When the pandemic turned our culinary lives inward-as the closure of restaurants and the necessity of home cooking made t...

Problem

Consumers are bored with their food…

and are looking to bring adventure into their kitchen!

Despite a plethora of choice, consumers are still bored with their food and are continually looking for new flavors and textures to try. Palates are starting to evolve from ketchup to spice and even crunch.

- Over a third of people feel burnt out by cooking due to cooking and eating the same types of foods.

(Source: OnePoll survey Q1 2022)

- Consumers are continuing to cook at home — a lasting result of the pandemic. 85% of people say they will continue cooking more at home than before.

(Source: Intrepid Report: Home Cooking in 2022 and Beyond May 2022)

- Clean labels are becoming table stakes — 61% of consumers are looking for condiments and sauces without additives or preservatives.

(Source: Mintel Report 2017)

Solution

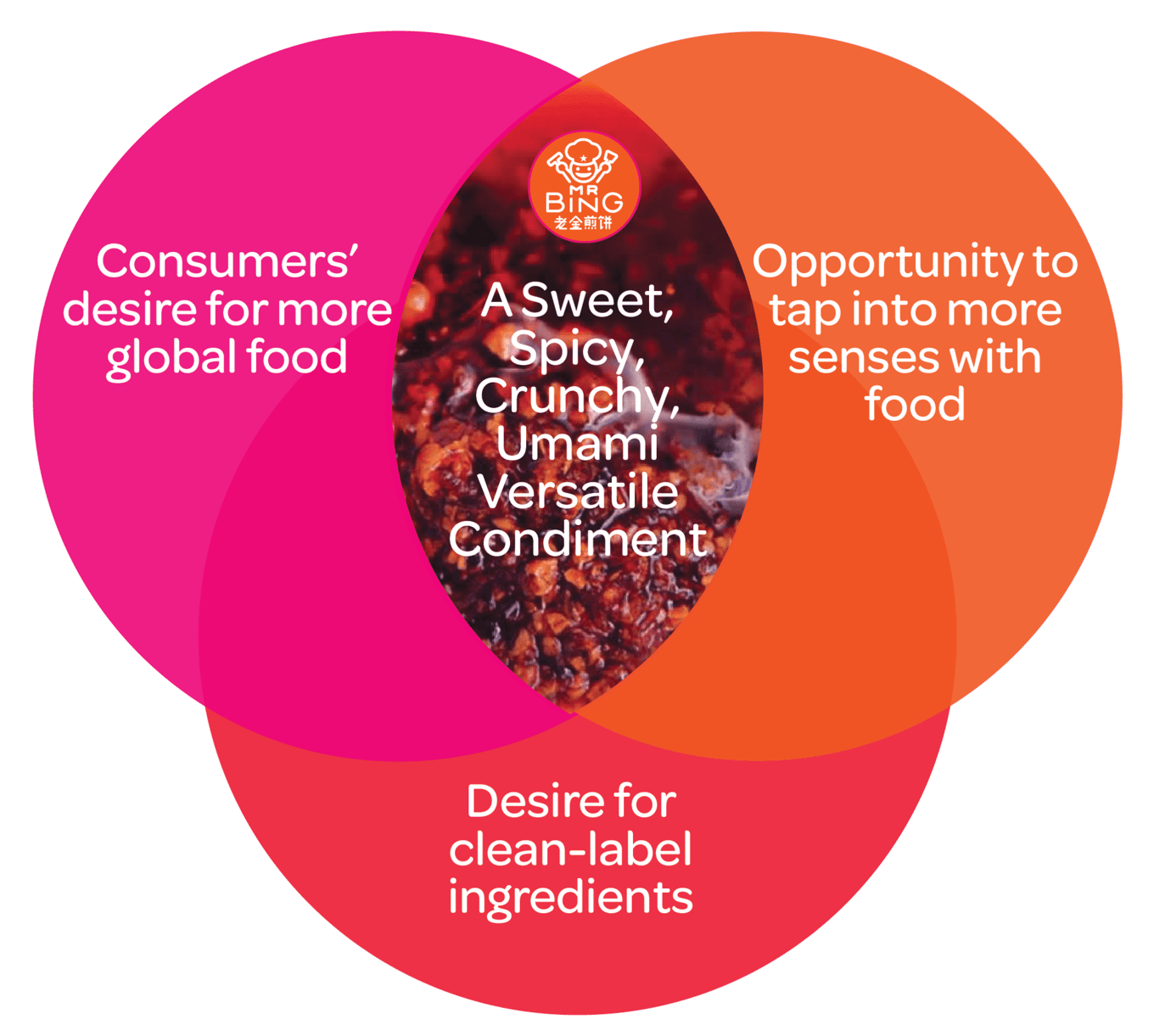

This rich opportunity for a new type of condiment hits a number of trends

Mr. Bing captures the most exciting elements of modern Chinese food and interprets them into accessible condiments and ingredients for the modern foodie and everyday cook.

The Mr. Bing brand was built in 2012 by Mr Bing Restaurants in Hong Kong and later in NYC. Mr Bing Chili Crisp launched in 2019, as a healthy replacement to the massively popular, billion dollar Laoganma Chili sauce.

Product

Chili Crisp,

our champion product: “Crazy delicious and addictive"

