If you've been paying attention to the Smart City, Smart Manufacturing, or Smart Building industries over the past 12 mon...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...

Cityzenith

Open for investment

Documents

Form C

SEC.gov

Form C

SEC.gov

Deal highlights

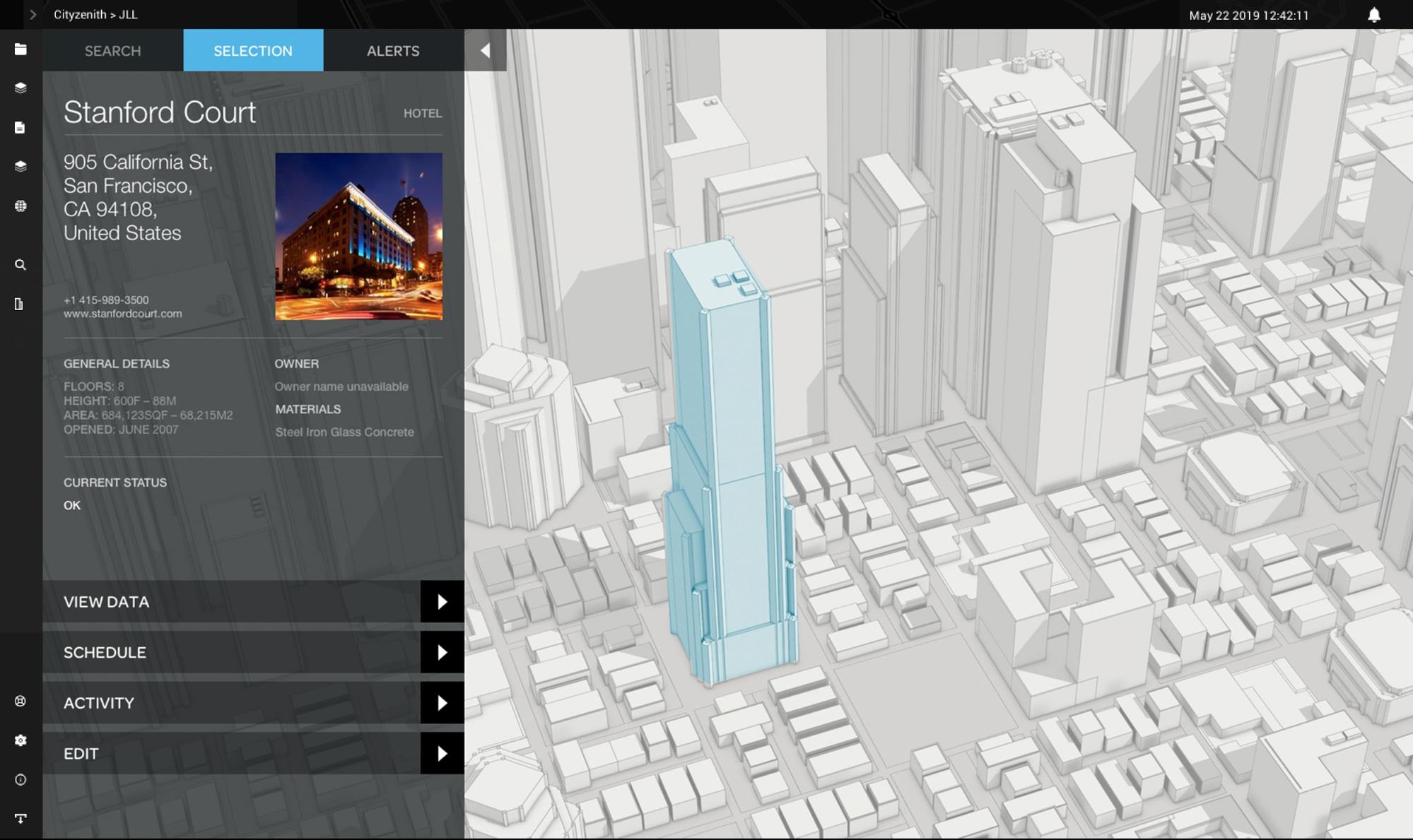

- Platform to create virtual replicas of buildings, infrastructure & other physical assets

