Sam Parks may have a degree in applied physics from Penn and have just closed a $2 million round of funding-but the brain...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

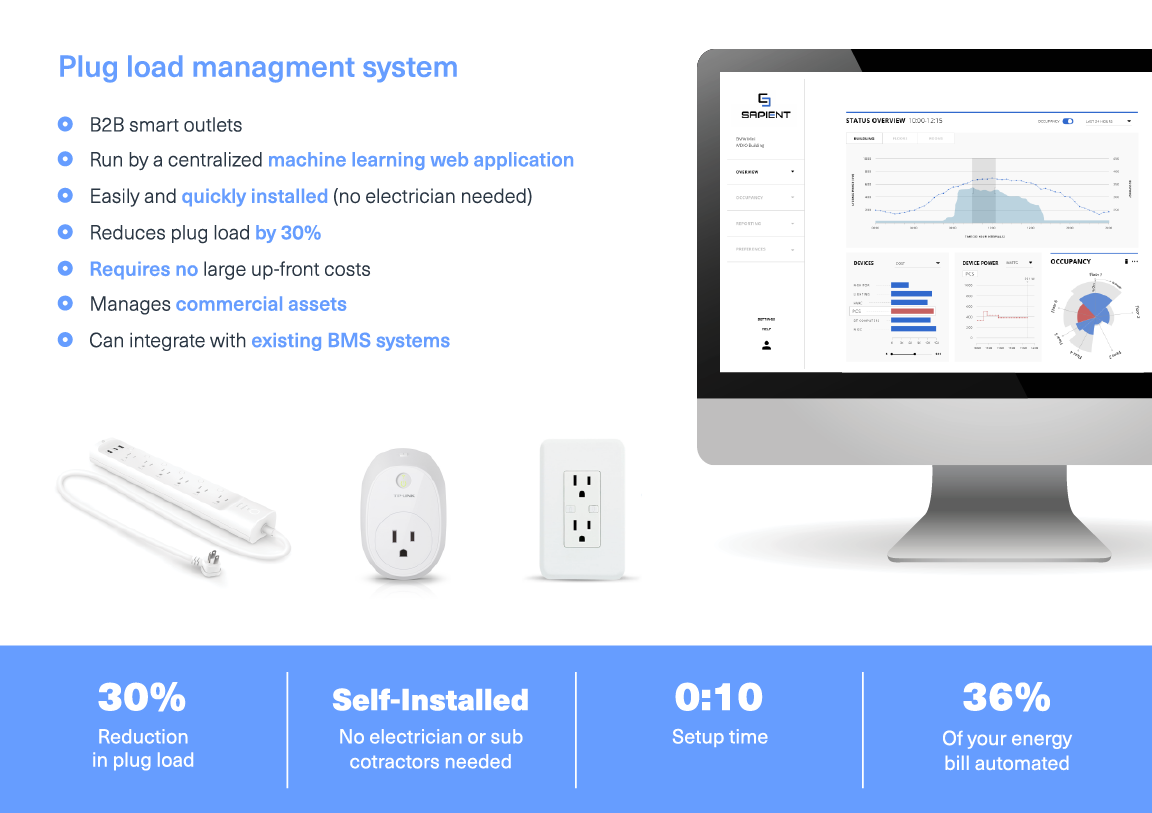

- The only enterprise plug load management system on the market

- Uses machine learning to optimize the delivery of energy to every single device in a building

- Leverages energy data to enhance asset management, safety, and space configuration

- Backed by BMW-MINI's Urban X, Urban Us Fund, Engage Ventures, Plug and Play Ventures, and Impact Assets