Mr Bing Chili Crisp is a crunchy, umami-packed, mouth-watering condiment and cooking ingredient that’s just a tad sweet and just spicy enough to make everything tastier. Inspired by Beijing street food, it’s made from crispy garlic, onions, rice bran, mushroom powder, and a blend of spices. Put it on anything—eggs, rice, pizza, pasta, chicken, burgers, or just eat it straight (seriously).

Mr Bing Chili Crisp is a crunchy, umami-packed, mouth-watering condiment and cooking ingredient that’s just a tad sweet and just spicy enough to make everything tastier. Inspired by Beijing street food, it’s made from crispy garlic, onions, rice bran, mushroom powder, and a blend of spices. Put it on anything—eggs, rice, pizza, pasta, chicken, burgers, or just eat it straight (seriously).

Traction

Significant

scaling in H1 2022

in Customers, Revenue growth, and Funding

Milestones

- Q4 2020 - $250K in annual revenues

- Q4 2021 - $300K in annual revenues

- Q1 2022 - $1.5M seed financing raised

- Q2 2022 - On the shelf in 5 Kroger divisions

- Q3 2022 - On the shelf in Sprouts and Fresh Market

- Q4 2022 - $3.6M run rate; $2.1M in annual revenues (forecast)*

- Q4 2023 - $5.7M in annual revenues (forecast)*

* Click here for important information regarding Financial Projections which are not guaranteed.

—

Significant expansion into retail,

food service, and distributors

Now in 3,000+ stores, including Kroger divisions, Sprouts, The Fresh Market, and Stop & Shop. Launching Costco in Q1 2023.

On the menu in 500+ restaurants,

corporate campuses, sport venues, and universities including:

Available through major nationwide

natural foods and foodservice distributors including:

