There's an old saying in real estate that the three things that matter most are "location, location, location." Unfortuna...

The maximum investment available in this offering is $5,000. If you are an accredited investor who would like to invest at least $10,000, please click here.

Overview

The Miami Cityfund will acquire and manage a portfolio of single-family residential real estate assets in Miami only. Our acquisition strategy will focus on (1) investing in the equity of owner-occupied single-family homes ("Homeshares") and (2) purchasing single-family rentals that we believe offer compelling values with the potential for significant appreciation while providing investors unprecedented access to the highest-demand, fastest-moving real estate markets, like Miami, Austin, and Dallas.

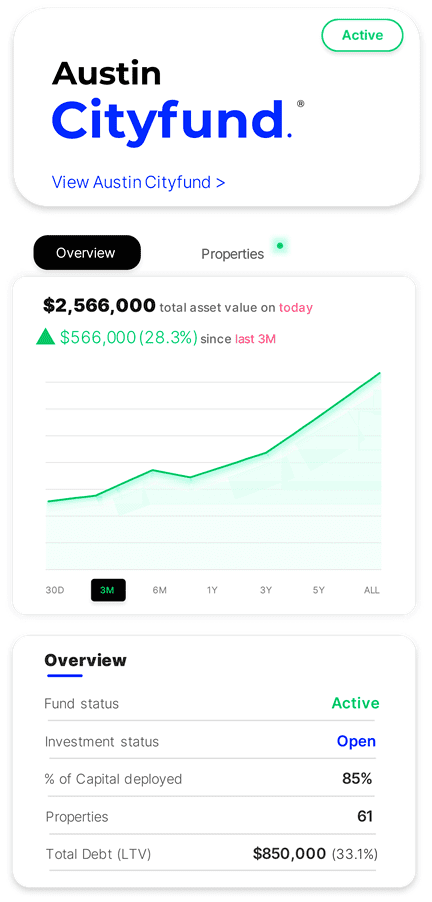

Other Cityfunds live now

*Note: Each Cityfund is an independent and separate offering, each Cityfund below has a separate Reg CF securities offering hosted by Republic (OpenDeal Portal LLC, CRD #283875) and issued by Cityfunds 1, LLC.

Cityfunds

A new real estate investment product, from Republic Real Estate and Nada.

What is a Cityfund?

A Cityfund is similar to an index fund in that it provides targeted exposure to residential real estate in a single city. Providing access to high-demand, fast-moving markets typically inaccessible to most investors. Cityfunds are designed to mimic the performance of residential real estate in one city only.

What makes Cityfunds different?

Why did we create Cityfunds?

We designed the Cityfund based on the transformation we have seen in the equities market from actively managed mutual funds to index-based exchange-traded funds (ETFs). Many ETFs enable investors to make very targeted investment decisions within a specific sector, geography, or risk profile.

We wanted to provide investors with this type of targeted exposure by creating a real estate investment product that provides targeted exposure to a specific city through a portfolio of residential real estate assets.

Miami

Miami is having a moment. An increasing number of entrepreneurs and investors are relocating from traditional tech hubs to emerging startup ecosystems, and Miami is emerging as the benefactor. With its tropical climate, diverse population, and lack of state income tax, Miami is quickly becoming a tech hot spot.

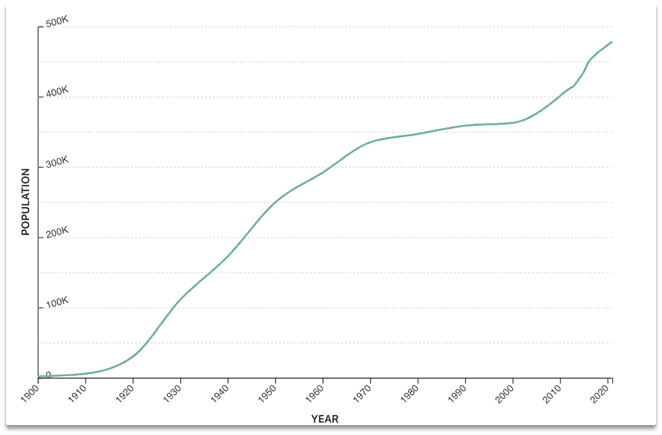

Florida has seen one of the nation’s biggest upticks in the number of new residents, according to U.S. Census Bureau data. From July 2019 to July 2020, Florida gained an estimated 241,256 residents, second only to Texas. Miami is the second-largest city in Florida (after Jacksonville) and its population has increased by nearly 20% since 2010. Miami's population is currently the highest it has ever been. After Washington, D.C., Miami is the most populous metro region in the Southern U.S.