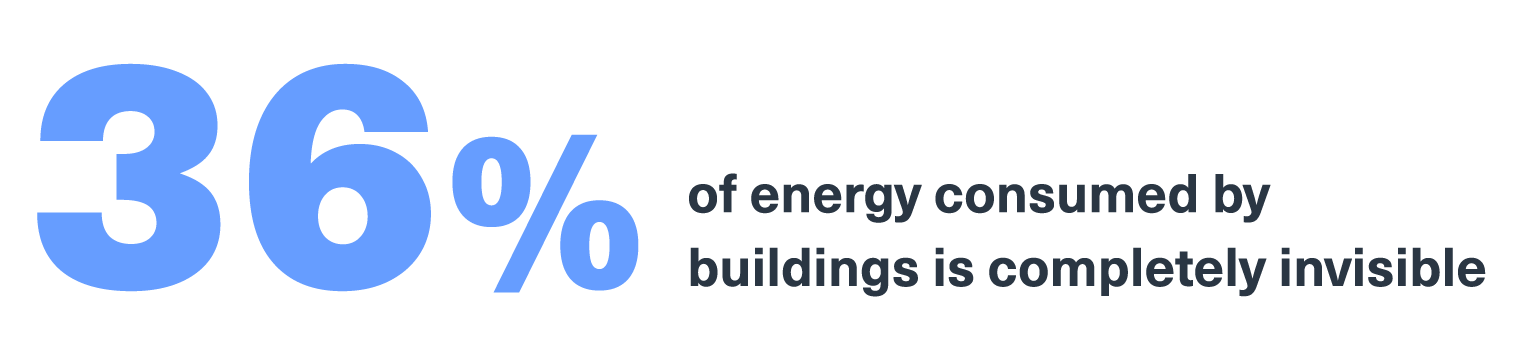

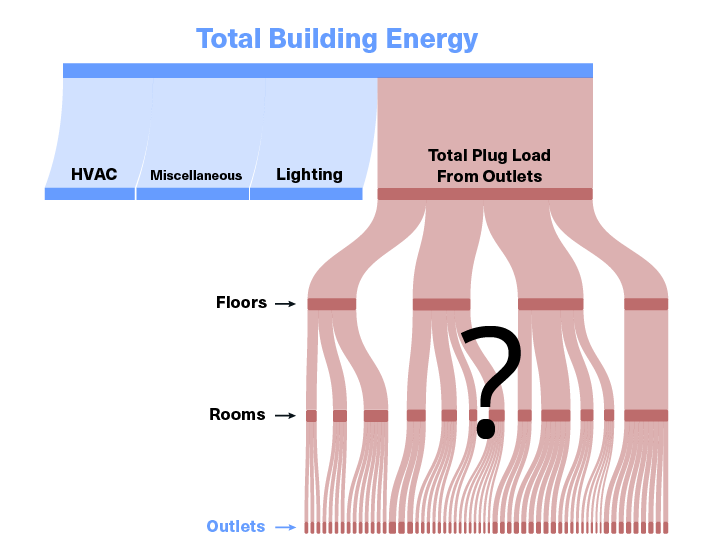

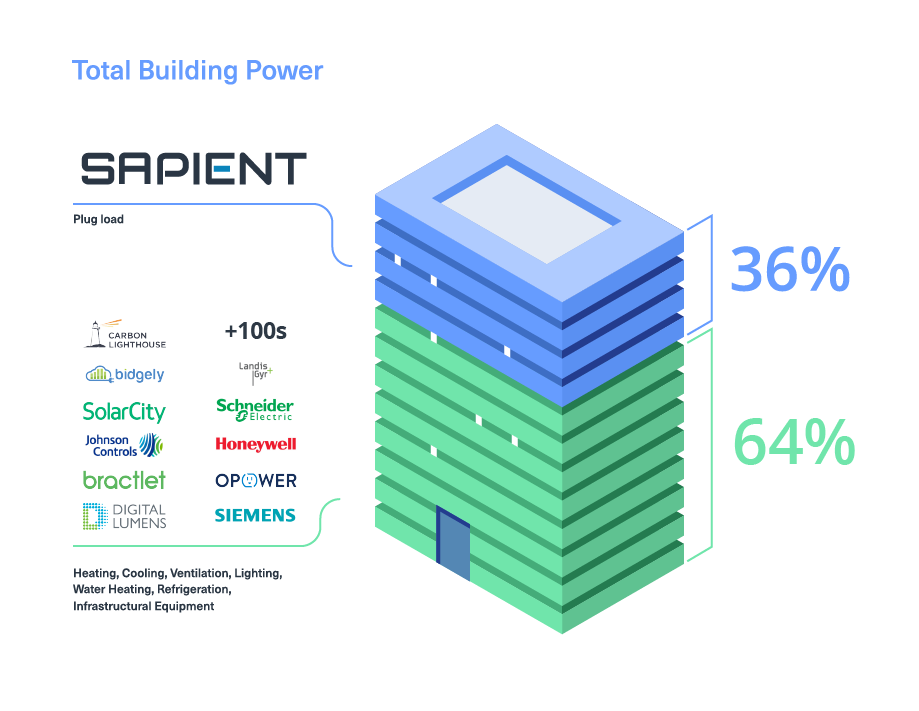

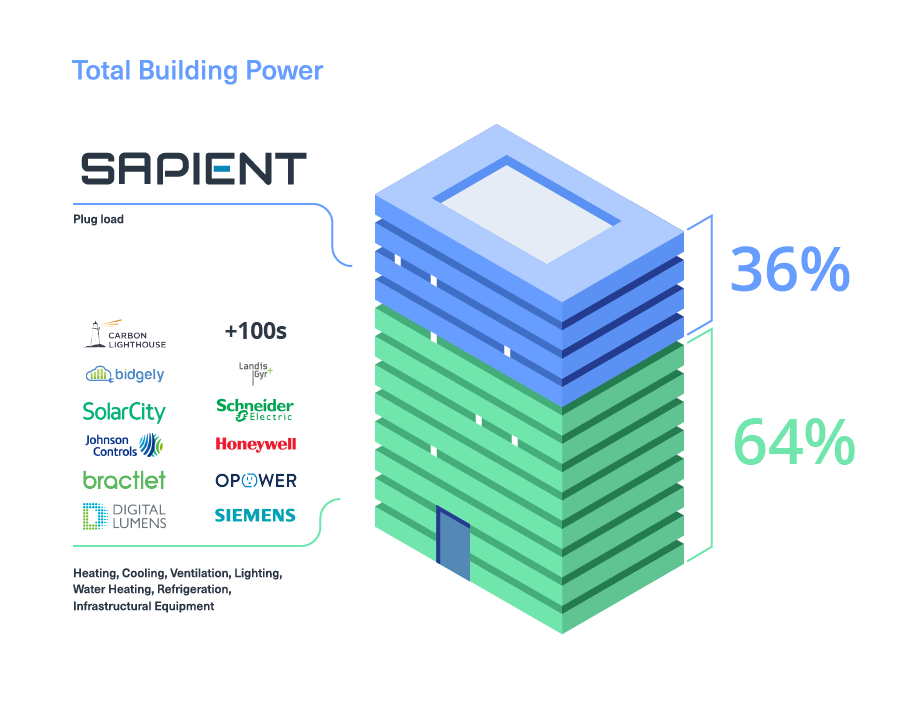

That 36% is plug load. Plug load is the energy consumed at each of the electrical outlets in a building. Miscellaneous devices are not managed or metered in any way but are responsible for 82% of plug load in commercial buildings.

Over the next ten years, plug load is predicted to reach nearly 45% of total building energy draw and surpass HVAC and lighting to make up the single largest portion of a building’s total energy consumption.

The final frontier for building efficiency

Until now, it has been impossible for businesses to audit, understand, and optimize the energy that is being delivered to all of the electrical sockets in their buildings. The result of that has been billions of dollars in waste, potential safety hazards, mounting environmental impacts, and a fundamental lack of understanding of the way that buildings consume a significant portion of their total energy.

