For February's Startup Happy Hour, StartupSac and the Carlsen Center for Innovation & Entrepreneurship at Sac welcomed Jo...

Problem

The cannabis industry brings high risks

As cannabis becomes a growing industry in the United States, financial institutions are faced with navigating new risks. The emerging cannabis industry is complex and brings with it a need for innovative risk management and compliance solutions.

Simplifying this complex problem unlocks a $85B opportunity.

Financial Institutions banking cannabis businesses are exposed to significant legal, operational and regulatory risk. The cannabis industry is complex and existing risk management and compliance solutions provide inadequate transparency.

Solution

Cannabis banking made easy

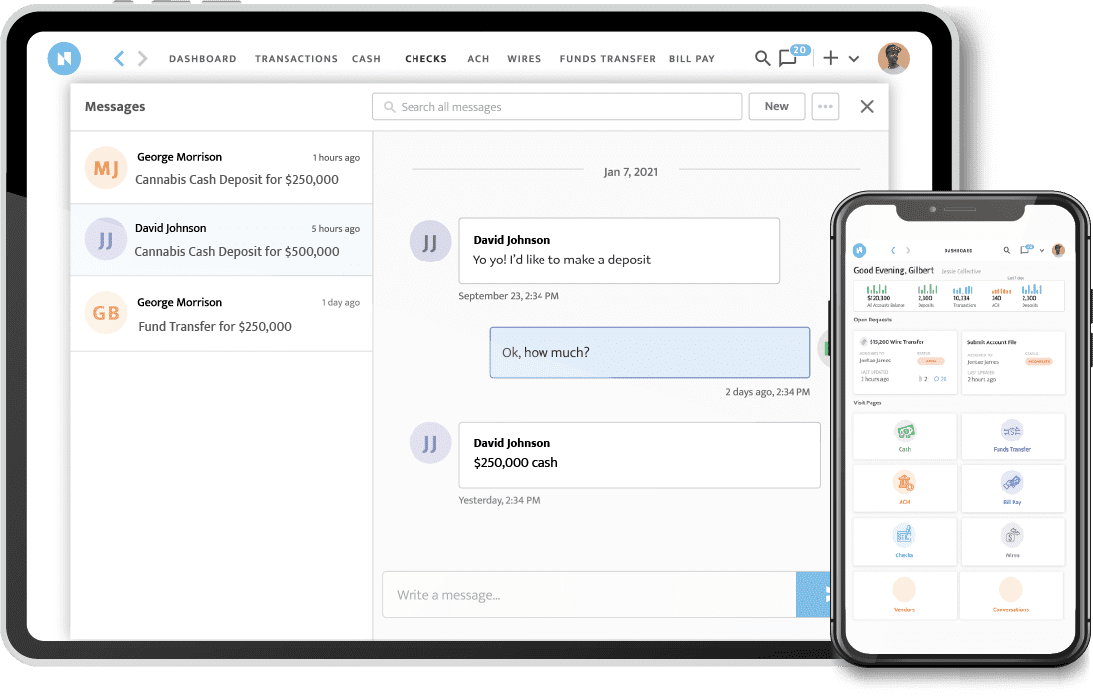

NatureTrak allows financial institutions to track and manage their risks in real time, providing peace of mind for both cannabis operators and the banks that support them.

Enhancing the legitimacy of the cannabis industry through real-time transparency and risk management, empowering all stakeholders - from seed to bank.

