Forget Seattle, Denver and San Francisco. Boise, Idaho, is poised to be the hottest housing market at the start of the ne...

Property

The Residences at Diamond Ridge is an apartment complex located just 1.25 miles from downtown Winston-Salem, North Carolina. Although the complex is fully leased, there is an opportunity to renovate and add long-term value to the property by doing significant interior and exterior renovations and increasing rents to market levels.

The property consists of 336 units averaging 852 square feet and currently has three playgrounds, a soccer field, a leasing office, and a non-functioning swimming pool, all which DeRosa Group plans to renovate to maximize the value of the property.

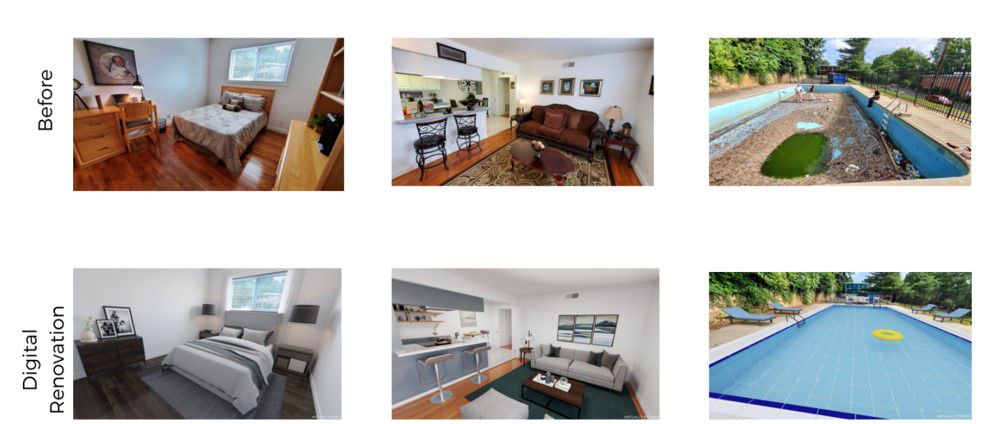

Project walk through

Business plan

The business plan for The Residences at Diamond Ridge consists of six steps towards profitability:

1. Renovations to improve the curb appeal and attractiveness of the property including:

- Adding three new playground sets onsite

- Painting all buildings

- Creating a community space: repairing the pool and extending the deck to add a basketball court, picnic tables, dog park, grilling area, and gym

- Implementing a targeted security and safety improvement plan

2. Interior Unit Renovations

- Updating the interiors of each unit to meet resident demand and raise rents to market, resulting in an anticipated average rental increase of $140 per unit.

3. New Management

- Bring best-in-class local property management systems and processes, while increasing onsite staff from 4 to 7 individuals, providing increased resident satisfaction and asset performance.

4. Flexible Low-Cost Agency Debt

- Quote received for a 75% LTV, 7-year floating-rate loan with two year interest-only at a 2.75% note rate.

5. Refinance Post-Stabilization

- Due to the significant anticipated increase in net operating income, the DeRosa Group will pursue a refinance after stabilization, utilizing longer-term fixed-rate debt which may also reset the interest-only period, improving cashflow.

6. Long-term Hold

- The anticipated hold period is 10 years. This hold period will allow for the DeRosa Group to take advantage of the strong fundamentals driving the Piedmont-Triad area.

Sponsor

The DeRosa Group is a family-owned business headquartered in Trenton, New Jersey. Matt and Liz started investing in real estate in 2004 with the purchase of a duplex outside of Philadelphia. Since then, the DeRosa Group has completed over $30 million in real estate transactions involving private capital including fix and flips, single family home rentals, mixed use buildings, apartment buildings, office buildings, and tax lien investments.

DeRosa Group is a developer and owner of commercial and residential property with a mission to “transform lives through real estate.” DeRosa is a people-focused, boutique development company who is proud of their proven track record of providing safe, profitable investment opportunities. DeRosa allows individuals to diversify their portfolios through passive “hands off” real estate investments.