- Only Digital twin platform to span entire lifecycle of the building from design through operations

- Customers include Cushman & Wakefield, JLL, Lendlease, W.S. Atkins, Prologis

- Secured $6M in funding to date

- Major global projects under contract in the US, Europe, the Middle East, and Asia

- Experienced management team with successful track record; CEO Michael Jansen generated a 1700% return for early investors in his previous business

- Digital twin market expected to grow at a CAGR of 37.87% to reach $15.66B by 2023

- Recipient of industry awards including “Best Innovation” from World Smart Cities Awards, “Best Tech Innovation in Commercial/Corporate Real Estate” from Realcomm Digie Awards and winner of Dreamit Urbantech Competition

- Press coverage from BBC, Architect’s Newspaper, and more

The problem

There is no single platform that meets the needs of the global Smart City industry

Architects, planners, property owners, and governments use dozens of disconnected tools. The problem costs the world 100’s of billions of dollars every year--we created Smart World Pro to solve it.

The world is building bigger real estate projects in larger numbers than ever before. “The world’s population could add another 2.5 billion people to urban areas by 2050.” (source: United Nations Department of Economic and Social Affairs)

As a young architect fresh out of Yale and Cambridge in the early 90’s, our founder and CEO, Michael Jansen, was thrown onto massive urban-scale building projects in Asia, and witnessed first hand just how complicated these large projects were to design, build, and operate.

Fast forward to 2016, owners and architects were using dozens and dozens of as many as 7,000 different, disconnected software tools and data services just to do one project, with almost none of those tools interoperating or cross communicating, making the task of designing and operating these large projects at scale almost impossible. It’s a $2 trillion dollar problem that impacts every major world market...and we created Smart World to solve it.

The solution

Ground-breaking new technology called "digital twinning"

Digital Twins are 3D virtual replicas of buildings, infrastructure, and other physical assets connected to the data in and around them. Digital Twins are used primarily to optimize performance and predict and visualize future outcomes across functional areas in cities like maintenance, energy consumption, space utilization, traffic management, and public safety.

Cityzenith’s revolutionary 3D Digital Twin platform, Smart World Pro, is pioneering the development and implementation of Digital Twins in Smart Cities around the world in the United States, the United Kingdom, the Middle East, and Asia.

The platform’s unique advantage is that it aggregates more software tools and data than any other platform in the market today, and is the only platform to integrate solutions across the entire life cycle of a city from design and construction through operations and tenancy. Think of it as a vast 3D Digital Legoland for building professionals, where all of the information that you need to design, build, and run a project, at any scale, is right where you want it to be. Digital Twin users include architects, planners, governments, property managers, construction companies, systems integrators, and many more.

Click here to see Smart World Pro in Action.

The world is building bigger Smart City projects in larger numbers than ever before. The planet must build the equivalent of 10,000 new cities by 2050 just to accommodate the expected population boom. How will the world meet this challenge? The solution lies in a ground-breaking new technology trend called “Digital Twinning”.

In December 2018, Cityzenith's Smart World Pro was selected by the Government of Andhra Pradesh in India as the Digital Twin platform of choice for the development of Amaravati, a new £5.12 billion world-class greenfield smart city capital for the state, designed by London-based Foster + Partners and Singapore-based Surbana Jurong. Amaravati will be the first entirely new city to be born as a Digital Twin. Everything that happens in Amaravati will be scenario-ized in advance to optimize outcomes, and adjusted on the fly to keep pace with change. The adoption of this technology represents a giant leap forward for Smart Cities: how they're designed, built, and managed, and even how they optimize their relationships with the private sector and their own citizens.

Press

As seen in

Traction

Since July 2018, we've signed contracts or LOIs with 10 major tier 1 customers

Cityzenith markets to global real estate owners, infrastructure players, and architecture and engineering firms, and has secured major global clients in each of these sectors since product launch last summer in 2018.

