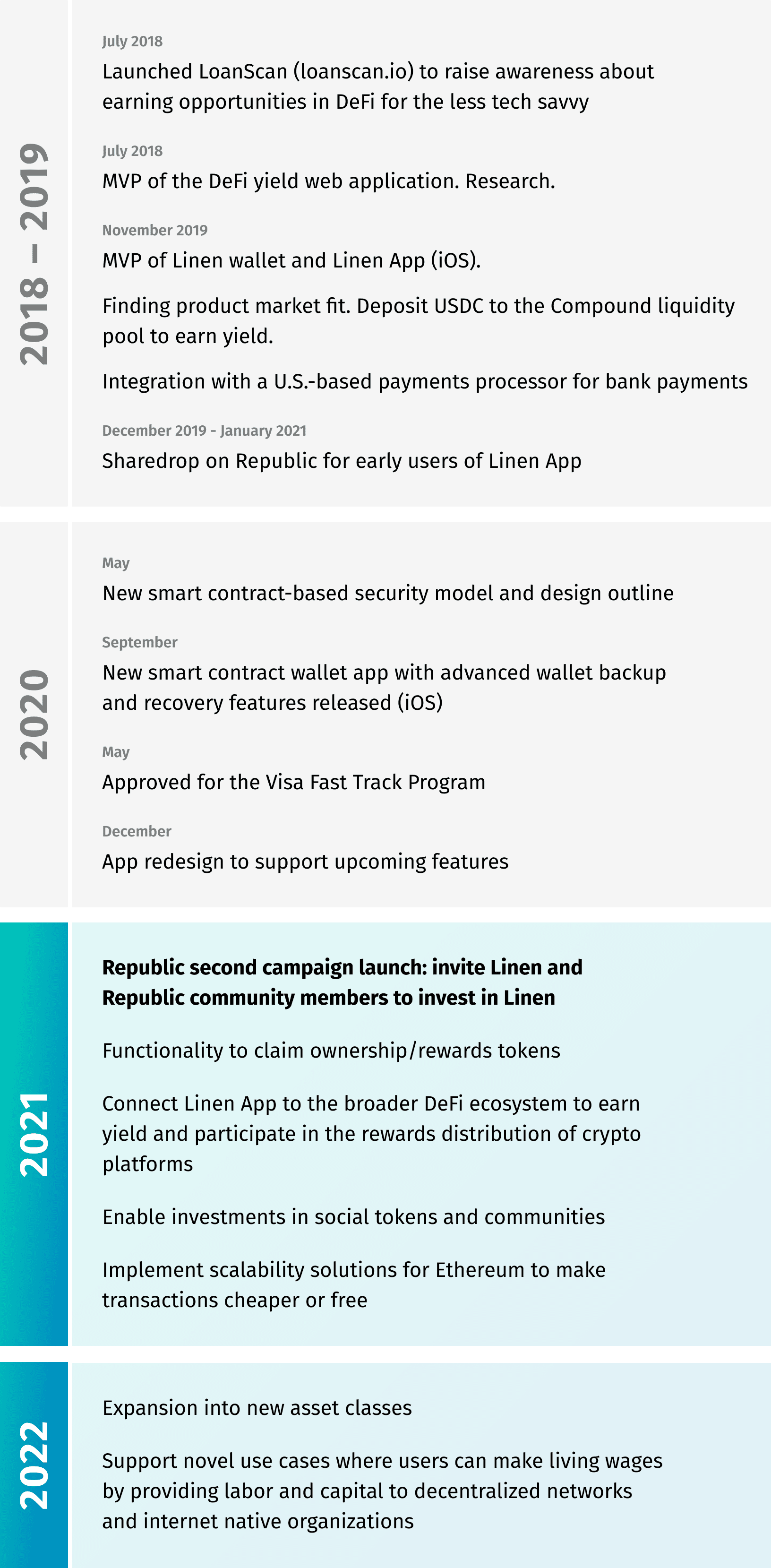

How did Linen App get started? My co-founder Alex and I entered Decentralized Finance (DeFi) at the beginning of 2018. Th...

Early Bird Special: $19.8M Valuation Cap for Crowd SAFE units sold until 11:59 PM PST on March 8, 2021; $22M Valuation Cap thereafter