Source: World Population Review.

Economic Center

Home to one of the country’s most spectacular waterfront skylines, Miami is the central business and finance center in South Florida and serves as an important commercial and cultural nexus between the United States, Latin America, and the Caribbean. Miami has the largest concentration of international banks in the United States, with companies such as HSBC, Espirito Santo Bank, and Banco Santander, among others.

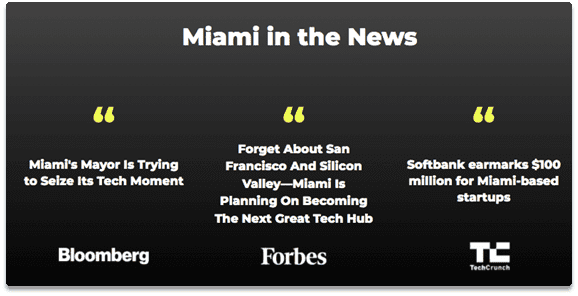

Entrepreneurial Hub

Urged by efforts from Miami Mayor Francis Suarez, technology companies, startups, entrepreneurs, and venture capitalists alike are making the move to Miami.

- Marcelo Claure, CEO of SoftBank and long-time Miami advocate, announced a $100 million fund dedicated solely to startups based in Miami or those planning on moving there.

- Spotify recently signed a lease in the Wynwood neighborhood of Miami.

- PayPal co-founder and co-founder of venture capital firm Founders Fund, Peter Thiel, recently bought an $18 million mansion in Miami.

- Google chief Eric Schmidt, Andreessen Horowitz general partner Chris Dixon, Craft Ventures' David Sacks, Founder's Fund partner Keith Rabois, Shutterstock founder Jon Oringer, media mogul Bryan Goldberg, and social media entrepreneur Steven Galanis who is head of Cameo are also following suit and relocating to Miami.

The Cityfund's goal is to take advantage of this momentum and growth in the Miami residential market and to aggregate an attractive, diversified portfolio of single-family residential properties that we believe have the potential to significantly increase in value.

Strategy

Acquisition

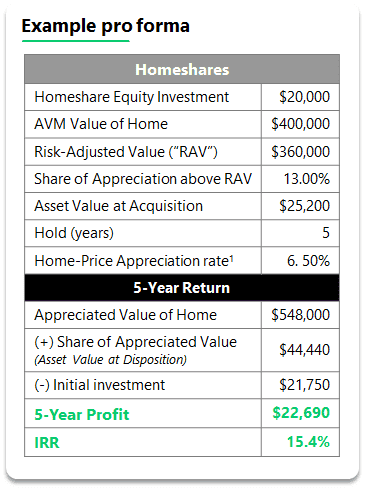

Nada’s Homeshares are investments into owner-occupied homes, whereby the Cityfund provides an upfront payment to a homeowner in exchange for a share of the home’s future appreciated value. Homeshare investments are made directly by Nada and sourced through their network of licensed real estate agents and direct-to-consumer marketing channels.

Nada has established consumer and property qualification standards; in addition, each Homeshare investment is placed at a risk-adjusted discount to market value—offsetting the risk of declines in home values and protecting the initial investment.

Management

Homeshare investments ensure the owner retains typical ownership rights and responsibilities. Each Homeshare investment is recorded on the title of each property and processed by Nada’s in-house Title and Escrow service.

Cityfund generates unrealized returns when the home appreciates in value. The Cityfund realizes cash returns when the homeowner takes certain actions, such as selling the entire home, refinancing their mortgage, or reaching the end of the agreed-upon term.

Acquisition

Nada leverages its boots-on-the-ground real estate team and market experience to source opportunistic property acquisitions. Acquisitions are targeted in single cities and their emerging fringe markets. Investment considerations include attributes such as high rental yield forecasts, attractive school districts, and light renovation costs. SFR properties are acquired a target gross yield of 8 - 12%.

