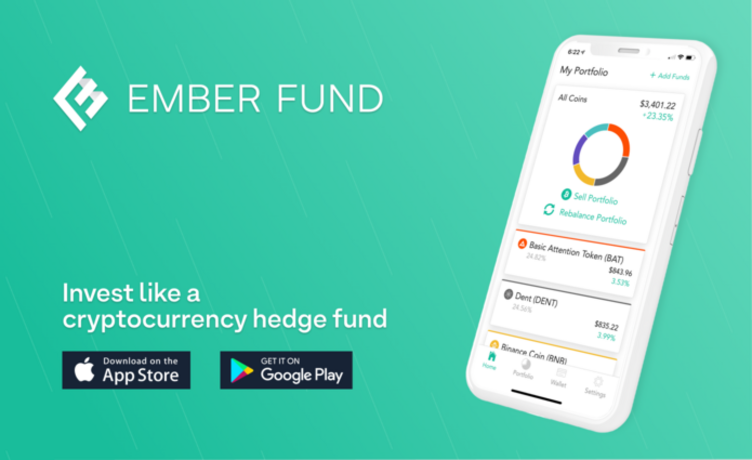

Ember Fund, makers of an AI-managed cryptocurrency portfolio app, is seeking to raise up to $1 million through a Securiti...

Problem

Investing in crypto is complicated

Cryptocurrency is unapproachable. It’s difficult for most people to understand Bitcoin, let alone follow the 2000+ cryptocurrencies on the market, and well over 90% are not legitimate. Most everyday investors want exposure but don’t know where to begin.

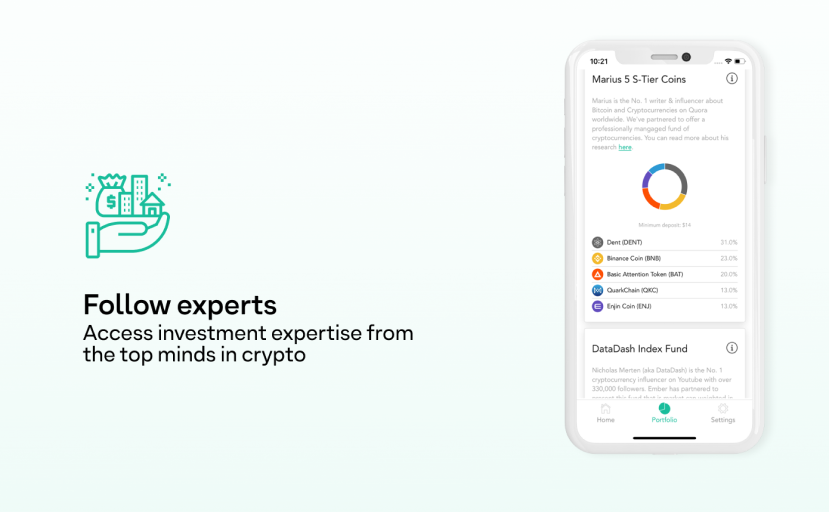

Sophisticated hedge funds and institutions continue to out-maneuver regular investors and capitalize on information advantages they have. Access to these funds is legally restricted to millionaires and billionaires and everyday investors are ignored, left out.

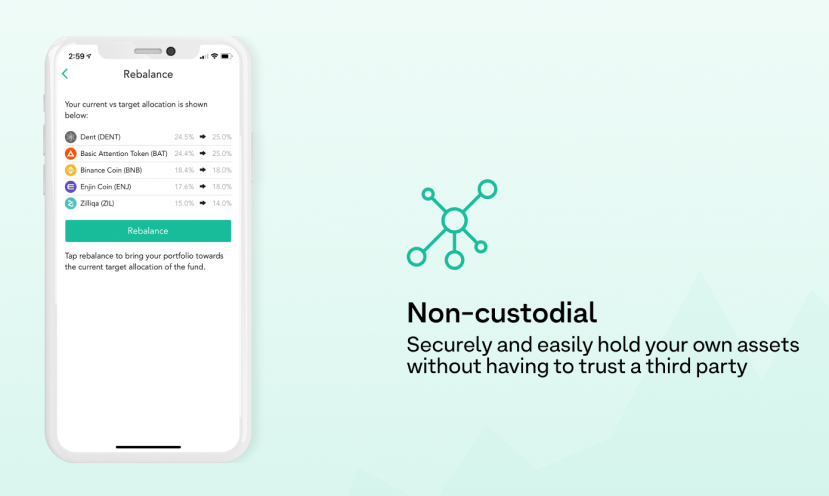

The original vision of cryptocurrency was to custody your own assets. Contrary to that vision, most solutions today are centralized, creating pools of crypto that are constantly targeted by hackers. Taking custody of your own crypto means more transparency, security, and unlimited control.