Problem

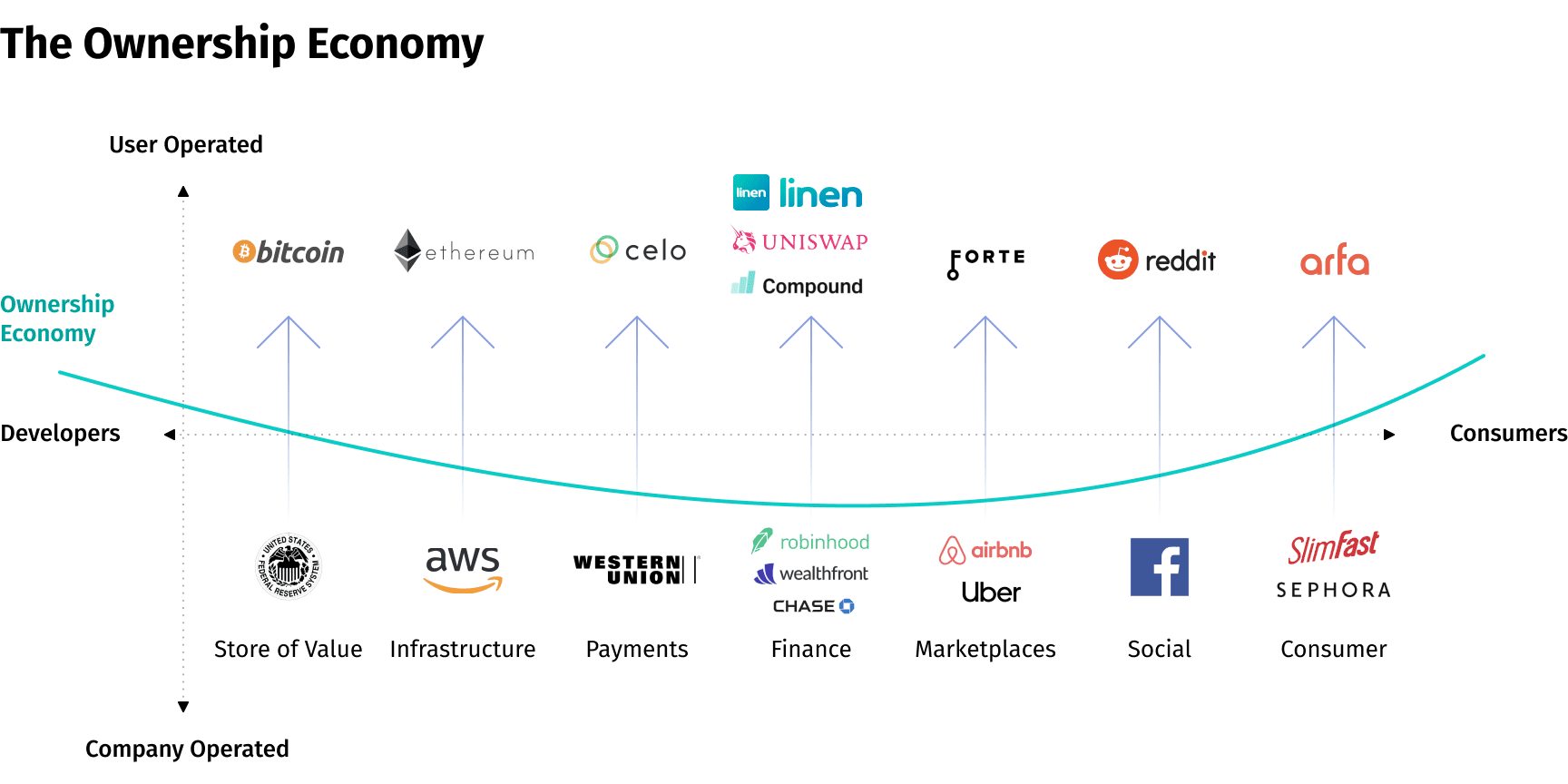

Ownership economy is a new way of building engagement between brands, communities, and customers

Technology giants like Airbnb, Uber, Robinhood, and others owe their success to their users. But the majority of the value they create is captured by a few early venture capital investors.

Unlike traditional companies, new community-owned platforms often allocate an unusually high percentage of their shares — sometimes 30% to 60% — to early users. This is because these companies and platforms recognize the enormous value created by early users. Would Airbnb or Uber be where they are without the first 10,000 loyal hosts or drivers?

New relationships between brands and customers are optimized for sustainability, ownership, equity, or community engagement — NOT for value extraction from customers.

Crypto networks highlighted a new economic foundation now being used by the next generation of market driven, user operated platforms. Credit for this image goes to Jesse Walden from Variant Fund. We edited the original image. Source: https://variant.fund/the-ownership-economy-crypto-and-consumer-software/

Crypto networks highlighted a new economic foundation now being used by the next generation of market driven, user operated platforms. Credit for this image goes to Jesse Walden from Variant Fund. We edited the original image. Source: https://variant.fund/the-ownership-economy-crypto-and-consumer-software/

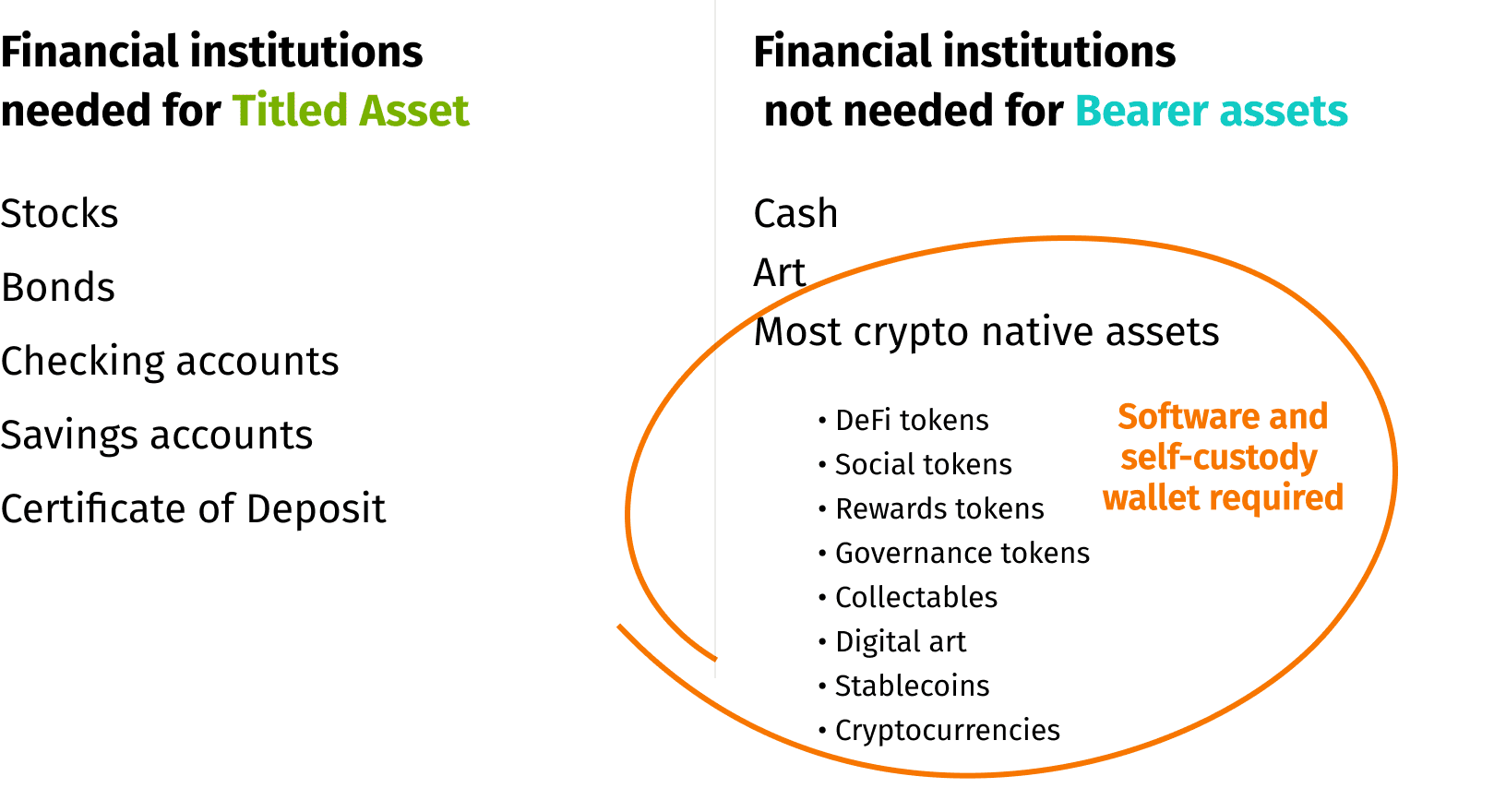

Many of these new use cases are possible today because ownership interest in platforms or networks is issued on blockchains in the form of “crypto assets” or “tokens.”

