Financial creators who have cultivated millions of followers deeply connect with and understand retail investors' needs a...

Problem

No one cares if individual investors make any returns

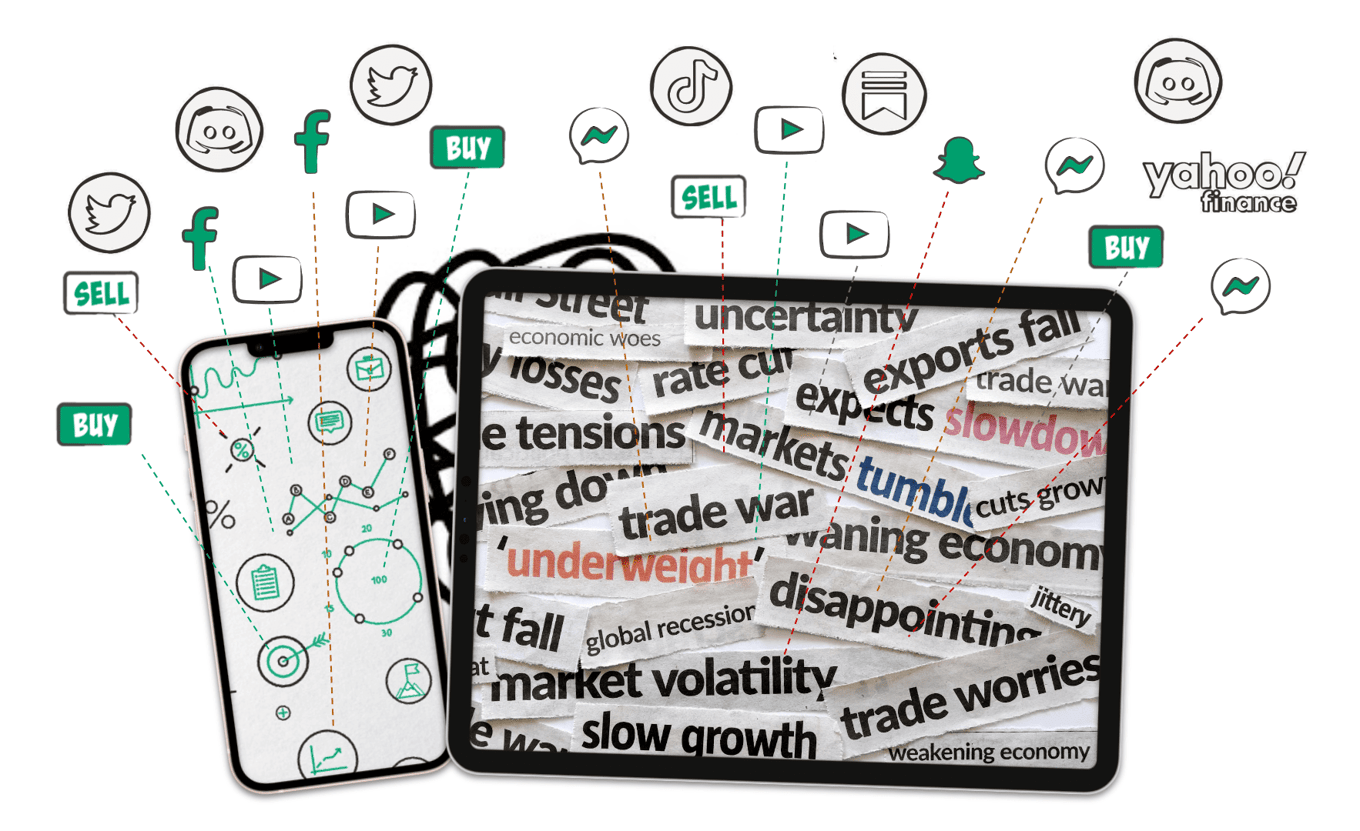

The internet is a chaos of content and misaligned incentives. It bombards investors with information, creates emotional reactions, and encourages hasty decisions, resulting in investment mistakes and lower returns:

Brokerages > want to sell more orders

Media and social media > want to sell more ads

Tools and websites > want to sell more data

Solution

Stock Card enables individual investors to gain higher returns

Our platform makes fact-based investment research digestible and eliminates reactionary and emotional decisions that are the leading causes of lower investment returns among individual investors.

With Stock Card, investment mistakes' likelihood decreases, and the possibility of higher returns increases.

Product

Delivering digestible insights and emotion-free decisions

Stock Card equips investors with five tools to make better decisions and generate higher returns:

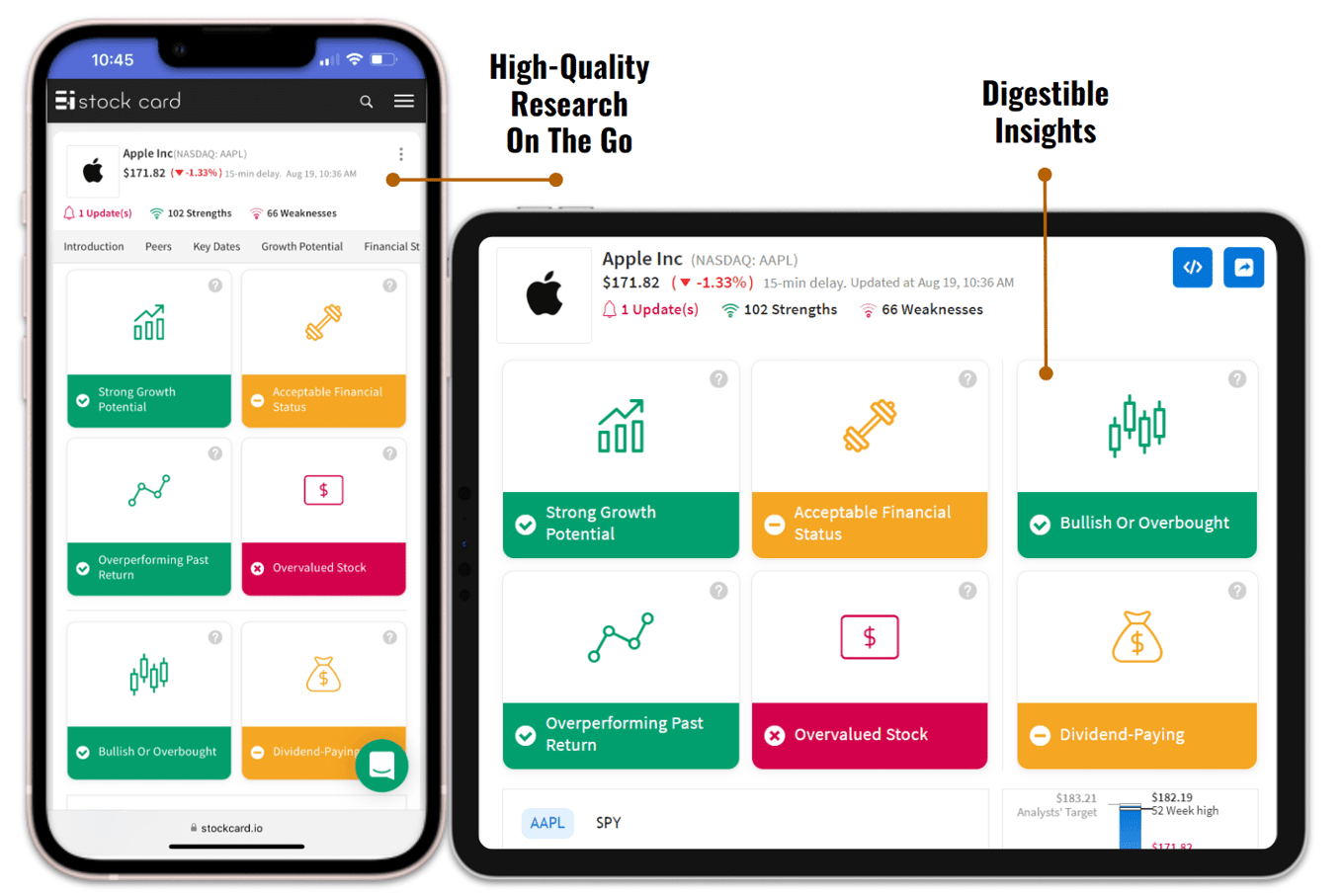

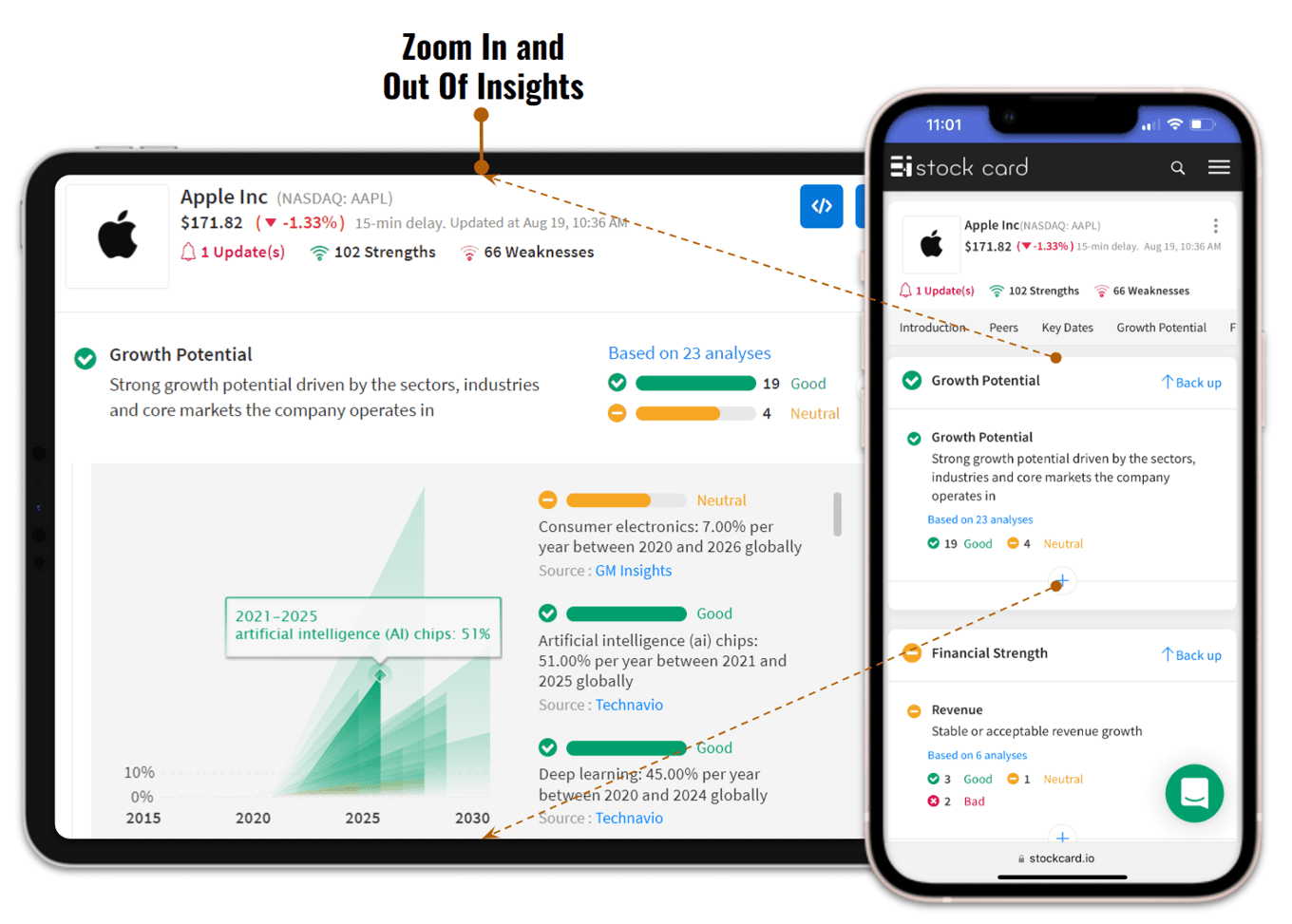

(1) Validating ideas using digestible insights

(2) Revealing details only if investors need them

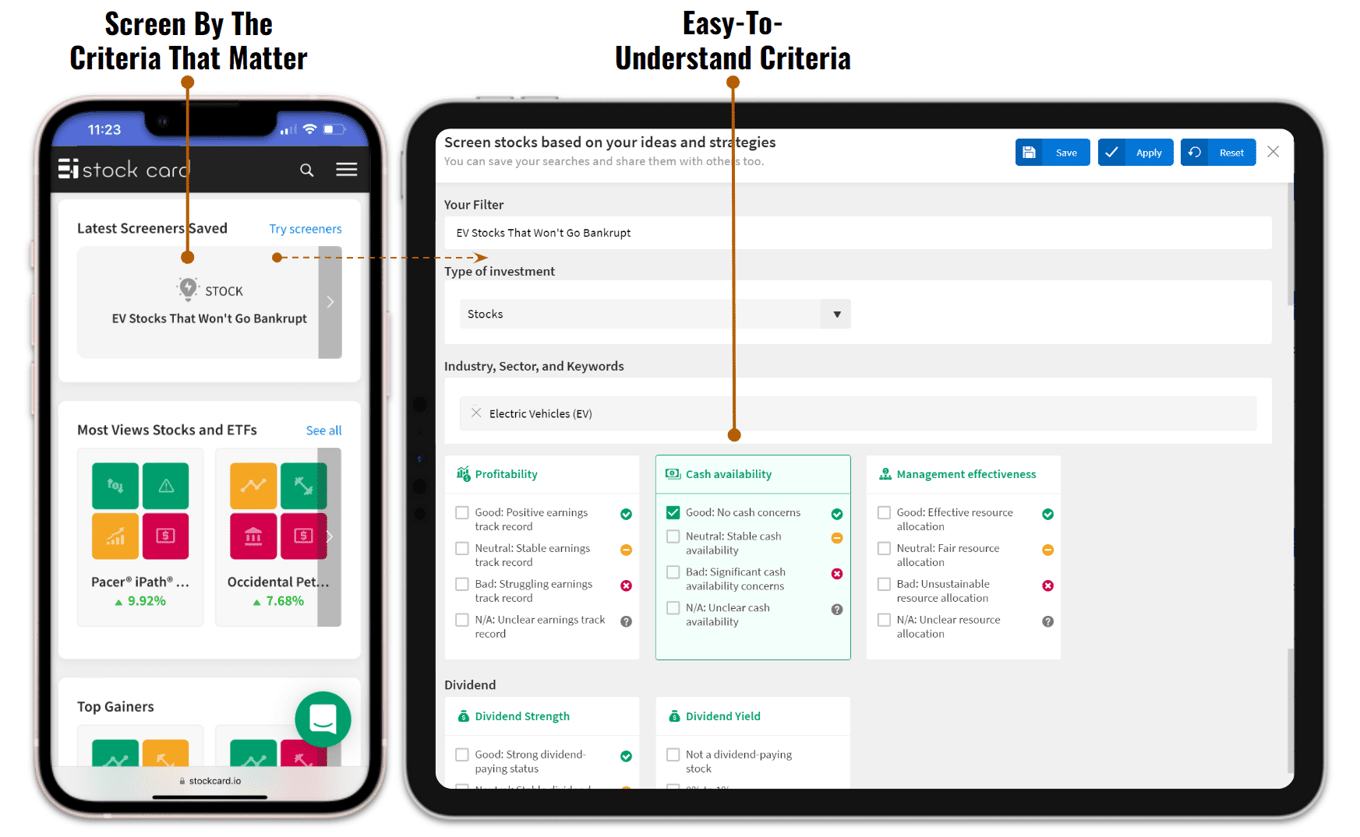

(3) Filtering ideas by easy-to-understand criteria

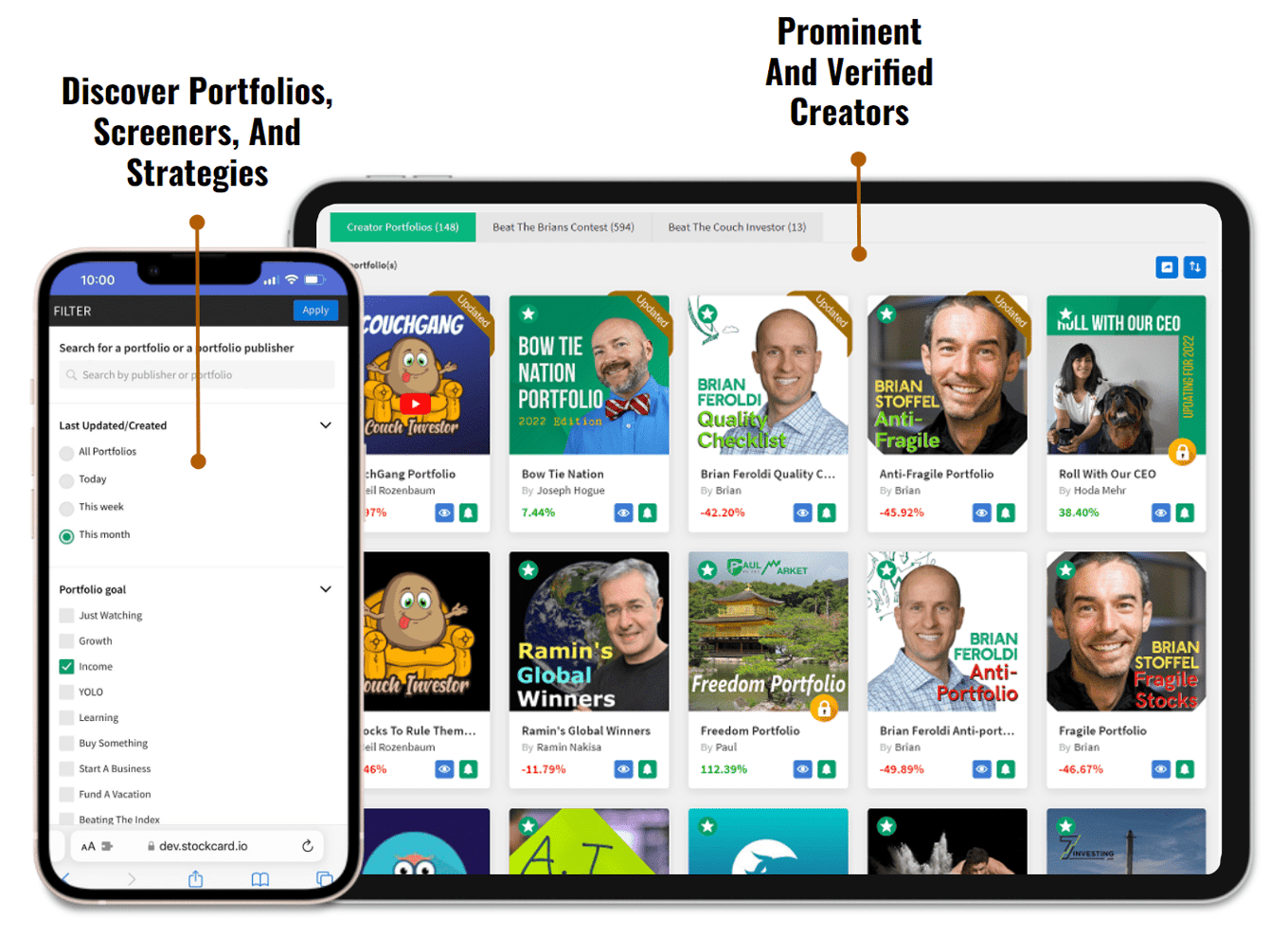

(4) Getting ideas from verified investors and creators

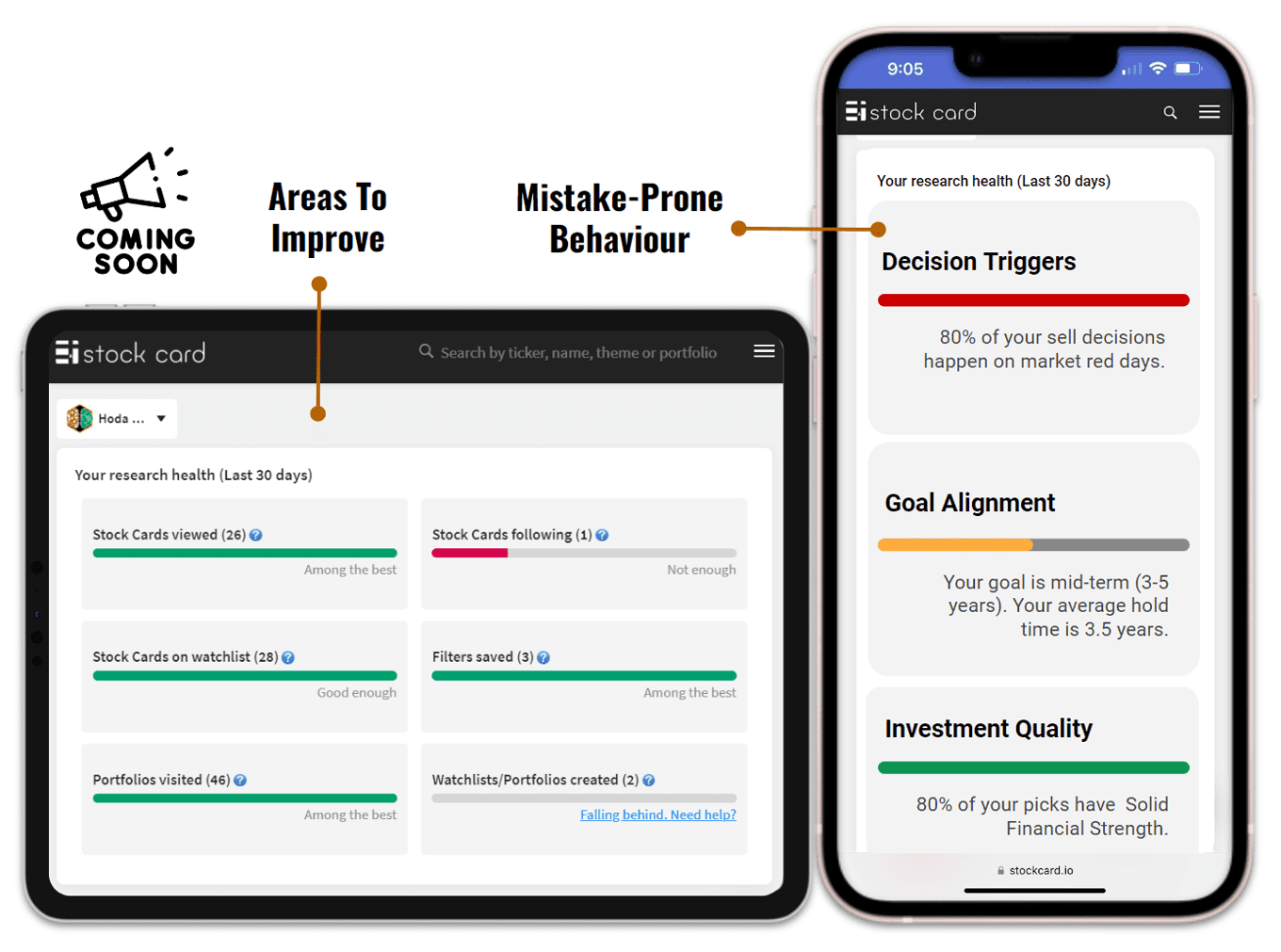

(5) Understanding mistake-prone behavior and decisions

How our users use Stock Card:

—

Stock Card transforms data into digestible insights

—

Details are revealed only if investors want them

—

Investors can filter ideas using everyday language

—

Creators that investors trust share portfolios on Stock Card

—

Investors get warnings about their mistake-prone behavior

Traction

Users love our product

Strong product-market fit

* The CAGRs (Compounded Annual Growth Rates) are based on our full-year 2022 forecast.