We are on track to achieve our goal this year of securing 12-15 customers. 4 of our customers appear in ENR Top 100 lists.

Amaravati Smart City, India

Foster + Partners

A marquee greenfield Smart City in India that will be home to 3.5 million residents

Cushman & Wakefield, Chicago

The world’s 3rd largest global property management firm

Global partnership to co-develop and co-sell Digital Twins solutions around the world

East West Rail Alliance, UK

U.K. (W.S. Atkins)

A 102 km rail and real estate development mega-project connecting Oxford and Cambridge

Euston Station, London

Lendlease

Asset management project for multiple commercial buildings

Elephant & Castle, London

Lendlease

With Southwark Council to deliver a GBP£2.3 billion regeneration programme on 28 acres in the centre of Elephant & Castle

King Abdullah Financial District, Riyadh

JLL

3D BAM Baseline Asset Modeling for 48 buildings

Prologis, San Francisco

$79 billion in total assets under management

3D BAM Baseline Asset Modeling for 4 major industrial facilities

Quantum Computing Center, Rhode Island

Entanglement Research Institute

A state-of-the-art quantum computing campus on 5.2 acres

Rudin Management Inc., New York City

New York City’s largest privately-held building owner

7 large commercial buildings in New York City corporate campus

Silk City, Kuwait

Perkins & Will

A new greenfield city on 60,000 acres near Kuwait City

Waterfront Tampa

SPP Properties (the 2nd largest real estate project in North America)

A $3.5 billion, 53-acre new Smart City campus/mega real estate deve heast Tampa Bay

Business model

Cityzenith's Smart World Pro platform is a SaaS solution

Users are charged recurring fees annually and payments are made in advance. Cityzenith also earns revenue by providing supporting professionals services solutions including 3D modeling, data loading, and custom API integration services. Approx. 66% of the company’s revenues recur annually.

Pricing Model

Smart World Pro (SWP) - Annual SaaS subscription - $30,000+

Smart World Web (SWW) - Annual SaaS subscription - $10,000+

Baseline Asset Modeling As A Service (BAMaaS) - Users manually import and model Digital Twins via our SWW platform - $500 per building

Modeling Services - Clients provide planned or existing building models i.e. CAD, Revit, Lidar, PDF to our modeling services team who model, process and import into SWP/SWW - $2,000 - $2,500 per building

Data Loading - Loading GIS, building, IoT, and other contextual data into SWP/SWW - $25 per hour

Data Hosting - Hosting all client data on AWS cloud - $6,000 annually

Custom Development - Cityzenith provides custom development for the creation of custom dashboards and custom user interfaces for clients - $100 per hour

Market

The digital twin market was valued in 2019 at $1.82B

It is expected to reach $15.66B by 2023, at a CAGR of 37.87% during the forecast period.

Market facts:

There are over 120 million managed commercial properties in the world (source: Cushman & Wakefield)

The world’s largest 100 real estate companies own assets worth 2.6 trillion

The world’s top 500 AEC firms billed over 50 billion last year (source: ENR)

Competition

We have a 3-4 year lead on potential competition in the market

Cityzenith’s platform is uniquely non-proprietary, and is preferred to expensive, closed platforms provided by major software players like Dassault. Smaller competitors have not raised as much funding as Cityzenith has, lack the same market awareness, or product maturity.

We segment competition into 2 categories: established and emerging.

Established players include:

ESRI

Autodesk

Dassault

Emerging players include

Urbanetic

Willow

Investors

Raised over $6M to date from individual high net worth investors

Cityzenith has raised over $6M in seed funding to date from private investors around the world in over 12 countries, including across the US, Europe, the MIddle East, and Asia. Individual investors have invested as much as $1M, and as little as a few thousand $$$.

What's next

We plan to use the newly raised funds to help us scale into profitability over the next 12 months

We are already talking to strategic investors about the next round, a growth financing, later this year. Cityzenith believes that a strategic exit via a sale or IPO is possible within 3-5 years, and hopes to provide a 5-10x return to investors on exit, minimally. Cityzenith’s CEO has provided investors returns that exceed 17x in the past.