Existing financial infrastructure is not set up to handle this change.

Solution

Linen: build wealth with the ownership economy

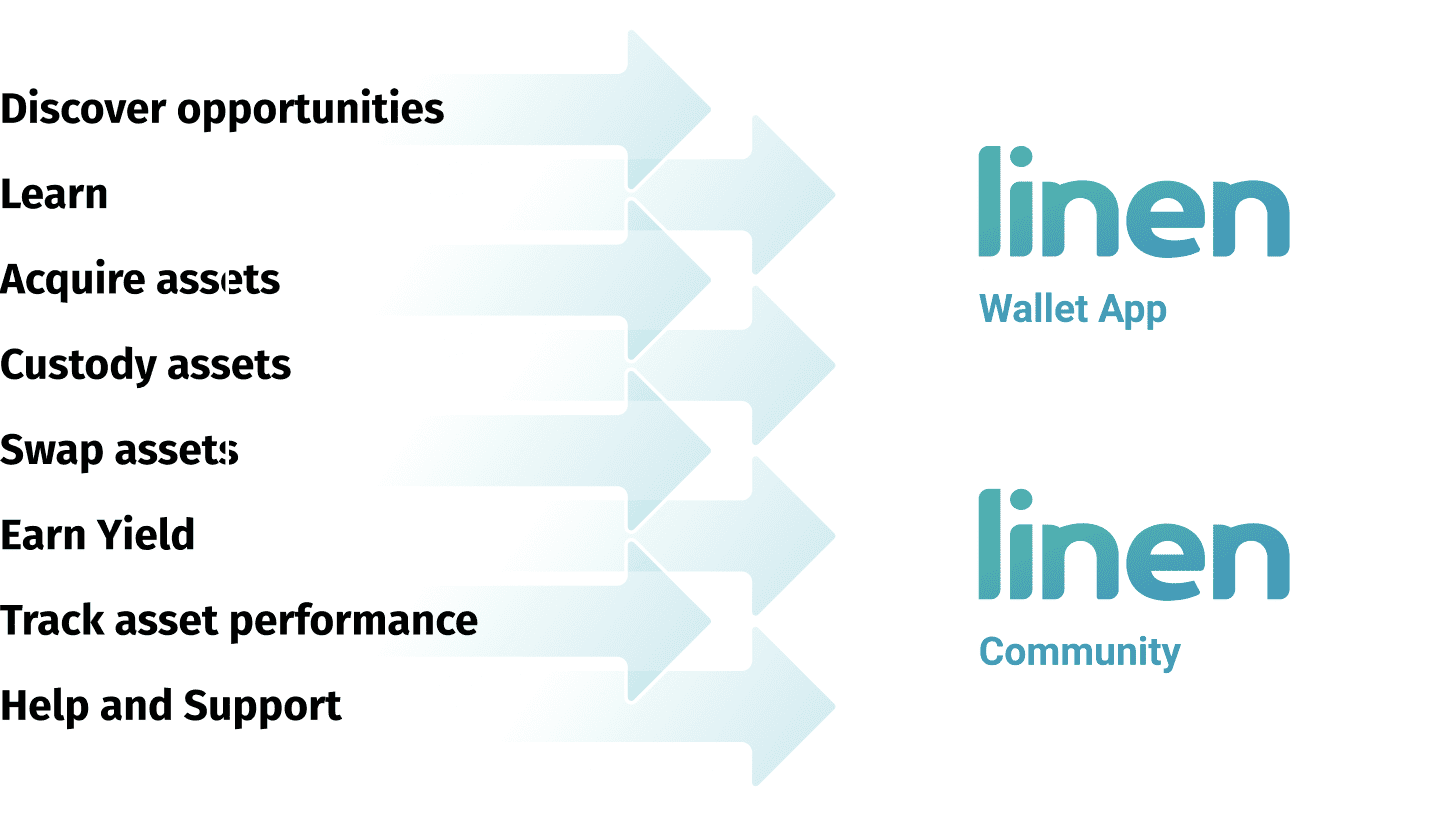

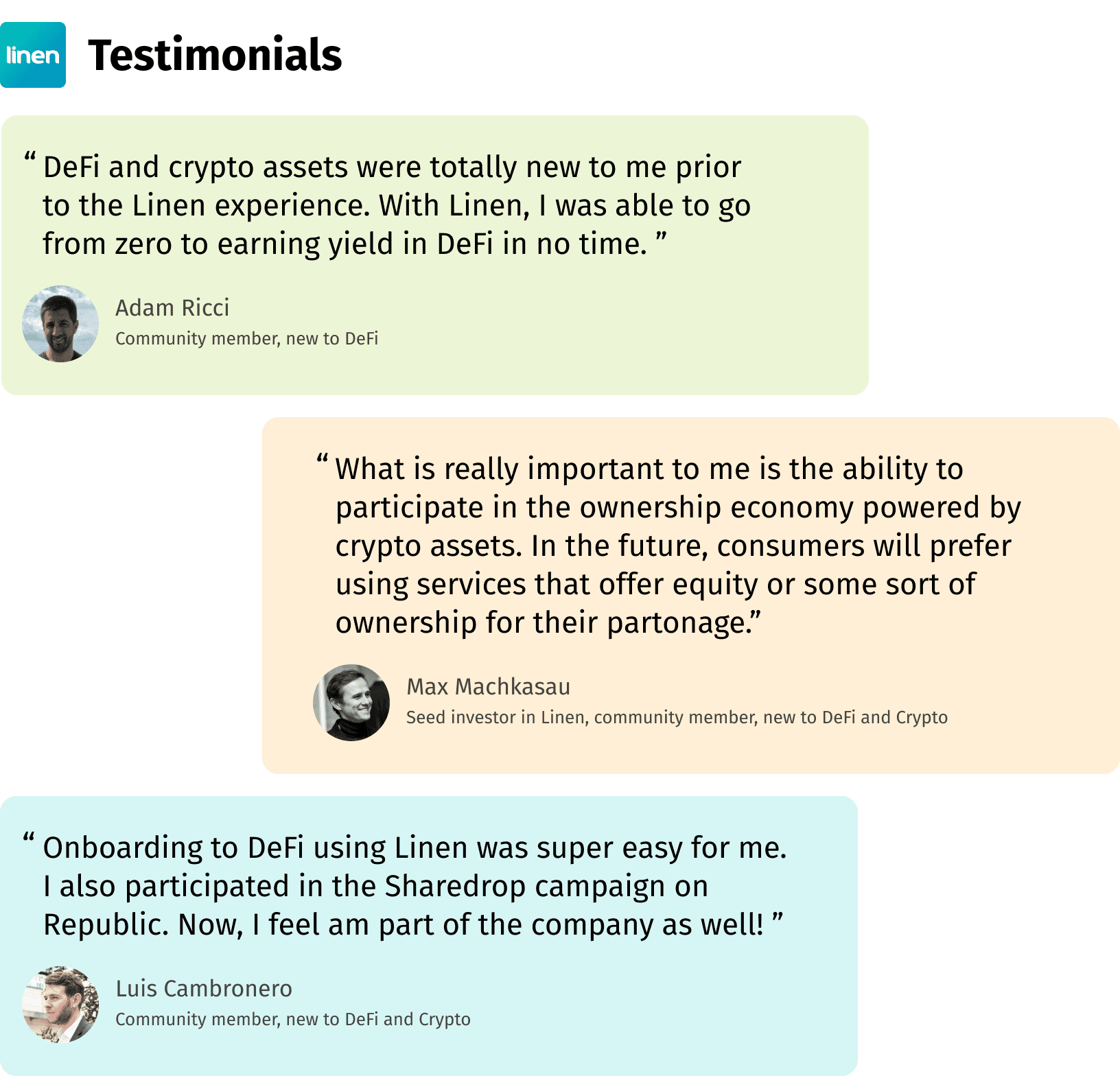

Consumers don't have the time and expertise to find and evaluate opportunities in the ownership economy, including those in Decentralized Finance. As a result, they do not receive the platform/community tokens they deserve for using products. Linen helps them discover, claim, hold, and sell such assets to earn passive income.

Self-custody wallets are the cornerstone of any crypto-powered application. Due to the technological barriers related to self-custody wallets and private key custody, most opportunities in the ownership economy are only available to tech-savvy people.

