New solution to offer enhanced durability and consistent dimensional accuracy, IoT tracking, and per-trip or activity-bas...

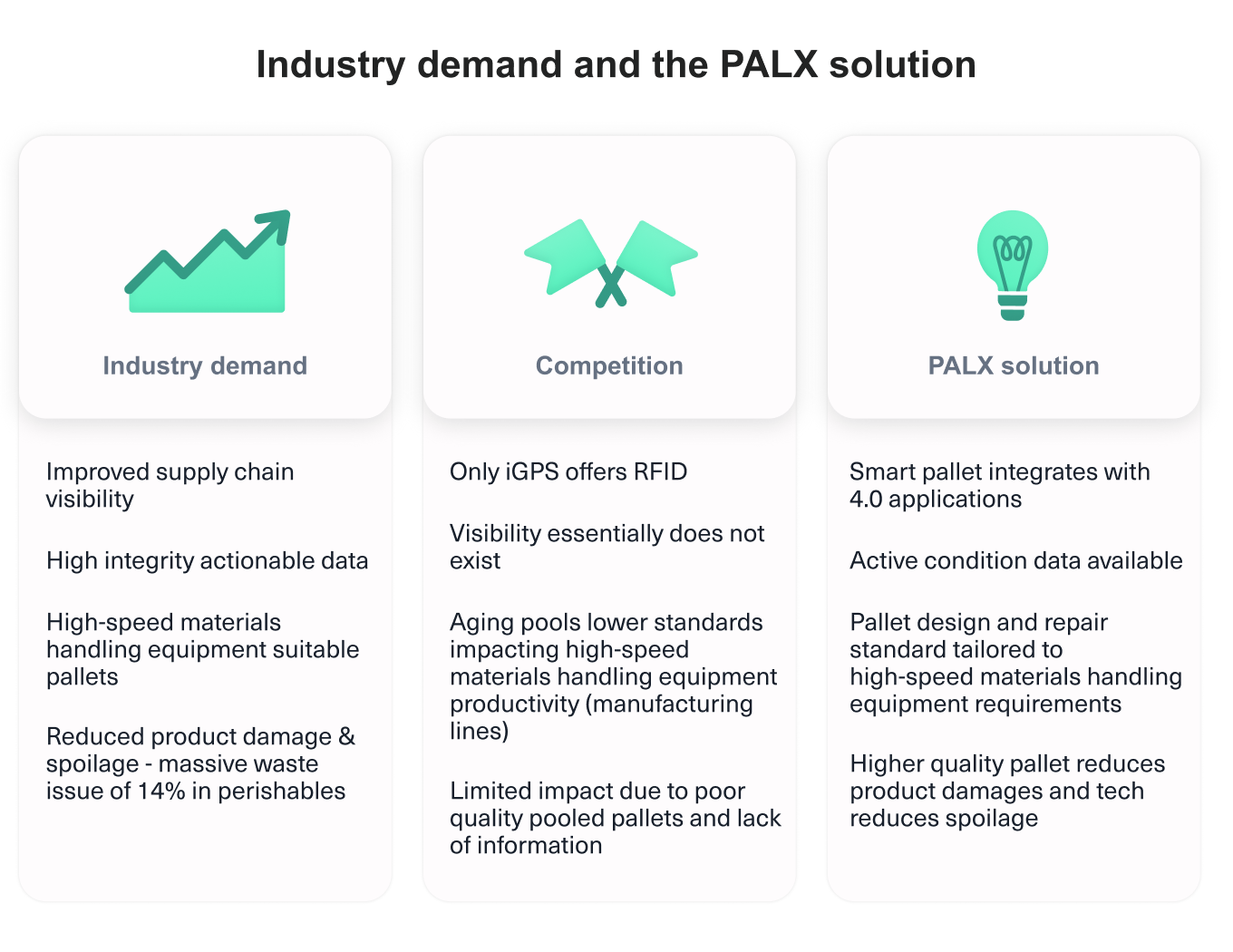

Problem

Poor quality pallets used by manufacturers and retailers increases costs throughout the supply chain, and ultimately for consumers

Poor quality pallets increase costs by causing high speed manufacturing equipment down time / loss of efficiency and product damage in transit throughout the supply chain. This occurs from manufacturers to warehousing and retailers, causing returns, safety risks and cleanliness issues at retail level.

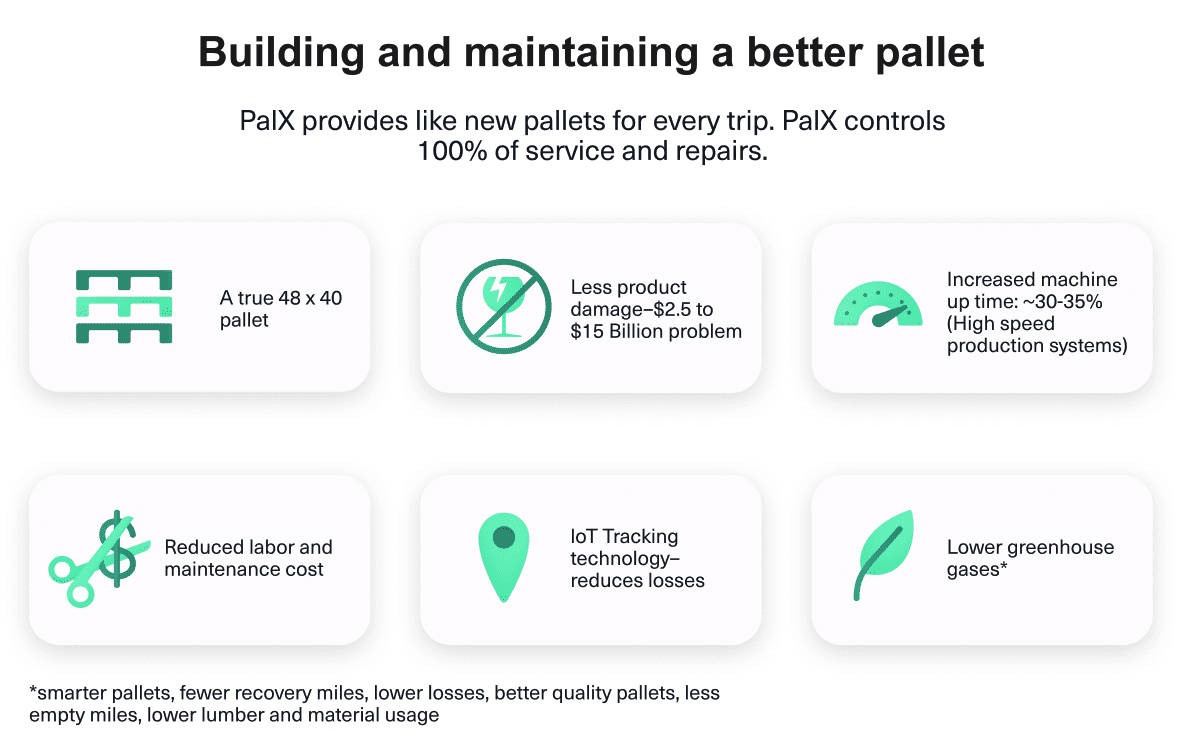

A recent US Fast-Moving Consumer Goods study reported product damage accounts for an estimated $2.5-$15B in losses per year. Growers and retailers discard at least 14% of grocery items that are never sold, and that number is even higher for perishables. A key part of the problem is poor pallets used by manufacturers and retailers.

