Gwangju City and ESTV decided to form a working council and jointly host world e-sports competitions, nurture and exchang...

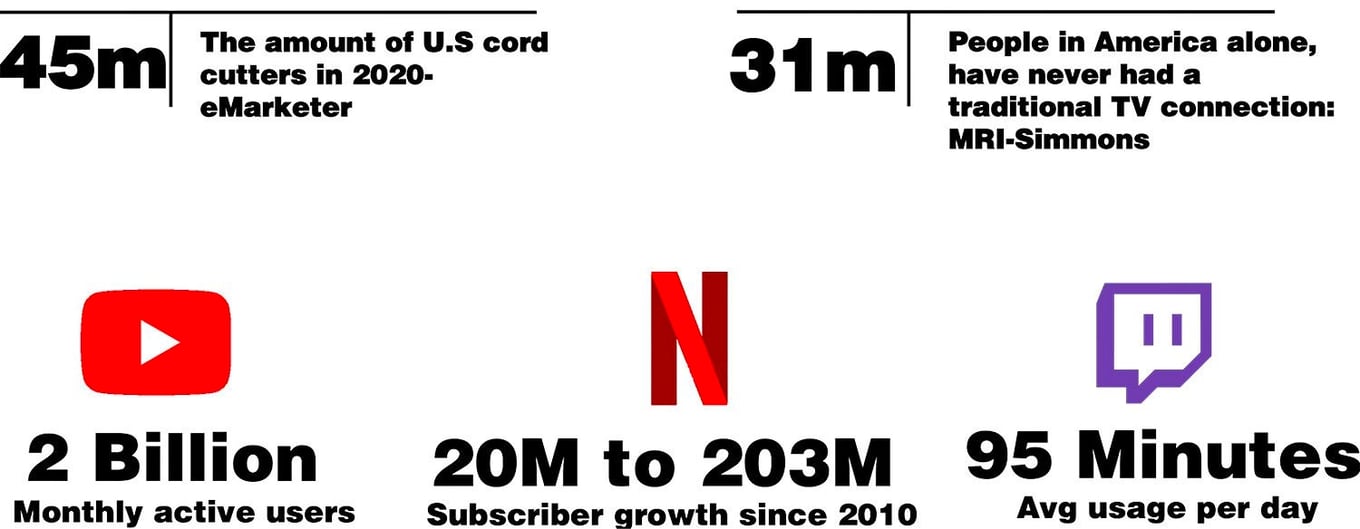

Opportunity

E-sports are transforming the media landscape...

—

...as a continuation of the global

shift to digital media:

—

Concept

ESTV

Worldwide 24-7 live

linear video channel dedicated to esports.

We champion the distribution of gaming content around the globe. Providing access and entertainment, we add value to everyone in new media.

The Ch annel

annel

ESTV is a dedicated channel for esports and gaming personalities. Watch live esports events, interact with your favorite gamers and celebrities and discover your favorite gamer’s lifestyle.

Background

Background

Launched in 2019 by the Founder of Television Korea 24 (TVK24) and TVK-POP Video on Demand, the first Korean American networks broadcasting in the U.S. since 2005.

