Problem

It’s never been more difficult for nurses to pay for school

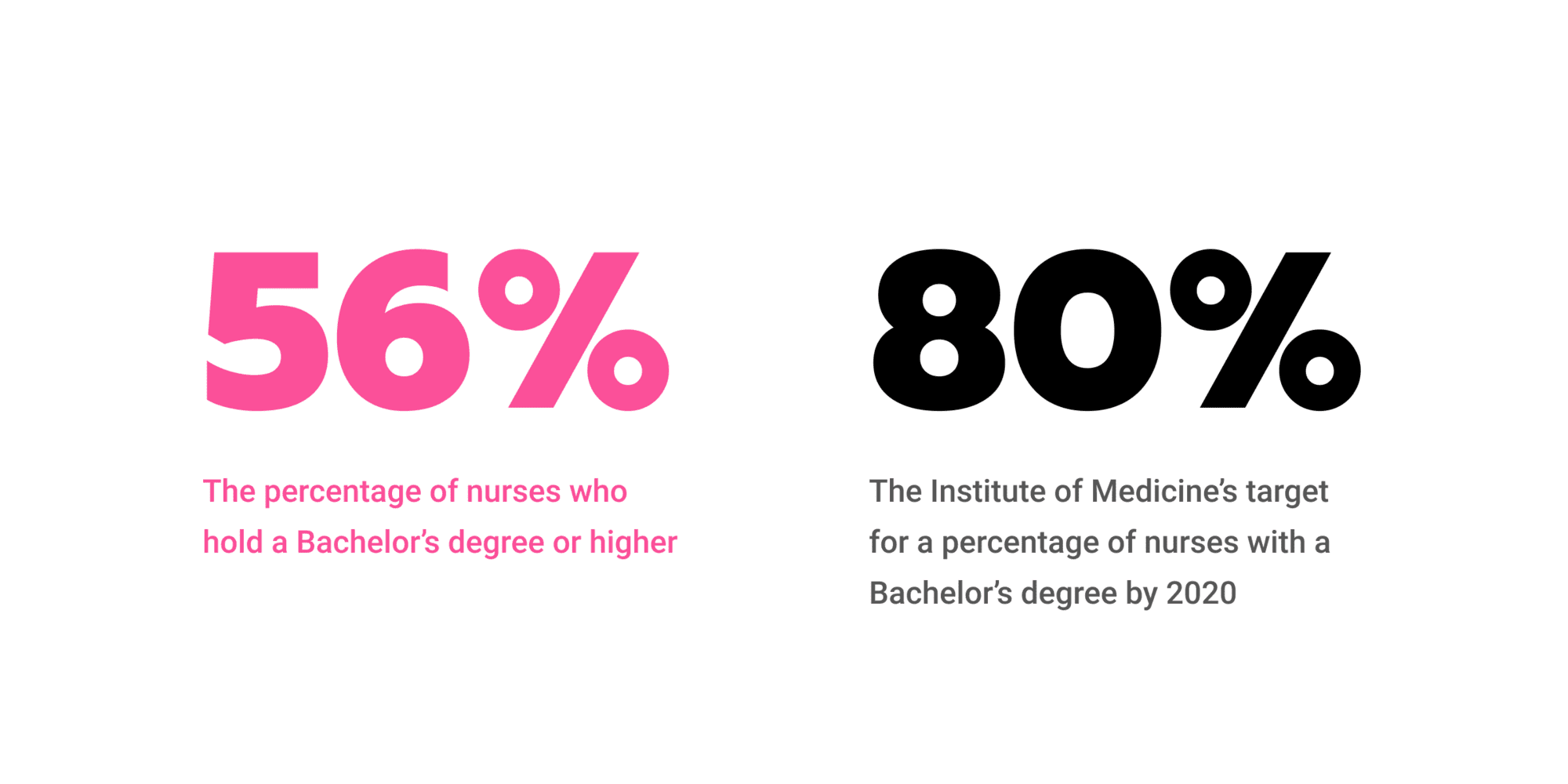

In a recent survey from LendEDU and FundingU, half of students surveyed said they dropped out of college because they couldn't find a way to pay for it. This only worsens the growing healthcare shortage in a field where just 56% of nurses hold a Bachelor's degree or higher, despite almost half of hospitals requiring a Bachelor's for new hires.

In a recent survey from LendEDU and FundingU, half of students surveyed said they dropped out of college because they couldn't find a way to pay for it. This only worsens the growing healthcare shortage in a field where just 56% of nurses hold a Bachelor's degree or higher, despite almost half of hospitals requiring a Bachelor's for new hires.

Federal student loans don't cover everything they need: only 9.43% of undergraduate private student loan applicants are approved without a cosigner, and lower-income students who work through school are 11% less likely to graduate than their higher-income peers.

Solution

Fairer, more accessible financing, built with nursing students in mind

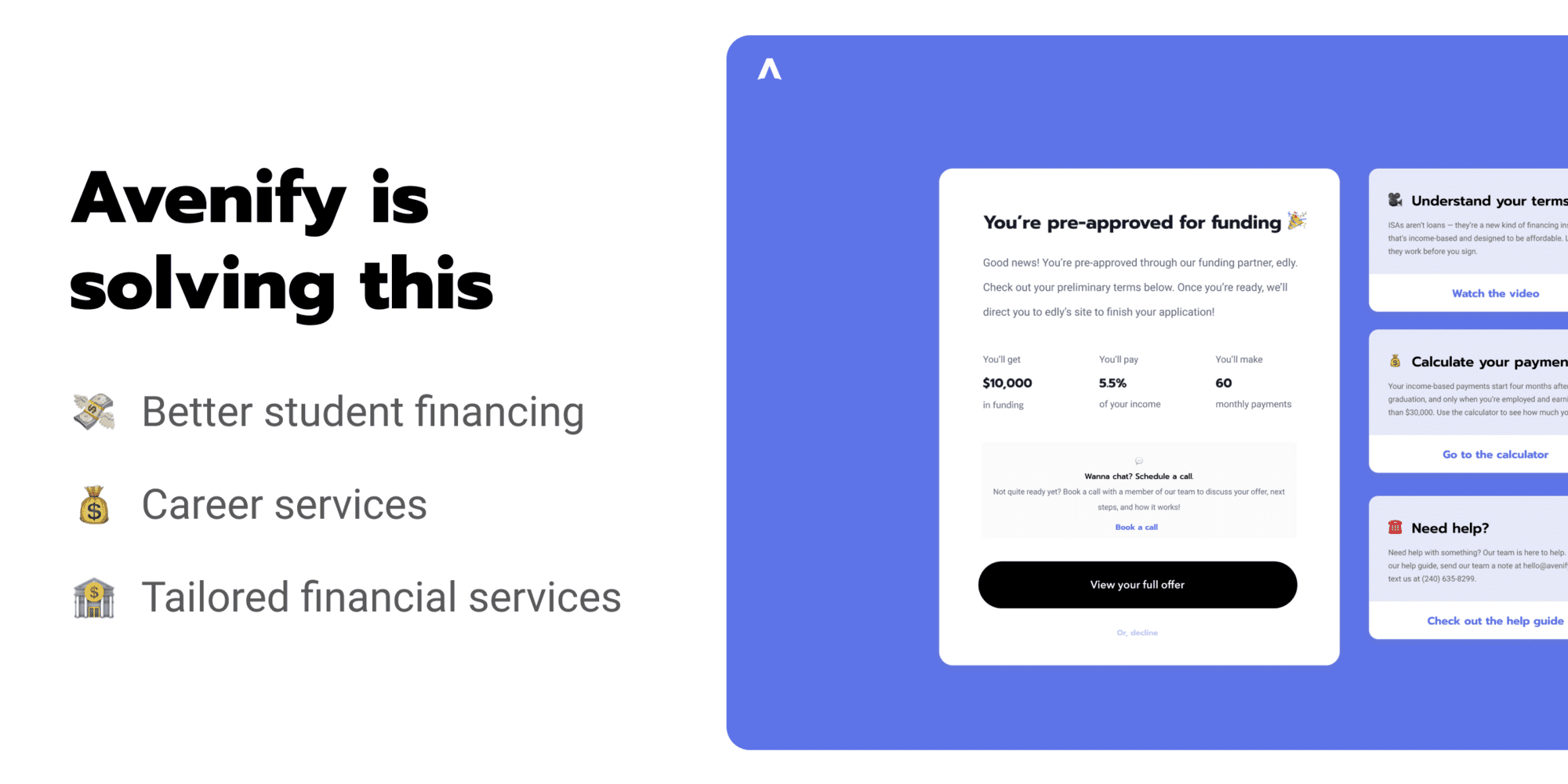

Since launching one of the first consumer ISA platforms on the market in Fall 2019, Avenify has helped nursing students across the country pay for school using income share agreements (ISAs), our alternative to traditional student loans.

Unlike traditional lenders, Avenify doesn't require a credit score or cosigner, sets funding terms based on their future earning potential (not their credit performance), and includes built-in unemployment insurance and career services to play an active role in solving the growing healthcare shortage.

Product

NerdWallet's #1 way to pay for nursing school

Avenify is a complete replacement for private student loans, providing accessible and affordable financing for nursing students and related professions through ISAs. Watch how they work.

Our career services products help our Members get jobs and increase their earnings. This de-risks our ISAs, ensuring our Members are prepared to graduate, pass their exams, and get hired. Partnerships with hospitals drive revenue through placement fees while helping our Members get hired faster.

On the backend, we partner with other lenders to match students with the most affordable rates for them, acting as the relationship manager and financial coach for our members.

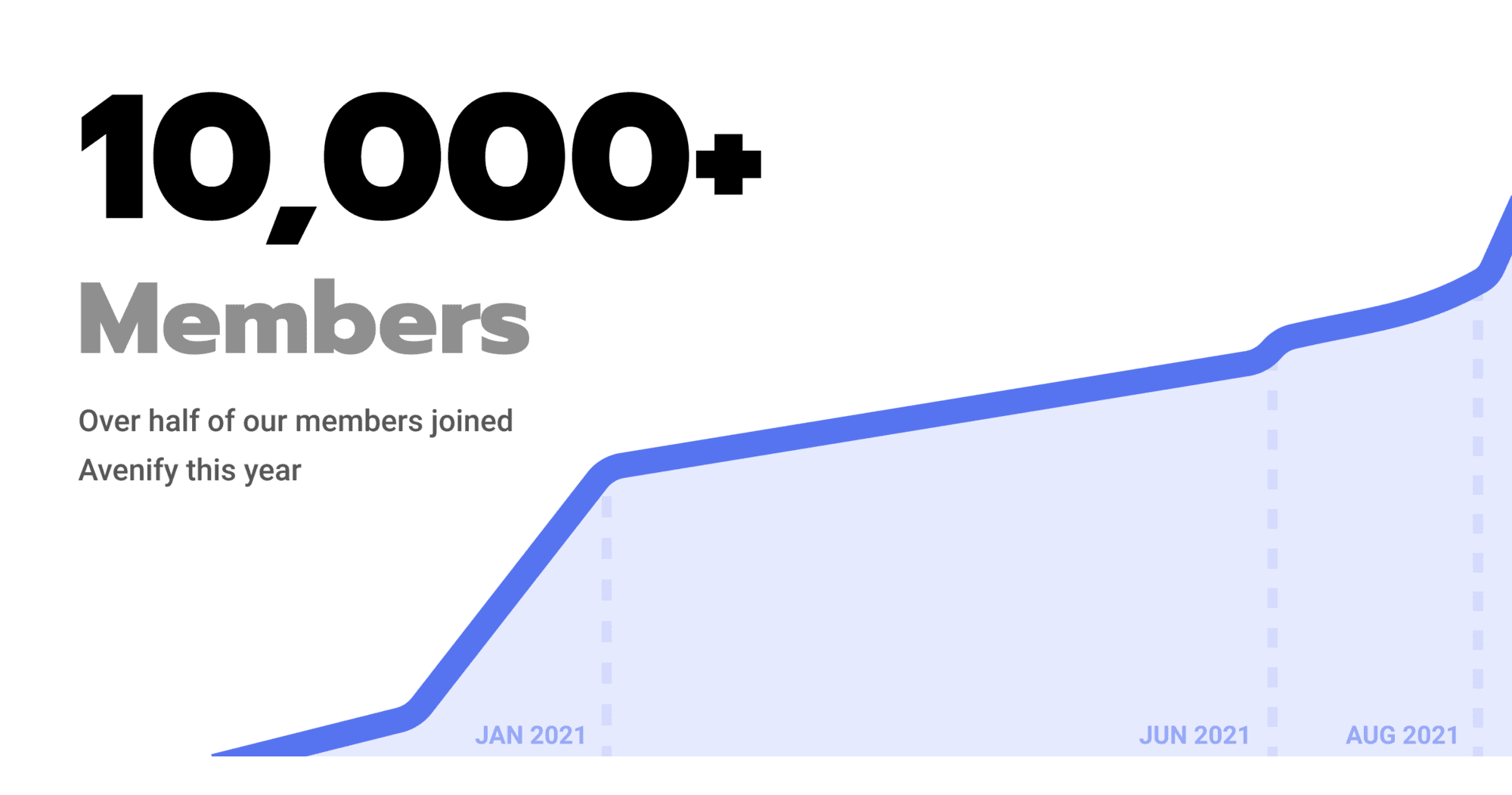

Traction

Thousands of members,

and millions in origination since launch

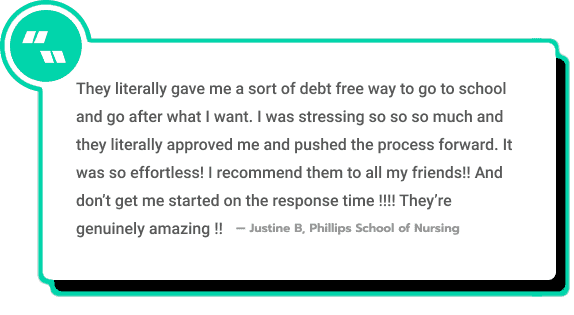

Since launching in Fall 2019, we've processed over $50M in application volume, grown to over 10,000 Members, and were rated the #1 private financing option for nursing students by NerdWallet.

Our marketing to date has been almost entirely organic. Our members come from student referrals, financial aid department advisors, and sites like NerdWallet and Student Loan Hero.

Based on our current growth, we expect to generate $2M in revenue over the next year and scale to over 50,000 members. Our solution has earned us recognition from leading institutions including Techstars, Barclay's, Money20/20, NerdWallet, Mercury Raise, the Silicon Slopes conference, Harper's Magazine, and more.

Our solution has earned us recognition from leading institutions including Techstars, Barclay's, Money20/20, NerdWallet, Mercury Raise, the Silicon Slopes conference, Harper's Magazine, and more.

Customers

Delivering consistent and predictable outcomes

in a market underserved by incumbents

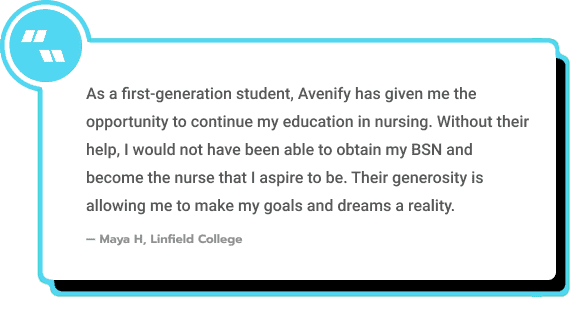

There are 4M nurses in the US who don't currently have a bank built for their needs, much less a student financing company. Avenify is focused on a market with unique, underserved characteristics.

Our focus on nursing enables us to build a strong alternative underwriting model based on predictable salary outcomes. Nurses are great employment bets because of the massive talent shortage in healthcare.

While doctors and dentists have plenty of options built for the super-prime, high-earner-not-rich-yet (HENRY) category, like CommonBond and SoFi, nursing students are overlooked.

According to our Fall 2020 survey, 30% of Members who responded said they wouldn't have qualified for traditional private loans.

Business model

$2M+ in projected revenue

by EOY 2022

with potential to scale to $100M+

Avenify acts as an affiliate partner for our network of capital partners, earning revenue upfront as a percentage of originated volume.

Unlike many other lenders, we don't hold balance sheet risk. This enables us to stay lean, avoid raising too much equity capital, and prioritize our efforts to grow LTV and play an active, long-term role in our members' success.

As we scale, we expect to onboard additional financial services partners in a similar model to offer additional products—like malpractice insurance, refinancing, loans, and more.

Market

Among the largest fields of study, and a valuable wedge to 4M nurses nationwide

Over half a million nursing students attend school every year, 70% of whom take out student loans. Over the course of their studies, the average nursing student will borrow an average of $30K in student loans—federal loans only cover half of that.

Excluding market expansion opportunities, we have the opportunity to originate over $5B in funding per year, worth hundreds of millions of dollars in upfront revenue.

The loyalty and trust we'll build with our members through an exceptional student financing experience enables us to grow alongside them to serve the nearly 4M—and rapidly growing—nurses and their families across the US.

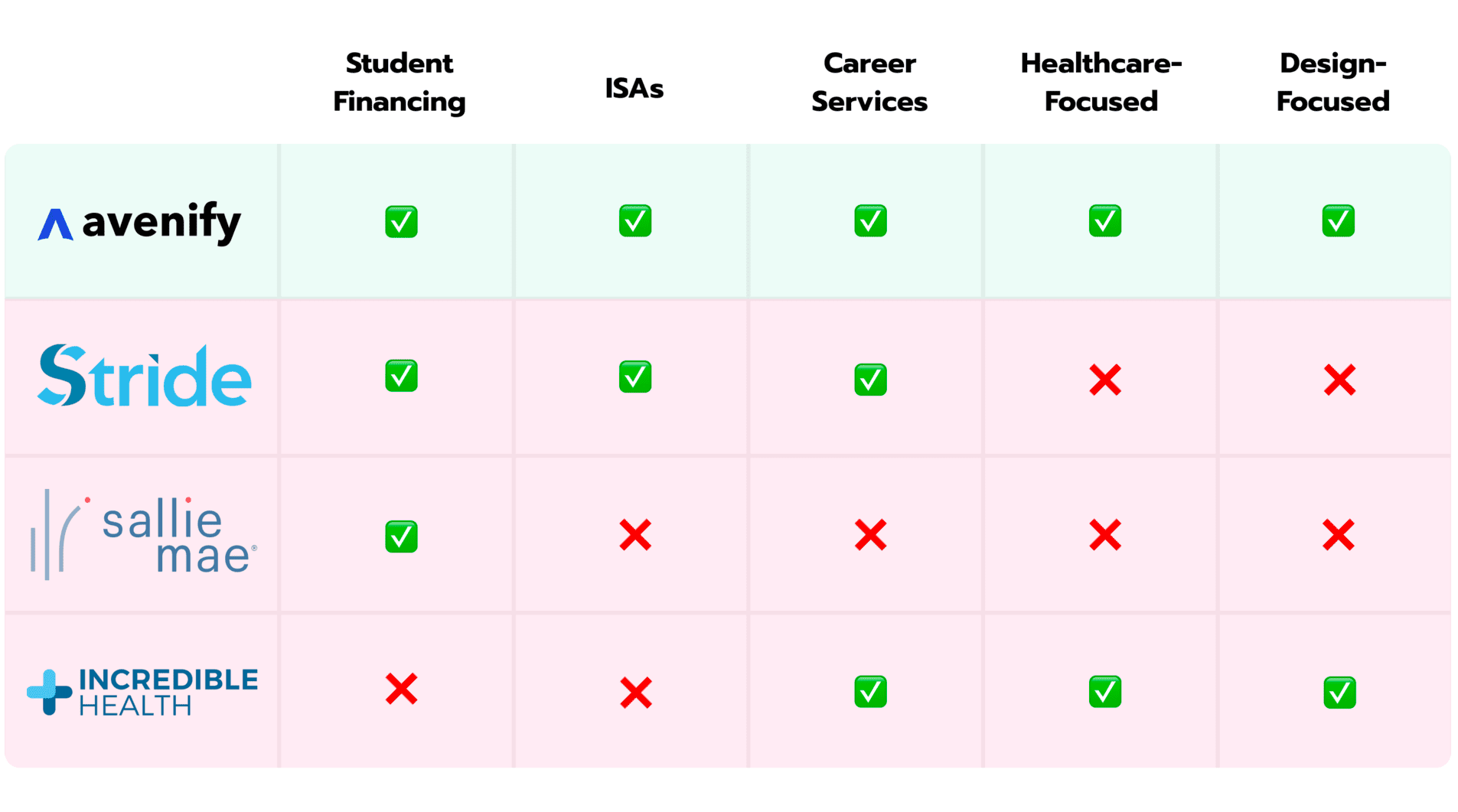

Competition

A leader in occupationally-focused student financing

Avenify is one of the only ISA startups focused on a singular vertical, one of few providers that don't rely on school partnerships, and the only financing company on NerdWallet built exclusively for nursing students.

This enables us to build a stronger brand, boost customer affinity, and provide value to our members more efficiently than our competitors.

While the alternative financing market continues to grow, we don't expect incumbents to enter any time soon. Companies like SoFi are tackling a large-enough market in student lending and mortgages, and not willing to risk their reputation or regulatory exposure quite yet, despite more than half of students surveyed saying they'd prefer ISAs over loans.

Vision and strategy

On track to scale, with over $300M in lending capacity

Avenify is on track to originate nearly $100M in funding by EOY 2022, with over $300M in capital available as we scale.

Over the next 12 months, we'll be making our first key hires focused on marketing, engineering, and member success, enabling us to generate $2M in projected revenue by EOY 2022.

In 10 years, what USAA is for the 1.5M active service members and their families, we'll be for the 20M+ people in healthcare—an affinity-focused financial services platform committed to solving the unique needs of our member demographic.