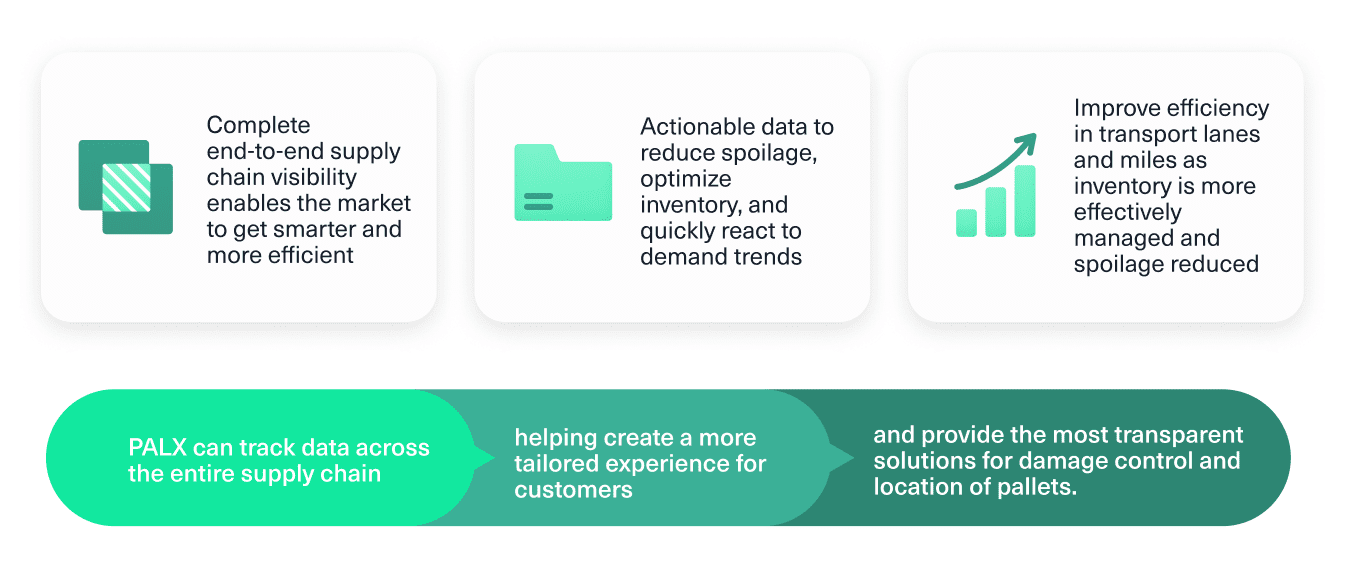

Solution

Disruptive technology and a better designed pallet creates a smarter, more efficient supply chain

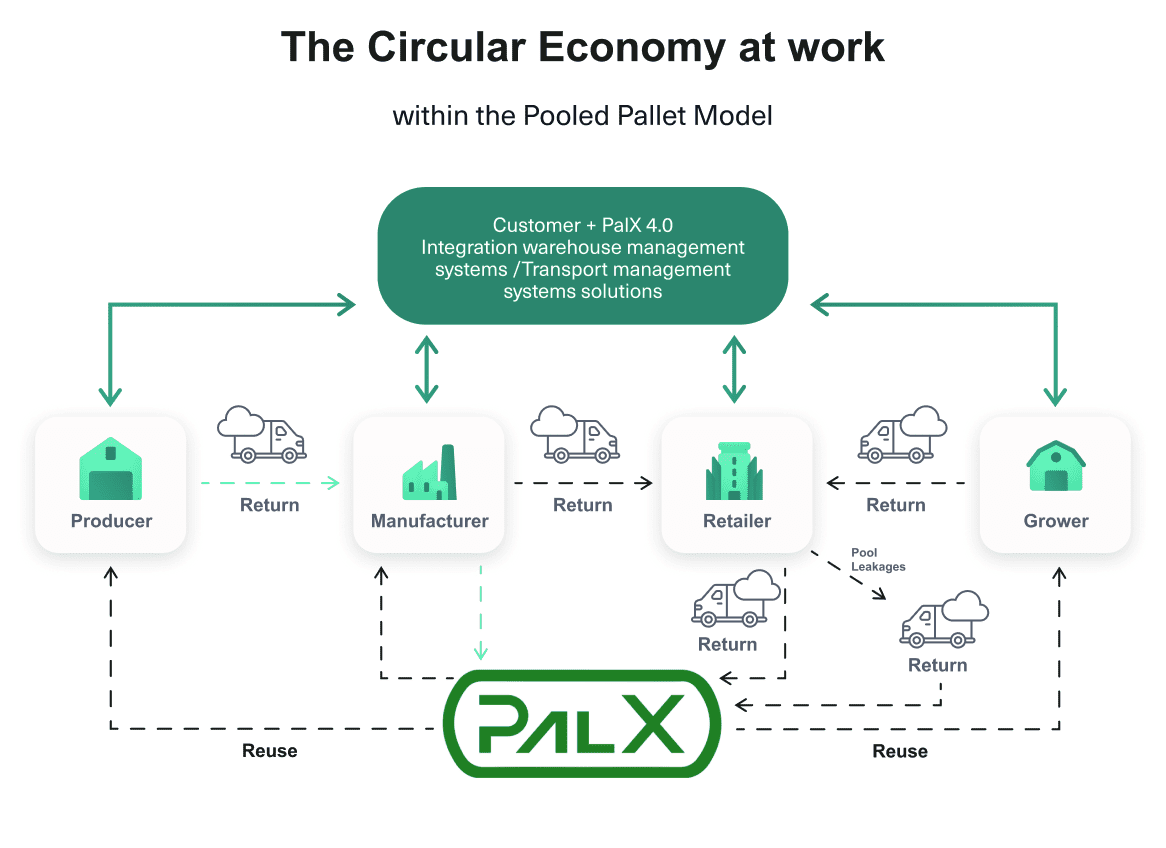

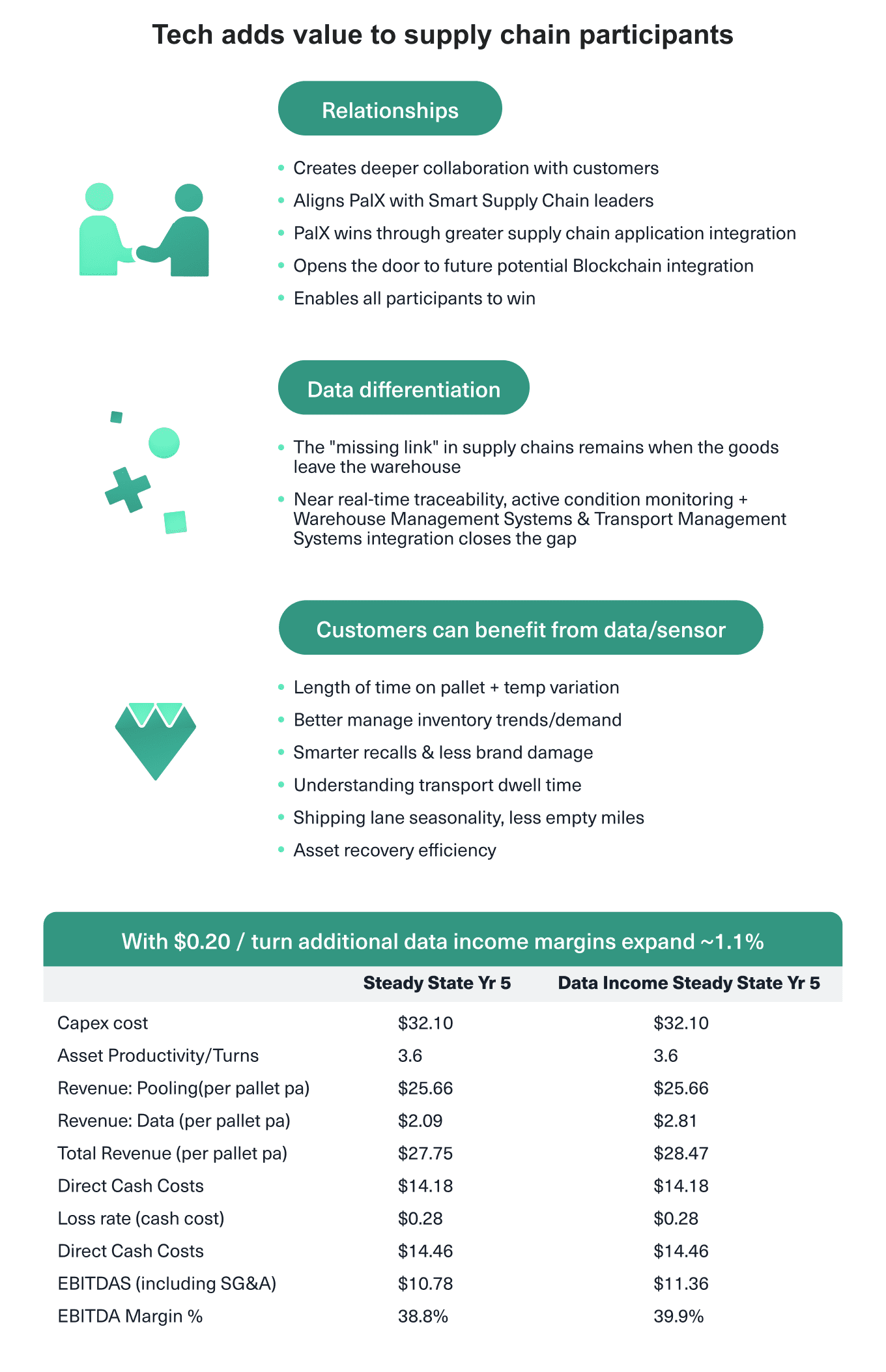

PalX brings value to the supply chain with the development of our Smart Pallets. Our technology will enable improved transparency, integrity, and visibility of the supply chain for all participants. Our better designed pallet not only absorbs most forklift abuse, minimizes damage, reduces debris, but also improves manufacturing plant efficiency, retail handling benefits, and safety overall.