Partnerships

Partnerships

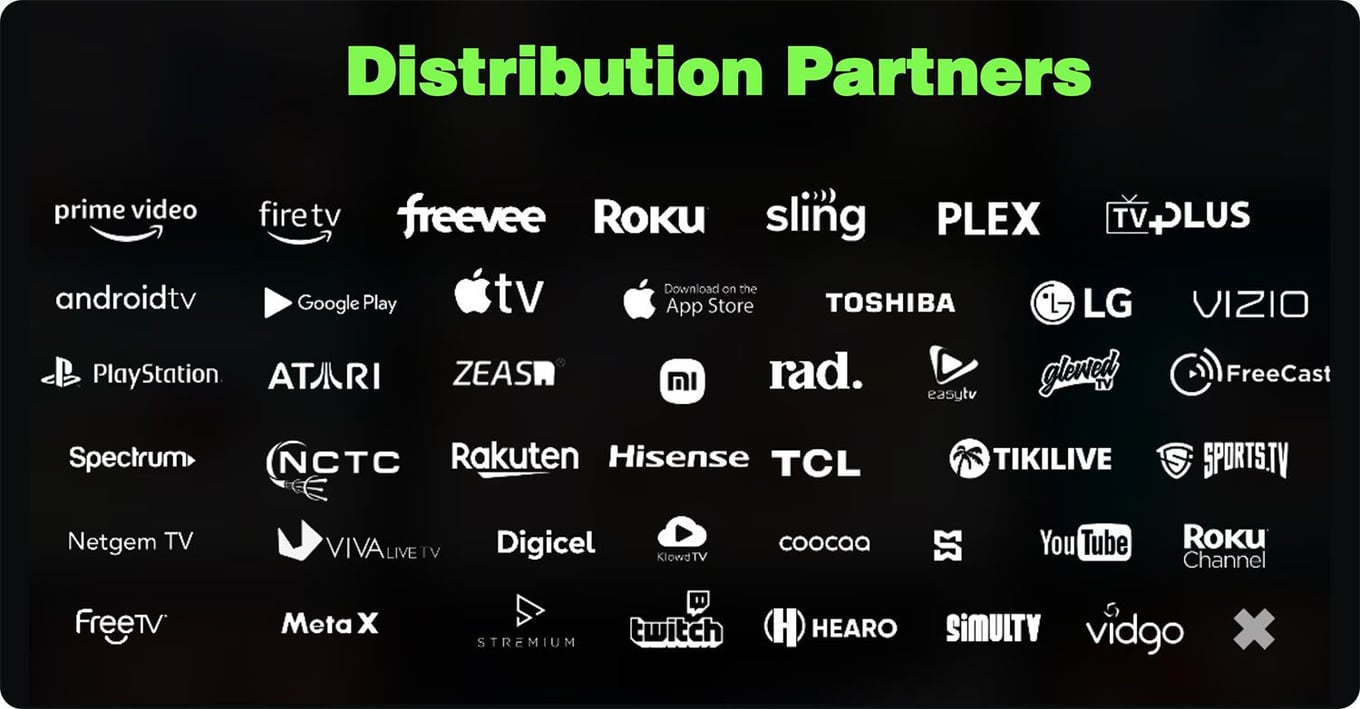

Full cross-platform content partnerships with the largest esports company and network — broadcasting, OTT, CTV, mobile and AVOD.

Product

ESTV+ on demand

Watch ESTV any way you want

- On Demand Channels

- On Demand Collections

- Featured / Popular Content

- Exclusive to ESTV

- News

- Racing Demographic:

