Matthew Sullivan is the founder and CEO of QuantmRE, the real estate marketplace that makes home equity accessible, inves...

Problem

Home Equity: Difficult for homeowners to access, and for investors to own

Residential Real Estate is the largest asset class in the world. It's a major driver of the economy and a major store of personal wealth, but most of this wealth is owned by households. In 2022 there was a record $28Trillion in equity locked up in residential homes in America. However, the illiquid nature of home equity means it's difficult to get access to it.

This presents a problem for many homeowners, and a challenge for investors.

The Problem for Homeowners

Traditionally, if you wanted to tap into the equity in your home, you had two choices: sell the property or go deeper into debt. However, with today's high interest rate environment, many homeowners can't afford to refinance their homes and give up the low interest rates they have secured on their mortgage.

There is also the question of eligibility. Even though many Americans have significant equity in their homes, if they do not meet the credit score or debt-to-income thresholds, they are locked out from accessing their home equity via traditional mortgage lending.

Homeowners who don’t qualify for a loan or don't want to give up their low mortgage rates are looking for an alternative solution to get cash out of their home equity.

The Challenge for Investors

Investors have not been able to invest in owner-occupied properties. There is a huge opportunity to provide investors with the ability to own a share of the equity in owner-occupied homes.

Investors want to be able to invest in the equity in residential real estate without the cost and involvement of property ownership.

Solution

QuantmRE makes home equity liquid and tradable

QuantmRE's Home Equity Investments enable homeowners to get access to their home equity without taking on more debt. A Home Equity Investment ('HEI') is a financial structure, protected by a lien on title, that provides cash to the homeowner in exchange for the investor getting a share of the current and future value of the property. A Home Equity Investment is not a loan or a mortgage, and it's not a home equity line of credit.

For investors, Home Equity Investments provide economic benefits that are not available in conventional real estate investments. With built-in downside protection, they can deliver positive returns in flat and down markets and enhanced upside participation in appreciating markets. An HEI is an asset-backed investment with a perceived protection against inflation.

For homeowners, Home Equity Investments are even more valuable. An HEI is not a loan and therefore the homeowner has no monthly payments, no interest rate charges and no added debt. They provide the cash needed by the homeowner without them having to take on more debt or sell the property. HEIs can solve current financial problems or enable the homeowner to capture a financial opportunity.

QuantmRE's online calculator makes it easy for a homeowner to find out how much home equity they could access by entering their address:

Why are Home Equity Investments attractive to Investors?

- HEIs are real estate investments, secured by a lien on title

- HEIs give investors the opportunity to purchase equity in owner-occupied residential real estate at a significant discount to the current market value.

- HEIs can generate positive investment returns in flat or declining real estate markets

- HEIs can provide enhanced, unlevered upside returns in rising real estate markets

- HEIs are secured by a Deed of Trust. They are recorded in a junior position to the existing mortgage, but senior to all homeowner equity

—

Home Equity Investments represent a compelling real estate investment and larger financial institutions have taken advantage of them.

QuantmRE's Home Equity Marketplace has been designed to enable Main Street investors to buy and sell Home Equity Investments with far lower investment minimums.

Product

We bring Home Equity Investments to the crowd

Currently, Home Equity Investments are only available to Institutions and they have committed $Billions of capital to this asset class.

QuantmRE's Marketplace makes fractionalized Home Equity Investments available to a wide range of investors, enabling them to benefit from this exciting real estate investment without onerous minimums or complicated qualifying requirements.

Home Equity Investments can be fractionalized and listed in the QuantmRE Marketplace. Investors will be able to build, model, manage and trade individual Home Equity Investments, pools or fractions of Home Equity Investments.

With QuantmRE’s Marketplace, an investor will be able to build their own portfolio of Home Equity Investments in hand-picked properties. This will allow investors to be directly engaged in the selection of their investments.

Compliance and Regulatory readiness.

In August 2022 QuantmRE announced its partnership with Texture Capital. This partnership broadens QuantmRE's compliance capabilities via Texture’s broker-dealer and Alternative Trading System (ATS) licenses and provides QuantmRE with the regulatory readiness to launch its Home Equity Marketplace.

“QuantmRE is unique in the digital asset space”, said Richard Johnson, CEO of Texture Capital. “In a rising interest rate environment where home values have been appreciating, I believe QuantmRE is ideally positioned to take advantage of rapidly increasing demand from homeowners to find alternative, debt-free solutions to access their home equity, as well as enabling a wider range of investors to actively participate in the previously untapped real estate asset class of residential home equity”.