To combat this, Linen designed and built wallet backup and recovery mechanisms that do not require users to write down passwords that can't be recovered. This lowers the barriers to enter the ownership economy and the broader crypto economy for tens of millions of people in a scalable way globally.

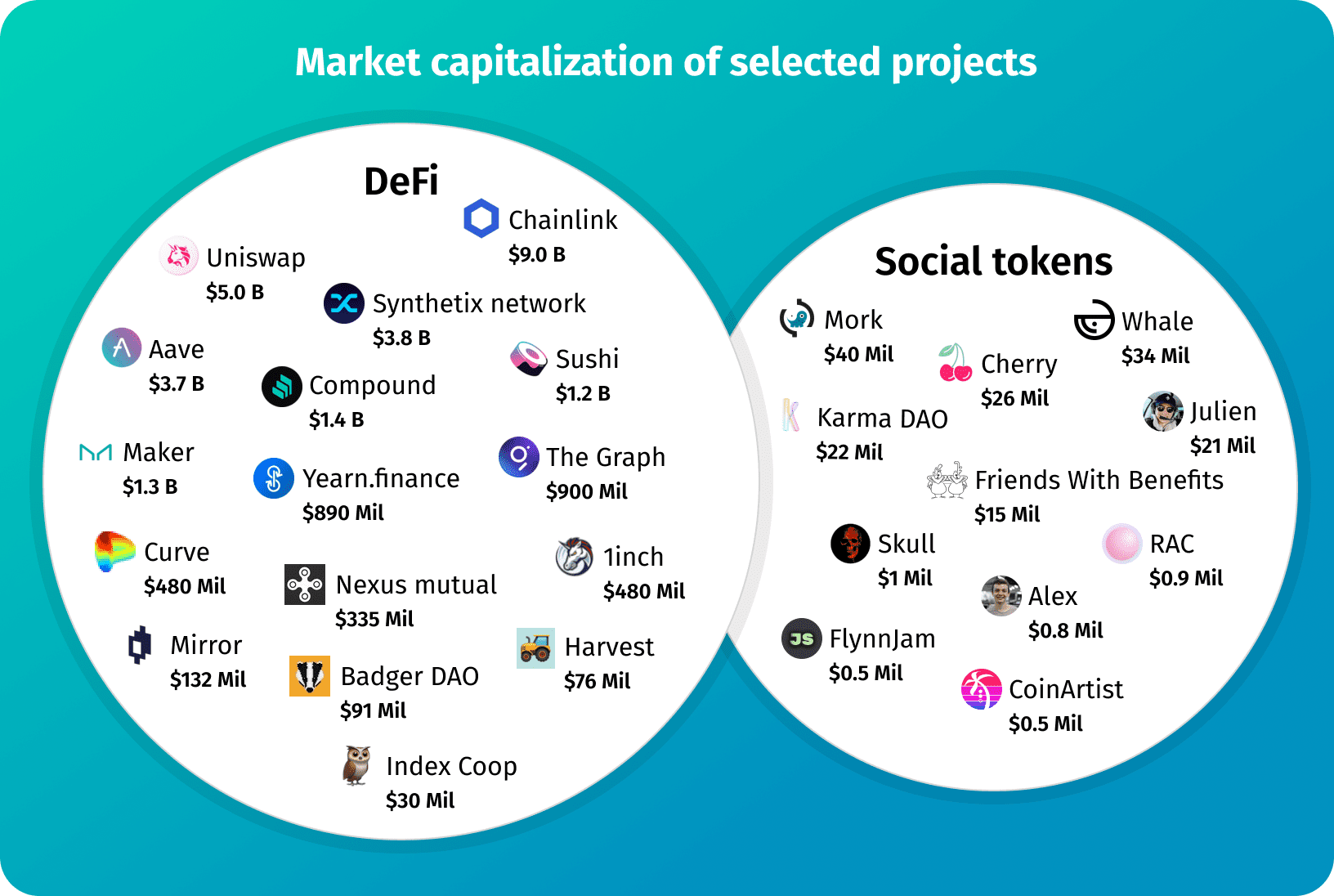

Areas of focus for Linen: DeFi and social tokens

as of January 31, 2021

as of January 31, 2021

Decentralized finance, or DeFi

Decentralized finance, or DeFi, minimizes reliance on trusted third parties for financial activities, such as exchanging assets and earning interest, to enable a fully self-sovereign financial system. It treats Wall Street and the rest of us as equals by allowing everyone to access the system and earn network equity tokens for using DeFi platforms.