Our Mission

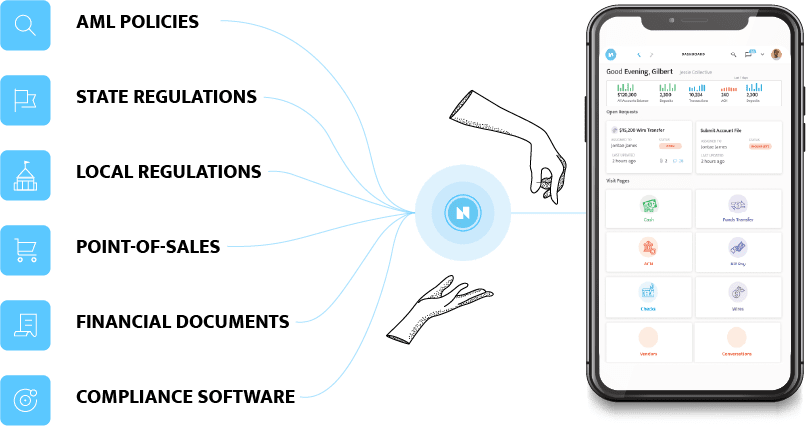

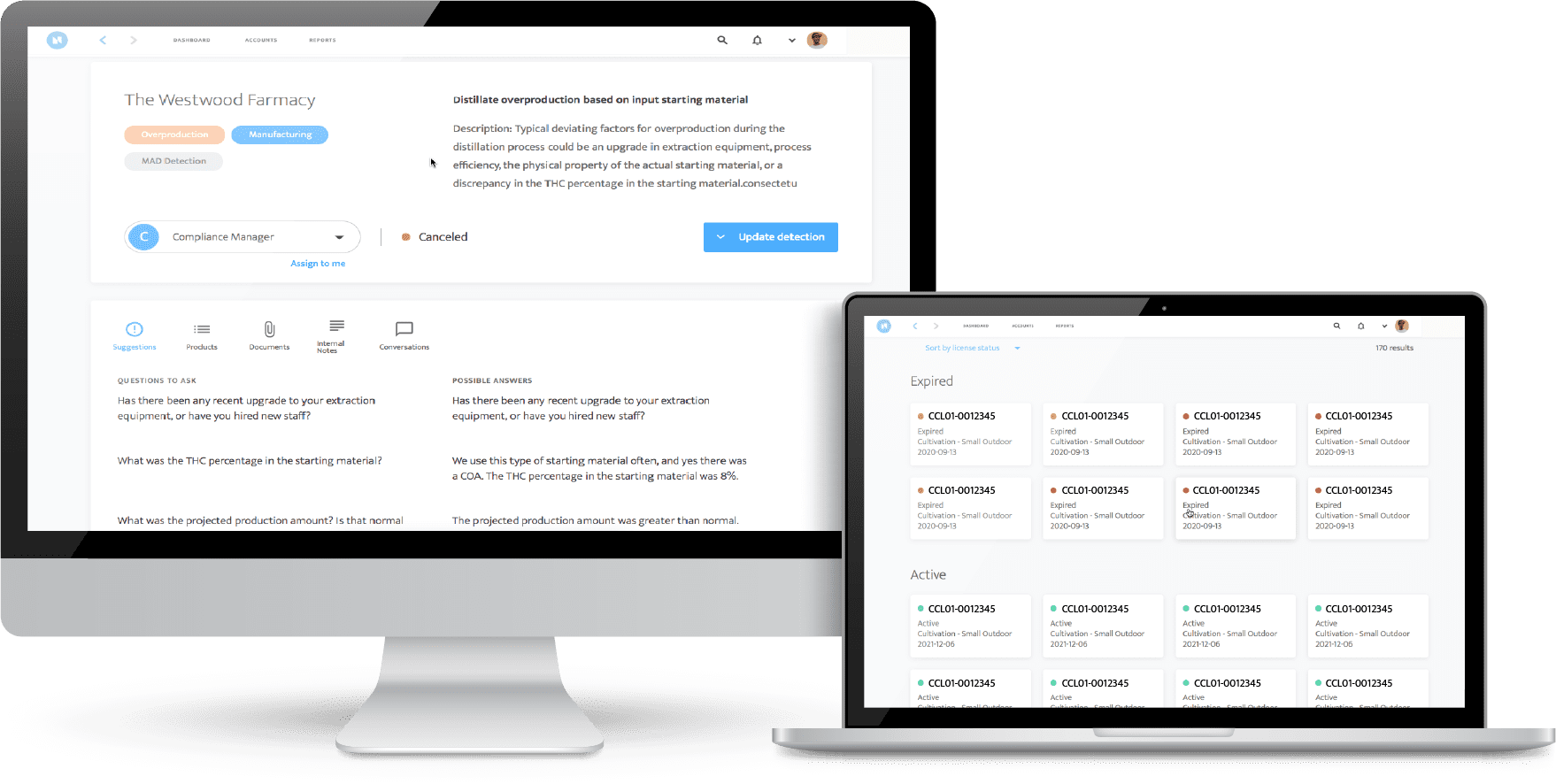

NatureTrak provides cannabis banking-as-a-service, a full suite of federal and state examined-tested compliance tools for any financial institution considering banking cannabis. NatureTrak's enterprise risk management platform enables financial institutions to safely bank Marijuana, CBD and Hemp with confidence by giving them full transparency and risk analysis for the business activities and operations of their commercial cannabis clients.