Management

Tenant placement is handled by Nada’s real estate sales team. Property management services are handled by third-party service providers that are managed by Nada.

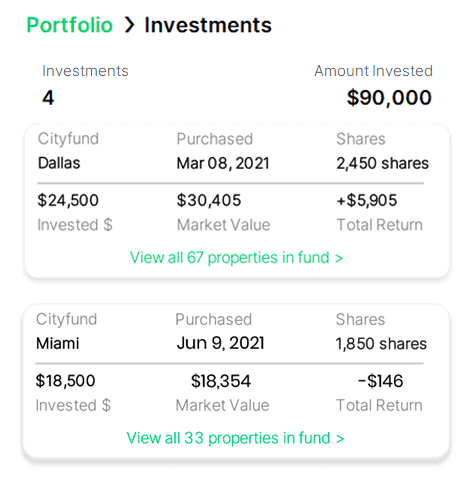

Nada app

The Nada Portfolio Manager app is fully integrated with Cityfunds and designed to provide investors with a transparent and seamless experience.

Investors receive real-time alerts for new acquisitions, valuation updates, and current news on Cityfunds.

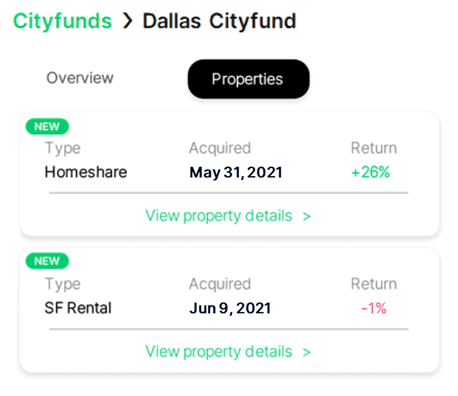

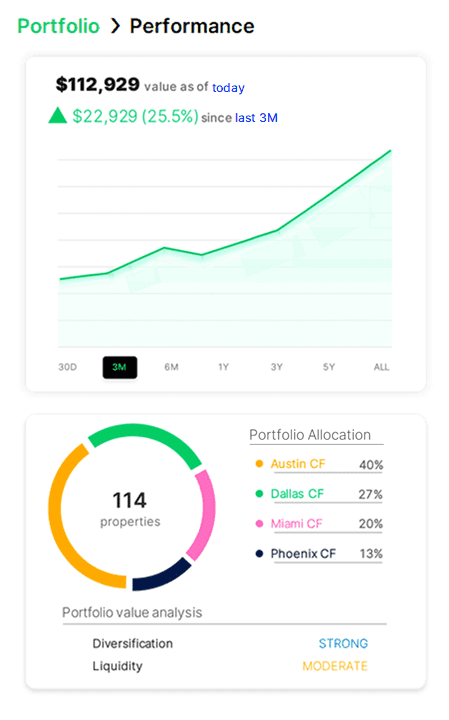

Note: These graphics are purely hypothetical and for illustrative purposes only and are not intended to reflect future returns or portfolio performance in any way. The value of our properties and investments may increase or decrease.

1) Automated log of your Cityfund investments (hypothetical)

2) Real-time notifications of new acquisitions (hypothetical)

3) Personal portfolio & performance tracker (hypothetical)

4) Monitor Portfolio-level performance--down to the property-level (hypothetical)

5) Be the first to know about new Cityfunds

Management

The managing member of the Miami Cityfund is Cityfund Manager, LLC, sponsored by Nada Asset Management and Republic Real Estate.

Republic Real Estate is the tech-enabled real estate investment vertical of Republic led by Jesse Stein who has 20+ years of industry experience and has been involved in multiple real estate public offerings and over $1 billion of real estate transactions.

Nada is a vertically integrated real estate platform that is democratizing real estate wealth through transparent and innovative solutions for home buying, selling, trading, and investing services. Making real estate ownership more accessible and affordable for everyone. Led by a team with 20+ years of industry experience and 20+ years of investment experience managing $1B+ in assets.