Customers

Consumers are looking for a

multi-sensorial culinary adventure

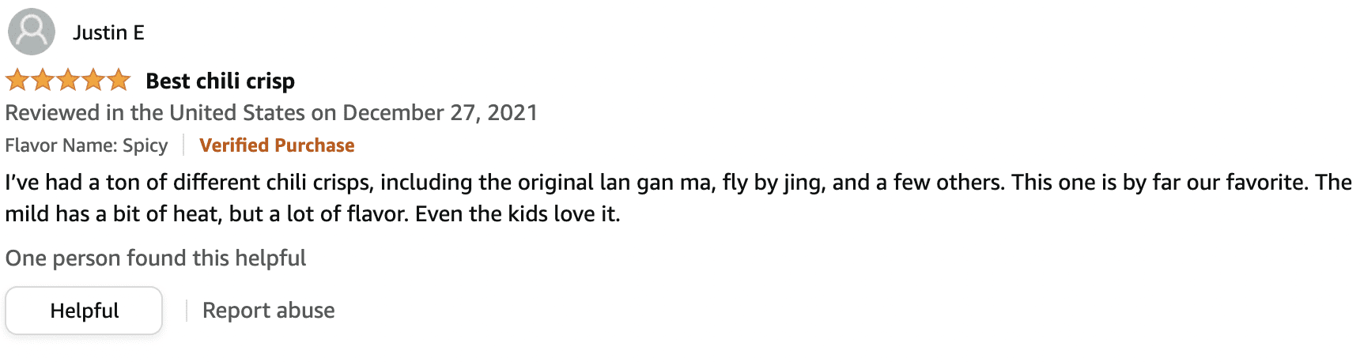

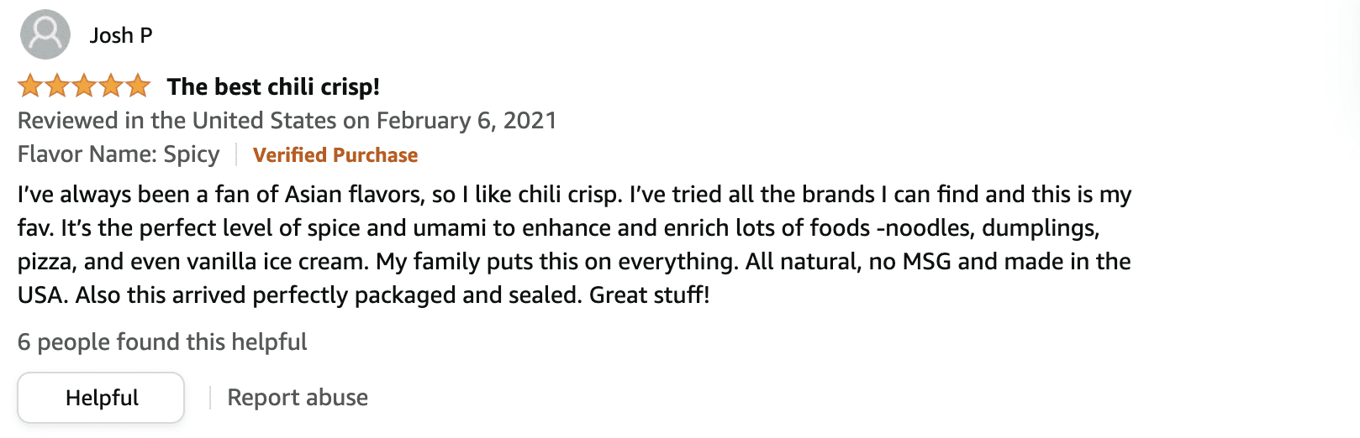

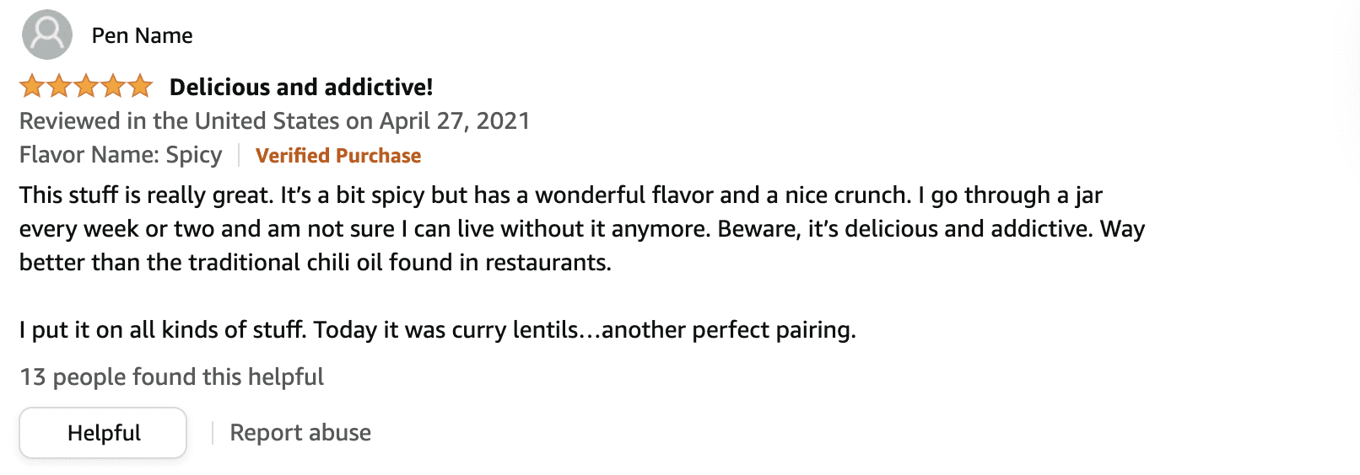

Mr. Bing consumers are anything but ordinary! Our consumers are flavor-obsessed foodies looking to feel more accomplished and inspired in the kitchen. Millennials, Gen-z's, trend-setters, and early-adopters all love our Chili Crisp. Mr. Bing is the perfect condiment for those who already enjoy Chinese and East Asian cuisines, as well as those who want to expand their palate.

Our reviews speak volumes

Business model

Strong validation across three focused channels

—

Revenues and forecast

| 2021 Revenues | $300K |

| 2022 Forecast | $2.01M |

| 2023 Forecast | $5.7M |

| Trailing 12 Months | $1.7M |

| 12M Run Rate (based on Nov '22) | $3.6M |

—

Approximate gross margins (Q4 2022)

True GAAP-compliant GMs, net of COGS, trade marketing, deductions and chargebacks, broker fees, and logistics.