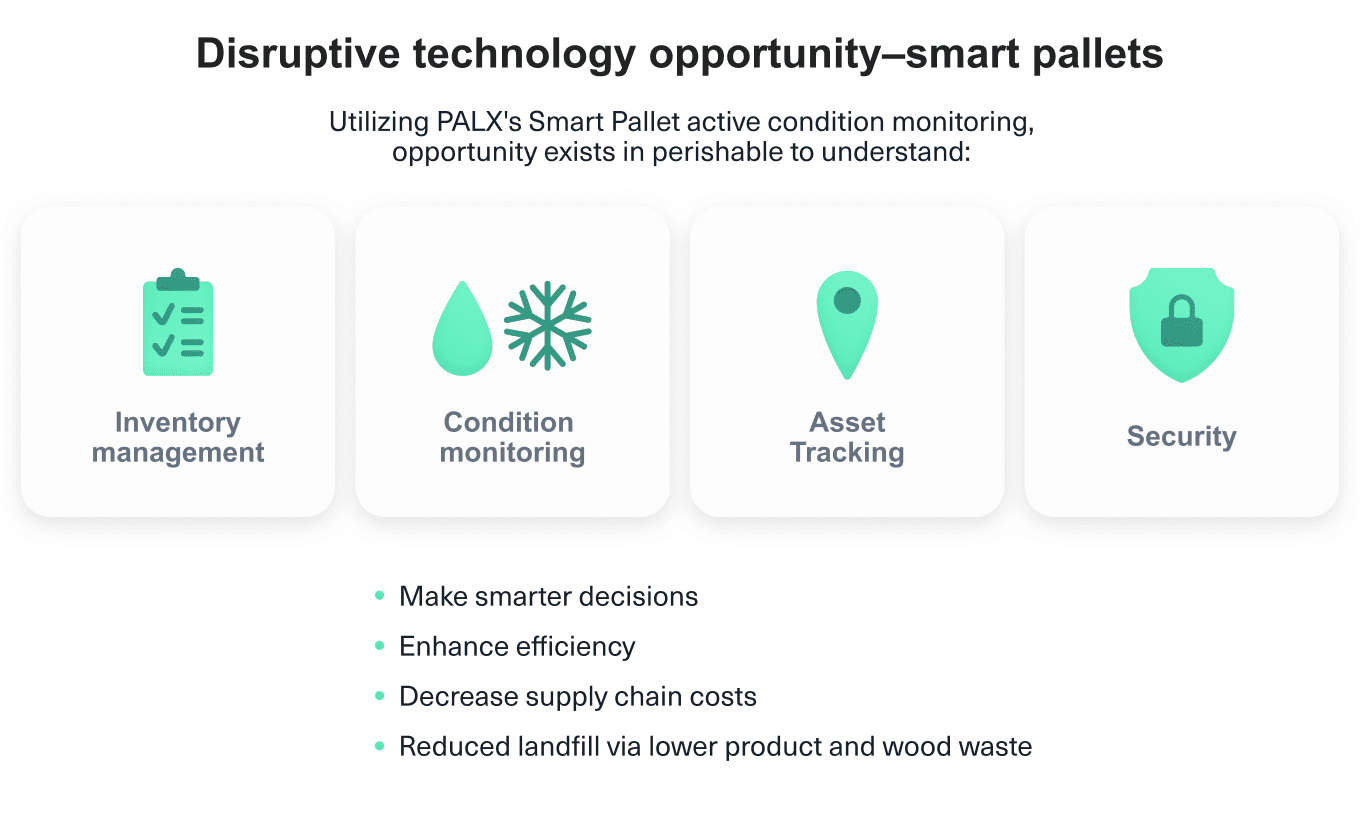

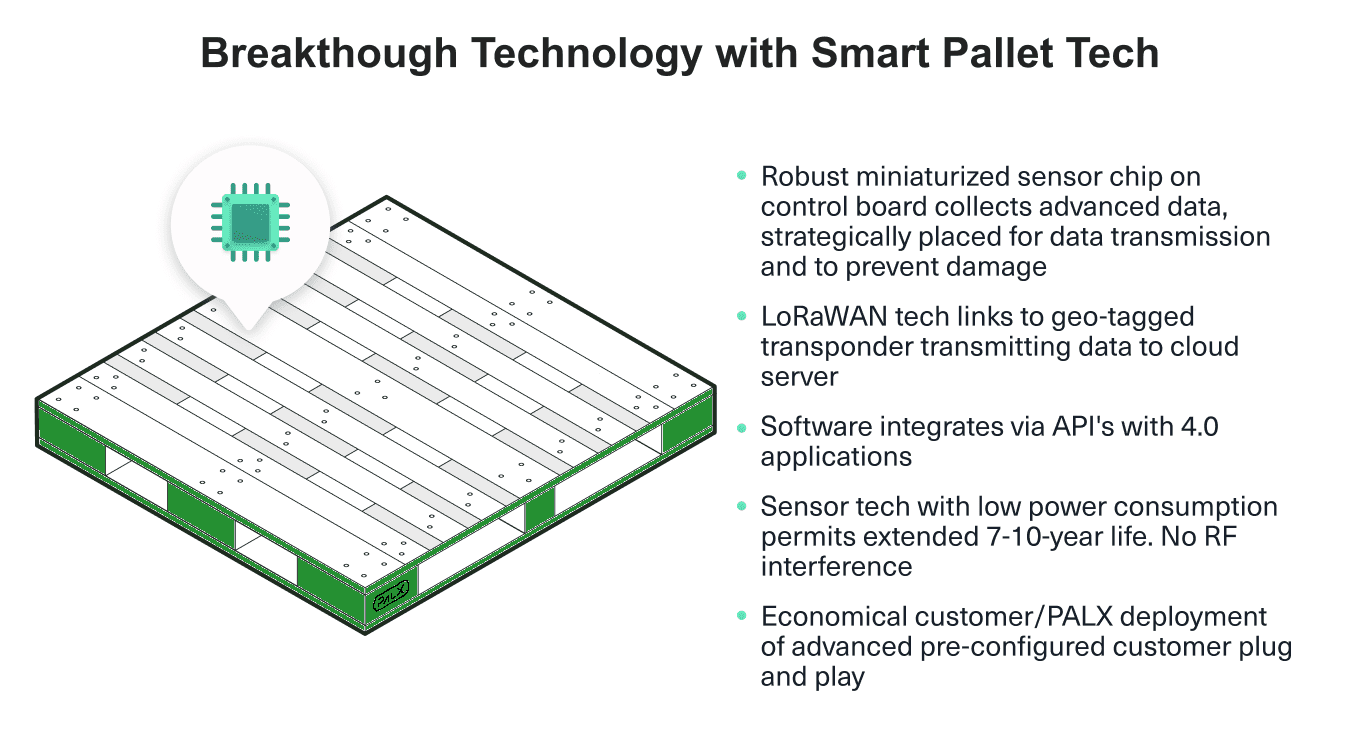

Product

PalX transforms the lowly pallet into a key digital supply chain link

PalX makes a market breakthrough with Smart Pallet tech. Each pallet has a control chip enabling the management of inventory movements, active condition monitoring, and security of both pallet assets and goods under load. We will provide like-new pallets for every trip and control 100% of service and repairs.