Product

Bringing confidence and clarity to the cannabis industry

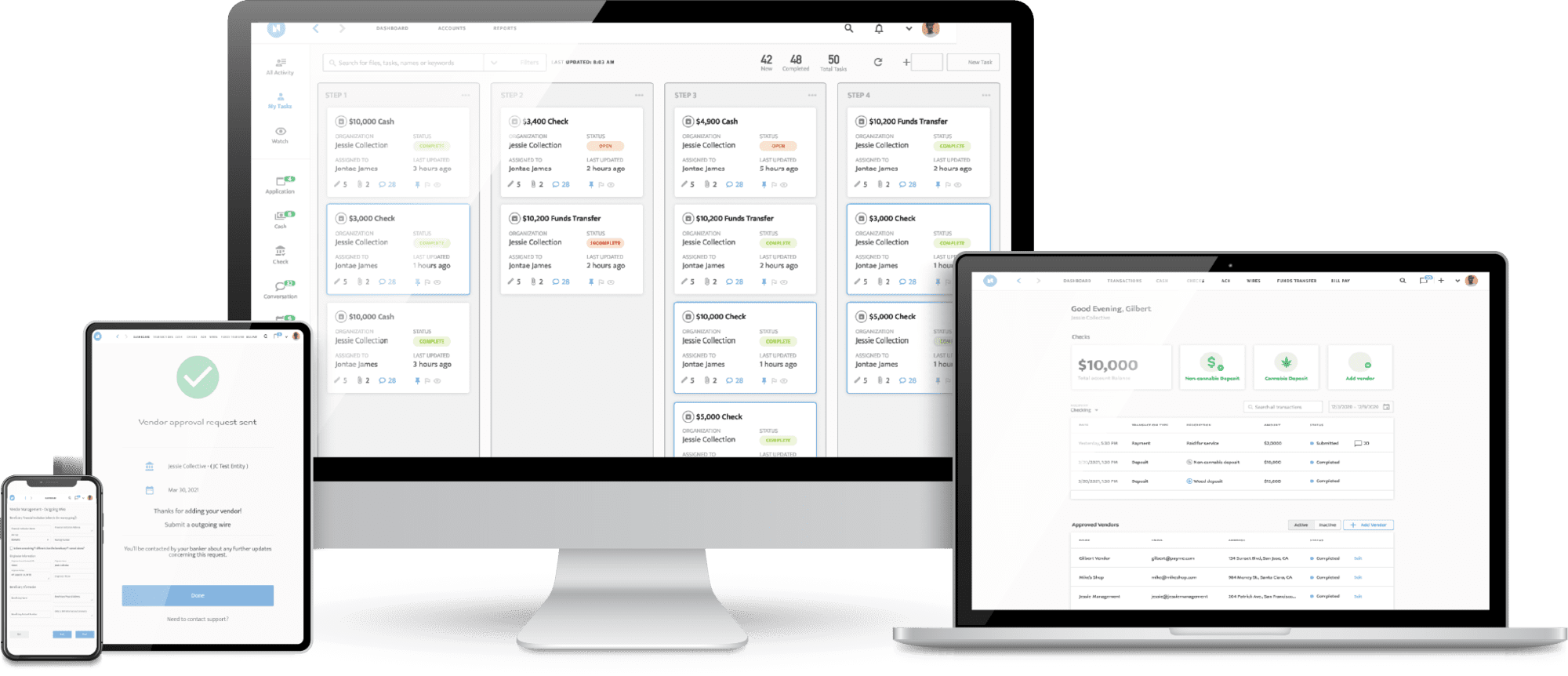

NatureTrak was launched in May of 2017 to build a complete solution under which licensed cannabis companies could execute electronic transactions through its network of partners, banks, and credit unions.

For the Cannabis Operator

Banks have rigorous standards for which cannabis companies can become clients. Namely, banks often need to know down to the 1% ownership of companies. NatureTrak offers verification service to clients, giving peace of mind and assurance of organization.

For the Bank

Financial institutions can pass federal audit checks by ensuring legitimacy for payments and deposits through cash flow management and inventory. Specifically, NatureTrak will match cash to an inventory system, keeping integrity and organization at the forefront.

Banks have core operating systems that have their own AML software. NatureTrak’s software becomes or can also integrate with banks’ AML, allowing them to manage workflow and liquidity. NatureTrak can also assign risk profiled to clients.

The company has a machine learning tool that flags unusual behavior for cannabis clients anytime during the seed to sale process. The ML is built on knowledge of “what a distributor looks like,” “what a retail storefront looks like,” “what a manufacturer looks like”, etc. It also automates the suspicious activity report process (SARS).

