Republic's own

digital security

Republic is uniquely positioned within the private investing ecosystem, leveraging its various partners, communities, and investors to scale and grow. Republic Notes sit at the heart of the Republic ecosystem and capture some of its value.

Each Republic Note gives its holder fractional ownership of the profits from investments made by certain lines of businesses within Republic.

Republic ecosystem

A global private investing platform

Republic has provided access to hundreds of investment opportunities across startups, gaming, real estate, & crypto

Today, the Republic ecosystem has facilitated:

Over $1 billion in investments,

From more than 2 million global community members,

From more than 100 countries around the world.

As we grow as a firm and pursue more exclusive investment opportunities, the Republic Note exemplifies our ongoing commitment to democratizing venture capital by creating an opportunity for the Republic community to share in a portion of Republic’s future success.

The Republic Note is issued by Republic Core, an entity within the Republic Ecosystem responsible for providing technology and business services powering the entire ecosystem.

Economic framework

Republic Note

How do Republic Note holders make money?

Republic Note is a profit-sharing digital security that gives investors a derivative right to the economic upside of certain business lines within the Republic ecosystem.

Liquidity events

When certain companies in which Republic has invested have an exit that generates cash proceeds, a portion accrues to Republic Notes.

When certain companies in which Republic has invested have an exit that generates cash proceeds, a portion accrues to Republic Notes.

Dividends

Every time the accrual reaches $2M in aggregate, pro-rata distributions will be made to all holders of Republic Notes.

Every time the accrual reaches $2M in aggregate, pro-rata distributions will be made to all holders of Republic Notes.

Limited quantity

No more than 800 million Republic Notes will ever be minted, and 30% of them are locked until 2023. Because supply is finite, if demand for Republic Notes rises, then their value may rise.

No more than 800 million Republic Notes will ever be minted, and 30% of them are locked until 2023. Because supply is finite, if demand for Republic Notes rises, then their value may rise.

Portfolio

Own a part of our portfolio's successes

Republic has the potential to realize profits each time one of the companies we invested in or helped fundraise—past, present, and future—gets acquired at a premium or goes public. Portions of the profits from these investments will get distributed to Republic Note holders.

Republic Capital

(Republic Maximal LLC and its subsidiaries, including Republic Capital Adviser LLC)

Republic Capital is Republic's private investing arm that invests in a non-obvious future across deep tech, fintech, and web3. Since we began in 2018, Republic Capital has operated over 150 investment vehicles, at points managing over $1 billion worth of assets.* Below are select companies belonging to Republic Capital's portfolio. You may view the most updated portfolio on Republic Capital's website.

The above companies are selected as a sample of Republic Capital's investments, constituting of "value add" strategic investments placed by Republic Capital Adviser LLC. In each case, Republic Capital or its affiliates hold a board seat, has introduced a keystone client or investor or has provided material support outside of its investment of capital to the applicable portfolio company. Past performance is not necessarily indicative of future performance. It should not be assumed that recommendations made in the future will be profitable or equal to that of the performance of the securities selected.

The above companies are selected as a sample of Republic Capital's investments, constituting of "value add" strategic investments placed by Republic Capital Adviser LLC. In each case, Republic Capital or its affiliates hold a board seat, has introduced a keystone client or investor or has provided material support outside of its investment of capital to the applicable portfolio company. Past performance is not necessarily indicative of future performance. It should not be assumed that recommendations made in the future will be profitable or equal to that of the performance of the securities selected.

Each time a company from the Republic Capital portfolio exits, 25% of Republic Capital's profits is accrued to the pool of proceeds to be distributed to Republic Note holders.

* The asset under management for Republic Capital, or any specific fund, account or investment strategy presented on this page may differ from any comparable AUM disclosure in other non-public or public sources (including public regulatory filings) due to, among other factors, methods of net asset value and capital commitment reporting, differences in categorizing certain funds and accounts within specific investment strategies and exclusion of certain funds and accounts, or any part of net asset value or capital commitment thereof, from the related AUM calculations. Certain of these differences are, in some cases, required by applicable regulation.

Republic US Funding Portal

(OpenDeal Portal, LLC)

The US Funding Portal ("Portal") has been central to our mission to democratize investing. Since its inception, the Portal has helped over 350 companies raise funds from their community, regardless of accreditation statuses.

Republic often receives a small percentage of the total raise for each offering it hosts in terms of securities commission. Each time a company that have raised funds through the US Funding Portal exits, 100% of the profits from Republic's holding gets added to the Republic Note dividend pool.