Solution

Ember Fund: the secure and easy way to invest

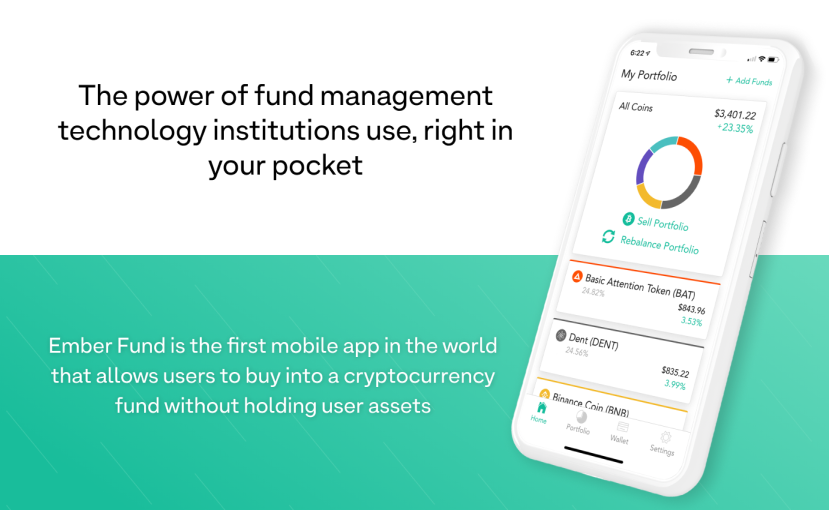

Ember Fund is the first, global mobile app that allows users to easily invest in pre-vetted cryptocurrency portfolios in just a few taps, without holding user assets. Follow the trades of experts in just one tap.

Ember Fund is non-custodial, meaning users hold onto their own assets, eliminating all the issues that come with trusting a third party (security, control, hidden fees, frozen accounts). We do not store any usernames, passwords or private keys, and everything is encrypted.

How it works

Product

Designed with a focus on security, usability, and privacy

Edge SDK

Ember uses cutting edge wallet technology powered by Airbitz/Edge. Edge, founded in 2014, is the most established non-custodial wallet system in the industry with an impeccable track record of security.

One-tap investing

Simply choose a fund and a method to make your deposit in just a few taps. Ember supports connecting with your bank account, credit cards, Coinbase or depositing from an external wallet.

Custody your assets

Retain full control of your own assets at all times without trusting a third party. No frozen accounts, no central trove of pooled assets, and full transparency.

On-chain transactions

Every transaction is done on-chain, meaning you can audit every single trade on the respective open, public, incorruptible blockchains.

Low minimums

Invest for as little as a few hundred dollars, add additional funds at any time, and liquidate your portfolio at any time with just one tap.