Our Technology

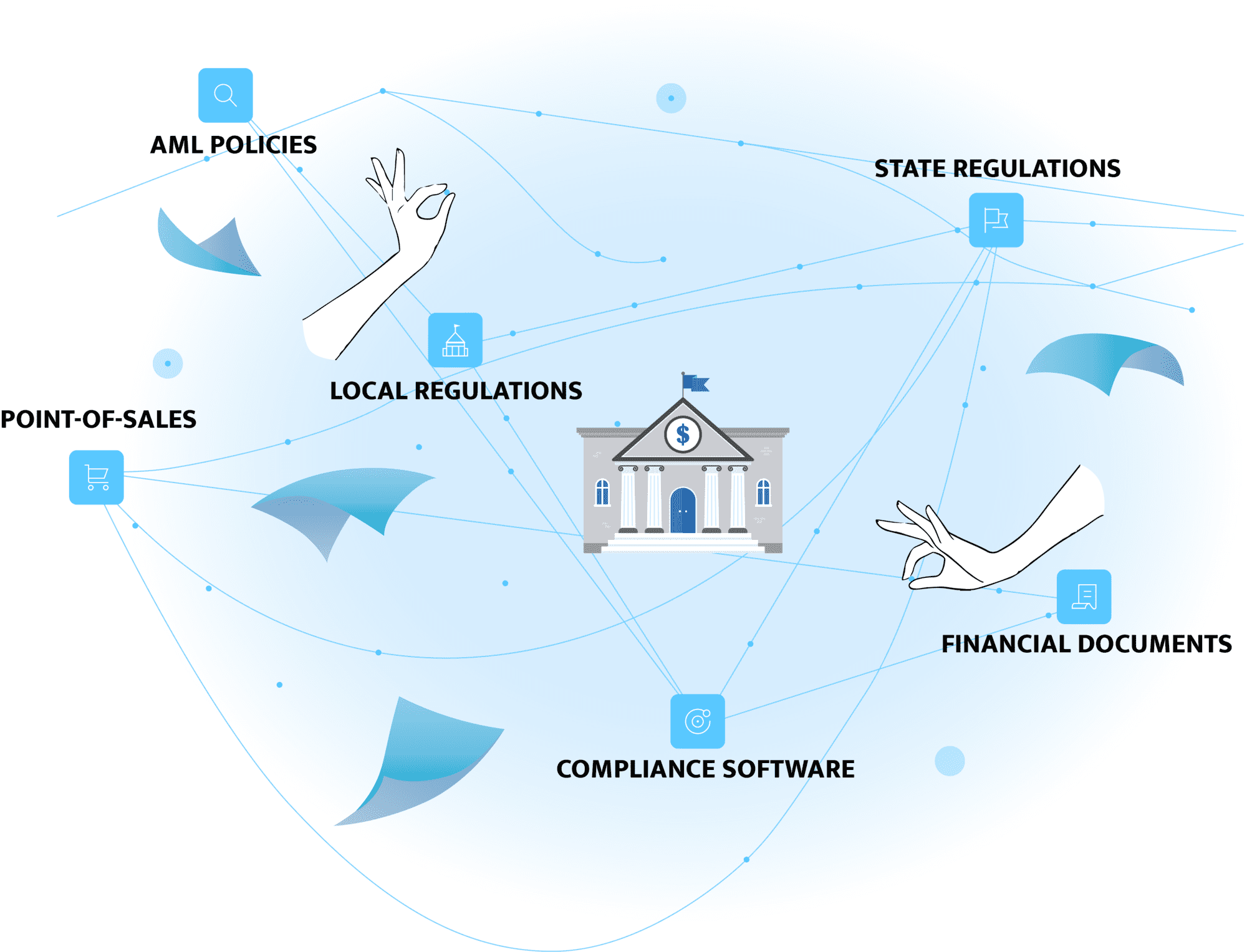

NatureTrak's platform is vertically integrated throughout the Cannabis-Related Businesses, supply chain, yet accessible by core banking systems.

Our patent-pending Marijuana Anomaly Detection "MAD" technology is the most comprehensive cannabis rules-based AI Solution that fully integrates with banks.

MAD aggregates complex transactional risk, enabling banks to optimize compliance process and requirements defined by OFAC, FinCEN, & BSA as it relates to SARS.

Value Proposition

NatureTrak's enterprise risk management platform allows financial institutions to safely bank Marijuana, CBD and Hemp with confidence by giving them full transparency, risk analysis for the business activities and operations of their commercial cannabis clients.

Traction

Revenue is expected to top $1M in 2021

The product originally started out as a seed-to-sale tracking platform for cannabis with a government contact with the U.S. Virgin Islands. NatureTrak's business operations for its current product started in October 2019 and have already started generating meaningful revenue in 2020.

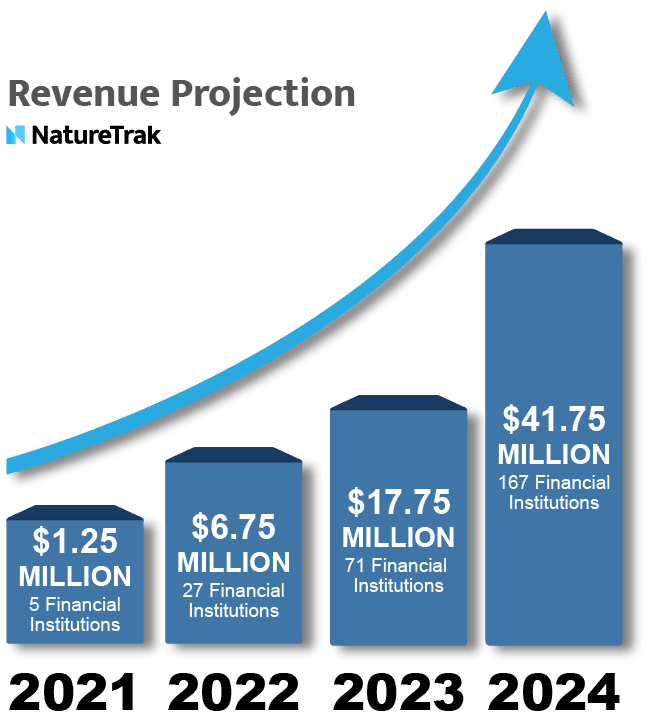

Financial Revenue Projections

Net revenue for 2020 is $179k, and is expected to top $1.2M for 2021.