* The CAGRs (Compounded Annual Growth Rates) are based on our full-year 2022 forecast.

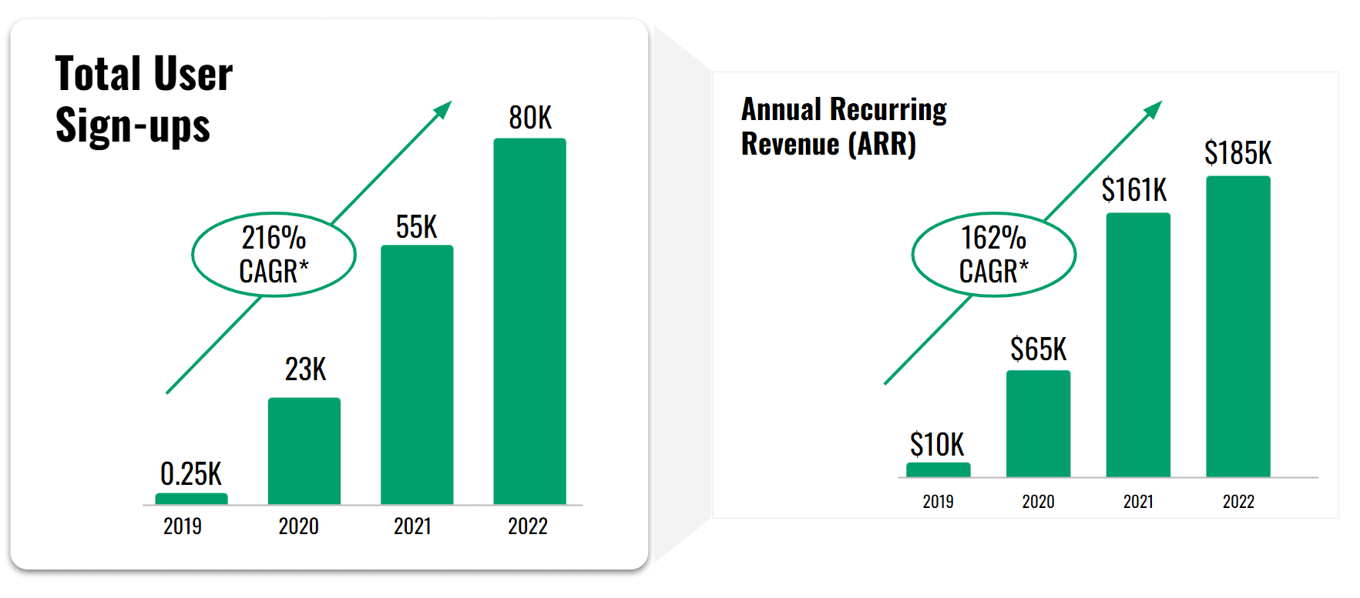

We grew our total sign-ups by 216%, compounded annually between 2019 and 2022. Despite being an early-stage technology startup, we also generate revenue that grew by 162% in the same period and signals product-market fit.

—

Other fintech apps request our B2B API

Opportunity is knocking. We have received unsolicited and organic API access requests from several Fintech apps even before we offer API access.

—

International users ask for expansion

Strong organic demand by users from Canada, Australia, the U.K., and India to expand Stock Card beyond the U.S. market represents significant growth opportunities.

Customers

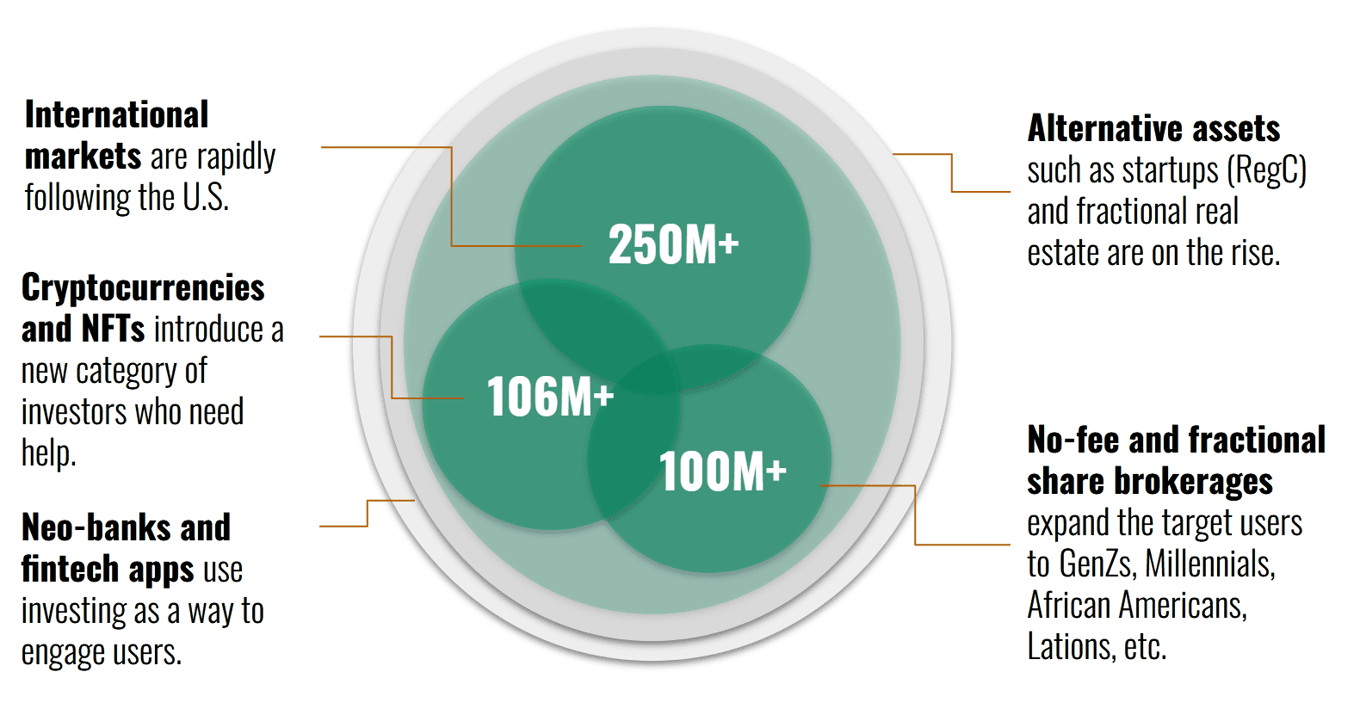

Powerful forces are growing our target customers

Our primary users are individual investors in their 30s and 40s who self-manage their long-term investments fully or partially.

Fintech applications and neo-banks and brokerages are also our B2B customers. They access our API to add our insights and visualization to their applications and engage users.