Note: To enable fractionalized HEIs to trade, QuantmRE will require additional approvals from federal and state regulators which the Company anticipates could be time and capital extensive. If the Company is not successful in obtaining the necessary approvals, the fractionalization and transferability of these Home Equity Investments could be limited.

Traction

Industry pioneers

with $12M+ in HEIs to date.

QuantmRE has built a trusted brand name, is revenue generating, and has established a demonstrable track record in originating Home Equity Investments.

We are pioneers in the Home Equity Investment industry and we believe we are the first company to have successfully offered and sold fractionalized Home Equity Investments.

Key traction points:

- Over $12M in Home Equity Investments originated across 80 transactions

- $1M of Home Equity Investments funded by management, listed in the Marketplace

- Initial beta-test market trades took place in November 2022. We believe this is a world first.

- Large investor base: 1450 registered investors from Republic rounds, over 750 additional investor registrations on our Marketplace

- Partnership in August 2022 with Texture Capital to enable fractionalized HEIs to be bought and sold in the Marketplace with the required regulatory compliance

We have also garnered a significant amount of press interest:

Note that the $12M in Home Equity Investments includes HEI transactions that were originated by QuantmRE and completed with other HEI companies with various structures and terms. To enable fractionalized HEIs to trade, QuantmRE will require additional approvals from federal and state regulators which the Company anticipates could be time and capital extensive. If the Company is not successful in obtaining the necessary approvals, the fractionalization and transferability of these Home Equity Investments could be limited.