*Past performance cannot predict future performance, investment results may vary and no guarantee of a return on investment is being made

Founder and team

Michael Jansen

Chairman & Chief Executive Officer

An impassioned architect, urbanist, and entrepreneur, Michael has founded and led high-growth companies in the US and Asia for more than two decades. He studied architecture at Yale and Cambridge, earned a Fulbright Scholarship, and worked as an architect in India and China for several years leading the Asia practices of two major US-based international architecture firms. In 2004, he founded a major BIM services company in India backed by Sequoia Capital, which grew to over 500 employees in just 4 years. In 2010, Michael assumed the helm at Cityzenith as CEO and embarked on his personal mission to transform life in cities around the globe. Michael has been featured on CNN, CNBC, and in several major business, government, and AEC publications worldwide. He has also received several awards for his work, including Building Design and Construction’s “40 Under 40” award. In 2014, Michael was honored as a World Cities Summit Young Leader in Singapore for his life-long contribution to improving sustainability and the quality of life in cities. A husband and father of three, Michael speaks four languages and plays the guitar.

Jon Feutz

Jon Feutz

CTO

Systems engineer and backend developer for the past 20 years, specializing in data collection and api design.

Served in the Air Force as a computer analyst and later as a lead developer and architect in a large financial institution

We have raised over $1,500,000 in this so far very successful fundraising round and have just under $500,000 remaining in this seed round. Google and Softbank are among major investment companies with whom we are discussing a next round larger growth investment. It’s time to say thank you to all the angel investors, over 120 from 12 countries, who supported us along the way.

The round will close with our Republic campaign, and this is your final chance to be a part of the amazing Cityzenith story.

Deal terms

$20,000,000

The maximum valuation at which your investment converts

into equity shares or cash.

Learn more

20%

If a trigger event for Cityzenith occurs, the discount provision

gives investors equity shares (or equal value in cash) at a reduced price.

Learn more.

$1.07M

Cityzenith must achieve its minimum goal of $25K before the deadline. The maximum amount the offering can raise is $1.07M.

Learn more

Learn more

Crowd SAFE

A SAFE allows an investor to make a cash investment in a company, with rights to receive certain company stock at a later date, in connection with a specific event.

·

Learn more

Documents

Form C

SEC.gov

Form C

SEC.gov

Bonus perks

-

Mention On Cityzenith.com Website

Sold out (0 left of 500)

- Mention On Cityzenith.com Website

- Invitation To Attend 1 Investor Update Call

-

Smart World Web Advance Release License, 90 Day Beta Trial (Estimated Release Date Q2 2020)

Sold out (0 left of 200)

- Mention On Cityzenith.com Website Including Photo and Bio

- Invitation To Attend 2 Investor Update Calls

- 2 Smart World Web Advance Release Licenses, 90 Day Beta Trial (Estimated Release Date Q2 2020)

-

Annual Shareholder Report

Limited (80 left of 100)

- Mention On Cityzenith.com Website Including Photo and Bio

- Invitation To Attend 4 Investor Update Calls + 1 Board Call

- 5 Smart World Web Advance Release Licenses, 90-day Beta Trial (Estimated Release Date Q2 2020)

- Annual Shareholder Report

-

“Digitize Your Home” … Cityzenith Will Provide You With Your Own Limited Smart Home Model In Smart World Pro, And Allow You To Participate In Our Customer Beta Program Coming In 2020 For The New Release Of Smart World Web

Limited (7 left of 10)

Why others invested

See all reviews (0) See all (0)The world of VR is taking most of the investment opportunities and I believe that the Cityzenith is breaking new Bounds and there is so much sucess in their model.

I invested because I have worked with companies from design to installation. This new platform can take the "guess work" out of the equation; not 100%, perhaps, but a great tool to transfer "vision" on paper to "reality" on earth. I am very excited!

I invested in Cityzenith because I like how they merged so many software utilities onto one platform. Simplifying this type of real estate planning is very efficient.