Management

John Green is a co-founder of Nada Holdings, Inc., where he has served as CEO and President since its inception in November 2018, where he manages all corporate vision, business model development, and expansion strategies to execute across all service verticals. Previously, Mr. Green served as a Strategic Advisor for Vámonos Credit, LLC, a brand focused on serving the Hispanic consumer across all aspects of a real estate transaction, from November 2017 until June 2018. Mr. Green was previously the Vice President of Strategy and Innovation at Pacific Union Financial, LLC., a top 10 independent mortgage lender, where he served as a growth strategy and implementation leader focused on new business ventures, technology, risk management, and go-to-market strategy, from November 2012 until June 2018. Mr. Green previously managed Quality Control for JPMorgan Chase – Mortgage from 2009 until November 2012. Prior to his career in financial services, Mr. Green was a professional recording and touring artist from 2005 until 2009, where he authored, and published two albums. Mr. Green has been a member of the American Society of Composers, Authors, and Publishers since 2006. Mr. Green is also an active and published member of the Forbes Finance Council.

Mauricio Delgado is a co-founder of Nada Holdings, Inc., where he has served as Chief Strategy Officer and Chief Product Officer since its inception in November 2018, where he manages all corporate finance, technology, strategic partnerships, and growth functions. Previously, Mr. Delgado co-founded and exited Vámonos Credit, LLC, a brand focused on serving the Hispanic consumer across all aspects of a real estate transaction, from July 2017 until June 2018. Mr. Delgado was previously the CEO and CFO of Tricolor Auto Group, LLC, a leading auto retailer and financer to the Hispanic consumer, which grew to >$300mm in revenue, from 2013 until the company was sold in 2016. In addition, Mr. Delgado has a proven track record in institutional investing as Principal at Investar Financial Venture Capital Group, as Director at Highland Capital Management, L.P., and as Vice President at Lehman Brothers Private Equity from 2006 until 2013. Mr. Delgado’s investing track record includes investing and managing over $1 billion of capital across the capital structures of companies in the financial services, technology, energy, and real estate sectors. Mr. Delgado graduated from Stanford University and received his BS in Computer Science and his MBA from Stanford’s Graduate School of Business.

Jesse Stein has served as the co-head of Republic Real Estate since its inception in May 2020. Previously, Mr. Stein served as the Chief Operating Officer of Compound Asset Management, Inc. from February 2018 until May 2020. Mr. Stein is also the Managing Principal of Advanced Fundamentals LLC, a data analytics and real estate indexing firm which he founded in July 2016. Previously, Mr. Stein served as the Chief Executive Officer of Commencement Capital, LLC from April 2016 until February 2018 and was a founding member and the Chief Operating Officer of ETRE Financial, LLC, a real estate financial services and information technology company, from August 2012 until February 2016. During his time with ETRE Financial, Mr. Stein also served as the Chief Operating Officer, Secretary, and a member of the Board of Directors of ETRE REIT, LLC. Mr. Stein graduated from Cornell University and received a Master’s Degree in Real Estate Investment from New York University.

Terms

We are currently offering up to 50,000 Interests at $10.00 per Interest through this offering. The minimum investment is $500 and the maximum investment is $5,000.

The maximum investment available in this offering is $5,000. If you are an accredited investor who would like to invest at least $10,000, please click here.

Management Fees

Cityfund Manager, LLC will receive the following fees for services related to the investment and management of the Portfolio's assets:

Asset Management Fee: 1.5% per annum of the aggregate capital contributions to the Cityfund.

Acquisition Fee: 1.0% of the gross purchase price of each single-family property we acquire.

Leverage

We may employ modest leverage on our single-family acquisitions to enhance total returns to our investors through a combination of senior financing on our real estate acquisitions, secured facilities, and capital markets financing transactions. Our target portfolio-wide leverage after we have acquired an initial portfolio of diversified investments is between 30-50% of the greater of cost (before deducting depreciation or other non-cash reserves) or fair market value of our assets.

Liquidity Event

We intend to enable the trading of Miami Cityfund Interests in a secondary marketplace in order to provide investors with liquidity for their investments. Although our goal is to provide this liquidity option, at this time, we have not identified a secondary marketplace platform and such future liquidity can not be guaranteed.