Social tokens

Social tokens are a new way for creators such as artists, video game streamers, brands, etc. to engage with their communities. Social tokens can offer a wide variety of community and ownership-oriented experiences, products, and services, such as exclusive content, early access, direct access to celebrities/influencers, etc. This area is very new, and the design space is limitless.

Product

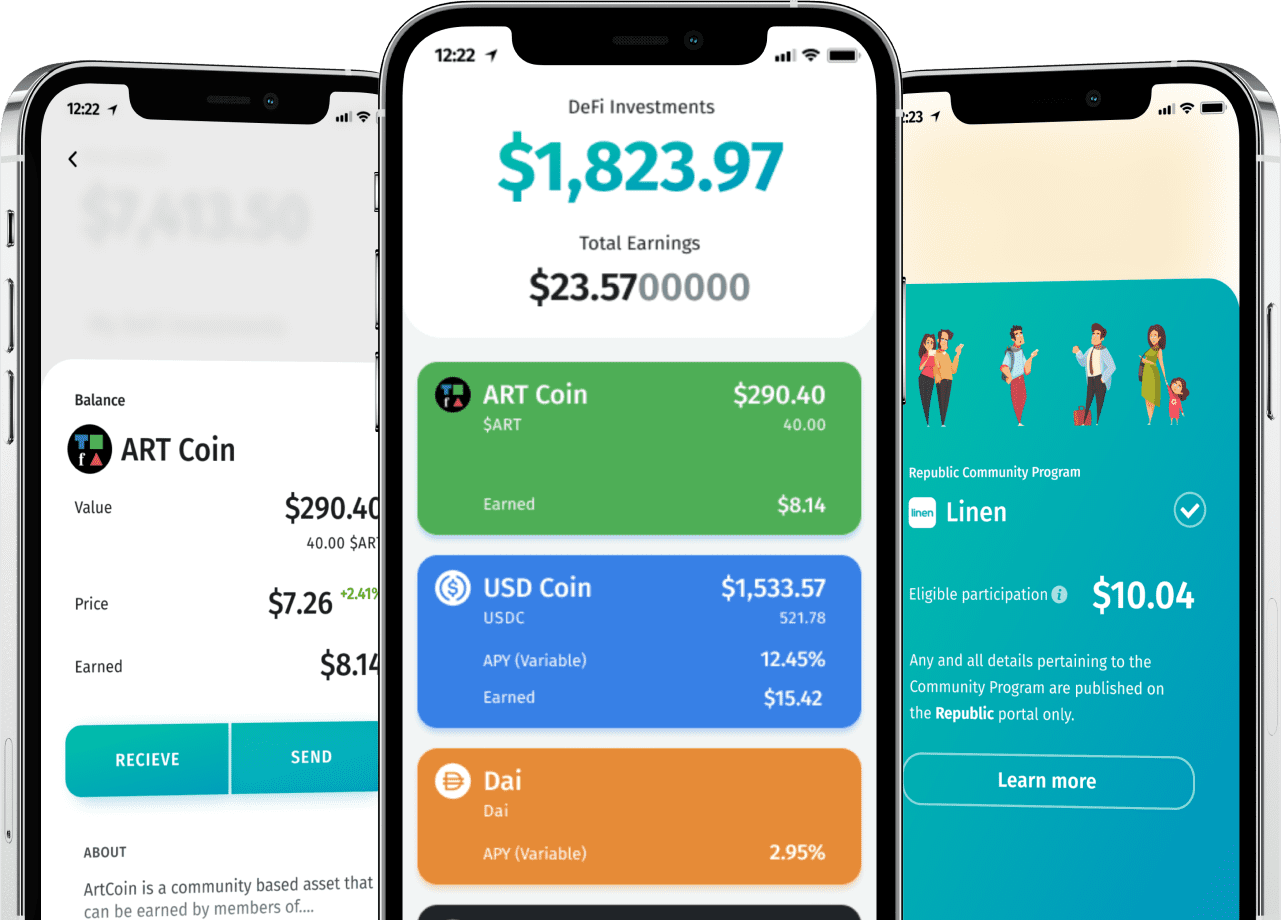

Full suite of tools for a novice to build wealth with the ownership economy: App, Wallet, Community

Specifically designed with the novice user in mind, the app abstracts away the complexities of writing down a recovery seed phrase (complex password that cannot be recovered if lost) as seen in the first generation of self-custody wallets.

How Linen App works

Join the community on Discord to learn about DeFi and the ownership economy.

Deposit stablecoins or other crypto assets, or make bank transfers (U.S. only for now) to your Linen wallet.

Access DeFi liquidity pools such as Compound to earn yield and network equity ownership tokens within the app.

Your assets are stored in a smart-contract wallet on the blockchain, and only you have access to them. Control your wallet from the mobile app. Access to the broader DeFi ecosystem is coming via wallet linking.

Sell assets in the app or withdraw to your external wallet.

Learn and hang out in the community chat

Traction

Over 1,300 deposits to DeFi pools made during beta testing!

Linen App is currently in beta release on iOS, and waiting list-only for Android. We are now on the second iteration of our wallet with:

App downloads over 15,000

Beta testing on iOS with over 600 users who made deposits to Compound liquidity pools.

Over 800 ambassador applications received, as community members express desire to be more involved.

Once users deposit crypto assets to earn yield in DeFi or to store, they keep the assets there and rarely withdraw.