- Chess

- College

- High School

- Pro Teams

- Video Podcasts

- Watch & Earn Reward Powered by Nodle Crypto Currency

- Watch Party Powered by Hearo Live

|

|---|

|

|

|---|

|

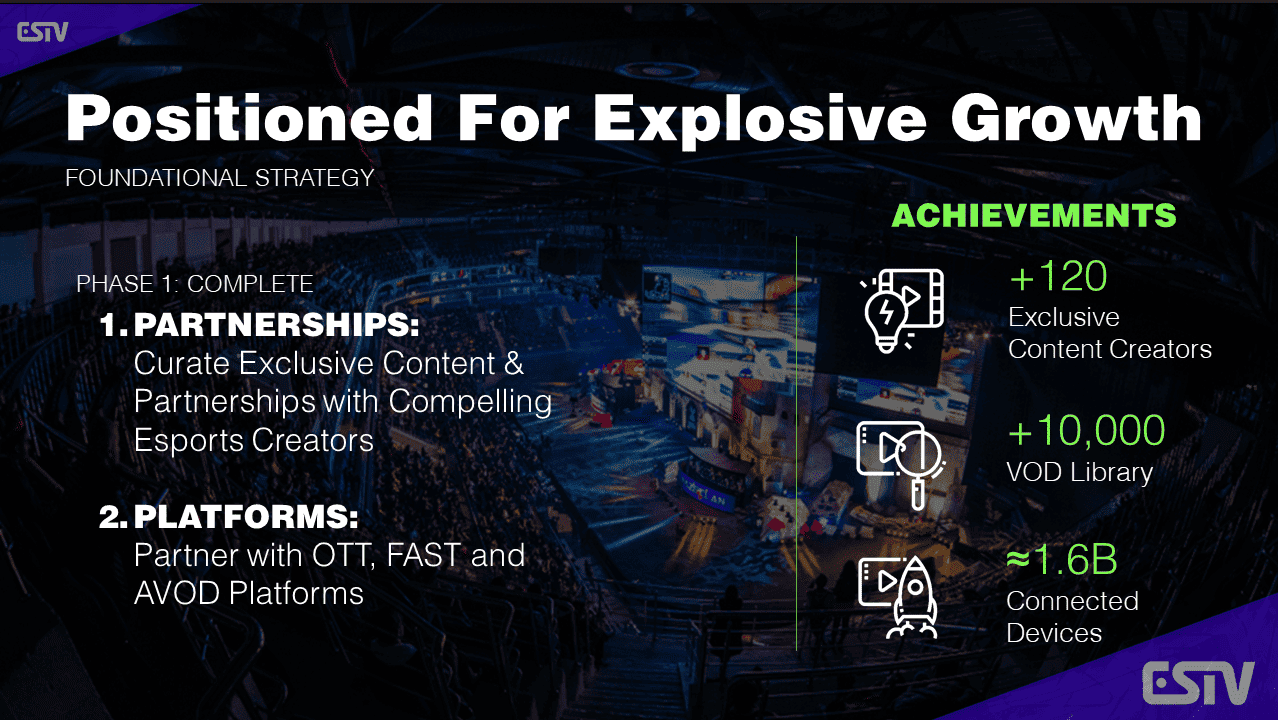

Traction

Positioned for

explosive growth

Phase 1 of our foundational strategy is complete:

- Partnerships

Curate exclusive content & partnerships with compelling esports creators - Platforms

Partner with OTT, FAST, and AVOD platforms

Phase 2 Initiatives:

- Relaunch ESTV+ 2.0 Mobile App

- Relaunch ESTV Pro Series Events

- Launch New Special Interest Channels: Simulation Football & NFT Gaming lifestyle content.

- Build & connect advertising technology platforms to enable programmatic ad buying

ESTV and ESTV+ applications are available on over 1.6 billion connected devices, streaming service subscriptions, and linear television platforms.

Customers

Viewership Makeup:

ESTV averages 14.69 Million unique users per month – of which 90 % are based in the US

- 8.7% is ages between 18 to 24

- 44.7% is ages between 25 to 34

- 33.2% is ages between 35 to 44

- 2.4% is ages between 45 to 54

Client Makeup:

Revenue-generating customers are brand advertisers who desire to reach GenZ, and Millennial audiences via advertising and event sponsorships. We offer 10 min of ad avails per hour and will be relaunching live events and original programming to provide additional brand integrations.