About Cityzenith

Cityzenith Team

Everyone helping build Cityzenith, not limited to employees

Press

This site (the "Site") is owned and maintained by OpenDeal Inc., which is not a registered broker-dealer. OpenDeal Inc. does not give investment advice, endorsement, analysis or recommendations with respect to any securities. All securities listed here are being offered by, and all information included on this Site is the responsibility of, the applicable issuer of such securities. The intermediary facilitating the offering will be identified in such offering’s documentation.

All funding-portal activities are conducted by OpenDeal Portal LLC doing business as Republic, a funding portal which is registered with the US Securities and Exchange Commission (SEC) as a funding portal (Portal) and is a member of the Financial Industry Regulatory Authority (FINRA). OpenDeal Portal LLC is located at 149 E 23rd St #1314, New York, NY 10010, please check out background on FINRA’s Funding Portal page.

All broker-dealer related securities activity is conducted by OpenDeal Broker LLC, an affiliate of OpenDeal Inc. and OpenDeal Portal LLC, and a registered broker-dealer, and member of FINRA | SiPC, located at 1345 Avenue of the Americas, 15th Floor, New York, NY 10105, please check our background on FINRA’s BrokerCheck.

Certain pages discussing the mechanics and providing educational materials regarding regulation crowdfunding offerings may refer to OpenDeal Broker LLC and OpenDeal Portal LLC collectively as “Republic”, solely for explanatory purposes.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC make investment recommendations and no communication, through this Site or in any other medium should be construed as a recommendation for any security offered on or off this investment platform. Investment opportunities posted on this Site are private placements of securities that are not publicly traded, involve a high degree of risk, may lose value, are subject to holding period requirements and are intended for investors who do not need a liquid investment. Past performance is not indicative of future results. Investors must be able to afford the loss of their entire investment. Only qualified investors, which may be restricted to only Accredited Investors or non-U.S. persons, may invest in offerings hosted by OpenDeal Broker.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC, nor any of their officers, directors, agents and employees makes any warranty, express or implied, of any kind whatsoever related to the adequacy, accuracy or completeness of any information on this Site or the use of information on this site. Offers to sell securities can only be made through official offering documents that contain important information about the investment and the issuers, including risks. Investors should carefully read the offering documents. Investors should conduct their own due diligence and are encouraged to consult with their tax, legal and financial advisors.

By accessing the Site and any pages thereof, you agree to be bound by the Terms of Use and Privacy Policy. Please also see OpenDeal Broker’s Business Continuity Plan and Additional Risk Disclosures. All issuers offering securities under regulation crowdfunding as hosted by OpenDeal Portal LLC are listed on the All Companies Page. The inclusion or exclusion of an issuer on the Platform Page and/or Republic’s Homepage, which includes offerings conducted under regulation crowdfunding as well as other exemptions from registration, is not based upon any endorsement or recommendation by OpenDeal Inc, OpenDeal Portal LLC, or OpenDeal Broker LLC, nor any of their affiliates, officers, directors, agents, and employees. Rather, issuers of securities may, in their sole discretion, opt-out of being listed on the Platform Page and Homepage.

Investors should verify any issuer information they consider important before making an investment.

Investments in private companies are particularly risky and may result in total loss of invested capital. Past performance of a security or a company does not guarantee future results or returns. Only investors who understand the risks of early stage investment and who meet the Republic's investment criteria may invest.

Neither OpenDeal Inc., OpenDeal Portal LLC nor OpenDeal Broker LLC verify information provided by companies on this Site and makes no assurance as to the completeness or accuracy of any such information. Additional information about companies fundraising on the Site can be found by searching the EDGAR database, or the offering documentation located on the Site when the offering does not require an EDGAR filing.

To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. Therefore, when you use the Services we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver's license, passport or other identifying documents.

Republic and its affiliates are not and do not operate or act as a bank. Certain banking services are provided by BankProv, member FDIC / member DIF. Digital (crypto) assets and investment products are not insured by the FDIC, may lose value, and are not deposits or other obligations of BankProv and are not guaranteed by BankProv. Terms and conditions apply.

Made in SF/NYC