Henry Yoshida is back at it again with Rocket Dollar, a new fintech startup co-founded with Thomas Young and Rick Dude, t...

Problem

Most Americans are not aware that their IRAs or 401(k)s can be used for investments outside of stocks, bonds, and mutual funds. The IRS has few limitations on investments that are not allowed inside of a retirement account. Yet, few know this, and the ones that do are frustrated by the cost and complexity of using their retirement savings to make investments in Real Estate, Private Equity, Crowdfunding, and other alternative asset classes. Yes, you can invest in this or other Republic opportunities via your IRA or 401(k) see rocketdollar.com/partners/republic-details.

Most Americans are not aware that their IRAs or 401(k)s can be used for investments outside of stocks, bonds, and mutual funds. The IRS has few limitations on investments that are not allowed inside of a retirement account. Yet, few know this, and the ones that do are frustrated by the cost and complexity of using their retirement savings to make investments in Real Estate, Private Equity, Crowdfunding, and other alternative asset classes. Yes, you can invest in this or other Republic opportunities via your IRA or 401(k) see rocketdollar.com/partners/republic-details.

Investing in alternative assets inside of retirement accounts is not a new concept. However, before Rocket Dollar, creating a self-directed account could cost thousands of dollars and require an attorney and CPA to set up and fund an account. Our founders experienced the pain of setting up and using self-directed accounts for their own personal investing. They knew that there had to be a better way to leverage the technology of today with a legacy process.

Investing in alternative assets inside of retirement accounts is not a new concept. However, before Rocket Dollar, creating a self-directed account could cost thousands of dollars and require an attorney and CPA to set up and fund an account. Our founders experienced the pain of setting up and using self-directed accounts for their own personal investing. They knew that there had to be a better way to leverage the technology of today with a legacy process.

Our competition made Rocket Dollar possible by being stodgy, inefficient, and expensive. This trend continues to cement our competitive advantages — efficiency and customer satisfaction through technology — transparent and fair pricing — responsive customer service — and full control over one's retirement savings.

Our competition made Rocket Dollar possible by being stodgy, inefficient, and expensive. This trend continues to cement our competitive advantages — efficiency and customer satisfaction through technology — transparent and fair pricing — responsive customer service — and full control over one's retirement savings.

Solution

Rocket Dollar was founded on the belief that tools available to the wealthy should be available to everyone. Everyone should be able to invest their own retirement money in whatever they want, not just a short menu of mutual funds offered to them by their advisor or plan sponsor.

Our team has created a process that makes it fast and straightforward for anyone to create, fund, and invest in virtually any permissible assets they wish with their retirement savings, with no penalties associated with early withdrawals.