Market

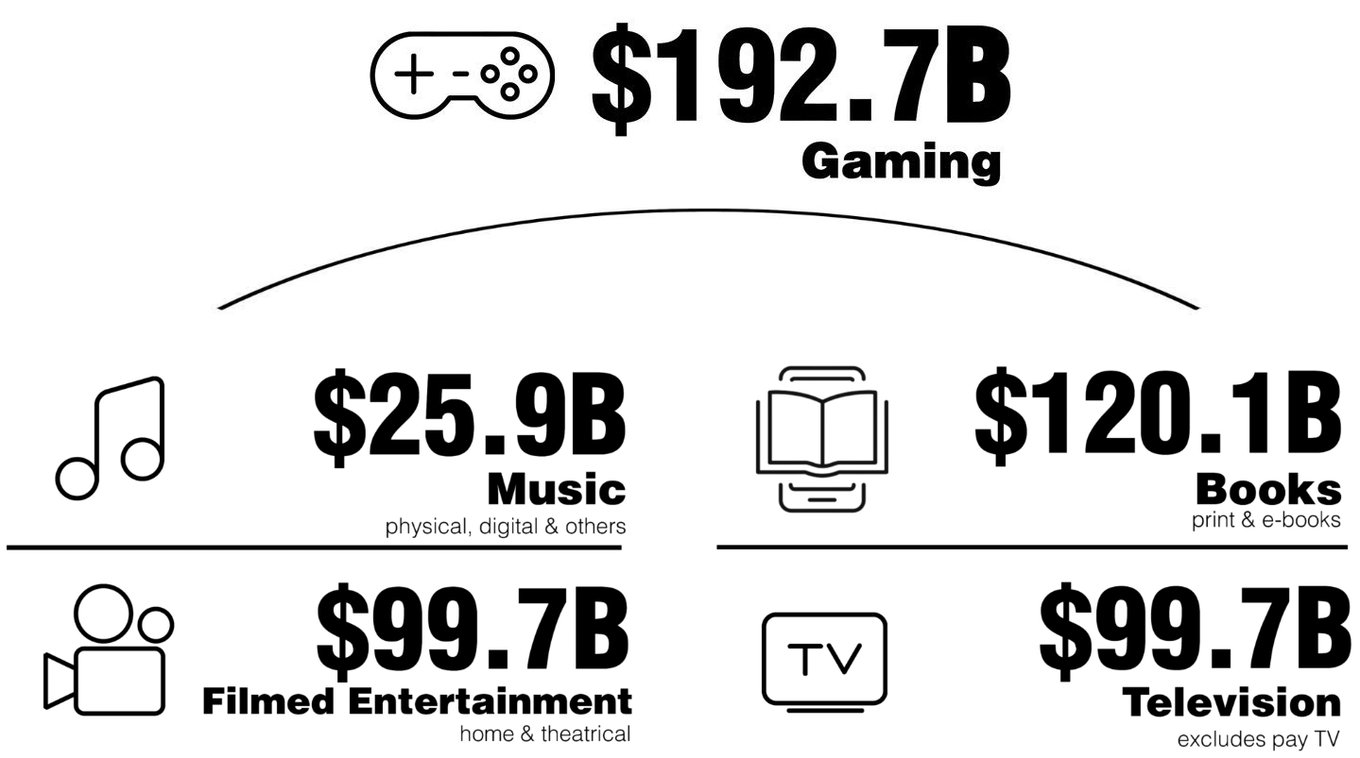

The gaming sector eclipses other forms of entertainment

The medium most favored by the young, video games, is among the sectors experiencing the most significant growth.