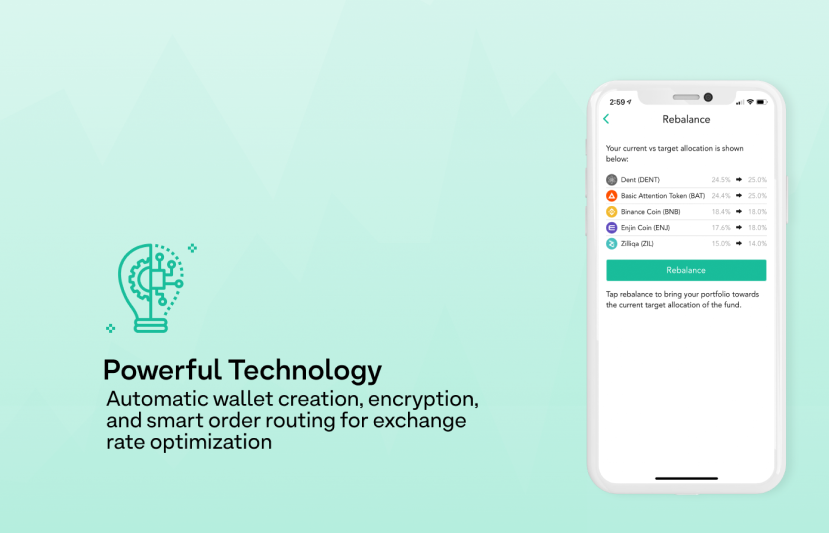

Order routing

We scour 8+ exchanges to find you the best rate on every trade (buy, sell and rebalance). Our smart order router saves an average of 1-2% per trade.