Product

How it works

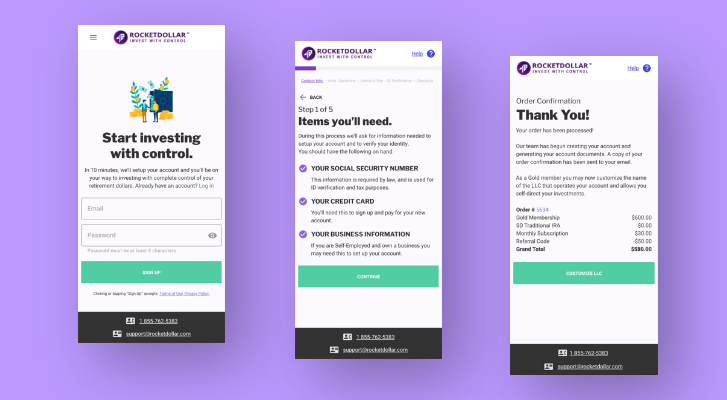

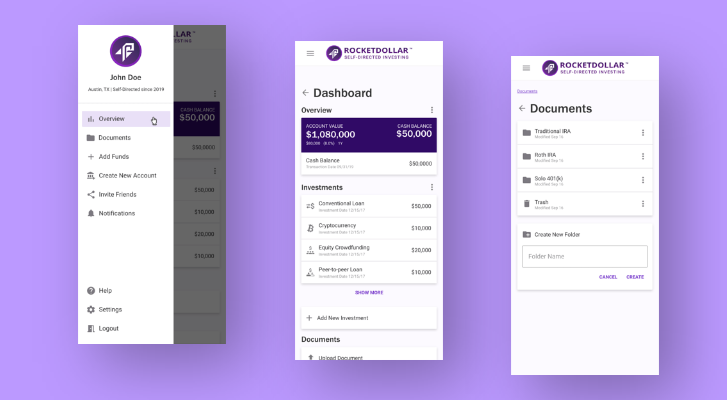

Getting started with a Rocket Dollar is easy. Folks can sign up for an account in ten minutes at RocketDollar.com, and within a couple of days, their account will be open, and they will be ready to sign their account opening documents.

Getting started with a Rocket Dollar is easy. Folks can sign up for an account in ten minutes at RocketDollar.com, and within a couple of days, their account will be open, and they will be ready to sign their account opening documents.

Our fulfillment team takes care of establishing the proper account, setting up the bank account, and making sure that customers have everything they need to fund their account.

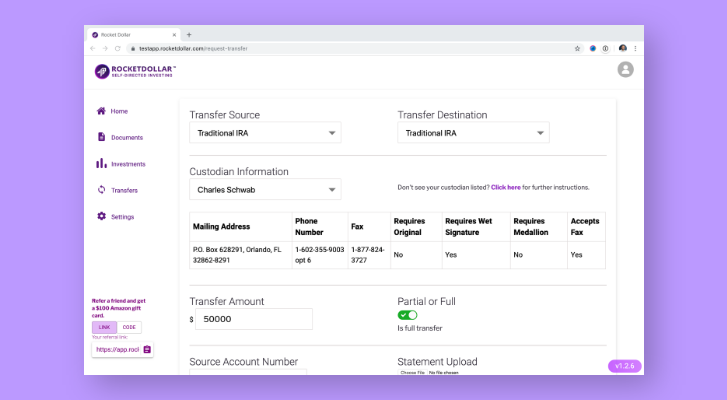

There are three ways to fund your Rocket Dollar account. The first is by transferring in an existing IRA that you may have with another provider. The second is by rolling over a 401(k) from a previous employer, and the third is by making a contribution to the account.

There are three ways to fund your Rocket Dollar account. The first is by transferring in an existing IRA that you may have with another provider. The second is by rolling over a 401(k) from a previous employer, and the third is by making a contribution to the account.

Funding a Rocket Dollar account is simple, as our team has created a patent-pending account transfer module, that allows customers to easily fund their Rocket Dollar account.

Making an investment through your Rocket Dollar account is as simple as writing a check or initiating a wire or ACH transfer. Investments made through Rocket Dollar are simply titled in the name of the retirement account, and funding directly from a customers’ Rocket Dollar account.

Making an investment through your Rocket Dollar account is as simple as writing a check or initiating a wire or ACH transfer. Investments made through Rocket Dollar are simply titled in the name of the retirement account, and funding directly from a customers’ Rocket Dollar account.