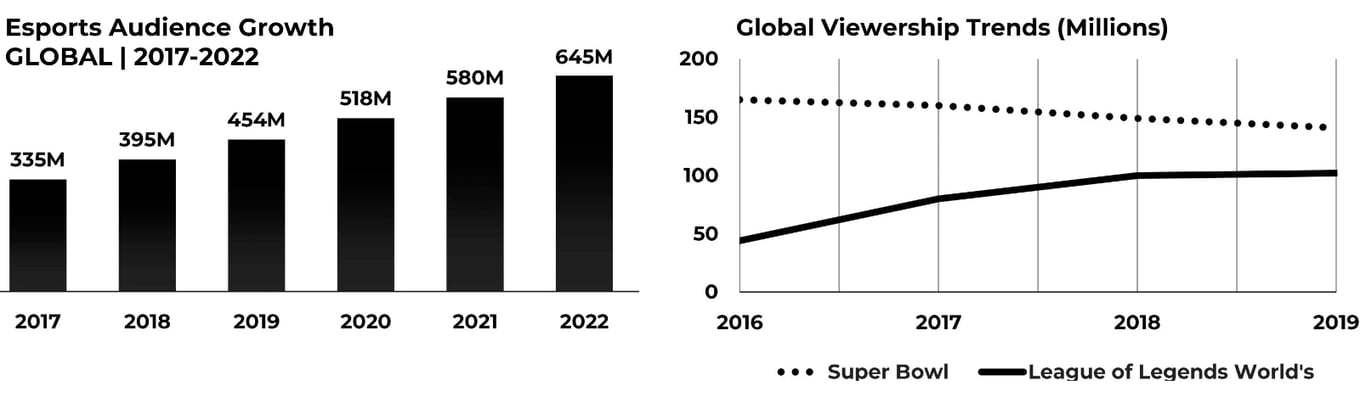

- The esports audience will reach 640.8 million by the end of 2025, with a 2020-2025 CAGR of +8%. [News Direct]

We expect sponsorship to account for $837.3 million—nearly 60% of global esports revenues. [NewZoo]

Games live-streaming audience expected to reach 1.41 billion by 2025, a CAGR of +16.3%. [NewZoo]

Esports is set to generate nearly $1.38 billion in revenues by the end of 2022. [NewZoo]

Marketers will keep spending more to meet customers where they are – in digital spaces.

——

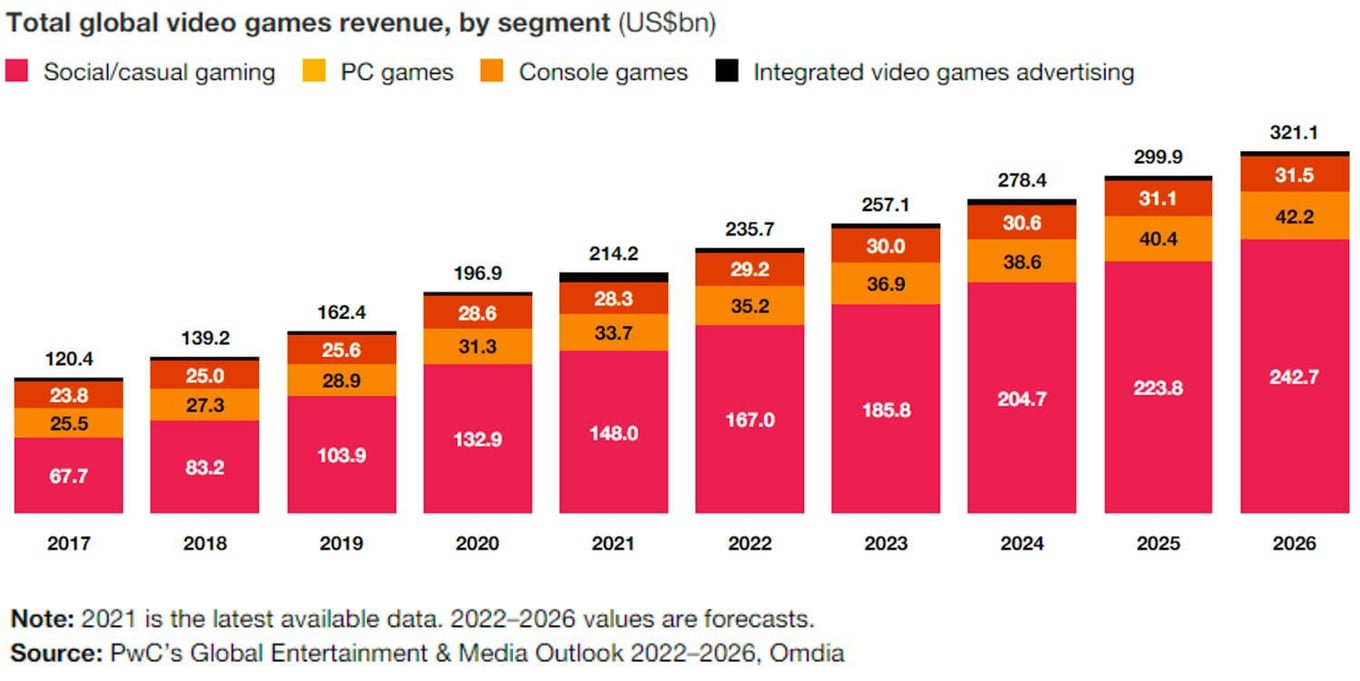

Gaming

Social and casual gaming is fueling a boom in the sector.