Below are select companies that have raised funds through Republic US Funding Portal. New companies are added regularly, and you may view a list of previous offerings on the Republic website.

The above is a selective snapshot of previous offerings hosted through the US Funding Portal. Past performance is not indicative of future performance.

The above is a selective snapshot of previous offerings hosted through the US Funding Portal. Past performance is not indicative of future performance.

Our ecosystem

Building a world of opportunity

Republic: A Global Ecosystem

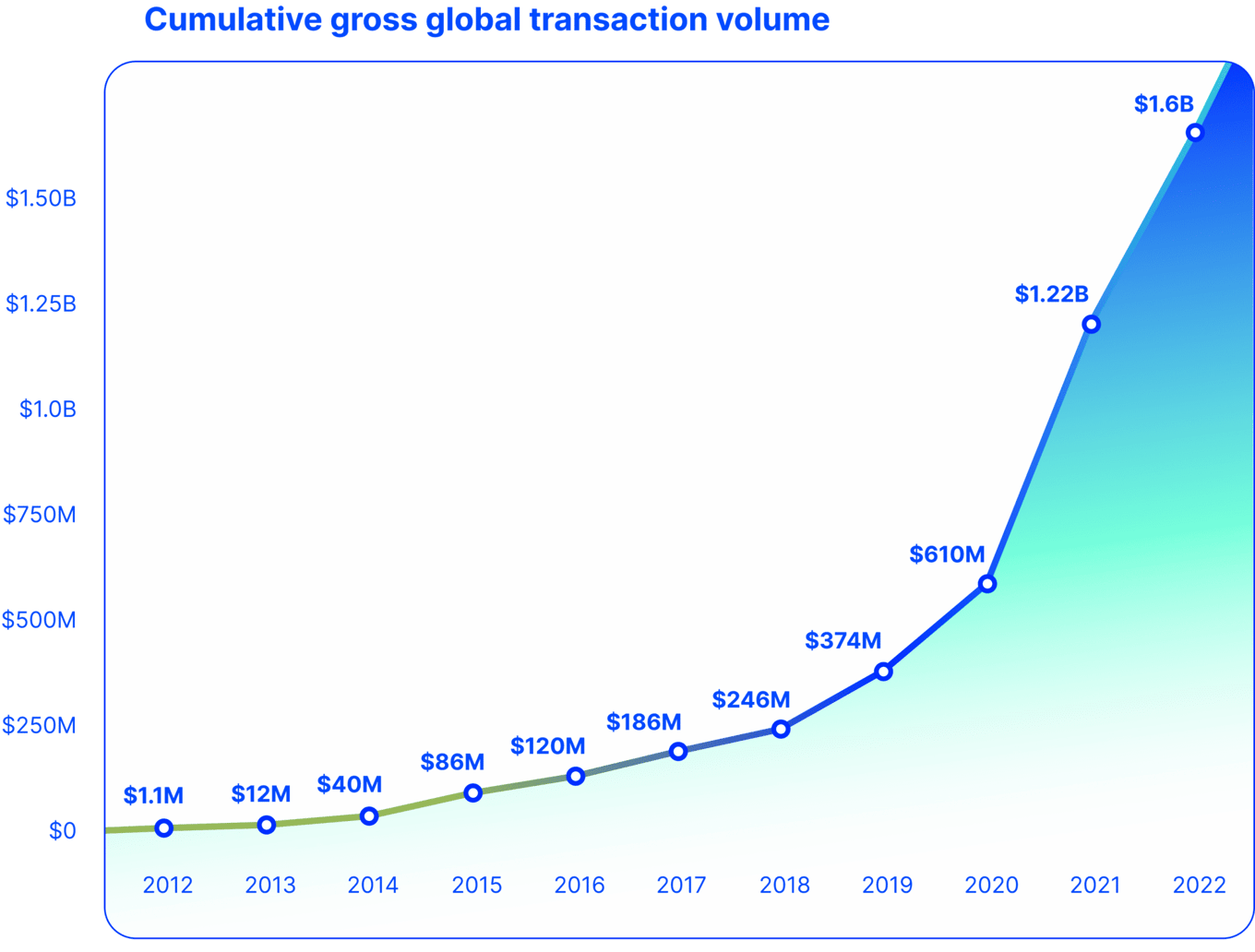

The Republic Note sits at the center of Republic, an ecosystem of businesses working to create a world where investment and ownership are truly accessible to everyone, everywhere. Started with a retail funding portal, Republic has since expanded into a full-stacked investment ecosystem that also services private businesses across sectors with institutional and accredited-only financing products. Our different business lines have facilitated in total over $1B in gross transaction volume since 2012.