Coin support

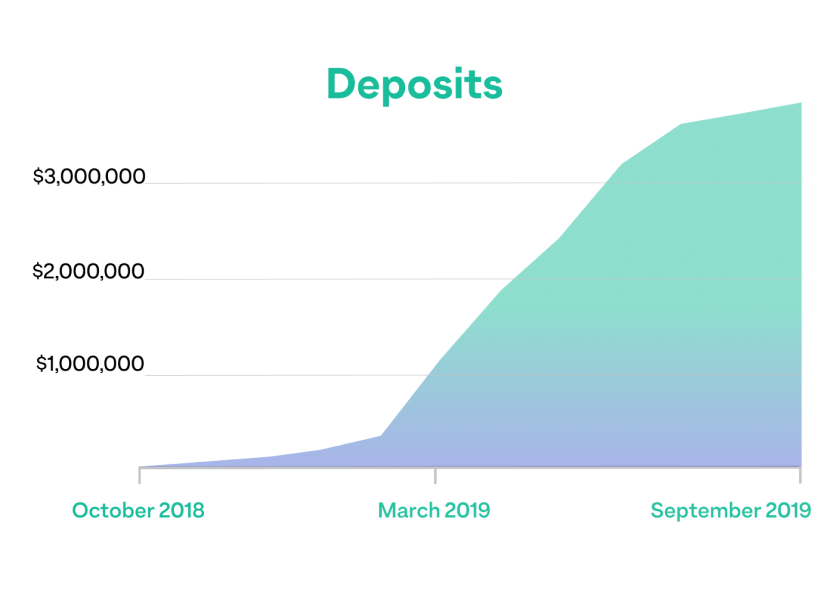

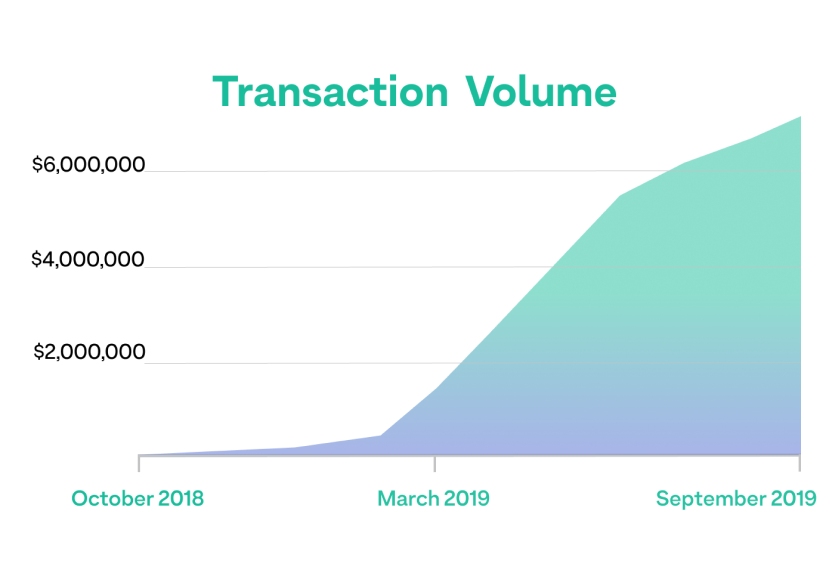

Traction

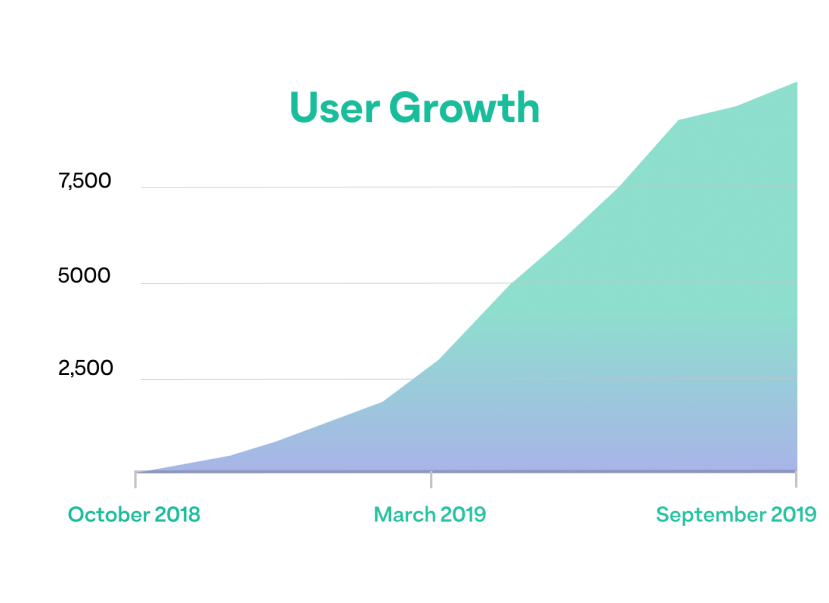

$10M in transactions and growing

Since launch at the end of 2018, Ember Fund has received massive traction and has processed over $10 million in transactions.

Media

Customers

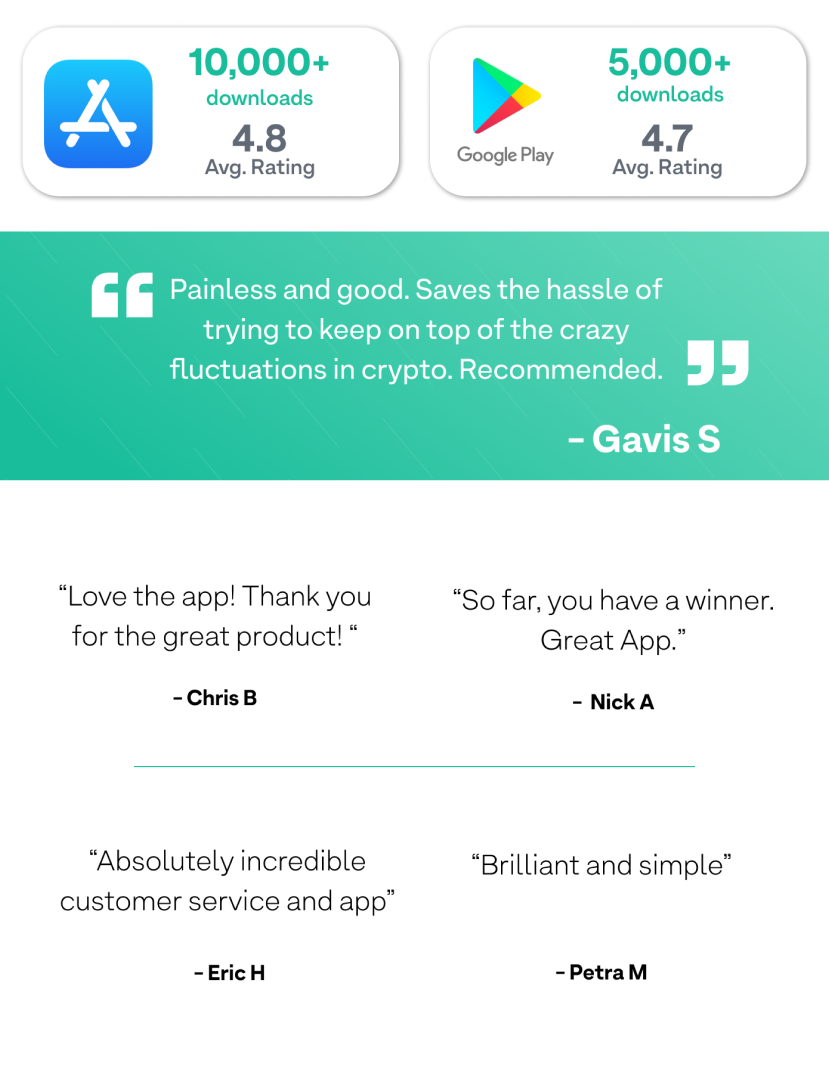

Users love Ember Fund

We're fanatical about customer support and our reviews reflect that.