——

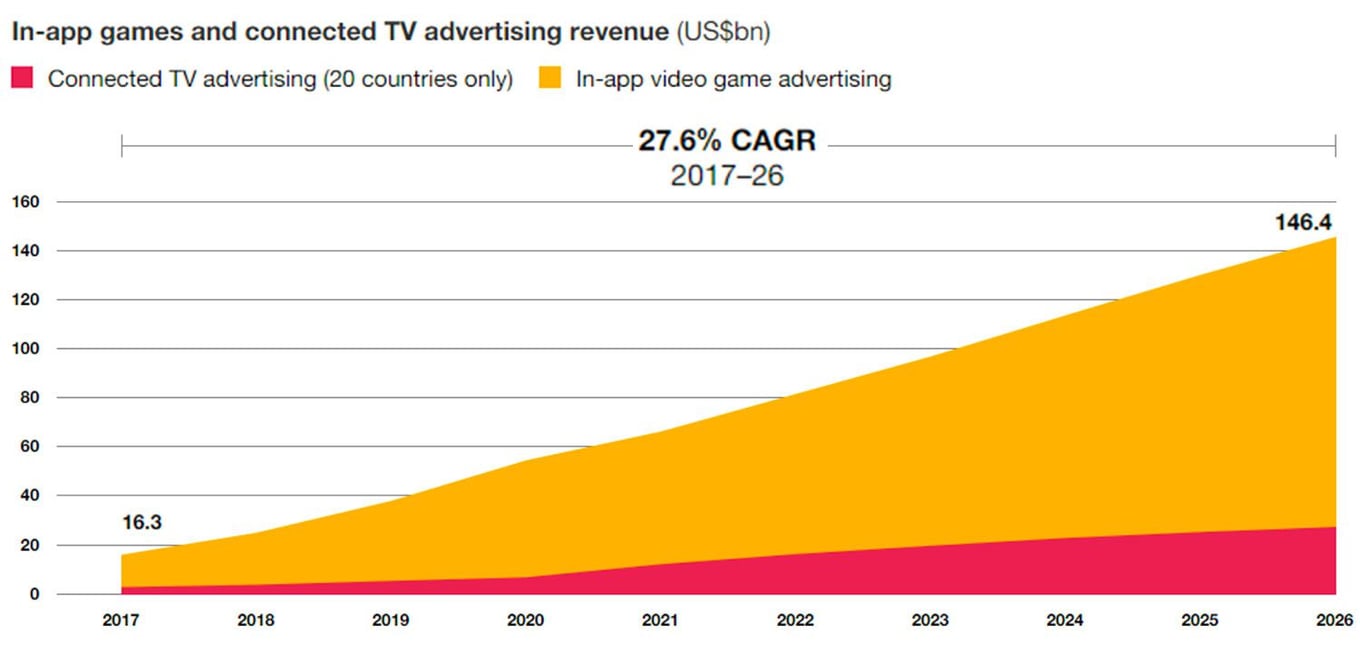

New platforms

Advertising on connected television and in video games is turning into a significant market.

Household brands are recognizing the value

of this elusive audience

"Esports as a marketing vehicle was an obvious choice for SoFi. It represents an unrivaled opportunity to engage with a young and difficult to reach audience, en mass."

"Esports as a marketing vehicle was an obvious choice for SoFi. It represents an unrivaled opportunity to engage with a young and difficult to reach audience, en mass."