Figures represented are reported as estimates from each business line and have not been audited. Figures include the volume transacted through Seedrs, which was acquired by Republic in September 2022. No offerings hosted by Seedrs or any Republic affiliates, other than OpenDeal Portal LLC and Republic Maximal LLC and its subsidiaries, contributes to the Republic Note.

Figures represented are reported as estimates from each business line and have not been audited. Figures include the volume transacted through Seedrs, which was acquired by Republic in September 2022. No offerings hosted by Seedrs or any Republic affiliates, other than OpenDeal Portal LLC and Republic Maximal LLC and its subsidiaries, contributes to the Republic Note.

In 2021, Republic closed two funding rounds, including a $36M Series A round in March led by Galaxy Interactive and a $150M Series B round in November led by Valor Equity Partners. Leveraging this momentum for growth, Republic announced the acquisition of UK equity crowdfunding business Seedrs in December 2021, jointly becoming the world’s first global private investment platform.

Distribution

Upcoming launch:

Introducing the

Republic Wallet

Republic Core has spent the past year building the Republic Wallet, our proprietary, non-custodial wallet intended to hold all digital assets issued through the Republic platform in the future.

The Republic Wallet is undergoing audits performed by Quantstamp, a leading provider in blockchain security so as to ensure optimal protection of users' information and assets. Once the audit is completed, the Republic Wallet scheduled for launch in the first half of 2023. The Republic Notes purchased through this offering will be distributed to users' Republic Wallet following its launch, making them the first assets to be held by the Wallet.*

*Distribution timeline may be subject to delays dependent on the progress of the audit or any other technical complexities that may arise.

Vision and strategy

Leading the transformation of digital finance

Venture capital used to be an exclusive sports amongst the wealthiest. Republic is here to change that, and to help anyone, anywhere own a piece of anything they’re passionate about—from a startup building climate change solutions, to an album from their favorite musician, and anything in between.

And in the process, we’re supporting the brilliant entrepreneurs behind tomorrow’s biggest companies.

Republic’s vision of democratizing investing and transforming entrepreneurship into a shared economy has been featured on CNBC, Bloomberg, Yahoo! Finance, Business Insider, the Korea Times and numerous other media channels. Its tokenization framework, including the Republic Note, has been reported in the Wall Street Journal, Fortune, GoogleTalks, CoinDesk and many more.

Funding

A robust network of renowned venture capital firms, strategic investors,

and our very own retail investor community.

In an industry as regulated and important as blockchain and private investing — and for a company with a vision as far-reaching as Republic — it is critical that it aligns itself with the most reputable partners in all aspects of its business.

The parent company of the Republic Note, OpenDeal Inc. dba Republic or “Republic Parent", has received investments from notable investors

The parent company of the Republic Note, OpenDeal Inc. dba Republic or “Republic Parent", has received investments from notable investors

Seeded by AngelList and founded by AngelList alums, Republic has a close relationship with AngelList and its affiliated companies CoinList and Product Hunt. The Republic Note was also one of the first investments made by Binance Labs, Binance’s venture arms, and is backed by the Algorand Foundation.

Republic Parent later went through several financing rounds, receiving the backing of industry-renowned institutions such as Galaxy Digital, and Valor Equity Partners (who led Republic’s $150M Series B funding round announced in December 2021).

Team and leadership

Built by a team of 300+ employees

Across our family of companies, every team member at Republic plays an instrumental role in growing the Republic ecosystem and, in turns, adds value to the Republic Note.

Ours is a team with extensive experience in investment, blockchain, law, engineering, and community building. The Republic team of 300+ full-time team members honed their expertise at reputable tech startups, respected law firms, and leading financial institutions. Many are founders, and collectively they speak over a dozen languages and hold degrees from some of the best universities in the world.

Recognizing that it takes a village to build a community, Republic has also fostered a growing network of advisors who are leaders in tech (such as Naval Ravikant of AngelList and Alexis Ohanian, Founder of Reddit), government (such as Jack Bienko of U.S. Small Business Administration), media (such as Randi Zuckerberg, prominent businesswoman and CEO of Zuckerberg Media), and impact (such as Shiza Shahid, former CEO of the Malala Fund).

Republic’s advisors and partners are mentors and allies to its core team, sharing the knowledge and influence needed for Republic to build a next-generation investment bank. One that curates investment opportunities through the lens of access, inclusion, and sustainable growth. One that enables and encourages everyone, everywhere to invest in innovations and teams that may shape our future.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...