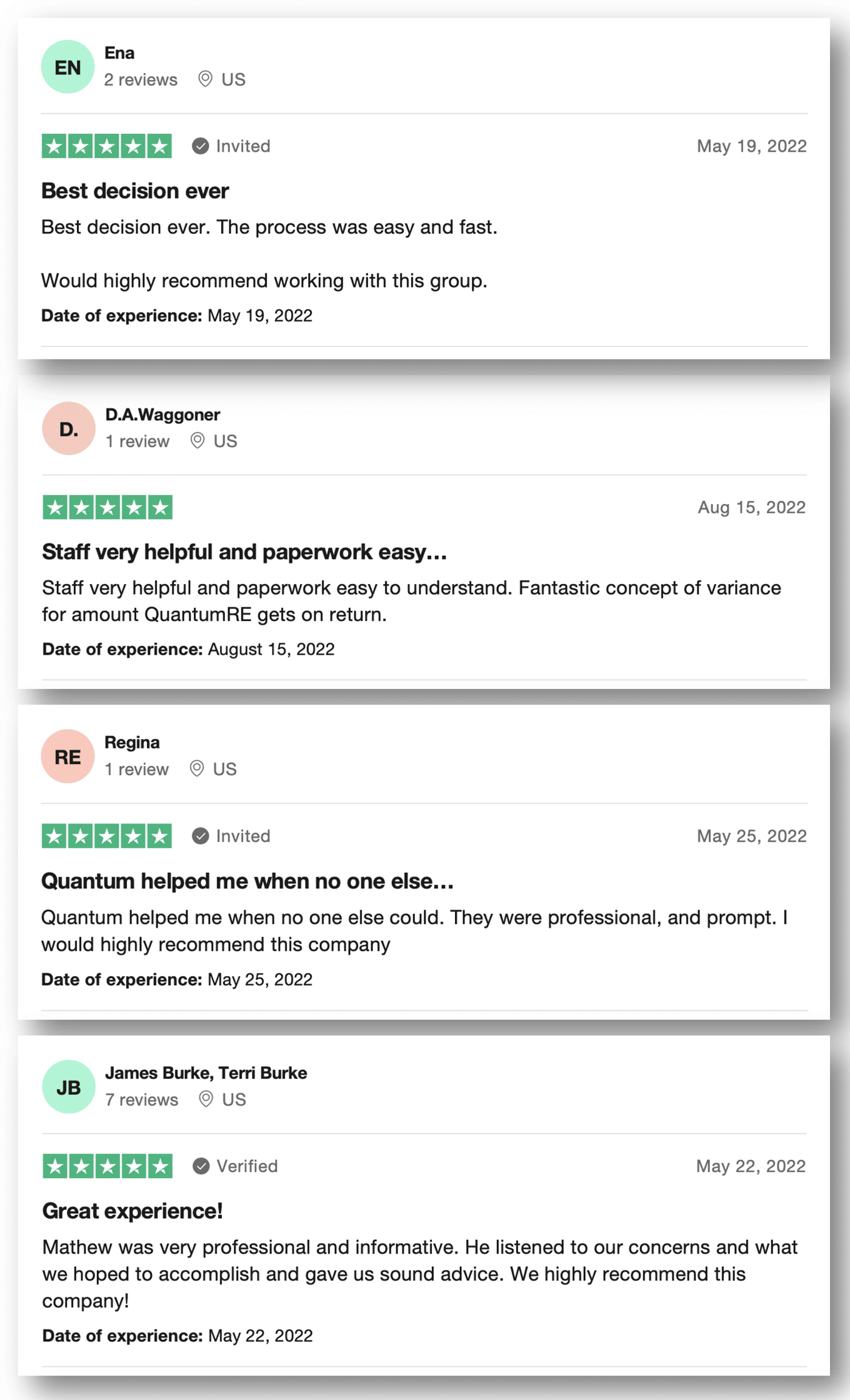

Customers

Our customers

love our product

With a QuantmRE Home Equity Investment, the homeowner can get a cash lump sum from their home equity with no monthly payments, no interest, and no added debt.

The homeowners that we have helped love our product and the Equity Freedom that our Home Equity Investments bring.