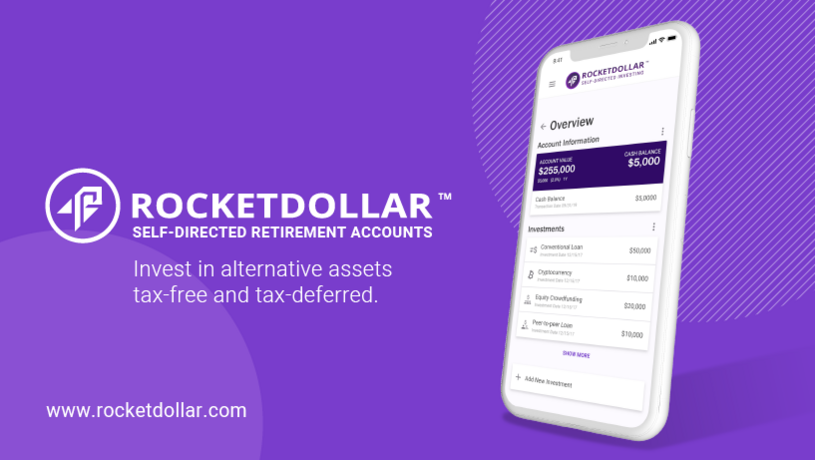

Our team has also created an investment tracker, accessible in the Rocket Dollar dashboard, which allows customers to track their investments across asset classes. Once an investment is made, it is entered into the tracker, and customers will be able to track the performance of all of their investments.