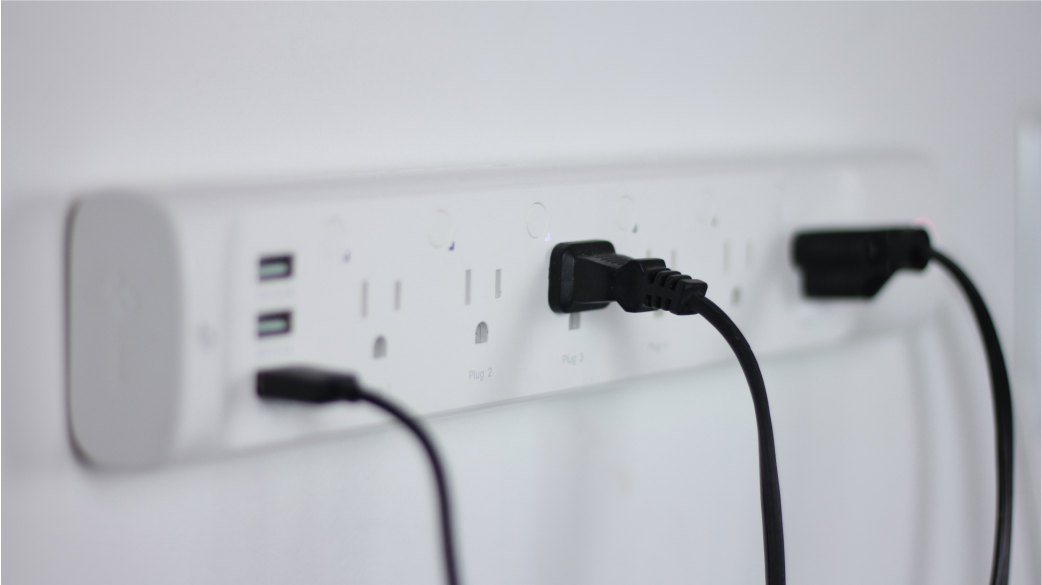

HVAC and lighting have been the poster children for building optimization and commercial IoT because they have historically been the largest combined portion of waste. But the largest efficiency gains will come from the optimization and automation of power delivery to the individual sockets that power all of the thousands of devices in our buildings, from monitors to laptops, lamps, vending machines, and countless other mission-critical devices. Plug load is now the greatest single source of waste in commercial buildings, and Sapient is the only solution addressing that problem.

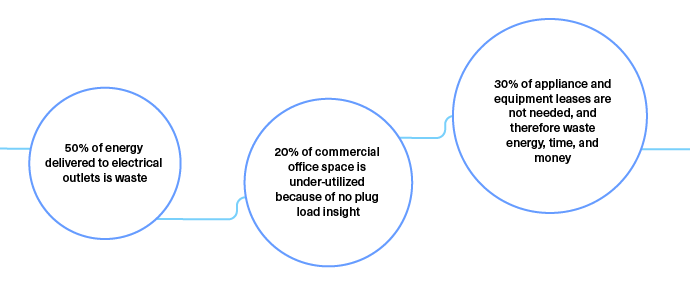

Sapient systems help save on more than just energy

Are there appliances in a building that cost thousands of dollars to run every year but that could be optimized to reduce costs? Should the leases on all of the printers, vending machines, and appliances be renewed each year, or only for those devices and appliances that are actually being used and are needed by the occupants of the building? How much is the business spending to power all of the laptops, space heaters, and monitors on a particular floor, region, or the building as a whole? By metering at every socket Sapient provides insights that allow companies answer all of these questions and many more in real-time.

