Iris App co-founder Chris Josephs joins 'Fox & Friends Weekend' to provide insight into young investors trading stock...

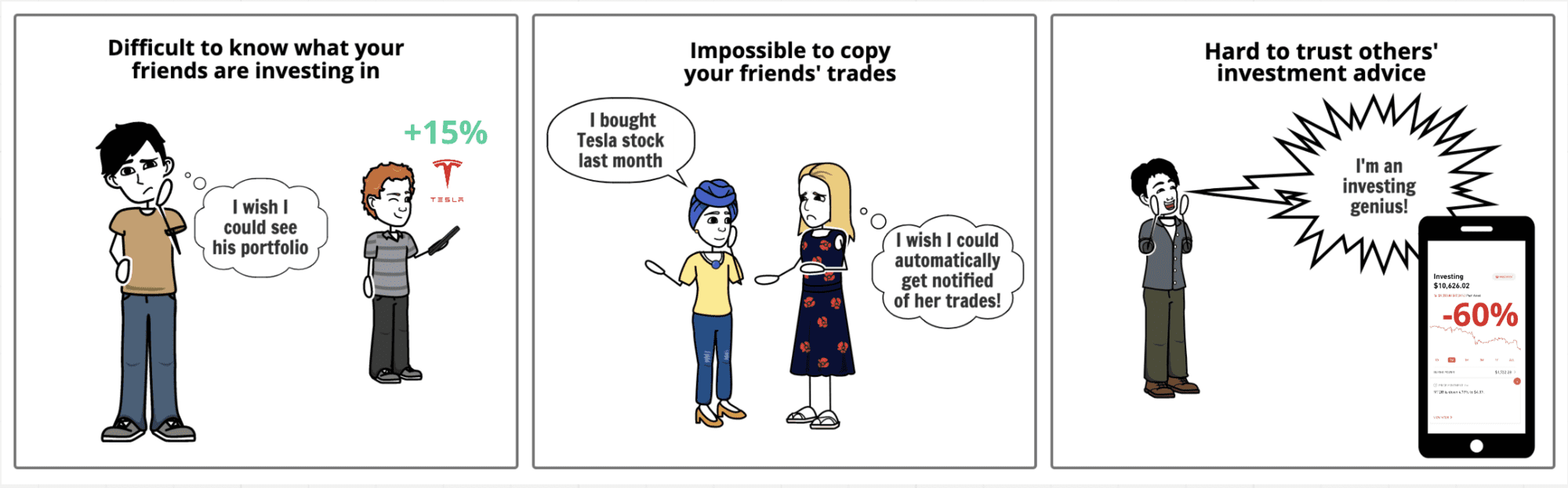

Problem

Investing together with friends is hard to accomplish

The investing landscape is shifting. Investing used to be driven by Wall Street. It used to be a complex and private activity for most people. Today, investing is increasingly driven by retail investors. It is collaborative, social, and transparent. Unfortunately, today's community platforms like Reddit, Facebook, Twitter, LinkedIn, and Discord are not built specifically for social investing.

Solution

Trade together. With magic.

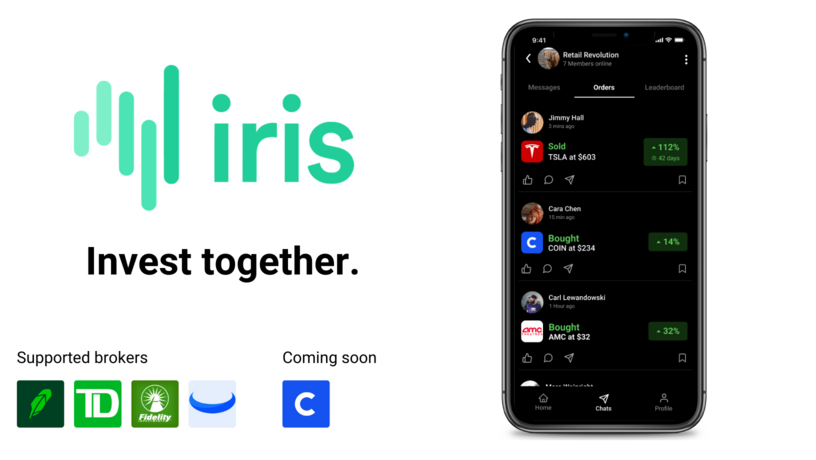

Iris is a social stock market app that lets users connect their brokerage accounts, and automatically share their real-time trades and portfolios with others.

