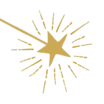

Parenting involving many, many milestones - for you and your little ones ( obviously, right?). Some pertain to your child...

Problem

Why do we put cash under the pillow for a lost tooth?

Money is not the currency of kids...

IMAGINATION is!

Parents want to give the most to their child. But...

- Our fast-paced, tech-centric world makes it hard to inspire moments of joy and wonder.

- Parents lack the time, creativity, or energy to create memorable moments.

- Besides, who has cash in their wallet anymore?

Solution

A re-imagined

tooth fairy tradition

Hold The Magic makes it easy for parents to deliver tiny gifts and stories in exchange for a lost tooth. We’re creating lasting memories by putting something more magical than money under the pillow.

We only need to provide proof

and their imaginations will do the rest.

Hold The Magic provides everything required

to bring the Tooth Fairy to life.

Instead of cash, parents leave a beautiful gold bag filled with magical toys and a story from the child’s tooth fairy. The experience inspires wonder and imagination with positive life lessons tucked in.

Product

Tiny fairyland

gifts and stories

We offer a variety of Tooth Fairy gift sets with themes based on a child’s interests. They are high-quality collectibles (little to no plastic) in beautiful packaging, each paired with stories that encourage self-care and positive life lessons. Each set includes ready-to-gift gold bags, good for 3 Tooth Fairy visits ($29.95 retail).

The lost tooth journey can begin

with the story of Lucy Tooth.

This 36-page hardcover picture book inspires a new tradition. When Lucy Tooth learns each time a fairy exchanges a lost tooth for money that a child loses a bit of magic, she decides to re-imagine the rules of the Tooth Fairy tradition and creates a special one of her very own.

Traction

Sold over 8,000 gift sets

to 2,727 customers

- $213k in revenue, over 4,000+ orders

- Buying for multiple kids drives a $69 avg. order value

- Customers value being prepared for future lost teeth

- Repeat customers (32%) = loyal customer base

- Over 10K unique web visits per month

- Ranked #1 for key phrases such as “tooth fairy letter”

We are growing

a strong fan base!

Customers

We’ve got your wings

Our customers are busy, yet they want to create lasting memories for their families. Guardians of all ages play Tooth Fairy, but most of our loyal fans are moms. They want to share and make great experiences, but they lack the time and energy to make it happen consistently.

Our product and marketing strategy seeks to:

- Inspire imagination with stories and gifts

- Deliver convenience to busy parents

- Create uniquely shareable experiences

- Develop educational and entertaining content

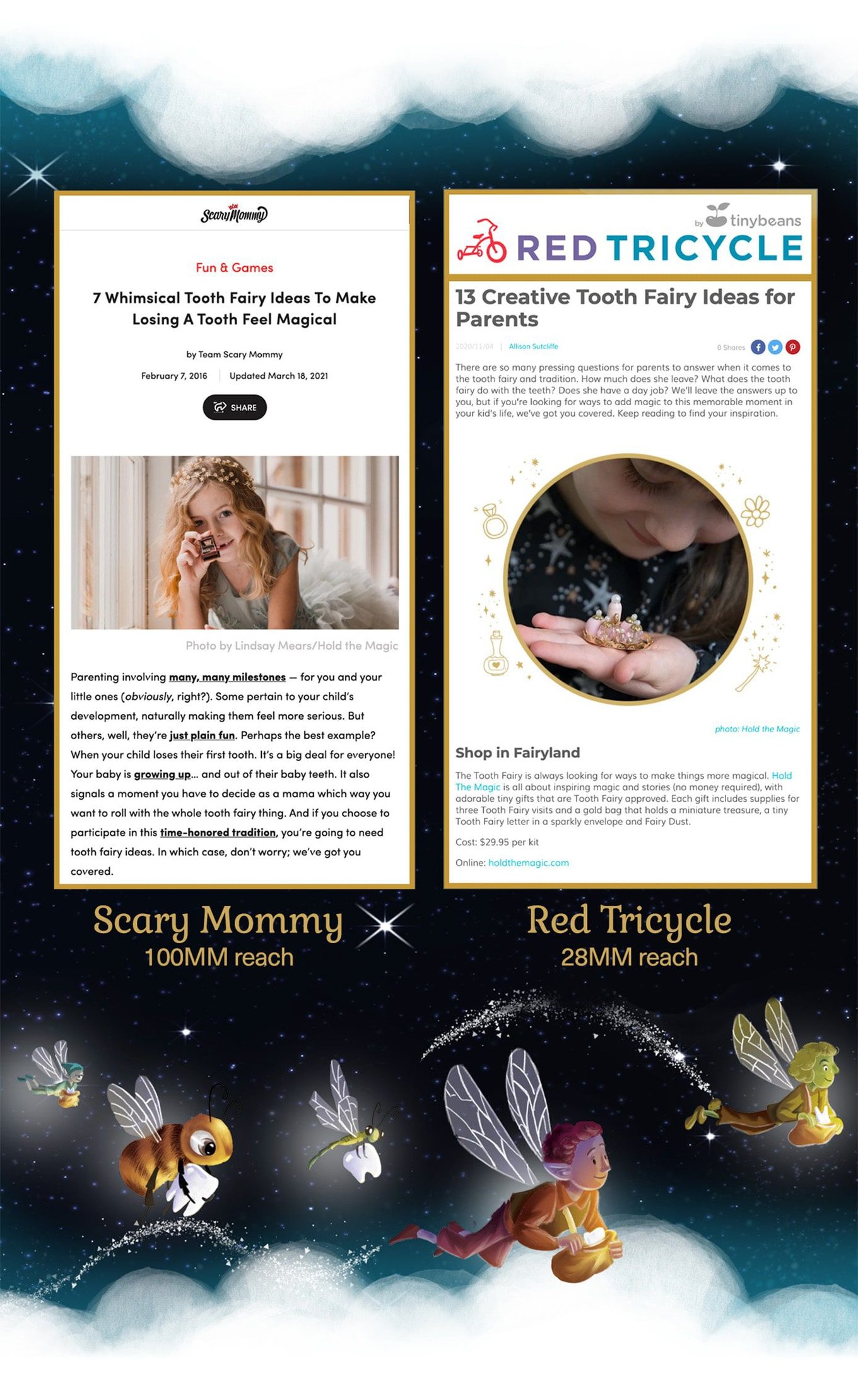

Sentimental moments are shareable.

Moms are highly engaged and sharing on social their worry about their child growing up too fast. Every lost tooth is a sentimental reminder.

Business model

Break-even analysis

Unit economics in eCommerce are already strong

Unit economics in eCommerce are already strong

Current CAC is $20

Average purchase is $69

3x multiplier before repeat purchases

We expect CLTV over $100 based on 32% retention

rate and adding to our product mix We expect break even at $50k monthly sales

We expect break even at $50k monthly sales

~76% gross margin

$15–20k direct marketing costs

$30–40k of salaries and freelancer costs

We expect to reach this by Q3 of 2022  We can grow faster by

We can grow faster by

Publishing original content to build brand awareness

Expanding our market to include younger kids

before first lost tooth with the Lucy Tooth

storybook and products

Entering adjacent product categories,

especially Pediatric Dental

Wholesale distribution with Lucy Tooth products

(Longer-term)

Market

The $3.48B tooth fairy market is ready for MAGIC

95% of families have a Tooth Fairy tradition where

they leave cash for a lost tooth.

But no brand owns what goes under the pillow.

Gap analysis

Parents are paying 2x more for

convenience and memorable experiences.

Competition

Cavities in the fragmented

tooth fairy market

There are many one-off brands selling pillows to stash money, products to hold teeth, and dolls to teach dental hygiene.

But our primary competition is cold hard cash left under

a pillow in exchange for a lost tooth.

Consider the globally recognized brand “Elf on the Shelf” that has tapped into the magic of childhood belief and family tradition in over 19 million households. Yet, they solely focus on the Christmas season.

Vision and strategy

Bring fairyland to life

Hold The Magic’s focus is to become a global brand bringing Fairyland magic to life through consumer products, entertainment-based content, and unique branded experiences.

Lucy Tooth and Wiggle Tooth are our “spokesfairies”. These brands will expand our product offering with books, toys, and dental care to widen our market to include children before the first lost tooth.