- VP, Sports Marketing and Media, SoFi

“In the long term, esports will be our biggest footprint. The younger generation, being born digital first, doesn’t really care about TV or traditional advertising. Esports is our tool to reach them.”

“In the long term, esports will be our biggest footprint. The younger generation, being born digital first, doesn’t really care about TV or traditional advertising. Esports is our tool to reach them.”

- Head of BMW Brand Experience Shows & Events

“Putting ourselves at the heart of the action we can build affinity with millions of millennial gaming enthusiasts and confirm our position as a global innovator’’.

“Putting ourselves at the heart of the action we can build affinity with millions of millennial gaming enthusiasts and confirm our position as a global innovator’’.

- Director of Sponsorships and Partnerships at Visa

"Leaning into esports represents ESPN’s focus on serving sports fans and expanding audiences."

"Leaning into esports represents ESPN’s focus on serving sports fans and expanding audiences."

- ESPN EVP, Sales and Marketing

Vision and strategy

Vision and Strategy:

- With funding, we will be able to relaunch customer activation programs like ESTV+ 2.0, which enable watch & earn currency programs that convert cryptocurrency enabling purchases of sponsor merchandise/services/NFTs, ESTV event tickets & VIP experiences. Our watch & earn wallet functionality will fully integrate with popular and highly accessible cryptocurrency wallets and exchanges using pokadot parachain.

- The ESTV Korea Virtual Gaming Center offers a unique portal into the birthplace of esports and the distinct culture of South Korea. It invites esports fans from around the world to participate in exciting watch & earn events, or engage in rewarding play & earn competitions. This innovative virtual world provides gamers with fulfilling experiences filled with exhilarating fun, unique K-culture surprises, and a multitude of rewards including home delivery of K-food. With your investment you’ll get a free VIP pass and experience a virtual trip that’s almost as good as going there.

- Leveraging the global brand power of ESTV (the ESPN of esports) we will bring together power-house pro series to create new and original content highlighting never before seen tournaments and exclusive events.

- Lastly, Gaming enthusiasts will delight in our Gamer Lifestyle NFT channel, which features collectibles, limited releases, and wildly popular artistic creations celebrating gaming culture & lifestyle.

Use of Proceeds

- Launching two new additional channels

Simulation Football League - NFT Gaming Art & Gaming Culture

- Expanded distribution of ESTV channels

- Relaunch of ESTV+ App with promotion & marketing budget

- Creating a virtual gaming center creating immersive ESTV Korea experiences

- Hiring ad sales & sponsorship team

- Technology enhancements to support Web3

- Content creation

- Original programming

- ESTV Pro Series events

Impact

MBE certification

by the National Minority Supplier

Development Council (NMSDC)

The National Minority supplier Development Council is the global leader in advancing business opportunities for its certified Asian, Black, Hispanic and native American business enterprises and connecting them to member corporations.

Criteria for Certification:

- United States citizens.

- Minority businesses must be at least 51% minority–owned, managed and controlled. For the purposes of NMSDC’s program, a minority group member is an individual who is at least 25% Asian-Indian, Asian-Pacific, Black, Hispanic or Native American. Minority eligibility is established via a combination of document reviews, screenings, interviews and site visits. Ownership, in the case of a publicly owned business, means that at least 51% of the stock is owned by one or more minority group members.

- Must be a for profit enterprise and physically located in the U. S. or its trust territories.

- Management and daily operations must be exercised by the minority ownership member(s).

Founders

Eric Yoon

Chief Executive Officer & Founder

Founder & CEO, ESTV & TVK24

Founder & CEO, ESTV & TVK24

Esports Advisor: NFL Alumni Association Business Advisor: Hearo.LIVE, TurnCoin, NODLE, MetaLife, Exverse, Devour, Metasport Arena

Ambassador: BAPES

Former Entertainment banker with Merrill Lynch & Swiss Bank – UBS.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...