We believe that together, we’re better investors and our app brings that same spirit of social sharing and community collaboration found in Instagram, Twitter, and Facebook to the investment world.

Iris is custom built for social investing

Iris shares holdings and trades in percentages; it does not share dollar amounts. Users have privacy controls to manage their sharing activity. Iris does not sell users' personal data.

Product

Iris gives you all the tools to trade together with friends

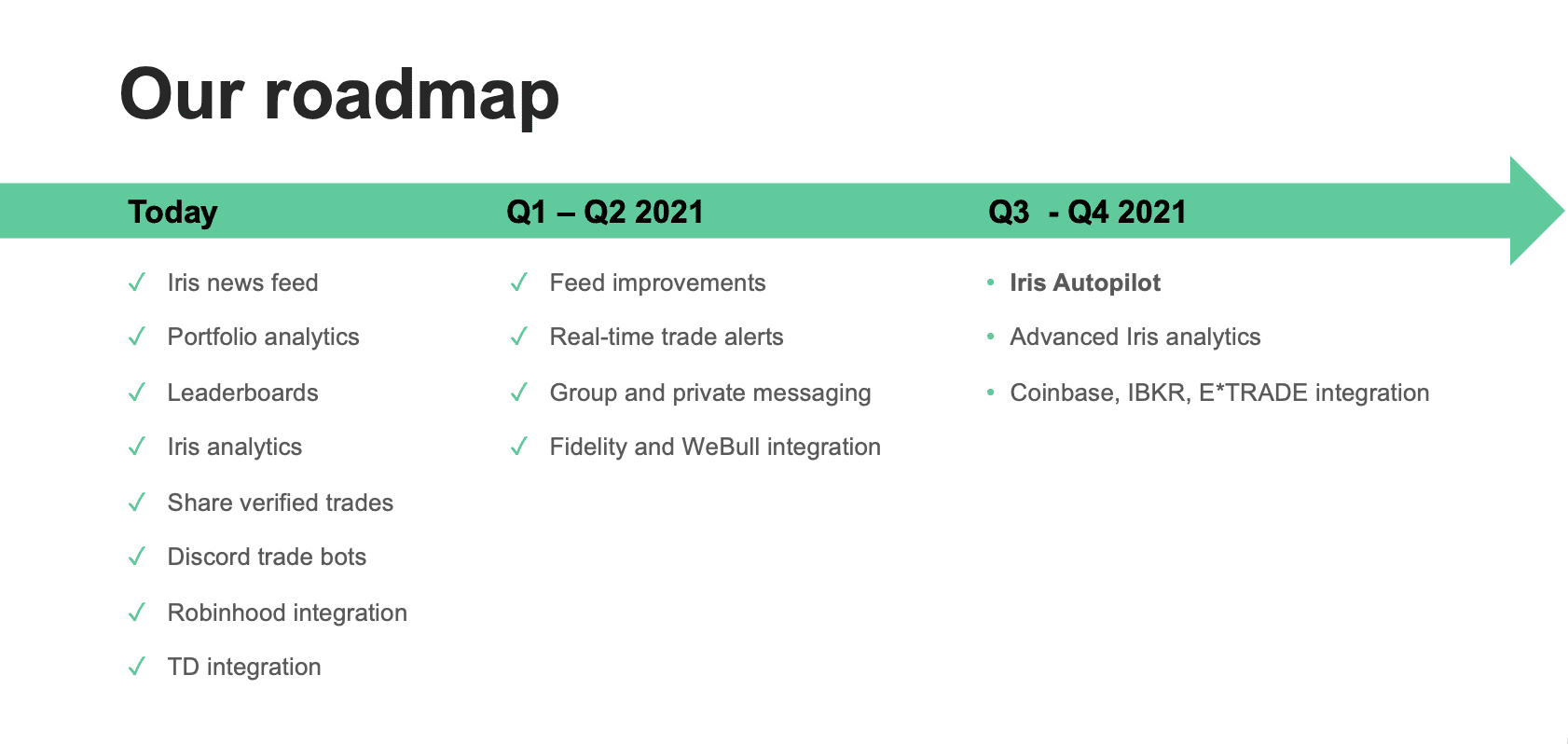

Simply connect your brokerage and let Iris do the heavy lifting for you. It works with Robinhood, Fidelity, TD Ameritrade, and WeBull today, with support for Coinbase, Interactive Brokers, E*TRADE, and Charles Schwab coming soon. Iris is available on iOS and Android.