Providence Capital, Ltd., in partnership, provides acquisition, construction and asset management, and “back-office” support to The DeRosa Group. The DeRosa Group and Providence Capital, Ltd. will have over 1,100 units under management upon the completion of this acquisition.

Offering

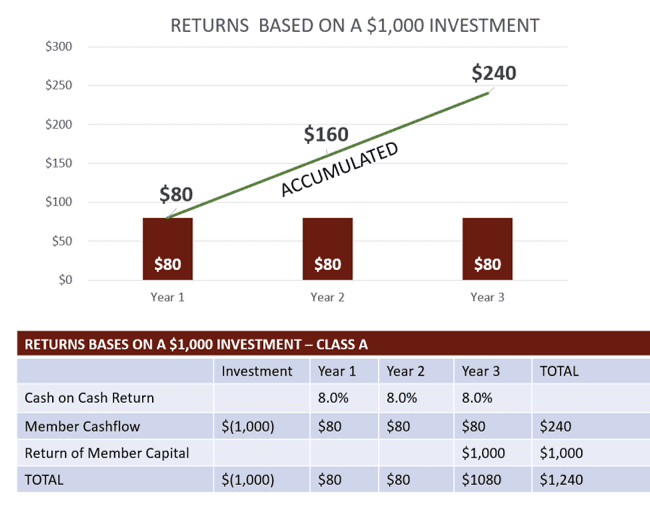

We are offering up to 1,070 Class A Membership Interests (the " Class A Interests") at $1,000 per Class A Interest. Class A Interest holders will receive an 8% annual preferred return for a period of 3 years at which point we intend to redeem the interests using proceeds from a refinancing of the property.

Financial Overview

Sources and Uses | |

| Property Purchase Price | $18,500,000 |

| Renovation Costs | $4,500,000 |

| Financing & Soft Costs | $1,190,000 |

| Total Use of Funds | $24,190,000 |

| Class A Equity | $2,000,000 |

| Class B Equity | $9,240,000 |

| Senior Mortgage | $12,950,000 |

| Total Source of Funds | $24,190,000 |

Cash Flow to Class A Members

Projected Returns

The return will be a fixed interest return of 8% APR for 3 years. The capital will be returned at the end of 3 years when refinancing is expected to occur.

Location

Winston-Salem, North Carolina which has seen great growth in recent years spurred by Wake Forest University, the health and technology sectors. Diamond Ridge is located just 1.25 miles from downtown Winston-Salem’s employment and entertainment hub, and is a quick ten-minute drive from two of the region’s most prominent medical centers, several universities, and prime retail shopping.

A Growing City

Employment growth in Winston-Salem has transformed the city into the third largest urban area in North Carolina with a total population of over 650,000 individuals. Downtown Winston-Salem has been the benefactor of nearly $2B Public and Private investment, specifically in the area known as the Innovation Quarter.

With 20 Regional Hospitals, over 20,000 medical jobs within a two-mile radius, growth of households making at least $100,000 expected to accelerate twice as fast through 2024 and the continued growth of the Wake Forest Innovation Quarter, Winston-Salem’s apartment market is expected to continue to perform well, consistent with the average annual rent growth of 4.9% the market has experienced since 2017.

Major Employers

Though historically known for its focus on logistics and manufacturing, with the help of several major universities, the Piedmont Triad region (located along the Interstate 85/40 corridor) has gradually diversified its employment base by consistently adding jobs to the health, education, and technology sectors.

The Innovation Quarter

The Wake Forest Innovation Quarter is only 1.5 miles from The Residences at Diamond Ridge. The Innovation Quarter is a 330-acre research park—the largest historic redevelopment project in state history, and is now one of the fastest-growing urban-based districts for innovation in the nation. The space is home to over 170 companies within 1.9M+ square feet of office and laboratory space, five academic institutions, retail and dining, and multiple event venues.

Oops! We couldn’t find any results...

Oops! We couldn’t find any results...