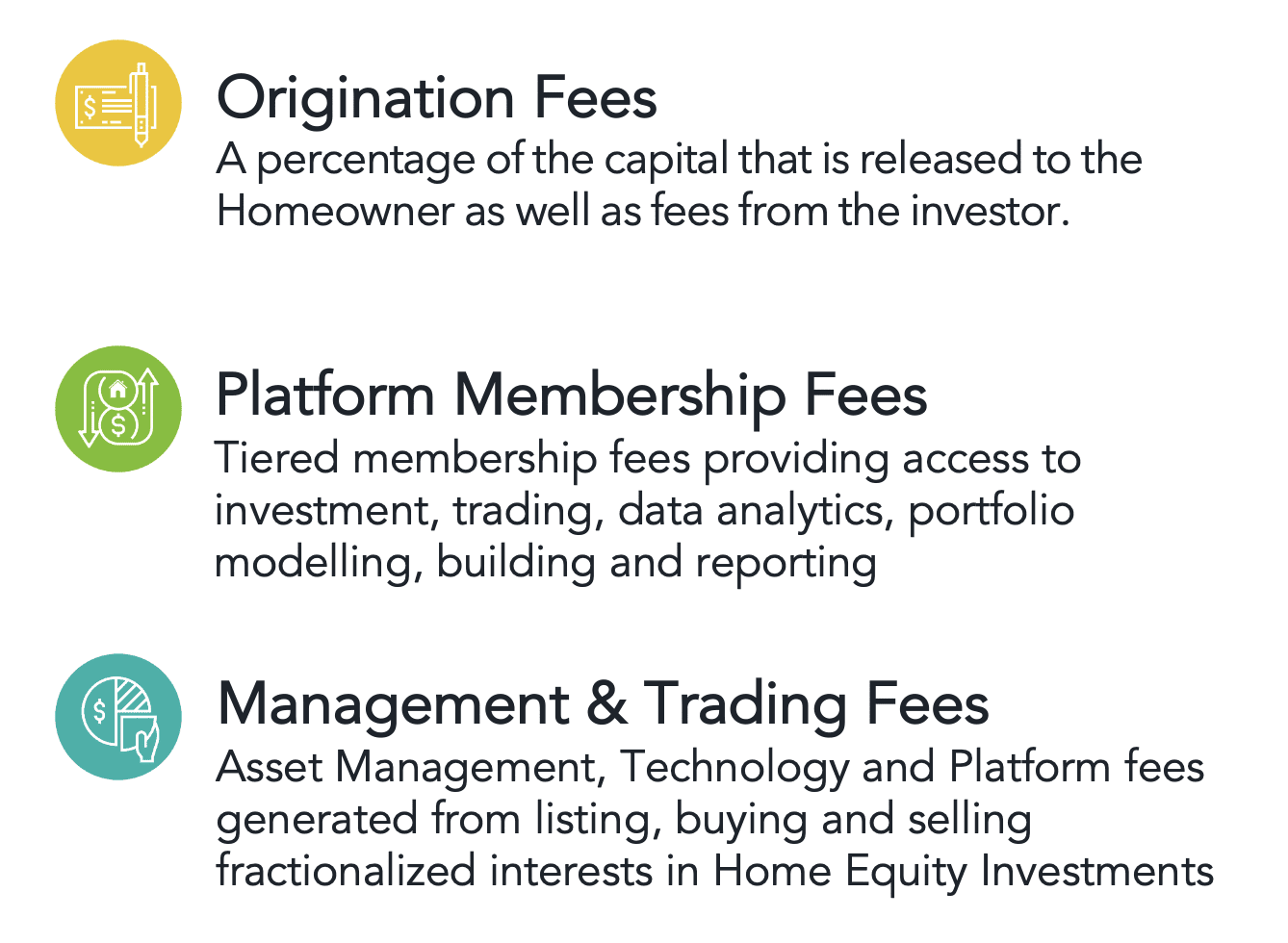

Business model

Strong unit

economics

We plan to generate revenues through the lifecycle of a Home Equity Investment, from origination to trading and settlement.

QuantmRE has been designed to generate revenues from the following activities:

Note: To enable fractionalized HEIs to trade, QuantmRE will require additional approvals from federal and state regulators which the Company anticipates could be time and capital extensive. If the Company is not successful in obtaining the necessary approvals, the fractionalization and transferability of these Home Equity Investments could be limited.

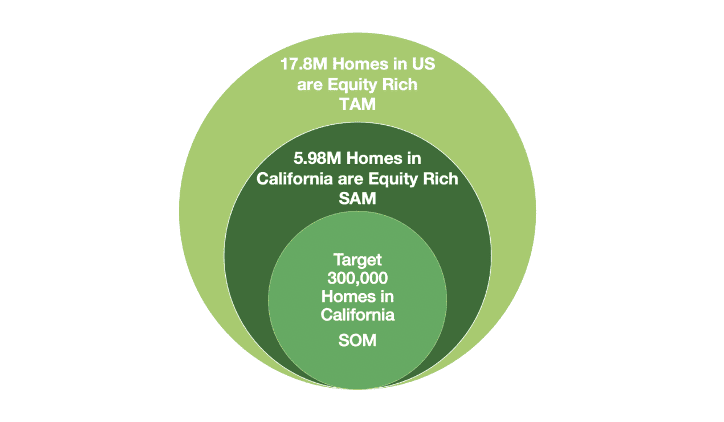

Market

Tapping into a rapidly growing, motivated market

Almost 18M homeowners in the US are 'equity rich' — meaning that they have 50% or more of equity trapped in their home. Total home equity in the US hit a record high of $28Trillion in 2022.

Leveraging direct-to-consumer marketing and existing channel partnerships, we are aiming to originate and offer in our Marketplace $50M of Home Equity Investments during 2023/2024. For investors, our blockchain-based Marketplace enables smaller investors to buy and sell personalized portfolios of this previously untapped asset class.

For investors, our blockchain-based Marketplace enables smaller investors to buy and sell personalized portfolios of this previously untapped asset class.

Our marketing strategy uses a combined approach of direct to consumer, via digital and social media advertising, and a channel partner network.

Our social media advertising strategy provides an efficient, scalable method of new customer acquisition. Part of the proceeds from this Offering will be used to increase our digital marketing and advertising spend to drive significantly more Home Equity Investment originations and to grow our institutional and retail investor base.