Key product features and demo

Traction

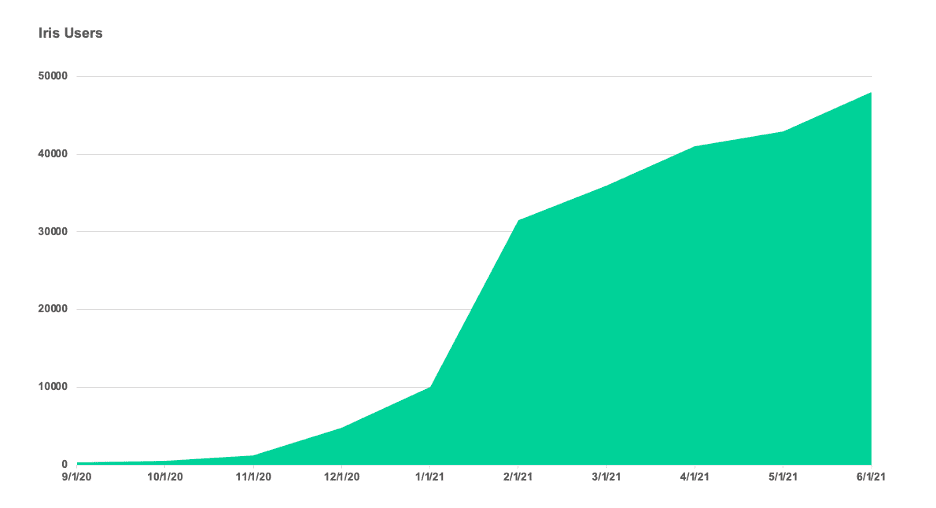

Added 47K users in 9 months

Iris officially launched in September 2020. Since then we’ve added 47K users and see over 11K monthly active users. We’ve tracked $4.1B+ in orders and see $170M+ in connected portfolios. Our growth is from 60% organic referrals and 40% influencer promotions - a blended CAC of <$1 per user.

The key to our user growth has been two-fold:

- We understand who our users are. Our typical user is a GenZ / Millennial, who "actively" trades, is early in their investing journey and has less than $50K in their brokerage account. They are willing to spend time actively trading to increase wealth, and they are very social and transparent with investment discussions. In every product feature and design choice, we ask: How can we make this person's experience with Iris magical?

- We understand the power of influencers. Influencers grow social platforms. Finance influencers are a new category emerging on all major platforms including Twitter, Instagram, YouTube, and TikTok. They are building brands with millions of followers. We have struck partnership deals with finance and lifestyle influencers like @InTheMoney, @Litquitdity, @TrustFundTerry, @ScottySire, @TikStocks, and others to share Iris with their audiences.

We're tremendously grateful to our users and our partners for being with us and supporting us so early in our journey.