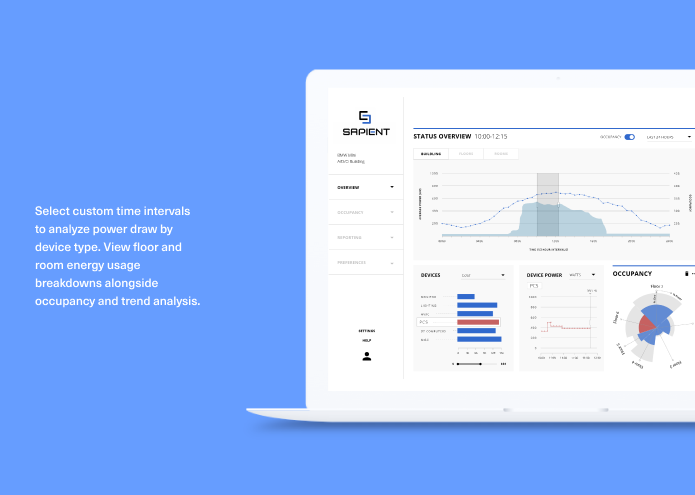

Sapient helps commercial buildings understand, forecast, control, and automate the energy consumed at the plug. It allows you to filter by individual device types, rooms, floors, regions of a building, departments, or any combination of those parameters, in order to drive better decision-making and reduce waste, improving businesses’ bottom lines, preventing the disruption of mission-critical devices, identifying underutilized space, and improving safety.

As seen in

The Sapient plug load management system is sold B2B and consists of smart sockets run by a centralized, enterprise-level machine learning web application. The installation process is quick and easy, with no electrician or rewiring necessary.

Disaggregate power data to understand how power is being used

Sapient enables you to select custom time intervals to analyze power draw by device type. Sapient allows you to view floor- and room-level energy usage breakdowns alongside costed occupancy metrics and trend analytics.

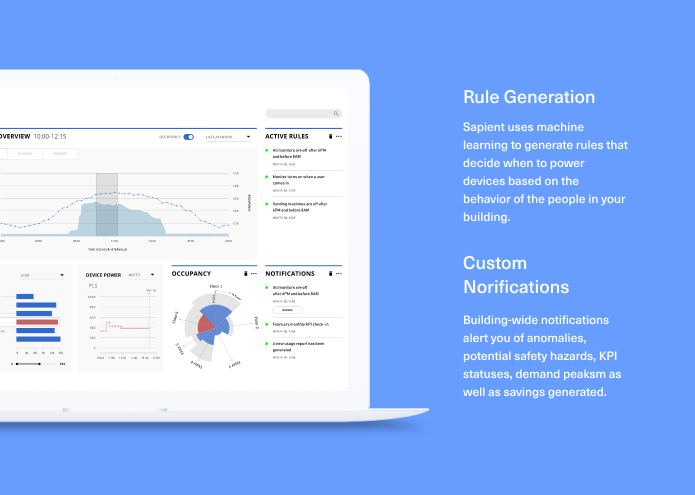

Apply rules to control plug load

Sapient uses machine learning to generate rules that optimize power delivery to devices based on the behavior of the people in the building. In less than a few seconds after a device is plugged in, Sapient detects the type of device it is. Our algorithms then work to understand the behavioral patterns of the building’s occupants and generate rules that control power delivery and reduce waste. Sapient provides custom notification alerts for usage anomalies, potential safety hazards, KPI statuses, demand peaks, and savings generated.

Previous Investors

Sapient is venture-backed and has previously raised capital from strategic real estate angel investors, BMW-MINI's Urban-X, Urban Us Fund, and Engage Ventures.