We are currently building a pipeline of several clients that have board approval for cannabis banking to become paying customers by 2022. We're also set to partner with a big four provider to help its consulting business perform forensic analysis on banks and governments.

Customers

Real testimonies from real people

Check out this interview with Chris Call, CEO of North Bay Credit Union and his experience with NatureTrak.

Remove the guesswork with NatureTrak’s full suite of Federal & State examined tested compliance tools for financial institutions banking cannabis.

Business model

NatureTrak captures up to $250K per bank partner from:

Zero-cost deposits. Fee income. Payment Processing.

We currently employ a shared revenue business model to the financial institutions. There is a $25k one-time implementation fee and a revenue share every transaction type (ACH, Cash, Checks, Wires) validated through the platform.

Based upon our pilot bank partners current deposit levels utilizing our platform:

When they convert to the basis points/per deposit volume model:

At 10bps or 0.1% our revenue would be 500K for just one client:

The financial institution is able to increase the spread percentage up to 1 - 2% from the deposits, fee income and payment processing from cannabis clients. The increase in the spread - the interest rate banks pay depositors and the interest rate banks loan to consumers - is where we receive a bps fee.

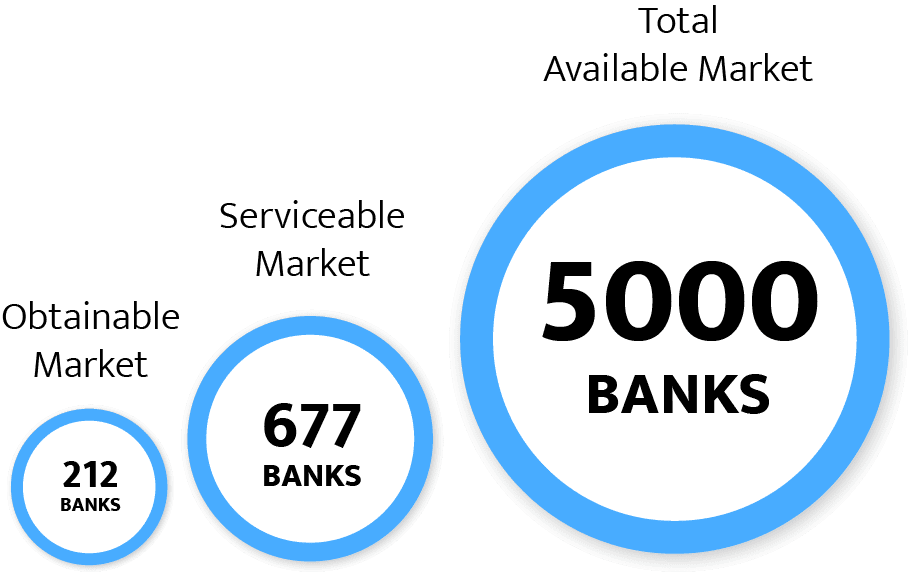

Market

A $1.25B TAM with high projected growth

Market size

The explosive growth of cannabis-related businesses in the United States will drive the need for enhancement compliance and transparency for financial institutions.