Customers

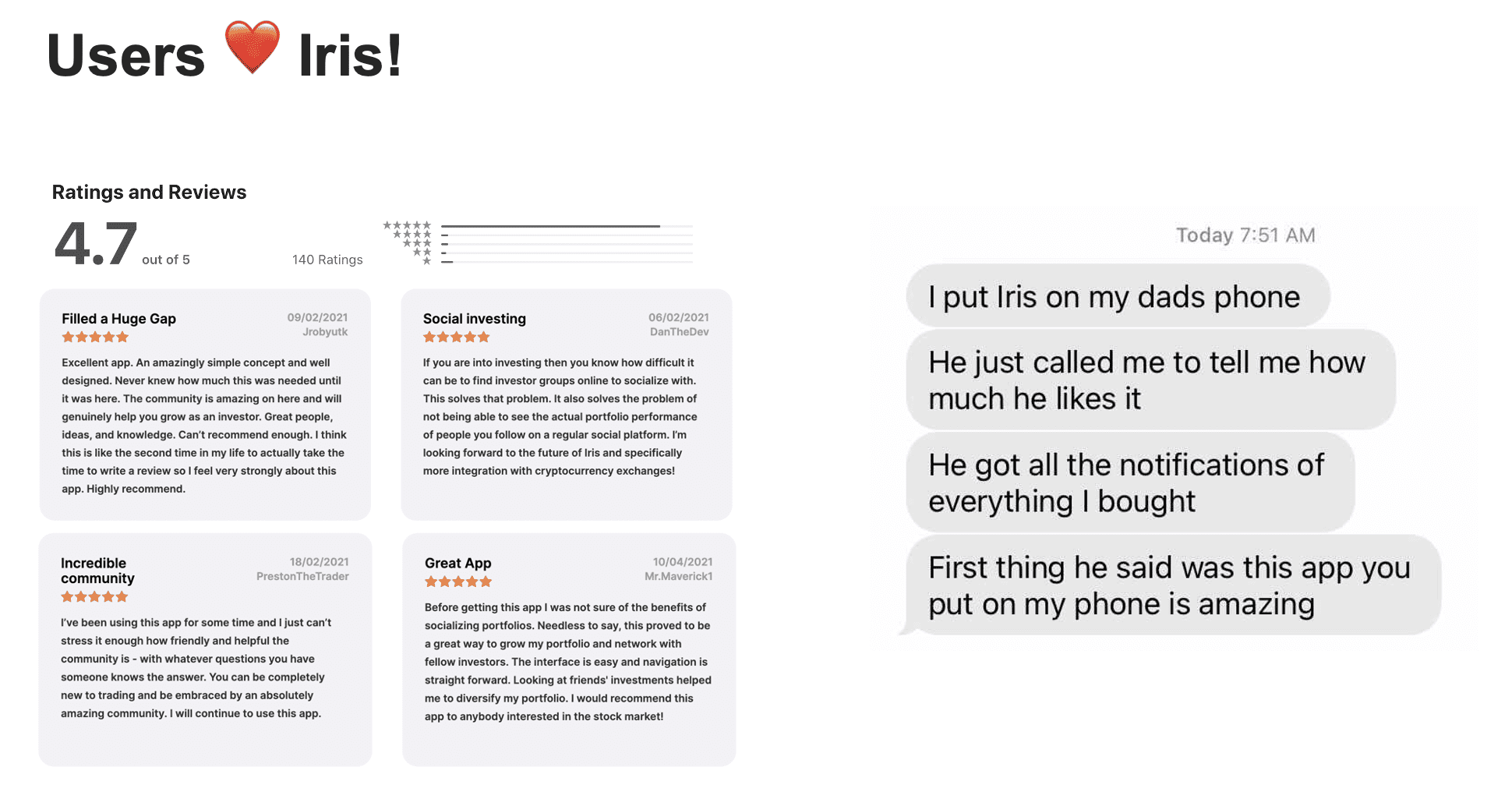

Rated 4.7 stars on iOS

We’ve seen not only phenomenal user growth but customer reception as well. Our product has been rated 4.7 out of 5 stars as of our campaign launch on Republic. In particular, users love the positive and encouraging Iris community as well as the incredible trade ideas they discover every day.

Business model

Commercialization plans

Currently, Iris is pre-revenue but we are exploring two monetization options:

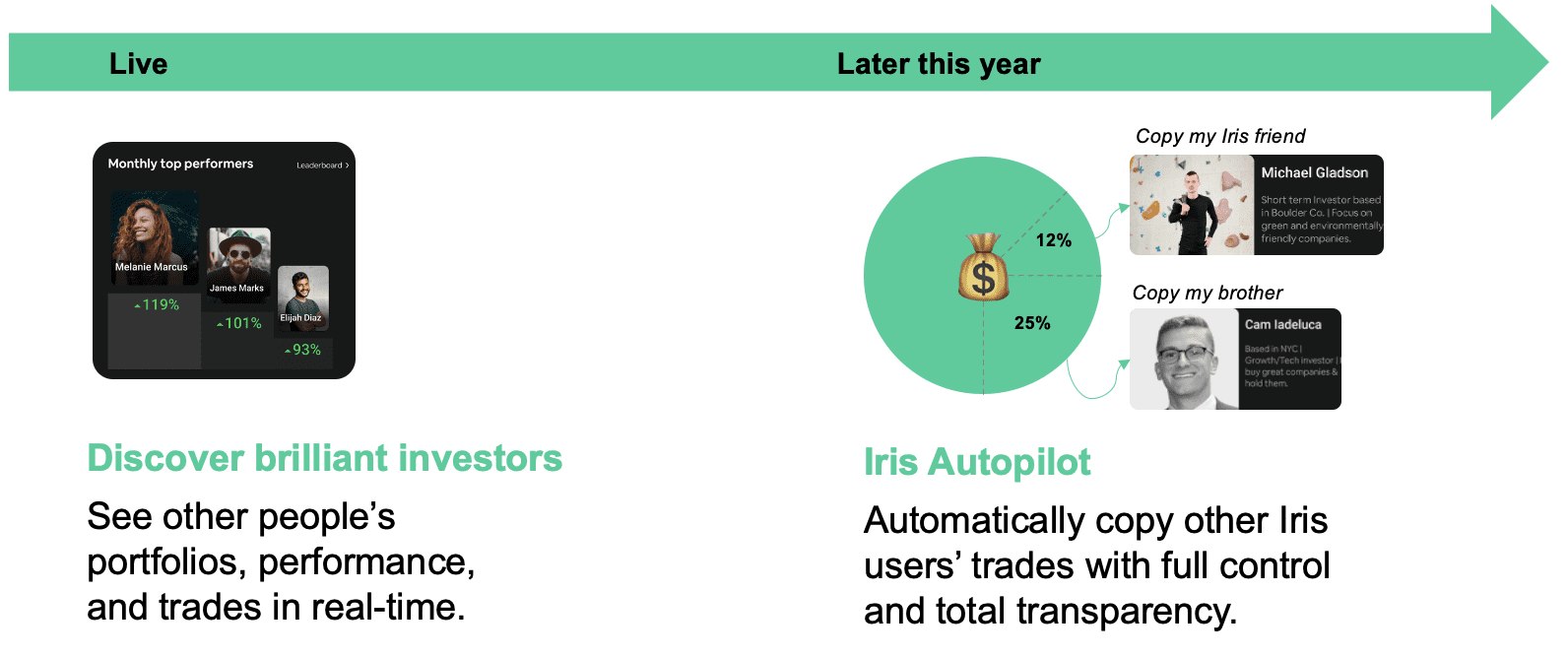

- Iris Autopilot. Users can allocate a portion of their portfolio to automatically copy trades of Iris’ most brilliant financial minds.

- Iris subscription. Iris will provide subscription services for market research and community analytic insights similar to Robinhood Gold.

The diversity of these monetization channels and the different offerings will allow Iris to broaden our customer base.

Iris does not and will not sell users' personal data.

Market

150M+ retail investors in US

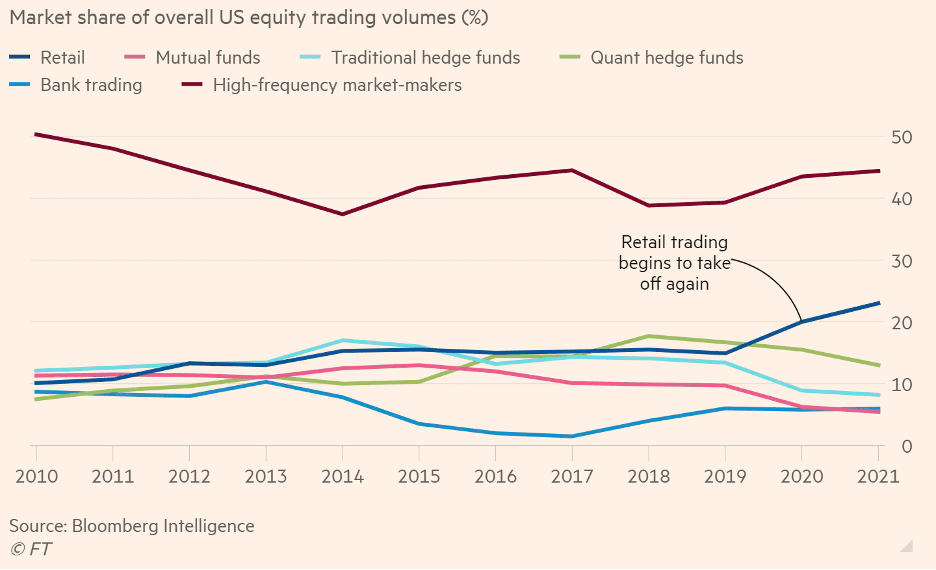

Retail investors are a growing and enduring consumer segment. There are 150M+ retail investors in the US as of June 2021 and they are trading at record levels.