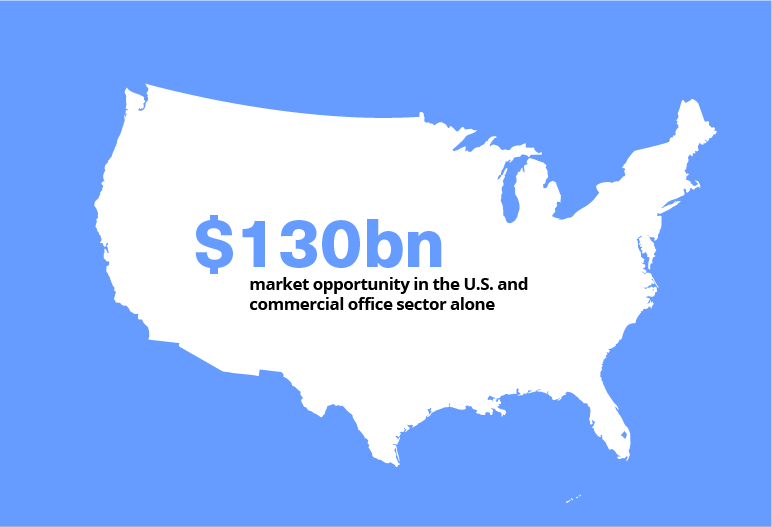

There are over 1 million commercial office buildings in the U.S., with a combined footprint of over 16 billion square feet. Sapient’s business model prices deployments on the basis of building square footage which can be used to calculate the total addressable market for commercial office space in the US. This equates to a $130bn market opportunity.

In addition, commercial building floor space is expected to increase 39% over 2017 levels by 2050, indicating that the market opportunity will continue to grow.

The market that Sapient operates within is saturated with companies that focus on building-wide power, HVAC, or lighting. Sapient enjoys a first-mover advantage in the industry, as it is currently the only established, dedicated plug load management system on the market. Several companies focus on selling smart outlets in the smart home IoT space, but these solutions are not designed for large-scale deployments, building-wide management and analytics, or enterprise-level software controls. There are no other companies that address the problem of plug load for businesses. We consider B2C smart outlet and smart home companies to be potential partners for future integration into the Sapient product suite in order to supplement our options for commercial real estate.