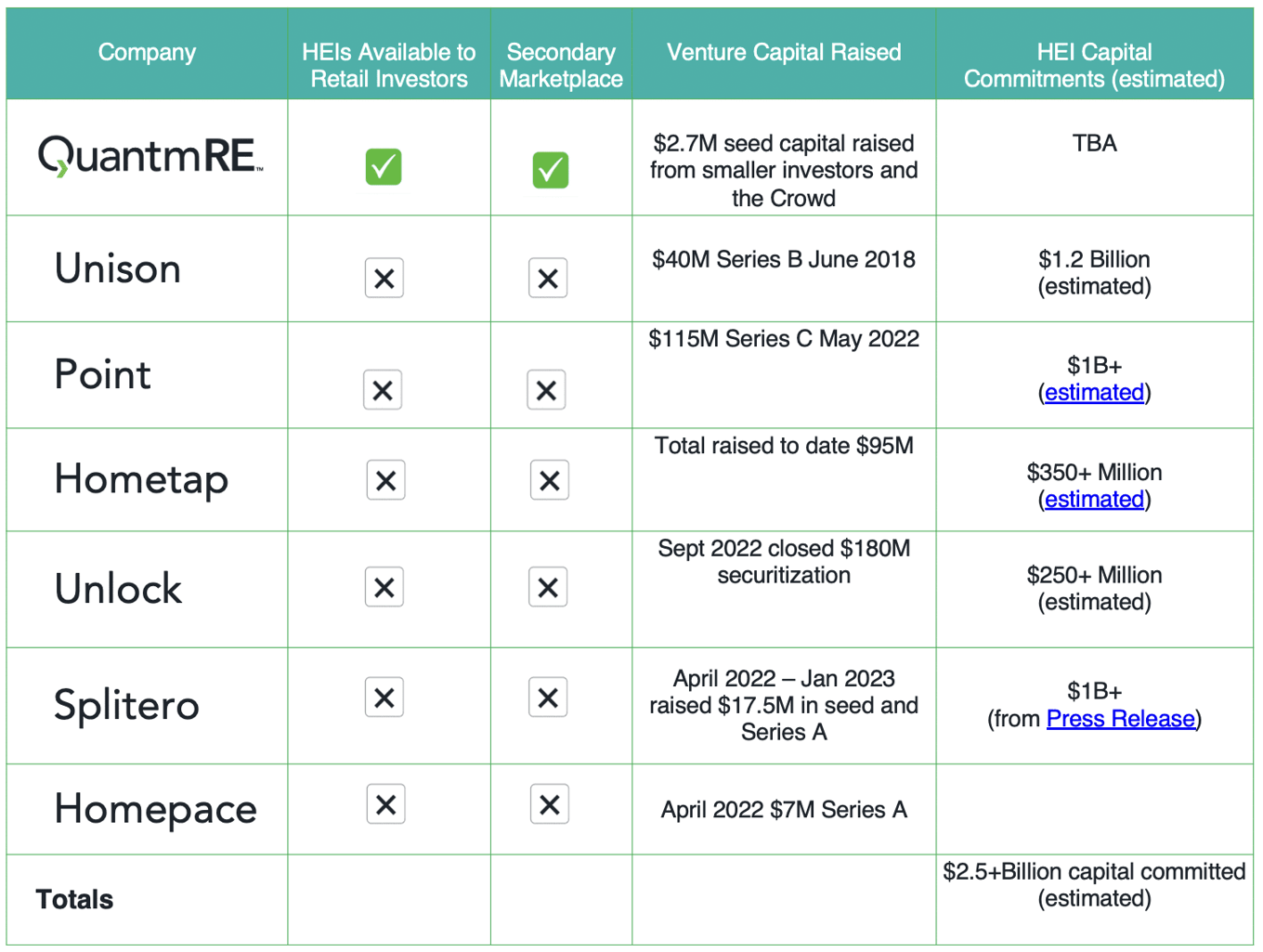

Competition

Our offering is unique, & our team is seasoned and experienced

Our team is comprised of pioneers in the shared equity space. We are actively originating Home Equity Investments and have already enabled homeowners to access millions of dollars of their home equity.

There are a limited number of companies competing in the HEI market, including Unison, Point, HomeTap, Unlock, Splitero and Homepace. None of these companies offer a Marketplace where smaller investors can gain access to fractionalized HEIs.

We also compete with companies like Lofty.ai, Fundrise, RealtyMogul, Crowdstreet, Groundfloor and other online platforms that offer real estate investments. None of these companies provide investors with access to the Home Equity Investment asset class.

We are different to all of the other Home Equity Investment and Real Estate Crowdfunding companies for the following reasons:

- The QuantmRE Marketplace is designed to provide retail investors with access to institutional-grade Home Equity Investments

- QuantmRE's Marketplace will provide investors with the ability to buy and sell fractionalized Home Equity Investments, not just the ability to buy investments.

- QuantmRE is not tied to specific capital sources—this means we have more flexibility when underwriting Home Equity Investments and can offer more competitive terms.

Note: QuantmRE's Marketplace will require approval from federal and state regulators which the Company anticipates could be time and capital extensive. If the Company is not successful in obtaining the necessary approvals, the fractionalization and transferability of these Home Equity Agreements could be limited.

Vision and strategy

Our vision is to become the largest global marketplace to trade home equity

Our mission is to enable the equity in residential homes to become liquid and tradable.

Our mission is to enable the equity in residential homes to become liquid and tradable.

We plan to expand the number of states where we offer Home Equity Investments, to deliver an increasingly diverse range of investment opportunities, and to enable homeowners to access capital directly from investors without the need for intermediaries.