Our timing could not be better

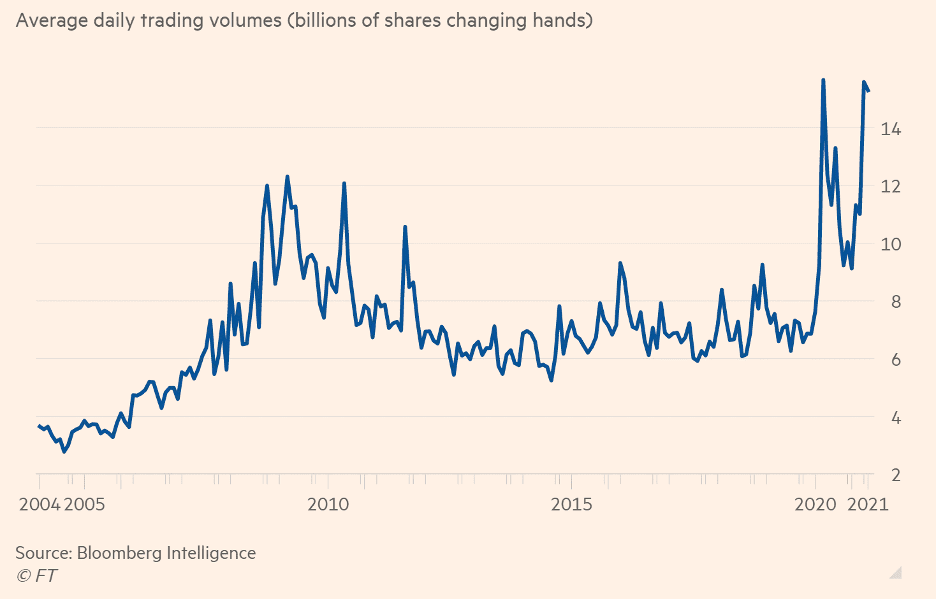

US retail stock trading volume hits new records in 2020

Retail trading volume is twice that of mutual and hedge funds combined

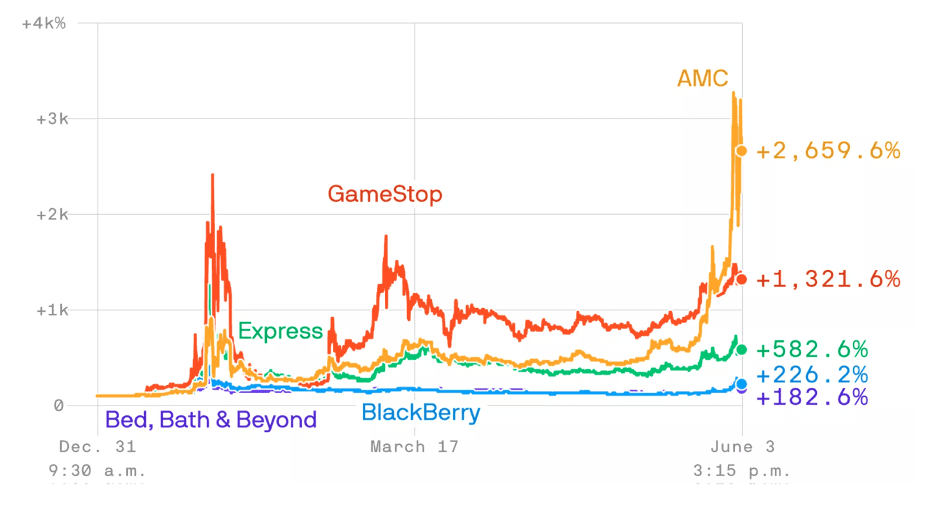

Social investing is moving the markets

What does this all mean? Our timing could not be better in launching Iris. Our user base is growing in number, they are more active in the market, and they are demanding online platforms to support their investment activity. Recent events like GameStop's frenzy have made this market hotter than ever, and we appeal to both the social and financial aspects of modern investing.