Traction

There's growing dissatisfaction in the pallet market and PalX is perfectly positioned to take advantage

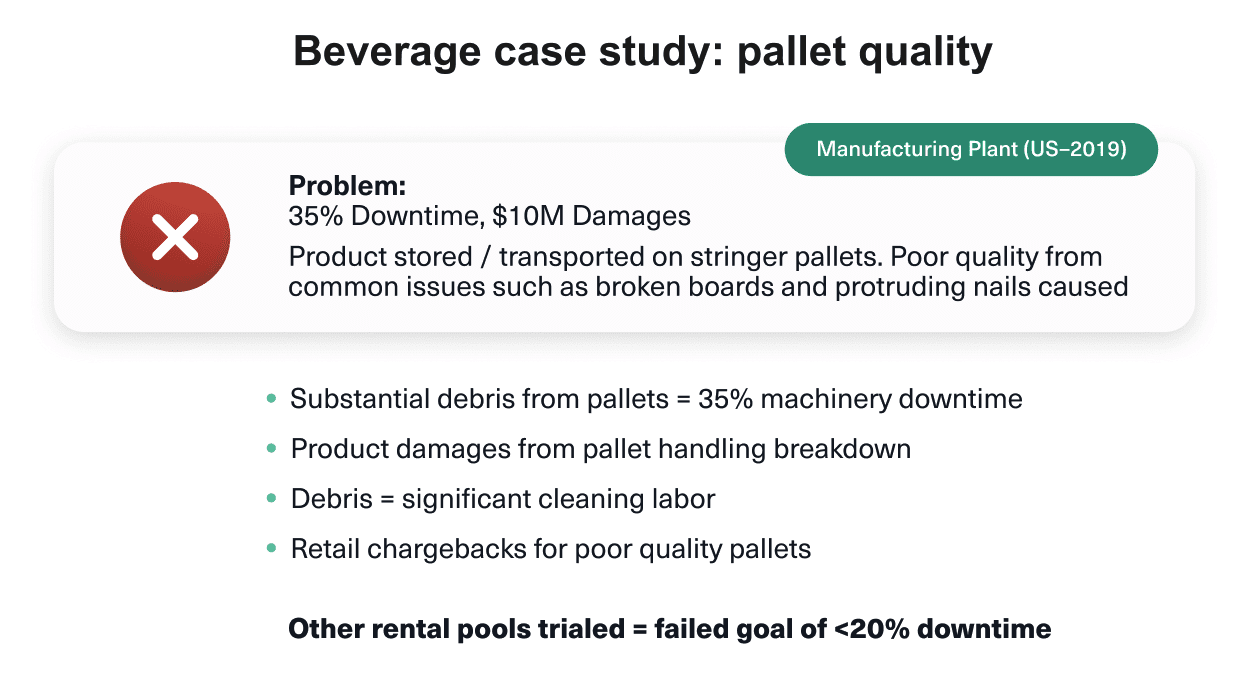

PalX has a sales pipeline with untapped interest. We’ve established a contract with a national brand and undergone a successful pilot with a national beverage brand. Our sales pipeline includes major national brands and smaller regional players, which will allow PalX to step up gradually in scale and to achieve our multi-million revenue opportunity.

Customers

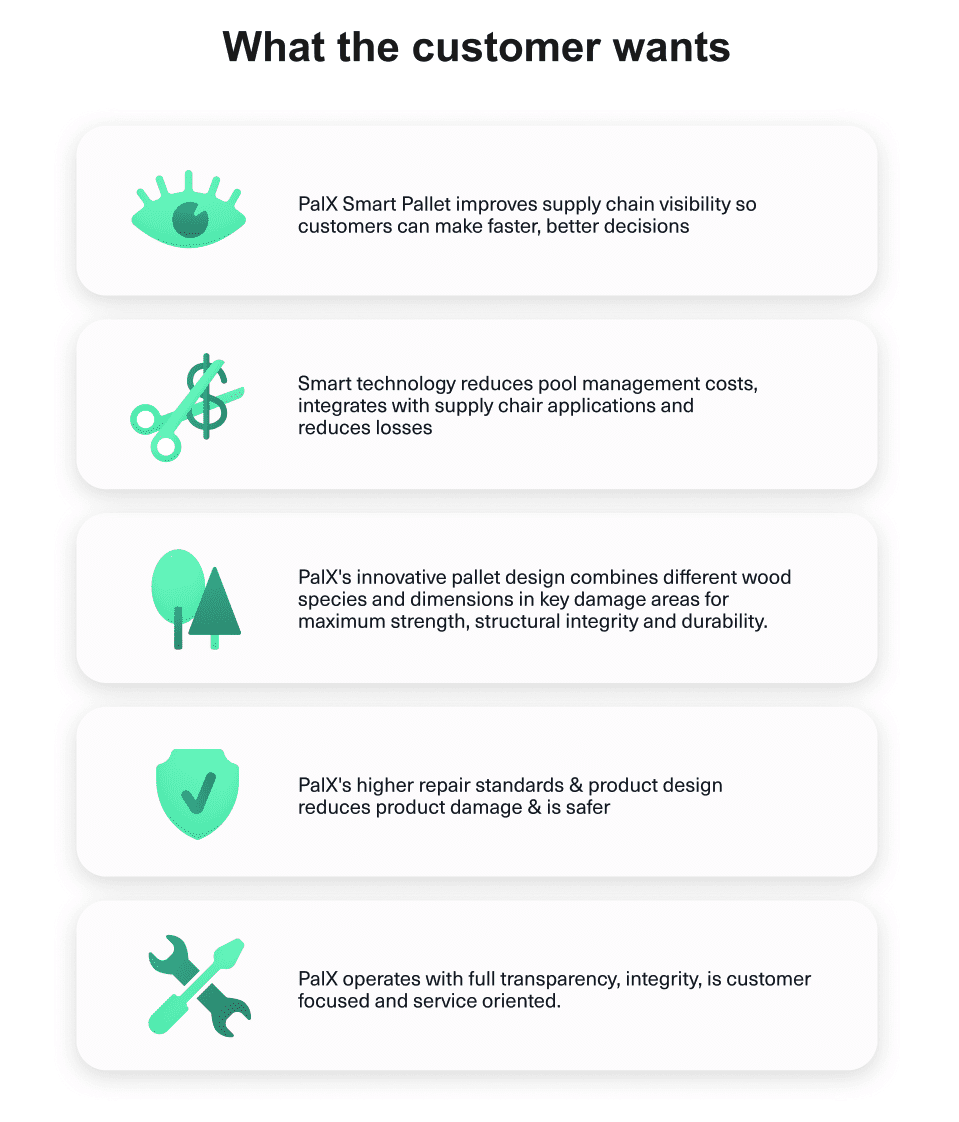

PalX's higher repair standards & stronger, more durable design reduces product damage & is safer

Upon launch, PalX will actively work with national and international-level consumer brands that require advanced technology to manage their supply chain. Our service will enhance supply chain visibility, reduce their pool management costs, integrate with supply chain applications, reduce manufacturing downtime and pallet losses.

Our case study with a national beverage brand saw a reduction of $10M in damages using better quality pallets more suited to automated high speed manufacturing equipment.