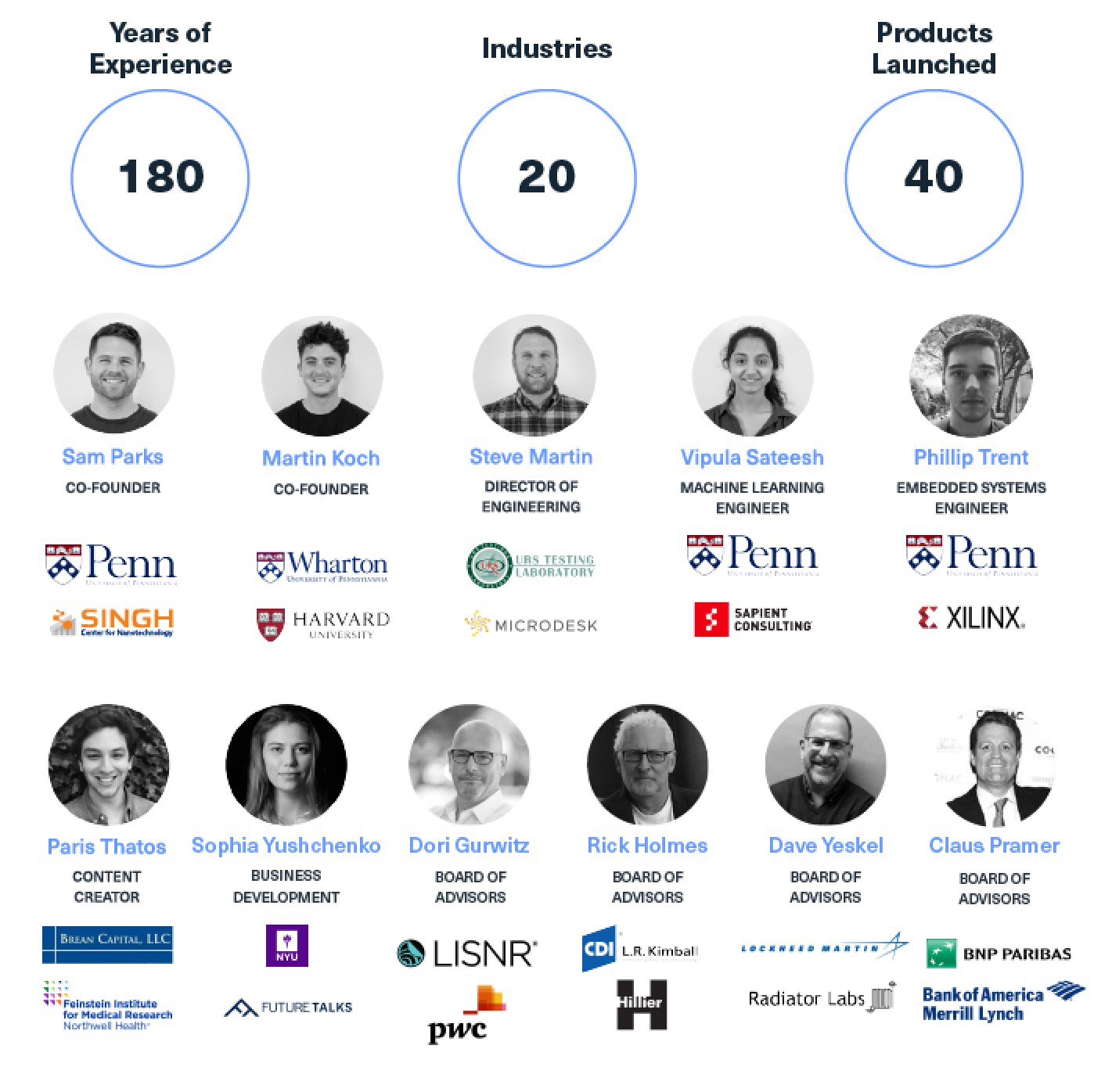

Sam is a graduate of the University of Pennsylvania in applied physics with research interests in quantum computation and quantum information technology. His experience began in the field of nanotechnology and nanofabrication as a scientist at the Singh Center for Nanotechnology and extends to the field of quantum engineering and computation at the University of Pennsylvania's Quantum Engineering Laboratory as a former applied physics PhD student. While his education includes extensive work in mathematics and computer science, he now develops the core of Sapient's technology suite.

Sam is a Sophia International Scholar, Reagan Fellow, and a recipient of the UPenn Scholar grant. Recently, Sam has spoken at regional eco-engineering and sustainability initiative conferences to inspire his generation of engineers and innovators to collaborate in a unified effort to integrate previously disconnected fields of science into sustainable technology.

Martin attended The Wharton School of Business, having studied real estate and law. Prior to co-founding Sapient, Martin explored asset management, as well as real estate and criminal law. Early in his career, he rose to the position of General Manager at a financial institution, managing day-to-day operations, while also serving on the Board of Directors. During this time, he developed a passion for solving big problems in sustainability which eventually lead to his decision to focus exclusively on building Sapient.

Martin is an avid language learner with a lifelong passion for mountain climbing, having spent nearly a year at high-altitude in the Himalayas including on Mount Everest, Chhukung Ri, and Island Peak.

Steve is driven by unrelenting curiosity and the fun of creating new technologies. His background in structural engineering led him to a twenty-year career building software systems focused on the virtualization of entire industries. Steve specializes in designing products built on BIM, CAD, GIS, IoT, and visualization technologies to address needs in the engineering, construction and operations lifecycle. Notable solutions he has delivered include web-based 2D and 3D asset management integrations that enabled data-driven exploration and reporting for floor plans and building systems.

Prior to Sapient, Steve established and oversaw the operations of a technology consulting division where he built and led a team of developers to meet the diverse needs of clients from startups to Fortune 500 companies. Steve is a lifelong learner who spends his free time listening to technology podcasts at the grocery, turning his old house into a smart home, and playing Minecraft with his kids.

Vipula is a graduate student of University of Pennsylvania in Computer Engineering. During her academic career, her focuses were Embedded Systems and Internet Of Things (IOT)- eventually delving into Analog and Digital Integrated Circuits during graduate school. Vipula has developed several end-to-end IOT products, while her current research involves parallel computing on Finite State Machines.