Traction

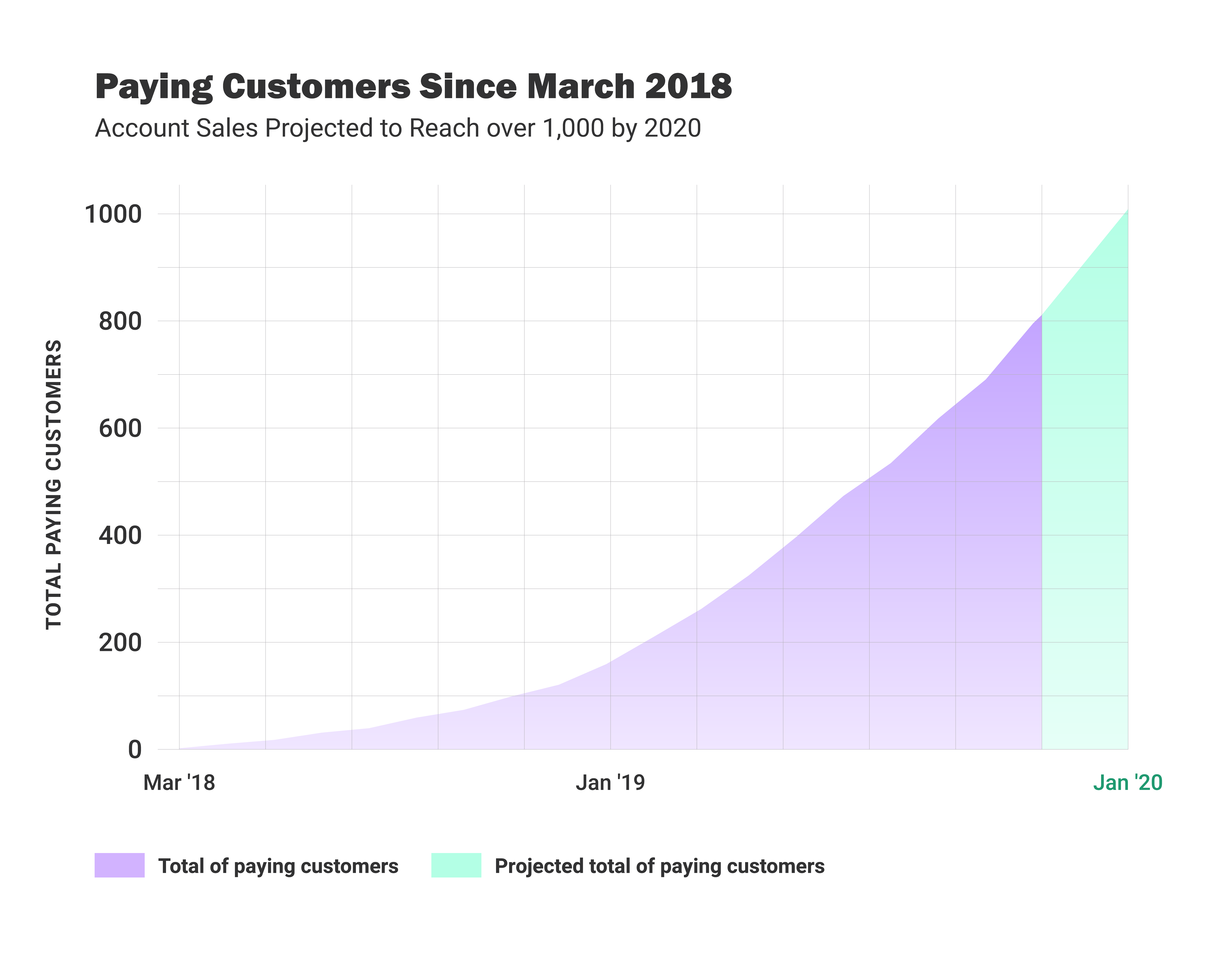

We currently offer two types of accounts at Rocket Dollar, the Self-Directed Solo 401(k) (launched in March 2018), and the Self-Directed IRA (launched in June 2018). Both accounts are available in Traditional (pre-tax contributions) or ROTH (post-tax contributions).