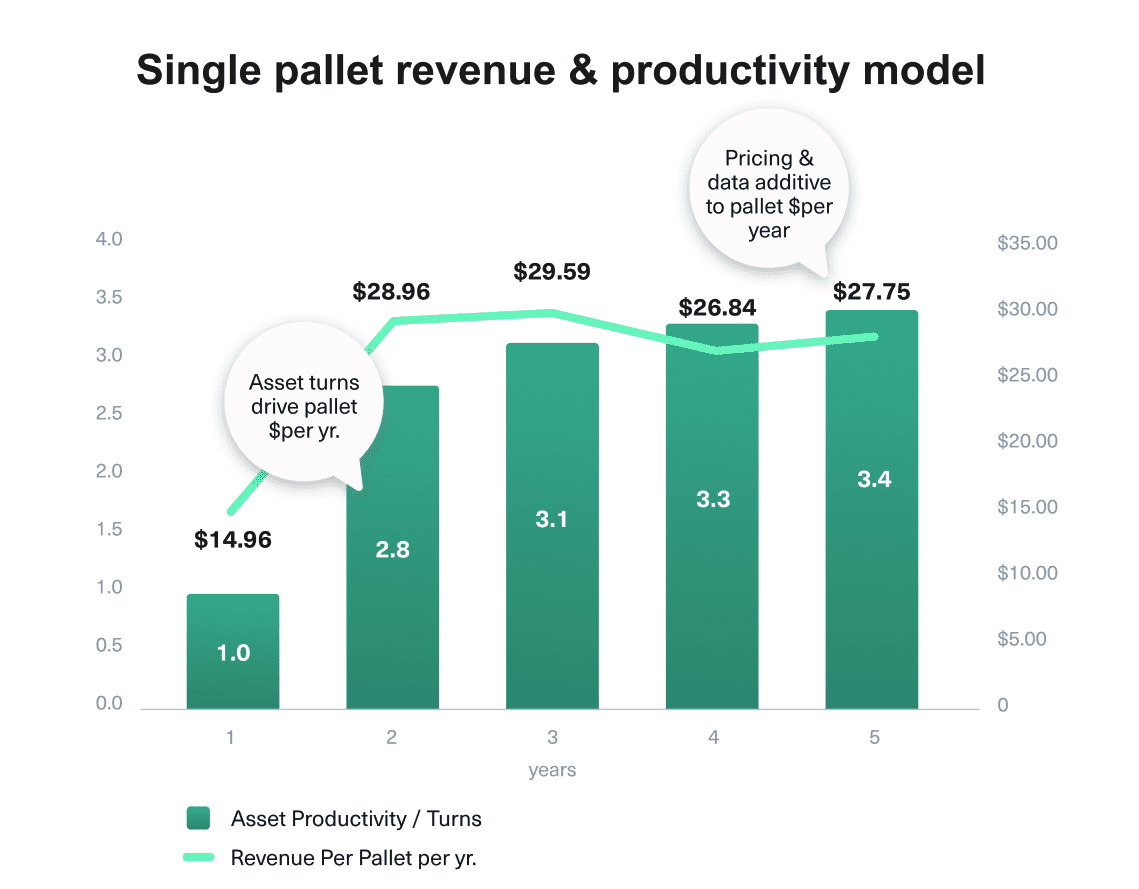

Business model

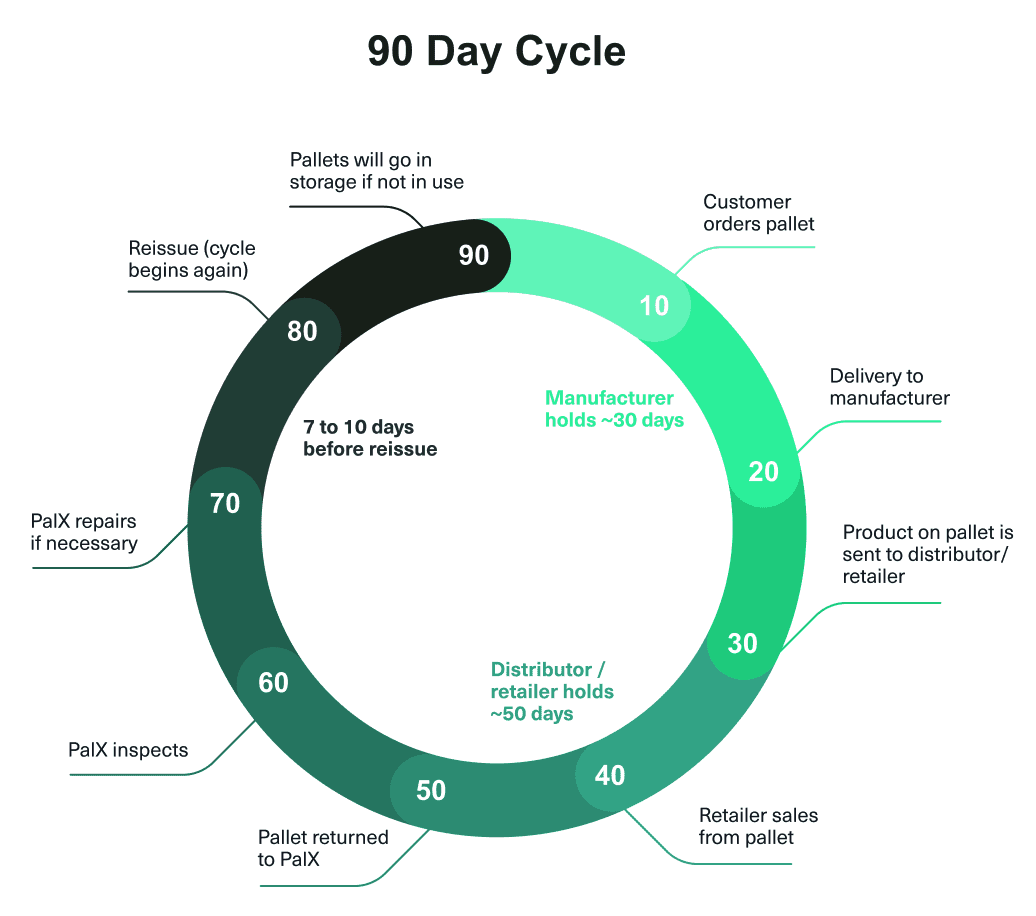

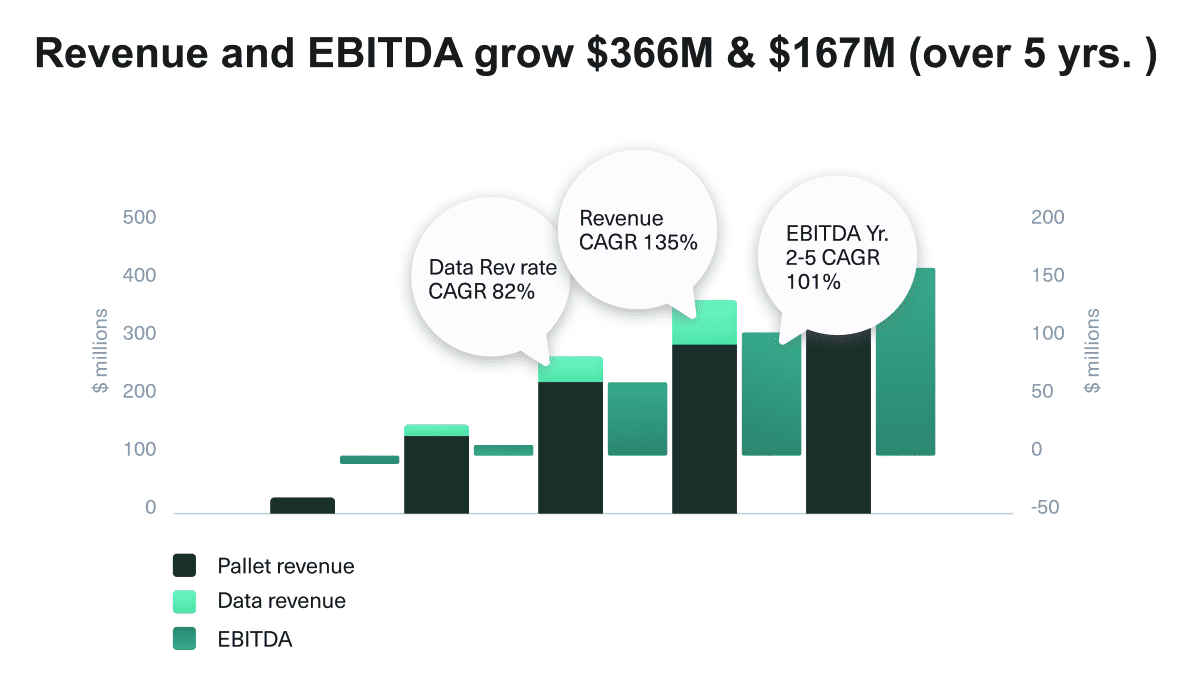

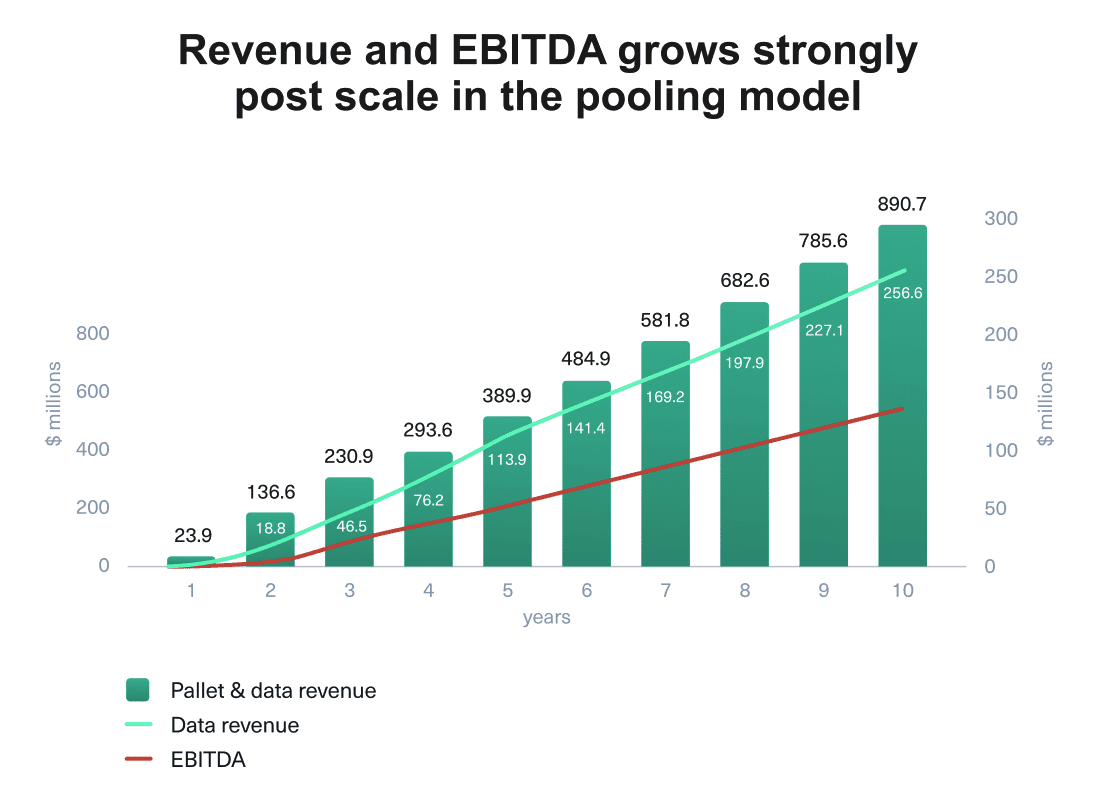

Our revenue model offers upside against other poolers

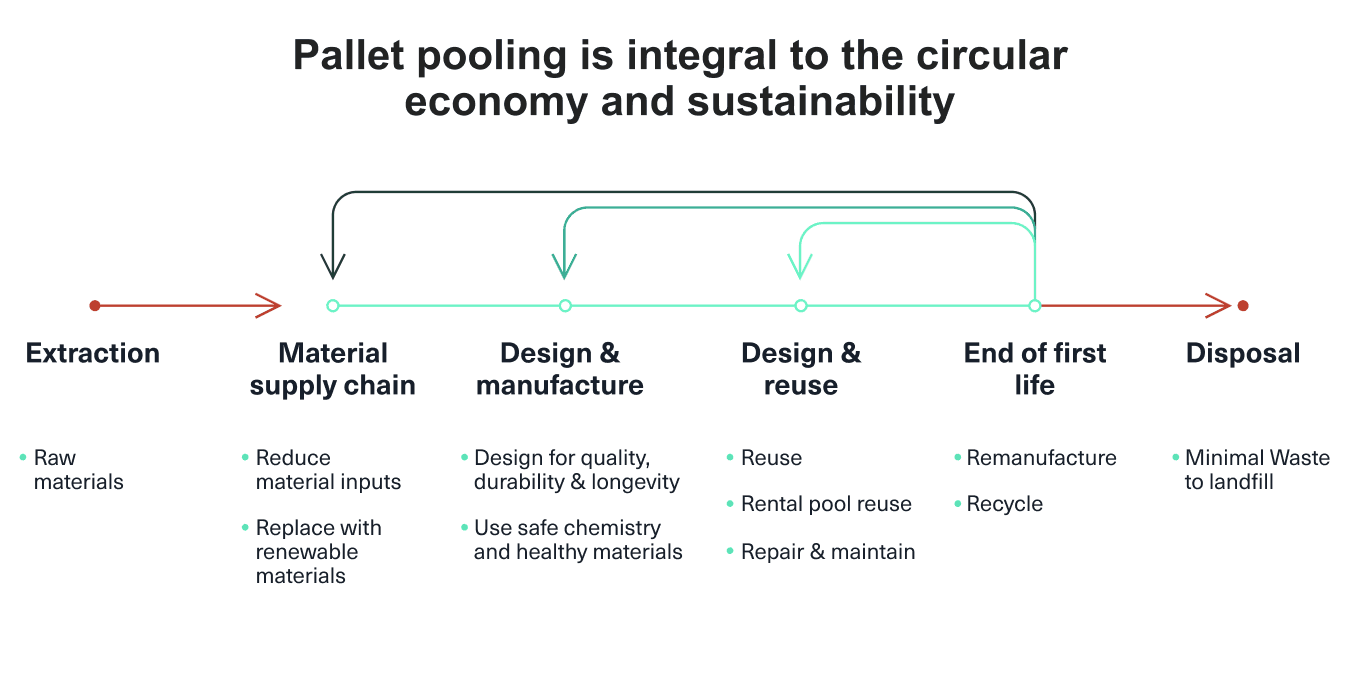

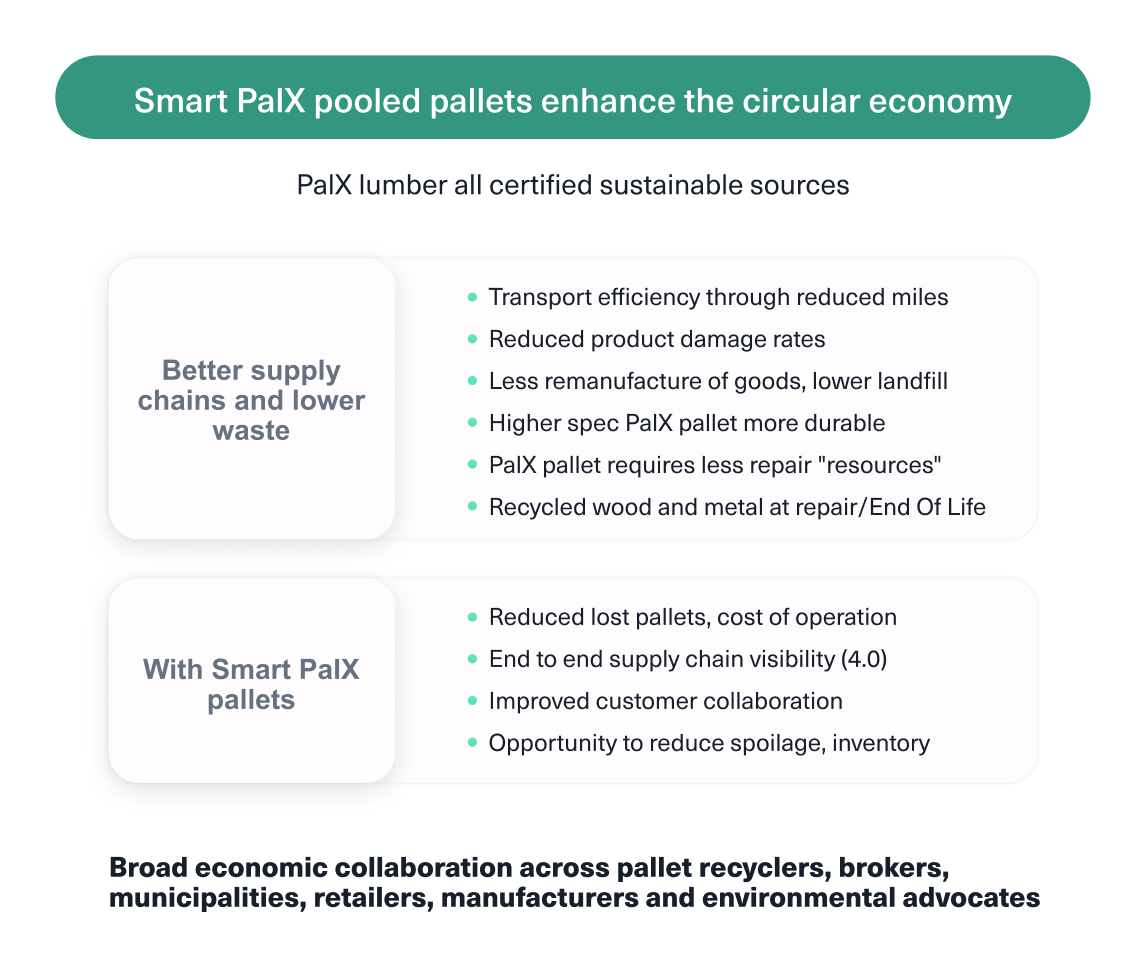

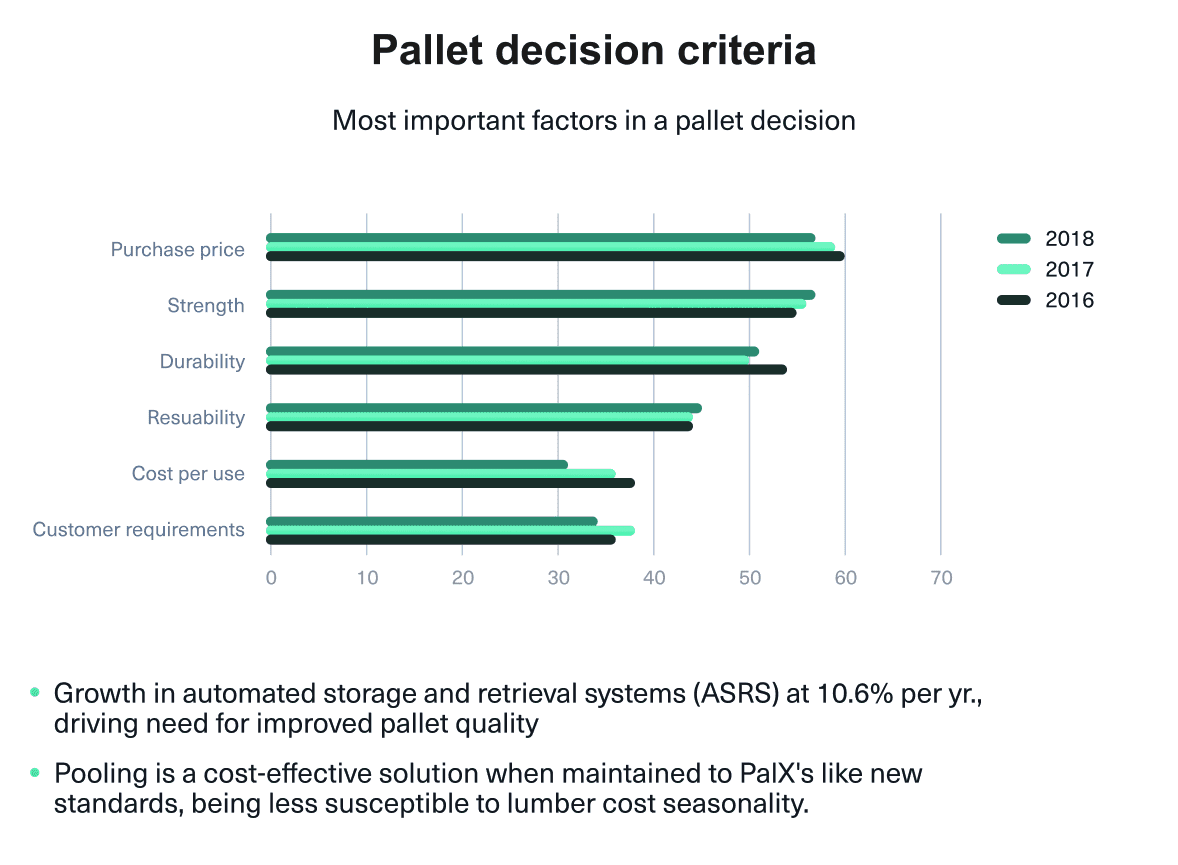

The current revenue per pallet year ranges from $18-26, excluding