Our vision is to deliver the platform that makes home equity accessible, investible and tradable on a global scale.

Impact

We're reimagining home equity financing

Traditionally, if you want to tap into the equity in your home, you have two choices: sell the property or apply for a loan and go deeper into debt.

We believe this is highly unsatisfactory. With the current market conditions, we believe obtaining a loan is only going to become more difficult for the average homeowner. In many cases, people may be forced to sell their homes to be able to access their home equity as they have no other option. This is particularly the case in today's high interest rate environment where the cost of a cash-out refinance is prohibitive.

QuantmRE offers Homeowners the alternative they need.

Home Equity Investments can positively impact people's lives by enabling them to access a potentially life-changing cash lump sum from their home equity without the burden of extra debt, without having to lose the low interest rate they have secured on their current mortgage, and without being forced to sell their home.

Funding

Backed by venture funds, Algorand, and the crowd

QuantmRE has raised over

$2.8M from a range of investors.

|

QuantmRE has closed two successful rounds on Republic since 2020, with a total of 1450 individual investments.

Founders

Matthew Sullivan

Founder and CEO

You can bet on our team to innovate, execute and scale QuantmRE. Our team is comprised of pioneers in the shared equity space who have helped homeowners access millions of dollars of equity in their homes, giving them the freedom to turn their equity into cash and take back control of their finances.

Matthew is the founder and full-time chief executive officer of QuantmRE. A serial entrepreneur, he is the founder of Crowdventure.com and co-founder of two real estate funds. He spent a number of years working alongside Richard Branson and the Virgin corporate finance team in London, UK, where he was appointed a director and Trustee of Virgin’s London Air Ambulance.

Matthew went to Westminster School in London, UK and studied Law at Birmingham University before pursuing a career in finance and stockbroking, specializing in the South East Asian markets. In 1997 he chose an entrepreneurial path and founded Europe’s first internet billing application service provider. Since then he has founded and led companies in the United Kingdom, Australia and the United States in the finance, telecommunications, technology and real estate sectors.

Matthew is the author of 'Head First—A Roadmap for Entrepreneurs', host of the 'Hooked on Startups' podcast, and holds a private helicopter pilot's license.

Summary

A message from QuantmRE's

founder and CEO, Matthew Sullivan

Whenever someone asks me to explain what we do at QuantmRE, I always start by describing the problem that we solve. It’s a problem that affects millions of people, and it’s a problem that may well affect you.

If you’re a homeowner and you have equity in your home, the only way to unlock that equity is to go deeper into debt. In most cases you will need to borrow money from a traditional lender, such as a bank, and you’ll probably be looking for a cash-out refinance, or a home equity line of credit. It’s possible that you may get turned down — your credit score may be too low, your debt to income ratio may be too high, or it may be some other reason. It’s also possible you decide not to borrow money at the current rates and lose the low rate that you’ve locked in on your mortgage.

There are many reasons why people get turned down every day for traditional bank financing, even though they may have hundreds of thousands of dollars of equity trapped in their home. We thought this was a wholly unacceptable situation when we founded QuantmRE five years ago.

Today, we are able to help homeowners access potentially life-changing amounts of capital that is trapped in the equity in their homes, without having to take on more debt, and without having to make extra monthly payments.

But there’s another, important part of our business that is equally as exciting. By providing homeowners with much-needed liquidity, we’re also creating new investment opportunities and opening up an entirely new asset class — the Home Equity Investment. Institutions have been actively investing in these assets for a few years now, but you may not have heard of them as they are simply not available to smaller investors.

Our marketplace, which we believe it the first of its kind, enables us to leverage technology, changes in securities regulations and real estate asset innovation to offer tradable Home Equity Investments to the Crowd in a way that’s easily consumable. We’re excited to be able to offer Main Street investors a chance to participate in an asset class that, today, feels like a closely guarded secret, available only to the larger financial institutions.

With our Marketplace, investors will be able to buy and sell the equity in owner-occupied homes and get exposure to owner-occupied residential real estate without having to worry about the usual problems with toilets, tenants and trash. At the same time, they will be helping homeowners unlock their home equity without the burden of additional debt.

That’s a win-win for everyone. And it’s an exciting investment proposition, because there are millions of homeowners who are sitting on trillions of dollars of home equity, looking for ways to access their home wealth.

We invite you to join us as an investor in QuantmRE, and come with us on what we believe will be an exciting, meaningful and profitable journey.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...