- Total US illicit cannabis market reached an estimated $66 billion in 2021

- US cannabis sales in 2020- $20 billion & an estimated $35 billion by 2025

- The legal marijuana industry worth is expected to reach $82.9 billion by 2025

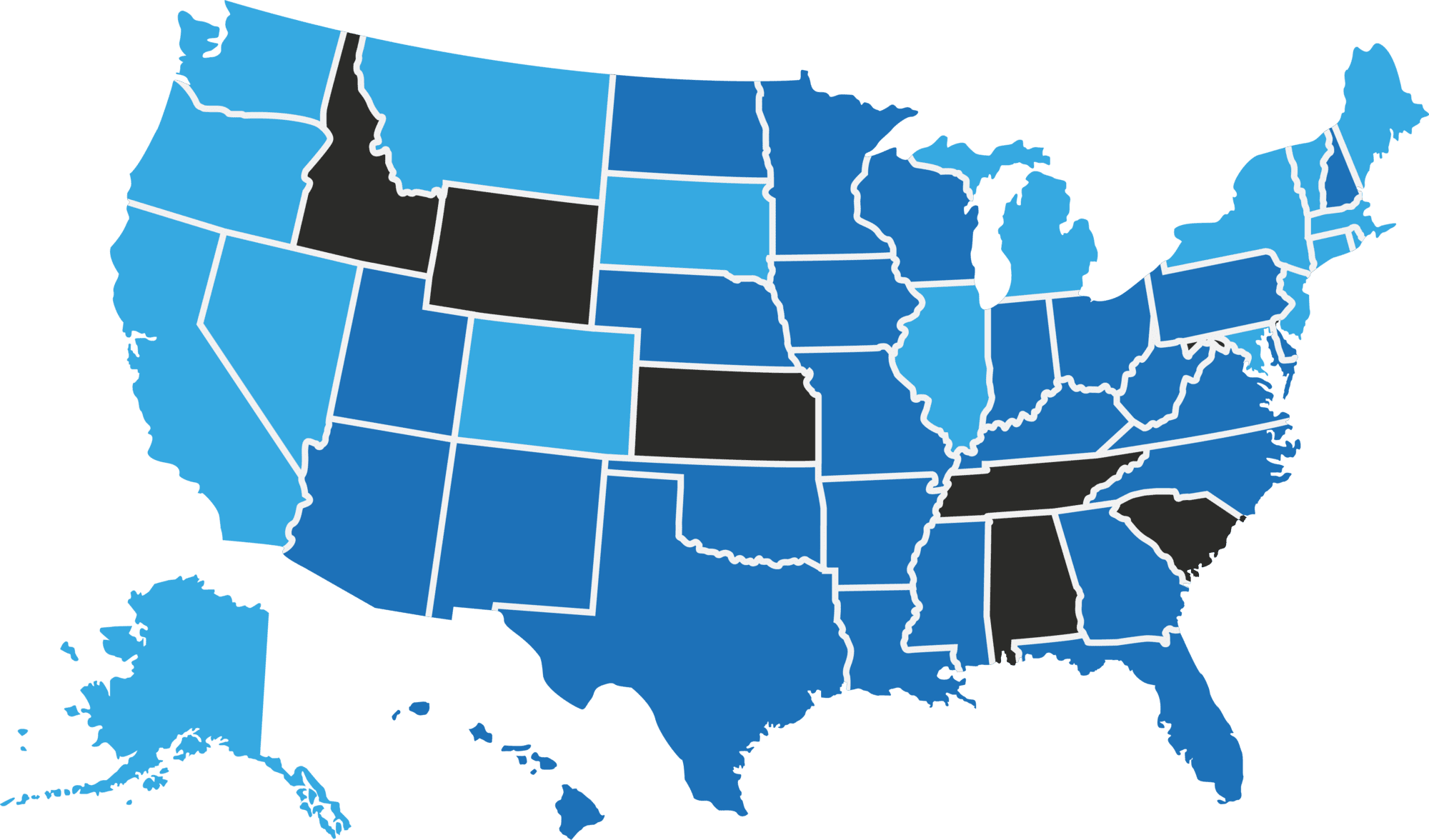

As cannabis becomes legal in more areas of the United States, NatureTrak is poised to capitalize on the upswing of the cannabis market.

At the end of 2020, over 650 depository institutions offered some form of cannabis banking. In addition, cannabis legislation has increased its support over the years in a number of states. Many traditionally conservative areas such as Florida have legalized the use of medical marijuana at the very least.

Monument in legalization

18 states have legalized recreational marijuana and 37 states have legalized medical marijuana. There are another 16 states expected to legalize recreational or medical marijuana in 2021.

Why now?

SAFE (Secure and Fair Enforcement) Banking Act - The purpose of this Act is to increase public safety by ensuring access to financial services to cannabis-related legitimate businesses and services providers and reducing the amount of cash at such businesses.

MORE (Marijuana Opportunity Reinvestment and Expungement) Act - This would remove cannabis from the Controlled Substance Act.

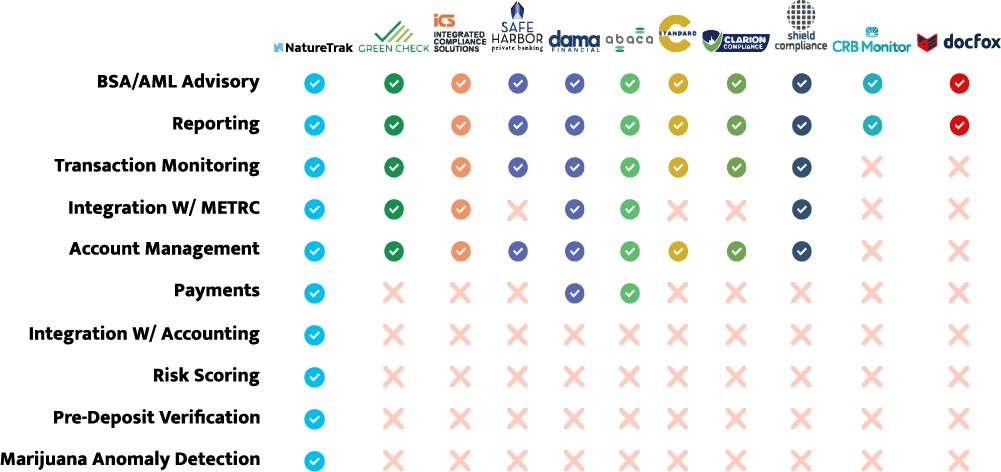

Competition

We are the technology company building the compliance infrastructure for cannabis banking