any data income. The PalX standard annual revenue per pallet is estimated at $24 to $28 for years 2 to 5. Our revenue model offers upside against other poolers. Pooling is integral to the circular economy and sustainability, and our model contributes to 6 key UN sustainable development goals.

*Current revenue per pallet year as of July 2021

Market

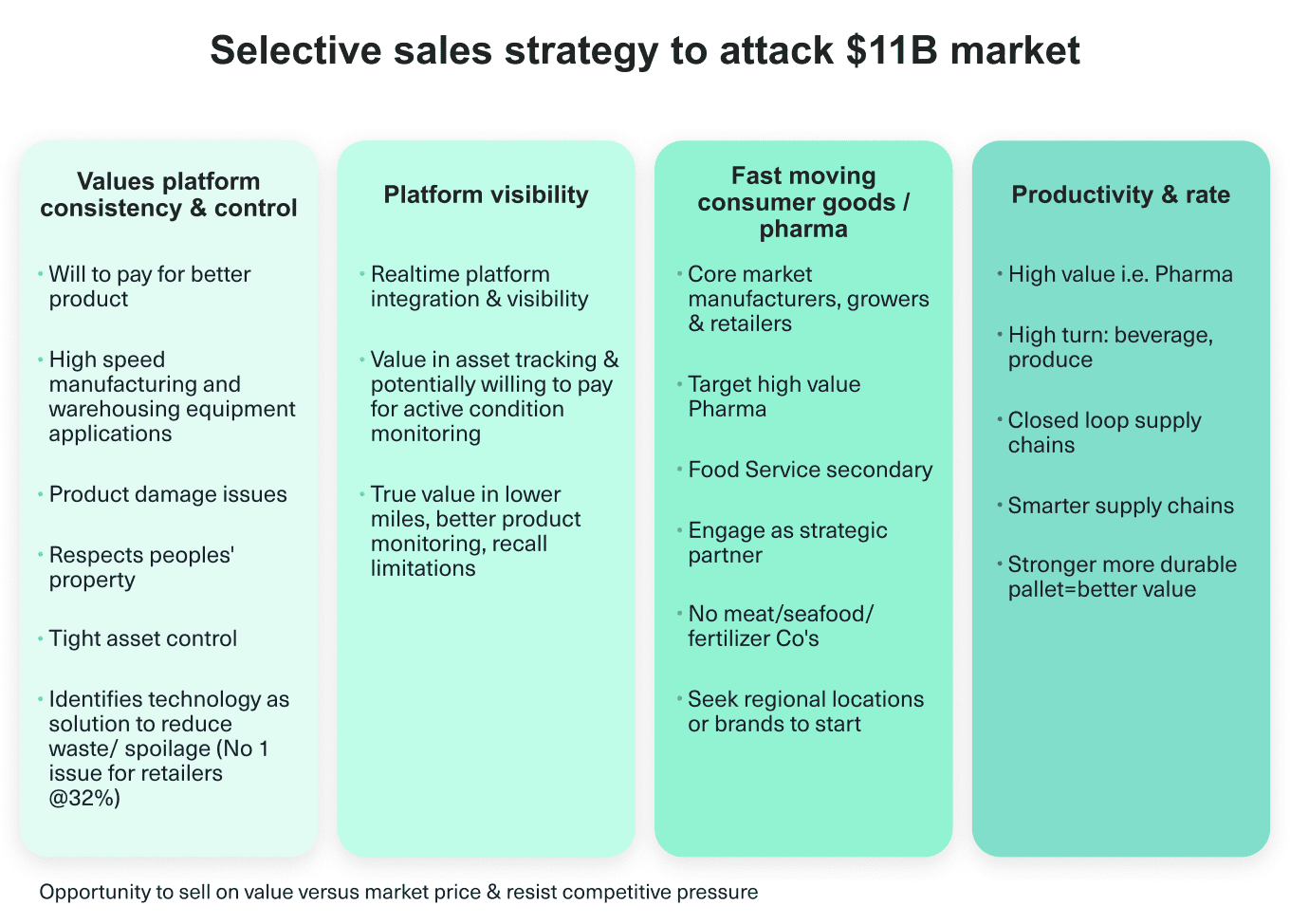

Operating in an $11B market

PalX has a selective sales strategy to attack an $11B market, of which the pallet rental segment is valued at $3.2B. To our knowledge, we have the first to market mover advantage and a strong opportunity to sell on value vs. market price. In 2019, there were an estimated 2.6B pallets in use. The opportunity is ripe to disrupt the sector, improve the value chain, and reduce CO2 emissions. The forecast CAGR is 4.2% from 2020-2025.