Vipula started her journey at Sapient in 2017 designing and optimizing printed circuit boards for Sapient's proprietary smart outlet and oversaw the design and implementation of several embedded systems. Currently, she now manages the development of Machine Learning models and experimental algorithms for device detection and modeling human behavior.

Phillip is a graduate of the University of Pennsylvania in computer engineering. He manages the embedded hardware and software subsystems responsible for tracking occupancy and human "hyper-location". His interests are in operating systems security, embedded software, and hardware/software interfaces.

He comes to Sapient with a background at Xilinx in hardware design, operating system development, and automation, as well as UI/UX design and iOS development. In his free time, he enjoys coffee, hiking, wine, and travel.

Sophia Yushchenko attended New York University Abu Dhabi, where she studied Economics, Psychology and History. In 2017, Sophia co-founded the NGO Connect Ukraine, which brings together social entrepreneurs and corporates, visionary innovators and creative artists, technologists, and ethical hackers from Ukraine and all over world to brainstorm ideas, develop prototypes and co-create projects able to define the future of Ukraine. She also co-founded the charity organization Children of the World to the Children of Ukraine to support children of Ukraine's fallen soldiers.

At Sapient, Sophia focuses on strategic business development and strategy as well as market and competitor analysis.

Paris is a graduate of the University of Pennsylvania, having studied neuroscience with coursework in the statistical and cognitive sciences. He has experience in the biotech space from both the equity and clinical sides, most recently designing and publishing mathematical models describing new surgical techniques in dermatology.

Paris is creating a library of literature from white papers to industry insight centered around the Sapient product.

Marketing and Business Development client engagement expert with over 25 years experience for architecture, planning, interior design and construction firms with a concentration on the college/university and corporate facilities markets.

Over the years, Rick has collaborated with firm principals and senior staff and implemented strategies to implement marketing and business development action plans to increase market share.

Dave has nearly 30 years of experience in business operations and program management and is a customer-focused leader in energy conservation and urban tech/smart cities. With diverse experience across private and public sectors, startups, and corporate environments, Dave has served as the program manager for Lockheed Martin and directed the largest commercial real estate energy efficiency outreach program in United States while at HR&A Advisors.

Dori is ranked at the top 5% of global workforce for Innovation and Leadership, and focuses on commercializing through innovation, business development, deal-making with strategic key technology partnerships. Dori has extensive experience working in fast-paced, early-stage, venture-backed entrepreneurial environments as well as established global multinationals.

Dori is a Techstars IoT Mentor and Alum, as well as a frequent speaker at key industry events such Mobile World Congress, CES, and NAB.

Claus has several decades of experience in the finance and business management sectors. He has worked in investment management, commodities trading and derivative sales, serving first as a Managing Director in the Commodity and Derivatives Sales Division at BNP Paribas and later as a Managing Director of the Commodity and Derivatives Division at Bank of America Merill Lynch. Claus has also advised several successful mining and technology start-ups.

Join us on the final frontier of building efficiency!

Deal terms

$9,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

20%

If a trigger event for Sapient occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

Sapient must achieve its minimum goal of $25K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

- Mention in our newsletter of over 40,000 subscribers

- Featured on our website | Mention in our newsletter of over 40,000 subscribers

- Sapient Partner Hat | Featured on our website | Mention in our newsletter of over 40,000 subscribers

- A Sapient Smart Socket | Sapient Partner Hat | Featured on our website | Mention in our newsletter of over 40,000 subscribers

- Sapient Partner T-Shirt | A Sapient Smart Socket | Sapient Partner Hat | Featured on our website | Mention in our newsletter of over 40,000 subscribers

- A Sapient Smart Power Strip | Sapient Partner T-Shirt | A Sapient Smart Socket | Sapient Partner Hat | Featured on our website | Mention in our newsletter of over 40,000 subscribers

About Sapient

Sapient Team

Everyone helping build Sapient, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC