Sustainable Scoop interviews Dr. Lockett Wood, CEO of Avivid Water

Problem

Most modern industries—clothing and textiles, mining, oil production, landfills, farming, chemical manufacturing—produce polluted water. We call this wastewater. But water is not waste to be discarded—it’s a precious resource to be protected.

Traditional wastewater treatment is slow, expensive, toxic, and produces byproducts that are difficult to store and transport safely. We need a fast, safe, and sustainable solution for industrial wastewater, and we need it now.

Solution

Avivid’s custom water treatment empowers customers to clean their water to drinking standards, reuse it, or release it to local wastewater treatment plants or the environment—at or exceeding permit standards.

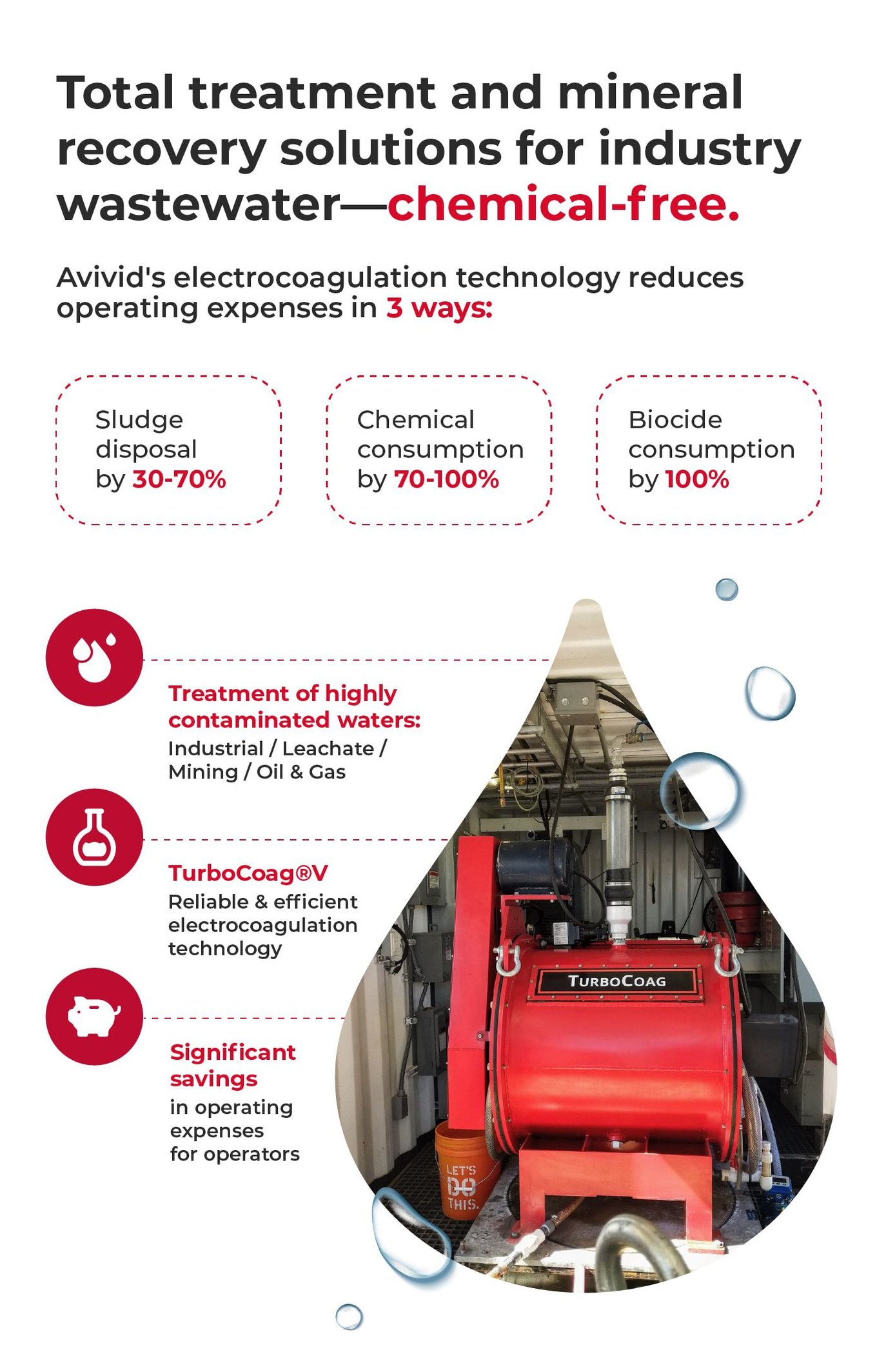

Our groundbreaking tech improves on a water treatment method from the 1880s called electrocoagulation (EC), the process of applying an electrical charge to water to clump suspended waste particles together in water for easy removal.

Operational issues like sludge accumulation and corruption of the anodes have plagued this method and prevented widespread adoption…until Avivid.

Product

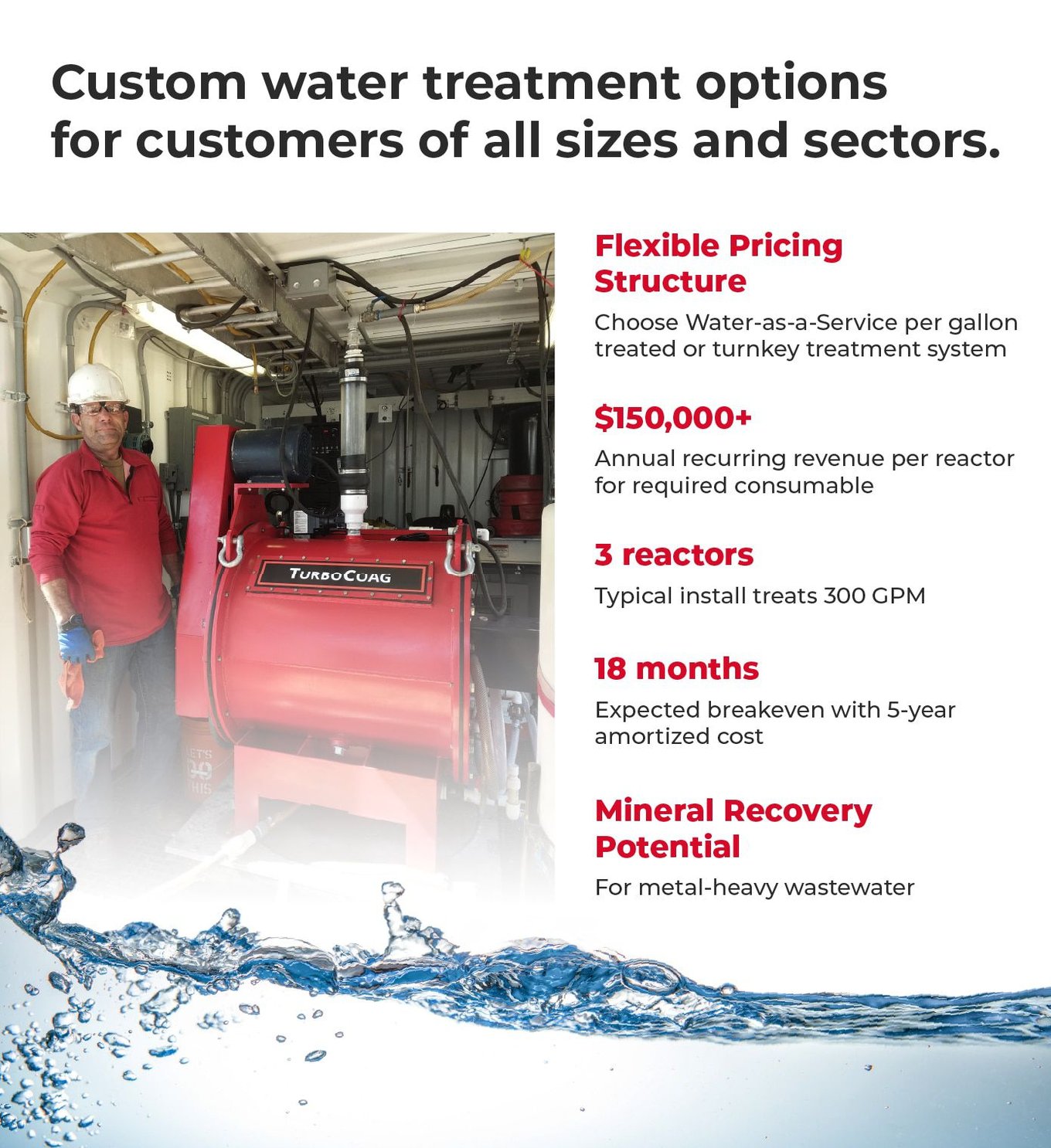

Avivid is engineered EC technology for next-generation water treatment and recovery with a complete, turnkey system that features our proprietary EC reactor, the TurboCoag® V. An innovative Tesla pump removes 99% of suspended solids, heavy metals, and biological contaminants in water—all without chemicals.

Traction

After years of research and development, Avivid’s patented tech is market-ready with a full customer pipeline. We’re fielding dozens of inquiries and running hundreds of water samples from interested prospective customers across industries.

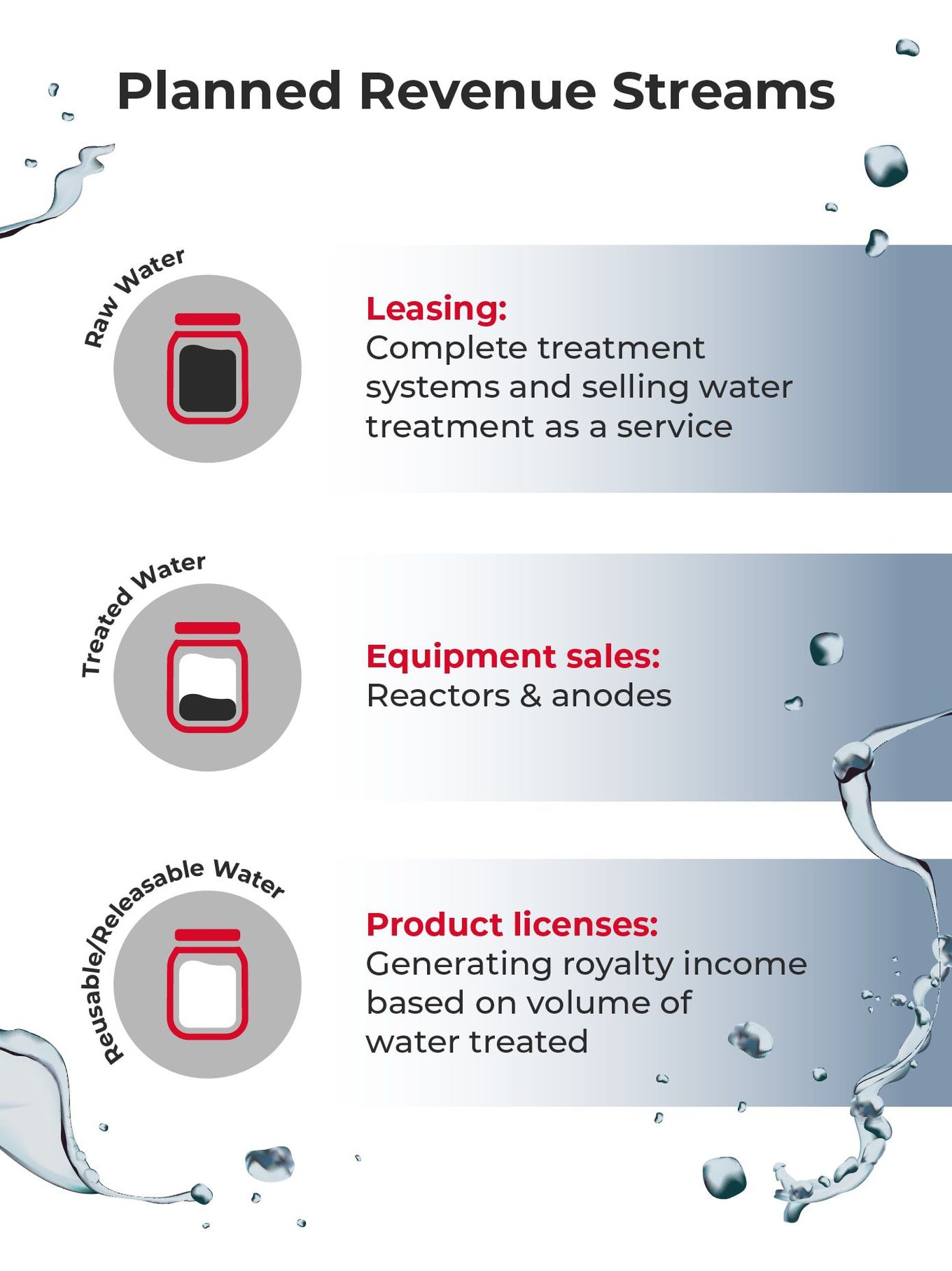

Business model

Market

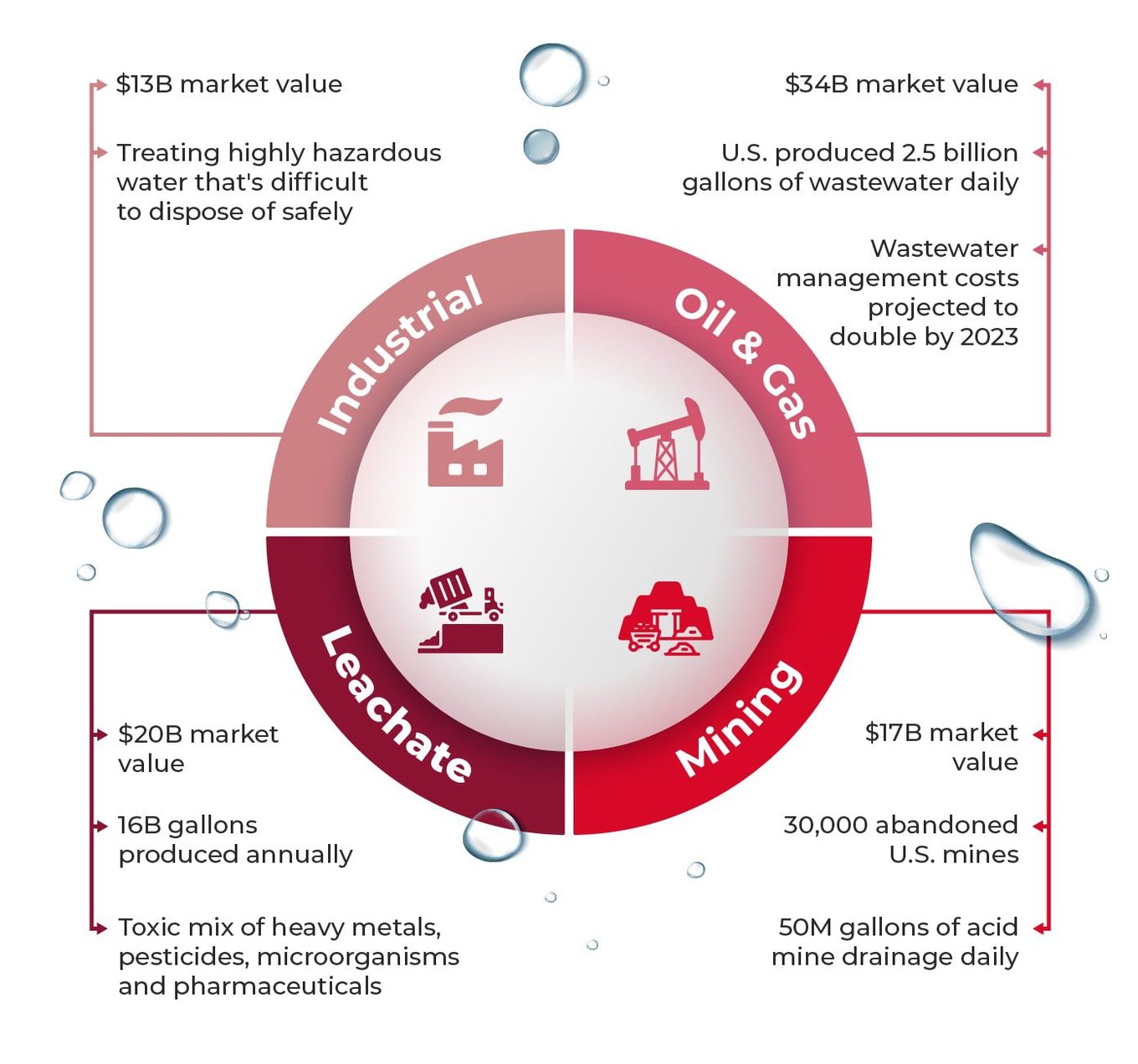

Avivid has the potential to minimize the environmental impact in 4 water markets: highly hazardous industrial wastewater, oil and gas water, landfill leachate, and mining water. In total, this is an $84 billion market opportunity.

In addition, the market for smaller $5M to $20M installations—untapped by larger water treatment companies—provides an opportunity for niche domination with our customizable, scalable turnkey solution. It’s clear that Avivid is uniquely positioned to clean up our world’s water.