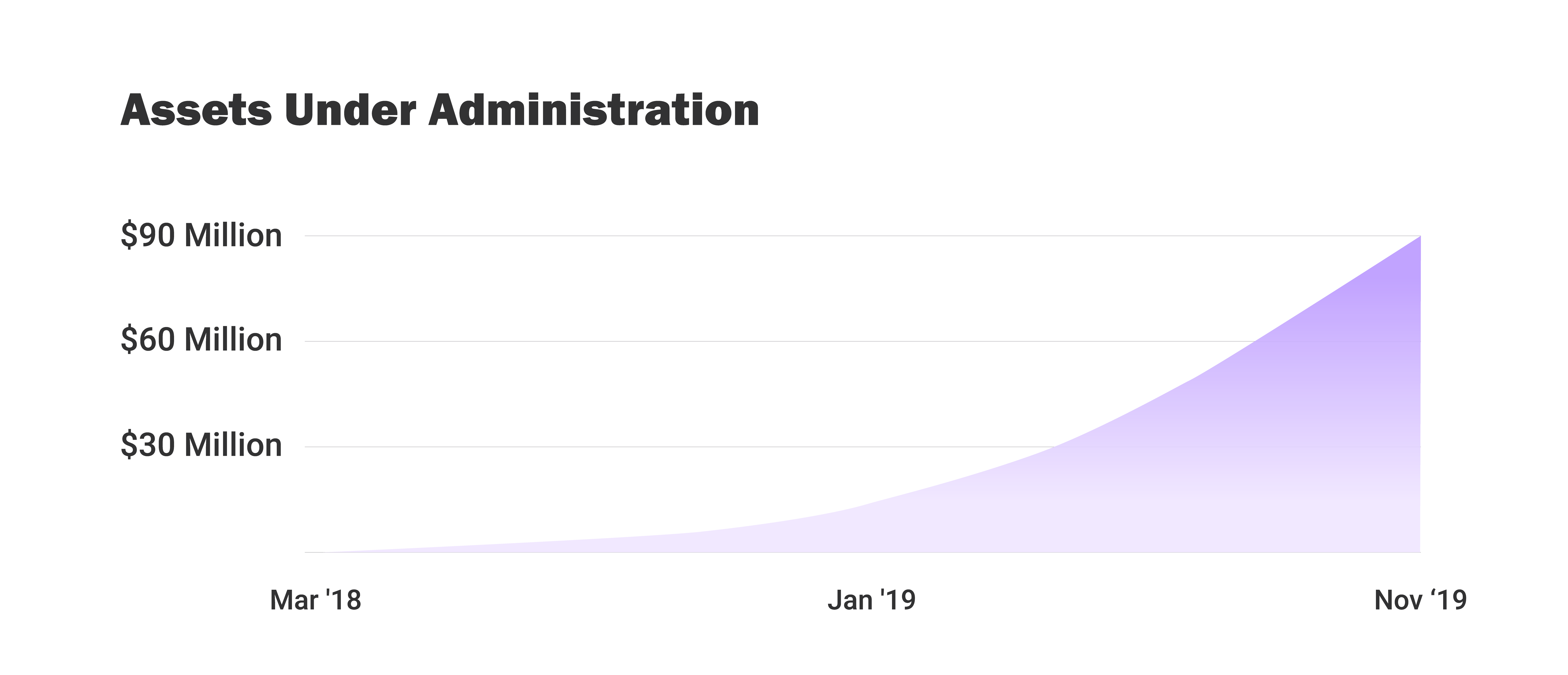

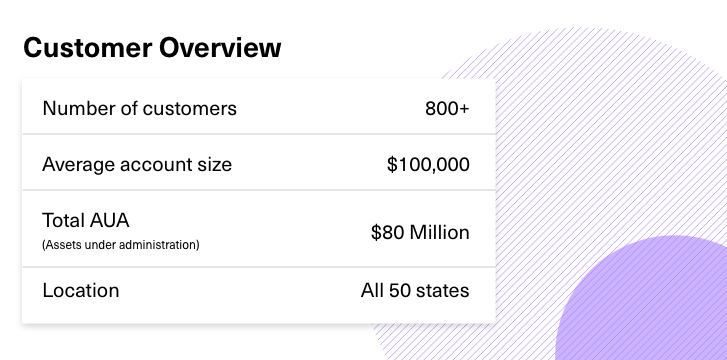

Since the launch of our first product, we have grown to over 800 paying customers. We have never offered a free or unpaid beta program.

Customers

Rocket Dollar benefits any investor who doesn’t want to just invest in a pre-set menu of stocks, bonds, and mutual funds. We proudly serve happy customers in all 50 states.

Business model

We charge a flat upfront fee of $360 to establish a new account and $15 per month for our Core product's on-going compliance. Unlike our competition, we decided to make our pricing transparent and straightforward.

The fee sheets used by some of our competitors are lengthy, and it's clear to see how those fees can add up!

While we currently do not make money on our customer's investments, we are exploring opportunities for revenue share agreements with our partners who are keen to work with our customer base.

In October 2019, Rocket Dollar launched a new, premium-level product at an increased price point. With this launch, Rocket Dollar has two service and pricing levels for IRA and 401(k) accounts. The product that it introduced last year and is currently offering is now Rocket Dollar Core (we removed a few features from the Core level). We branded the new, premium product as Rocket Dollar Gold. It has enhanced services, and for the first time, tangible Rocket Dollar branded items - checks, a logo checkbook wallet, and Rocket Dollar will provide a debit card to customers. The Rocket Dollar Core offering will remain at the current pricing model of $360 sign-up fee and $15 per month compliance fee. The Rocket Dollar Gold account level is priced at a $600 one time sign-up fee and $30 per month. Rocket Dollar Gold customers will receive expedited account opening and fund transfers, phone support, an initial supply of Rocket Dollar logo checks, branded debit card, an allowance for free wire transfers, and year-end tax form preparation.

Since the launch of Rocket Dollar Gold, approximately 23% of new clients have opted for this choice. New Rocket Dollar Gold customers have transferred approximately double the amount than our overall average to the Rocket Dollar platform.

Market

There are over $30 trillion deployed in retirement accounts. Less than 1% of that goes to local and non-public investments. Over $28 trillion of investments are invested passively into the stock market either directly or through ETFs and mutual funds, and these same dollars could have a more significant impact and returns by investing in the businesses that people know, touch, and love.