Generation Investor (Gen I) is rising

Both of our customer groups are rapidly growing due to global tectonic shifts such as:

1) Commission-free and fractional share investing,

2) New investment opportunities such as cryptocurrencies, start-ups, and real estate by individual investors,

3) Growing number of fintech companies using investment features to engage their customers.

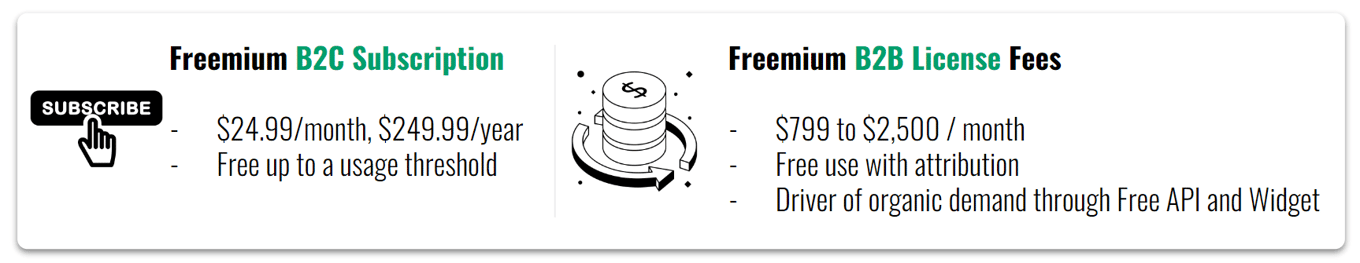

Business model

Our business model also drives growth

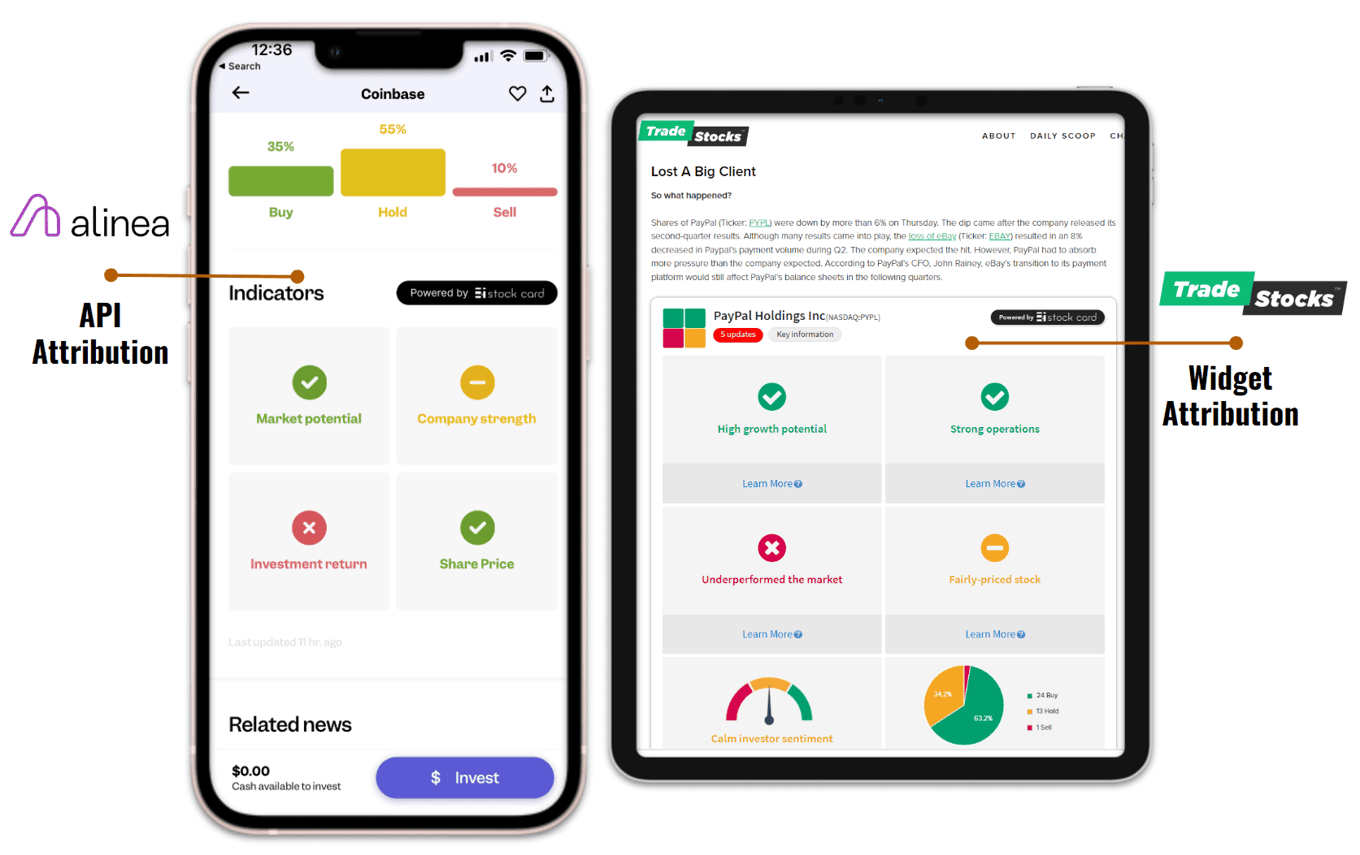

B2C users sign up for free limited access and upgrade to a paid plan for unlimited access. B2B users access our API for free with Stock Card attribution and link-back. To remove it, they pay a license fee. This model results in a powerful organic user acquisition channel as free tier B2B clients showcase Stock Card to their users.