Competition

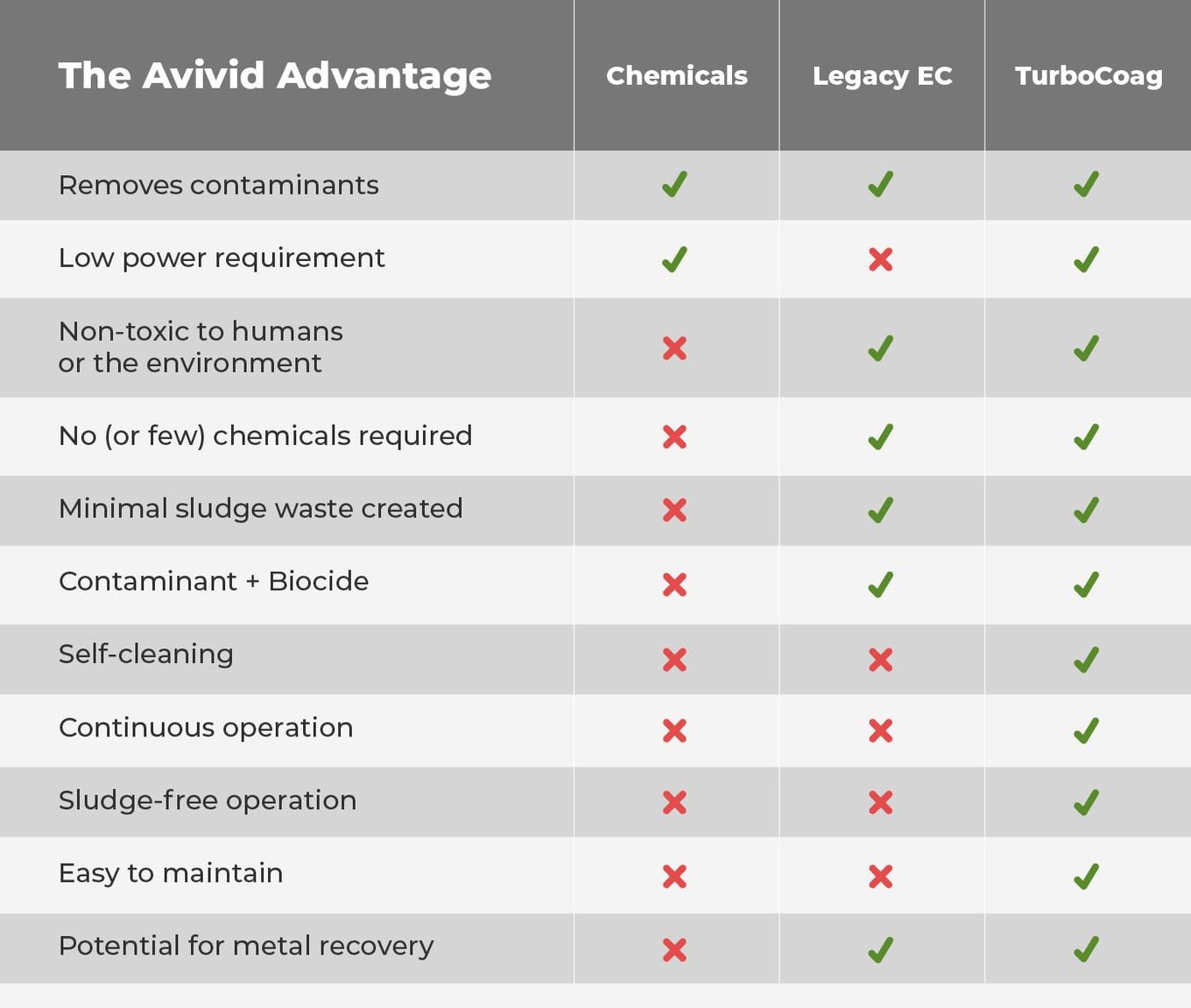

Other legacy electrocoagulation systems are energy-intensive, difficult to maintain, and have high sludge accumulation.

Our patented TurboCoag technology is capable of cleaning some of the world’s most contaminated water—without toxic or harmful chemicals, and with optimized efficiency and the potential for precious metal recovery.

Vision and strategy

Fresh water is a finite resource, with only .0001% of the world’s water readily available for human use. Keeping this water clean is essential for environmental conservancy, resource recovery, and worldwide health.