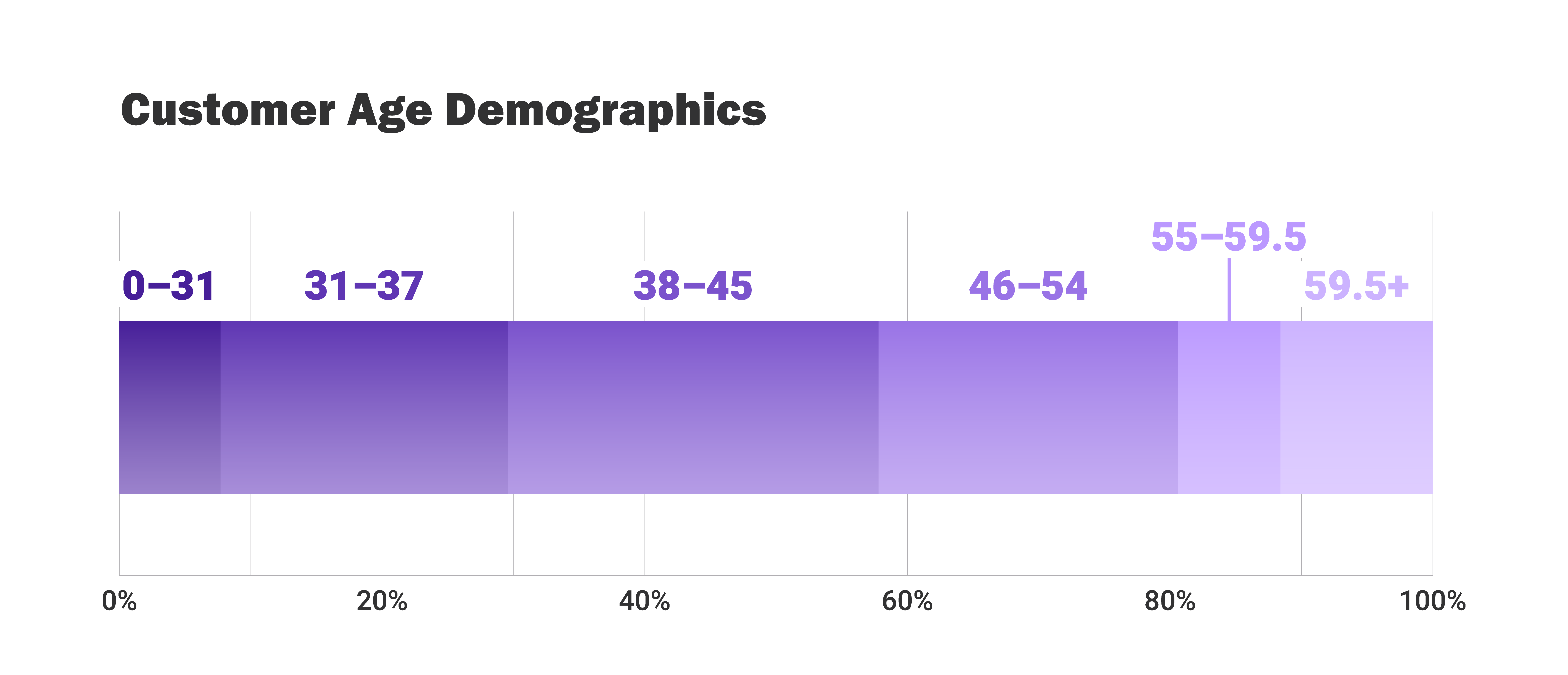

We cater to Americans who want more out of their retirement savings. Folks who work hard, are smart about their money and want to accelerate their vision of retirement by investing in assets in which they have confidence. People who desire access to non-correlated and alternative asset classes. Those who wish to be active, not passive, for a least a portion of their retirement assets. Investors who are locally aware and socially conscious.

Incumbent retirement providers focus on providing broad market exposure but neglect the values and communities of their investors. Rocket Dollar allows its customers to invest in local businesses and ventures that promote their communities, and along with that, the people with whom they live and work.

From neighborhood homes for friends, coffee shops for communities, to the next up-and-coming ride-sharing platform, technologies changing the lives and prosperity of our customer's friends, family, and neighbors are all available for investment through the Rocket Dollar platform.

Vision and strategy

Acquisitions will open a whole new realm of possibilities for Rocket Dollar as our industry is highly fragmented (below the handful of existing players), and there is no active roll-up in the sector. Acquisitions have many benefits; foremost, they represent a known cost of customer acquisition that is far below the lifetime value of the account.