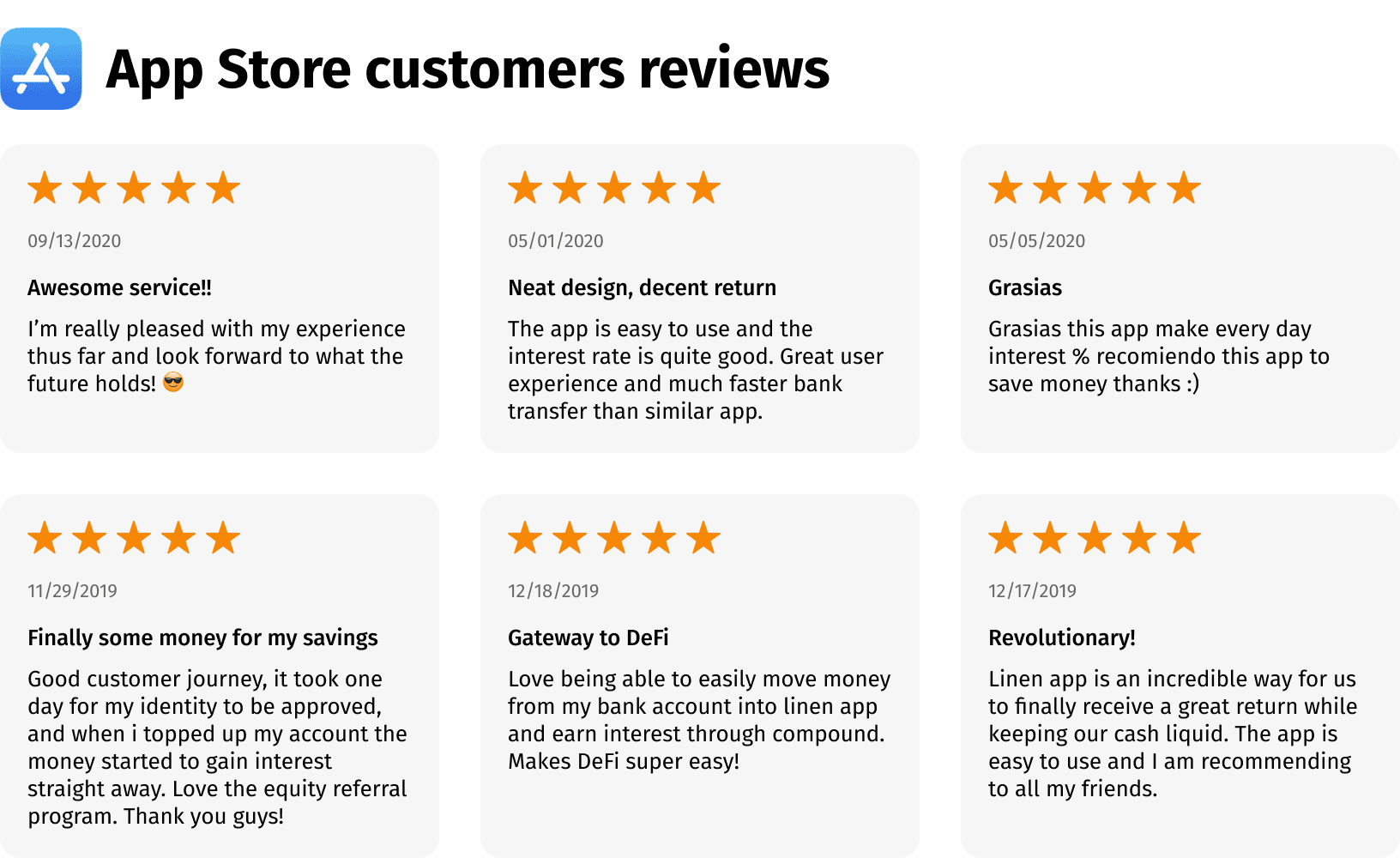

Customers

Linen appeals to users who are new to Decentralized Finance (DeFi), social tokens, and crypto in general due to its simplicity, community feel, and superior user support.