Several competitors offer "compliance" software that verify cannabis deposits and withdrawals within 30 to 90 days. This time delay happens for several reasons including: manual data entry, exchanging of invoices and purchase orders, etc.

NatureTrak's - cannabis banking-as-a-service is a full suite of Federal and State examine tested compliance tools for financial institutions of all sizes to safely and profitably bank cannabis

NatureTrak addresses a need to have real-time validation by integrating with and aggregating data from several software suites used by financial institutions and cannabis industry businesses that enable our banking customers to scale.

We give the financial institutions the ability to audit, track, validate and bank cannabis companies with full transparency and regulatory compliance.

Thanks to NatureTrak - regulators, operators and banks have the ability to conduct legal cannabis business with confidence.

We are the technology company building the cannabis compliance infrastructure for cannabis banking.

Vision and strategy

NatureTrak's approach to solving cannabis enterprise

In the near term, NatureTrak will mainly focus on refining the existing product and expanding into states that have already passed cannabis legislation.

In the long term, NatureTrak's goal is to allow cannabis businesses to be banked compliantly alongside other traditional forms of business.

The Plan for Revenue Growth

|  |  | |

| Product Market Fit | Validation | Growth & Success | |

| Goal of Phase | Customer Success | Market Acceptance | Market Expansion |

Target Market | Innovator/ Early Adopter | Early Majority | Late Majority |

Process Approach | Plot Program/ Market Requirements Fulfillment | Codify Sales Process | Codify Sales process & Customer Systems |

Sales Hiring | FI Network/ Referrals | Sales Process Builder | Domain Experts/ Experience |

| Demand Generator | Align to Customer Profile and Commitment | Select Partners/ Target Messaging/ Focused Medium | Multiple Media Channels/ Sales Driven/ Focused |

| Pricing | Customer Commitment/ Alignment | Establish/ Stabilize Deal Economics | Domain Experts/ Experience |

| Compensation | Customer Success Driven | Customer Success/ Economic Modeling | Market/ Competition |

Funding

$3.4M raised to date

To support NatureTrak's mission, we've raised over $3.4M to date from notable investors including various angels and HNWI in Sacramento.

Past, Present & Future

2017-2019

- Raised $500k from Friends & Family

- Raised $1.4M Seed 1 Round

- Track & Trace Contract - Government of U.S.V.I. (Avera)

- First payment processing partnership (Vector Payments)