We can also acquire a trust company charter along with a portfolio of accounts, allowing us to self-custody our accounts in addition to offering custody service to other firms in our industry. Along with the possibility of acquiring a trust charter, we are actively researching the requirements and process to obtain a "non-bank custodian" designation from the IRS. This designation will allow Rocket Dollar to be the custodian of its IRA accounts and opens up new possibilities for revenue generation from the cash balances held by our customers.

In 2020, we plan to offer a new service to our customers, one that is not currently offered by any provider in our industry - an alternative IRA/401(k) account, which can also seamlessly accommodate traditional investment products. This "Rocket Dollar Advisor" account will initially offer a family of low-cost ETF products at a low management fee and access to trading traditional assets such as stocks and mutual funds. This will be our first effort in monetizing our assets under administration and should grow our average account size as many of our customers will be able to have the market-exposed portions of their retirement accounts along-side their alternative investments with Rocket Dollar Advisor. There will be no need to keep a separate IRA account with a traditional broker or advisor when the Rocket Dollar account can hold tradable securities.

Funding

To date, Rocket Dollar has been capitalized with $3.7 million in a combination of Founder's and Executive Team investments ($355,850) and outside angel investors and institutions. Rocket Dollar's first external financing was a Convertible Notes round of $1.5 million, with a large part being individual investors and family offices. We then issued a $150,000 SAFE to Village Global through its Network Catalyst program. Village Global is a San Francisco based accelerator and mentorship network. In mid-2019, Rocket Dollar completed a company-lead Series Seed round of $1.6 million, which converted all of the existing convertible notes and the Village Global SAFE and included an additional investment of $163,000 by Village Global. Our capitalization is now comprised only of common equity and the Series Seed Preferred.

We have no debt or other long term obligations.

As mentioned above, compared to other startup firms less than two years old, we have a high investment participation rate of its executive team. The team has invested directly, aside from any option grants, $355,850 in the common and preferred shares of Rocket Dollar. Notably, many of the individual investors who have purchased Rocket Dollar's convertible notes or preferred shares have done so through tax-deferred Rocket Dollar accounts.

Founders

Henry is CEO and Co-founder of Rocket Dollar. He is a Certified Financial Planner™ professional, licensed Realtor®, and has 17 years of experience in finance. In his recent past, Henry was the founder of venture capital-backed Robo-advisor retirement plan platform Honest Dollar (acquired by Goldman Sachs). He was also the founder of MY Group LLC ($2.5 billion retirement plan advisory firm) and spent ten years as a Merrill Lynch Vice President.

He graduated from The University of Texas at Austin, has an MBA from Cornell University, and lives in Austin with his wife and two daughters.

Thomas is a marketing professional with years of experience in the startup community. He started his career at AngelSpan before founding a marketing agency catering to financial professionals. His experiences with clients led him to the self-directed space, where he quickly realized that people want more control and that there needed to be a way to make it safe, secure, and fast for people to invest their retirement savings in the assets of their choice.

Thomas lives in Austin and enjoys running around Lady Bird Lake when he's not thinking of ways to share the Rocket Dollar story. He's from Mexico City and attended the University of Texas at Austin, where he pursued a degree in Economics.

Rick is a technologist, financial professional, and serial entrepreneur. He holds a Series 65 and founded QuantAdvisor, an Internet Registered Investment Advisor, in 2011. As a technology consultant, he's planned and implemented large data infrastructure projects for the banking, pharmaceutical, government, retail, and manufacturing industries. His best-known clients include Bank of America, the Transportation Security Administration, the State of Texas, and Bristol-Myers Squibb. He has founded or been an early key employee at five different startups. Three found funding, and two were acquired.

Dude lives in East Austin with his wife and three children and is a manager of the Austin Huns Rugby Club. He is from Tuscaloosa, Alabama, and attended American Intercontinental University.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...