Business model

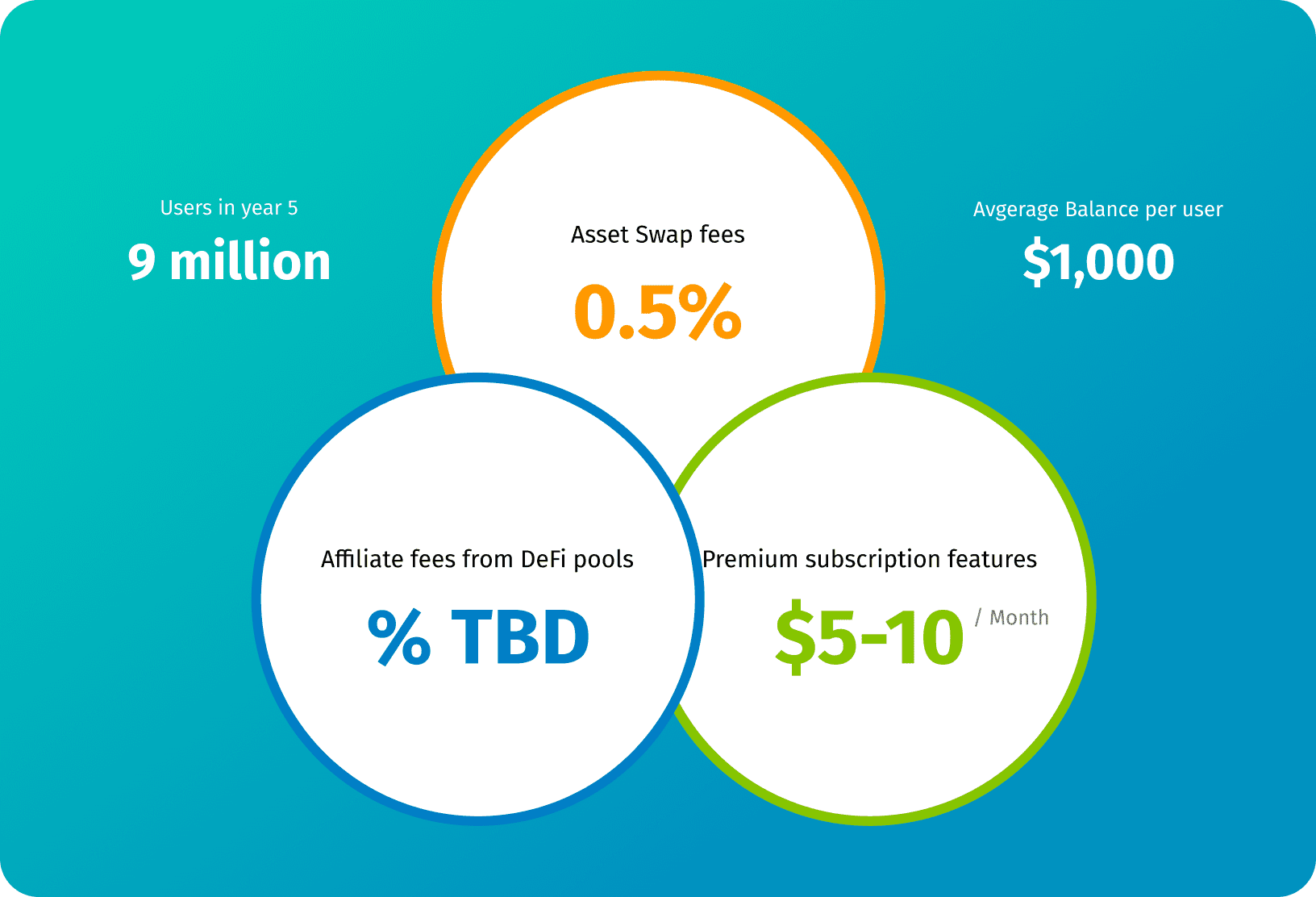

Highly scalable transaction-based revenue. Low operating overhead due to a self-custody system design.

User self-custody of assets allows us to grow in a scalable manner as a software company and not as a capital-intensive financial institution. Taking into account the global nature of DeFi and communities utilizing governance and social tokens, Linen has the potential to achieve $90 million in revenue by year 5.

Expected path:

Expected path:

9 million users in year 5. For context, leading fintech companies Robinhood and Revolut have way more users and are operating primarily in a single regulatory jurisdiction. Our self-custody wallet design is more scalable than the custodial business model used by financial institutions.

$1,000 average balance per user.

Asset swap fees: 0.5%.

Affiliate fees from DeFi pools earning yield (% TBD).

Premium subscription features $5-$10 per month.

Market

Rapidly growing market

We have exposure to the following markets:

Broad crypto assets. The market size of crypto assets is projected to grow to $3 trillion by 2025. We think this is a very conservative estimate because this number is already $950 billion as of January 2021.

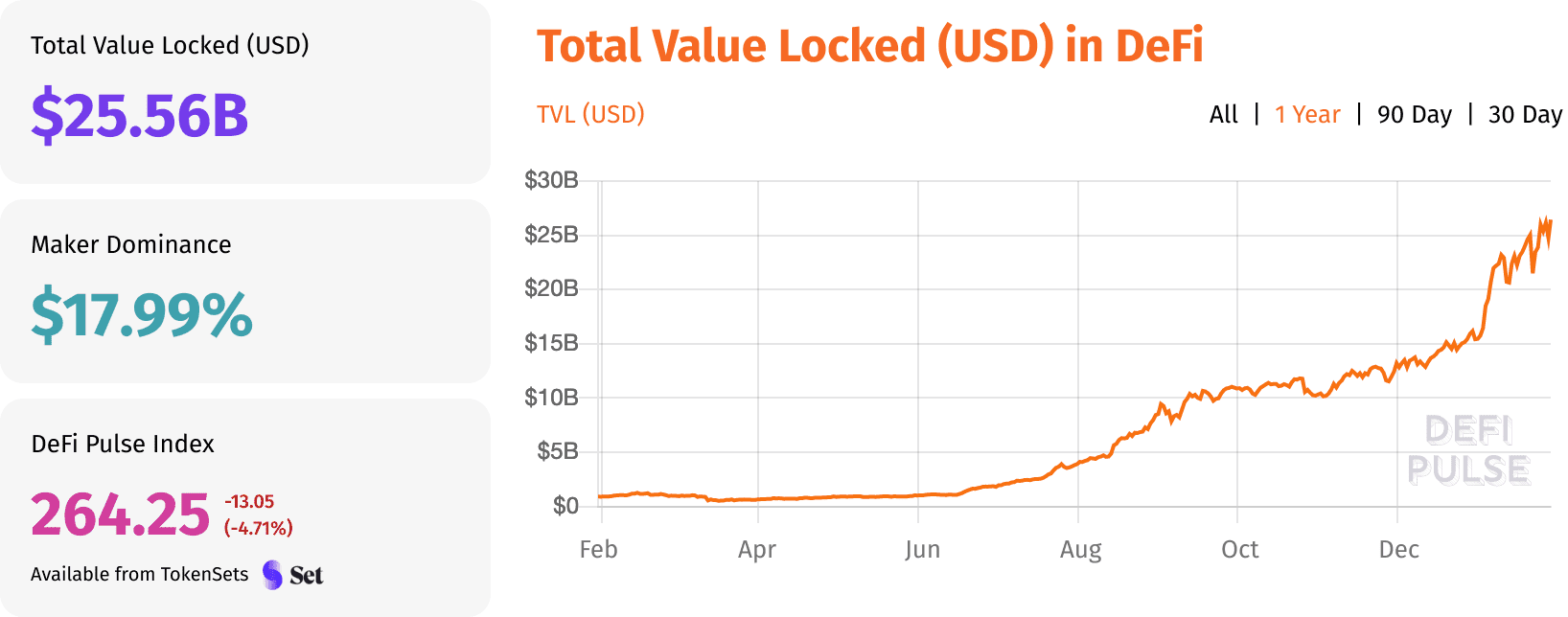

DeFi. Asset value locked in DeFi smart contracts today is already $25 billion. It grew rapidly from $920 million within 12 months.

Source: DeFi Pulse as of January 28, 2021.

Source: DeFi Pulse as of January 28, 2021.

Why now?