| Consolidated | 35% |

| Retail | 32% |

| Foodservice | 35% |

| Ecommerce | 41% |

—

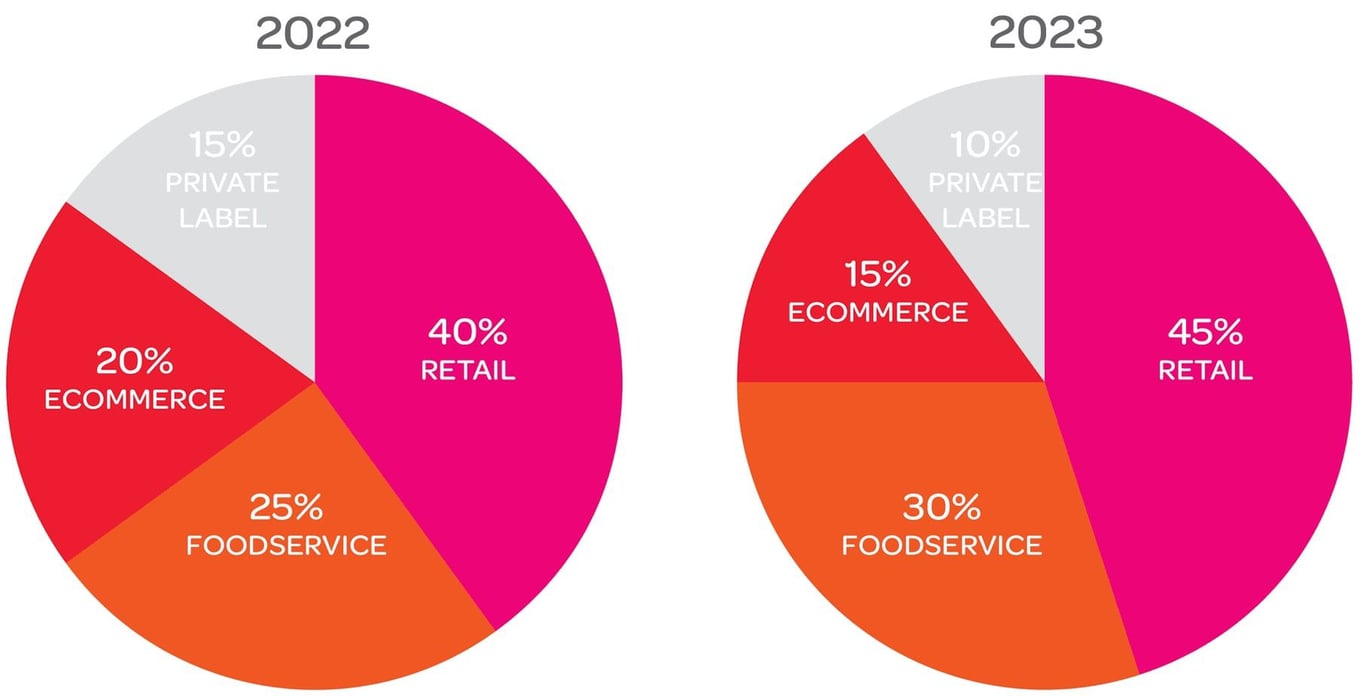

Channel split

