature of one's financial picture. In addition, higher-net worth clients I worked with often raised financial questions related to their kids' situation and it became quickly apparent that "something" was missing. It was virtually impossible to answer financial planning questions for younger individuals. The seed was planted.

I then moved to the world of investment banking and business valuation.

During my business valuation years the solution to the financial planning problem clicked. Just like business are valued based on both their tangible assets (their balance sheet) and intangible assets (brand, reputation etc), individuals possess intangible assets that current financial planning solutions do not take into consideration.

And the rest, as they say.....

I am truly excited by the opportunity ahead and have assembled a great team with finance, FinTech, security and online consumer marketing experience to drive us forward.

I hope you'll join us on our journey!

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...