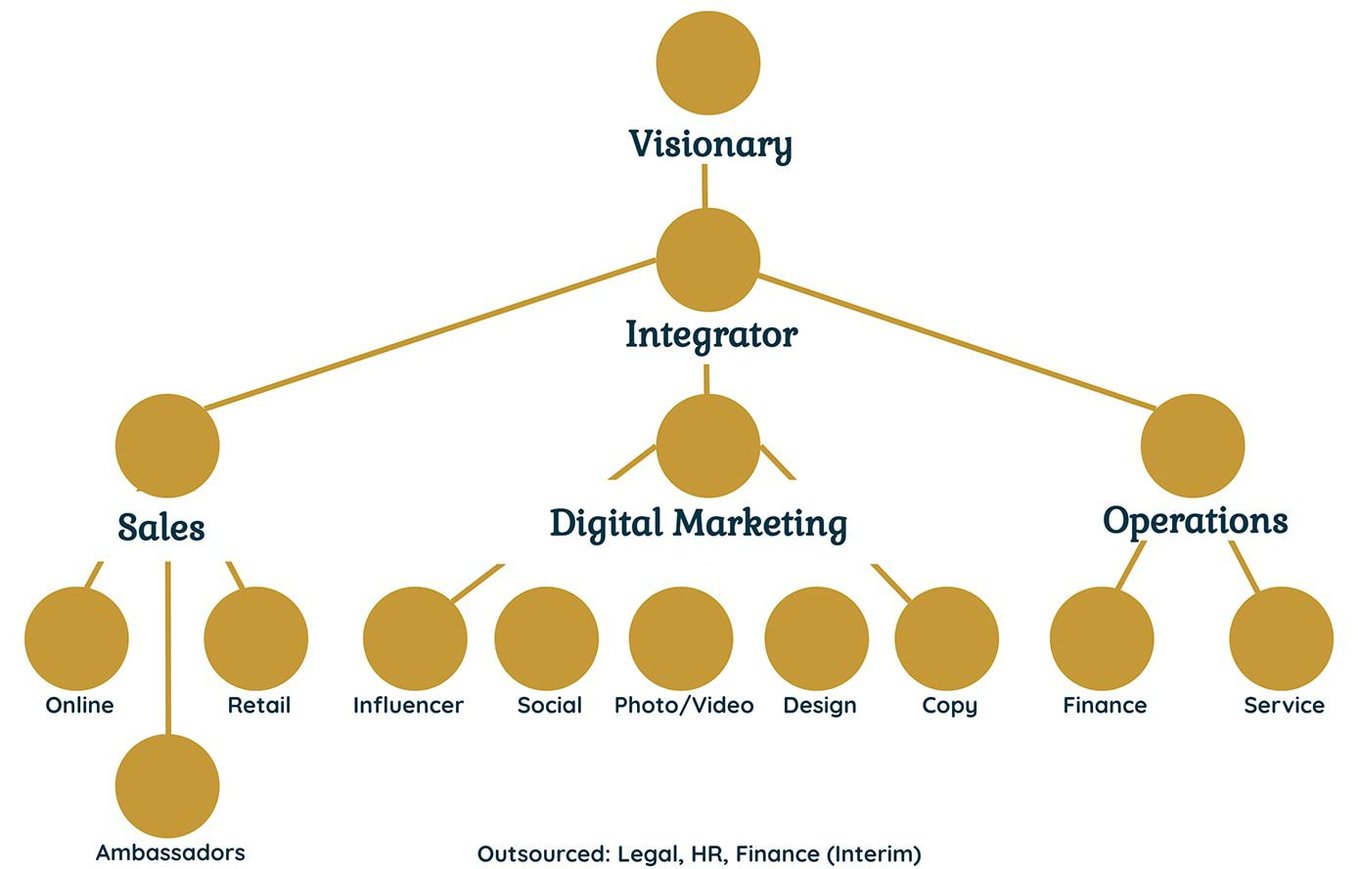

Product Diversification and Revenue Channels

Future Organizational Structure

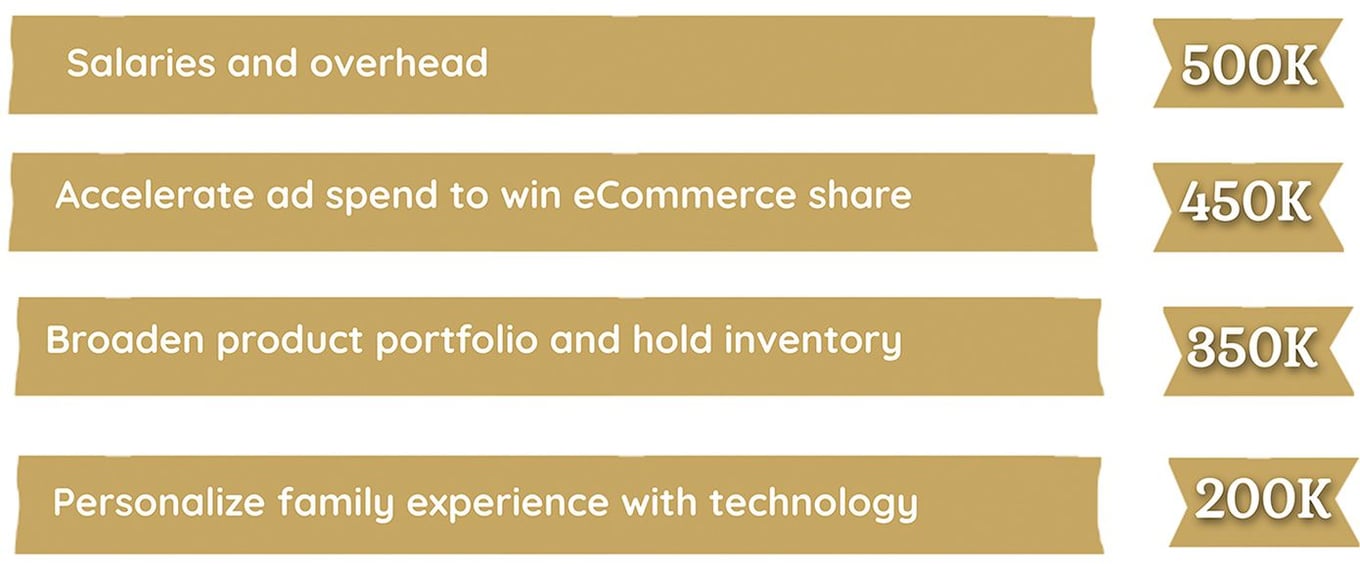

Funding

We have raised $325K under SAFE note

We’re looking to raise $1.5M under similar terms

The net proceeds from this offering will be used to accelerate our growth rate as a function of having additional capital to invest in product development, marketing, sales initiatives, and working capital.

—

Funding fairyland

Without these angels who believe in Hold The Magic as much as we do, we would never be able to put our wings on for children everywhere.

—

They Lift Us Up

Tim Koogle

Impact Investor, Former CEO of Yahoo!

Tim Koogle is a private venture capitalist, entrepreneur and business leader, and philanthropist. Having sold his first company to Motorola at age 29, he then had a long career in starting, running, and growing businesses of scale. From 1995 to 2001 he served as Yahoo! founding Chief Executive Officer and Chairman of the Board of Directors. Tim is on the board of a number of private early stage companies in which he is a venture capital investor. He was a founding investor, board member, and Chairman of Method Home, (now a profitable $1B revenue company), and founding investor, board member, and Chairman of Olly, (now a profitable $300M+ revenue company).

Pam Scott

Impact Investor, Founder of The Curious Company

Pam is a designer, strategist and angel investor who has worked with some of the world’s most innovative companies and non-profits – IDEO.org, Mini Cooper, Nike, PSI, The Robert Wood John Foundation and the Global Center for Gender Equality among them. In 2000, she started The Curious Company, a strategy and design studio where she and her colleagues practice Human-Centered Design to help organizations address social issues with greater empathy, understanding, creativity and effectiveness. As an investor and creative advisor, she’s helped launch Method Home, Olly and a number of other consumer companies. Outside of work, Pam is a daughter, sister, aunt, wife, competitive athlete, avid gardener and committed maker. She and her husband Tim live in Northern California with their pride of rescue cats.

Sara Menke

Founder, CEO of Premier Talent Partners & Ajna Software