Competition

Iris's technology is unmatched

Iris's closest competitors are other social investing platforms like Commonstock, Finary, and Wolf Financial. Our key differentiator:

Our indirect competition are social brokerages like Robinhood, eToro, and Public.com. The key competitive advantage we have is that Iris is brokerage agnostic and offers social stock-market conversations to its users across brokerages.

Vision and strategy

Investing on autopilot

Iris today lets users see other people’s portfolios, performance, and trades in real-time and discover brilliant investors. However, our long-term plan is to build a wide range of products, including an automated investing platform.

This is because the overarching purpose of Iris is to accelerate the shift from an elite few “managing” humanity’s wealth to having every person on the planet manage their own money, which will be a major catalyst in bringing prosperity to the masses.

Turning every person on the planet into a self-directed investor is a monumental challenge. Many find it time-consuming, complex, or boring. Today, Wall Street elites manage most people's money In pension funds and retirement accounts but they do a terrible job at it, often delivering below-market returns, charging astronomical fees, and providing little transparency into investment decisions.

People need an alternative to Wall Street. People want complete transparency over how their money is invested. There are incredible everyday investors who make amazing returns. A future where we follow these brilliant minds is more hopeful than a future where we blindly entrust Wall Street.

Today, these retail heroes remain hidden behind the walls of their brokerage. Iris will uncover these retail traders so that the rest of us can choose which ones we want to follow on Autopilot.