Actual screenshots from B2B customers

Actual screenshots from B2B customers

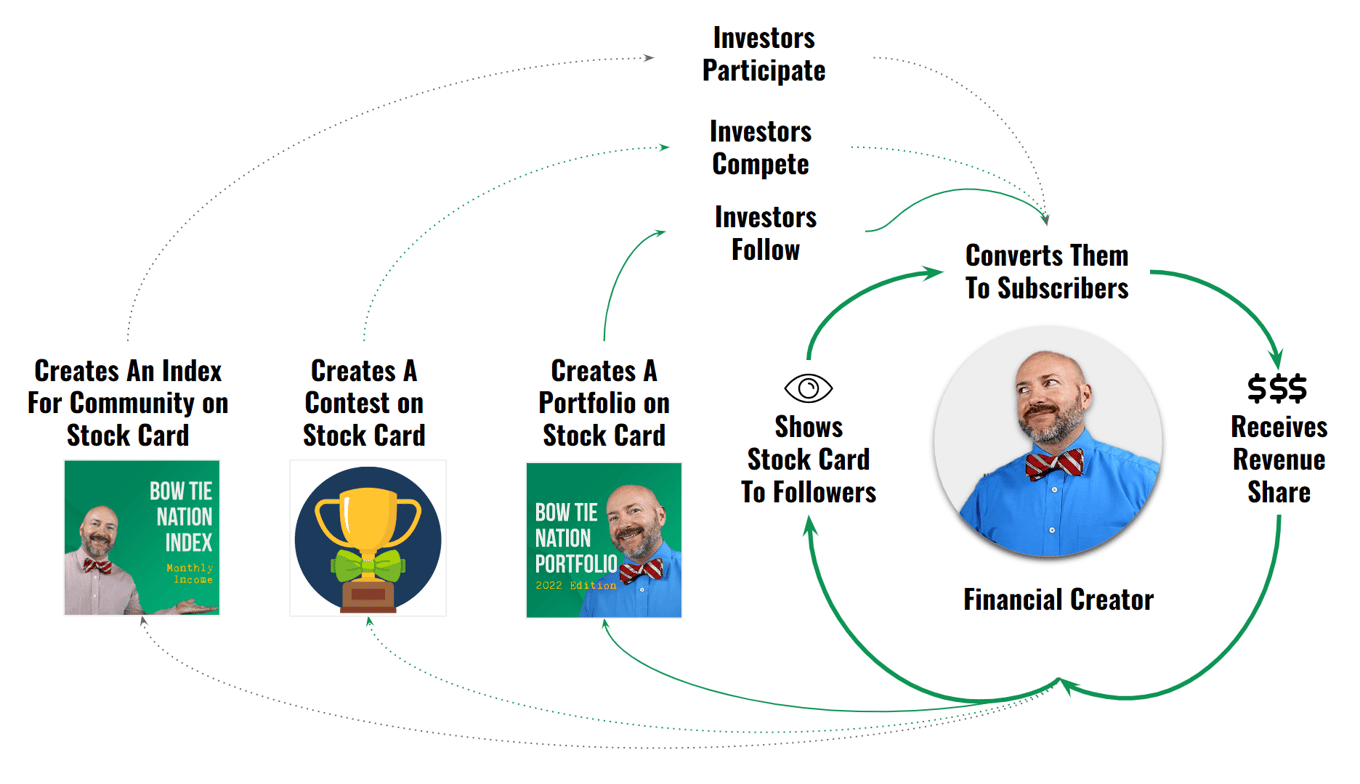

Partnering with prominent financial influencers to grow

Image is our partner, Joseph Hogue, Let's Talk Money YouTube with ~600K followers

Image is our partner, Joseph Hogue, Let's Talk Money YouTube with ~600K followers

We have a growth flywheel through revenue-share partnerships with financial influencers (creators) who use our Creator Toolkit. Our current partners include prominent creators with 1M+ combined followers.

Market

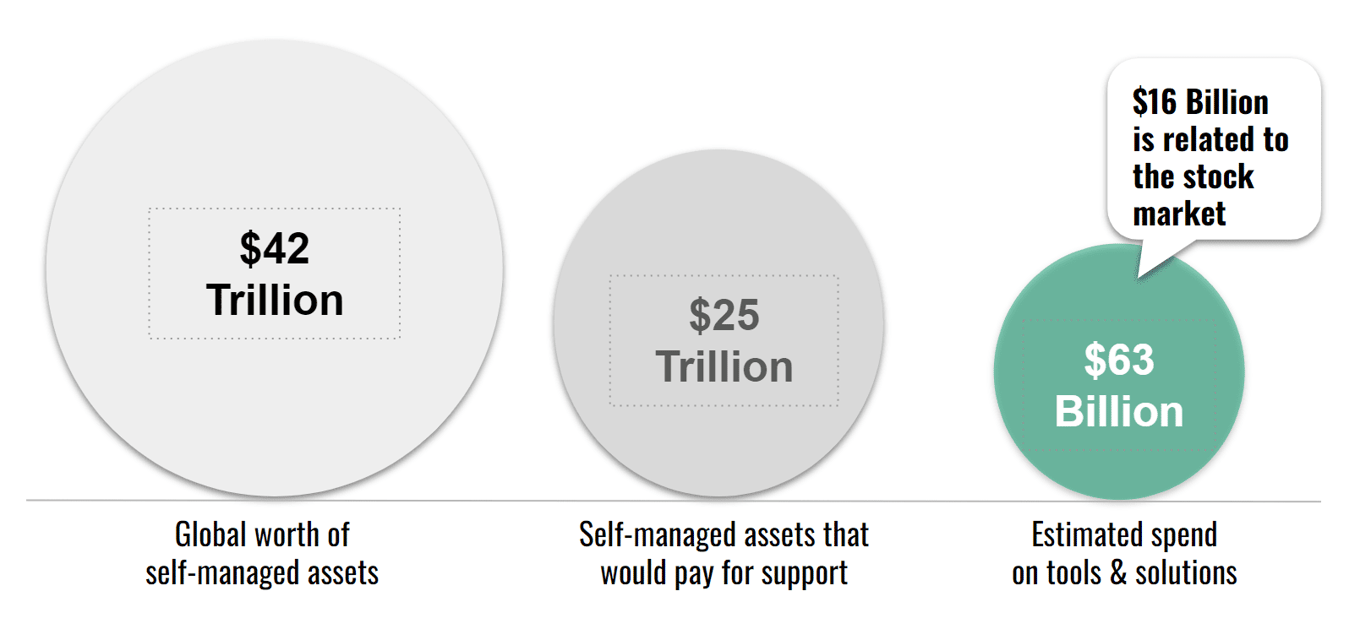

Serving retail investors is a $63 billion opportunity

According to Boston Consulting Group (BCG), the global assets under management (AUM) totaled $103 trillion in 2021. Individual portfolios represent 41% at $42 trillion. An estimated 60% do not work with advisors to manage all or part of their assets, leading to a $25 trillion worth of AUM being self-managed. We expect 0.25% of the total assets to be spent on tools, creating a $63 billion market.

We used a bottom-up analysis of the U.S. households' average invested wealth to estimate the stock market sub-segment at $16 billion. It confirms that the stock market research tools and applications are a massive market opportunity, and expanding to other assets multiplies it significantly.