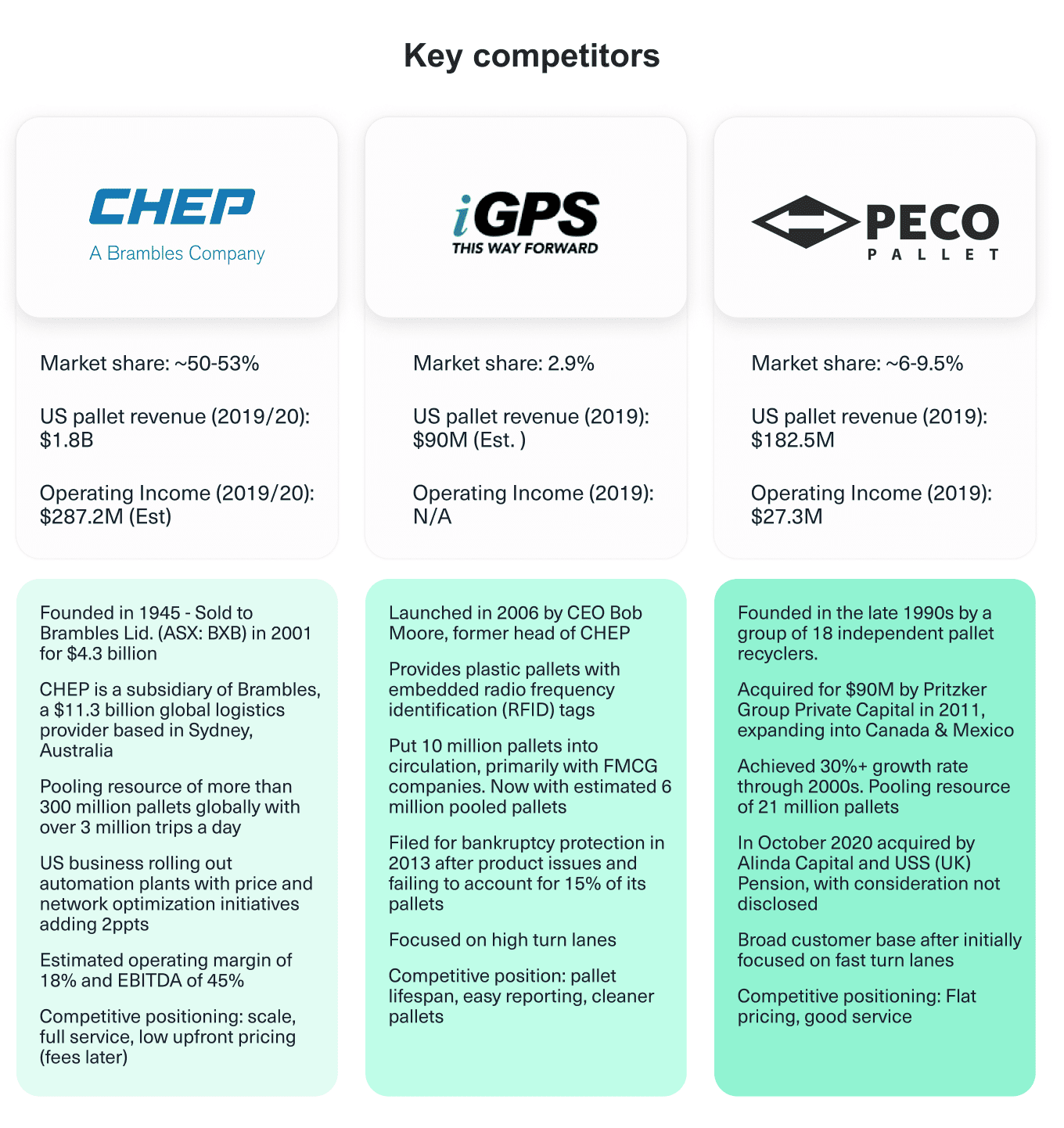

Competition

The pallet industry has remained virtually unchanged

The pallet industry has remained incredibly stagnant since the first introduction of pallets during the early 20th century. Now, PALX is competing in a new frontier of consumer shipping technology with one monopolist and a couple of smaller competitors.

Vision and strategy

Redefining the goods transport industry

PalX plans to further develop its client pipeline and product portfolio. Our ultimate goal is to completely redefine the pallet—and consequently the Fast Moving Consumer Goods—industry.

Funding

Raising to scale operations

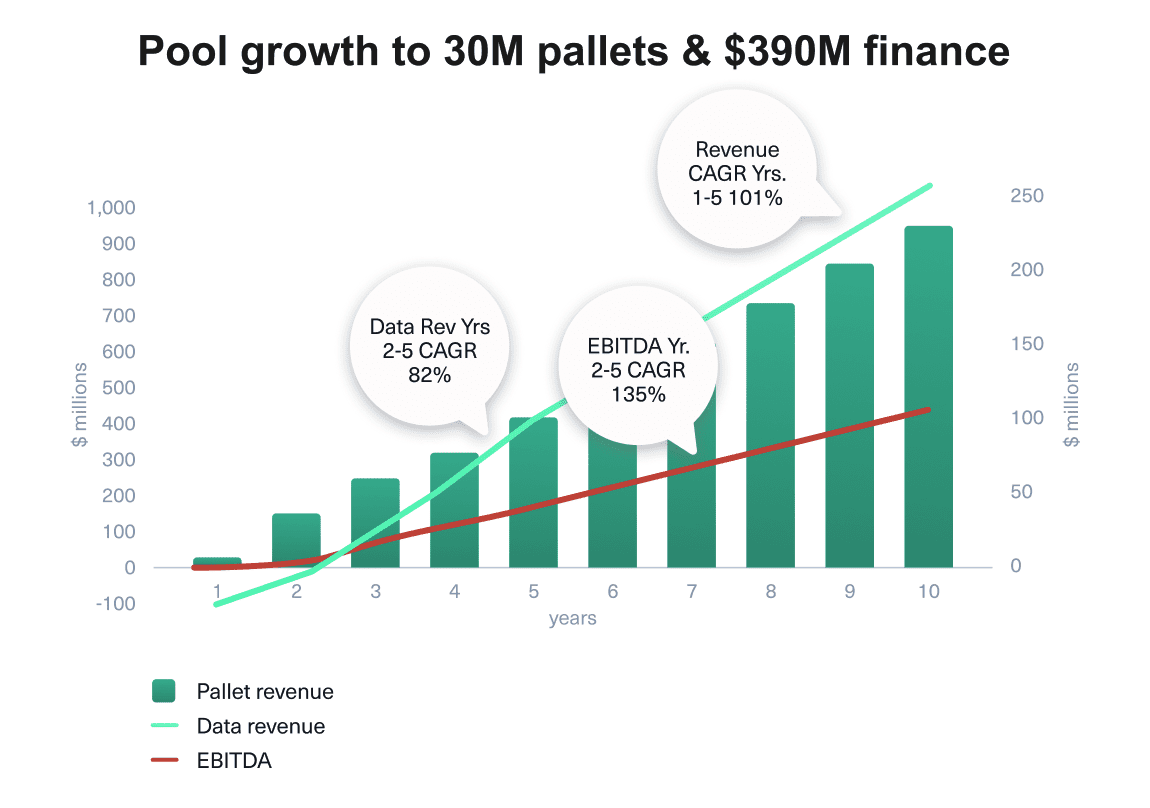

PalX is seeking new funding to allow us to complete sensor product finalization including tech stack, production of PalX Smart Pallets for customer field testing, initial operating costs, and working capital needs, and an opportunistic exit after five years at a potential 7x EBITDA.

Founders

Industry experience critical in complex supply chain business

Board and Management have tremendous depth of experience in the supply chain space. And specifically within the pallet industry and all its components, whether it's building, repairing, managing the most efficient logistics network or utilizing the resources of >600 pallet recyclers, the team has depth.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...