Returns

Cityfunds are designed to provide returns that are related to the home-price appreciation of a specific market. While we are focused on sourcing acquisitions that have the potential for capital appreciation, the market will ultimately determine returns. We cannot assure you that we will attain this objective or that the value of our properties and your investment will not decrease.

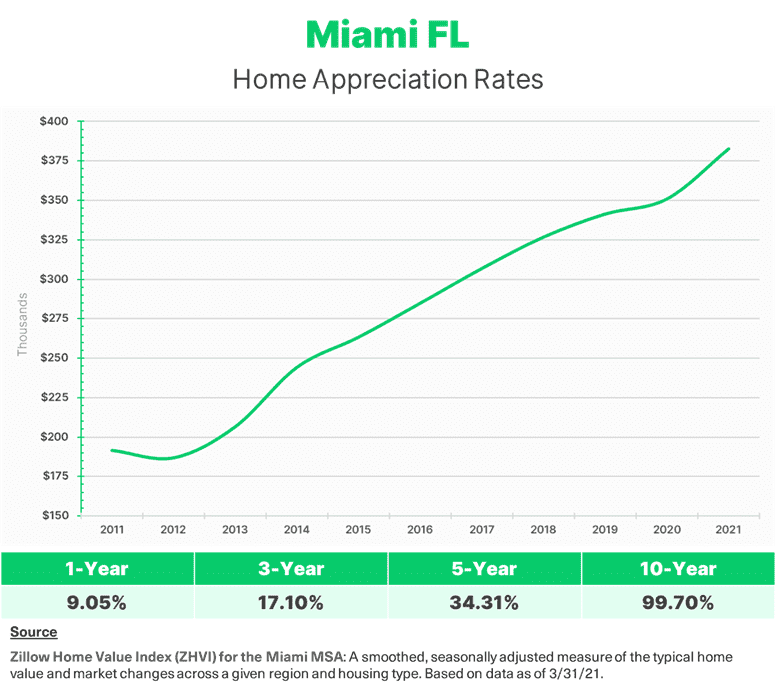

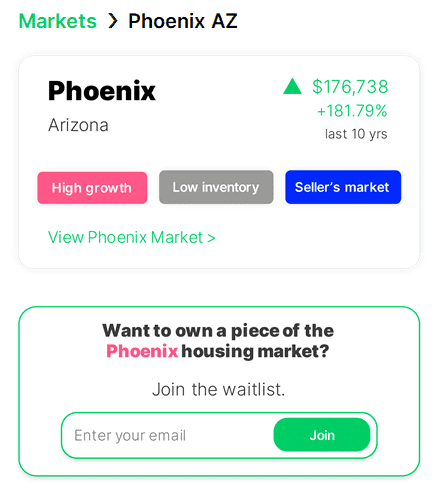

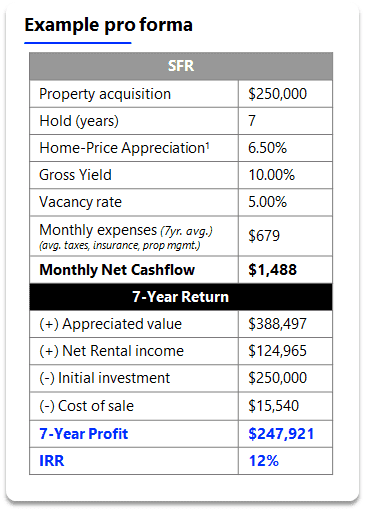

Market Data

Based on recent historical and assumed continuing home-price appreciation, we expect both our single-family rental acquisitions as well as our Homeshare investments to generate annual internal rates of return ("IRR") of between 12% and 15% over a 7-year period. These estimated returns may not be met.

We have provided examples below for hypothetical investments in a single-family rental property and a Homeshare property investment to exhibit how these returns would be generated based on our underlying assumptions.

The hypothetical return assumptions we make below include the income we receive from renting these properties as well as home price appreciation.

The hypothetical return assumptions we make below include home price appreciation as well as the discount to market value that we make our investment ("risk-adjusted value").

Disclaimers

* Past performance is not indicative of future results. No assurance can be provided that the market or the value of our investments will appreciate or will not depreciate in value.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...