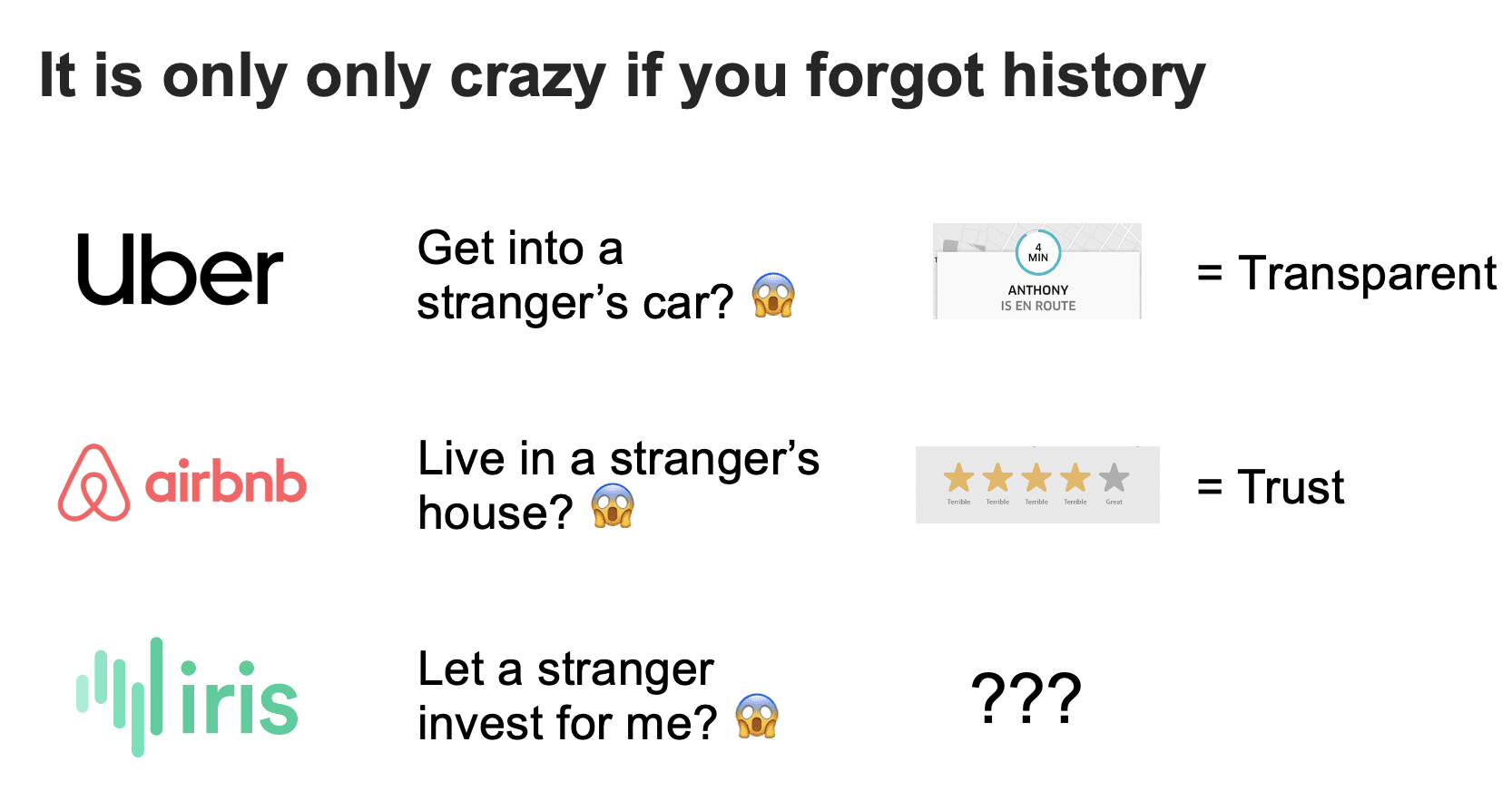

Are we nuts to think that people will let their family, friends, and even internet strangers manage their money for them?

Iris has successfully developed our first product and generated massive traction over the last 9 months. Moving forward, we plan to introduce Iris autopilot, advanced analytics and build integrations to more brokerages.

Funding

Backed by Incline VC and Path VC from San Francisco

Prior to our Republic campaign, we’ve secured pre-seed funding from Incline VC and Path VC, raising $650K+ including from friends and family.

Founders

A team with breadth and depth of experience

Brian Schardt, CEO and CTO: Brian developed a love for business in high school when he started selling violins online. He paired an efficient Chinese manufacturing process, with his custom violin designs to produce an amazingly high-quality instrument for a fraction of the cost. By working with Lindsey Stirling (largest YouTube violinist) to market the violins to the masses, he grew Inova Sound into a successful business, all before graduating high school.

Brian's zest for programming video games and learning software engineering early led him to start a crowdfunding website that was acquired while he was in college. This passion for engineering also led him to work for a smart locker startup, Parcel Pending. In his first 2 weeks on the job, Brian successfully built critical product features that the company estimated would cost $3M and many months to develop.

Prior to Iris, Brian led PwC's technology startup branch, New Ventures. At 23, and as one of the youngest managers at PwC, he developed a customized derivative trading tool for large clients like Bank of America and Cargill, with a specialized focus on security and reporting. His love for the stock market and his experience with difficulties talking about investing in a transparent way with his family and friends led him to found Iris.

Adi Lingampally, COO and CFO: Adi has been deeply passionate about investing ever since he won a stock market trading competition in the 7th grade. A lifelong trader in public and private equities, his goal now is to help others understand the importance of investing and make it easy to do so. Previously, Adi was a Principal with Oliver Wyman, a leader in financial management consulting. His thoughts on technology and AI have been published in Harvard Business Review and World Economic Forum. He holds an MBA from the University of Michigan.

Chris Josephs, Growth: Chris holds a Bachelors degree in Finance and Marketing from Villanova University. After working in the finance industry out of college, he quit his job to pursue entrepreneurship and founded a sports compression company. He is an expert in brand storytelling, building strategic partnerships, and leads Iris' growth initiatives.

Aaron Langley, Engineering: Aaron holds a B.A. in Liberal Arts (focused on Math and Philosophy) which served as a foundation for his engineering career in the commercial IoT/Robotics industry. Aaron spent 3 years leading the development of large-scale consumer and business-facing IoT products before joining Brian, his good friend and college roommate, to help lead the development of Iris. Aaron embraces the idiosyncrasies of online investing forums like WallStreetBets and wants to bring the best of what they offer to Iris.

Scott Schardt, Engineering: Scott's goal is to flip the dynamic of the retail trader engagement with the market on its head. He is a one of the founding engineers on the Iris team and is passionate about building a quality product.

We have a team of nine professionals, including seven employees, dedicated to making cementing Iris's spot as the go-to app for social trading.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...