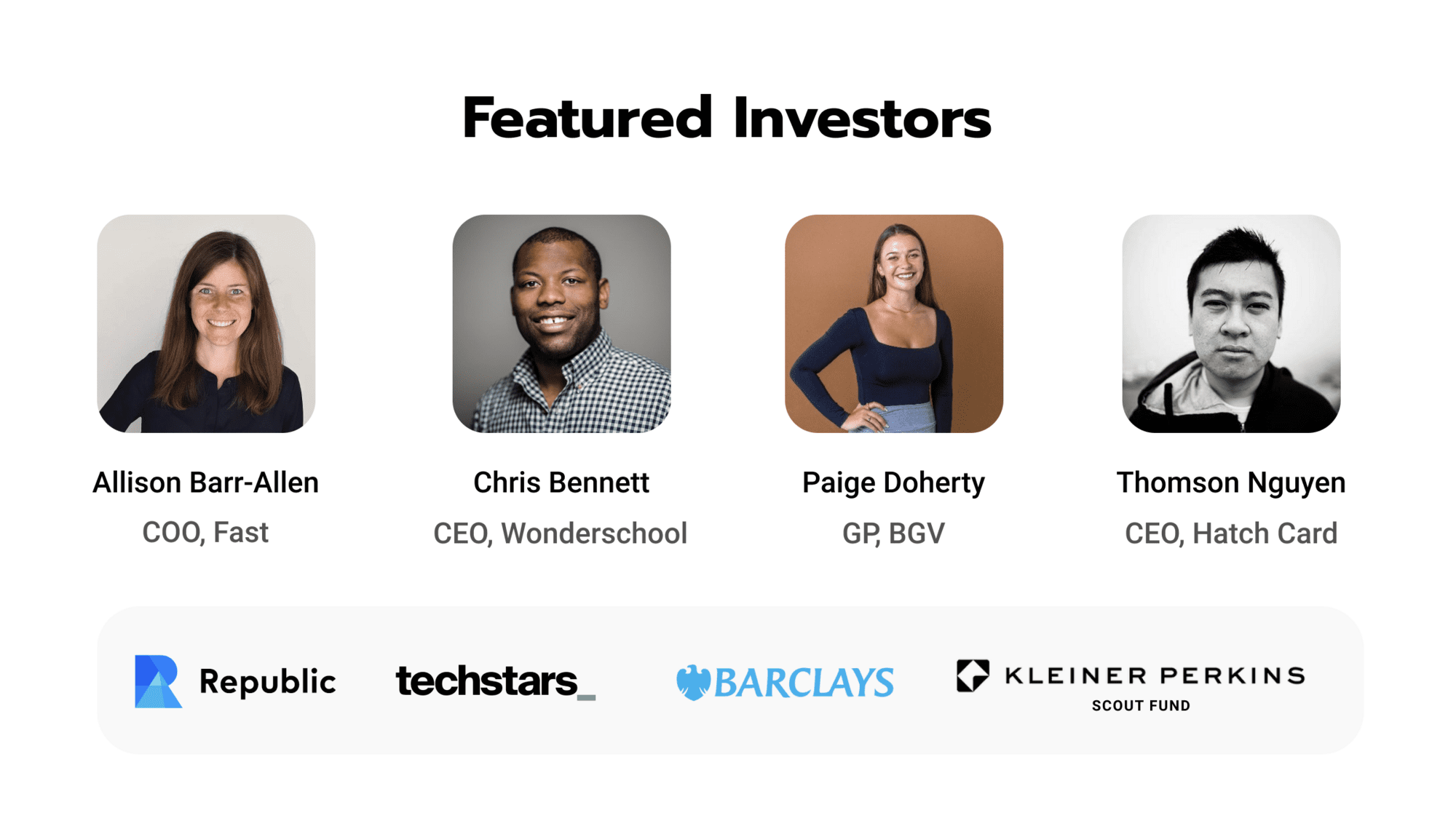

Funding

Backed by Techstars, Barclay's, and a 1205%-complete Republic campaign

We're incredibly proud to be backed by some of the most talented investors and operators in our space, including Techstars, Barclay's, and the Kleiner Perkins Scout Fund.

We previously closed a successful round on Republic, where we raised 1205% over our minimum goal for $301K. Now we're looking forward to growing our passionate supporter base of nearly 1,200 investors.

Founders

Scrappy, talented,

and ready to scale

The Avenify Team: Sherrise (left), Justin (middle), and Timo (right)

The Avenify Team: Sherrise (left), Justin (middle), and Timo (right)

After meeting at the University of Oklahoma, Justin and Timo founded Avenify in October 2018.

Justin's experience at startups, including Product Hunt and Republic—paired with Timo's experience in economics, math, and computer science—enabled them to take Avenify from zero to over 10,000 members, and raise hundreds of millions of dollars in financing for their members.

As part of this round, we're hiring engineers, marketers, and designers to join Sherrise (Avenify's first hire, Marketing & Community Manager, and former nurse) to reach millions of frontline healthcare workers across the US.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...