Business model

1.5% on all transactions

We source liquidity from over 8 exchanges and search for the best exchange rates on every transaction (buy, sell, rebalance). Because we are exchange-agnostic, we’re able to simply search and execute at the best price. We’ve seen that on average we are able to procure a rate that is 1-2% better than the average market rate effectively making most trades free.

Our margins are over 95%. Most of our direct costs associated with our revenue are simply hosting costs which are minimal.

Market

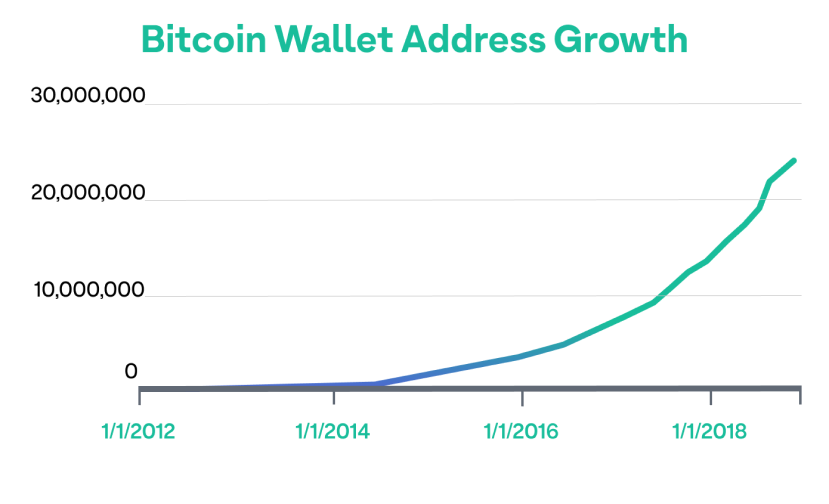

Tapping into a rapidly growing $10B+ addressable market

The crypto market is surging, with over $6B daily transactions processed in 2019 alone. We expect this to increase 10x to reach $60B+ in transactions by 2024 which translates into ~$50-$100 billion in fees collected per year.

The number of people with a Bitcoin wallet is rapidly growing.

Competition

Competitive advantages

Vision and strategy

Build product, quickly scale

We've been able to rapidly build and launch Ember Fund - our app was built and launched in 7 months with 3 full-time engineers. We've now been live for 12 months, have generated substantial traction (revenue, happy customers) and are now preparing to scale.

Product

Continuing to build out the product based on user feedback (auto-rebalancing, better trade execution, stop losses, new coin support, internationalization)

Launch other innovative products (hedging mechanism, negatively correlated assets, etc)

Support new funds: Technical Analysis Fund, Algorithmic/Quant Fund, Lending product, and others

Scale

Promote and continue building out our referral program

Continue to partner and sponsor cryptocurrency influencers with reach and voice that aligns with our brand

Scale-up existing paid marketing channels and add more marketing channels (Google, Facebook, Twitter, and Youtube)

Long Term Vision

Build the world's first decentralized bank, with an entire suite of products to manage your crypto assets

A B2B version of the app that would allow fund managers a private label version of the app

Continue to add financial products like derivatives, loan products and other tokenized assets