Board Member Sara Menke is a cereal entrepreneur. Where Sara has over 20 years of experience serving as Founder and CEO at Premier Talent Partners, she also founded Ajna Software, an unbiased SaaS technology in addition to a business services company. Sara is an enthusiast, committed to agile business philosophies. She is driven and works tirelessly to help bring innovation, simplicity and efficiencies to the businesses she serves. Sara played an integral role in developing innovative recruiting strategies that have greatly impacted many of the bay area’s fastest growing and most impactful companies. Passionate is a word often used when describing Sara. Sara has a BA from USF and an MD in life.

Frank Ghali

Founder, CEO of Jordan Park

Frank has been an advisor to institutions, founders, entrepreneurs, executives, and their families on all aspects of wealth management since 2000. He founded Jordan Park in 2017. Prior to founding the firm, Frank was with Goldman Sachs from 2000 to 2017, serving as Managing Director from 2011 to 2017. He was previously a founding partner in an import/export business in the New York metropolitan area. He serves on the board of Built Technologies, a commercial construction lending software company in Nashville, and on the University of Pennsylvania Carey Law School Board of Advisors. Additionally, he is a member of YPO, a global leadership community of business operators and executives. He earned his BS/BA in Business Administration from Rutgers University and JD from the University of Pennsylvania, concurrently earning a Certificate of Study in Financial Management and Public Policy from the Wharton School of Business.

Founder

Meet the founder fairy

Shannon Cahoon

Shannon CahoonFounder, CEO

Shannon has played Tooth Fairy, among every other magical being, for the past 10 years for her two imaginative kids, which is where the idea for Hold The Magic began. Her deeply felt passions include creating thoughtful gifts, sharing creative magic with the world, and making every detail as beautiful and memorable as possible.

Shannon is a big picture-thinker with a creative mind that just won’t stop. In 2004, she founded and oversees a full-service branding and marketing agency, Madplum Creative. Shannon has worked for many highly successful advertising agencies, including Tracy-Locke/DDB Needham and Digitas USA, a Publicis Groupe agency. A Creative Director and a relationship manager by trade, Shannon has an uncanny knack for getting right to the soul of a project and articulating a brand through strategic communication. Her trademarks include sensitivity to business objectives, the ability to inspire creative teams, and a keen focus that refuses to let a single detail fall through the cracks.

A secret detail: Shannon grew up in the Texas hill country where she believed she was a mermaid in Lake Travis.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...