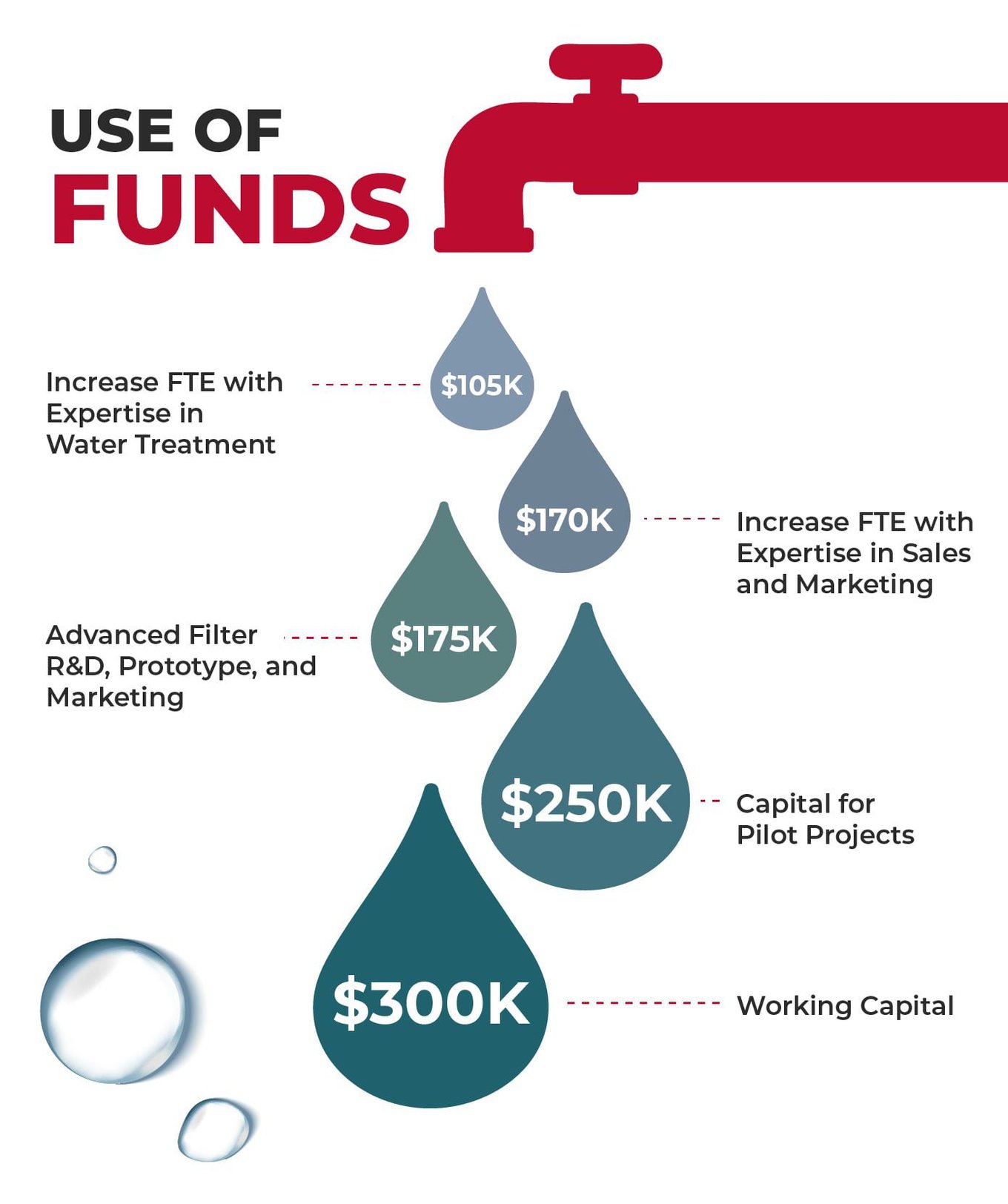

Avivid is raising $1M in 2022 and up to $5M in 2023 to meet our mission: cleaning the world’s most polluted industrial water.

Funding

As proof of our powerful concept, we were able to completely fund Avivid using small investments from friends, family, and our founder. Today, we’ve bootstrapped our way to success, earning awards from the State of Colorado and reinvesting our profits to make Avivid as market-ready as possible—without being accountable to any outside VC or angel investments.