Self-custody is expected to be the primary method of storing long-tail crypto assets such as governance tokens, social tokens, digital art objects, etc. Self-custody of a private key is also required to access decentralized applications

Over 100M app downloads of self-custody wallets with seed phrases (mostly used by the tech-savvy) in App Store and on Google Play = market validation

Emergence of DeFi yield appeals to non-speculators and draws new crowd to crypto and DeFi

Community engagement models powered by tokens provide great user acquisition tools and path to monetization for influencers, video game streamers, and others

Emergence of the ownership economy = better user engagement + skin in the game when customers can have a say in how platforms and services are run

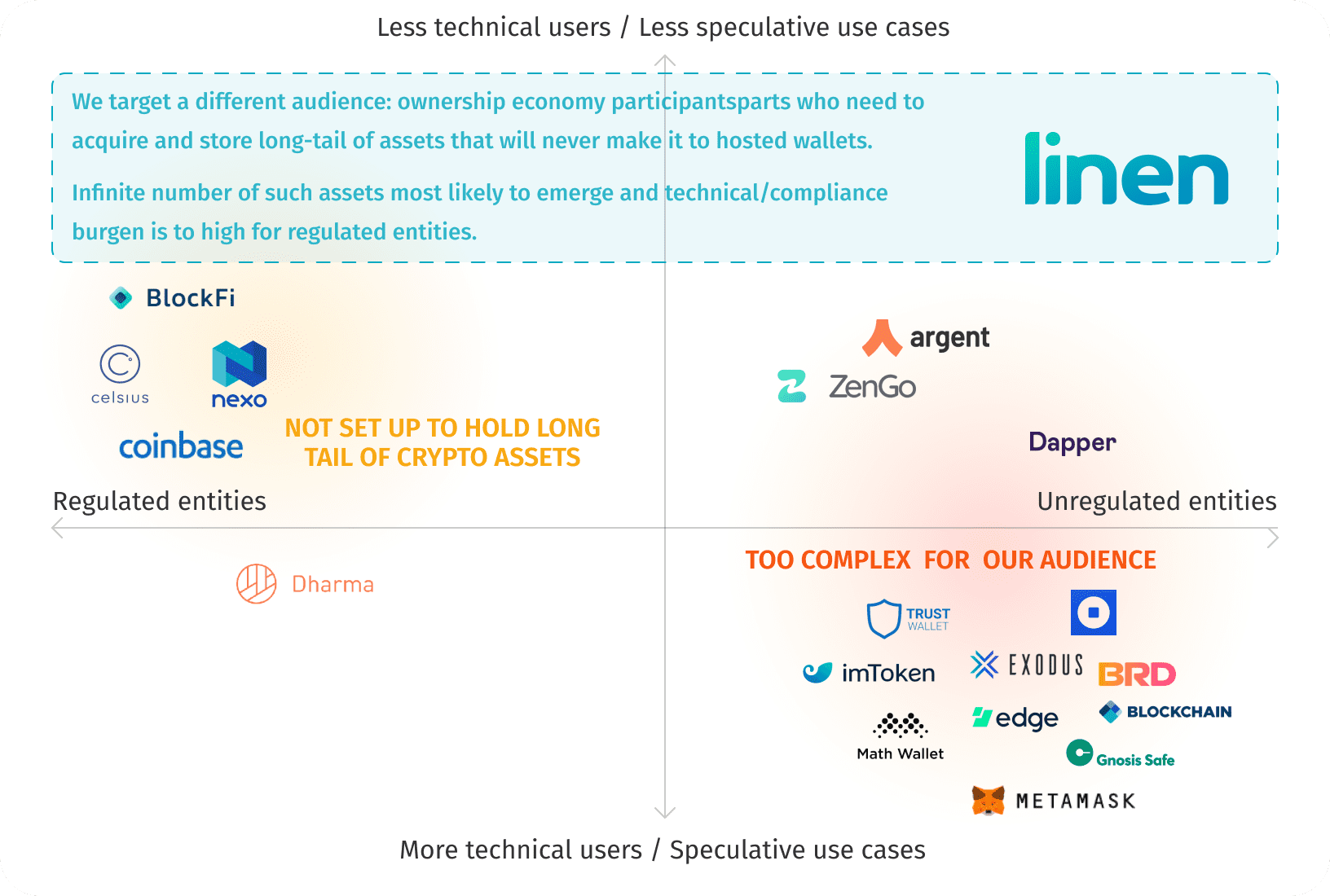

Competition

Our wallet design allows us to onboard millions at scale and with low cost

There are two types of players:

Hosted wallets where users do not have access to their private keys, cannot participate in DeFi, and cannot acquire the long tail of assets or access third-party decentralized applications (Dapps).

Self-custody platforms (wallets) optimized for a tech-savvy audience.

By far, the biggest wallets today are custodial wallets and services such as Coinbase Consumer and BlockFi. The primary use case for custodial wallets is to buy and sell a limited number of crypto assets in U.S. dollars. These players are beneficial to DeFi and the broader ownership economy as they provide a cost-effective way to acquire stablecoins and Ether with U.S. dollars. Subsequently, these stablecoins are transferred to self-custody wallets and used in DeFi.

There are also self-custody wallets that use a seed phrase (special password) for backup and recovery; but such wallets are harder to use for the average person because the passwords cannot be recovered if lost or forgotten. These wallets are usually used by early adopters and the tech-savvy. Notable players are MetaMask, TrustWallet, BRD, and Blockchain. Linen uses a different wallet design and technology that makes it very user-friendly and lowers barriers to enter DeFi and other crypto services.

Vision and strategy

Anyone should have the ability to own platforms they use and build wealth using frontier technologies

We envision the future of platforms where users are owners of services that they consume/add value to. Our goal is to empower our community with knowledge and provide tools to participate in the ownership economy.

Funding

$1.7 million in seed financing from Coinbase, Polychain Capital, HashKey Capital, Youbi, and angel investors

We are giving our users and community members the opportunity to invest alongside leading investors.

Our long-term vision is to be owned by the users and community members of Linen. In our previous Republic campaign, we distributed financial interest in our company to early users of the Linen App who helped us test the app and provided feedback.

Founders

Experienced founders with unique Wall Street and blockchain experience

Vitaly and Alex became fascinated with crypto networks and incentive mechanisms in 2015 and haven’t left the rabbit hole since, even through up and down cycles.

🤖 Vitaly Bahachuk – ex-tech investment banker turned entrepreneur.

Writings:

- The Future of Crypto-Powered Finance and How We Get There

- Decentralized Finance (DeFi) in Layman’s Terms

👨💻 Alex Bazhanau – distributed systems engineer with a background in advertising tech

Writings:

Vitaly and Alex became fascinated with crypto networks and incentive mechanisms in 2015 and haven’t left the rabbit hole since, even through up and down cycles.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...