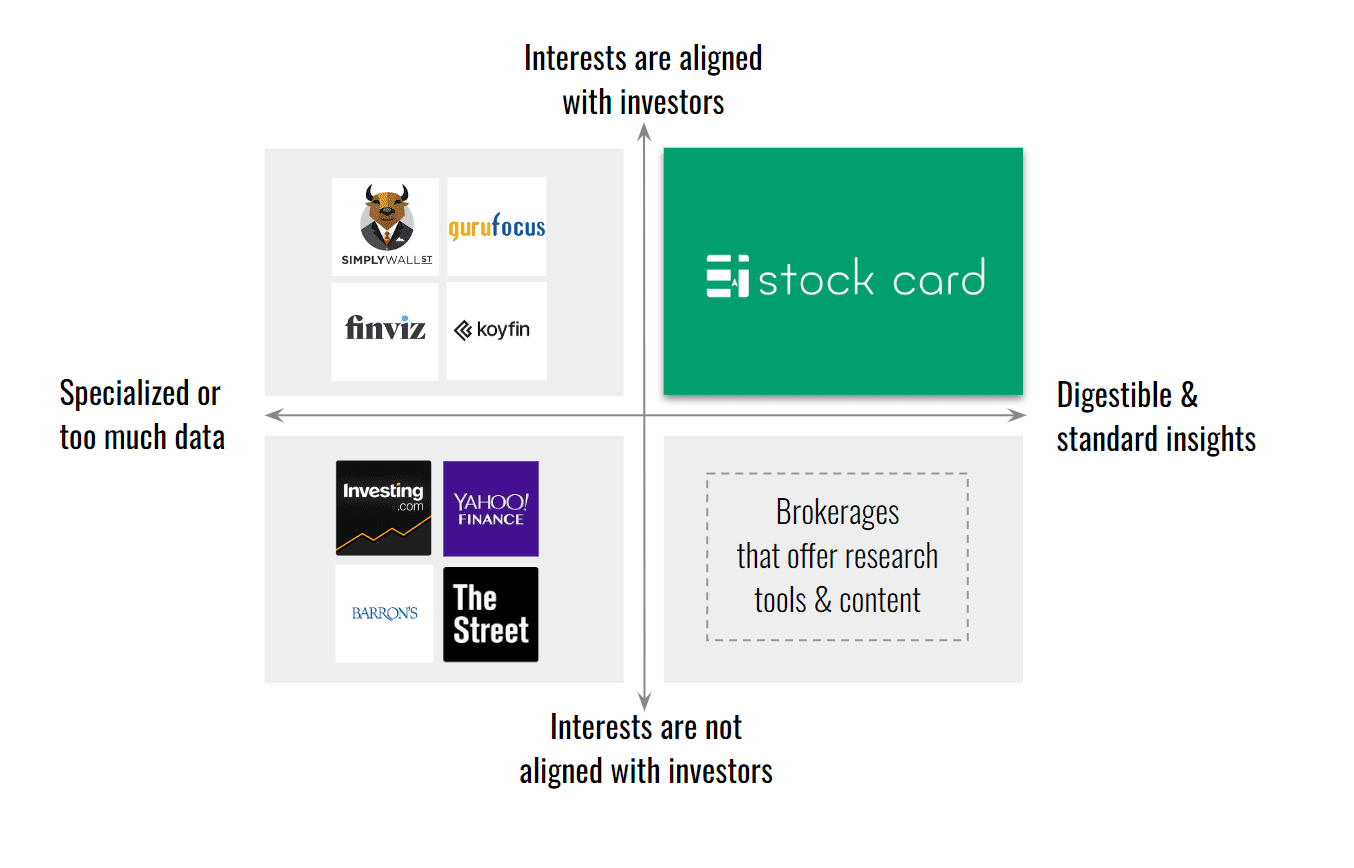

Competition

Differentiating based on a deep understanding of users

We invest significantly in understanding our users' needs and behavior to differentiate Stock Card from competitors in two ways:

(1) Intuitive insight, not more data: Most individual investors spend less than 30 minutes researching before a transaction with a little data deep dive. Contrary to competitors, we use our proprietary Insight Engine and algorithm to transform the data users don't expect into insights they want.

(2) Make money when users do: Economic incentives dictate a product's direction. Our competitors with click-based advertisements or order-flow business models lack the economic incentive to make users better investors. In contrast, we drive less frequent and more diligent investment decisions.

Vision and strategy

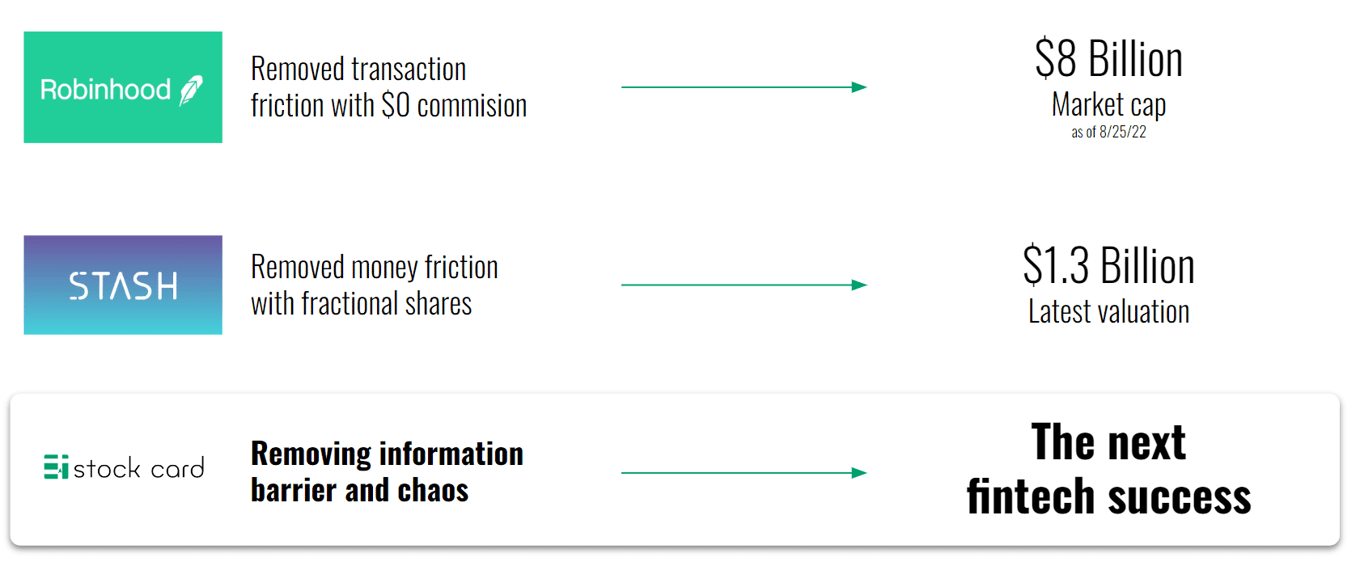

Removing friction for retail investors can potentially create unicorns...

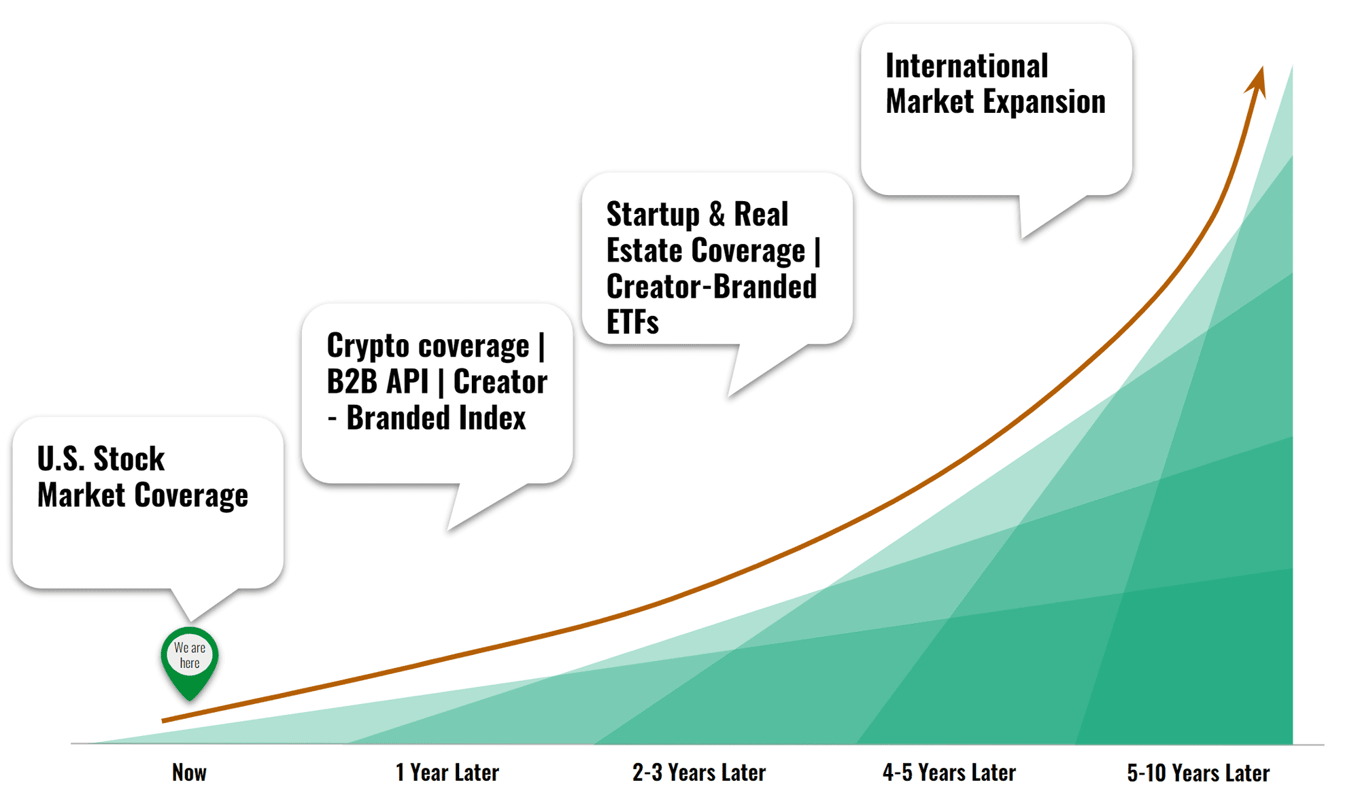

... and we are just getting started*

We will expand to other assets, cryptocurrencies, startups, real estate, and countries with sizeable individual investor populations, such as Canada, Australia, and India. We also follow the "always be launching" approach to strengthen the existing platform.