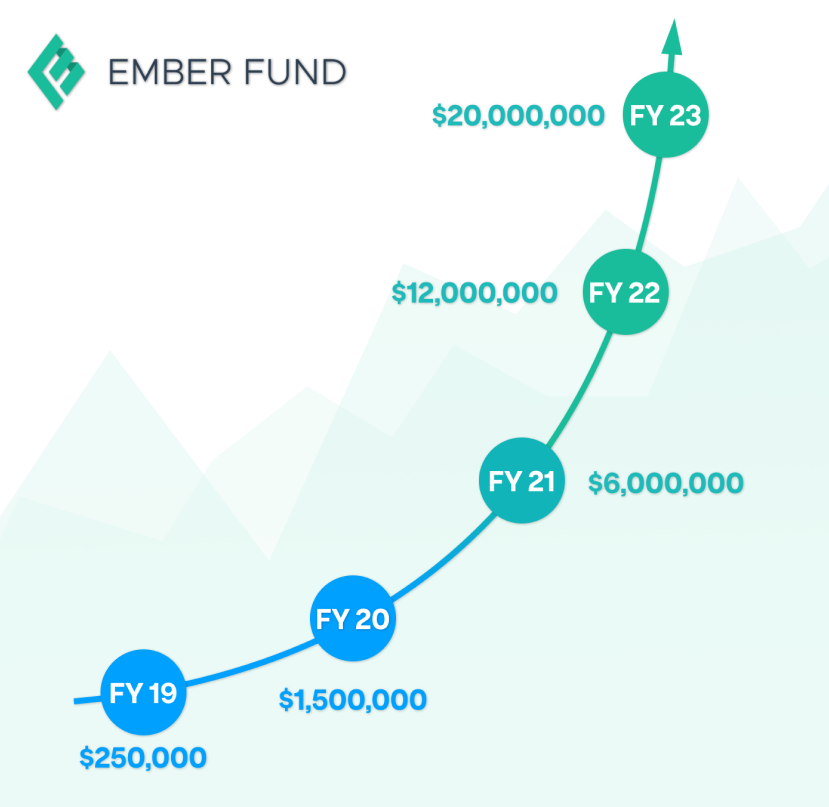

REVENUE

Funding

Bootstrapped with zero debt

Ember Fund has to this point been completely self-funded with no outside capital. With a limited budget, we built the product, secured partnerships and executed over $10 million in transactions through our platform in 9 short months. With additional funding we will be able to scale the business to a $1+ million run rate.

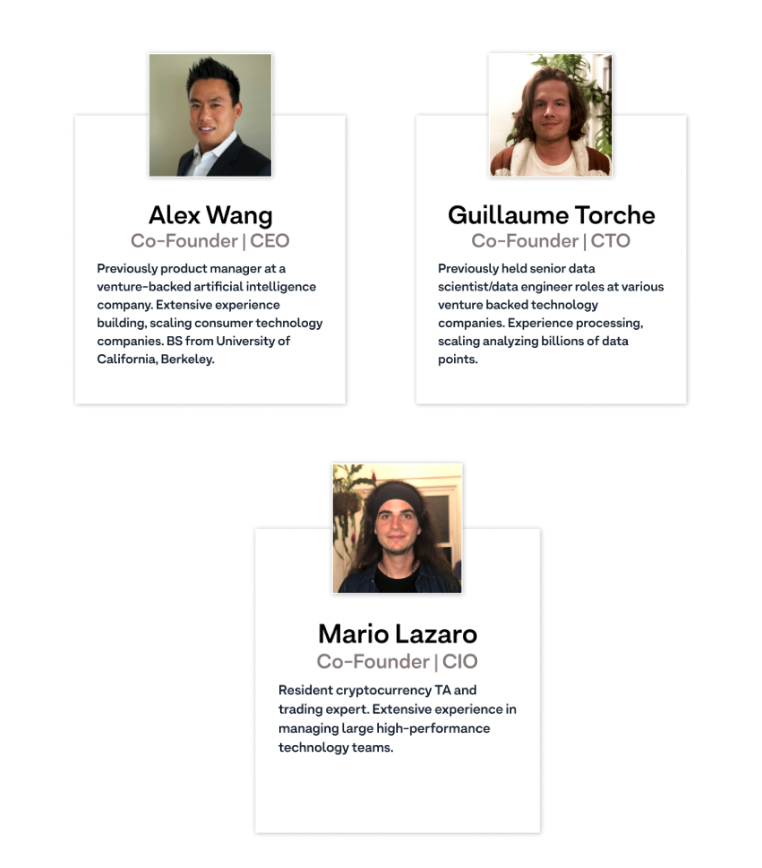

Founders

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...