Founders

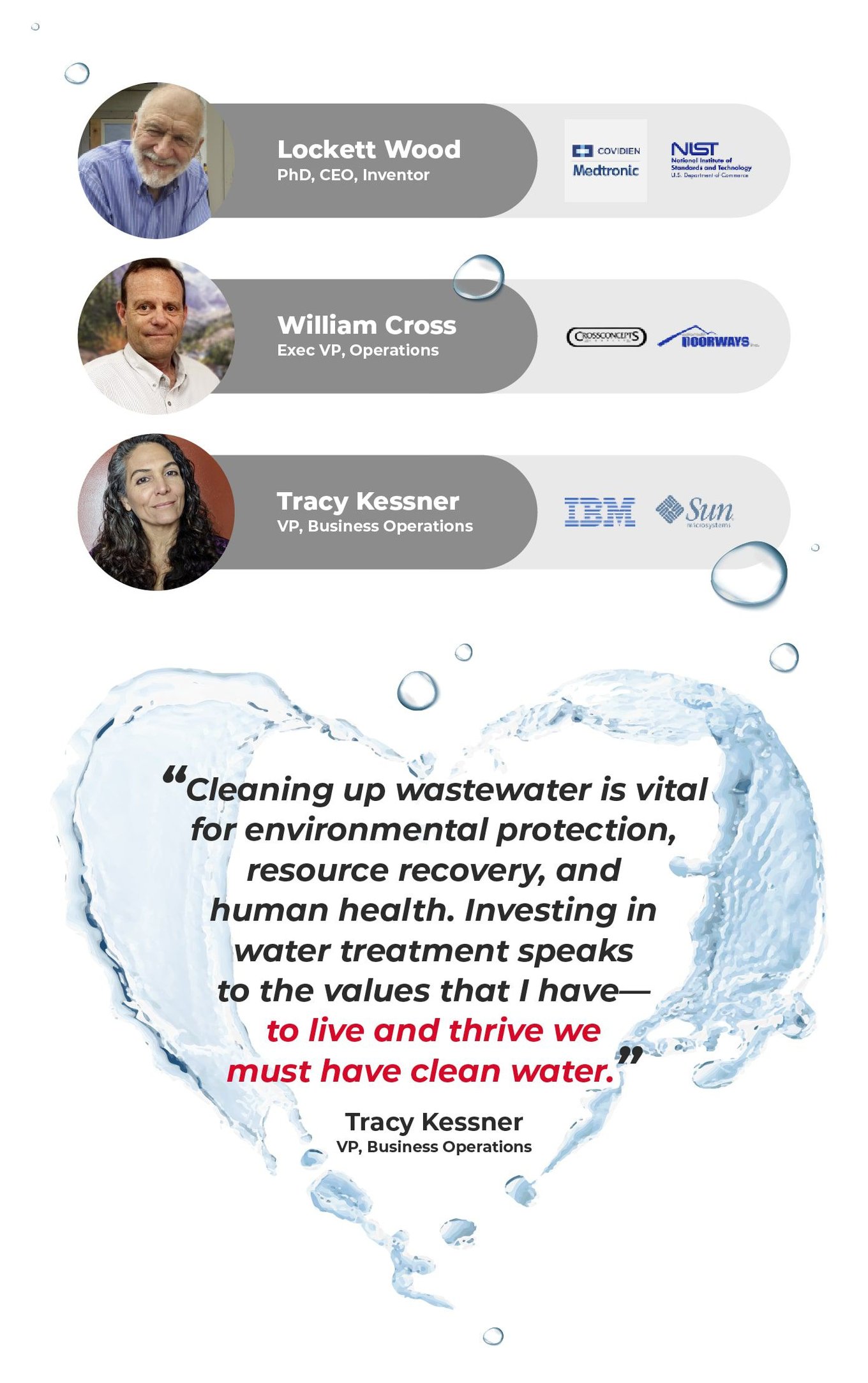

Our company was founded by Dr. Lockett Wood, a Ph.D. physicist, electrical engineer, and experienced tech startup founder. Before Avivid, co-founded both Colorado Data Systems and Cybermedic, companies that grew to massive multi-million-dollar revenues before exiting by sale.

The entire Avivid team is uniquely experienced in both our industry area of expertise and business development. We have led the successful launch and operation of more than 10 new businesses and a public offering in their previous careers.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...