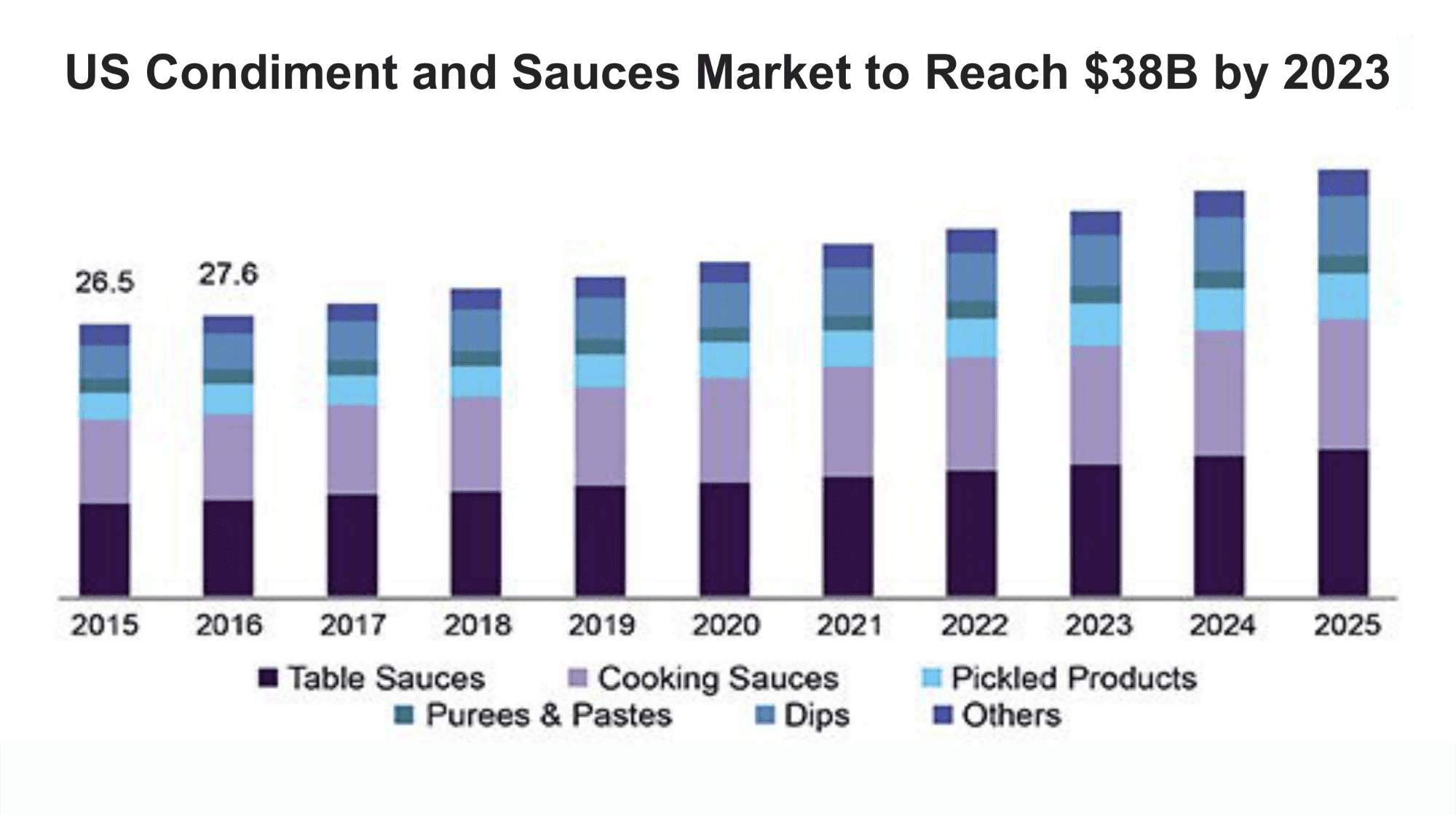

Market

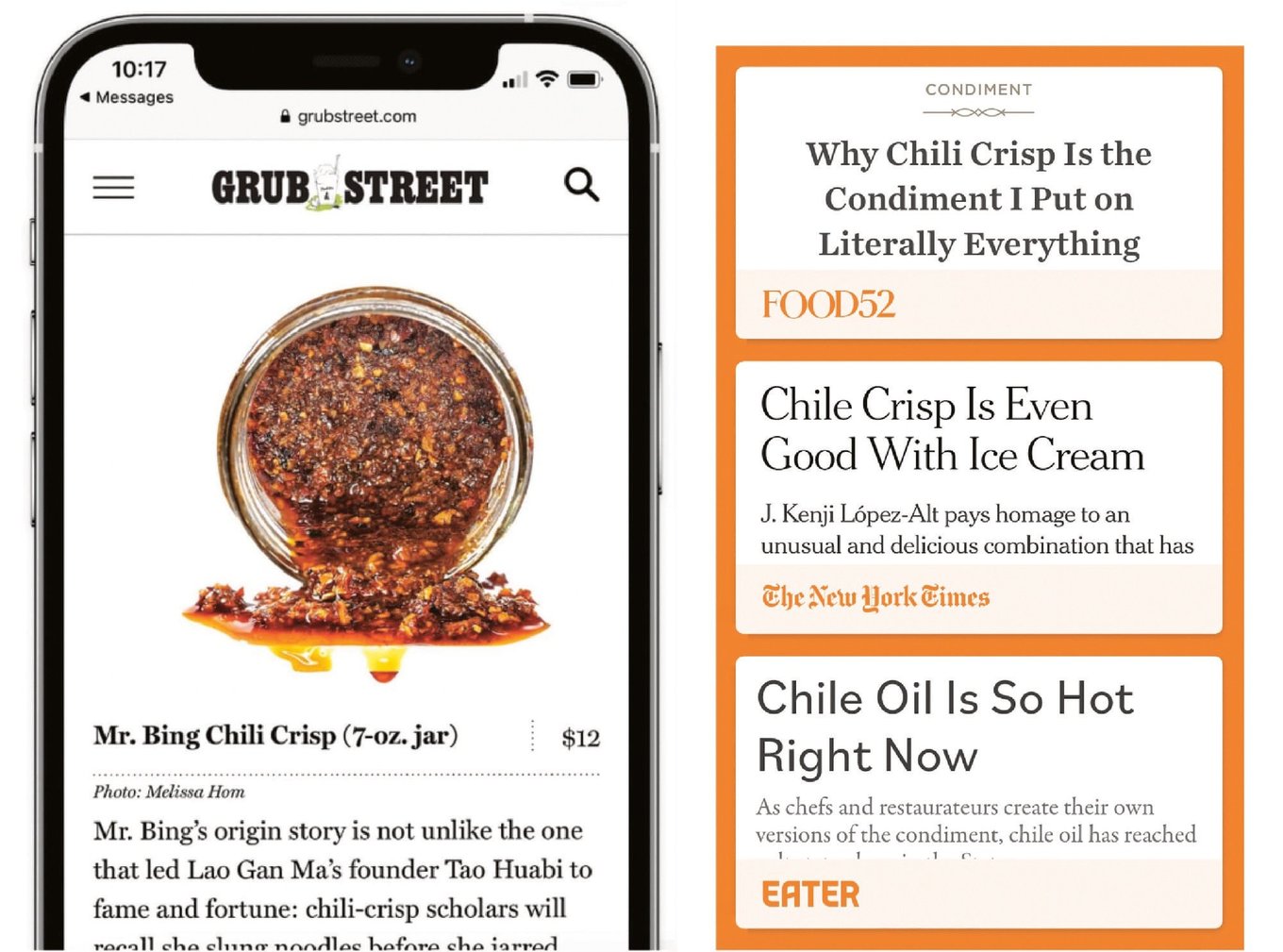

This sweet-spicy, crunchy Sauce is a $1B global industry

and growing double digits!

—

Market size and growth

Chili Crisp Category is $1B and Growing, estimated to be $250M in the USA in 2022.