- Introduced “Marijuana Anomaly Detection” (MAD) - Money 2020

- Selected Top 20 FinTech Company - Money 2020

2020

- Raised $500K bridge round

- Contract w/Design Partner (NBCU) for PoC

- Implemented risk management solution into production at NBCU

- Raised $500K bridge round

- Hired Compliance Officer

- Hired Chief Revenue Officer

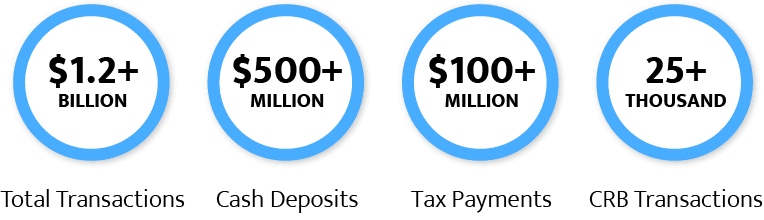

- $1.0 Billion in total transactions

- $500 Million in cash deposits

- $100 Million in tax payments

- Acquisition of Copacetic Strategies

- Strategic Alliance with Simplifya & HDCS

Timeline and Use of Capital

- 2Q-Q421: Scaling of Marketing/Sales/Customer Ops

- 3Q-Q421: Block Chain Integration

- 2Q-4Q21: General and Administrative

- 2020-’23: Scaling of Development Staff

- 2020-’23: Execute Product Development Road Map

Remaining Objectives

- Complete MMV v1 of BRM Platform

- Secure 5-10 pilot participants

- Develop C-baSS pipeline

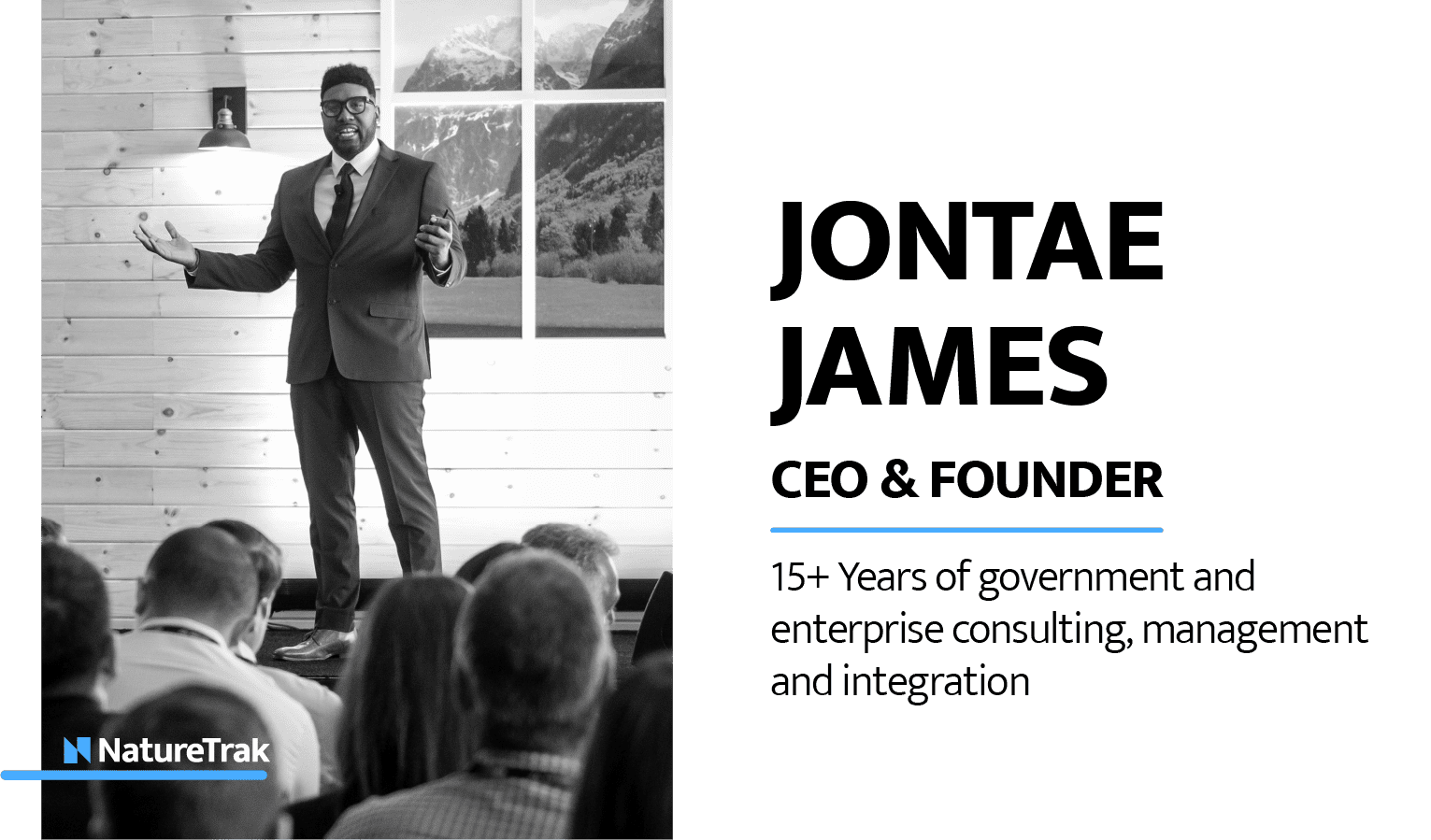

Founders

An innovative entrepreneur, big on creating enterprise solutions

Action-oriented with a strong ability to communicate effectively with executive, consumer and business audiences.

Jontae has over 15+ years in government & enterprise SaaS sales and marketing. An innovative entrepreneur, big on creating enterprise solutions that address real world problems. Action-oriented with a strong ability to communicate effectively with executive, consumer and business audiences.

Prior to NatureTrak, he was Co-founder of Bluntli, a digital licensing platform in the cannabis industry which specialized in patient and entity license verification back in 2015. This was the first of several track and trace technologies to bring transparency and visibility into the emerging cannabis market. Jontae has led a boutique venture capital organization’s sales and marketing for early-stage start-ups. He is passionate about entrepreneurship and launched a consumer-driven mobile app created to promote a more active, connected and productive employees called Your Out Of Office (YOOO!).

Along with a community building solution aimed towards entertainment industry & media agencies to develop business partners to align resources with social media platforms - celebrity campaigns, political media campaign, news releases, events and promotions. He holds a BA from University of St. Francis in business management.

Note

Note that information displayed above is accurate as of the date of the most recent Form C filing.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...