* Click here for important information regarding Financial Projections, which are not guaranteed.

* Click here for important information regarding Financial Projections, which are not guaranteed.

Impact

Enabling people to fund their aspirations through better investing

At the core of our company's spirit sits our desire to enable everyone to fund their dreams through investing's compounding power.

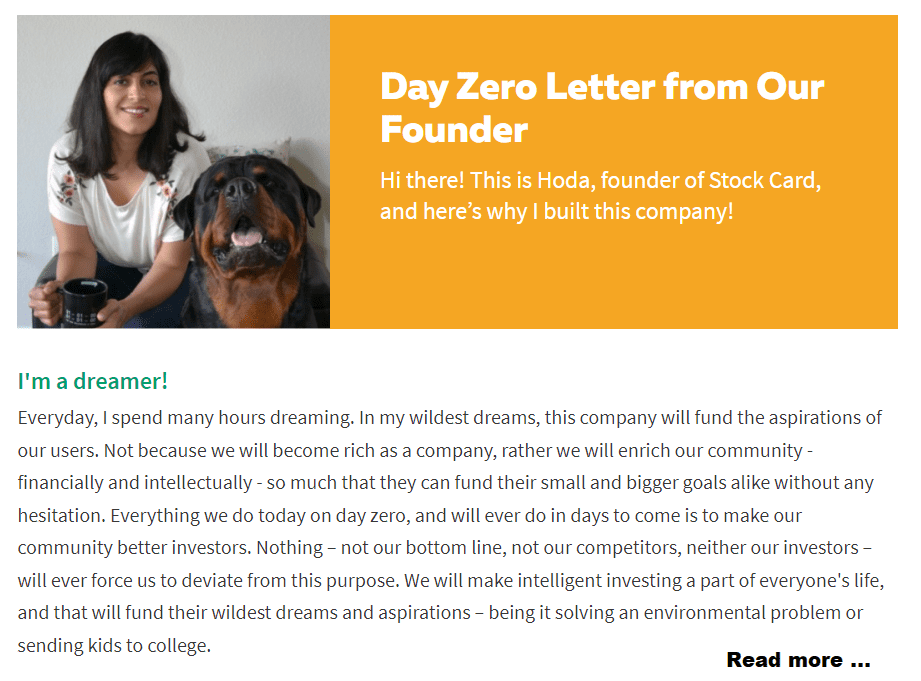

In her Day Zero letter, our founder shares her vision for the future:

(1) To enable everyone to fund life aspirations by discovering and validating the best investment ideas.

(2) To create the "unwork" environment where we are excited to "tap dance" from joy to work every day.

(3) To maintain our enthusiasm to try new ideas, fall in love with experiments, and transform them into reality.

(4) To never become sleepers, feel too comfortable, lose passion for our work, and leave if we do so.

Funding

Supported by visionary early investors and creators

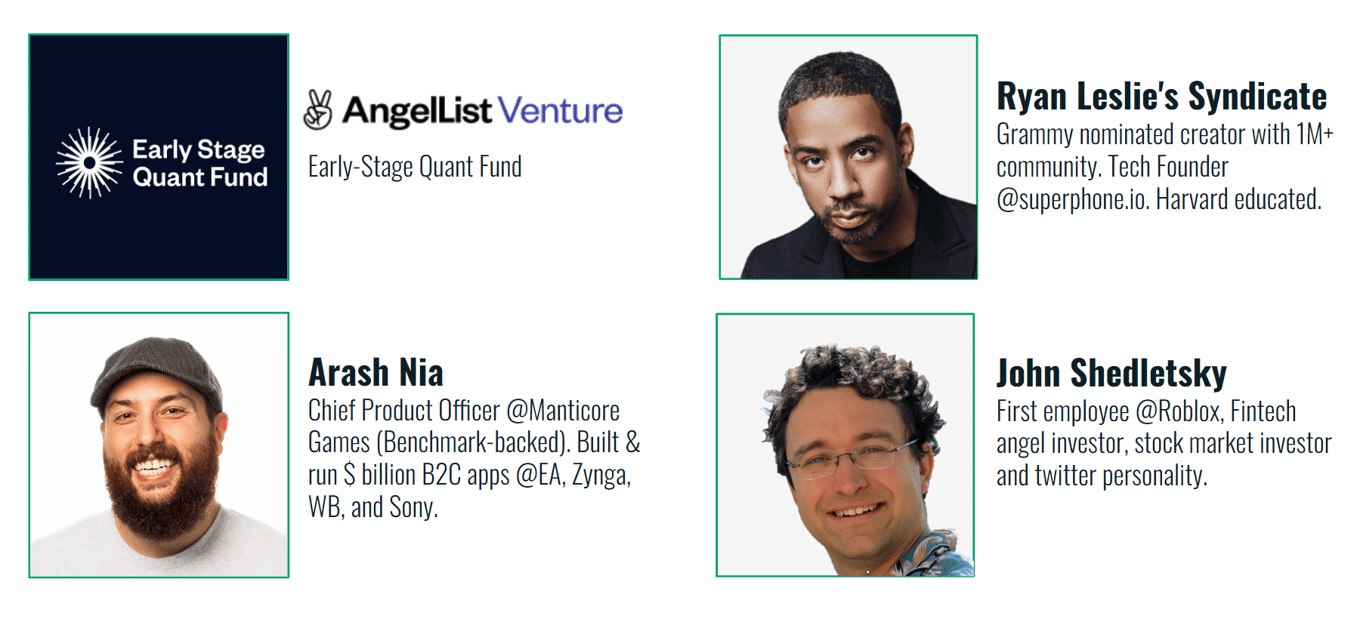

Our board member, Arash Nia, Chief Product Officer at Manticore Games, and Roblox's first employee and Twitter personality, John Shedletsky, are our early investors.

Founder of Superphone.io, Grammy-nominated artist, and a financial creator with 1M+ followers, Ryan Leslie, and his syndicate are also investors.

AngelList's Early Stage Quant Fund invested alongside Ryan's Syndicate too.

Lastly, our founder is an investor in the company. She believes in funding her dreams through her investments. And she has done so by funding our early days with the proceeds of her other investments.

Founders

Founded by an investor with 15+ years of tech experience

Hoda Mehr is our founder and CEO. She is a Nasdaq Entrepreneurship Milestone Maker who started investing as a teenager, assisting her father in managing the family's portfolio.

Before starting Stock Card, she built & brought to market multi-million-dollar software products and led several new business launches and due diligence processes in tech companies.

Hoda is a financial creator with 35K+ followers (blogger, YouTuber, Podcast host), was a columnist and contributor to TradeStocks.com and The Motley Fool (Fool.com), with featured work on Inc.com, and an MBA and Economist by training.

Summary

- Tackling an ever-growing problem faced by estimated 400M+ individual investors globally

- Massive $63 Billion market opportunity

- Strong product-market fit signals in the form of 216% annual user growth and 162% annual revenue growth (2019-22)

- Strong organic demand for B2B expansion

- Solid growth potential in new markets and geographies

- Strong growth flywheel through creator partnerships

- Already partnering with prominent creators with 1M+ followers

- Founder with a deep understanding of the retail investors who has already invested significant personal capital in the company

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...