- 200% increase in mentions of chili crisp on restaurant menus, the fastest growing word on menus. (Source: Datassentials)

25% growth in hot sauce market in the USA in less than 4 years. (Just Food)

$1.02B United States sauce market in 2018. (Fortune Business Insights)

- $22B United States condiment market in 2020. (Ibis World)

—

Indicators and comparables

- 2020: Cholula chili sauce acquired for $800M by McCormick & Co. (USA Today)

- 2018: Huy Fong Sriracha $80M in revenue in USA. (Fortune)

- 2017: Sir Kensington’s “better for you ketchup” acquired for $140M. (NYT)

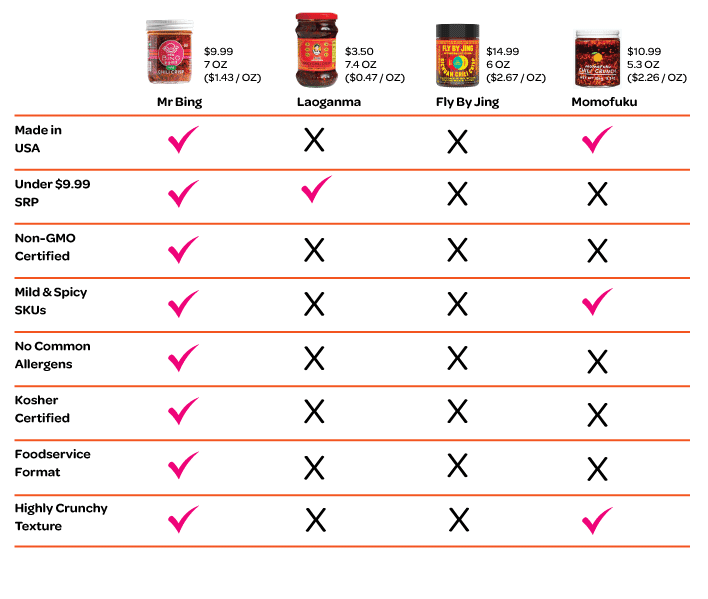

Competition

Unique in the marketplace

Mr. Bing Chili Crisp has incredible flavor and crunch, with the attributes that matter to modern consumers.

