Opportunity

NYC's naughtiest dessert brand goes national

In this post-pandemic world, consumers are seeking:

- An escape from their day-to-day

- Shared, immerse experiences

- Perfect, shareable social media moments

Enter Sugar Wood, a haven of inclusivity and a champion of sex-positivity, in NYC's vibrant Soho neighborhood. Our lineup includes our naughty waffles, scandalous cookies, cheeky popsicles, and titillating chocolate bars designed to delight and entertain.

More than just serving dessert, Sugar Wood believes in:

Expanding Horizons

From our 700 sq ft in Soho, we're expanding into the US e-commerce scene in 2024, aiming to sweeten direct-to-consumer and retail channels alike, with a keen eye on gifting and celebrations that call for a bit of Sugar Wood flair.

157 Prince Street & beyond

Our Soho spot is more than a shop; it's where our experience begins. It's the heart of Sugar Wood, pumping our unique blend of joy and naughtiness across America.

Sugar Wood: Primed for Sweet Success

Sugar Wood stands at the forefront of market trends and consumer preferences, perfectly positioned for growth and engagement:

- Social Media Savvy: with the average TikTok user engaging 17 times daily, our content is ripe for capturing the hearts and screens of Americans.

- Bachelorette Market Potential: The US bachelor/bachelorette party sector, projected to have reached $17 billion in 2023, is a rich field to showcase our unique offerings. Nearly 60% of these celebrations budget around $1,000, while a lavish 10% allocate over $4,000.

- Tech-Enabled Celebrations: The rise of Batch, the premier bachelorette party planning app, which recently secured a $9 million Series A, signals the growing tech infusion in event planning.

Experiential Retail Rise: The post-pandemic surge in "Museum" retail attractions (Museum of Ice Cream, Color Factory, Balloon Museum) and interactive art exhibits (Van Gogh, Rembrandt, ArTecHouse) highlights a broader appetite for immersive experiences. In this vibrant landscape, Sugar Wood is not just participating; we're leading the parade, one sweet step at a time.

Product

Where Naughty Meets Flavor

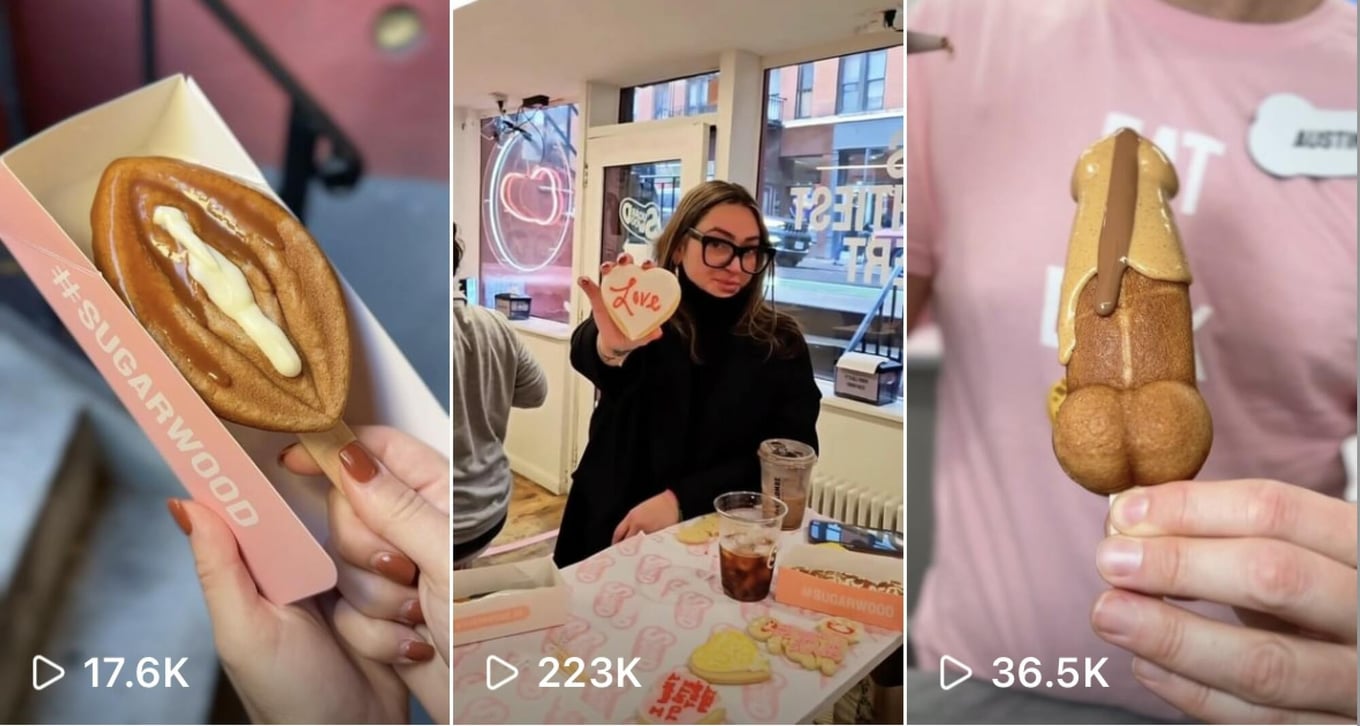

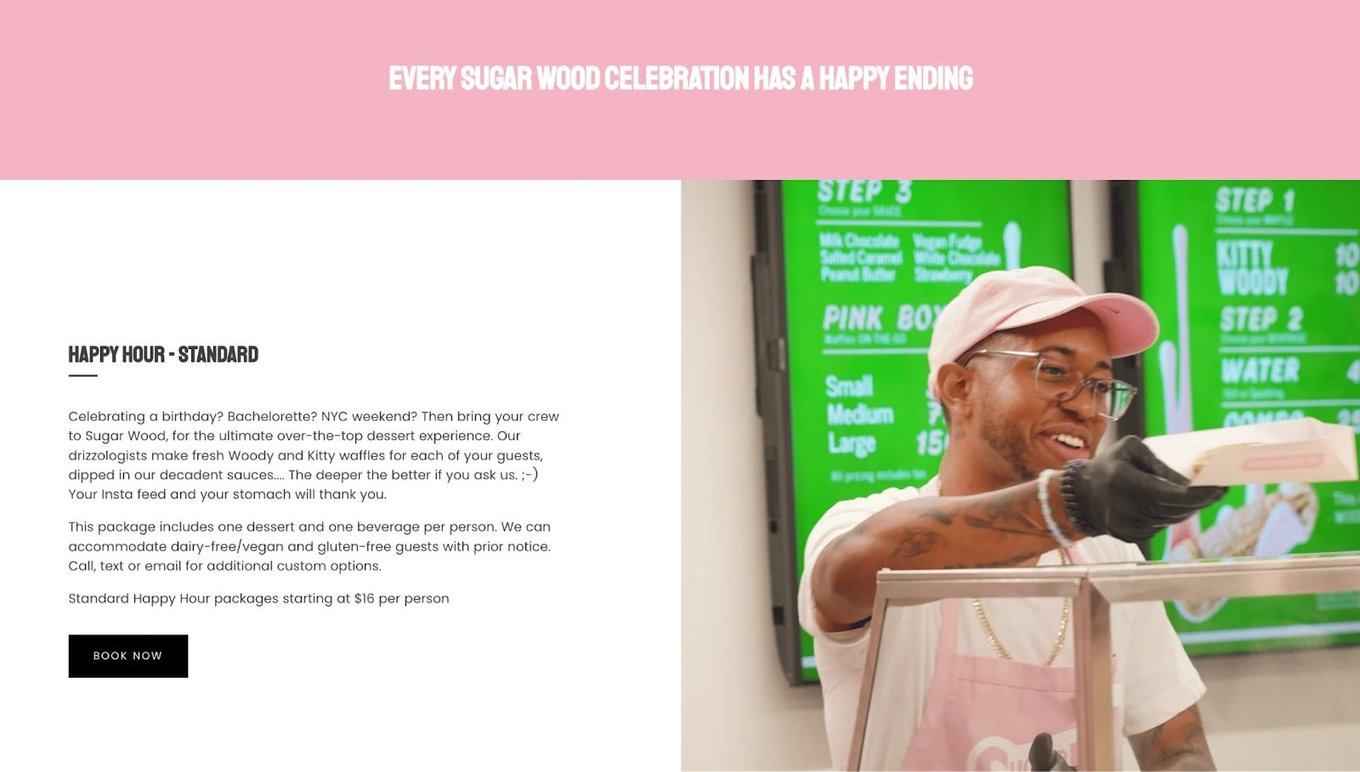

At Sugar Wood, we've perfected the art of blending cheekiness and charm with our array of desserts and merchandise. Our menu, featuring the playful Woody & Kitty Waffles, tantalizing popsicles, scandalous cookies, and sinful chocolate bars, is crafted to engage and generate buzz.

Beyond sweets, we extend our brand's spirit into branded items, including t-shirts, totes and candles, designed to enchant and engage. Our offerings don’t just end at the counter; with party boxes, nationwide shipping, and private events, we ensure Sugar Wood's unique flavor reaches every corner, inviting consumers to a world where lighthearted fun meets tasty excellence.

Every touchpoint, from our treats to our tweets, is imbued with the intent to engage, share, and cheekily surprise, without ever crossing into vulgarity. In a marketplace of the mundane, Sugar Wood stands as a beacon of uniqueness, making not just desserts, but lasting impressions.

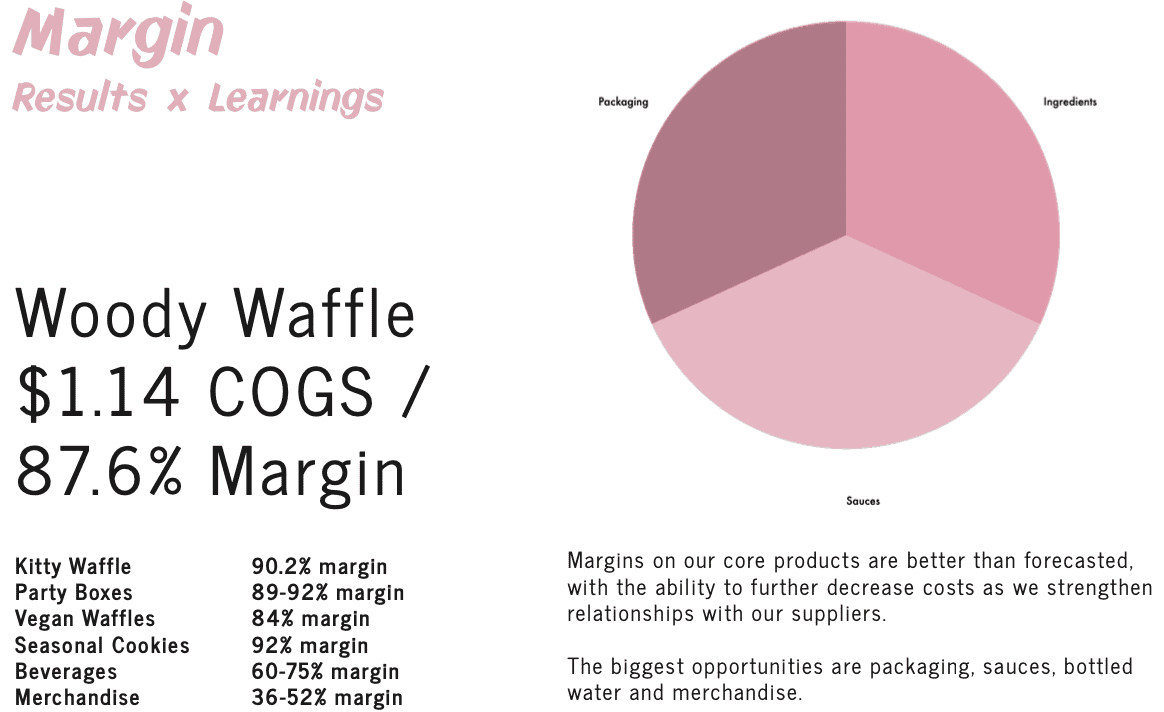

Oh, And Did We Mention The Margins?

Our direct-to-consumer shipping model also shines, delivering joy without compromising on profitability:

Magnum Party Box: Priced at $179, this crowd-pleaser includes 13 waffles and four signature sauces, maintaining a delectable margin of 77.4%.

- Waffles (cost): $14.82

- Sauces (cost): $4.72

- Packaging (cost): $4.87

- Average shipping: $16.00

At Sugar Wood, we blend financial wisdom with culinary adventure, creating an investment as appealing as our desserts.

Traction

Our Woody Is Growing (Globally)

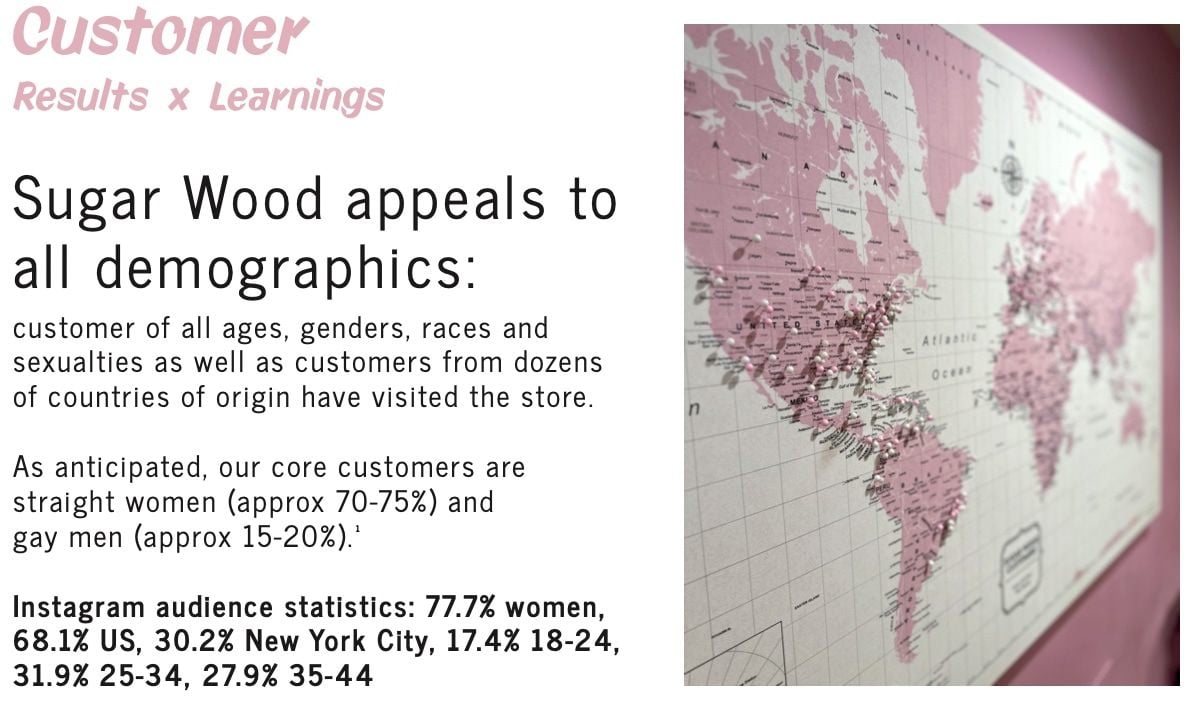

In just a year and a half, Sugar Wood has whipped up a deliciously devoted global fanbase, flirting its way into hears and fees with playful prowess and a cheeky charm that's hard to resist. Here's a taste of our mouthwatering milestones:

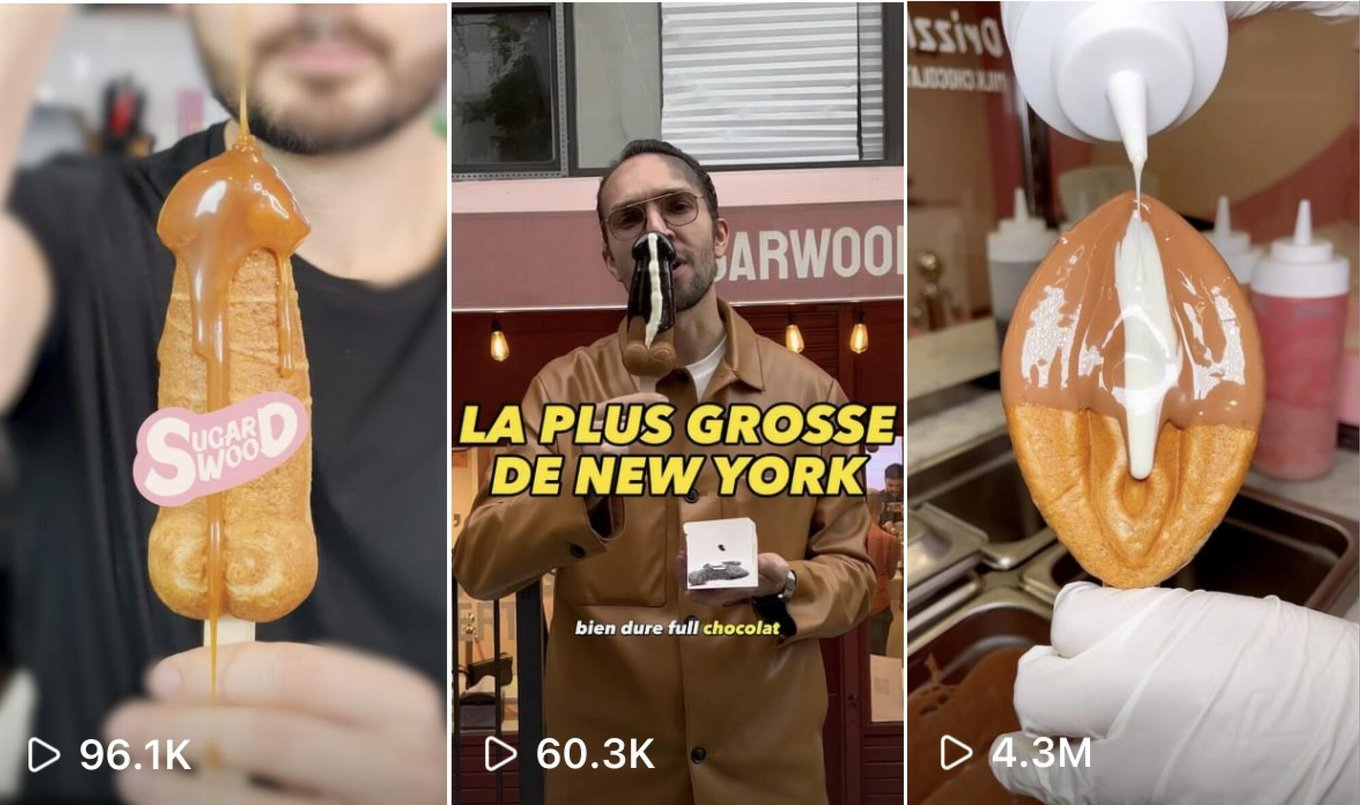

- Social Media: Sugar Wood boasts over 55,000 followers between Instagram and TikTok.

- Viral Ideos: Our videos have seduced screens worldwide, amassing 21 million views.

- Map-Worthy Momentum: With 150,000 interactions on Google Maps, we're not just a spot but a destination.

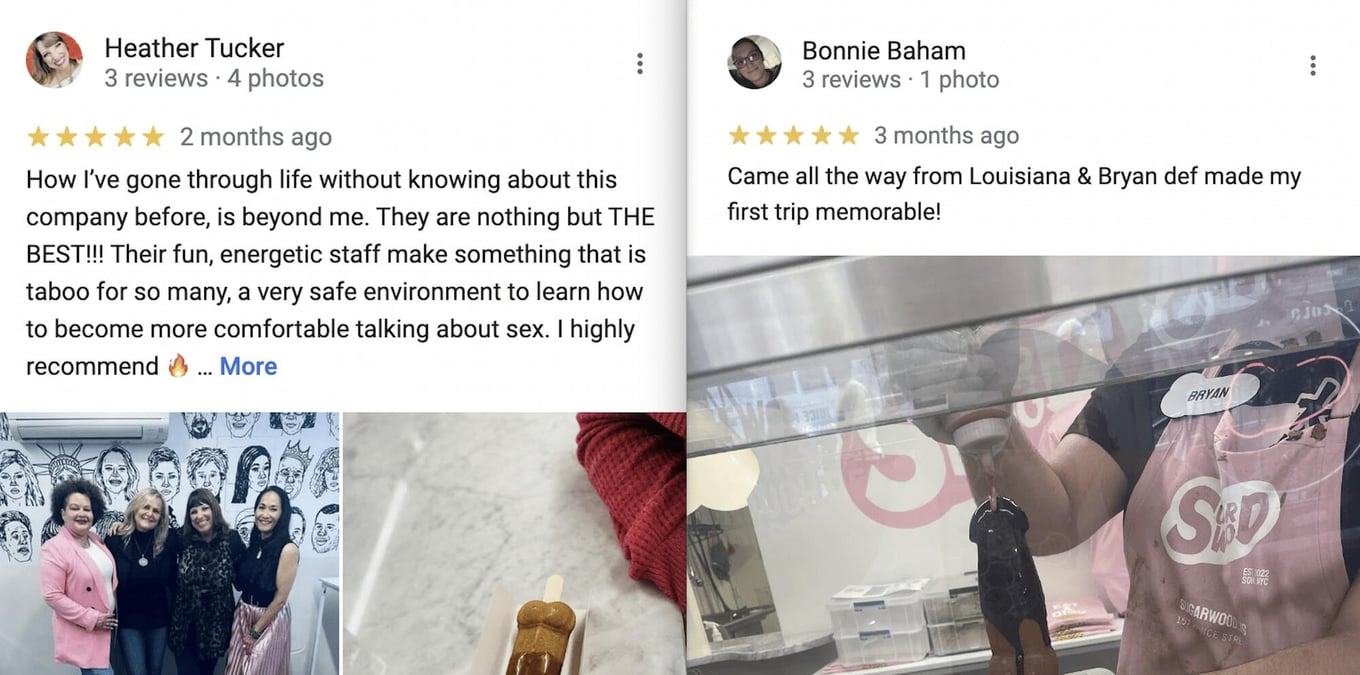

- Stellar Impressions: Our Google charm shines bright with a 4.8-star rating.

Our recipe for success also includes a dash of daring collaborations, blending sweet with savvy:

- Playful Partnerships: From our titillating collaboration with Durex condoms to our sultry partnership with the dating app HUD.

- Audacious Audios: We teamed up with the provocative Whoreible Decisions and In Yo Mouth! podcasts.

- Decadence with a splash of education: Joining forces with tele-healthcare pioneers Wisp and QCarePlus.

- Mainstream is calling: Upcoming collaborations include Focus Features and Island Records.

At Sugar Wood, it's not just about serving desserts; it's about creating connections, once cheeky treat at a time.

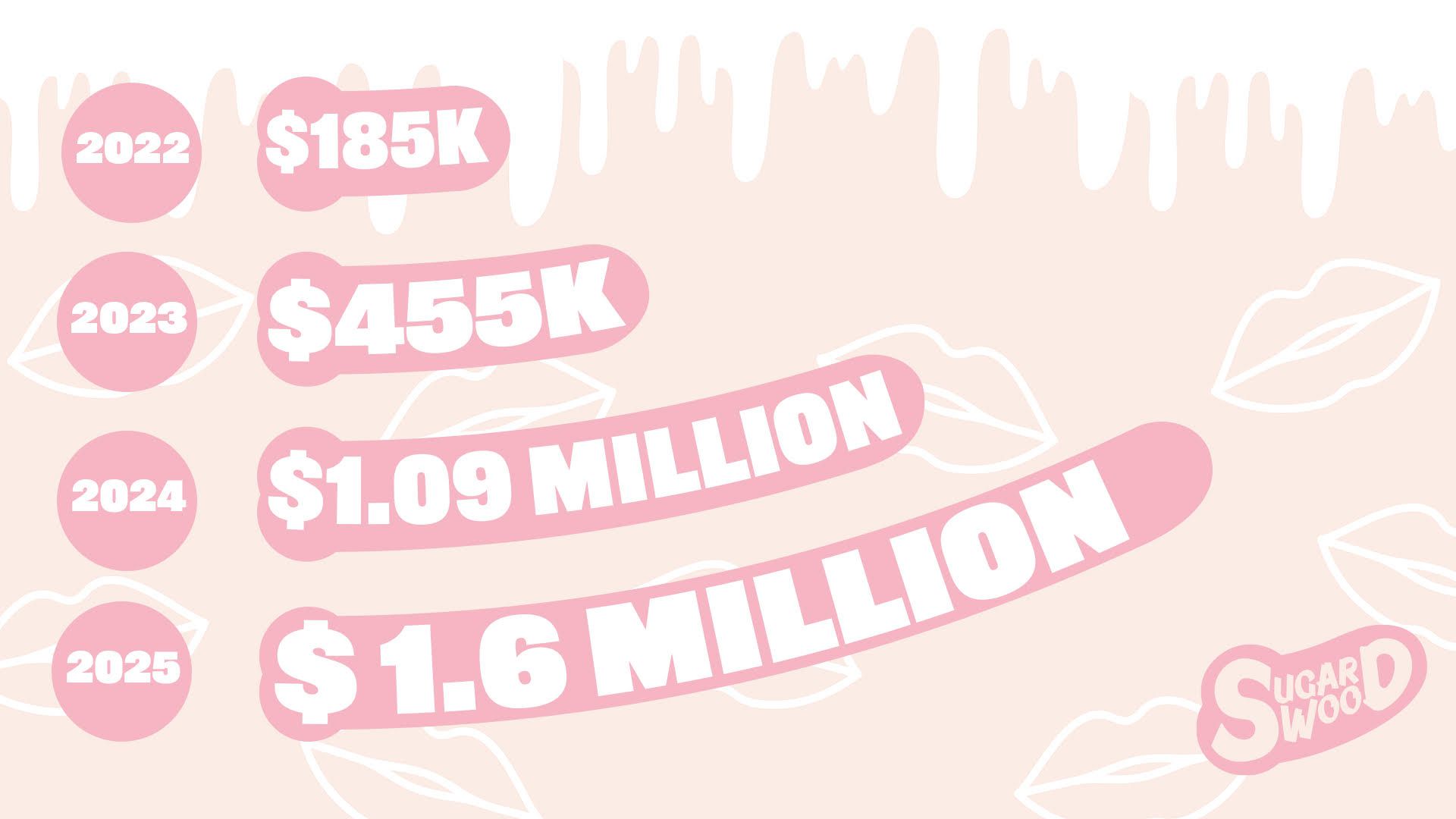

Let's Talk About Revenue, Baby

Sugar Wood's global sweet spot

At Sugar Wood, we're all about spreading joy, and our map is a testament to the love we've received, dotted with pins from dessert devotees from across the globe. It's not just a map; it's a mosaic of moments shared by our sugar-smitten fans.

When it comes to social media, our Woodys and Kittys are magnets for engagement - every post is a spark of connection, drawing likes, loves, and laughs from an audience captivated by our cheeky charm and mouth watering creations.

A taste of Some Viral Sugar Wood Moments

The Press Is Hooked Too

Business model

Strategic Business Model Evolution at Sugar Wood

Sugar Wood is embracing an omnichannel approach to fuel our next growth chapter. While our NYC flagship store continues to be the heart of the Sugar Wood Experience, we acknowledge the geographical limitations faced by many of our potential customers. In response, we're expanding our digital footprint to ensure Sugar Wood can reach dessert enthusiasts everywhere.

Our website, sugarwood.co, now operates on Shopify, offering customers a streamlined checkout experience. This enhancement is part of a broader initiative that includes transitioning our in-store POS systems to Shopify in Q2, enhancing our ability to gather and utilize customer data across all shopping channels.

We're excited to announce that we recently revamped our website experience, which includes redesigned product pages, more engaging visuals and an updated site architecture. Additionally, we'll introduce expanded product lines and custom packaging for our waffle and cookie boxes, designed to create an unforgettable unboxing experience for our customers.

To bolster these initiatives, we're ramping up our digital marketing strategies, encompassing SEO, Google Ads, email, and SMS marketing, to connect with our audience more effectively.

Financially, this strategic pivot is promising. Our e-commerce operations are expected to achieve margins between 68-72%, contributing a 34% increase in overall company revenue.

Vision and strategy

Strategic Growth and Profitability Plans for Sugar Wood

Our objective is to elevate Sugar Wood to a prominent national presence by the end of 2024, focusing on a robust direct-to-consumer strategy, specialized private event and catering services, and continued growth of our NYC flagship store.

In our pursuit of expansion, significant marketing resources are being allocated towards events, catering, and key holiday periods. Remarkably, up to 40% of our revenue is generated from targeted occasions such as bachelorette and birthday parties, as well as major holidays like Christmas, Valentine's Day, and the winter season. This highlights the substantial growth potential within our events segment.

Understanding the diverse revenue streams of Sugar Wood—spanning online, in-store sales, and private events—is crucial for recognizing the expansive opportunities in event planning and execution.

To streamline event bookings, we've integrated a self-booking feature on sugarwood.co, utilizing the Peek app for effortless scheduling of in-store and on-premises events. Further enhancing our event strategy, we've forged partnerships with notable party and travel planning platforms, as well as with local hotels. Our efforts extend to simplifying online orders for both local and nationwide delivery and actively engaging in wedding/bachelorette industry events and expos to broaden our network.

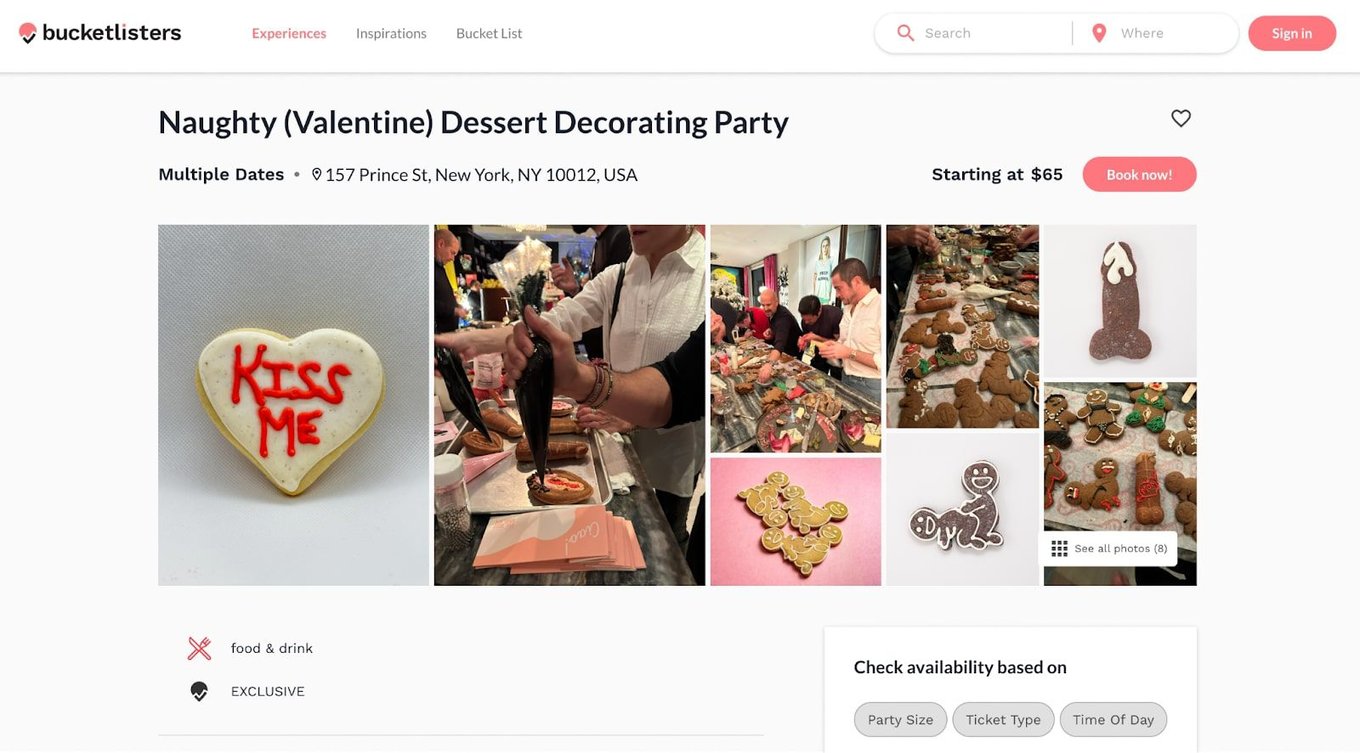

A particularly exciting advancement is our collaboration with BucketListers a digital media company with local, national and international reach. This relationship has evolved into a Cookie & Waffle Decorating Parties ticketed event series, promoted to NY Bucket List's audience of 1.9 million. The initial series in February is projected to contribute $10,000 to Sugar Wood's revenue, marking a promising development in our expansion strategy.

Leadership

Founder with extensive experience in marketing and brand building, and one previous exit

Hi I'm Austin Allan. I'm a seasoned marketer, brand builder, and out of the box thinker. That's me below with Tom Smallwood, the award winning pastry chef who consults on Sugar Wood's recipes.

Austin Allan is a distinguished professional with an extensive background in marketing, brand development, and innovative thinking. His entrepreneurial journey commenced in 2013 with the creation of Tio Gazpacho, a pioneering brand in the drinkable bottled soup sector. Demonstrating exceptional strategic acumen, Austin successfully garnered investments from notable figures such as celebrity chef and philanthropist José Andrés, as well as General Mills. The culmination of his efforts and visionary leadership was the acquisition of Tio Gazpacho by Novamex in 2019. Novamex, a multibillion dollar beverage conglomerate based in El Paso, TX is known for managing a diverse portfolio that includes brands like Jarritos soda, and newer acquisitions C2O coconut water and Steaz iced tea.

Austin is supported by a cadre of remarkable advisors and investors, contributing to the foundation of his success.

- Michelle Muller - Co-Founder & CXO of Little Spoon. Investor Experience Advisor

- Tim Franks - Partner KKR London & Andrew Pirrie. Investors

- Bert Duarte - Managing Director, Charlesbank Capital Partners. Investor

- Aaron Schlaphoff - Partner, Paul, Weiss, Rifkind, Wharton & Garrison LLP. Investor

- Jason Lenhart - Vice President Technology Engineering, JetBlue. Investor

- Tom Smallwood - formerly of Magnolia Bakery and contestant on Food Network's Spring Bakery Championship Season 8. Culinary Advisor

- Sal DiBenedetto - @thegrubfather (385K followers). Social Medial Management & Strategy

"Investing in Sugar Wood was a no brainer for me. I'm privileged to know Austin Allan for well over a decade and had a front row seat to his work ethic and behavior running his first startup. As an entrepreneur myself, I am keenly aware that the success of a business is directly tied to the founding team and their drive "to win." I would bet everything all over again on Austin, given the chance." - Michelle Muller

"We had been following Austin’s career and got excited when he was thinking of something new. We have been investors in a number of consumer facing brands on a personal basis both in Europe and the US, and Tim is a 25 year veteran consumer focused investor within a couple of the world’s largest private equity houses. We like the margins, the potential return on capital and the brand positioning." - Tim Franks & Andrew Pirrie

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...