Vision and strategy

Our mission: ensure Chili Crisp is the go-to condiment across all tables

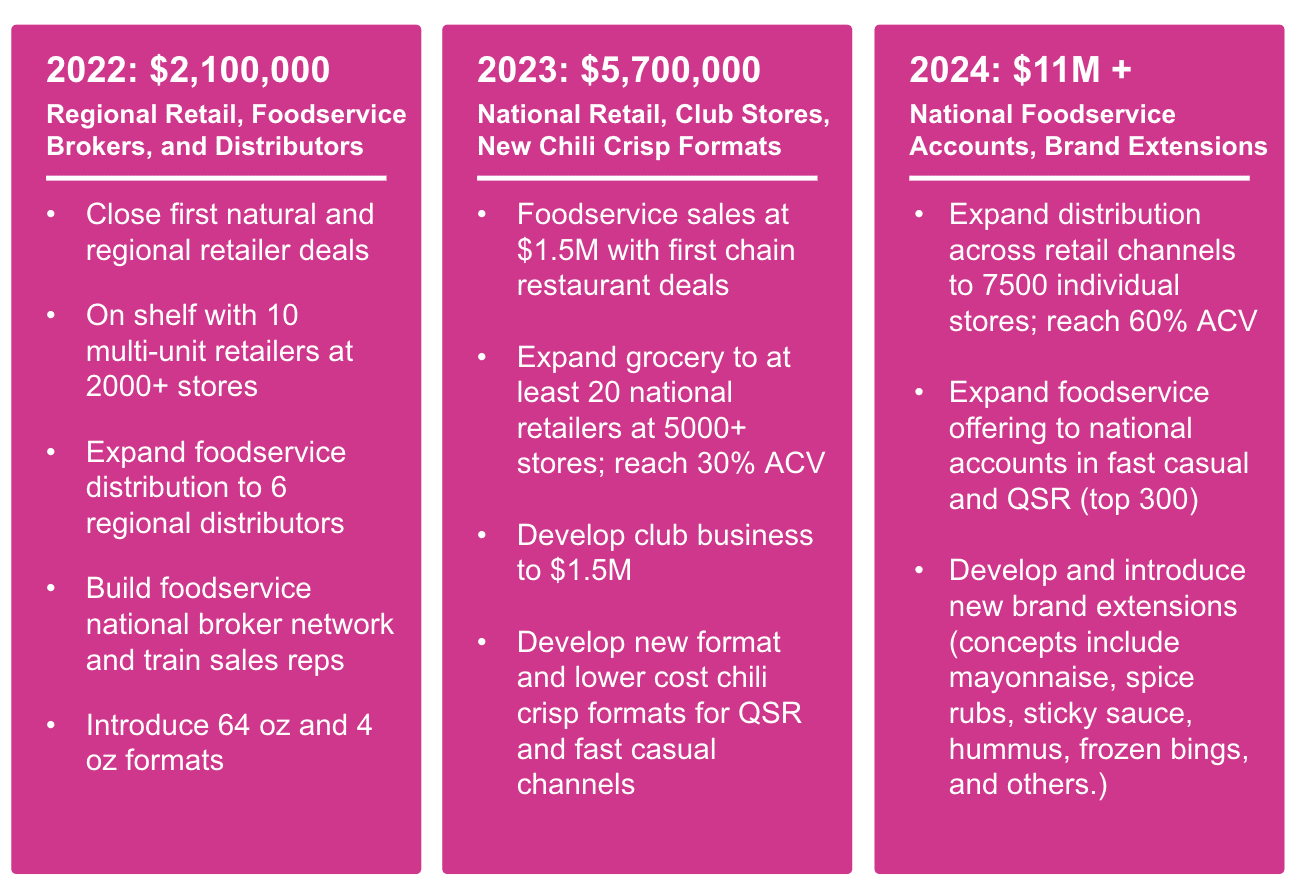

Nearly $20M in projected annual sales in 3 years*

* Click here for important information regarding Financial Projections which are not guaranteed.

—

Delivering inspiration and convenience

with a robust Innovation roadmap

Flavor line extensions and partnering with other packaged host foods - showcasing the versatility of chili crisp

Packaging format innovation that delivers enhanced convenience

—

Ambition to be a master-brand that transcends categories, bridges cultural gaps, and promotes diversity & understanding through a mutual love of food

Support of Chinese and Asian American and Pacific Islander charities, including Heart of Dinner

Collaboration with Chinese and Asian American and Pacific Islander artists and creators in our community

Published recipe book with education recipes on using Chili Crisp in different types of food

Food trucks on college and corporate campuses showcasing Mr Bing ingredients in heritage jianbing and other foods

Partnerships

Partnership with Celebrity Chef Jet Tila

"Mr Bing is the gold standard chili crisp for use in everyday or new dishes, adding unique twists and delicious flavor without it being difficult." – Jet Tila

Funding

A cohort of investors experienced in food and CPG

Now our biggest fans have the chance to invest in Mr Bing, and join retail and foodservice veteran stakeholders, including:

- Altamont Capital: Private Equity Firm with $4.5B in assets

- Bryan Gaw: Exec. Director, Kerry Properties Ltd., Hong Kong

- Go-Tan Family: Owners of Europe's Largest Sriracha Brand

- Kirkham Family: Early Operators of Black Rifle Coffee

- Food Foundry: the Foodservice Industry's Top Accelerator

Founders

Mr Bing was founded by Brian and Ben, who met in Beijing in 1998 and spent 15 years growing businesses and raising families while living across China and Hong Kong, including opening Mr Bing restaurants in Hong Kong in 2012. In 2019, when restaurant customers demanded to buy chili crisp by itself, the packed food business was born.

Although the restaurants closed during the 2020 pandemic, the Mr Bing story lives on in a jar.

The company is a minority-owned business, whose owners include Chinese and China-diaspora investors from Shanghai, Hong Kong, Singapore, Canada, and the US. Mr Bing supports the cultures that inspired us by giving a portion of our revenues to charities that foster Chinese arts and community.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...